Irvine is a premium Orange County Community, but how large is the premium for the land? Today we will take a look.

Irvine Home Address … 14132 MOORE Ct Irvine, CA 92606

Resale Home Price …… $559,900

We never lost control

You're face to face

With The Man Who Sold The World

Nirvana — The Man Who Sold The World

Has any man sold more homes than Donald Bren? I don't know, but I doubt it. He and his Irvine Company are planning to sell a few more. Any takers?

Irvine Co.: 1,350 homes sold, more coming

April 8th, 2011, 3:00 pm — Jon Lansner

The Irvine Co. — fresh from a remarkable 2010 where their Irvine villages were a top-selling new-home project in America — will officially launch four more North Irvine projects Saturday.

The company has sold 1,350 homes in North Irvine communities since January 2010 —

Perhaps the Irvine Company is not used to having fact checkers follow them around, but the sales numbers they throw out are not accurate. And I strongly suspect the sales numbers are intentionally exaggerated to create false urgency to sell more homes.

From January 2010 to February 2011, they closed on 642 home sales. The numbers they are reporting are double what really sold. Perhaps if I were dependent upon the Irvine Company for advertising revenue, perhaps I would let transparent lies pass by, but since I don't fear them pulling ad revenue from me, I will provide accurate numbers.

and officially launches 12 model homes in four neighborhoods (DETAILS HERE!) in the Stonegate neighborhood. All told, the four new projects — click on sketches above for larger images and details — consist of 486 homes from one-bedroom, 1,129-square-foot flats to 2,974-square-foot, 5-bedroom detached homes. Prices? From the mid-$300,000s to high-$700,000-plus.

Dan Young, Irvine Co.’s homebuilding chief, continues to credit detailed market research for the company’s success — a distinct rarity in a homebuilding world that elsewhere runs near historic lows.

He's right in pointing out that the Irvine Company is leading the way out of the home building recession. They restricted sales so much in 2008 and 2009, they didn't overbuild and saturate the market with product they couldn't move. The activity in 2010 stands in stark contrast to the rest of the industry.

“It’s got to be about the house,” he says of the projects continued focus, which he admits sounds simplistic — but it is not.

The Irvine Co.’s ongoing research found that the key buying group are young professionals who are picky — “they grew up in great homes” — and want something different than their parents’ house — “their expectations are higher.”

The long-vanished real estate boom, in Young’s eyes, made house selling so easy that bad homebuilding habits were born so that homes were “engineered not designed,” and that “took a lot of the romance out of the product.”

Having worked in architectural firms as a land planner for a number of years, I can attest to what Mr. Young is saying. When architects are busy, they are more concerned with putting out drawings and getting paid than they are about the nuances of the product. Plus, overly cost conscious builders end up stripping down the design to it's simplest and easiest to build form.

The new research helped the Irvine Co. plan homes that trade housing traditions — like a formal dining area– for large, kitchen-linked “great room” with a built-in “home management” area plus a covered, outdoor “California room” dining area. Buyer feedback has also led to further innovations, such as building bigger and more functional kitchen islands that are sculpted “more like a piece of furniture.”

It didn’t hurt the homebuilding endeavor that the Irvine Co. was blessed with a well-financed owner, billionaire Don Bren, who was able to put his own cash at risk on new homes when other builders still scramble for construction financing. ”We were in a position, financially, to take the large risk,” adds Young, who notes that the homebuilding effort has met or exceeded every financial plan including, “a good profit.”

The should be able to make a good profit considering they likely have less than $100/SF into the house itself, and the land basis is near zero.

The Irvine land premium

When the Irvine Company developed the Ranch, through good land planning and a commitment to quality, they have managed to create an enormous premium for Irvine compared to other inland Orange County communities. Only the beach communities carry a higher premium on the land.

I created the chart above by taking the median home prices and dividing it by the median lot size. Similar to a $/SF for houses, this reflects the value of the underlying land.

