The academic paper i am reviewing today attempts — and fails — to accurately define and describe a relationship between foreclosures and the economy.

Irvine Home Address … 12 SANTA RIDA Irvine, CA 92606

Resale Home Price …… $859,000

Brain damage, ever since the day I was born

Drugs is what they used to say I was on

They say I never knew which way I was goin

But everywhere I go they keep playin my song

Eminem — Brain Damage

Academic writing is the only endeavor that you can take common sense, mathematically measure it, statistically analyze it, pompously write about it, and still get it completely wrong. The academic article featured today attempts to take a common sense idea — foreclosures impact house prices and the economy — and try to find some relationships that may have predictive power. They failed. They failed because they didn't properly identify causation.

Correlation is not causation

Have you heard the term post hoc ergo propter hoc? It means that just because something follows an event doesn't mean the first event caused the other. The error the authors make today is rooted in the same problem.

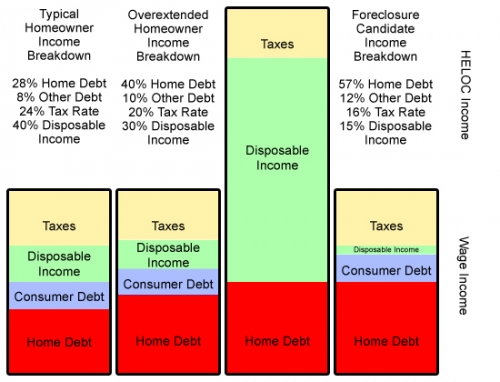

These authors have identified foreclosures as a causal event or circumstance which leads to other economic woes. In fact, foreclosures are another symptom of the same underlying problems — excessive debt, toxic mortgages and borrower insolvency. Foreclosures do not cause indebtedness. But excessive indebtedness is the cause of all our economic problems including foreclosures.

The bubonic plague analogy

Let's say we are doctors examining the circumstances and conditions surrounding bubonic plague, also known as the black death. Doctors noticed bulbous lesions called buboes patients often displayed before becoming very ill and dying. It would be reasonable to postulate that the buboes were the cause of death. They weren't. The nasty black buboes are merely another symptom of the disease.

in the same way, foreclosures aren't the cause of anything. People taking on excessive debts under terms with onerous and sometimes escalating payments is the root cause of all the woes in the housing market. Lenders created more debt than current incomes can support under stable terms. When the system collapsed, many borrowers became financially distressed and stopped making their mortgage payments. Mortgage delinquency is at the core of our economic problems.

Mortgage delinquency can be caused by excessive debt or borrower distress. The excessive debts of the Ponzis would have taken out the housing market even if the collapse didn't spill over into other areas of the economy. However, the implosion of the Ponzis did cause widespread economic pain because the loss of consumer spending and the dramatic decline in the demand for real estate. Therefore, the excessive debt distressed an entire class of borrowers who may or may not have been as irresponsible as the Ponzis.

Mortgage delinquency may or may not cause a foreclosure. A certain amount of mortgage distress is always present in the market. Usually, when people get into financial trouble, they simply sell their house, pocket the equity, and go on with their lives. No foreclosure. However, once prices start to fall, people submerge beneath the surface of their debts, and they can no longer sell into a rising market. With resale not being an option, many more foreclosures occur.

Since mortgage delinquency is the real problem, and since foreclosures are an incidental byproduct that only occurs when market conditions are bad, foreclosures are not the direct cause of anything. Also, not all delinquent borrowers have become foreclosures as lenders are building a huge shadow inventory of delinquent mortgage squatters, and not all foreclosures make their way onto the MLS immediately as lenders often take their REO off the market hoping for better days.

Distressed resales lower prices, and foreclosures often become distressed resales. This relationship is direct. Lenders know this, so they are withholding inventory from the market to prevent prices from going any lower. Further, lower prices prompts more of the marginally distressed loan owners into default creating an indirect impact and a self-reinforcing downward spiral.

Notice that foreclosures, though a big part of the story, are not a direct causal factor for much of anything. Keep the plague analogy in mind as you sift through the academic formalities.

Foreclosures, house prices, and the real economy

Atif Mian, Amir Sufi, Francesco Trebbi

10 February 2011

Several academics, policymakers, and regulators emphasize the role of foreclosures in the Great Recession and subsequent global crisis. This column provides one of the first attempts to show this empirically. Using micro-level data from all US states, it shows that foreclosures had a significant negative effect on house prices, residential investment, durable consumption – and consequently the real economy.

How does a negative shock to the economy get amplified into a severe and long-lasting economic slump? The answer may be found in your house. An extensive body of theoretical research shows that the forced sale of durable goods – in many cases a house – can have two undesirable consequences. First, the price of these goods is driven down. Second, these negative price effects can lead to a significant decline in real economic activity (see for example Shleifer and Vishny 1992, Kiyotaki and Moore 1997, Krishnamurthy 2009, Lorenzoni 2008, and Shleifer and Vishny 2010 for a recent discussion). Indeed, many academics, policymakers, and regulators have emphasized these models in building an understanding of the recession of 2007 to 2009.

