Most stories on the Irvine Company are planted in the media as advertisements disguised as news. Today we learn how to properly read and interpret these stories.

Irvine Home Address … 203 BRIARWOOD Irvine, CA 92604

Resale Home Price …… $269,000

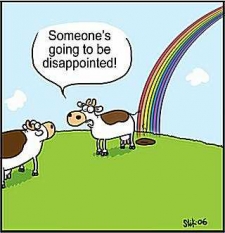

I believe the morning sun

Always gonna shine again and

I believe a pot of gold

Waits at every rainbow's end

Catherine Warwick — Pollyanna

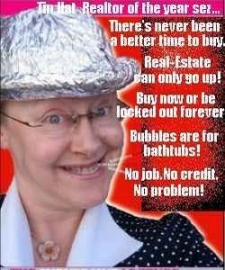

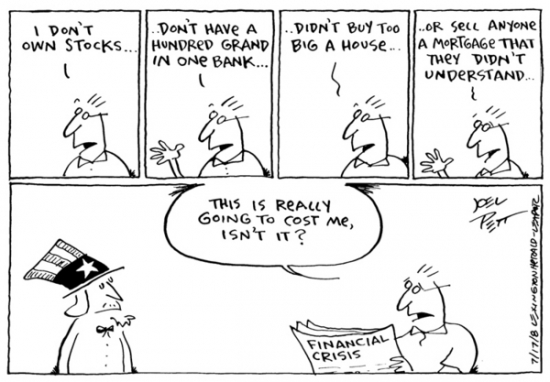

When the National Association of realtors issues a press release, they always spin the data like a Pollyanna. Their rosy projections are intended to cajole buyers into action whether or not that action is good for the buyer. Their actions are completely self serving.

realtors have bullshit and spin down to a formula. Barry Ritholtz, a blogger who is as disdainful of the NAr as I am, has decoded the pattern of self-serving nonsense realtors serve up with every press release.

How to Read National Association of Realtors News Release

By Barry Ritholtz – April 20th, 2011, 2:19PM

Pardon our belated look at Existing Home Sales (but we’ve been busy).

For this post, we will look at our favorite chart — Existing Home Sales (NSA) — and also teach you how to read a National Association of Realtors news release.

Our favorite chart, courtesy of Calculated Risk, is below. It shows the Existing Home Sales BEFORE they get seasonably adjusted. The pattern you see is the home sales pattern — bottoming in December January, and peaking in June/July/August. Note the ongoing weakness — until the tax credit kicked in. Now, in 2011, we see more signs of weakness.

As to the National Association of Realtors, there is a small secret to reading their news release: You need to ignore every other paragraph. It typically looks like this:

Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data

Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit

Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data Data data data

Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit Spin Bullshit

The secret is to focus on the data, and ignore the spin.

For example:

Sales of existing-home sales rose in March, continuing an uneven recovery that began after sales bottomed last July, according to the National Association of Realtors.

Lawrence Yun, NAR chief economist, expects the improving sales pattern to continue. “Existing-home sales have risen in six of the past eight months, so we’re clearly on a recovery path,” he said. “With rising jobs and excellent affordability conditions, we project moderate improvements into 2012, but not every month will show a gain – primarily because some buyers are finding it too difficult to obtain a mortgage. For those fortunate enough to qualify for financing, monthly mortgage payments as a percent of income have been at record lows.”

Existing-home sales, which are completed transactions that include single-family, townhomes, condominiums and co-ops, increased 3.7 percent to a seasonally adjusted annual rate of 5.10 million in March from an upwardly revised 4.92 million in February, but are 6.3 percent below the 5.44 million pace in March 2010. Sales were at elevated levels from March through June of 2010 in response to the home buyer tax credit.

NAR’s housing affordability index shows the typical monthly mortgage principal and interest payment for the purchase of a median-priced existing home is only 13 percent of gross household income, the lowest since records began in 1970.

According to Freddie Mac, the national average commitment rate for a 30-year, conventional, fixed-rate mortgage was 4.84 percent in March, down from 4.95 percent in February; the rate was 4.97 percent in March 2010. Data from Freddie Mac and Fannie Mae show requirements to obtain conventional mortgages have been tightened, with the average credit score rising to about 760 in the current market from nearly 720 in 2007; for FHA loans the average credit score is around 700, up from just over 630 in 2007.

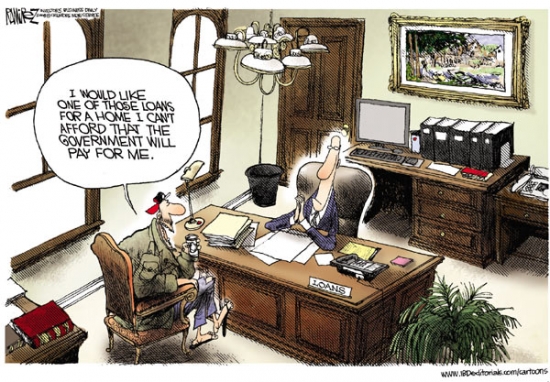

“Although home sales are coming back without a federal stimulus, sales would be notably stronger if mortgage lending would return to the normal, safe standards that were in place a decade ago – before the loose lending practices that created the unprecedented boom and bust cycle,” Yun explained.