Irvine has always had a price premium, but when you factor in the fact that lots are also 20% to 30% smaller than surrounding communities, the $/SF of lot value is extraordinarily high. Creating this premium from nothing is the real genius and accomplishment of Donald Bren and the Irvine Company.

If you compared Irvine to the remainder of Orange County, how large is the Irvine land premium? How much more do buyers in Irvine pay on a per-square-foot basis than the Orange County median? Quite a bit.

From 1988 to 1994, the premium hovered around 50%, but in 1995 it began to climb. From 1995 to 2009, the Irvine premium hovered between 50% and 80%. When land values in the subprime areas crashed and took down the Orange County median, the Irvine land premium rose to unprecedented levels.

IMO, the elevated Irvine land premium reflects the fact that prices have not fallen in Irvine compared to surrounding communities. Perhaps Irvine has taken another step up from the crowd and the Irvine premium will remain above 80% permanently.

I doubt it.

It seems far more likely to me that resale asking prices in Irvine will continue to fall. Perhaps the Irvine Company will be able to hold pricing on its new product, but they may find sales goals elusive as the substitution effect drags down the high end and brings the Irvine land premium back into its historic stable range.

That check won't be very big

Sometimes when I comb through the property records, I feel like I am spinning the wheel of fortune. Some of these owners didn't spend their equity, so they leave the closing table with big equity checks. Most have some degree of Ponzi borrowing. My observation is that well over half have increased their mortgage. Some borrow a lot and some borrow a little, but most borrow something.

The owner of today's featured property borrowed enough to put a major dent in their closing check. At least they won't be a short sale.

Todays featured property was purchased on 7/22/1994 for $235,000. The owners used a $188,000 first mortgage and a $47,000 down payment. At first they behaved well, and when they first refinanced in 1997, they paid down the first mortgage to $186,000. However, on 12/10/2001, they opened a $50,000 HELOC and went Ponzi.

On 10/3/2002 they refinanced with a $232,500 first mortgage and got another $25,000 HELOC. They had gone Ponzi, and there was no looking back.

On 8/24/2004 they obtained another $75,000 HELOC, and they increased it to $100,000 on 4/18/2005.

On 7/26/2005 they refinanced with a $350,000 first mortgage, and finally on 4/24/2008 they obtained their final $100,000 HELOC. There is no way to be sure if they spent it. Either way, they already nearly doubled their initial mortgage and Ponzi borrowed at least $165,000 — money that won't be in their closing check.

Irvine House Address … 14132 MOORE Ct Irvine, CA 92606 ![]()

Resale House Price …… $559,900

House Purchase Price … $235,000

House Purchase Date …. 7/22/1994

Net Gain (Loss) ………. $291,306

Percent Change ………. 124.0%

Annual Appreciation … 5.2%

Cost of House Ownership

————————————————-

$559,900 ………. Asking Price

$111,980 ………. 20% Down Conventional

4.84% …………… Mortgage Interest Rate

$447,920 ………. 30-Year Mortgage

$113,830 ………. Income Requirement

$2,361 ………. Monthly Mortgage Payment

$485 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$117 ………. Homeowners Insurance (@ 0.25%)

$52 ………. Homeowners Association Fees

============================================

$3,015 ………. Monthly Cash Outlays

-$401 ………. Tax Savings (% of Interest and Property Tax)

-$554 ………. Equity Hidden in Payment (Amortization)

$208 ………. Lost Income to Down Payment (net of taxes)

$70 ………. Maintenance and Replacement Reserves

============================================

$2,337 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,599 ………. Furnishing and Move In @1%

