Ireland experienced a housng bubble even larger than ours, and they are facing many of the same problems.

Irvine Home Address … 24 Wayfarer Irvine, CA 92614

Resale Home Price …… $695,000

Life's backwards

People turn around

The house is burned

The house is burned

Sinead O'Connor — Fire on Babylon

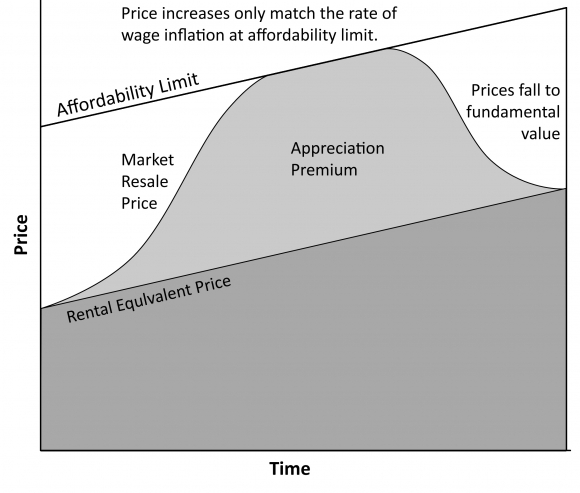

The day investors stopped using toxic loans as a conduit to inflate prices, credit crunched, and the fate of the housing market was sealed. It was only a matter of how long and painful the journey back to reasonable valuations was going to be.

Many with a vested interest in real estate refuse to face that the value of the house is burned. Owners don't want to face it, banks don't want to face it, and the government isn't forcing them to face it. Lenders have life backwards: they have a value on their books that determines what they need to get for their bad loans or its underlying collateral. Markets don't work that way.

Irish Banks Seek to Delay `Evil Day' as Home-Loan Losses Rise

By – Mar 10, 2011 4:01 PM PT

Perched on a chair overlooking a wood panel-lined room in Dublin’s High Court, a bespectacled Judge Elizabeth Dunne has become all-too-used to hearing from the victims of Ireland’s economic meltdown.

Each Monday, Dunne presides over repossession hearings, with one in 10 Irish mortgages now in trouble. At the end of last year, more than 79,000 borrowers were behind on payments or had loan terms altered due to “financial distress,” the country’s central bank said on Feb. 28.

“Things are getting worse and worse,” said Dunne, as she weighed the case of a couple about 114,000 euros ($158,000) in arrears on a 558,938-euro home loan, one of 74 cases on her list on March 7. “Putting off the evil day is not going to help.”

I don't think the banks share her view on the evils of putting off the day of reckoning.

Our mortgage default rate runs at about 10% just like Ireland's, and their banks are delaying repossession just like ours are.

Irish mortgages account for more than a third of about 270 billion euros of loans that remain with the nation’s so-called viable lenders — Allied Irish Banks Plc (ALBK), Bank of Ireland Plc, Irish Life & Permanent Plc and EBS Building Society. The country’s new coalition parties are not convinced “that there has been proper transparency or full disclosure by the banks” on home-loan impairments, Alan Shatter told RTE Radio on March 7, two days before his appointment as Minister for Justice.

Wow! Someone in Ireland's government actually seems to care about what happens on banks balance sheets. No politician in the United States is questioning the accounting gimmicks currently being used by our major banks.

Historically, banks have always controlled the Republicans, but now with Democrats showing little or no spine when it comes to reigning in the banks, lenders are being allowed to post bogus accounting numbers on the idea that the market will come back and they will be made whole. That isn't gong to happen. There are far too many banks on the wrong side of the trade. They all have copious amounts of property, and they all need to dispose of it at top dollar.

“There has been a continual under-estimation of loan impairments in Irish banks over the past few years,” Ray Kinsella, banking professor at the Smurfit Business School at University College Dublin, said by telephone. “I am seriously concerned about mounting loan losses in their mortgage books.”

New Stress Test

The bad loans may be reassessed as early as this month when Ireland’s central bank concludes a third round of stress tests on the country’s lenders. The results will determine how much of a 35 billion-euro international bailout fund Ireland will need to draw down.

A year ago, Irish regulators stress-tested for a 5 percent loss rate on Irish mortgages. This year’s review “will take account of the deteriorating economic conditions and hence” loan-loss assumptions “may be higher,” said Nicola Faulkner, a spokeswoman for the central bank, by e-mail.

