realtors take advantage of their status as trusted experts to manipulate buyers, and they feel no responsibility when their statements are exposed as lies.

Irvine Home Address … 7 THORNWOOD Irvine, CA 92604

Resale Home Price …… $549,000

You're so good at stretching the truth,

into a sugar coated lie.

Everyone takes a bite.

I have been dining with the enemy.

It was a wolf in sheep's clothing.

Now it's so clear to me.

Oh-hhh-ohh

I've had enough of your games

if you're not trembling, you'd better be

cause we're gonna be the end of you

I've had enough of your games

I'm gonna show them who you really are

And I can tell you right now, it won't be pretty

The Providence — Wolf In Sheep's Clothing

There are some things that never made sense to me. I remember when I first read about prejudice, slavery, and segregation in grade school. I didn't understand how people could treat each other that way. It still doesn't make much sense to me.

Realtors are liars. We all know that, yet we tolerate and even encourage the behavior. Why would anyone want to hear bullshit? Apparently some people do. That doesn't make much sense to me either.

I proposed regulating the realtors in The Great Housing Bubble. Now others are calling for restrictions on realtors ability to represent financial performance.

Dr. Brent White of the University of Arizona has been featured in IHB articles on a number of occasions: Should You Walk Away from Home Debt? — Dec 21st, 2009; Strategic Default Is Merely Collecting On Home Price Protection Insurance Sold By Lenders — Apr 30th, 201; The Latest Lie about Strategic Default: Borrowers Are Emotional Fools — Jun 1st, 2010. He has consistently been right about the housing bubble.

Since Dr. White's paper is so long — and so good — I am reprinting it with some edits for brevity with limited commentary. I am not indenting and italicizing the quoted text to make it easier for you to read. What follows is not my original writing.

Arizona Legal Studies

Discussion Paper No. 11-10

Trust, Expert Advice, and Realtor Responsibility

Brent T. White The University of Arizona James E. Rogers College of Law

March 2011

Abstract: Real estate agents benefit from the trust associated with portraying themselves as real estate experts, yet are generally not legally responsible for the advice that they give. This lack of legal responsibility is at odds with psychological propensity of individuals to trust perceived experts. It also creates a genuine moral hazard, fueled the housing market bubble and contributed to the suffering of homeowners whose real estate agents encouraged them to buy as the market began to burst. In response to this problem, this article proposes a new regulatory regime requiring real estate agents to choose between two paths: (1) accept legal liability when they negligently, recklessly or intentionally make inaccurate or misleading pronouncements about a home’s value or investment potential; or (2) embrace their role as “salespersons” and refrain from offering advice or opinions about the real estate market to their customers.

TRUST, EXPERT ADVICE, AND REALTOR RESPONSIBILITY

Introduction

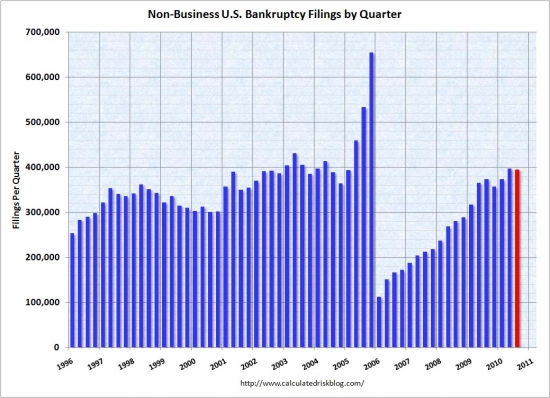

As the housing crisis enters its fourth year, national home prices are down over 30%, more than 11 million homeowners are underwater on their mortgages, and over 6.5 million homeowners have already lost or given up their homes to foreclosure. Over 4 million more homes are in the pre-foreclosure process – and most economists predict that the crisis has yet to run its course.

