Today I have a guest author who came to share his insights into what happens after mortgage delinqency.

Irvine Home Address … 3 East ALBA Irvine, CA 92620

Resale Home Price …… $610,000

I've never been so poor.

I bought something I can't afford

Most people can relate with a new car

but this is more value by far

Bankruptcy — Antifreeze

Joe Weber is a local bankruptcy attorney, a daily reader of the IHB, and a frequent astute observer. (I won't tell you who he is.) I have gotten to know Joe over the last year, and I asked him to share his perspective with the broader IHB readership.

From Joe's website, www.bkrights.com, “Attorney Joseph A. Weber has represented thousands of people and businesses in bankruptcy. He is a graduate of St. Leo University, the American College of Law, and has been a member of the Orange County Bar Association, The National Association of Chapter 13 Trustees, The National Association of Consumer Bankruptcy Attorneys, and the Orange County Bankruptcy Forum. He is the author of Credit Limits, a book about the proliferation of bankcards.”

Joe sees what happens at the end of the line. When Ponzis implode, most of them end up in Joe's office. He is privy to the gory details of Ponzi debt as he sees it every day in his practice. He has seen the credit bubble inflating and taking over consumers lives for decades now.

Joe Weber's observations on debt, foreclosure, and bankruptcy

When I first saw a person with six figure credit card debt I was shocked. That was in the middle 80s. Now I see it every day. Since the 1960s, non-rich people having large lines of unsecured credit became commonplace. Since the 80s, my law partner and I have filed thousands of Bankruptcy cases. Almost all of them have significant credit card debt, in addition to the traditional medical and store debt. I wrote the book “Credit Limits” in the early 90s about this phenomenon. In the nearly 20 years since then, more people have universal (e.g. Visa, Master Card, Discover) cards than ever before. Kids still in or just out of high school have them, many with credit lines of 5K or more.

After the housing bubble burst and many banks failed, credit tightened up. Of the folks we saw coming in for Bankruptcy consults, many had had their credit limits cut, and the interest rates on their cards sharply raised. Like the housing bubble, this created a “musical-chair” effect: monthly payments increased, but those who regularly took advances to meet installment payments on other accounts couldn’t do that anymore. And those who regularly took 30-40K out of their home “equity” to pay down the credit cards, couldn’t do that anymore as this particular ATM was shut down too. Then, many of those who would work longer hours or take a second job to service their debt found it impossible, as overtime and employment opportunities also dried up.

As 2011 starts I’m seeing more people in debt who are unemployed or grossly underemployed than any time in my career, even compared with the early 90s. I just don’t believe that government statistics accurately give the true picture- almost every day I talk with someone who is not only unemployed or underemployed, but who has just given up looking for work altogether, living back with parents or crashing on a friend’s couch.

As IHB has clearly laid out, people with low income can’t qualify for large mortgages when liar loans and other “alternative financing” aren’t available. I believe that many more people have to become employed or better employed before things go back to normal.

All Bankruptcies concern debt and assets and how they are treated. Natural persons (unlike “paper” entities like corporations and LLCs) get their debts discharged or wiped out in Chapter 7. Natural persons get their debts reorganized in Chapter 13. The two big housing-related issues I’m seeing now are: 1) Junior lien deficiencies during or after foreclosure; and 2) Homeowners behind on their mortgage payments reorganizing mortgage back payments in Chapter 13.

During the Great Housing Bubble, many people bought houses with 80/20 loans. In California, if the house later goes down in foreclosure and the junior lien (2nd mortgage) was never refinanced, then the lender cannot collect money from the former homeowner. If that loan was acquired AFTER the original purchase, (non-purchase money), then whoever signed the note could be liable for any money not realized from the foreclosure sale. These days, what usually happens is the holder of the 1st Deed of Trust forecloses and becomes the owner of the property, the lien of the 2nd TD is extinguished; the holder of the 2nd never gets a dime, then they look to the former homeowner for whatever the balance was. This can be devastating, as the balance could easily be in six figures and most people can’t just write a check for it.

.jpg)

If the person files a Chapter 7 Bankruptcy and receives a Discharge, this obligation is then wiped out. Another strategy Bankruptcy clients employ is to file a case under Chapter 7 and delay foreclosure- once a case is filed a “stay” goes into effect, preventing collection actions including foreclosure. If back mortgage payments aren’t brought up to date and the bank wants to continue with the foreclosure, they have to apply to the Bankruptcy judge for permission to continue, or what is called “Relief from the Automatic Stay.” If the creditor moves at top speed they can get relief in as little as 5-6 weeks. Some mortgage holders/servicers elect to do nothing, and wait for the Chapter 7 case to end, typically 4-5 months after it was first filed. This affords the debtor/homeowner even more time to stay in the property without making payments.

In Chapter 13 Bankruptcy a person can propose a Plan to the court to make up back mortgage payments over time, usually 60 months. And in Chapter 13, junior liens (2nds, 3rds, etc.), if there is no value to secure them, can be stripped off the house, leaving only the 1st mortgage.

(Joe Weber is a Bankruptcy attorney in Costa Mesa. His site is www.bkrights.com)

[end of commentary]

As a follow up question, I asked Joe:

I have believed from the start that foreclosure followed by bankruptcy was going to be the ultimate resolution for those who succumb to mortgage distress. Right now that is shaping up to be millions and millions of bankruptcies. What do you see as the ultimate resolution for those who stop paying their mortgages?

His response was:

Foreclosure. I've seen too many people pay too much for a house they never could afford in the first place. And many of them STILL can't afford that house, even after saving it through Chapter 13 restructuring or non-Bankruptcy loan modification. A large percentage of homes nationwide have negative equity. We've yet to understand, then see the long-range effect of this.

Unfortunately, I see more foreclosures “cleansing” the market and bringing prices back in line to true value.

Thank you, Joe.

The impact we don't see

Many flamboyant spenders during the bubble are quietly contemplating their options. Joe only sees borrowers who have decided to do something about their problem. But many more are in denial, ignoring creditor queries, and hoping the problem will simply go away. Perhaps the lender will forget they were owed money, right?

