The National Association of realtors, in a deliberate attempt to deceive buyers, exaggerated home sales data during the housing bust.

Irvine Home Address … 5042 GREENCAP Ave Irvine, CA 92604

Resale Home Price …… $534,900

Pray for daylight,

Pray for morning,

Pray for an end to our deception

The Crüxshadows — Deception

Will realtors ever stop lying to us? Apparently, they thought it best to show a market with robust sales even though the reality was low sales. Starting in 2007, just as sales volumes were plummeting because prices were high and qualifying buyers were scarce, the National Association of realtors revised their methodology in a way that overstated sales significantly over the last 4 years. In others words, if you thought sales rates were tolerably low, you were deceived by as much as 20% by the NAr.

This lie was completely self serving. The NAr wanted to dupe buyers into thinking the market was stable to induce transactions that never would have gone through if buyers had known the truth. Many of those buyers in 2007 and 2008 are now underwater, and with the double dip, the 2009 and 2010 buyers may join them.

What those buyers deserved was to be educated to the reality of the housing market. What they got instead was reassuring lies.

Home Sales Data Doubted

Realtor Group May Have Overstated Number of Existing Houses Sold Since 2007

By NICK TIMIRAOS

The housing crash may have been more severe than initial estimates have shown.

The National Association of Realtors, which produces a widely watched monthly estimate of sales of previously owned homes, is examining the possibility that it over-counted U.S. home sales dating back as far as 2007.

The group reported that there were 4.9 million sales of previously owned homes in 2010, down 5.7% from 5.2 million in 2009. But CoreLogic, a real-estate analytics firm based in Santa Ana, Calif., counted just 3.3 million homes sales last year, a drop of 10.8% from 3.7 million in 2009. CoreLogic says NAR could have overstated home sales by as much as 20%.

While revisions wouldn't affect reported home-price numbers, they could show that the housing market faces a bigger overhang in inventory, given the weaker demand.

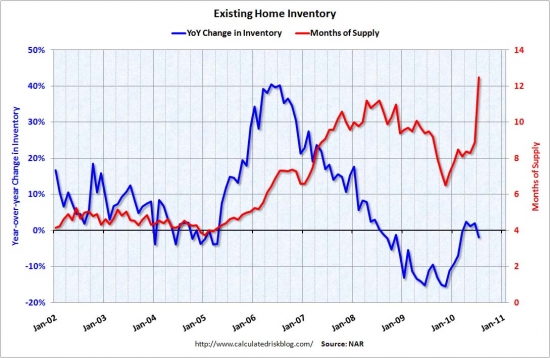

This is the core of the deception. The actual sales numbers are a jumble of numbers the NAr can spin however they like; however, the months of supply calculation is a widely known market gauge with an accepted interpretation: more than 6 months of inventory is bad and less than 6 months is good. In order to manipulate this statistic, the denominator (home sales) needs to be as large as possible. Anything which overstates home sales directly impacts the months of supply.

In early 2007, months of supply had been above 6 months for about a year. Is anyone surprised they found a way to change their sales numbers to bring the months of supply down? This summer, existing-home sales sunk to lowest level ever recorded. I wonder how bad it really was? And how large did the months of supply get? And how many months of supply do we currently have?

Manipulating sales numbers for the months of supply calculation is very important to those who believe it is always a good time to buy. Steve Thomas of the now defunct Altera Real Estate used escrows rather than closed sales because it had the same effect.

In December, NAR said that it would take 8.1 months to sell some 3.6 million homes listed for sale at the current pace, but the number of months it would take could be even higher if sales are revised down. Any revisions wouldn't have an impact on homeowners, but it could have consequences for the real-estate industry. Downward revisions would show that “this horrific downturn in the housing market has been even more pronounced than what people thought, and people already thought it was pretty bad,” said Thomas Lawler, an independent housing economist.

NAR said the data, which are used by economists, investors and the real-estate industry to gauge the health of the housing market, could be revised downward this summer. Lawrence Yun, chief economist at NAR, wasn't specific about whether and by how much the revisions could reduce reported sales, and he raised the possibility that the CoreLogic estimates have understated the number of home sales. “This is a very important issue, and we are looking at it carefully right now,” Mr. Yun said.

Economists say any overstatement is the result of difficulty tracking data during market corrections. “This is an economic data issue, not a gaming-the-numbers issue,” said Sam Khater, senior economist at CoreLogic. “Any time you get big shifts in the market, the numbers go haywire for a bit.”

Over the past decade, a growing number of housing-research firms have sprouted up, offering new ways to track home sales.

CoreLogic, which was spun off from First American Financial Corp. last year, measures sales by tracking property records through local courthouses. The firm says its data covers approximately 85% of all home sales tracked by NAR.