What a joke. Their real estate prices are going to halve over a five year period, and they will take forever to get back to the peak. Their 5% loss rate likely didn't factor in the market conditions created by their own inventory.

Ireland is suffering after a decade-long real estate boom collapsed in 2007. Already, the state has bought 72.3 billion euros of risky commercial property loans from the banks, at an average discount of 58 percent. Irish house prices, which quadrupled in the decade to 2007, have since plunged more than a third. Unemployment has tripled to 13.5 percent over the same period.

Who is lining up to buy their overpriced homes?

House Price Declines

This year’s tests may stress loan books against the unemployment rate rising to 16 percent, house prices falling 60 percent from their peak and “negligible” economic growth, said analysts including Jim Ryan and Michael Cummins of Glas Securities, the Dublin-based fixed-income firm, in a note to clients March 9. The central bank declined to comment.

That is classic. These private analysts portray the reality of what is going to happen to the economy and the housing market. Obviously, the central bank doesn't want to run that stress test (a realistic one) because it would show how totally screwed they really are.

More than 300,000 households, or about 40 percent of mortgages, may find their mortgages are worth more than their homes, so-called negative equity, before the property market bottoms out, said David Duffy, an economist at the Economic & Social Research Institute in Dublin, who estimates that house prices will fall by as much as half from peak to trough.

We currently have 25% of our mortgages underwater, but if prices drop another 10%, we could easily reach 40% of mortgages underwater at the bottom.

His estimate of a 50% drop in Ireland looks reasonable when you consider prices more than doubled in 7 years.

Prices in Ireland are probably near where they would have been if no housing bubble occurred. However, a housing bubble did occur, and after the collapse, the downward price momentum and problems with supply will continue to push prices lower and cause an overshoot to the downside.

Morgan Kelly, a University College Dublin economics professor dubbed “Doctor Doom” for his bleak assessments of Ireland’s housing market, wrote in the Irish Times on Nov. 8 that banks face “mass mortgage defaults” and a “wave of foreclosures.” Kelly declined to be interviewed.

Strategic default will ravage what's left of the market there just as it has in Las Vegas.

EU Bailout

Iceland, where almost 40 percent of residential mortgages were in negative equity by December, decided that month to write off mortgages and other household debt by as much as $858 million. Unlike Ireland and other western nations, the Nordic nation placed its biggest lenders in receivership in 2008 rather than offer taxpayer-funded capital injections.

Ireland has bolstered its banks with 46.3 billion euros of additional capital over the past two years. The nation was forced to agree to an 85 billion-euro bailout on Nov. 28, led by the European Union and the International Monetary Fund. That package includes 10 billion euros to recapitalize the banks up- front and a further 25 billion euros of “contingency” capital to be used if required.

“When the teams from the EU, ECB and IMF arrived in November, they probably thought they would find huge holes remaining in the banks’ loan books, but they did not,” said Alan Ahearne, who was economics adviser to Brian Lenihan, the former finance minister. “It’s not that there’s some black hole in the Irish banks that hasn’t previously been discovered.”

Actually, I think there is…

10 Billion Euros

Still, a previous regulatory target for banks to hold 8 percent core tier 1 capital, a gage of financial stability, “wasn’t enough to support confidence in the banks” given the economy’s problems, Ahearne said. Ireland agreed as part of the bailout to increase lenders’ capital levels to no less than 10.5 percent by the end of this month.

The 10 billion euros of initial capital destined for banks under the rescue package “pretty much covers our base case scenario” for remaining losses in Irish banks, said Ross Abercromby, a London-based analyst at Moody’s Investors Service, by telephone. “The additional 25 billion euros contingency fund would cover our stress scenario, which is pretty severe.”

Moody’s estimates that losses on Irish mortgages may be as high as 14 percent where the loan-to-value ratio is over 90 percent. That rises to 16 percent “in our worst case,” the ratings company said.

Household debt soared from 48 percent of disposable income in 1995 to 176 percent in 2009, catapulting Irish consumers into fourth place in 2008 in an international league table of personal indebtedness from 17th place in 1995, according to Ireland’s Law Reform Commission.

Are the analysts correct, or will Ireland's banks be looking for more bailouts?

Savings Rise

On the other hand, Irish households’ net savings as a percentage of disposable income rose from zero in 2007 to 12 percent in 2009, according to the Central Statistics Office. The savings rate should remain around the same level for this year and next, the ESRI said on Jan. 20.