Usually it isn't until the collection calls get overwhelming that people realize they have to act. With so many bad loans and bigger issues to deal with, following up with collections on old bad debts has not gotten the attention it will over the next several years. Also, since lenders are pretending many non-performing loans will still be paid, they are ignoring the problem too, probably hoping for another government bailout.

In the end, these debtors will be coaxed out of hiding, and they will be forced to work out something with their creditors. For an increasingly large number, the only workout is a bankruptcy.

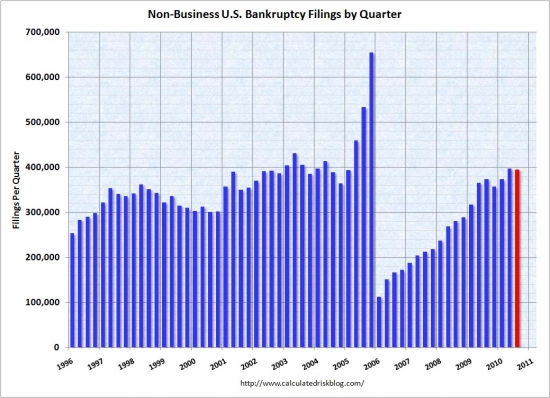

The trend of increasing bankruptcies will likely continue. Bankruptcy reform in 2005 was supposed to reduce the number of bankruptcies permantenly. As the number of bankruptcies continues to rise, the failure of this legisltation will be apparent.

Gold in shadow inventory

There is a group of delinquent borrowers in shadow inventory that don't concern the bank: squatters with equity. The owner of today's featured property hasn't made a payment in a couple of years.

Foreclosure Record

Recording Date: 10/30/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 07/21/2009

Document Type: Notice of Default

However, the bank is in no hurry to foreclose? Why is that? Well, as long as they property has equity, the bank is merely adding to the principal balance the lost interest, penalties, and every fee they can dream up.

From a banks perspective, shadow inventory can be divided up into two broad categories: 1. those delinquent borrowers with equity where they can recover their capital in foreclosure, and 2. those delinquent borrowers with no equity that will cause a huge loss. The bank has no urgency to foreclose on the first group, the ones with equity, because its actually better than if the loan were performing. Not just are they booking the interest as income, they are also getting fees and penalties.

Banks will not move aggressively to foreclose on squatters with equity because they are a hidden cash cow. The probably watch reports to see if the remaining equity is getting low enough that they may not recover their capital in a foreclosure. When a borrower's equity runs dry is when their foreclosure will be bumped to the front of the queue.

Banks are in no hurry to foreclose on the group with no equity because of the losses it will cause. Basically, the only people the bank feels any urgency to act on are those with marginal equity. These are the delinquent borrowers who consumed their equity with non-payment. As soon as equity is gone, they are a prime target because the bank has extracted all they can, and any further delay costs them money.

Today's featured owners were minor Ponzis. They did consistently add to their mortgage, but it was very small amounts that shouldn't have been a source of financial distress. Unemployment is a likely culprit here.

Irvine Home Address … 3 East ALBA Irvine, CA 92620 ![]()

Resale Home Price … $610,000

Home Purchase Price … $236,000

Home Purchase Date …. 7/21/97

Net Gain (Loss) ………. $337,400

Percent Change ………. 143.0%

Annual Appreciation … 7.0%

Cost of Ownership

————————————————-

$610,000 ………. Asking Price

$122,000 ………. 20% Down Conventional

4.82% …………… Mortgage Interest Rate

$488,000 ………. 30-Year Mortgage

$123,731 ………. Income Requirement

$2,566 ………. Monthly Mortgage Payment

$529 ………. Property Tax

$150 ………. Special Taxes and Levies (Mello Roos)

$102 ………. Homeowners Insurance

$139 ………. Homeowners Association Fees

============================================

$3,486 ………. Monthly Cash Outlays

-$436 ………. Tax Savings (% of Interest and Property Tax)

-$606 ………. Equity Hidden in Payment

$225 ………. Lost Income to Down Payment (net of taxes)

$102 ………. Maintenance and Replacement Reserves

============================================

$2,771 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,100 ………. Furnishing and Move In @1%

$6,100 ………. Closing Costs @1%

$4,880 ………… Interest Points @1% of Loan

$122,000 ………. Down Payment

============================================

$139,080 ………. Total Cash Costs

$42,400 ………… Emergency Cash Reserves

============================================

$181,480 ………. Total Savings Needed

Property Details for 3 East ALBA Irvine, CA 92620

——————————————————————————

Beds: 3

Baths: 3

Sq. Ft.: 1915

$319/SF

Lot Size: 3,825 Sq. Ft.

Property Type: Residential, Single Family

Style: Two Level, Contemporary

View: Park/Green Belt

Year Built: 1980

Community: Northwood

County: Orange

MLS#: S651655

Source: SoCalMLS

Status: Active

——————————————————————————

Premiere Location on Cul de Sac Street-3 Bedrooms, 2.5 Baths w/ Approx. 1915 S. F. , Wood Floors, Vaulted Ceilings, Sunny Kitchen w/ Newer Appliances, Tile Counters, Wood Floor, Garden Window, Breakfast Nook w/ Pantry, Spacious Family Room w/ Double French Doors & Sidelights Opens to Private Backyard, Built-In Entertainment Unit, Brick Fireplace & Recessed Lights, Formal Living Room & Dining Room, Master w/ Walk-In Closet & Window Shutters, Master Bath w/ Dual Vanity, Tile Floor & Tiled Shower, Private Backyard has Hardscape w/ Brick Accents & Grassy Area, Walk to Tot Lot & Large Grassy Area Behind Home, Walk to Award Winning Schools including Prestigious Northwood High, Enjoy Resort-like Association Amenities w/ Pools, Huge Spa, Tennis Courts, Volleyball Courts, BBQ's & Remodeled Clubhouse, No Mello Roos, Low Tax Rate, Assoc. Dues $83/Month

Thank you for reading the Irvine Housing Blog.

