Money Magazine takes a detailed look at the housing debacle and the squatting phenomenon.

Irvine Home Address … 32 COLUMBUS Irvine, CA 92620

Resale Home Price …… $799,000

I am the Astro-Creep

A demolition style

Hell american freak

I am the crawling dead

A phantom in a box

Shadow in your head

White Zombie — More Human Than Human

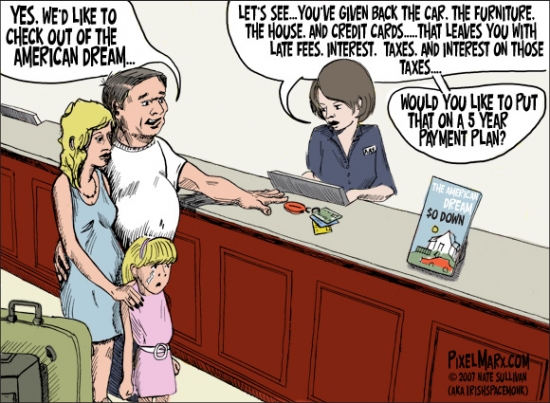

Is shadow inventory all in your head? Is it real? Are there really debt zombies roaming the shopping malls spending the money they should be putting toward their mortgage?

Home ownership in California means you gorge on HELOCs when times are good, and squat in luxury when your creditors cut you off. Its a great system for Californians. They get to spend as they please and pass the bills off to the rest of America in taxpayer bailouts. I see no reason to believe it will not happen again soon.

Welcome to Zombieland: Ladera Ranch, California

By Pat Regnier, assistant managing editor — December 7, 2010: 4:10 PM ET

ORANGE COUNTY, Calif. (MONEY Magazine) — Joshua and Irene Vecchione are cleaning the dinner dishes one evening in October when Joshua's cellphone rings. It's Rhea from the Chase collections department, and she wants to know if he has $123,000 today. That's what it will take to get the Vecchiones current on their mortgage.

Rhea is a new caller, but Joshua has been talking with Chase reps a lot since February 2009, when he and Irene stopped making the $8,000 monthly payment on their five-bedroom spread in Ladera Ranch, Calif., an upscale development in south Orange County.

After a few months, they were allowed into a trial mortgage-modification program, which let them pay less than half as much and kept Joshua on the phone as Chase requested more and more documents.

In July, though, the bank decided the couple didn't merit a permanent "mod." The Vecchiones, who own the toy store in Ladera, began negotiating with Chase to do a short sale, in which the lender allows the debtor to sell for less than what's owed and walk away. So what Rhea says troubles Joshua: They're still listed in Chase's system as an active foreclosure.

"How am I in foreclosure?" he asks after hanging up. "I'm not in foreclosure."

I think it was because you quit paying your mortgage almost two years ago. I'm not sure, but I think that is pre-requisite for the bank to call a foreclosure sale, or at least it is supposed to be. So, if you haven't been paying your mortgage, there might just be a chance that you are in foreclosure.

In a way, many people who don't get their loan modifications should thank the banks for accelerating their default. Some of these people might have held on for years making their payments if the bank had not induced them to default by holding out the possibility of a lower mortgage payment. Without question, the banks created many strategic defaults by the incentives they put into the system.

A few weeks after that call, the Vecchiones get another one, this time approving the short sale. They bought it for more than $1.1 million in 2006 — the height of the bubble — with a high-rate, interest-only mortgage. Paying it meant staycations and other cuts, but they figured they could refinance in a couple of years, as the house grew in value.

You know how the story ends, but in 2006 few people (especially in the O.C.) had any idea what was coming, and lenders were hardly waving folks away from the cliff.

There's a spot in the backyard where Joshua once planned to add a little apartment for his parents. Now he figures his family of five will move in with them. He's sad not to have one last holiday season in the house. But if all goes as planned, the entire process, from first missed payment to renting the U-Haul, will have taken 22 months.

Since these owners obtained the beneficial use of a house that was supposed to cost them $8,000 a month, does anyone else like the idea of taxing these people on the $176,000 in squatter benefits?

