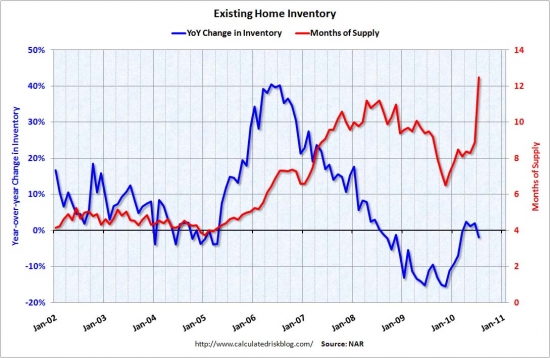

Each quarter the banks release a wave of foreclosure properties, then they cook up a delay while the MLS absorbs them.

Irvine Home Address … 7 ARESE AISLE Irvine, CA 92606

Resale Home Price …… $450,000

Dumbstruck

Color me stupid

Good luck

You're gonna need it

Green Day — Waiting

In early February, an ruling in Nevada against Trustee Corps, the trustee for Bank of America in Nevada, prompted them to postpone and cancel all their foreclosure actions in Nevada this month. Several other trustees did the same. Ostensibly, this delay is necessary to review their paperwork. In reality it is part of a quarterly cycle of release and wait.

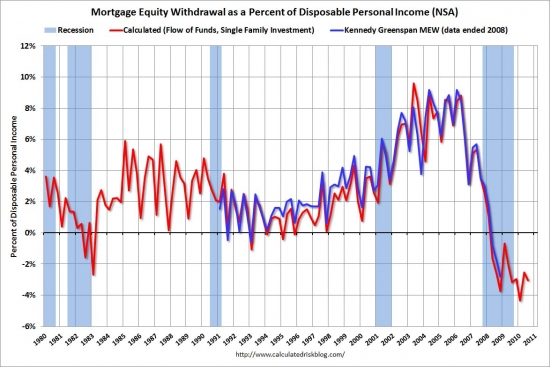

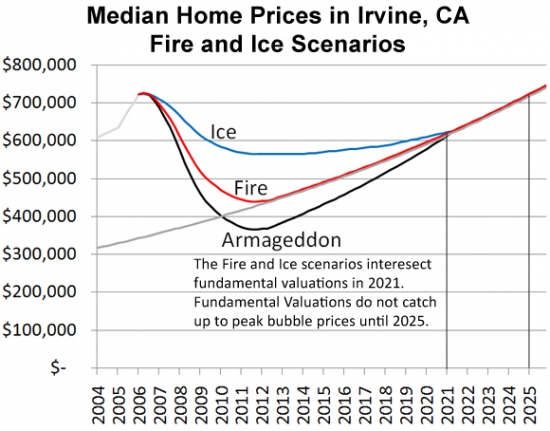

The banks need to process these delinquent borrowers and either get their money back. Right now it is tied up in a wasting asset with a liquidation value far less than their original loan amount. This liquidation can't go too fast or prices will crash, and strategic default will create a downward spiral that wipes the market out. Liquidation can't go too slow, or lenders and investors go broke servicing their wasting asset.

The method banks use is to process properties in spurts then wait to see the results. Depending on their internal circumstances, some banks may process more REO and some less. Now that I have been watching this market long enough, I can see the quarterly lull in processing. I wonder what their excuse for delay will be in May?

Investors' foreclosure appetite grows, headaches arise

NEW YORK |

NEW YORK (Reuters) – Investors are flocking to home foreclosure sales in California and other states where banks have rescheduled auctions postponed last year to fix loan servicing flaws.

But often their intentions to purchase the distressed properties are still stymied by disagreements over a fair price or as auctions are simply canceled.

In California, bank-set “opening bids” won 14,068 properties from auctions last month, a 51 percent rise over December, ForeclosureRadar.com said in a report this week. Investor purchases rose more than 50 percent to 3,272, but were dwarfed by the 12,279 auctions canceled, it said.

“There's just not a lot of inventory” made available, said Sadie Gurley, a managing partner with New York-based GreenLake Investment Partners, a new entry into the field of investors seeking to profit from the “shadow inventory” building up on bank books.

“It's like a funnel,” she said.

Personally, I like the black hole analogy.

The trend is similar in other high foreclosure states, such as Arizona and Nevada, according to ForeclosureRadar.com.

Distressed property sales have accounted for a significant share of the housing market, rising to 36 percent in December from 32 percent a year earlier, according to the National Association of Realtors. The purchases can be made by investors or banks, which have ramped up “short sales” in which they agree to sell a home below the balance on the mortgage.

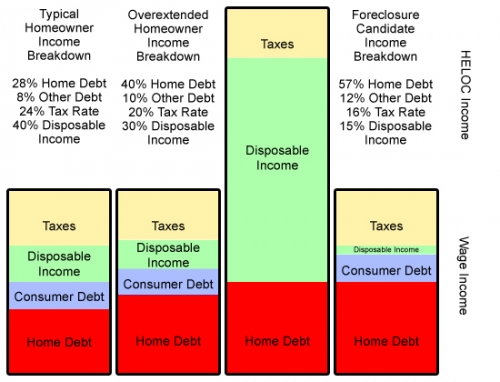

The number banks carefully watch is the percentage of distressed sales. Numbers over 30% stymie appreciation. Distressed sales over 40% make prices go down. Lenders have collectively decided that massive shadow inventory is superior to prices in free fall.

Investors — who typically aim to buy, fix and re-sell the houses — are lining up as banks restart foreclosures from moratoriums imposed last year to review faulty processes, such as “robo-signing” of court affidavits or other document issues.

Revelations of shoddy servicing further muddied the foreclosure process, which to investors is key to cleaning up excess inventory and aiding housing's recovery.