NAR, which is due to report January home sales on Wednesday, uses a sample of sales data reported by local multiple-listing services to calculate monthly changes in sales.

So CoreLogic actually counts them and the NAr uses some statistical voodoo to estimate them? Hmmm… I wonder whose methodology will prevail?

To produce estimates of annual sales, it uses a model that is benchmarked to the figures reported in the decennial U.S. Census. The model requires making certain assumptions for population growth and other measures in between the census surveys.

Those models could have over-counted sales due to recent consolidation among multiple-listing services, which has resulted in those firms having wider coverage of housing markets. NAR's tally could be distorted if the firms “are sending us more home sales because they have a larger coverage area, but without informing us” that their reach has grown, said Mr. Yun.

Because not every home sale goes through a multiple-listing service, NAR must also make additional assumptions. For example, it must estimate what share of transactions are “for-sale by owner,” and the housing downturn has sharply reduced that segment of the market. Consequently, the NAR could over-estimate sales if it hasn't properly adjusted for a smaller “for-sale by owner” share, said Mr. Yun.

NAR typically produces revisions of home-sales data at the end of every decade based on the latest Census survey data. But because the 2010 Census didn't ask U.S. residents about home sales, NAR must devise a new way to build its home-sales model.

So the NAr's methodology is rooted in a ten-year old piece of data that is no longer being collected? I think they have some significant revising to do.

Here's what I don't get. If every major retailer can operate a national database of their store inventory, why can't the NAr. Why can't the NAr simply query their database and tell us exactly how many homes sold, where they sold, and for how much? They try to make themselves valuable by being the purveyors of vital information, but they operate arcane systems and produce unreliable reports.

Several economists approached NAR late last year with questions about its modeling. NAR economists promised to study the issue during a December conference call that included economists from the Mortgage Bankers Association, Fannie Mae, Freddie Mac, the Federal Reserve, the Federal Housing Finance Agency and CoreLogic.

Economists from the Mortgage Bankers Association said they became skeptical after the MBA's index of mortgage-purchase applications appeared to be a less reliable indicator of home sales. The index had been closely correlated to NAR existing home-sales data until 2007. Even assuming a high share of all-cash sales, purchase-loan application data suggests that home sales have been overstated by 10% to 15%, said Jay Brinkmann, the MBA's chief economist.

“If they are off by this much, this consistently, it would be sending the wrong signal to the market,” said Mr. Brinkmann.

Downward revisions in existing home sales could have an impact on real-estate related businesses, but economists said it isn't clear that they would have a meaningful impact on the broader economy, which typically relies more heavily on new-home construction to drive growth.

Write to Nick Timiraos at nick.timiraos@wsj.com

Really, most rational people already knows the NAr is duplicitous. That's why realtors in used house sales are held in the same regard as slimeballs in used car sales.

Barry Ritholtz at the Big Picture had this to say to the realtors before this latest scandal:

Attention RE Agents: NAR Spin is Counter-Productive !

We have had a god-awful run of Housing data. New and Existing Home Sales, Defaults and Foreclosure data, even the Case Shiller report — all have been utterly horrific.

In light of this, I want to make the following announcement: Attention RE Agents! The National Association of Realtors are doing you a terrible disservice.

Consider the following comments from a RE Agent, published exactly three years ago (September 4, 2007) in the Realty Times:

“The National Association of Realtors and your state association will always have published reports that sound better than what you are personally experiencing in the market. Please understand that they support us. They know that whatever they say will end up in public press. We do not need any more negative press! When you read reports that we have reached the bottom or that the market has actually gone up, take it with a grain of salt. Their job is to permeate the world with good news about real estate.”

In other words, mislead the public with spin. Create false hope. Lie. This agent was defending the National Association of Realtor’s blatant dishonesty — a mistake on its face — just as the damage they did began to have an effect.

What the NAR was offering to buyers, sellers, their agents, indeed, anyone involved with Housing, was the blue pill.

The sort of nonsense the Realtor’s group peddles helps explain why sellers have incorrectly believed a recovery was imminent, even as housing went through a historic collapse. It is why home owners incorrectly still expect their homes to go appreciate by 10% a year.

These false beliefs have real world consequences. They create ridiculous expectations among sellers, who selectively grab onto any positive news they can. They choose the temporary blissful ignorance of illusion — that damned blue pill — versus embracing the painful truth of reality (i.e., the red pill).

This confirmation bias leads sellers into mis-pricing the value of their homes. They have been a season or even a year or more behind the pricing curve the entire way down.