The Long Goodbye

There are stories like the Vecchiones' slowly unfolding all around the culs-de-sac of Ladera Ranch — and in prestigious zip codes across America. The foreclosure crisis has hit lower-income communities the hardest, but it has touched every slice of the market, and resolving it may well be harder in places where homes are too expensive to attract investors with ready cash.

The reason this crisis hit the lower income communities first (so far worst, but really only the first) is because the loans given to the lower income communities reset or recast first. The Option ARMs and interest-only loans given to Alt-A and prime customers are resetting and recasting now. Many of those borrowers have already accelerated their defaults and are squatting in shadow inventory.

The shadow inventory problem will be much harder to resolve in prime areas where prices are far too high because there are not enough buyers able to pay the inflated prices to absorb the inventory. Prices will have to come down on mid to high priced homes or the banks are going to own them for a very long time.

Naperville, a tony Chicago suburb, has more than 230 homes valued at over $300,000 in danger of seizure, according to RealtyTrac, a foreclosure data provider. Monmouth County, a New Jersey Shore area that boomed in the early 2000s, has 462 over $400,000.

Ladera, an unincorporated community of about 25,000, is conspicuously affluent — it's home to Tamra of The Real Housewives of Orange County. The schools are strong, the surrounding chaparral foothills pretty. Good jobs are to be had in nearby Irvine. In short, this is a place a lot of folks would consider a slice of heaven, which is why MONEY began following what was going on here two years ago, as the dream of the house that made you rich began crumbling.

Now heaven has turned into limbo, where defaulters may live for a year or more with a giant mortgage they can't fully pay. Not counting homes already in the foreclosure process, about one in 10 Ladera mortgages is at least 30 days late, according to LPS Applied Analytics. And houses in the foreclosure process have been delinquent an average of 16 months, up from seven in 2008.

Ten percent of Ladera Ranch loan owners are not making their payments. That is a lot of distressed mortgages. If that many houses have to go through the foreclosure meat grinder, prices will get pushed much lower.

The national figures are almost as ugly. And what they show is that our collective real estate hangover is far from over. And limbo will start to last even longer as the "robo-signing" scandal raises questions about the integrity of the foreclosure process.

To judge from recent stories about poorly (if not fraudulently) documented seizures, you would think servicers are snatching up houses quickly. In fact, rushed doc signings and long delinquencies are two sides of the same problem: During the boom, lenders tripped over themselves to create millions more ultimately unsustainable mortgages than they can now unwind.

Yet for the housing market to return to health, there needs to be resolution for these zombie loans that won't ever be paid in full and won't quite die either. Until they can be eliminated through short sales, foreclosures, and permanent modifications, the zombies will keep home values from recovering and suck momentum from the economy. They're not departing soon.

As Christopher Thornberg of Beacon Economics in Los Angeles puts it, "This is going to bleed on for years. People will wander in and out of trouble."

Foreclosures are essential to the economic recovery.

It Only Looks Healthy

On MONEY's first day back in Ladera Ranch this summer, what jumps out is how nice the place still looks — no air of depression here. Although it's a bubble-era town, having sprung up in 1999 from what had been a real ranch, Ladera isn't like some of the foreclosure disaster zones you've heard about — the outskirts of Phoenix, say, or Riverside County, Calif., just over the Santa Anas.

Ladera wasn't a magnet for "drive till you qualify" buyers who might have been better advised to rent. The average credit score on a loan here was a solid 734.

Today 4.4% of homes in Ladera with mortgages are in some stage of foreclosure, compared with less than 3% for Orange County. That's given the place a bad rap locally, even though the vast majority of Laderans are, of course, paying their mortgages.

"What's annoying is the perception that Ladera has a bigger group of people who were irresponsible," says Devon Hocker, a real estate agent and publisher of a local magazine.

The facts are what they are. With a 10% delinquency rate and a 4.4% foreclosure rate, Ladera Ranch is above the average for Orange County and above the average for the nation. How is that possible with a large concentration of high wage earners?

Houses were wired for broadband and set up for home offices, she says, attracting entrepreneurs who had high incomes, at least in the boom. (Many were in real estate; a local joke goes that when you're pulled over on the main drag of Antonio Parkway, the deputy asks for your registration and broker's license.)

