Housing markets around the country are plunging to new lows. it has renewed the debate as to how low and how long.

Irvine Home Address … 122 STREAMWOOD Irvine, CA 92620

Resale Home Price …… $129,900

Go first in the world, go forth with your fears

Remember a price must be paid

Be always too soon, be never too fast

At the time when all bets must be laid

Gordon Lightfoot — The House You Live In

When is the right time to buy? Timing does matter. Be always too soon, be never too fast. The people who bought the dip in 2007 or 2008 were too fast. Were the 2009 buyers too fast or too soon?

Early 2009 was not the bottom. In fact, the artificial bottom delayed the durable bottom, probably for a couple of years because the capitulatory selling and the destruction of debt has not been allowed to occur. Rather than a steep dive, we are gliding to a higher bottom years later than it should have been. Perhaps it was worth it to save the banks. Homeowners will almost certainly agree the heroic efforts and market manipulation was worthwhile. Renters and prospective buyers, not so much.

Home prices: The double-dip is near

By Les Christie, staff writer — March 6, 2011: 5:02 PM ET

NEW YORK (CNNMoney) — That big sucking sound you heard last week? That was the air being taken out of the housing market by a slew of bad reports followed by some dire predictions by an industry bubble-spotter.

On Tuesday, we found out that home prices were near their post-bust lows. Two days later the government reported that January saw a double-digit dip in the number of new homes sold.

hen Robert Shiller, the Yale economist and co-founder of the S&P/Case-Shiller home price indexes, dropped this bomb: “There's a substantial risk of home prices falling another 15%, 20% or 25%,” he said.

Wow! Robert Shiller is really bearish. A decline that substantial would require the complete breakdown of the lending cartel and higher interest rates. As the economy improves, people will go back to work, and housing demand will pick up, albeit slowly. Low interest rates, increasing demand, and prices already below rental parity in most markets would suggest prices would not decline that significantly.

For prices to go down, loan balances need to decrease, and more supply needs to be released to the market. Interest rates are still low, and if they stay low, prices will stabilize near where they are now. If interest rates continue go up, which is a more likely scenario given we are near historic lows, then mortgage balances will stagnate, and prices will trend lower.

We are in a market trying to avoid catastrophe. The risks are to the downside.

That's a stunning enough pronouncement to make house hunters consider putting purchases on hold. And that may not be a dumb move: If prices are near a double dip — meaning they fell after the bust, rose a bit during recovery and are now heading back down — there may be better deals ahead.

“There will be differences by market, but generally, you may get a big discount by waiting a year [to buy],” said Dean Baker, co-director of the Center for Economic and Policy Research, who thinks the price drop will be closer to 10% or 15%.

Baker looks at the ratio between local home prices and annual rents to judge whether markets are overvalued. If the median-priced home sells for more than 15 times the median annual rent, there's a good chance prices may come down.

On a national level, Shiller and other economists compare home price changes with income growth over the years. Before the bust, home prices had been outpacing earnings since the late 1990s.

Just to get that back to a normal ratio — which we last saw in 1998 — home prices would have to drop another 15%, according to Anthony Sanders, a director of Real Estate Entrepreneurship at George Mason University.

“Even after the bubble burst, the ratio of income to home prices is still way too high,” he said.

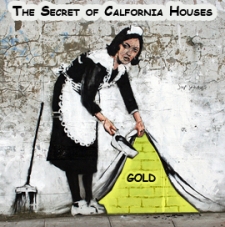

Some of the discrepancy in the price-to-rent ratio is caused by the distortion of asset value caused by very low interest rates. The only reason we in Irvine look at a $650,000 house and feel the price is reasonable is because based on our incomes, we know we can get financing for that amount. If interest rates were 9% — which is the 40-year average — the same house at $475,000 seems pricey.

Naturally, many disagree with these assessments. Karl Case, who co-founded the home price index with doom-sayer Shiller, believes that the market will “bounce along the bottom all year.” If that's the case, buyers who take the plunge now shouldn't expect big profits if they sell in the next few years, but they shouldn't have to take a major hit either.

I said this in a post last week. It all depends on how you define a “major hit” and what it would take for that to happen. If you know you are going to sell in less than 5 years, you probably shouldn't buy because you may not cover your real estate commission on the way out. Even if you think you are going to stay longer, beware that you may need to sell at the bottom, and after commissions, half or more of your 20% down payment would be lost.

However, people who are going to live in the same house for seven to ten years or longer can take advantage of the low interest rates and fixed-rate financing to lock in a payment lower than rental parity in most markets. In that instance riding out a 10% decline is not a “major hit.”

Also, buying the bottom tick of the market may not lock in the lowest cost of ownership for a financed buyer. If prices are going down because interest rates are going up, the cost of ownership is unchanged. Only the price of money has gone up. The lowest cost of ownership may actually be obtained at a higher price point. That being said, I don't think we have seen the bottom in affordability either.

Besides, a home purchase is more than a potential investment, especially for families planning to stay put for a while. The big plus for them is the pleasure of living in their own homes.

“People should base their decision on affordability, lifestyle choices and home preferences, not on investment,” said Lawrence Yun, the National Association of Realtors' chief economist.

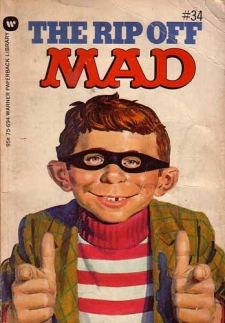

Yun waits until the housing market collapses before he says something intelligent. That wasn't the song and dance the NAr used back in 2006. Take careful note of the section that says REAL ESTATE IS A GREAT INVESTMENT.