Astutely observing the housing market and combating California Kool-Aid since 2006.

Have a great weekend,

Irvine Renter

Great article – love the Ramifications of Borrower Delinquency chart – it makes the whole flow a lot clearer.

Resale Home Price … $610,000

Home Purchase Price … $236,000

Home Purchase Date …. 7/21/97

Just like a fine bottle of wine…

Must be some major improvements in the weather over there between ’97 and ’11!

1997 Beginning Salary Information by Occupation

Occupation

Chemical Engineer $42,758

Computer Science $45,000

Software Engineer $57,668

Mechanical Engineer $39,852

Electrical Engineer $39,811

2010 Average Starting Salary Information by Occupation

Chemical Engineer $61,776

Software Engineering: $57,099

Mechanical Engineering: $58,392

Electrical Engineering: $59,074

Information Sciences & Systems: $54,038

Aerospace Engineering: $57,231

Industrial Engineering: $57,73

Computer Engineering: $60,879

Must be those HUGE salary increases between ’97 and ’11! That explains things!

http://www.crackthecode.us/images/28_Yorktown_Nothing_To_See_Here.jpg

I know some people that just when into Ch 13. It sounds like 5 years of living a second class life. They are still in the house, but I wonder if by the end they will wonder if it was worth it.

I don’t know. I don’t think debt improves anyone’s lives.

I don’t think debt improves anyone’s lives.

It sure improves the lives of shareholders at American Financial Institutions. They have families with children to feed, clothe, and send to Harvard as well.

What the hell is a Tot Lot? When I was a kid we called it a Park or a Playground. A Tot Lot must be something extra wonderful.

Is it as awesome as I am imagining?

http://www.crackthecode.us/images/Irvine_Tot_Lot.jpg

Sometimes things are named differently to reflect their purpose.

A tot lot is a playground area and/or structure that is more geared for younger children.

I guess that’s hard to fathom for someone who is not a parent.

Condescend much?

And you’re wrong. A tot lot is a picnic area for bears where they serve tater tots. Didn’t you see the picture?

That’s it? A playground for children younger than children?

With such a cute name, I was picturing a little lot in the woods with cute cuddly bears to snuggle and eat tater tots with.

What a letdown. 🙁

“Tot lot” is a fairly new term, and a fairly silly sounding one as well.

Actually, tot lots and parks are prevalent in Irvine.

Numerous families, even those residing in other areas, bring their kids to our parks and tot lots.

It certainly sounds like a word that was invented by a woman to emasculate the husband. I am sticking with “Park” despite what the gals call it.

The little “Tot” won’t care what you call it and if you tell your friends that you are taking the boy to the park, they will not be concerned with the mundane details about the park having been specially designed, designated, and blessed for individuals referred to as “Tots”.

JMHO.

@AZDave:

I wonder what happened to you that you feel it necessary to take out your internet angst on parents and children.

I don’t see anyone making fun of karate chopping computer programmers here.

“Everybody loves Kung-Fu coding…”

Ugh, we are going personal today.

Who said anything about internet angst against parents? I am just having fun with the word Tot Lot. Anyone with a sense of humor will see that it was obviously tongue in cheek and not some madman rant. I know you are challenged in that department so I should be more sensitive. I do get a kick (no pun intended) at how you freak out and take offense to any type of joke that involves parents and children. Something about it must strike you as true to get you so wound up is all I can assume.

I’ll try to be more sensitive toward your feelings in the future.

Hug.

I’m pretty sure a more accurate reference would be Snot Lot if it’s little ones…

“I’m pretty sure a more accurate reference would be Snot Lot if it’s little ones…”

+1

Snot Lot

Does this refer to the parents or the children? Please clarify.

AZDavid is hilarious. You, on the other hand, need a thicker skin. Maybe you’d be better off keeping within the safe and friendly confines of your local totlot.

Hey might be best served to stick to “Kung-Fu computer coding” and leave the parenting to well parents and the procreating to those with better “code”.

Not sure if this applies to Orange County money buying homes in Las Vegas, but I found it interesting:

Small investors play big role in healing housing market

http://www.housingwire.com/2011/03/17/small-investors-play-big-role-in-healing-housing-market

Yes, “healing” the housing market is what they are doing. “Healing“; the same way that they heal the stock market-

Because the whole reason we build housing is because investors seek well balanced and diversified investment portfolios.

“Small investors” = “prey”

And once again, the easiest way to make a small fortune in the stock/bond/real estate market is to start with a large fortune…

I was thinking about using that article for a post.

You’re right that it is more prevalent in the lower priced markets. There are many mom and pops at the Las Vegas auction site. Too many….

I guess it does make sense that the bank would wait until the extra fees and interest for missed payments equals the equity in the house to foreclose, since if the bank does foreclose and gets more than the amount owed (including said fees and interest), I believe the difference goes to the homeowner.

What can the payment on this thing seriously be right now if you had the fortune of having been born at the right time to buy this place in 1997?

Thousand bucks a month maybe worst case scenario assuming that they were never smart enough to refinance as interest rates shot downward?

Something is not adding up. If they can’t afford to pay that mortgage then no way will they be able to pay rent on one of the low-end crackerjack boxes over there.

So, if we use the salary numbers provided by David, that $236K home should now be worth around $325K if interest rates rise to ’97 levels? In terms of affordability, I’d be hard pressed to believe otherwise.

You would think. However, awhile back, Irvine HO submitted evidence that his personal salary did increase during this time period so clearly – Irvine stopped employing new college graduates at some point in time which invalidates the premise of my entire argument.

Isn’t that right, Irvine HO? Tell us the story about how you got that pay raise again.

What does my salary increase have to do with Irvine stopping employment of college graduates?

Doesn’t that just support the fact that these large down payments coming from people in their 20s is sourced from something other than a previous flip (unless they bought a home when they were 15)?