Because Ladera is so young, owners are more likely to have paid nosebleed prices and to have financed with one of the easy-pay mortgages that swept California after 2005. If someone told you he had a fixed-rate loan, quips Hocker, you knew he had just arrived from the Midwest.

Being from the Midwest, I never considered any kind of financing other than a fixed-rate mortgage. The fact that houses were not affordable using a fixed-rate mortgage is what told me there was a housing bubble early on.

The exotic loans also attracted flippers, who set the market's torrid pace. Troy Lowder says he went through four houses in Ladera; a friend and family members did the same, buying as tracts were first developed. "We all went from neighborhood to neighborhood, Phase 1 to Phase 1," he says. Lowder made more than $200,000 on one deal.

The flood of easy money shows on local streets. Planners designed neighborhoods to appeal to different psychological profiles: One was for green types, another for the "achievement-oriented." Landscaped trails and pocket parks dot the area — amenities that developers skimp on in less frenzied markets.

"You won't see another Ladera Ranch for a good long time," says Brooke Warrick of American Lives, which did market research for the development.

The area's desirability, and the potential inventory that is still in limbo, have produced an odd dynamic. While the median home price fell from $780,000 in 2007 to $530,000 in 2009, according to the service DQNews, you can't waltz into Ladera and snap up a quick bargain.

"Many houses are on backup offer," says a man out with his agent on a sunny afternoon. (He asked not to be named.)

Big deal. Many houses are in backup offers because it is a ridiculously priced short sale that the bank has taken more than a year to approve because the borrower is hiding money from the second mortgage holder or the borrower will not agree to pay up.

This appearance of vitality masks a deeper problem, and not only in Ladera. Simply put, housing isn't bought and sold now in anything resembling a normal market. On the one hand, the federal government has worked overtime to keep houses attractive, with super-low interest rates, higher conforming loan limits, and, until recently, a homebuyer's tax credit. Those moves have real costs, and low rates hurt savers even as they help owners.

Meanwhile, foreclosure moratoriums, mod programs, and bank delays have kept homes off the market, to the detriment of would-be buyers.

"They've done an amazing job of restricting supply and stimulating demand," says Sean O'Toole of ForeclosureRadar, which sells data on California foreclosures to investors.

Up to this point, says Brookings Institution economist Karen Dynan, "there was an argument that delaying foreclosure — even if you couldn't prevent it — was valuable, because the economy couldn't have withstood the consequences" of more homes dumped onto the market.

That is a great argument if your a banker or a loan owner. If you are a renter or a buyer, that argument sucks.

But the zombies remain, threatening a second leg down in prices should the pace of foreclosures speed up. Recent numbers suggest this deflation was already starting, says housing analyst Ivy Zelman of Zelman & Associates. But with the robo-signing scandal, she adds, it's unclear what happens next.

How Many Zombies Are Still Out There?

Estimating the number of zombies isn't a simple matter. Rick Sharga of RealtyTrac says mortgage servicers are delaying filing notices of default, the first public record of a problem.

An October report from Amherst Securities takes internal industry data on all loans with late payments, as well as loans now current that were once delinquent, and applies a formula that calculates the probability that those loans will ultimately fail.

The rough national count of zombie mortgages: 7 million. Considering that existing homes sell at a rate of 5 million a year — and that a six-month inventory is a sign of a healthy market — that's a big backlog.

It might be bigger. There are 2.6 million on-time loans where the borrowers are deeply underwater — that is, they owe a lot more than the house is worth. All told, about a quarter of mortgages in the U.S., and a third in California, are underwater, according to Core Logic, and Ladera residents are quite aware of the incentives to try to get out of such loans by defaulting to seek a modification or short sale.

I am curious if lenders thought the word would not get out.

When MONEY met Stuart and Judy Manley in 2008, they were trying to sell their Ladera town-house for $430,000 and trade up; they couldn't, and homes near theirs are now selling in the $200,000s.

They've seen neighbors receive modifications that drastically cut their rates. The Manleys' trouble is that they aren't in trouble; they're making payments on a fixed-rate loan.

"When you call and ask for assistance or a modification, they laugh and say, 'You don't call us, we call you,' " says Judy.