$5,599 ………. Closing Costs @1%

$4,479 ………… Interest Points @1% of Loan

$111,980 ………. Down Payment

============================================

$127,657 ………. Total Cash Costs

$35,800 ………… Emergency Cash Reserves

============================================

$163,457 ………. Total Savings Needed

Property Details for 14132 MOORE Ct Irvine, CA 92606

——————————————————————————

Beds: 4

Baths: 2

Sq. Ft.: 1910

$293/SF

Property Type: Residential, Single Family

Style: One Level, Contemporary

Year Built: 1975

Community: 0

County: Orange

MLS#: S653562

Source: SoCalMLS

Status: Active

On Redfin: 4 days

——————————————————————————

Immaculately maintained open plan single story detached home in the Colony. STANDARD SALE! Master and 2 bedrooms on ground floor level, permitted addition includes loft currently used as 4th bedroom. Large family room and bay window views of a private, tree-lined, greenbelt. Peaceful cul de sac street. Adjacent to all shopping and the 5 freeway on/off-ramps. Many upgrades including: quiet, dual pane custom Anderson windows, 6 panel doors, Travertine 16' tiles and carpeting, landscaped bricked yard with built in grill. Roof is 2 yrs new Eaglelite Concrete tile, All appliances-insured and inspected plus replaced AC, Heat, Vents about 6 years ago. Annual Termite inspections. The Colony has the lowest HOA fees in Irvine-$52.00/month-NO Mello Roos, includes free clubhouse use w/ bbqs, pool/lifeguard/swim team, basketball, tennis, volleyball, serene tree-lined park with large tot-lot playground. Many community events. 4 Blocks-Irvine HS; 6 Blocks-College Pk. Elementary; 10 Blocks-Venado Middle.

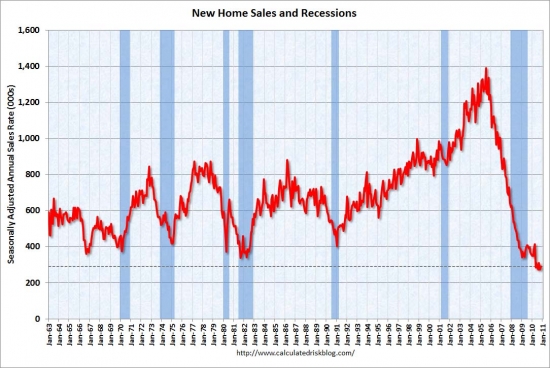

There is another takeaway between your Irvine new home sales graph and CR’s. The nationwide giant peak in 2005, 75% above the early 2000’s run-rate, compares to Irvine being at the same level. There is also the dip in Irvine’s sales in 2004, while nationwide was still booming.

I’m sure you know this, but Irvine’s small lots are a feature not a bug. They allow parks & schools to be closer to each home. In my part of NC, land around the edge of our city is not scarce. But if you look at sales & construction, they are more in neighborhoods with smaller lots than slightly further out neighborhoods with much larger (1-2 acres or more) lots. Part of it is the amenities, but also if you have a large lot, and your neighbors have large lots, you don’t have many neighbors. For some that is a feature, but for others, it’s not.

I understand the land premium, and discussed this with my dad in FL. I did not and still do not understand why the premium changed so much during the bubble – this was even more pronounced in FL.

Land value is very closely tied to home price, and when home prices went up much more quickly than the cost of construction, the “left over” fall to land residual and developer profit. Land values skyrocketed during the boom and crashed very hard when house prices went down. Basically, 80% or more of the change in price of houses went directly to land value — a process that works in both directions.

As for the lot size, I think smaller lots can be made more desirable by their configuration and neighborhood amenities, but consumer behavior is nearly always going to favor larger lots. Woodbury did a good job of substituting private use spaces (yards) for public use spaces (parks). However, if done poorly, high density products can quickly degrade into near slums.

In terms of development in Irvine, during the boom, was TIC selling lots to builders/contractors? Was a good part of the run-up in new home cost builder profit or was it all in the land sale?

As a follow-up, BK said on OCReader that builders were only allowed 6% margins even back when they purchased land from TIC. I found that strange but here is what he said:

http://www.ocreader.com/forum/viewtopic.php?p=15491#p15491

Could TIC really exert that much control back when they sold the land to the builders?