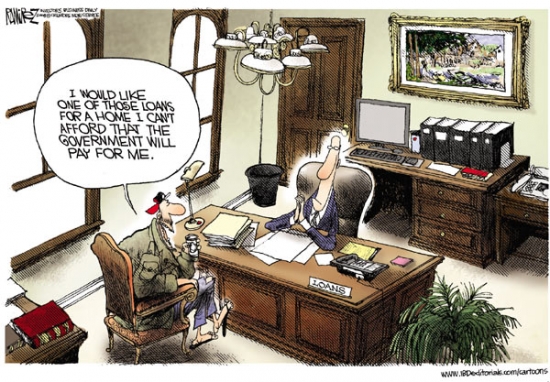

Public discussions over the causes and responsibility for the housing crisis have focused primarily on homeowners, who are said to have bought homes that they could not afford; lenders, who are alleged to have been irresponsible in their lending practices; and the government, which is alternatively accused of meddling too much in the mortgage market or failing to regulate the market when it should have. Largely lost in this discussion has been the role of the real estate brokerage industry in both stoking the housing bubble and then delaying public recognition that the bubble had burst.

Moreover, while homeowners, lenders, and the government – and by extension taxpayers – have all taken significant losses due to the housing meltdown, those in the real estate brokerage industry have borne no financial responsibility for their role in creating the housing bubble and burst. This includes not only the National Association of Realtors (NAR), but also individual real estate agents. Indeed, even real estate agents who knowingly conveyed overly-optimistic forecasts for the housing market and intentionally gave misleading advice to their clients have escaped responsibility for the financial suffering caused by their actions in the wake of the housing collapse.While such real estate agents may be a minority, even the most unscrupulous agents escape responsibility – as courts generally treat real estate agents as mere salespersons, who are simply not responsible for their advice or opinions.

Courts’ treatment of real estate agents as mere salespersons is at odds with most agents’ self-description as professionals who have specialized expertise on the housing market and who owe a fiduciary duty to their clients. Court decisions are also detached from the concrete reality of real estate transactions in which buyers hire and trust real estate agents to guide them through the complex process of purchasing a home. Indeed, literature from the cognitive sciences suggests that, because homebuyers are generally novices making complex decisions on the basis of limited information, real estate transactions are exactly the type of transactions where individuals are most likely to hire and trust a perceived expert.

This discrepancy between homebuyers’ psychological propensity to trust perceived experts and the legal rule that a buyer may not reasonably rely upon his real estate agent’s advice, creates a genuine moral hazard in which real estate agents benefit from the trust associated with portraying themselves as real estate experts, yet avoid responsibility for the advice that they give. This discrepancy is made more problematic by the fact that many buyers are likely unaware that their real estate agents bear no legal responsibility for their advice and opinions, and buyers are thus likely to place undue reliance upon their agents’ recommendations.

In response to this problem, this article suggests two possible paths: (1) fully professionalizing the real estate agent’s role, including regulations subjecting agents to legal liability when they negligently, recklessly or intentionally make inaccurate or misleading pronouncements about a home’s value or investment potential; or (2) de-professionalizing the real estate agent’s role by requiring mandatory disclosures to buyers that real estate agents are “mere salespersons” and barring real estate agents from offering advice or opinions as to a home’s value or investment potential. But – as the housing meltdown has shown – the middle path, in which real estate agents may represent themselves as professional experts but are treated as mere salespersons when it comes to legal liability, is both untenable and unfair.

The Rhetoric of Homeowner Responsibility

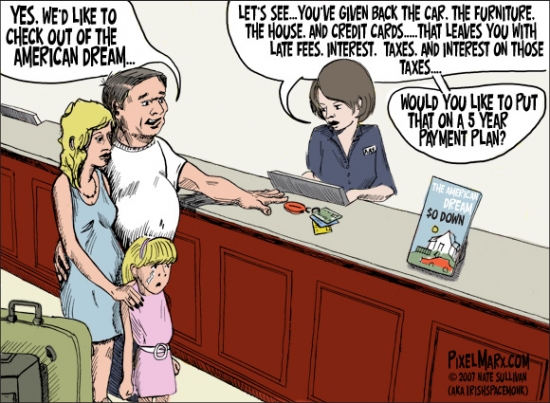

Looking back to 2005 and 2006, when the United States was in the throes of the housing bubble, it seems remarkable – if not downright foolish – that so many people in overpriced markets were willing to pay hundreds of thousands more for average-sized homes than those same homes would have sold for just a few years before. Moreover, in order to do so, these home buyers were willing to take on mortgage payments that frequently required all of their disposable income and were two to three times more than they would have paid to rent a similar home. Now that home prices have come crashing down, many of these homeowners find themselves throwing all of their disposable income into homes worth much less than they owe.