The Manleys say they won't consider it, but the social stigma of default may be fading. David Averell, a mortgage broker, says that a neighbor who stopped paying "is the pop star of the neighborhood. Everybody wants to know how to be that guy."

What's the Holdup?

Why the process of unwinding bad loans has moved so slowly is an even more complicated question than how many zombies exist — as complicated, in fact, as the mortgages themselves, which were often created by one lender, sold off to investors, and then passed around among different servicers. (Chase, for example, wasn't the Vecchiones' original lender). The most obvious explanation is that the industry is simply overwhelmed. "Foreclosure activity is six times the normal level," says Sharga.

That leads to confusion; Patti Arnold, an escrow officer in Orange County, just had a short sale fall through because the bank demanded the owner get a power of attorney from her deceased spouse. Second and third mortgages add to the mess. Lien holders have competing interests, and that gums up short sales as Lender A haggles with Lender B over how much cash the latter gets, says Arnold.

Some market watchers believe banks have incentives to take their time.

"Because of the drop in home prices, lenders aren't necessarily motivated to rush properties onto the market," says Alan White, an expert on mortgage law at Valparaiso University.

A flood of inventory that weakened prices could motivate more borrowers to default. There's even fear for the banking system as a whole. Although most mortgages are owned or insured by Fannie Mae or Freddie Mac or have been sliced up into investment pools, trillions of dollars of whole loans sit on banks' books, many of them second mortgages, says Daniel Alpert of the investment bank Westwood Capital, which buys and modifies distressed loans

These second mortgages are difficult to pass off to the US taxpayer. The denial over the fate of these loans keeps our banking system in need of amend-extend-pretend.

The modification of a loan's principal or the sale of the house whether in a short sale or after foreclosure — forces the bank to write off its loss. Alpert thinks banks are "slow-walking" the process, hoping the market rebounds.

Amherst's Laurie Goodman counters that investors' losses get worse the longer a default drags on. (In fact, Fannie Mae in September told servicers to speed things up.) Goodman blames the slog more on modification programs which, as the Vecchiones have learned, often merely delay the loss of a house.

In the government modification program called HAMP (which the Vecchiones didn't qualify for because of their jumbo loan), about half the trial participants drop out. And a huge percentage of modified loans go back into delinquency.

Not that getting a mod is easy to begin with. Stella Matadama from the Consumer Credit Counseling Service of Orange County has personally worked on 95 modifications during the past year. She's succeeded with 18. In all, fewer than 470,000 of the 1.3 million trial modifications done under HAMP have led to permanent relief.

Loan modification programs are a proven failure, and they will continue to be.

Life Underwater

Orange County has long been a bastion of conservative values; the idea of homeowners not paying and then staying put rankles. Larry Roberts, a local blogger and real estate investor better known as IrvineRenter, calls them "squatters."

One hot question is how much of this is "strategic" defaulting — that is, how many people who have stopped paying have simply decided they will no longer pour money into a bad investment? Californians talk about short sellers with BMWs and/or conspicuous surgical enhancements. (A tour of Ladera short-sale listings confirms the first part of the story.)

But the financial picture of defaulters usually isn't rosy. "There's a strategic element in most defaults, and few defaults are purely strategic," says analyst Goodman. "You have your hours cut back at work or go through a divorce and re-evaluate … You don't just say, 'Oh, it's three o'clock, time to default.' "

Not surprisingly, people who approach real estate as an investment show the most sang-froid about defaulting. Troy Lowder, the flipper, lost his last house in Ladera, purchased in 2006 with a mortgage that didn't even require paying the interest due every month.

Option ARMs were ideal loan for flippers. The low payments made holding costs negligible, and the large financing amounts made any flip within reach.

He had planned to sell at a profit in a couple of years, but comparable houses were soon going for $400,000 less than he had paid. And since both Lowder and his wife worked in real estate, less money was coming in.

"It sucks. We lost everything," says Lowder. But he says he'd play the game again in another boom.

Rik Hendrix's story is probably more typical. When he bought his house in 2008, he says, he was earning a six-figure salary as an assistant service manager at an RV dealership. But his wife got a better job, so he decided to go back to mechanic work to spend more time with his kids. Now he's going through a divorce and taking home half what he did as a supervisor.