Some stable areas, such as Texas and the Midwest, will probably not experience price plunges at all, but other markets, such as Seattle, Portland and inland California, could still fall substantially, according to Baker.

Even for the markets most likely to rebound, projected returns are minimal. Fiserv, which provides financial information and analysis, projects that the best performing market over the next two years will be Tacoma, Wash. — and it will only record a price increase of 12%. That means those in average markets can only hope for single-digit returns.

OMG! What are people's expectations? Is a housing market underperforming if it doesn't produce 10%+ annual appreciation? Now I see where the general public picks up its dumb ideas.

With home-price gains so modest, it doesn't pay to buy unless you're pretty sure you'll stay for five years or more. “With high transaction costs, buying and selling, it probably will not work out financially,” Baker said.

Nicolas Retsinas, of the Harvard Joint Center for Housing Studies, recently advised his own daughter about buying a home. She was returning to Providence, R.I., but it might only be for a few years.

He told her to rent — not that it mattered. “Whose kids listen to them anyway?” he asked.

Even those with longer time horizons should not take it for granted that their purchases will pay off. Home prices could stagnate well into mid-decade.

The issues of rising interest rates and lingering bad debt and shadow inventory will be with us for the rest of the 10s. We haven't crested the top of the foreclosure wave yet. Which means we have three to five more years of processing new buyers into foreclosed homes and eliminating old borrowers from the buyer pool while their credit repairs, a process that takes at least two years, with problems lingering for up to seven.

With the turmoil from the bubble being so long lasting, it is difficult to foresee what will happen to house prices beyond the bubble. If we print a lot of money, inflation will bring values up by devaluing houses relative to everything else. You can put $12 gas in your $50,000 Honda Civic parked in your $500,000 house. If we don't go crazy printing money, and if unemployment lingers, appreciation could be tepid for a long time.

Despite the gloom, many Americans remain confident about home buying. A survey released Monday by Fannie Mae revealed that 65% of people believe it's a good time to purchase, with 78% expecting prices will rise or remain the same over the next 12 months.

And buyers may take heart from some positive recent indicators, such as an up tick in the sales of existing homes in January; a drop in vacant rental homes; and more investors snapping up properties.

There's also been an upswing in the number of high-end homes — those costing more than $750,000 — being sold, according to Yun. The wealthy buyers of these properties have lots of choices of where to place their money and many are investing in real estate.

“The smart money is making their move,” said Yun.

That is among the dumbest quotes of the bubble by Lawrence Yun. The smart money is making their move… Makes you want to be one of those savvy investors that's “in the know.” A spinmeister in action.

Lawrence Yun could polish a turd.

Processing shadow inventory

This weekend's featured property is a small condo that a bear rally buyer picked up on 8/2/2007 for $229,000. He used a $206,100 first mortgage and a $22,900 down payment. He quit paying sometime before September of 2009.

Foreclosure Record

Recording Date: 03/31/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 12/14/2009

Document Type: Notice of Default

The lender waited until December to foreclose paying $128,000 on 12/13/2010. This is now REO.

Earlier when I was saying the below median is at or near the bottom. This is what the bottom looks like. This property is selling for more than 40% off its purchase price from 2007. This was after the peak in 2006 when this property hit maximum value.

Couple a 40% decline in price with interest rates below 5%, and affordability is outstanding. Now if the rest of the market continues to compress, we may see affordability become the norm — even in Irvine.

Irvine Home Address … 122 STREAMWOOD Irvine, CA 92620 ![]()

Resale Home Price … $129,900

Resale Home Price … $129,900

Home Purchase Price … $229,000

Home Purchase Date …. 8/2/2007

Net Gain (Loss) ………. $(106,894)

Percent Change ………. -46.7%

Annual Appreciation … -15.4%

Cost of Ownership

————————————————-

$129,900 ………. Asking Price

$4,547 ………. 3.5% Down FHA Financing

4.85% …………… Mortgage Interest Rate

$125,354 ………. 30-Year Mortgage

$26,440 ………. Income Requirement

$661 ………. Monthly Mortgage Payment

$113 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$22 ………. Homeowners Insurance

$242 ………. Homeowners Association Fees

============================================

$1,038 ………. Monthly Cash Outlays

-$62 ………. Tax Savings (% of Interest and Property Tax)

-$155 ………. Equity Hidden in Payment

$8 ………. Lost Income to Down Payment (net of taxes)

$22 ………. Maintenance and Replacement Reserves

============================================

$851 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,299 ………. Furnishing and Move In @1%

$1,299 ………. Closing Costs @1%

$1,254 ………… Interest Points @1% of Loan

$4,547 ………. Down Payment

============================================

$8,398 ………. Total Cash Costs

$13,000 ………… Emergency Cash Reserves

============================================

$21,398 ………. Total Savings Needed

Property Details for 122 STREAMWOOD Irvine, CA 92620

——————————————————————————

Beds: 0

Baths: 1

Sq. Ft.: 0475

$273/SF

Lot Size: –

Property Type: Residential, Condominium

Style: One Level, Contemporary

View: Creek/Stream

Year Built: 1977

Community: Northwood

County: Orange

MLS#: S648565

Source: SoCalMLS

Status: Active

——————————————————————————

Nice upper studio with new carpet, paint and sheet vinyl. In the heart of Irvine with schools, shopping and transportation close by.

.jpg)