Any sympathy for these homeowners aside, they made the decision to purchase their homes. Thus, the common view holds, they must bear the consequences of their actions. They should have known that paying three times more for a mortgage than they could have paid to rent the same house was simply unwise. They should have foreseen that hugely inflated home prices might decline. And they shouldn’t have been so careless in taking on the burden of a mortgage payment that required all or most of their disposable income. If they now find themselves in a terrible predicament, it’s one of their own making. They signed their mortgage knowing full well that they were taking on a huge financial responsibility – and, if they now regret that decision, they have no one to blame but themselves.

This argument has great emotional appeal, as it ties into the American ethos of personal responsibility and the angst in some quarters that Americans are increasing losing sight of this value. This American ethos holds that ultimate decision-making responsibility lies with self. Messages of personal responsibility are big winners when it comes to the public dialogue related to underwater homeowners.

Indeed, many underwater homeowners themselves believe that they should accept responsibility for their mistake in buying at the wrong time. They blame themselves for being foolish – for not seeing this coming. If they hadn’t been in such a rush to buy a home, if they had listened to that voice inside themselves telling them that housing prices seemed crazy, if they had done some more research about the state of the housing market before making such a big decision, if they had bought a more modest home and not put all their eggs in the homeownership basket, and – better yet – if they had just rented instead, they wouldn’t find themselves in this mess.

The “Buyers Agent”

Such self-recrimination aside, it’s not typically the case that homebuyers make their decisions in isolation. While the ultimate decision may be their call, potential homebuyers are subject to a variety of outside influences including family, friends, and – critically – real estate agents (aka, “realtors”). Indeed, over 79% of homebuyers work with an agent in purchasing a home. As self- described experts on the housing market, buyer’s agents serve a variety of functions including assisting buyers in finding a suitable property, preparing an offer, and negotiating with the seller. Agents also typically advise the buyer as to an appropriate price, and whether the property is a good investment.

… Buyers may worry, for example, about whether they are purchasing at the right time or making a good financial decision by investing in real estate. This was particularly likely to be the case when housing prices reached the stratosphere during the boom and a reasonable person might have questioned whether it really made sense to buy at those prices. Anxieties are also likely to be pronounced now in a declining market, when a buyer might reasonably worry that the market still has a ways to go to hit bottom. Buyers in both situations will typically turn to their real estate agents for advice and reassurance. Real estate agents not infrequently respond – both in booming and declining markets – by assuring their clients that it is a “great time to buy,” and that buying a home is a wise and safe investment. Real estate agents will also typically offer some rationale why this is the case.

Because most buyers lack the perceived knowledge or experience of their real estate agents, buyers frequently trust their agents’ opinions and representations on such matters. Indeed, the buyer has probably engaged the agent for their expertise. Many successful agents work hard to further cultivate this trust throughout the relationship, including the sense that the agent is not simply “a salesperson,” but rather “a reliable adviser who cares more about the customer than the transaction.” If the agent succeeds in engendering this trust, it can pay “back in spades” at decision time, when the buyer is called to trust the agent as the “expert.”

But while homebuyers are called to trust real estate agents as experts, real estate agents also sell houses for a living. This dual role as advisor and salesperson creates an inevitable conflict of interest for real estate agents. For example, if a real estate agent had told her clients in 2005 and early 2006 that some of the country’s most prominent economists believed that housing prices were unsustainable or, in late 2006, that these same economists were arguing that home prices were headed for significant declines, her clients might have decided not to buy. If too many of her clients made this decision, the realtor could not have earned a living. It’s not good business to tell prospective homebuyers that the housing market may crash.