Ask any listing agent how difficult it is to get sellers to become realistic in their asking prices. Real Estate agents would be moving a helluvalot more houses if they were not fighting misinformation that the NAR has put into the marketplace. Many, many agents have confirmed that, even in this crummy environment, a good house properly priced will sell.

Here’s a question for you reality (vs NAR realty) agents. Ever wonder why you seem to be having such a hard time convincing sellers to set reasonable asking prices? Ever ponder why they have such a distorted sense of the true value of their homes? Ever try to get them to set reasonable asking numbers that are competitive with current market prices?

The short answer: NAR spin.

To see how bad this false NAR narrative has become, check out this new show on HGTV: “Real Estate Intervention.” The show’s hosts travel town-to-town in an attempt to convince homeowners to sober up, put the magic mushrooms away, and price their houses realistically. They literally drag these poor bastards to nicer comparable homes to theirs — better locations, bigger square footage, nicer kitchens — all in an effort to TALK SELLERS INTO REALISTIC PRICE POINTS. It staggers the imagination: A television show actually had to be created to counter-act the excess stupidity coming from the Realtor’s trade group.

Gee, where do you think sellers got these crazy ideas? Might the NAR, by encouraging a fantasy, be actually hurting the housing market as a whole?

Even the normally staid NYT has recognized how absurd the NAR spin has become. This past weekend, Joe Nocera began an article with the sentence: “You have to wonder sometimes what they’re smoking over there at the National Association of Realtors.”

When the Gray Lady asks if your economists are high, isn’t that are warning sign that you must make a major change? How on earth is having a reputation of being stoners good for the RE business?

And, buyers have figured out that the NAR news releases are unmitigated fantasy. They have learned that any organization that has to go to such lengths to spin bad news must know that the news is much much worse. The result has been a Real Estate buyers strike.

Here it is, three years after that lame defense of NAR spin, and we can see the damage that spin has wrought. It is readily apparent that the NAR has become counter-productive to the agents they are supposed to be serving.

No, the NAR is not supporting you. They are making your jobs much, much harder. They are spinning the public, and doing you an enormous disservice.

Try RealityTM! Its what is working these days.

Perhaps the NAr will implode or new blood within the organization will see the organizations role differently. What they need is a commitment to accuracy rather than a commitment to spinning. What should they do if it really isn't a good time to buy? Is a listing agent duty bound to lie for a client to convince a buyer the property is a good investment? Is a buyer's agent who pushes their clients into a sale serving or harming them?

The National Association of realtors has a belief pathology. A core belief is eating away like a cancer — buyers can-should-must be manipulated into purchasing a house. This core belief guides many of their programs, advertising campaigns, and general attitude toward both buyers and sellers. Based on their advertising, I would say they think buyers are stupid sheeple.

The not very assuring truth

Buying can still be a good choice even in a declining market. Buyers who are motivated to save on renting are the stabilizing force in any real estate market, and it is the activity of these buyers that ultimately turns the tide. Those who bought in 2008-2010 can still have positive outcomes, particularly if they hold for several years. Those who purchased knowing this reality made a conscious choice to buy even with the financial circumstances.

Not every real estate purchase need be motivated by obtaining appreciation. Some people bought knowing they were overpaying in a declining market because it was the right time for them and their family. They examined the financial implications of their decisions and did it anyway. That made the decision right for them whatever those of us on the outside might think.

Clear decision making made with real data almost always produces a good outcome. Every buyer deserves the opportunity to decide for themselves based on good information. Unfortunately, it isn't what buyers get from realtors.

(BTW, if you haven't seen it, Keith at Housing Panic made a new post after two years. It said to buy real estate.)

A Master HELOC Abuser

I was greatly impressed by the reliability and the amount of the housing ATM withdrawals by this owner. This house is a piece of crap. The guy who bought this in 2001 obviously didn't do much to it, so most of the HELOC booty was likely pissed away.

- This house was purchased by the former owner on 9/18/2001 for $351,000. The owner used a $275,000 first mortgage a $40,800 second mortgage, and a $35,200 down payment.

- On 4/10/2002 he refinanced with a $106,500 stand-alone second. This effectively withdrew his down payment and gave him some extra spending money.

- On 8/27/2003 he refinanced with a $395,250 first mortgage.

- On 5/13/2004 he refinanced with a $570,000 first mortgage.

- On 4/27/2005 he refinanced with a $653,000 first mortgage.

- On 2/28/2006 he refinanced with a $572,000 first mortgage and a $143,000 HELOC.

- On 4/20/2006 he refinanced with a $636,000 Option ARM with a 1.25% teaser rate, and he obtained a $79,500 HELOC.

- Total property debt is $715,500.

- Total mortgage equity withdrawal is $399,700,

-

Total squatting time was about 18 months assuming the NOD was filed in a timely manner.