OK, I cheated — I moved a paragraph to make this funnier. But the idea is that you look at the data and ignore whatever it is they are spinning about it.

Barry is right on, as usual. With his preamble, let's take a detailed look at how the Irvine Company operates.

The specifics of data, spin and bullshit

For greater clarity, we need to define some terms before we analyze an Irvine Company press release.

Data: Factual statements that present statistics or some measurable phenomenon. Presenting data is ostensibly the reason for a real estate press release. However, the real intention is to spin the data or otherwise manipulate the interpretation.

Spin: The offered interpretation of data that forwards the agenda of the organization issuing the press release. Spin is usually a plausible interpretation that is most often taken out of context, knowingly, by the authors.

Bullshit: An interpretation of data that is either not factual, or the data itself is not factual, or an interpretation that is not plausible based on the data. Bullshit is an obvious lie an organization passes off to a gullible public in hopes that nobody catches on.

The color coding of text above will be used to help decipher the nonsense that follows.

Analyst: Why Irvine new home sales are booming

Veteran Southern California real estate analyst G.U. Krueger adds his commentary on the housing market to this blog in a spot we call “Thursday Morning Quarterback.” Here’s his latest installment. …

The Irvine Company sold 1,350 new homes in its North Irvine communities since January 2010.

This false statement falls under the category of repeating a lie long enough that people come to believe it. Back in February, I reported that the Irvine Company opens two new developments with 2,600 houses, and later I asked How large is the Irvine land premium?

The truth is from January 2010 to February 2011, the Irvine Company closed on 642 home sales, not the 1,350 number they keep repeating.

Despite some signs of slowing, the projects are still running between 4 and 8 sales per month.

Four to eight sales per month? That is terrible. Nice spin sandwiched between some negative data points.

If sales don't pick up, they will either slow production, or they will start offering incentives to close deals. I doubt they would lower prices, particularly after creating their own bottom by selling under market properties in 2009. They will maintain prices by providing necessary incentives until that doesn't work any more.

How come, they are doing so well, when new home builders elsewhere are faltering?

Here's our Top 10 list why that is:

10. Irvine is an economic powerhouse in its own right. In 2009 its businesses employed 209,000 people. Its top three industries were Manufacturing (14%); Professional, Scientific, and Technical Services (12%); and Health Care (8%). These are well paying jobs.

This time we got spin as bookends on data. When did manufacturing become a well paying job? How many factory workers are buying $800,000 Irvine homes? Fifty percent of good paying real estate and mortgage jobs have left Irvine over the last several years.

9. Also, Orange County jobs are growing again since March 2010 and it is the above mentioned industries, which are partially driving the recovery. Ultimately it is all about good jobs.

8. Key socio-economic indicators are stellar. The State’s Academic Performance Index averages a whopping 931 for Irvine, one of the best city performances in California. And its violent crime rate is low. Both indicators add to the value proposition of the community.

The facts presented above are very good reasons to live in Irvine. Notice the author had to punch-up the facts with spin.

7. About 50% of Irvine’s employees live within a 20-mile radius, a captive audience which spread the “water cooler buzz” about the Northern Irvine community throughout the OC.

The fact at the beginning of the sentence is meaningless, and the bullshit that follows it is silly.

6. Irvine is an ethnically diverse city – 50% Caucasian, 39% Asian, and 9% Latinos. There is your secret weapon, and the Developer leveraged it with deliberation. Check out the Irvine Company’s website, which touts its new homes in English, Korean, Chinese, and Spanish. Smart.

That point was a mixture of fact, spin, and ass-kissing bullshit.

5. New housing supply is tight in Irvine as one would expect in a “closer in” location with great jobs. Essentially, no new homes were started in 3 years and what new home competition there is currently, consists mostly of product based on the design palette of the housing bubble.

The reason new home supply is tight in Irvine is because the Irvine Company is a monopoly that controls the production of all new homes in Irvine. It has nothing to do with location. Also, there is no new home competition in Irvine, and there is very little competition in Orange County. Rancho Mission Viejo is waiting to see what the Irvine Company does, and the small builders are not active on infill sites because prices are not stable and sales volumes are low. The Irvine Company is proud of their new floorplans, but competitors are not building bubble era designs.

BTW, I find it interesting that they acknowledged a housing bubble in their press release.