While highly-conscientious real estate agents might have nevertheless issued such warnings, many undoubtedly did not. Such agents were not necessarily acting nefariously, as many agents may have truly thought that residential real estate was a great investment. Like most homebuyers, many real estate agents didn’t see the crash coming. One doesn’t have to look far to find real estate agents who lost their own shirts in the housing collapse. Many real estate agents, however, must have at least heard the warnings that the real estate market was headed for trouble – and, if they didn’t, they weren’t paying attention.

NAR Spin

While an average person, caught up in their own lives and deluged by information in the internet age, might not have been aware of this debate, a real estate expert should have been – at least in order to be worthy of the expert label. Indeed, these warnings so alarmed those in the real estate brokerage industry that the New York Times reported that in August of 2005 that Robert Shiller had already “become the bugaboo of the multibillion-dollar real-estate industry. Its executives, like many Wall Street economists, say that low interest rates and a growing population will keep house prices rising, even if future increases are smaller than recent ones.” In other words, at least some experts in the real estate brokerage industry were well aware of the housing bubble warnings – and actively dismissed them.

The NAR, in particular, tended to discount any concerns about the housing market in 2005, 2006, and even well into 2007. The persistent line of the NAR during the height of the housing bubble was that there was no bubble – and that buyers should jump before prices got even higher. Moreover, as the housing market began to weaken in 2006, the NAR’s chief economist, David Lereah, explained that the market would land on a “high plateau” in 2006, and that the market was just leveling out, “headed for a soft landing.” Lereah argued that home prices had never declined on a national level before, and that worries of a national bubble bursting were absurd:

I’m getting tired of all these doomsayers. We live in houses, and our houses are not going to crash. This isn’t the stock market…. Local economies are relatively healthy. There’s job creation – this isn’t a scenario where bubbles burst. Can there be one or two or three or several local markets where prices actually go down? Yes. But to generalize for 30 markets or the whole real estate marketplace – that’s absurd.

Once prices did start to decline on a national level and continued to do so into 2007, the NAR assured its members and prospective buyers each month – for months on end – that the housing market had hit bottom and prices would soon begin to rise again. As Mr. Lereah would famously declare in March of 2007: “It looks like we've bottomed out. . . . When it's all said and done, this contraction in housing is probably going to be the least severe contraction we've ever had, which is going to surprise a lot of people.” Prices continued to decline for over three years thereafter, declining an additional 23% by July 2010. …

… Given all the indications of trouble in the residential real estate market beginning in late 2005, the NAR has been criticized for repeatedly dismissing concerns of a bubble and for not warning buyers that it might, in fact, not be a good time to buy:

By being such dishonest brokers of information, the NAR has now made themselves look ridiculous. No one knows what the future will bring, but consistently absurd spin offered up by the Realtor group not only does a disservice to the public, but is now working against the interest of Realtors themselves.”

Indeed, after leaving the NAR, Mr. Lereah himself admitted that he had put a “positive spin” on the housing numbers:

I worked for an association promoting housing, and it was my job to represent their interests. If you look at my actual forecasts, the numbers were right in line with most forecasts. The difference was that I put a positive spin on it. It was easy to do during boom times, harder when times weren't good. I never thought the whole national real estate market would burst…. [Looking back] I would not have done anything different. But I was a public spokesman writing about housing having a good future. I was wrong. I have to take responsibility for that.

The Blind Leading the Blind

Mr. Lereah’s admission of having spun the numbers aside, one can understand why many individual real estate agents – most of whom have no training as economists or as investment advisors – might have believed what they were being told by the NAR’s chief economist. As such, an agent might have understandably decided that there was no need to mention to his clients in 2005 and 2006 that some economists were predicting a bursting of the bubble and huge price declines to follow – assuming of course that the agent was paying attention to these warnings.