Foreclosure Record

Recording Date: 10/28/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 09/14/2009

Document Type: Notice of Default

The bank bought this at auction for $519,000 on 12/29/2010. Hard to say how bad their loss is on that Option ARM, but they will be lucky to recover half after all the fees have been paid off. And Irvine is one of the better recovery areas. Option ARM investors are getting wiped out.

Irvine Home Address … 5042 GREENCAP Ave Irvine, CA 92604 ![]()

Resale Home Price … $534,900

Home Purchase Price … $519,000

Home Purchase Date …. 12/29/10

Net Gain (Loss) ………. $(16,194)

Percent Change ………. -3.1%

Annual Appreciation … 18.2%

Cost of Ownership

————————————————-

$534,900 ………. Asking Price

$106,980 ………. 20% Down Conventional

5.02% …………… Mortgage Interest Rate

$427,920 ………. 30-Year Mortgage

$111,009 ………. Income Requirement

$2,302 ………. Monthly Mortgage Payment

$464 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$89 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================.jpg)

$2,855 ………. Monthly Cash Outlays

-$394 ………. Tax Savings (% of Interest and Property Tax)

-$512 ………. Equity Hidden in Payment

$209 ………. Lost Income to Down Payment (net of taxes)

$67 ………. Maintenance and Replacement Reserves

============================================

$2,225 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,349 ………. Furnishing and Move In @1%

$5,349 ………. Closing Costs @1%

$4,279 ………… Interest Points @1% of Loan

$106,980 ………. Down Payment

============================================

$121,957 ………. Total Cash Costs

$34,000 ………… Emergency Cash Reserves

============================================

$155,957 ………. Total Savings Needed

Property Details for 5042 GREENCAP Ave Irvine, CA 92604

——————————————————————————

Beds: 4

Baths: 2

Sq. Ft.: 1856

$288/SF

Lot Size: 5,000 Sq. Ft.

Property Type: Residential, Single Family

Style: One Level, Contemporary

Year Built: 1970

Community: El Camino Real

County: Orange

MLS#: P768698

Source: SoCalMLS

Status: ActiveThis listing is for sale and the sellers are accepting offers.

On Redfin: 11 days

——————————————————————————

NO HOA OR MELLO ROOS. 4 BD/2 BTH HOME, LIVING ROOM, FAMILY ROOM WITH FIREPLACE, CROWN MOLDING, 2 CAR ATTACHED GARAGE WITH LAUNDRY HOOK UPS, SCRAPED CEILINGS. NEEDS SOME TLC.

.jpg)

The way I look at it is that there are 120Million homes, and you don’t need to maintain much data on them (all publicly available) address, last couple sales, whether it has a mortgage. Maybe 10kB of data. That is 1.2TB of storage needed. Granted, a large database, but small enough to fit on a desktop hard drive. With all the computation power available, there is no reason for estimating important statistics.

What’s worse, this is NOT the NA[r]’s first offense! They’ve done this trickery before!

Home sales rise, price slump points to weakness

Sales rose even as demand for home loans slumped in January. The NAR has been accused of overstating the rate of home sales by as much as 20 percent.

While acknowledging the trade group might have overcounted sales, NAR chief economist Lawrence Yun told reporters: “I would be highly surprised if it was 20 percent.”

The NAR is reviewing its data and will release benchmark revisions later this year. Yun said the last benchmark revisions in 2000 showed an overcounting of about 13 percent.

Oh no, not 20%! We only lie about our success by 13%. Aren’t you proud of our honesty?

Vipers, all of ’em!

-Darth

And notice how the initial overestimates command big headlines and BREAKING NEWS banners on all the MSM news sites. Then the downward revisions get buried in little a little noticed blurb. Which do you think gets the most attention and has the most influence?

What happened recently in the south Orange County market. My daily Redfin “new listings” updates usually have 2-6 new listings. Today there are 35! Did one of the big lenders decide to list all its reos?

Maybe this is the beginning of the spring selling season. :question:

Hope you are right. Thinking of buying in Lake Forest/Foothill Ranch.

Those two areas are gonna get crushed.

Would be nice to buy post crush. Care to share why/when you think that will happen?

That’s the million dollar question. No one knows for sure, but it’s safe to say that local prices will continue to fall until they reach a point where the next generation of buyers can swarm in and prevent further deterioration. Even with the govt/FED subsidizing mortgages, we still can’t find enough qualified buyers to prevent further declines.

Lee, any specifics to those areas though?

“Those two areas are gonna get crushed.”

How are these two different?

“How are these two different?”

JMHO ~ I’m generalizing here. Those two cities experienced the price benefit of being in S Orange County, without the benefit of white collar incomes.