I would imagine that TIC would just stop selling lots to builders if they found their margins creeping > 6%. It does somewhat make builders contractors for the developer. Builders, especially those that remembered the early 90’s crash, would probably trade the profit for security. I would also imagine that building is stronger in Irvine than in other areas of SoCal, so not getting blacklisted by TIC would be prudent.

6% also puts the contribution of the builder on equal footing as the realtor.

“Could TIC really exert that much control back when they sold the land to the builders?”

Yes, they can and they did.

The retail lease contracts are similarly structured so profits are limited by onerous profit sharing agreements with TIC’s retail division.

Perhaps if I get really ambitious for a post, I may do an analysis of how much of a typical Irvine resident’s paycheck goes either directly or indirectly to TIC. It’s an astonishingly high percentage when you consider they sell the houses, rent the apartments, and control the commercial centers.

“6% also puts the contribution of the builder on equal footing as the realtor.”

That is an interesting perspective. Makes sense, writing poorly worded property descriptions takes the same skill and effort as building a home — right?

I have to step back and say there has been amazing progress made today. It has finally been acknowledged that Irvine has always had a large premium outside of the rental premium. I say congratulations to the psychological progress and acceptance to this fact based on the hard data that has always existed.

The premium for Irvine should apply to rentals too. Think Manhattan. Prices are insane, but rents are too.

That rents & prices in Irvine are more divorced than other areas is something different than the pure land premium.

I’ll let the peanut gallery chime in on how vastly inflated rents are in Irvine, but let’s take a look at today’s irvine property with tremendous freeway access. Monthly cost of ownership is $2300, I’d bet it rent for $2500. You could drive your car directly into your yard.

hah, and any drunk on the off-ramp to the freeway can drive their car directly into your yard also!

I forgot to comment in the post on how awful the location of this property really is. The back of this house is adjacent to the peak breaking area for cars exiting the freeway. So in addition to the freeway noise and pollution from being so near the 5, the owners of this property have to deal with the loud and irregular sound of people breaking. I imagine squealing breaks are rather jarring at 2:30 AM.

This house requires both soundproofing and air quality remediation.

From the realtor comments on Redfin:

“Backs to Culver exit off of 5 freeway. You don’t see it, but you hear it clearly.”

So you said that there is a premium to own over rent, yet this property seems to have ownership costs below your estimated rent. That says that there is no premium over renting.

Premium 1 is why it is more expensive to rent in Irvine vs. somewhere else.

Premium 2 is why it might be more expensive to buy/own in Irvine vs. renting in Irvine.

“It has finally been acknowledged that Irvine has always had a large premium outside of the rental premium.”

The post never made any reference to rentals nor to rental premiums. You are making stuff up and seeing what you want to see rather than what is really there.

“I say congratulations to the psychological progress and acceptance to this fact based on the hard data that has always existed.”

Sometimes the bullshit you spout is really hilarious.

PR was stating that you acknowledged the large premium that always existed for Irvine.

He is implying you have acknowledged the rental premium in the past but have final acknowledge the other premiums that have historically existed.

Not sure what he is making up exactly.

“It has finally been acknowledged that Irvine has always had a large premium outside of the rental premium”

When did IR ever talk about “a large premium outside of the rental premium”

That is what PR is making up.

I guess you’re right. Irvine is exempt from the housing decline that’s now impacting every other community in Orange County, including NB, LB, etc.

Way to go! 🙂

@lee

didn’t know that anyone stated that…much less PR in this particular post.

All areas have declined. It is just a matter of what degree.

Don’t tell me, it was all that gov’t intervention that didn’t save Miami, Las Vegas or the inland empire but it sure saved Irvine. Phew. The central bank sure can focus its “save” button on a particular neighborhood.

“Don’t tell me, it was all that gov’t intervention that didn’t save Miami, Las Vegas or the inland empire but it sure saved Irvine.”

You talk as though you think this is over.