While this may seem reprehensible in retrospect, individual real estate agents would have had a powerful psychological need to believe that there was no housing bubble – and later that prices would land softly. This need would have arisen from the fact that a real estate agent who did not believe these things, yet failed to advise her clients that buying a home in 2005, 2006 or 2007 was a risky proposition, could not have seen herself as ethical and honest individual. However, an agent who advised her clients that buying a home was risky would have likely driven many clients away.

In other words, a real estate agent’s built-in conflict of interests – and the psychological need to see herself as ethical and honest person – would have consciously and unconsciously motivated her to selectively perceive information that supported her belief that residential real estate was a good investment and to discount information that did not. Confirmation bias, disconfirmation bias, and the tendency of individuals to engage in motivated reasoning are well-documented in scientific literature – and it’s safe to assume that real estate agents suffer from the same psychological biases as all other human beings. [The OC Register Says California had no real estate bubble.]

Additionally, real estate agents as a class would have been susceptible to herding behavior, which refers to the tendency of individuals to go along with the crowd – often despite their own misgivings. A real estate agent who had his own doubts as to the sustainability of the housing market would have been confronted by the apparent fact that few of his fellow agents agreed. If most other real estate agents were bullish on the housing market, an agent might reasonably have concluded that he must be wrong about his doubts – especially to the extent that he was not sure about his own judgment in the first place. Few individuals will stand alone and reject the reasoning of their cohort. Ironically, however, the more individuals who cast their own judgments aside and go along with the crowd, the stronger the herding behavior becomes, even though many – or even the majority – of the real estate agents in the crowd may have heard the warnings about the overheated housing market and privately feared that the herd was about to run off a cliff.

Given these psychological biases, one can also understand those real estate agents who, once the housing market began to soften, told their clients that the market was just leveling out, and would not decline. Moreover, to the extent that real estate agents believed the “all real estate is local” mantra,80 they might have felt justified in keeping any concerns or negative information about the national housing market to themselves, so as long as the buyer was not paying more than local “market prices.” In short, it’s understandable that many realtors may have chosen in 2005 and early 2006 to “accentuate the positive” and to say nothing to their clients about signs of trouble brewing in the housing market. Some might also have genuinely felt certain that their clients were making a good investment. …

Walking Away Scot-Free

Unlike buyers, who have been stuck in underwater homes, and lenders, who have also taken significant losses, the NAR has walked away scot-free from its role in contributing to the housing crash and the losses that its inaccurate advice caused homebuyers. Moreover, real estate brokers and agents have kept the billions of dollars in commissions, including $100 billion in 2005 alone, generated, at least in part, from assurances to their clients that the prices they paid for their homes actually reflected the homes’ value and that buying a home was a good investment. Indeed, the NAR indicated to the New York Times that it is not aware of any case where a real estate agent has been held liable for inaccurate representation as to a home’s value or its investment potential. Westlaw and Lexis-Nexis searches similarly reveal no cases holding real estate agents liable for price or investment advice – and many that do not.

Real estate agents generally escape liability because courts treat them as mere salespeople, or connecters of sellers and buyers, who bear no legal liability for their pronouncements about the health of the housing market or their investment advice, including statements affirmatively guaranteeing a buyer a positive return on their investment. Courts also generally refuse to hold realtors responsible when they misrepresent a property’s fair market price – or mislead investors as to a property’s rental value. Instead, courts typically hold that matters of price are matters of opinion, not fact; that the buyer is assumed to have done their own research; and that the buyer is not entitled to rely upon their agent’s opinions. Courts generally find that, absent fraud or non-disclosure of a material“fact,” real estate agents are not responsible for their opinions, no matter how wrong or recklessly given. In short, courts echo the popular view that homebuyers have no one to blame but themselves for their decision to purchase their house.

… But one might question why, if a real estate agent negligently, recklessly or intentionally made inaccurate pronouncements about the housing market or gave misleading investment advice to his client, the agent should completely escape personal responsibility for his actions – either for the advice itself or for offering opinions as to matters outside his expertise. It is unclear why the ethos of personal responsibility does not extend to the agent. Moreover, absolving real estate agents of responsibility for their advice creates a genuine moral hazard in which agents profit from the buyer’s purchase of a home, but bear no risk if the advice that they gave to induce that purchase is wrong, or intentionally misleading. Real estate agents risk other people’s money – and get paid even if the agent knows that the risk is reckless, or downright foolish.