Thrifty, how do you get daily new listing updates on Redfin? I don’t see an option for that.

LarryB

Assuming you have a Redfin account, click on the “My Redfin” tab in the upper right of the page, then on “saved searches” then under “email notification” choose the frequency.

You must have saved search(es) in order to get the notifications.

It’s a very nice way to keep tabs on specific areas of interest.

Regarding numbers that don’t add up,

I have one nit to pick:

Why does (currently) your chart read 778 active properties in Irvine’s inventory, while redfin lists 822 properties active in Irvine?

I don’t think you’re intentionally doing it just to push your brokerage, but I want to know “Why don’t they match up?”

It seems like none of you in real estate pick from the same numbers…

I’m starting to research something that’s been bothering me this past year: If demand has slumped to the extent that it (really) has, and real estate taxes will not get paid to the level that they have in the years past..what does this really mean for our future. I’m seeing a huge..huge negative trend for California.

If our public schools are getting their budgets slashed, and class sizes (even in Irvine…1st-3rd grades had 20 kids per teacher up until a couple of years ago…now those classes hold 35 kids) keep growing. UC and Cal State schools keep raising prices and allowing more and more “out-of-state/foreign” students since they pay much higher fees…and shut out our California kids since we pay far less. Where will this state be in 15 years? Our kids’ futures (near futures) are getting very compromised in this mess.

“now those classes hold 35 kids”

Can you provide anecdotal evidences backing that statement?

I have seen the classroom size go from 20 to as high as 33 over the past 3 years. My son is currently 32 out of 33 in his 3rd grade class at Hicks Canyon elem.

My kids were at Westpark. The ed-data site has only been updated through ’08-’09 (!) for class sizes. While we were there, there was an annual fundraising for maintaining class sizes at 20-1 for K-3. We paid around $200/student (for those who actually paid) to keep it that way. Now they don’t do that fundraising anymore, and the class sizes, as of last year, were up to as much as 35-1. This is happening all over Irvine. Let see if they update the site to reflect that change…

http://www.ed-data.k12.ca.us/Navigation/fsTwoPanel.asp?bottom=/profile.asp?level=07&reportNumber=16

Thanks TW and jb for your responses.

This was a year ago. New cuts are coming soon.

http://articles.ocregister.com/2010-03-17/education/24639509_1_class-sizes-budget-proposal-time-in-district-history

The Irvine Unified School District Board of Education unanimously approved more than $19.8 million in cuts and budget reductions for the next two years

Schedule 12 furlough days over the next two school years – four this year and eight the next – for teachers, administrators and administrative assistants.

•Increase average class sizes to 30 for first through third grades and increase ninth-grade class sizes to 32 students.

That news is from a year ago. They’ve restored 4 furlough days for this year, so it was 4 days last year and 4 days this year.

This isn’t just Irvine, and at least Irvine has the IPSF (Irvine Public Schools Foundation) to help shore up things like music, art and science. Other districts are much worse off.

ttp://newsflash.iusd.org/2010/11/based-on-unanticipated-revenue-iusd-restores-four-furlough-days-including-two-student-days/

I remember, that time Obama printed another billion and gave it to schools in California.

GASP! “The children“!

Come now, David…weren’t you a children long ago? 🙂

Well, for one thing California relies inordinately on its income tax rather than property taxes to fund the state…

Personal Income taxes make up 48% of the state General Fund, sales tax rates range from 8.25% to 9.75%, depending on the county. Sales taxes raise roughly $35 billion in revenues of which $23 billion (a 5% rate) is devoted to the state General Fund.

In the state of California, unlike most other states, the schools are guaranteed 40% of the general fund revenues…your property taxes are a minimal amount of the funds that the local skewl districts receive.

“Where will this state be in 15 years?”

I met a retired 48 year old cop 3 weeks ago. He served his 25 years.

Stop asking questions, and pay up!

is it true their retirement is north of 90% of pay while active?

It depends on the number of years of service they have. In OC the formula for a Plan F safety employee (Sheriff, Fire, Probation Officer) who is 50+is:

3% of average monthly compensation (36 month average in most cases) x years of service credit = % of final pay (aka monthly pension amount)

OT is not includable in the average salary computation, the formula maxes out at 100%, and the % of monthly compensation (the 1st factor in the equation) is slightly lower if you are under age 50. Safety members may retire at any age if they have 20 years of service credit, but they wouldn’t achieve 100% of pay until they have 33 years in….

It gets a lot more complicated, but this is the gist anyway…

Shame on California for treating it’s police force well. The thought of it makes me sick.

the topic is an unsustainable public sector choking the private sector. Is retirement at 48 common among the private sector?