"We're not selling as many accessories, and that's where you make your money," he says.

All this made his $5,000 monthly housing nut unsustainable. He finished a short sale in late October and says he was able to pay off a lot of credit card debt while not paying his mortgage.

An assistant manager at an RV dealership had a $5,000 monthly nut. No wonder the housing market is in trouble.

The Vecchiones, too, took an income hit. Their store is a Ladera fixture, but the crash squeezed local wallets. "The average person spent $40 per birthday gift, and that went down to $15 or $20," says Joshua.

He claims Chase wouldn't put them in a trial modification until he missed a payment; Chase says that's not policy.

In any case, the couple celebrated when they made their first $3,260 trial modification payment, thinking they were on their way to saving their house. But a trial merely slows the foreclosure machinery while the bank makes a decision.

Owners typically still owe the balance they aren't paying, plus additional late charges if they aren't approved for permanent terms. The Vecchiones were first turned down for not enough income, let back in, then rejected for not fitting Chase's financial models, decisions with which Joshua disagrees. Regardless, by that point they were even deeper in the hole.

Anyone who thinks the banks are doing them a favor with a loan modification hasn't read the terms carefully.

The common thread in these stories: Once homeowners are underwater, it doesn't take much to set them on the path toward losing their house, especially if they stretched to buy. That's what has made the foreclosure crisis into such a Gordian knot. The more defaults, the further prices fall; the further prices fall, the more people default.

Getting Out From Under

Do we have to muddle through several more years of foreclosures and a semi-functioning housing market, or can the situation be improved? That's a tough question; a lot of conflicting interests would require resolution. If you didn't overreach for your mortgage, it stings a bit when your neighbor gets help or stops paying on the house he couldn't afford.

Then again, your property's value will go down if the bank forecloses on that neighbor. If you're a renter who wants to buy, a wave of foreclosures that drives down prices sounds like just the ticket — but only if that wave doesn't roil the economy enough to cost you your job.

Do any renters reading this story believe that their job was saved by the government subsidies that keep house prices out of reach?

So Congress and the Obama administration have tried to walk a fine line. The White House has resisted calls for a national foreclosure moratorium, and HAMP has proved to be anything but a radical homeowner bailout.

Under HAMP, mortgage servicers get a subsidy for modifying a loan, but the vast majority of those modifications reduce only monthly payments, not the principal, meaning homeowners remain underwater.

To really slice into the inventory that will eventually end up in foreclosure, argues Amherst's Goodman, we'll need a program that pushes servicers to reduce the principal owed for those who could afford a mortgage closer to current market values, perhaps while forcing them to give up some future appreciation. This would still leave lots of foreclosures, but it could more quickly sort who can and who can't save their home.

Another approach: Ease struggling homeowners out of their loans altogether, so they can make a fresh start. Investment banker Alpert and the economist Dean Baker have separately proposed giving defaulters a temporary right to rent their homes at market rates. Homeowners would have less incentive to prolong the foreclosure process, but they would still lose their investment and their good credit. And people in houses way beyond their means couldn't afford the rent.

The Right to Rent Would Flatten the California Housing Market.

Banks and mortgage investors would bear the direct costs of such efforts — boo-hoo — but here again, that doesn't mean you'll pay nothing. As Brookings' Dynan notes, the banking system remains fragile: Want another bailout?

And economist Bill Emmons of the St. Louis Fed thinks that forced write-downs would make lending unpredictable, which in turn could make mortgages costlier. In any case, given the climate in Washington, the chances for any major federal legislation seem slim. It's more likely that a push for write-downs will come from state attorneys general pursuing the robo-signing scandal. "The AGs are out for blood," says analyst Zelman.

So the ultimate workout remains unclear, but two things are certain. First, says Dynan, for the economy to get back on solid footing, households have to unwind much of the leverage they've taken on, and mortgage defaults are an inevitable part of that. (note the impact on disposable income in our consumer-driven economy when the ATM is turned off.)

The question is whether families who misjudged the real estate market (the majority of whom are not as affluent as folks in Ladera) must bear the brunt of the cost of this deleveraging, or if more of the burden can be placed on the lenders that inflated the bubble — and that have, as noted, already enjoyed a bailout.