Treating real estate agents as mere salesmen also runs counter to their self-description as professionals and to their representations to their clients that they owe them a fiduciary duty to look out for their best interest – an obligation that a mere salesperson does not have. Nevertheless, courts seem to assume that homebuyers do or should understand that, despite their agent’s protest to the contrary, their agent is no different in principle than a car salesperson. Everyone knows not to trust a car salesperson to look out for their best interests. Puffery is to be expected and one should enter a car lot at their own risk. As far as most courts are concerned, the same apparently goes for hiring a real estate agent. …

Choosing a Path

At a basic level, courts’ descriptions of what individuals should do when making complex financial decisions about whether to purchase homes (i.e. – ignore the opinions of their agents) is at odds with what people actually do (which is to seek and trust expert advice). Moreover, most people likely hire a real estate agent without any knowledge, or reason to suspect, that their agent’s “false statements concerning the market are held to be matters of opinion, judgment, seller’s talk” – and that their agents are not legally accountable for the advice that they give.

This approach is not only detached from the concrete reality of real estate transactions, but also fundamentally unfair to buyers, who are doing exactly what an amateur who must make a complex decision typically will do: engage and trust an advisor that they believe to be a qualified expert to guide them through the process. In addition to leaving unsuspecting homeowners without redress, not holding real estate agents to account runs counter to notions of professionalism and the ethos of personal responsibility.

There are two basic ways to address the discrepancy between homebuyers’ psychological propensity to trust their real estate agents and the general legal rule that buyers may not reasonably rely upon their agents’ advice. The first path is to change the legal rule, fully professionalize the real estate agents’ relationships to their clients, and formalize their fiduciary duty. The second – and opposite – path is to bring the real estate agent’s role in line with the legal rule, which means de-professionalizing the realtor-client relationship and clearly delineating real estate agents “mere salespersons.”

The first path may find the most support with real estate agents, as there has been and continues to be a substantial movement among real estate agents to professionalize their vocation. Indeed, as previously discussed, the NAR markets “realtors” as professionals and many real estate agents tend to see themselves as professionals, rather than mere salespersons. But despite strides toward professionalization, the real estate brokerage industry has still resisted legal responsibility when real estate agents negligently or recklessly offer inaccurate advice, or even intentionally manipulate their clients into making poor decisions.

If real estate agents are to be treated as “professionals,” however, they should be subject to regulations similar to those to which other advisory professionals are subject. As an analogous profession, for example, investment advisors have an “affirmative obligation” under the Investment Advisors Act “of utmost good faith and full and fair disclosure of all material facts to their clients, as well as a duty to avoid misleading them.” Investment Advisers must also be competent, “have reasonable and objective basis for investment recommendations,” and must ensure that that “any investment recommendations are appropriate considering the client's financial objectives, needs and situation.” …

Regardless of a client’s ultimate decision, being a professional carries an obligation to be vigilant in fully advising clients of the risks associated with purchasing a home (particularly in an inflated or declining market). Professional advisors should not, as the NAR Realtor Magazine suggests, push their clients “off the fence” by misleadingly suggesting that renting costs 7 times more than owning, or by telling them that they can “pretty much count on” appreciation of inflation plus 2 percent. Professional advisors should not practice scripts that “accentuate the positive” or engage in any form of puffery. Rather, they should soberly caution clients about potential negatives and positives and help clients dispassionately weight benefits and risks. And they must put their clients’ interests ahead of their own at all times, even if it means losing the sale or the client. In other words, if professionalism is to be the chosen path, real estate agents must accept a fundamental change in their role in real estate transactions. They must also give up the benefits of being mere salespersons, including the benefit of being largely free from legal liability.