I’d wager not.

We all value police officers, teachers, etc. The question is can we afford to pay them as well as we do?

So, because it isn’t common in the private sector, the public sector cannot have it?

It’s not offered in the private sector because it’s not sustainable. At least not for any entity that wants to be viable long term.

Just to clarify, because it doesn’t exist in the private sector means that it shouldn’t exist in the public sector?

I for one don’t mind paying them what they get. I mind not being able to get rid of incompetence. Some teachers really stink.

cruz please ponder Big C’s comment.

You’re right! It should exist in the private sector as well. Since, as a taxpayer, I’m paying for the public sector’s benefits, maybe the public sector can chip in and help pay for my benefits. (But I guess that would just be returning some of my money back to me . . .)

Listen Cruz … I have no problem with treating cops well. I have no problem with sensible collective bargaining for the unions. But come on … 48 years old and retired. WTF is that????

One one side we have fat ass bankers who walk away from a bankrupted firm with half a billion dollars, and on the other side we have civil servants retiring when they’ve only lived 1/3 of their adult lives. So I have the audacity ask, can’t we find something in the middle? WTF?

You’re right, we should keep old cops working and on the payroll, even though a younger and more physically capable person would better serve the community in that position.

If I need someone to save my ass one day, I want the guy in the prime of his life doing it, not some 55 year old guy. If that means we have to buy the 50 year old out (by giving him a nice retirement package) so be it.

I don’t buy that argument Cruz. The best cops are generally the most experienced cops.

It’s a fair bet that they aren’t even retired. Just collect a pension, plus work another job. And often it is a good buddy consulting contract for public administrators, or security for ex-cops. Two incomes for some years after retiring, with one of them guaranteed. Not a bad deal. And don’t forget the health care (for the entire family).

I agree that judgment, generally, gets better with experience. At the same time, I believe that cops need to be physically capable of doing their job.

At what age do you think cops should retire?

Anyone who risks their lives for the public for many years deserves the right to retire earlier than those of us who are safely behind a desk.

Just my opinion.

What is the difference if a cop has a gun?

Many Irvine’s cops are women. Are they “more physically capable” than a 55-year-old man?

Cruz, why do you discriminate against age? Surely a 55 year old cop is just as capable as a 5’2 female officer. We allow these gals with little physical capability to “serve”.

Cruz, STFU with hero card. Not every donut eating cop is chasing down criminals. The older, less fit guys can do paperwork and teach the younger guys. And what the fuck is up with the excuse…I’m 50 and too old to chase criminals…maybe you need to get your fat ass shape. There are plenty of 50+ year olds who would put a beating on guys half their age. And that’s part of your job description (being physically fit) so don’t make any excuses.

If you can’t tell, I have had it with the people like you playing the hero card to justify raping tax payers and being able to retire at the ripe old age of 50 while you jet set around the country. Remember, you are doing a job that requires very little education and has an endless pool of qualified applicants. In the real world it’s called supply and demand.

How about asking…

“At what age should cops leave the force and go get jobs in the private sector?”

It’s all pure Arithmetics.

A typical person will work for 50 years contributing enough money each year to provide for 10-15 years of retired life.

It seems that public workers lobbied incredible pensions. The state spent $2 billion in 2000, now – $6 billion, it’s 200% increase. Nice!

I can’t tell if you think I’m a cop or not or if you’re just generically making statements. I’ll let you know that I’m not a cop and I’m not a public sector employee nor is anyone in my family, although I do know a few cops and other civil servants.

I have no problem paying a little extra in taxes if it means having the best teachers and police/fireman in my community. Those putting their lives on the line to keep me safe (call it the “hero” card if you want) deserve to be treated well and compensated fairly.

Cruz, there is a world of difference between being compensated fairly and raping the tax payers. The way the system is currently set up, safety workers here in CA are raping the tax payers. Where else can you get a job that requires at minimum a GED that guarantees well over six figures of compensation and insane retirement and healthcare benefits? That’s right, no where else but government. When you get their corrupt unions to bankroll corrupt politicans elections and agenda, you better bet your ass you will get overcompensated workers.

Remember what I said, regarding supply and demand. There are literally hundreds if not thousand of qualified candidates to fill each cop/firefighter position. Why is that? Because anybody with an IQ greater than 50 realizes its a giant gravy train. Nepotism, favoritsm usually figures big in the hiring for these positions.

Since this country/state/city is broke, you will be seeing more outrage at the compensation packages that many of these public employees have. They are ludicrous and UNSUSTAINABLE. And the way Calpers is set up is the tax payer will make up for any bad investments if the well runs dry. I guess you won’t have a problem paying more taxes so the heroes and retire at 50 with 90% of their salary. Do me a favor, you can pay my portion also. You are blind if you don’t realize what is going on!