Or that maybe the 30-40yo crowd buying homes in Irvine are making more now than they did 10 years ago?

If you can afford your $250k dream home in Phx, surely someone else the same age as you with a higher salary can afford a $350k condo in Irvine.

Don’t be jealous… yesterday was the day for wearing green.

Doesn’t that just support the fact that these large down payments coming from people in their 20s

Are you actually arguing that most people buying houses in the current Irvine market are in their 20’s? LOL, I’ll have what he’s having.

Where did I say “most people”? Reading is fundamental.

Again… you’re all the way in Phx… what do you know about the Irvine market?

Check out the demographics of the people buying the $300-$600k attached/detached products in the latest developments of Irvine, then you can take your shoe out of your mouth.

Maybe you should stop having whatever you are having.

You said:

Doesn’t that just support the fact that these large down payments coming from people in their 20s

That sounded as though you were speaking about a large portion of the people buying houses in Irvine.

I get it – you were exaggerating.

Check out the demographics of the people buying the $300-$600k

Point me to them. I want to see ages of buyers, down payment amounts, and types of financing used all lined up in a nice little table.

Where can I find that?

Or that maybe the 30-40yo crowd buying homes in Irvine are making more now than they did 10 years ago?

You don’t get it, do you? The “inflation” adjusted salaries between ’97 and ’11 are not double or triple so the doubling and tripling of house prices is not backed by adjustments in salaries.

Uhh… you chart is breaking down “beginning” and “starting” salaries.

The people who are in 30-40yo (or higher) crowd and buying in Irvine are not just getting out of college and looking for a job. They are in established careers that have seen doubling or more of their salary since 10-15 years ago when they were “starting”. Maybe you’ll understand in 10-15 years.

And don’t get me wrong… I’m not saying everyone has seen those type of salary increases and that does not justify the stupid prices in Irvine. But the people do exist, and that’s why prices are stickier here.

Uhh… you chart is breaking down “beginning” and “starting” salaries.

Come on, Irvine HO. Make me believe you earned that salary increase.

It’s a point of reference – just like median house price. We could have gone with the average salary of a working professional with 10 years experience in ’97 versus ’11 and the trend would be no different.

The only way that your argument makes sense is if the average age of the Irvine House buyer has increased dramatically since 1997. But how can that be with all these 20 year olds that you claim are buying houses?

Why don’t you look at your salary chart.

Chemical E. salaries up 50%

Mechanical E. up 50%

computer E. up 33%

Interest rates. 10 year treasures.

1997. 6.3%

2010. 3.3%

Based on this, payments on 300k loan @ 6.3% and payments on 600k loan @ 3.3% are 41% higher.

Wow look at that, affordability increase in line with salary increases. (yes, those are treasury rates and not mortgage rates but used as illustrations).

Doesn’t explain all of it price increase but if you lived in Irvine 1997, you would know how much better developed the area has become since 1997 even if weather is the same.

Chemical E. salaries up 50%

Mechanical E. up 50%

And houses are up 250%, genius. That’s a F— of a lot more than a 50% salary adjustment. Are you saying that a 50% salary increase justifies a 250% housing cost increase? They teach arithmetic over there in those fine Irvine schools don’t they?

Oh, it’s because Irvine is more developed now. Is that the new story to justify bubble prices? We have more Shopping Malls now?

Keep stroking yourself.

Why did you ignore affordability? You must have been in between strokes and your eyes darted.

Due the math.

If I were a professional making 120K in 1997 and i make 50% more, my gross is 180k. (before you talk about no one makes 50% more, go look up nominal personal income statistics for calif.)

I can afford a 212% more expensive home in 2010 @ 3.3% rate vs as compared to 1997 @ 6.3% sending the same 28% of income on mortgage debt.

Pure genius indeed.

Well at least you haven’t pulled your normal bullshit of stating that home prices should be 1999 levels because wages haven’t increased in 12 years. See you are learning something.

If I were a professional making 120K in 1997

LOL! Who do you think you are kidding?

How many households in Irvine were pulling in 120K fiscal year ’97? Do you have any idea how stupid you look? That’s even higher than the 2005 median family income and you are popping off as though that was the norm in ’97. Get out of here.

Well at least you haven’t pulled your normal bullshit of stating that home prices should be 1999 levels because wages haven’t increased in 12 years. See you are learning something.

You are a moron. Salaries have not increased in nominal terms. Factor in the cost of groceries, gas, education, etc and all of those “gains” are totally wiped out before we even start talking about house prices. Did your parents have children that lived?

@AZ

I looked it up for you since I know looking up real statistics isn’t something you do before you post.

PER CAPITA Personal incomes from 1997 to 2010 in California went up 60%.

Do the math Dave for us.

Income up 60%

Interest rates down 52% (ARM Rates even lower).

What should prices be?

LOL. you are such a jackass.

Use whatever numbers you want. Go from 50k to 75k. go from 10k to 15K. Us 500k to 750k. Factor in drop in rates and do you think the % they can afford to purchase more of changes?

Oh that’s right, math and percentages are different in AZ.

LOL. you are such a jackass. Use whatever numbers you want.

Yea, I’ll interpret that as you admitting to being full of hot air.

Oh that’s right, math and percentages are different in AZ.

They are clearly different in your world. You obviously did not attend a fine Irvine school district if you let a bumpkin from AZ run a circle around you.

Maybe I should move to Irvine; it sounds pretty easy to get a six figure job with minimal knowledge of arithmetic required.

AZ,

some more mental math for you.

If I made 1000 dollars in 1997 and I spent 10% on your gas, groceries, etc, then I spent $100. leaves me 900 bucks.

If the cost of those things went up by 50%, (actual GDP inflator is 21% for that period), then I am now spending $150.

My wages went up 50% as well over that period. Let’s see what happens…1500 bucks – 150 bucks, that leaves me with 1350.