Banks have limited sales to others by keeping their opening bids above what the local markets will bear, investors said.

On average, in California, investors are paying 25 percent below market value when winning the auction, versus a 15 percent premium bid of banks that take properties into their “real-estate owned,” or REO, portfolios, said Sean O'Toole, chief executive officer of ForeclosureRadar.com.

“In California, the average foreclosure is $150,000 upside down in the mortgage, so if the bank doesn't drop the bid from the amount owed, there's no chance the investor is going to purchase it,” O'Toole said.

It's even worse in Nevada. I saw a property go to auction on February 25 in Las Vegas that was purchased for $3,000,000 in 2006. It was an amazing 7 bedroom 6 bath 4,800 SF mansion. The opening bid was $742,000. How's that for a lender haircut?

Many others are canceled as banks redouble efforts to modify loans, conduct a short sale or if they find problems with documentation, he added.

In January, more than 12,000 were canceled in California alone, up from December but down from a year earlier.

At Bank of America Corp, the largest U.S. mortgage-servicing company, postponements will continue as it works on loan modifications, a spokeswoman said.

O'Toole believes the banks are holding onto properties to avoid write-downs, or sometimes to extend servicing fee revenue.

That's exactly what they are doing. Some of the properties are being held in limbo because servicing agreements provide greater incentive to keep shadow inventory than to process the foreclosure. Also, as i have written about many times, lenders simply are not in a position to write down the loans.

It all adds up to a “measured strategy” by banks compared with dumping the homes on the market, said Bruce Norris, president of The Norris Group, in Riverside, California. For those properties priced attractively to investors, competition is fierce, he said.

Banks will drop opening bids — sometimes just hours ahead of auction — springing investors into action to check out the property. These are crucial moments for investors, since margins as tight as 17 percent are easily eroded by necessary repairs or costly delays if the home is still occupied, which it is most of the time, Norris said.

I am always amazed at how the auction system is set up to obtain the least amount of recovery at sale. The true for-sale inventory is not known until the morning of the auction making prior research nearly impossible. The properties are not prepared or marketed in any way. The information needed to sharpen your pencil and bid a bit higher is difficult to obtain as there is no central database as good as the MLS. In short, the entire process conspires against high bids.

In the past, the inefficiencies of the system were part of the carrot and stick approach lenders would use to get delinquent borrowers to pay. The last thing anyone with equity wants to do is let the house go to auction where they may lose everything. In an appreciating market, the threat of foreclosure motivates borrower compliance. Once borrowers go underwater, this threat turns to work against lenders who now face a low capital recovery at foreclosure.

Former owners are hanging on “more often because of all the news articles about robo-signing and maybe the lender didn't have the right to foreclose,” he said, adding “unscrupulous” lawyers are giving owners a greater sense of entitlement.

Bailouts and False hopes. That's all they are.

Even so, he expects inventory to rise for the next six months as the system plays “catch up” from the slowdown in the second half of 2010, he said.

“Banks are figuring out that having REO is much more expensive,” he said. “That's why they modify first, short-sale second and then reduce bids at a trustee sale. All those options net the bank more than REO.”

Higher loss severities will force lenders to resolve bad loans and liquidate REO. The realization that servicing is more expensive in the long run than immediate liquidation will prompt banks into action. The lenders in the weakest financial condition will try to wait and liquidate last in hopes the market will bail them out. The strongest institutions will sell first lowering the prices for everyone else and eventually bringing an end to the cartel behavior.

Irvine Home Address … 7 ARESE AISLE Irvine, CA 92606 ![]()

Resale Home Price … $450,000

Home Purchase Price … $643,000

Home Purchase Date …. 2/24/06

Net Gain (Loss) ………. $(220,000)

Percent Change ………. -34.2%

Annual Appreciation … -6.7%

Cost of Ownership

————————————————-

$450,000 ………. Asking Price

$15,750 ………. 3.5% Down FHA Financing

5.02% …………… Mortgage Interest Rate

$434,250 ………. 30-Year Mortgage

$93,389 ………. Income Requirement

$2,336 ………. Monthly Mortgage Payment

$390 ………. Property Tax

$54 ………. Special Taxes and Levies (Mello Roos)

$75 ………. Homeowners Insurance

$290 ………. Homeowners Association Fees

============================================

$3,145 ………. Monthly Cash Outlays

-$386 ………. Tax Savings (% of Interest and Property Tax)

-$520 ………. Equity Hidden in Payment

$31 ………. Lost Income to Down Payment (net of taxes)

$56 ………. Maintenance and Replacement Reserves

============================================

$2,327 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,500 ………. Furnishing and Move In @1%

$4,500 ………. Closing Costs @1%

$4,343 ………… Interest Points @1% of Loan

$15,750 ………. Down Payment

============================================

$29,093 ………. Total Cash Costs

$35,600 ………… Emergency Cash Reserves

============================================

$64,693 ………. Total Savings Needed

Property Details for 7 ARESE AISLE Irvine, CA 92606

——————————————————————————

Beds: 3

Baths: 3

Sq. Ft.: 1614

$279/SF

Lot Size: –

Property Type: Residential, Condominium

Style: Split-Level, Other

Year Built: 1992

Community: Westpark

County: Orange

MLS#: P768717

Source: SoCalMLS

Status: ActiveThis listing is for sale and the sellers are accepting offers.

On Redfin: 11 days

——————————————————————————

Short sale!!! Excellent location & quiet area in gated community. This charming European architecture home with marble fileplace, plantation shutters recessed lighting, custom designer light fixtures, new upgraded custom paint & upgraded carpet, mirrored wardrobes, central vacumm system, vaulted ceilings, water softner. Many windows with lots of natural sun light.

Baths: 3

Baths: 3

.jpg)

.jpg)