4. Existing home inventory is tight. In March 2011, the resale inventory was 4.5 months in Irvine and overall vacancies were just 5.9% of its housing stock, well below the State’s 8.1% and the Nation’s 11.4%. Shadow supply is under control. Foreclosures and defaults are rising, but they are relatively low and the rise is likely to be temporary. The delinquency pipeline is dropping. For example, in September 2010, 30-day delinquencies for non-agency mortgages were down 30% in Irvine to 113 from 159 a year earlier.

It's difficult to sort through the facts, spin and bullshit above. First, the existing inventory is not tight. The months on the market continues to rise as inventory is growing faster than sales. I like how he spun the data with qualifying words.

The manipulation of the vacancy data is spin that borders on bullshit. Vacancies are elevated over historic norms everywhere because we overbuilt homes during the bubble. We have a glut of empty homes in most communities. Many of these homes are held in shadow inventory which is not under control. He notes foreclosures and defaults are rising, but they he lapses into total bullshit about it being low and temporary.

At least the press release finishes well..jpg)

3. The new homes in North Irvine are in a nice and established master plan with parks, retail, and other amenities. No mere promise here, but a realized vision. The developer kept tight control of the neighborhood. There was no contagion effect from busted new home tract sites.

This is another strength of the Irvine Company. They do deliver a top-notch product.

2. Extensive consumer research compelled the Developer to insist on fresh, new housing product. Their design palette trades formal dining areas for kitchen-linked ‘great rooms’. They also create more indoor-outdoor living spaces, taking advantage of one of the best climates in the world. This design “turn” became real because of the ueber-element of money. The developer was in total financial and design control and hired builders best suited for the new paradigm.

The Irvine Company has done a nice job with the new floorplans. Although, the idea that floorplans can be fresh or innovative is on par with the idea that finance can innovate. Floorplans change over time, but they don't advance. The good floorplans of the 70s are just as useful and desirable today as they were when they were the innovation of their time.

1. The ultimate reason of success in the northern Irvine new home projects, however, is “the pride, respect, and dignity of everybody involved”, according to Larry Webb from The New Home Company. Often public builders are just engineering homes instead of designing them and, worse, they are obsessed with the financial wizardry that keeps Wall Street happy. What was done in North Irvine was a much needed refocus on building and designing homes to meet the desires of changing consumer tastes, kind of a provocation these days in the building industry?

Focusing on the details of the floorplan is a great thing. It becomes much easier to do when you are selling a small fraction of what you used to sell.

The spinmeisters at the Irvine Company are going to have to raise their game. The standard of bullshit they were able to pass off in the past will not longer get past the scrutiny of me and the IHB. It's obvious the Orange County Register, who is desperate for advertising money, is not going to tell the truth.

So what is really going to happen?

Wells economist: Foreclosure supply points to 'long, arduous' recovery

Despite better-than-expected new home sales in March, a Wells Fargo economist said builders will continue to struggle until the foreclosure wave begins to recede.

The Census Bureau reported new home sales increased 11% in March. But they remain at “an extremely depressed level,” said Wells economist Anika Khan. Builders dropped inventories of new homes to 183,000 units, the lowest level since 1967. Khan attributed the monthly increase from slow sales in February to harsh weather that month.

Khan points out builders are pressured by the ever-widening price gap between new homes and foreclosures. The median price of an existing home is $159,600, roughly 25% below new home prices of about $213,800. In California, median prices for traditional home sales are 88% higher than previously foreclosed homes, according to the California Association of Realtors.

I see this price gap in Las Vegas in particular. It is so inexpensive to own a home in Las Vegas that many people are opting to buy new rather than save 25% and buy a resale simply because they can easily afford the new home. New homes sell for near rental parity there even though you can find a comparable product less than 5 years old selling for 25% less. Unfortunately, as resale prices continue to decline, this gap is getting stretched, and the substitution effect is taking sales from the builders. Those circumstances won't change in Las Vegas any time soon.

“The large price gap will continue to make it difficult for builders to compete,” Khan said. “Unfortunately, the gap will likely remain until the pace of foreclosures moderates.”

In a separate report released earlier in April, Khan said builders have “little incentive” to ramp-up building activity with foreclosures and short sales taking up such a large percentage of the market.

Housing starts rose 7.2% in March to a pace of 549,000 units. Khan projects starts to increase to a 620,000-unit pace in 2011, an increase of 5.9% from the year before.

“Single-family starts remain at extremely depressed levels and any recovery will be long and arduous due to the oversupply of existing homes on the market and the increasing amount of distressed transactions,” Khan said.

The reality for new home sales isn't good.

A flip gone bad

Today's featured property was originally purchased by a Ponzi in 2003. She HELOCed and refinanced herself into oblivion terminating with an Option ARM in 2006. She quit paying in mid 2009, and was promptly foreclosed on.