A couple of questions that I don’t know the answer to but I’m willing to look at with an open mind:

1) what is the average pension for a cop in CA? I don’t know the answer to this but I feel like you are taking an extreme example and making it the norm?

2) what % of the overall budget do pensions make up? If it is a small %, I hardly see how it is “bankrupting” the state.

Cruz, google SB 400, this essentially let the flood gates open for the 3@50 rip off. These pensions were retroactively gifted and pretty much guaranteed that any safety worker making a career out of it would have a six figure pension. Do the research yourself!

Stanford released a study showing that the unfunded liability of these pensions in CA is 500B, yes that’s half a trillion dollars. That’s no small chunk of change.

Like I said, educate yourself and you might change your opinion!

What’s more is that they can then take any other job and still receive their pension. Pretty sweet if you can stand the work.

and those receiving unemployment benefits can work under the table. sign me up.

Big difference – unemployment benefits are much, much less, and don’t come with free health care as well. I don’t think you are actually going to find anyone willingly choosing to go on unemployment vs. keep a job. And that under the table job is going to be sub-minimum wage, not a $120k per year easy street. But feel free to try it!

I was merely indicating the gaming which exists regardless of socioeconomic strata.

Yet, we are still suprised to learn of the gaping black hole that government has become, a mockery really.

My surprise is the lack of public willingness to argue for MAJOR spending cuts and accept reality. Are we that bad at arithmetic?

You gotta be kidding me, you are asking that question! Damn right there are people who would rather sit on their lazy asses and collect a check than go get a job.

The last time UE checks almost ran out I heard a news story on a local all-news radio station – the reporter on the street interviewed some UE folks on the street how tough it was finding a job. Two of the three interviewees said that they weren’t looking until their check ran out. Yeah, not the PC story they were looking for. Heard it once, and the story vanished off the air.

I used to work for a company in Tucson who worked closely with Police Departments. Who do you think we were hiring to go out and sell our product? Ex-police officers. Also had a few ex-police chiefs in our ranks to use their contacts in the business to steer us in. Of course, all these retired guys were collecting pensions at the same time. Pretty sweet indeed.

What exactly is wrong with these guys collecting their pensions and then working. IF you saved $ for 25 years, retired from that job, went and got another job and drew down your savings from the first job, would that be wrong? They put in their 25 years. The deal was that they get a pension when they retired. What are you complaining about? I agree, 90% is overly generous. But they have a right to the pension, that was the contact.

Why count actual sales when you can use statistics to derive any answer that you want? These guys aren’t so dumb.

I suggest everyone watch this secret video of a new NA”r” economist in training at the “r”ealtor academy. It explains everything.

Glad to read that some are coming out of the NAR matrix. Writing of house sales instead of home sales.

Economist are hired based on what the client wants to hear or the desired conclusion. That’s way the same set of economists are hired by one party and another set are hired by the other party or wing. NAR has their set of economists.

So if the numbers during the bust were overstated… does that mean the numbers now are even higher in relation?

Real estate is back!!!

Just kidding.

Demand for Irvine among buyers remains high relative to everywhere else.

There’s no more of a “wait and see” approach.

The new home spigot got turned up in a big way.

Assuming this premise holds, and let’s say Irvine pricing remains at 2004-2005 levels. If neighboring cities drop to 2002 levels, will there be no or maybe just marginal impact on Irvine?

I believe neighboring cities have already dropped to those levels (at least in south OC and Santa Ana).

What I’m worried about, is if Irvine is supposed to drop to 1999 levels (AZDave prediction), what impact will that have on neighboring cities? Is there such thing as a negative price on a home?

be careful making fun of AZDave’s wild predictions. we are a long way from the bottom and interest rates moving North might make 1999 prices in real terms, and maybe even nominal, a reality.

Who’s making fun? You’re the one calling it “wild”. 🙂

I’m just remarking that if Irvine is behind the curve and eventually gets to 1999 pricing, does that mean the other OC cities will be selling at early 1990s pricing?

A Lake Forest 3CWG 3000sft home selling for $300k? Is that possible?

I am a wild guy, what can I say.

I can’t say where Irvine is going to bottom out. I know what I believe most of these houses are worth and I personally would not pay 1 penny above the 1998 price tag. That doesn’t mean there are not legions of lemmings out there who will. I just refuse to live the rest of my life in servitude to bankers. If someone else wants to do it, I don’t care – just do it with your own money. I am glad that at least now we are seeing the majority of buyers bring money to the table. I believe that the majority of the money being brought though is from older buyers who still have equity in circa ’90’s or prior purchases. We’ll see how long this keeps going as interest rates rise and or prices stay flat for years and years. I predict a decline is coming, but inflation is coming as well. Maybe Irvine will hold out until inflation catches it? We’ll see. At least here in AZ, I’ll be ready to buy at ’98 prices in the next couple of years. Irvine is not my problem but it is interesting to watch.