To the first point i say, “duh!” forced sale of any good means taking the highest offer no matter how low that offer is. Of course that pushes prices down.

To the second point, if an entire industry is geared toward the production of the asset crashing in price, it stands to reason that a significant economic decline will ensue.

These two points are not where i differ with their findings. It's when we dive into the details of causation that a disagreement arises.

Unprecedented foreclosures

In recent research (Mian et al. 2011), we examine this idea in the context of the recent rise in foreclosures in the US. We ask to what extent this has been responsible for the recent collapse in house prices and the fall in durable consumption and residential investment – important factors in determining major macroeconomic fluctuations (Leamer 2007).

The stylised facts suggest a correlation at the very least. The top left panel of Figure 1 shows that aggregate foreclosure filings in the US increased from 750,000 in 2006 to almost 2.5 million in 2009. While we do not have data on foreclosures before 2006, the mortgage default rate increased above 10% in 2009, which is more than twice as high as any year since 1991. By any standard, the recent US mortgage default and foreclosure crisis is of unprecedented historical magnitude.

This sharp rise in foreclosures has been accompanied by large drops in house prices, residential investment, and durable consumption. As the top right panel of Figure 1 shows, nominal house prices fell 35% from 2005 to 2009. The drop in residential investment from 2005 to 2009 shown in the bottom left was larger than any drop experienced in the post World War II era. The drop in durable consumption is also large, but more comparable to recent recessions.

Figure 1.

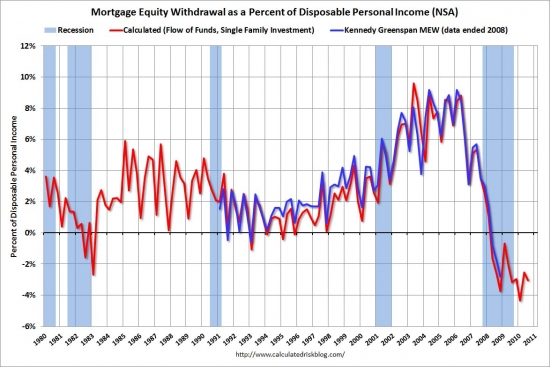

These authors don't mention the effect of HELOC abuse — because they probably don't realize how important or widespread it really was. People spending their homes is where the action was at. The lack of mortgage equity withdrawal is also why the economy is in the doldrums.

Empirical strategy

A glance at the aggregate data may lead to the conclusion that foreclosures have an obvious negative causal effect on house prices and therefore real economic activity. But isolating a causal effect of foreclosures on house prices is a significant challenge because house price declines or other negative economic shocks will lead to a rise in foreclosures. Or in other words, how do we know that foreclosures are the cause of declining house prices and economic weakness rather than an effect?

You don't because they aren't.

Our empirical strategy is designed to isolate as accurately as possible the causal effect of foreclosures on house prices and the broader economy.

No, what they are really doing is looking for correlations and hoping they find some causal link. In this instance, they picked the wrong causal factor.

We start with a micro-level data set covering the entire US from 2006 to end 2009 with information on house prices, residential investment, auto sales, mortgage delinquencies, and foreclosures. We have all of these variables at the zip code-year level, with the exception of residential investment and auto sales which are at the county-year level.

I would love to see a study on mortgage delinquency as the casual factor. Of course, with amend-extend-pretend and shadow inventory, the direct relationship which exists probably breaks down in early 2008. However, mortgage delinquency started the chain of events the caused this national catastrophe.

Our strategy to isolate the effect of foreclosures on outcomes relies on variation in foreclosures that is driven by state rules on whether a foreclosure must take place through the courts (a judicial foreclosure). In states that require a judicial foreclosure, a lender must sue a borrower in court before conducting an auction to sell the property. In states without this requirement, lenders have the right to sell the house after providing only a notice of sale to the borrower (a non-judicial foreclosure). Figure 2 maps out those states with different rules. As first highlighted in the economics literature by Pence (2006), the 21 states that require judicial foreclosure impose substantial costs and time on lenders seeking to foreclose on a house.

Figure 2.

Nice map of the judicial versus non-judicial states. It may tells us something about how long it takes a property to go through foreclosure, but it provides little else of value.

Foreclosures and house

Using this instrumental variable approach, we find that foreclosures have a substantial effect on house prices. Our state-level baseline estimate suggests that a one standard deviation increase in foreclosures in 2008 and 2009 leads house price growth to be two-thirds of a standard deviation lower over the same period.

What they have found is a correlation without direct causation.

Our estimate of the effect of foreclosures on house price growth is robust to extensive controls for demographics and income differences across states. All specifications explicitly control for the effect of mortgage delinquencies on house prices. In other words, our estimate captures the incremental price effect of foreclosures above and beyond delinquencies. In addition, the effect is robust to the use of either the Fiserv Case Shiller Weiss or Zillow.com house price indices.

I wish I were smart enough to understand how their study manages to isolate the impact of foreclosures above and beyond the delinquency that caused the foreclosure. I don't think it can be done because the causation does not exist.