That is impressive. Savings will provide the internal capital for Ireland to prosper again. Americans are not quite so thrifty.

Irish Life & Permanent Plc Finance Director David McCarthy said he doesn’t believe there are undiscovered losses in banks’ mortgage books. The group, which has 26.3 billion euros of Irish home loans, saw arrears of less than 90 days peak in mid-2010, McCarthy said on March 2, and they’ve “been falling, albeit quite slowly, since then,” he said.

Bank of Ireland spokeswoman Anne Mathews referred to CEO Richie Boucher’s Nov. 12 statement to analysts that there was “clear evidence” that arrears were “beginning to stabilize.” Allied Irish and EBS spokesmen declined to comment.

‘Different Phenomenon’

The Irish home-loan market is “a totally different phenomenon” to the commercial real-estate market, said John Reynolds, chief executive officer of Belgian-owned KBC Ireland.

“Irish banks have been hamstrung by a narrative that has been allowed to develop that all their lending was as mad as their real-estate lending,” said Reynolds. “The reality is that the Irish banks, when they didn’t do the real-estate stuff, which was a seductive drug, did bog-standard, criteria-driven lending.”

If that statement is accurate, Irish banks may be better off than we give them credit (pun intended). Our banks are hamstrung by real estate losses, but they are severely hampered by derivative losses and commercial losses. It wasn't housing that brought down Citi.

“Banks are exercising huge forbearance on borrowers in arrears,” partly because of pressure from the authorities “but also because they don’t want to repossess houses as there’s no second-hand market to sell them,” said Kinsella, the banking professor. Lenders only held 585 repossessed residential properties at end-2010, according to the central bank.

The new government said on March 6 it may bring in a two- year moratorium on repossessions “of modest family homes where a family makes an honest effort to pay their mortgages.” Currently, mortgage holders can enjoy 12-month protection from legal action if they are co-operating with lenders.

The coalition also pledged to fast-track changes in laws requiring bankrupted individuals to wait 12 years before they are discharged from their debts.

Wow! That really is different than what we are doing. Here in the United States, the GSEs have been moving to relax the waiting period so they can manufacture enough buyers to recycle their bad loans.

If Ireland does make it more restrictive to get a new loan, their housing market is really going to crumble. I believe this policy to be an empty threat to deter strategic default. Nice idea, but the defaults are going to occur anyway, and the policy will end up quietly being changed to get buyers back into the queue.

Rising Interest Rates

The issue of full recourse for mortgage loans is positive for banks, if not for borrowers in negative equity, said Abercromby. “If that level of recourse is watered down, by introducing less stringent bankruptcy laws, you could be looking at higher losses,” he said.

And if they don't relax those laws, they are sentencing an entire generation to debt servitude.

That's really the issue faced both here and abroad: increase bank losses and reduce the debt burden on the population, or limit the bank losses and force families to spend their entire working lives to pay for the mistakes of bankers. Each government through its own process will determine who the winners and losers are in the battle of the banks versus the people.

From what I am seeing here in the US, the banks will probably win. Prices will stay inflated, debt-to-income ratios will remain elevated, and everyone will be forced to put the maximum amount of income possible toward a house payment if they want to own something comparable to a rental. People will drink the appreciation kool aid, but with everyone already stretched to the max, prices won't go up any faster than inflation. What happens then?

There is also concern that rising interest rates will hit borrowers who have managed to remain out of trouble so far. ECB President Jean-Claude Trichet signaled on March 3 the bank may raise its benchmark rate from a record low of 1 percent as soon as next month.

Banks have already increased variable home loan rates from an average of 3.16 percent in mid-2009 to 3.87 percent by November, according to the ESRI. Lenders, including Irish Life and EBS, have hiked borrowing costs again since then.

Meanwhile, at least half of all Irish mortgages are so- called tracker products, with pricing linked to ECB’s key rate, according to the Irish Banking Federation.

More than fifty percent of Irish mortgage are ARMs underwritten at the bottom of the interest rate cycle. Hmmm… do you think they may have some payment shock to deal with over the coming years as interest rates rise?

Adjustable rate mortgages will separate the successful owners from the unsuccessful ones over the next decade. Those trying to save a few dollars today will pay a higher price when they refinance. If they roll over a series of 3-year ARMs, in nine years, they may be paying the same mortgage balance at 9% instead of the 5% or less borrowers are locking in today.

ARM holders are signing up to give ever-increasing payments to their lenders for the foreseeable future.