Second, the status quo has costs, even for those who've stayed in homes they can't afford. It's stressful: Before her short sale was approved, Irene Vecchione feared her house would be foreclosed at any moment and visited the courthouse-steps auction in Santa Ana, where scruffy guys in wraparound shades snap up houses, to see how her dream might end.

And every month that the Vecchiones, and millions like them, don't pay in full is another month they don't rebuild their credit. Finally, when a modification doesn't work out, a homeowner has simply thrown good money after bad. "We paid what they told us to pay," says Joshua. "But we're in the same position as people who just didn't bother."

A responsible borrower goes Ponzi

The lure of free money is difficult to resist. Even those who demonstrated that they could borrow responsibly later blew up after they spent a pile of free money and couldn't pay it back. HELOC money is like heroin or cocaine: don't try it because you might like it, and once your hooked, it ends badly.

- This property was purchased on 9/26/2000 for $452,000. The owner used a $332,000 first mortgage and a $120,000 down payment.

- On 1/28/2002 she refinanced with a $322,000 first mortgage.

- On 1/18/2002 she refinanced with a $331,200 first mortgage. Through her first two years of ownership she at least broke even on her debt.

- On 4/11/2003 she refinanced with a $322,500 first mortgage and a $50,000 stand-alone second. It was the beginning of the end.

- On 2/27/2006 she refinanced with a $450,000 first mortgage.

- On 3/13/2007 she refinanced with a $450,000 first mortgage.

- On 4/7/2008 she borrowed $70,000 from a friend who was just wiped out in the foreclosure.

- Total property debt was $520,000.

- Total mortgage equity withdrawal was $198,000.

- The lender moved quickly once they issued the NOD.

Foreclosure Record

Recording Date: 08/25/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/24/2010

Document Type: Notice of Default

The property was sold at auction for $641,000 on 9/28/2010. The flipper is trying to make almost $160,000 on the deal. Do you think the market will give it to them?

Irvine Home Address … 32 COLUMBUS Irvine, CA 92620 ![]()

Resale Home Price … $799,000

Home Purchase Price … $452,000

Home Purchase Date …. 9/28/2010

Net Gain (Loss) ………. $299,060

Percent Change ………. 66.2%

Annual Appreciation … 250.9%

Cost of Ownership

————————————————-

$799,000 ………. Asking Price

$159,800 ………. 20% Down Conventional

4.87% …………… Mortgage Interest Rate

$639,200 ………. 30-Year Mortgage

$163,001 ………. Income Requirement

$3,381 ………. Monthly Mortgage Payment

$692 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$133 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$4,206 ………. Monthly Cash Outlays

-$822 ………. Tax Savings (% of Interest and Property Tax)

-$787 ………. Equity Hidden in Payment

$299 ………. Lost Income to Down Payment (net of taxes)

$100 ………. Maintenance and Replacement Reserves

============================================

$2,997 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,990 ………. Furnishing and Move In @1%

$7,990 ………. Closing Costs @1%

$6,392 ………… Interest Points @1% of Loan

$159,800 ………. Down Payment

============================================

$182,172 ………. Total Cash Costs

$45,900 ………… Emergency Cash Reserves

============================================

$228,072 ………. Total Savings Needed

Property Details for 32 COLUMBUS Irvine, CA 92620

——————————————————————————

Beds: 5

Baths: 3 baths

Home size: 3,230 sq ft

($247 / sq ft)

Lot Size: 5,300 sq ft

Year Built: 1979

Days on Market: 35

Listing Updated: 40513

MLS Number: S638691

Property Type: Single Family, Residential

Community: Northwood

Tract: Pl

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Great 5 bedroom PLUS bonus room model… Could be 6 bedrooms as bonus room has a closet. Interior tract location with livingroom with vaulted ceilings, 1 bedroom downstairs, open kitchen, familyroom w/fireplace, plus den downstairs, spiral staircase. Huge master with sitting area with fireplace has vaulted ceilings also and large bath, walk-in closet. All bedrooms are good sized. BRAND NEW roof just installed. 3 car garage, great bonus room, back yard has firepit, in ground spa. Park located within tract. This beautiful familyhome is in a great area with an excellent school district… This is NOT a short sale.

.jpg)