WTF!?!? What if prices up twice as fast which 100% instead of 50%. I sent 200 dollars now. Wtf, I am left with 1300 dollars instead of 900. That is another 400 bucks I can spend on a down payment on overpriced Irvine real estate or that I could use to pay all cash for your dream AZ home~ Nice.

Yes, I purposefully left out education as it is quite apparent you haven’t had any that involved any basic math or it was a waste of money.

—

Salaries have not increased in nominal terms. Factor in the cost of groceries, gas, education, etc and all of those “gains” are totally wiped out before we even start talking about house prices. Did your parents have children that lived?

—

Haha. Let’s keep trading insults instead of doing the math.

Tell us how to calculate the appropriate value Dave.

60% higher wages. 52% lower interest rates.

Do the math.

You don’t know how to use the PV function in excel do you?

Yes, I purposefully left out education

Then why did you waste your time replying? You think that you can just cherry pick a few things and ignore others that do not support your logic? Let’s talk about tuition costs of ’97 vs ’11 and student debt being encumbered by ’97 graduates vs ’11 grads. It is the most expensive run up of all the examples I gave. But you just purposely didn’t want to talk about it because my education was a waste of money. Brilliant.

as it is quite apparent you haven’t had any that involved any basic math or it was a waste of money.

I don’t think that is why you left out. You left it out because you know I had a valid point but your thick-headed numbskull of a head could not find a way around it.

I know, I know – you are down to pride at this point. Keep blowing, your face is not even close to red yet.

Please do not mix up nominal and real.

http://economics.about.com/cs/macrohelp/a/nominal_vs_real.htm

got your riled up huh Dave?

I graduated in 1994. I don’t have any college aged kids.

How does education inflation affect me with my housing purchasing decisions?

You should have said healthcare. But alas, that would mean that you actually knew wtf you were talking about.

Come on Dave. Stop skirting the question…

do the math for us.

same 28% of income for housing.

nominal wages 60% higher. Interest rates 52% lower.

What should house be worth?

Do the math for us Dave. Do the math for us.

If you can afford your $250k dream home in Phx, surely someone else the same age as you with a higher salary can afford a $350k condo in Irvine.

Don’t be jealous… yesterday was the day for wearing green.

Yup, totally jealous of you and all your success in life.

I assume that you are going to fully support and encourage your children to start buying up Irvine real-estate and take out huge mortgages just like you had to OH WAIT.

Yet another example of your classiness… or as you put it “having fun”.

Do they teach you that in forum commenting class?

Rule #1: When you can’t make a good argument, bring their children into it.

Rule #2: If they don’t have children, talk about their mother.

I think it is a fair question to ask and very relevant. Would you encourage your children to take out huge mortgages and buy Irvine real estate?

Could you see your children paying 600K for today’s featured house? Are you going to help out with that down payment?

Fair enough.

“Would you encourage your children to take out huge mortgages and buy Irvine real estate?”

I would encourage them to be financially responsible. If they can afford a huge (which is a relative term) mortgage and it’s close to rental parity… why not? Whether or not they should buy Irvine real estate is another question altogether, they should buy where it is convenient for them. It should be close to their jobs and be a nice safe place to live, like most of Orange County.

“Could you see your children paying 600K for today’s featured house?”

I take it you mean if they were old enough to do so now. Personally… I’m not too keen on that area of Irvine and I prefer newer. But if they are married and looking for a starter home and it had to be in Irvine, probably not because there are newer products that are $500kish that might make a better starter right now. And if you can afford $250k in Phx, then if my kid had a dual income household, $500-$600k seems reasonable in Irvine.

“Are you going to help out with that down payment?”

If they needed it… yes. But just like me and my parents before me, I would hope they could do it without my assistance because that means they have already learned how to save and spend responsibly.

Quid Pro Quo time:

You still haven’t answered my question on whether you plan to have a mortgage with your $250k purchase.

I would encourage them to be financially responsible.

.

.

.And if you can afford $250k in Phx, then if my kid had a dual income household, $500-$600k seems reasonable in Irvine

You think it is financially responsible for a “dual income” household to buy as much house as the aggregate income can afford? I don’t – you are doubling your odds of running into financial trouble.

You still haven’t answered my question on whether you plan to have a mortgage with your $250k purchase.

I have stated in the past that I would most likely put 50% down and pay the remainder off within 10 years. I would likely finance it on a 15 year term to get the lower interest rate.

I have no intention of slaving to a bank for 30 years. I plan on actually owning in the clear. I think it is pretty obvious that the majority of these loans being issued to Irvine house debtors will for the most part never be fully made whole by the debtor. It makes no sense for these banks to be handing out 30 year loans to people over the age of 35 even if they have 200K down payments. Obviously, the plan for most folks is to let the next guy in line come along and buy them out at some point.

You two are very entertaining 🙂

Rar.

.

http://www.crackthecode.us/images/wrong_on_the_internet.jpg

No doubt. I made the mistake of reading this thread during a slow inning at my *children’s* baseball game. I laughed out loud, right when a kid got hit by the pitcher.

I blamed the rarified air.

You think it is financially responsible for a “dual income” household to buy as much house as the aggregate income can afford? I don’t – you are doubling your odds of running into financial trouble.

Not trying to insult you but I think a single income here is more than your single income in Phx. So a “dual-income” is probably more than just double if aggregated.

And I did say “reasonable”… but noticed I was pointing more towards $500k than $600k. Rents for a 3/2 in Irvine are about $2500, a mortgage for $525k with 20% down runs at about $2300+. A 5/1 or 7/1 with 3.5% down also runs at the same monthly.

And the parameters were “In Irvine”. Realistically, I would probably recommend to them to buy their starter outside of Irvine for a better value and when they have kids, upgrade to a bigger home (if there salaries have increased) either in Irvine or some other OC city. And who knows, if home values stayed the same, and they increased their pay, the mom could stay at home and they could be single income.

Just because I like Irvine and our current circumstances prefer it, doesn’t necessarily mean I would recommend it to my kids or anyone else. Remember, I think Irvine is overpriced too, I’m just presenting my observations on why it may tend to stay that way.