Tracker Rates

While banks may be able to contain bad-loan losses on their mortgage books, “a big and ongoing problem is that a large part of their mortgage books are based on ECB tracker rates, which banks are funding at a loss,” said Karl Deeter, operations manager with Dublin-based Irish Mortgage Brokers.

Back in the High Court, Dunne is listening to how a house builder from Co. Cavan, close to the border with Northern Ireland, is 67,000 euros in arrears on a 360,000 euro home loan taken out three years ago.

Times are hard out there, says the man, who has a plant hire and quarrying business, but is making partial remortgage payments. “I understand that well,” says Dunne. “I see that every Monday.”

To contact the reporter on this story: Joe Brennan in Dublin at jbrennan29@bloomberg.net

To contact the editor responsible for this story: Edward Evans at eevans3@bloomberg.net

ireland had a real estate bubble very similar to ours, and they are grappling with the same issues we are in its deflation.

I wonder if you can pick up any good cashflow properties there now that prices have crashed?

That pesky comparable

It must be nice to believe a precious cottage still commands peak pricing. Well, good luck to these sellers with the appraisal because a model-match just sold last week for $488,000.

|

$488,000

Sold on Mar 09, 2011 |

0.05 miles

3 bd / 2.5 ba 1,571 Sq. Ft. |

It's pretty hard for an appraiser to ignore a week-old model-match a few blocks away that just sold for $207,000 less. Perhaps he can bump up the value with the upgrades. Pehaps a price as high as $525,000 might be justifiable, if the appraiser were so inclined.

If these owners want to get $695,000, it better be an FCB with a lot of cash. The're going to need it.

For the record, these people were responsible borrowers. They only increased their mortgage once, and it certainly appears that money was put into the property.

Irvine Home Address … 24 Wayfarer Irvine, CA 92614 ![]()

Resale Home Price … $695,000

Home Purchase Price … $236,000

Home Purchase Date …. 7/21/97

Net Gain (Loss) ………. $417,300

Percent Change ………. 176.8%

Annual Appreciation … 7.9%

Cost of Ownership

————————————————-

$695,000 ………. Asking Price

$139,000 ………. 20% Down Conventional

4.82% …………… Mortgage Interest Rate

$556,000 ………. 30-Year Mortgage

$140,972 ………. Income Requirement

$2,924 ………. Monthly Mortgage Payment

$602 ………. Property Tax

$150 ………. Special Taxes and Levies (Mello Roos)

$116 ………. Homeowners Insurance

$139 ………. Homeowners Association Fees

============================================

$3,931 ………. Monthly Cash Outlays

-$709 ………. Tax Savings (% of Interest and Property Tax)

-$691 ………. Equity Hidden in Payment

$256 ………. Lost Income to Down Payment (net of taxes)

$116 ………. Maintenance and Replacement Reserves

============================================

$2,904 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,950 ………. Furnishing and Move In @1%

$6,950 ………. Closing Costs @1%

$5,560 ………… Interest Points @1% of Loan

$139,000 ………. Down Payment

============================================

$158,460 ………. Total Cash Costs

$44,500 ………… Emergency Cash Reserves

============================================

$202,960 ………. Total Savings Needed

Property Details for 24 Wayfarer Irvine, CA 92614

——————————————————————————

Beds: 3

Baths: 3

Sq. Ft.: 1571

$442/SF

Lot Size: 3,024 Sq. Ft.

Stories: 0002

Year Built: 1980

Community: Irvine

County: Orange

MLS#: 11003979

Source: VCRDS

Status: Active

On Redfin: 1 day

——————————————————————————

A Beautiful 3 bedroom 2 1/2 a bath remodeled cottage home inside the loop in desirable Woodbridge. The kitchen features granite counter tops, new appliances, hardwood floors and new cabinets. Crown molding throughout the house. Remodeled bathrooms with granite counter tops and tile flooring. New paint throughout the home. Custom wood shutters, mirrored wardrobe doors. Painted garage floor. Dining room and family room opens to a beautiful landscaped private patio. New front landscape. Woodbridge offers community lakes as well as the community pools.

I would like to wish my visiting Irish mother-in-law a

.jpg)

.jpg)

Basically, they can take the rent, pretend it was a loan payment, and ignore the real value of the collateral. If they hold it as a rental long enough, they will pay off the amortizing loan.

Basically, they can take the rent, pretend it was a loan payment, and ignore the real value of the collateral. If they hold it as a rental long enough, they will pay off the amortizing loan.