There is no housing bubble in Irvine, the numbers prove it.

http://www.crackthecode.us/images/28_Yorktown_Nothing_To_See_Here.jpg

So if the numbers during the bust were overstated… does that mean the numbers now are even higher in relation?

iho,

The numbers are STILL being overstated. The NA[r] has admitted that they haven’t yet fixed their overcounting problem.

While acknowledging the trade group might have overcounted sales, NAR chief economist Lawrence Yun told reporters: “I would be highly surprised if it was 20 percent.”

The NAR is reviewing its data and will release benchmark revisions later this year. Yun said the last benchmark revisions in 2000 showed an overcounting of about 13 percent.

http://www.reuters.com/article/2011/02/23/us-usa-economy-housing-idUSTRE71L10U20110223

Also, your statement above implies that we are no longer in the bust. That is incorrect. The bust is ongoing. The national median home price hit a new low this month that dates back to April 2002.

Sorry to disturb your day with this bad news. Please return to the enjoyment of your 3CWG now.

-Darth

Darth… please remove your mask, it is obscuring your reading glasses:

I said:

“Just kidding.”

So, there is no disturbance in my force… err… day.

May the 3CWG be with you.

Marc Faber gave the green light to purchase US real estate or land. He sees far less downside risk in owning property than holding cash, savings, etc. Those holding hard assets and/or leverage (on a conservative level) will benefit.

Remember, 2008 represented financial industry default. The problem has now been transferred to the government and tax payer. Sovereign default is next and the repercussion to the dollar will not be good.

dont forget to smile!

jeeez i’m starting to sound like lee in irvine!

Dont take leverage advice from Steve Thomas and family =)

Yeah, I read that Faber is long Irvine Real Estate

Specifically, the premium TIC areas.

I remember Marc Faber saying to buy farm land with attached water rights.

I also remember him being cautious on residential RE.

You have a link with him green lighting going long on residential RE?

http://marcfaberchannel.blogspot.com/2011/02/marc-faber-on-alex-jones-show-2011-02.html

2:30

he prefers land but realizes most americans are averse to hard assets except real estate.

People holding CDs,MM,bonds, etc are going to get smoked.

disclaimer – alex jones is too much for me

The only investors who may get “smoked” are those with assets whose principal can change in value. That excludes mm funds and cds. Bonds don’t fall into that category.

go talk to an old german person who had savings, or parents who had savings, post WWI.

do we just completely ignore purchasing power?

Hey matt … that’s not cool. I have thin skin. Watch it!

🙂

Like to read this blog

Sorry about the previous post. I’ve been a long time follower of real estate blogs, but wanted to make my first post and it didn’t go well. I had a question, especially for Lee in Irvine. However, I’d like to get opinions from anyone who would like to comment.

I’m thinking seriously of buying a house in Seal Beach. Specifically, I’m looking at Rossmorr, the Highlands and the Hill in Seal Beach. It seems that prices in these areas for the past year or so have held steady in the low 600s for smaller homes to 800s for bigger homes and even 1M plus for even bigger homes.

I’m not sure if there is going to be another significant price drop in the area. I’d like to hear your opinions.

Thanks

our current “bear market rally” is the result of artificially ultra low interest rates and various other forms of subsidy. this is the exact reason why it seems like the market is at bottom. our government has chosen to sacrifice the dollar to prop up banks and real estate prices.

if you have cash, you should buy gold, silver, commodities, farmland, or even rental or residential real estate. own something tangible or you will get your ass kicked.

Having some leverage will allow you to pay the loan back with cheaper dollars in the future. do an analysis where the cost of everything you buy increases 5X. if you can still afford to pay your new Seal Beach mortgage at that point, go for it! Seal Beach has always been one of my favorites so i am quite biased. Homeowners there also experience the “Irvine Syndrome” where prices never decline.

Matt,

Thanks for giving me your point of view. I love Seal Beach and I’m doing my best to keep my emotions in check during this decision-making process.

“How on earth is having a reputation of being stoners good for the RE business?”

Not as bad as being a realtor. Stoners hurt our society and lie WAY less than NAR scum

Ok, I’m feeling a bit antsy tonight so here goes: Any moron willing to pay $534,900 for this dump deserves what he gets. What’s that you say? That’s the price you pay to live in Irvine, and that’s the state of the market? Good luck with that one.

PS – Our good Freddie Mac needs our help!