If professionalism comes at too great a cost, real estate agents could embrace their role as salespersons,171 not only when sued but also when representing themselves to clients. Indeed, given that real estate agents are unlikely to agree as to the best path, there could be two categories of agents: “real estate advisors” and “real estate brokers” – just as there are investment advisors and stock brokers. In this two-tiered system, real estate advisors would be free to represent themselves as professional real estate experts (provided that they could demonstrate sufficient knowledge of real estate valuation, real estate investment and housing market economics). Such advisors might be in high demand to buyers looking to make wise purchasing decisions. But in exchange for the trust of buyers, real estate advisors would be required to accept potential legal liability similar to that of investment advisors.

Real estate brokers, on the other hand, would bear no responsibility for customers’ unwise purchasing decisions – aside from being required to disclose known material facts and defects about the property itself. In exchange for this free pass, and to protect buyers, brokers under such a system would be barred from representing themselves real estate advisors, as “professionals,” or as “experts” possessing specialized knowledge in real estate. Rather, brokers would be limited to representing themselves simply as salespersons. As salespersons, brokers could still provide many helpful services, including helping their customers find a suitable home, analyze and select neighborhoods and schools, and navigate the closing process.

But brokers would be strictly prohibited from offering advice or opinions as to the appropriate purchase price for a particular property, the current state or direction of the real estate market, or whether purchasing real estate is a wise investment decision. Broker training would emphasize that brokers are not to volunteer such opinions, and must respond to questions seeking such opinions by telling their customers that they are not legally allowed to offer an opinion. Brokers who broke this rule should also be strictly liable if their advice or opinions turned out to be inaccurate. …

Conclusion

The above discussion is not intended to disparage the majority of real estate agents who work conscientiously and ethically for their clients. Rather, the proposals in this article are all forward-looking and borne of the recognition that real estate agents – like homebuyers, mortgage brokers and banks – played a significant, if unwitting, role in creating the housing bubble and burst. In others words, by drawing lessons from the past, the proposals are designed to prevent its reoccurrence. Moreover, the hope is to engage real estate agents in discussing these forward-looking proposals – and not to punish them for past mistakes.

That said, it must be recognized that many homeowners might not currently be stuck in underwater homes if more real estate agents had listened to that voice inside themselves telling them that the market was crazy, had sought to educate themselves about the dangers of an inflated market, and had advised their clients that they might want to sit it out. Additionally, much suffering could have been avoided if the NAR had been a more objective purveyor of information to the public and to its members – instead of a cheerleader for the housing market encouraging potential buyers to get in before the “window of opportunity” closed.

A genuine moral hazard underlies the current role of real estate agents and the NAR. This moral hazard fueled the housing market bubble and contributed to the suffering of many people that the NAR and its realtor members encouraged to buy homes as prices began to decline. Unfortunately, the legal system allows real estate agents to benefit from the trust associated with portraying themselves as professionals, yet to avoid the consequences of the advice that they give – no matter how reckless or objectively misleading that advice may be. Other than their reputation, real estate agents have no skin in the game. They profit if people buy, but suffer no loss if they buy in error. This state of affairs is unfair to unsuspecting buyers and runs counter the ethos of personal responsibility. It should continue no more.

Real estate agents should be required to choose between two paths: (1) fully professionalize their role, including accepting legal liability when they negligently, recklessly or intentionally make inaccurate or misleading pronouncements about a home’s value or investment potential; or (2) embrace their role as “salespersons” and refrain from offering advice or opinions about the real estate market to their customers.

[end of academic report]

I fought the urge to add to Dr. White's already lengthy report with my agreeing comments. He laid out the case for regulating realtors clearly and backed it up with rigorous research. I highly recommend reading the unabridged version.

I think they got it all

I've been trying to find other interesting stories in the property records, so I pass on a number of run-of-the-mill HELOC abuse properties. Today's featured property stood out because these owners managed to extract the maximum value out of their tenure in this house.

- The property was purchased on 3/31/1998 for $263,500. The owners used a $255,500 first mortgage and a $ 8,000 down payment. They never owed this little again.

- On 9/21/1998 they refinanced with a $261,000 first mortgage and withdrew most of their down payment.