Now, back to you:

I thought you wanted to pay all cash? Even at 50%, how are you saving $125k? Wasn’t it you would couldn’t believe anyone in Irvine could save $200k?

Oops… sorry, I broke it out of the thread.

BTW: If we’re actually talking a starter home in Irvine, I would probably point them to a 2/2. Those run just over $400k… even less if you go older or attached/condo route.

So did I pass your adoption interview? 🙂

Not trying to insult you but I think a single income here is more than your single income

You think that every single person in Irvine is banking more than I am here in AZ? You think that my 250K limit is some kind of function of the maximum loan that a bank would let me hang myself with?

I would probably recommend to them to buy their starter outside of Irvine for a better value

Thank you, so you are finally admitting that Irvine is not a good move for first timers.

And who knows, if home values stayed the same, and they increased their pay, the mom could stay at home and they could be single income.

Wishful thinking. May or may not work out. Not a good strategy.

I thought you wanted to pay all cash? Even at 50%, how are you saving $125k? Wasn’t it you would couldn’t believe anyone in Irvine could save $200k?

I could pay all cash today if I wanted to live in a less desirable neighborhood. I live well below my means as my rent is about 1/5 of my monthly after-tax income.

I have never said that nobody in Irvine can save 200K; I just understand what it takes to resist the urge to increase the standard of living. I do not believe that most people will live below their means for the sake of saving up a down payment. I think it is the exception over the rule.

You think that every single person in Irvine is banking more than I am here in AZ?

I did not say every single person. But I do think that for a comparable job to whatever you do probably gets a higher wage in SoCal than in Phx. Go to your favorite median income source, Wikipedia, and extrapolate the data from there. Desert wages seem to be a “bit” lower than coastal ones (almost half?).

Thank you, so you are finally admitting that Irvine is not a good move for first timers.

Uhh… when have I said otherwise? And if you look at my follow-up, I would recommend a 2/2 for a starter if it had to be in Irvine. So Irvine could be a good move for first timers depending on the product they bought.

I live well below my means as my rent is about 1/5 of my monthly after-tax income.

I have never said that nobody in Irvine can save 200K; I just understand what it takes to resist the urge to increase the standard of living. I do not believe that most people will live below their means for the sake of saving up a down payment. I think it is the exception over the rule.

Sorry to burst your fantasy… but you’re not the only one who can save. It’s not like some special superpower reserved for people who live in the desert. And you seem to contradict yourself, you say you didn’t claim anyone in Irvine couldn’t save $200k, but then your next sentence says you don’t believe they can. So what is it? *Most* people in Irvine CANNOT save $200k? Is that the rule… not the exception?

I did not say every single person. But I do think that for a comparable job to whatever you do probably gets a higher wage in SoCal than in Phx.

I accept this; California does pay inflated wages as a result of the massive debt that banks have allowed local consumers in that region to take on. You do have a distorted income level versus other parts of the country which is why the unemployment rate in CA is worse than most of the rest of the country. Why pay more for the same quality of work you can get in another state where house prices are not WTF prices so folks will work for less?

Uhh… when have I said otherwise?

I have been saying for quite awhile now that the current market in Irvine is not being supported by first time buyers. What you have are people doing as you said, selling in other areas and “upgrading” to houses in Irvine. You have mocked that argument since the day I presented it and now you say that you would encourage your children to buy their first house outside of Irvine and “upgrade” later.

Sorry to burst your fantasy

It’s true, I did get a little wild with the Cocaine last night and went off into a wild drug induced fantasy about saving money. In between climbing the walls, I checked out the US personal savings rate and found that it is approximately 1% to 3%, smoked some more crack, and then figured out that that means A LOT of people are not saving. Now, maybe Irvine is a special bastion of Savers the buck the trend – but personally, common sense does not allow me to conclude that. Have you noticed that IrvineRenter has not come close to running out of F’d house debtors to profile yet? How can this be if Irvine is different than everyplace else and full of savers who live below their means?

I have been saying for quite awhile now that the current market in Irvine is not being supported by first time buyers.

No one has made the claim that is has. The only one who said something close to that was your jpg homie IrvineRenter who said that “none” of the buyers in the 2010 New Home Collection were move-up buyers.

What you have are people doing as you said, selling in other areas and “upgrading” to houses in Irvine.

No… that would be only part of who is buying. Others save (I know of at least 5 people who have) and many others get that FCB help (money from parents/relatives) or even dividends from investments/stocks.

You have mocked that argument since the day I presented it…

No. I know there are move-up buyers, but not the majority you think it is. Your theory claims most of them are like that. The problem with that is people in their 20s (of which a large portion bought in the sub-$500k range in Irvine), this is their first home, it is impossible for them to be a move-up buyer. Where did they get the money? I outlined that above… or maybe they are like SuperDave from Phoenix.

… and now you say that you would encourage your children to buy their first house outside of Irvine and “upgrade” later.

Yes… because I’m not an FCB. I’m not the Irvine demographic that’s currently buying in Irvine. If you ever can get access to the public records for sales in the past few years in Irvine, check out the last names… you will be quite amazed.

Oh… and you are still skirting my question from earlier… if you didn’t claim prices in Irvine would get down to 1999… what are you now predicting them to be?

haha. not only can you not do math, you have some revisionist history bullshit.

You have stated in the past that the majority of people who are upgrading have come up with the money from bubble area flips. Or how else could they have come up with the money.

Oh yes. IR’s profiling of 1200 to 1500 overextended buyers in irvine over the years is clearly representative in a city of 200K+.

As for savings, I have no idea what Irvine’s saving rate is. but using a national average savings rate in a country where 40% fall below the proverty line at some point in a 10 year period is totally analogous to the population of Irvine.

jpg homie

???????

I know of at least 5 people who have

Oh, so yesterday, I was accused of deploying “heresay” in my arguments and now look at this. Irvine HO knows 5 people who saved money.