Foreclosure Record

Recording Date: 12/23/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 09/18/2009

Document Type: Notice of Default

At the foreclosure auction in January of 2010, the property was purchased for $258,000. After overpaying at auction, the flippers plowed more money into the property and put it for sale.

Property History for 203 BRIARWOOD

| Date | Event | Price | |

|---|---|---|---|

| Apr 28, 2011 | Price Changed | $259,000 | |

| Apr 06, 2011 | Listed (Active) | $269,000 | |

| Apr 04, 2011 | – Delisted (Cancelled) | — | |

| Apr 02, 2011 | – Price Changed | * | |

| Mar 26, 2011 | – Price Changed | * | |

| Mar 24, 2011 | – Price Changed | * | |

| Mar 18, 2011 | – Price Changed | * | |

| Mar 05, 2011 | – Price Changed | * | |

| Feb 24, 2011 | – Price Changed | * | |

| Feb 09, 2011 | – Price Changed | * | |

| Jan 15, 2011 | – Price Changed | * | |

| Dec 14, 2010 | – Price Changed | * | |

| Nov 23, 2010 | – Price Changed | * | |

| Nov 18, 2010 | – Price Changed | * | |

| Sep 07, 2010 | – Price Changed | * | |

| Jul 23, 2010 | – Price Changed | * | |

| Jun 30, 2010 | – Price Changed | * | |

| Jun 22, 2010 | – Price Changed | * | |

| Jun 07, 2010 | – Price Changed | * | |

| May 20, 2010 | – Listed (Active) | * | |

| May 19, 2010 | – Delisted (Cancelled) | — | |

| May 01, 2010 | – Relisted (Active) | — | |

| May 01, 2010 | – Pending (Backup Offers Accepted) | — | |

| Mar 20, 2010 | – Price Changed | * | |

| Mar 15, 2010 | – Price Changed | * | |

| Feb 23, 2010 | – Price Changed | * | |

| Feb 22, 2010 | – Price Changed | * | |

| Feb 12, 2010 | – Price Changed | * | |

| Feb 03, 2010 | – Listed (Active) | * | |

| Jan 27, 2010 |

Sold (Public Records)

This home was sold at a foreclosed. |

$258,000 | |

It looks like they managed to get the property in escrow just as the tax credit was expiring. Then it fell out of escrow.

It's never a good thing when a property falls out of escrow, but when it falls out at the top of the market, it turns out even worse for the flipper.

They relisted the property almost a year ago, and they have been chasing the market down ever since.

Greed kept them in the hunt past the prime selling season, and by the time they realized they needed to cut their price to get out of the property, it was too late. Now they are looking at a $30,000 loss after their renovation and carrying costs.

So much for easy money in real estate.

Irvine House Address … 203 BRIARWOOD Irvine, CA 92604 ![]()

Resale House Price …… $269,000

House Purchase Price … $258,000

House Purchase Date …. 1/27/2010

Net Gain (Loss) ………. ($5,140)

Percent Change ………. -2.0%

Annual Appreciation … 3.3%

Cost of House Ownership

————————————————-

$269,000 ………. Asking Price

$9,415 ………. 3.5% Down FHA Financing

4.78% …………… Mortgage Interest Rate

$259,585 ………. 30-Year Mortgage

$58,235 ………. Income Requirement

$1,359 ………. Monthly Mortgage Payment

$233 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$56 ………. Homeowners Insurance (@ 0.25%)

$299 ………. Private Mortgage Insurance

$385 ………. Homeowners Association Fees

============================================

$2,332 ………. Monthly Cash Outlays

-$127 ………. Tax Savings (% of Interest and Property Tax)

-$325 ………. Equity Hidden in Payment (Amortization)

$17 ………. Lost Income to Down Payment (net of taxes)

$54 ………. Maintenance and Replacement Reserves

============================================

$1,951 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,690 ………. Furnishing and Move In @1%

$2,690 ………. Closing Costs @1%

$2,596 ………… Interest Points @1% of Loan

$9,415 ………. Down Payment

============================================

$17,391 ………. Total Cash Costs

$29,900 ………… Emergency Cash Reserves

============================================

$47,291 ………. Total Savings Needed

Property Details for 203 BRIARWOOD Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 1

Sq. Ft.: 941

$286/SF

Property Type: Residential, Condominium

Style: One Level, Other

Year Built: 1978

Community: 0

County: Orange

MLS#: P776605

Source: SoCalMLS

Status: Active

On Redfin: 19 days

——————————————————————————

Private end unit overlooking greenbelt in beautiful, peaceful neighborhood of Irvine. This unit has been renovated with new paint throughout, new carpet, new baseboards around all rooms and brand new kitchen appliances. Tile entry opens to spacious living room. There is also a separate room for laundry. Walking distance to parks, North Lake, schools and association pool.

Have a great weekend,

Irvine Renter

.jpg)