- On 11/12/1998 they obtained a stand-alone second for $50,000. These owners had lived in the house only 8 months before they got their first $50,000 in free money.

- On 12/28/2000 they refinanced with a $284,000 first mortgage and a $71,000 stand-alone second.

- On 1/8/2003 they refinanced with a $396,000 first mortgage.

- On 1/23/2004 they refinanced with a $489,250 first mortgage.

- On 5/3/2005 they obtained a $70,000 HELOC.

- On 2/16/2006 they obtained a $576,000 first mortgage and a $72,000 HELOC.

- On 3/7/2007 they made one last trip to the home ATM for a $572,000 first mortgage and a $143,000 stand-alone second.

-

Total property debt is $715,000.

- Total mortgage equity withdrawal is $459,500.

- Total squatting time is about two and a half years so far.

Foreclosure Record

Recording Date: 11/23/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 08/09/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 12/04/2008

Document Type: Notice of Sale

This one is bad. Think about the unceremonious fall from entitlement this family is about to endure. This property has been supplementing this families income from the day they moved in. They created a mountain of Ponzi debt, defaulted the moment the ATM was shut off, and they have been allowed to squat ever since. It will come as a big shock to them when they have to start paying for their housing. They're accustomed to the house paying them.

Irvine Home Address … 7 THORNWOOD Irvine, CA 92604 ![]()

Resale Home Price … $549,000

Home Purchase Price … $263,500

Home Purchase Date …. 3/31/98

Net Gain (Loss) ………. $252,560

Percent Change ………. 95.8%

Annual Appreciation … 5.7%

Cost of Ownership

————————————————-

$549,000 ………. Asking Price

$109,800 ………. 20% Down Conventional

4.82% …………… Mortgage Interest Rate

$439,200 ………. 30-Year Mortgage

$111,358 ………. Income Requirement

$2,310 ………. Monthly Mortgage Payment

$476 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$92 ………. Homeowners Insurance

$82 ………. Homeowners Association Fees

============================================ .jpg)

$2,959 ………. Monthly Cash Outlays

-$392 ………. Tax Savings (% of Interest and Property Tax)

-$546 ………. Equity Hidden in Payment

$203 ………. Lost Income to Down Payment (net of taxes)

$92 ………. Maintenance and Replacement Reserves

============================================

$2,315 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,490 ………. Furnishing and Move In @1%

$5,490 ………. Closing Costs @1%

$4,392 ………… Interest Points @1% of Loan

$109,800 ………. Down Payment

============================================

$125,172 ………. Total Cash Costs

$35,400 ………… Emergency Cash Reserves

============================================

$160,572 ………. Total Savings Needed

Property Details for 7 THORNWOOD Irvine, CA 92604

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1458

$377/SF

Lot Size: 4,416 Sq. Ft.

Property Type: Residential, Single Family

Style: One Level, Cottage

Year Built: 1978

Community: Woodbridge

County: Orange

MLS#: S652285

Source: SoCalMLS

Status: Active

On Redfin: 1 day

——————————————————————————

Single story home located in the Woodbridge Village of Irvine. Spacious open floor plan with a large living room and a cozy fireplace. Upgraded kitchen with granite counter tops and newer cabinetry. Upgraded bathrooms, crown moldings, custom paint. Two car garage with driveway.

.jpg)

.JPG)

.jpg)

We developed the IHB calculator because most of the online calculators are intentionally misleading. Most rent-versus-buy calculators were not designed to give people accurate information. Most of these calculators were designed by realtors with the intention to present buying in a favorable light no matter the truth. It part of the ongoing campaign by realtors to dupe buyers into action — even if buying is harmful to the buyer — to generate sales commissions.

We developed the IHB calculator because most of the online calculators are intentionally misleading. Most rent-versus-buy calculators were not designed to give people accurate information. Most of these calculators were designed by realtors with the intention to present buying in a favorable light no matter the truth. It part of the ongoing campaign by realtors to dupe buyers into action — even if buying is harmful to the buyer — to generate sales commissions.

.jpg)

.jpg)