Good for you. You know 5 whole people who saved money. Why is it that the personal savings statistics of a much larger sample do not support your sanguine conclusion?

if you didn’t claim prices in Irvine would get down to 1999… what are you now predicting them to be?

I have not skirted it at all. I have said that I do not know. Prices could fall to ’98, prices could remain flat. Common sense says that it will fall somewhere in the middle. The government is trying to create a bunch of inflation and I am not capable of predicting what the impact will be. Could Irvine hold up and wait for inflation to catch? Maybe. I don’t know. This is the same answer I give you every time you ask and you keep forgetting. Not the Alzeimers again, is it?

You just trapped yourself.

I can’t use 5 people I know to demonstrate that people do save to buy houses in Irvine… but you can use my recommendation to my fictional starter home buying children to prove your majority move-up buyer theory.

Good one.

Oh yes. IR’s profiling of 1200 to 1500 overextended buyers in irvine over the years is clearly representative in a city of 200K+.

Are you studying with Planet Reality now? You do realize that in that 200K+, some people do share a roof. If you are going to do a comparison, you should at least get your units straight. You know, comparing 1500 pounds of apples to a 200K+ picograms of apples might yield an incorrect conclusion. But you are the math wizard here – you knew that.

As for savings, I have no idea what Irvine’s saving rate is. but using a national average savings rate in a country where 40% fall below the proverty line at some point in a 10 year period is totally analogous to the population of Irvine.

Yea, the only thing you forgot about is that the savings rate is calculated as a percentage of Disposable Income. Obviously those 40% below the poverty line don’t have as much Disposable Income so they are not going to be weighing down the number and crowding out all those Irvine savers as you would love to believe. It does not matter that Irvine Dick saved 1000.00 and Poor John only saved 5 bucks.

Nice try. Keep blowing.

Blow blow –

What Does National Savings Rate Mean?

An estimate from the U.S. Commerce Department’s Bureau of Economic Analysis (BEA) of the amount of income left over after subtracting consumption costs and expenditures. The National Savings Rate, though it is referred to as a “savings rate,” does not actually measure the amount of money Americans are saving or investing for the long-term. National savings include savings left over from personal, business and government.

Investopedia Says

Investopedia explains National Savings Rate

The National Savings Rate is confusing at first glance, due to the fact that it is often substantially less than what the typical American reports contributing to their employer-sponsored retirement plans and IRAs. This difference is because the national savings rate includes government savings, and they are usually reporting deficits which lowers the national savings rate.

http://www.bea.gov/briefrm/saving.htm

Don’t the fact gets in the way Dave.

Come on now, do the math for us.

but you can use my recommendation to my fictional starter home buying children to prove your majority move-up buyer theory

I didn’t trap myself at all. I never proved nor claimed to prove that the majority of buyers were moveups. Yes, that is what I believe, but I cannot give you a mathematical proof without numbers that are conveniently not made available to me.

An estimate from the U.S. Commerce Department’s Bureau of Economic Analysis (BEA) of the amount of income left over after subtracting consumption costs and expenditures.

Well done! That is “Disposable Income” – exactly what I said. Thank you for augmenting my argument with a Wiki definition.

The National Savings Rate, though it is referred to as a “savings rate,” does not actually measure the amount of money Americans are saving or investing for the long-term. National savings include savings left over from personal, business and government.

Which is exactly why your trying to say that people below the poverty line are crowding out the Irvine savers is NONSENSE.

Do you like stepping on rakes? You aren’t one of those Sadists are you?

—

You do realize that in that 200K+, some people do share a roof.

—

Yes I do. 2.6 persons per household per 2010 census. 212k people in Irvine. So if he has profiled 1200 cases, then 1.4%.

Yes, totally representative.

Wow, the power of actually looking things up.

Come on Dave, do the math for us.

Personal income up 60%. Interest rates down 52%.

28% of income on housing.

How should have housing values changed over that time?

Do the math for us.

lol.

—

I checked out the US personal savings rate and found that it is approximately 1%

—

False.

last 3 years, 5 to 5%.

—

Which is exactly why your trying to say that people below the poverty line are crowding out the Irvine savers is NONSENSE.

—

False.

I didn’t saying anything about crowding out Irvine savers. I stated that using national average to extrapolate what Irvine savings rate is incorrect.

—

Come on Dave, do the math for us.

Personal income up 60%. Interest rates down 52%.

28% of income on housing.

How should have housing values changed over that time?

Do the math for us.

Yes I do. 2.6 persons per household per 2010 census. 212k people in Irvine. So if he has profiled 1200 cases, then 1.4%.

Wow, the power of actually looking things up.

You are lumping children into the batch? I thought we had laws against that. Have you no heart?

I would be a little more conservative and not expect individuals under 18 years old to be included in that.

Keep going. You are getting there (Slowly).

I’m finally home with my hp and thought I’d do some math.

If someone bought this house in ’97 at $236K with 20% down, their payment would have been $1,400 at 8% int. This is 28% of a $59K salary.

This year, say someone comes along to buy the house making 60% more which is $94K. They put 20% down on the $510K home which translates into a payment at 5% of $2,200 (28% of their income). If interest rates were still at 8%, however, that $2,200 would only buy a $300K mtg instead of a $408K mtg. With 20% down, the house would be “worth” $375K. So, if interest rates go back up to 8% at some point, there could be a drop of around 25% in order to maintain the same level of affordability.

That’s my backwards way of trying to justify a likely decrease in prices.

Are you serious that renting a 3/2 for $2500/mo is going to be a wash versus buying a $525k home (with 20% down). What planet is your math from? Sure it’s the same if you don’t factor in Property tax, insurance, HOAs or any other related costs of owning. My home cost just a smidge less than that and my monthly nut is $3300/mo. (with 20% down and 4.875% 30yr). Add in monthly stuff like the pool guy, the gardener, maintenance and I am probably close to $4k.