Here’s what I think. Some cities, like the one’s you mentioned above have already, or close to, hit bottom. Other cities, like Irvine, and most of OC, have not … in the meantime, the long-term perpetual decline continues.

Japan has been dealing with it for more than 2 decades. I don’t know if it’s gonna last that long in America, but I do know this ponzi scheme is not done unwinding. The fire is not over … no way.

which might all come true…

But why was Irvine and most of OC different versus those other cities you mention as having hit bottom?

Why have those markets hit bottom while OC will face a continue slow grinding decline?

Rarely are such questions asked: Are premiums being acknowledged? Is amazing progress being made? Is Irvine sophistication being respected? Are PhDs and FCBs being misunderestimated? Is our children learning? Is the passive voice being used?

Where is IHO? Shouldn’t he be telling us how many sales there were last weekend at the grand opening of Stonegate or Woodbury East, or whatever they call those tiny lots?

You rang?

Maricopa, the lone SFR project in Stonegate, had 5 sold buttons out of the 8 available in Phase 1. Starting prices for those overpriced homes were $800k+… can you believe that — for a 2400sft home with only a 2-car garage, no formal dining or living and only 4 bedrooms? It was an FCB convention!

And it gets worse… Laguna Altura has almost the same exact floorplans (with a few tweaks that should have been included in Maricopa) for almost $200k more:

http://www.irvinepacific.com/LagunaAltura/Map-and-Amenities.aspx

Check out those prices… detached condos going for almost $800k, SFRs starting at mid $900ks! Irvine land premium indeed… also gate and proximity to Laguna Beach premium.

Did we just time jump back to 2005? Bleh.

If they can get those prices, more power to them. I can’t see the bubble rally resuming like they think it is. Either sales will be weak or incentives will increase, or perhaps both.

I am hoping for a TON of both.

I think TIC central command understands how strong demand is for new product in Irvine.

Through price increases, they’re able to gauge how much the buyer can take, like $5.00 gas

If there’s push back and sales are particularly slow or weak, a few token concessions are thrown in.

Either way, they still come out ahead.

Hello All –

…any thoughts or prediction to prices and sales when QE2 ends early summer? We clearly have rates at seriously subsidized lows. If rates rise a point or 2 in the next 12 months what will happen to prices and sales?

Where do you think rates will be in 12 months? If you were a bank would you lend someone money for 30 years for less than or about 5%??

Just some interesting thoughts about where we are going…

BD

The US inflation rate at nearly 10% using the previous methodology.

http://www.cnbc.com/id/42551209

Interesting stuff. I wouldn’t be surprised if rates don’t climb 2-4 percent in the next 5 years for a 30 year fixed mortgage.

BD

BS

How loud were people talking about inflation in 2007? Besides IR & others here talking about housing inflation. Check the shadowstats. Their inflation measure was > 10% for 2005-2007 and around 10% for the whole period of 2001-2008.

So we had the same old-measure CPI during 2001-2008, AND a massive housing bubble (a serious form of inflation that produces a massive resource shift), yet most of these inflation hawks were mum. What’s changed?

Yes there is primium on Irvine land and its all Don Bren. At age 78 he has very little or no debt and and the capital to call the shots. As a minority shareholder in TIC around 1978 he raised hell with the marketing of the first phase of Woodbridge. The real estate market had a great run up from late 1975 to late 1979 and folks were camping out for a new home in Woodbridge. Well Don Bren made if kown that the price points were to low. At the time the ranch was owned by the Ford/Fisher/Taubman partnership. Al Taubman and his partners from Michigan were always happy with thier returns on the TIC investment and I’m sure Don Bren will get every thin dime he can out of ranch.

If you want a new home in Irvine I would wait for the Five Points group development on El Toro base. They have leveraged capital and have to sell homes, fast.

RE: Has anyone sold more houses than Don Breen?

William Levitt probably has him beat.

http://en.wikipedia.org/wiki/William_Levitt