You’re late to the party… but I didn’t say it was a wash, I was just comparing princ+int. Here it is from an online mortgage calculator:

If your house was less and your rate was 4.875%, and your princ+int is $3300, something is wrong:

Even if you factor in 1% tax rate (no MRs on older homes), that’s only another $440 per month. Factor in interest and tax writeoffs and even with maintenance (no pool for this 3/2) and an HOA, you’re probably at or below $3000.

I’ve shown you my math… show me yours.

>When I first saw a person with six figure credit card debt I was shocked. That was in the middle 80s. Now I see it every day.

Six figure? More than $100,000? Every day.

This debt will be forgiven after the bankruptcy, and only after 7 years the person will be able to start collecting credit cards again.

If somebody earns $100,000 a year, he/she brings home only $5,000 a month. How much can he/she save? About $2,000 a month. It’ll take 50 months to save $100,000, especially with the current 0% saving rates.

At the same time, banks offer free $100,000 each 7 years on credit cards. Are they stupid?

If somebody earns $100,000 a year, he/she brings home only $5,000 a month.

Sounds about right. Probably closer to 6K but depending on how you set up your tax withholdings, certainly possible.

especially with the current 0% saving rates.

Well, we know that Irvine is different and everyone who lives there is a saver and not like the rest of the State\Country.

Let’s assume all these Irvine folks are living below their means and living in a crackerjack box for 2K a month. Let’s also assume that they have no life, don’t shop, don’t eat, don’t drive, etc and save 4K a month. You can save up 200K in 50 months. That’s only a little more than 4 years! And then you will be ready to put down a nice down payment on a fine Irvine tract house that sits 5 feet from the neighboring house and embark on a 30 year indentured servitude to repay a jumbo loan.

See?! It can be done! You aren’t so special are you?!

There are not so many companies in Irvine that pay $100,000. And many of them have disappeared amidst the crash of New Century style companies.

Your figures of $60,000 are more common.

For example, the biggest company in Irvine is the UCI. It cut salaries 10% last year.

If I were an Irvine bigshot wage slave right now, I would be just slightly worried that my company was going to realize that they can get the same work quality in a neighboring state for much less the cost.

Not a big deal if you rent as you are mobile and can move elsewhere and work for less. If you are a house debtor making payments on an overpriced mortgage then you are much more limited and your company does not give a rat’s rear end about how big your mortgage payment is.

It seems that the working people don’t buy in Irvine.

I spoke to one of those Asian “investors”.

He has brought his family from Vietnam on tourist visas, bought a small condo for $400,000, sent his kids to school and the UCI. So easy!

Shhh.

Anecdotal evidence pales in comparison to Dave’s “beliefs”.

You two need to head to the rec center for a

lock-in and hash it out over a death-match of Scrabble, Connect-Four and Battleship.

Awesome piece. Thank you!

Regarding the holders of the second trust deeds:

What percentage of them are really “going after the foreclosed homeowner” for the “extinguished proceeds”? I imagine they’re pissed, but c’mon. Do they really expect to get $100K+ from foreclosed persons?

Do you witness 2nd DT holders pursuit in 100% of the cases? 80%? 50%? Less?

To me the most impressive statement in this piece:

“the lien of the 2nd TD is extinguished; the holder of the 2nd never gets a dime, then they look to the former homeowner for whatever the balance was. This can be devastating, as the balance could easily be in six figures and most people can’t just write a check for it.”

Man, I wonder how many borrowers think they’re finally in the clear after the foreclosure hell is finally over with, only to find mysterious people hunting you down for tens of thousands of dollars you don’t have.

I’m expecting the next great IHB interview to be held with an OC psychiatrist and and OC cardiologist, though not necessarily in that order.

I don’t know what the percentages are but nowadays every week I see people with an old 2nd coming after them for money. The Statute of Limitations is 6 years.

The debt collection business has become even more sleazy over the last decade. The Statute of Limitations for credit card debt is 4 years, yet there’s a whole industry that buys expired paper and STILL calls the people and tries to collect money from them! This is legal. The Statute of Limitations is a DEFENSE, not a PROHIBITION. And a certain percentage of those folks don’t know any better and will actually pay money to these scumbags.

-Joe Weber

http://www.bkrights.com

A friend just finished going through BK but is still living in her house and not paying the mortgage on a first and second (not purchase money, but probably doesn’t matter due to BK).

I’ve always wondered two things about scenarios like this:

1. If and when the bank(s) foreclose I’m assuming she is protected from any judgments even though they are occurring chronologically post-BK? How does the BK shield from future events?

2. She has been investigating a loan mod. If she gets one now (and signs her life away post BK), I’m assuming the BK doesn’t protect her should she end up defaulting down the road? My recommendation to her has been to absolutely not sign any loan mod/contracts, but she has these fancy plans about renting out the house until she can become employed again (yes, she’s unemployed). Add to that she is very much under water. Stupid huh!

1. Yes.

Future events aren’t covered other than the fact that creditors can’t collect once their debts was discharged.

2. Basically correct- new contracts/obligations aren’t part of the BK. She should spend a couple dollars and have a real estate attorney look over any loan mod docs before she signs.

-Joe Weber

http://www.bkrights.com

My goodness, what pathetic comments for such a great article. As a relatively ignorant researching aspiring homeowner I usually learn so much from the comments sections. Today I just got confused and had to stop reading because of the mean spirited threads. If you two want to box please just email each other so everyone else can respond to the relevant piece. And don’t bother whacking at me now, I’m not coming back to this thread. Adults acting like 10-year olds, you two.

What happens after mortgage delinqency is that the delinquent DEADBEATS get to continue to live RENT FREE in the house FOR YEARS because banks REWFUSE to put their MASSIVE RE LOSSES ON THE BOOKS.

The entire U.S. government’s policy in regards to dealing with FAILURE, FRAUD and FISHY FINANCES is to SWEEP EVERYTHING UNDER THE RUG, PAINT OVER FAILURES and APLLY GOLDEN BANDAIDS to cover up its FESTERING, ROTTEN, STINKING SORES.

Good luck with THAT approach.