We also employ a zip code-level border regression discontinuity specification that is similar to the specification that Pence (2006) uses for credit. This specification allows us to compare zip codes that are very close to each other in geographical distance and observable characteristics. Consistent with the state level correlations, there is a sharp increase in the foreclosure rate as one crosses the border from a judicial requirement state into a state with no judicial requirement. However, there is no similar jump in other observable variables as one crosses the border. Focusing only on zip codes that are very close to the border between two states that differ in judicial foreclosure requirement laws, we find similar two-stage least squares estimates of the effect of foreclosures on house prices. The similarity of the results using the zip code-level design mitigates omitted variable concerns in our other regressions.

That paragraph as loaded with some serious jargon (and bullshit). It would be interesting to see a study of judicial versus non-judicial foreclosure in a market where the substitution effect across boundaries came into play, perhaps Alexandria, Virginia versus some nearby Maryland zip codes.

Our results confirm that foreclosures have a strong negative effect on house prices that goes beyond a simple correlation.

Again, their results are wrong because they have identified the wrong causal factor.

Foreclosures, investment, and consumption

We then turn to residential investment and durable consumption. Employing a similar two stage least squares estimation strategy, we find that a one standard deviation increase in foreclosures per homeowner leads to a two-thirds of a standard deviation decrease in permits for new residential construction. Further, a one standard deviation increase in foreclosures leads to a two-thirds of a standard deviation decline in auto sales. Our estimates are robust to controls for demographics and income.

We use our microeconomic estimates to quantify the aggregate effects of foreclosure on the macroeconomy. Our estimates suggest that foreclosures were responsible for 15% to 30% of the decline in residential investment from 2007 to 2009 and 20% to 40% of the decline in auto sales over the same period.

Think about what they are saying logically. Wouldn't it make more sense that residential investment would decline when prices crashed? How are homebuilders supposed to run their businesses when the sale price of their product was in freefall? Who were they going to sell those homes to? The foreclosures didn't cause the homebuilders to pull back on new construction. A lack of sales did that.

Mortgage delinquencies and distressed sales — many of which were foreclosures — did cause prices to go down which in turn created the circumstances where builders were not incentivized to spend on residential investment. The decisions of homebuilders lowered residential investment. Foreclosures were only part of the mix that occurred in the same time period — correlation without causation.

One advantage of our study relative to the existing literature is comprehensiveness. Our analysis covers the entire US as opposed to one state or one city and we examine foreclosures all the way through the to the end of 2009. We are also the first to use state laws on judicial requirement for foreclosure to identify the effect of foreclosures on house prices – the importance of an instrument for foreclosures has been highlighted throughout the in the literature. Further, to the best of our knowledge, we are the first to examine the effect of foreclosures on real economic activity.

Foreclosures and the Great Recession

It is important to emphasise that we do not take a stand on whether foreclosures help to bring house prices, durable consumption, or residential investment closer to or further from their long-run socially efficient levels.

That is a shame. This is the main reason foreclosures are a good thing. If the market were allowed to follow its natural course, we would have seen a violent drop in prices followed by a sustained recovery. As it stands, we abbreviated the fall and now we will endure a longer and slower drop.

For example, in the absence of foreclosures, house prices may display downward rigidity given loss aversion (Genesove and Mayer 2001). Alternatively, house prices may be kept above their socially efficient level by government support.

I think we have seen plenty of government support.

Further, it is conceivable that the declines we document would occur in the long run even in the absence of foreclosures;

Yes, since mortgage delinquency is the real root cause, the foreclosures are not necessary to make prices go down. In fact, with the amend-extend-pretend policy at the banks, we have not seen near as many foreclosures as we should have given the high level of mortgage delinquency.

it is also conceivable that states where foreclosure is relatively easy will experience a faster housing recovery.

IMO, due to the extensive shadow inventory, the speed of judicial processing is not a big deal. Lenders don't want to process foreclosures quickly. They want to bury their heads in the sand.

But our estimates suggest that foreclosures lead to more abrupt declines in these outcomes than would be observed in the absence of foreclosures, and these declines are likely to be more painful in the midst of a severe recession. This is consistent with the amplification mechanisms emphasized in Kiyotaki and Moore (1997) and Krishnamurthy (2003). We believe that these results demonstrate a direct connection between a financial friction – forced sales induced by foreclosures – and a reduction in residential investment and durable consumption during and after the recession of 2007 to 2009.

Our estimates of the effect of foreclosures on residential investment and auto sales can partially explain both the magnitude and length of the recession of 2007 to 2009. For example, the sharp rise in foreclosures began relatively late in the recession and continues into 2010. If we combine this fact with the finding in Leamer (2007) that residential investment is among the most powerful components leading the US out of recession, it is possible to argue that foreclosures have likely contributed to the length of the recession and sluggishness of the recovery. Similar arguments apply to our findings on auto sales.

Leamer (2007) identifies durables as the part of consumer spending with the strongest negative affect on economic growth during recessions . Under the assumption that our results on auto sales extend to the entire durable goods share of the economy (23.6 % of GDP in 2008), foreclosures can explain the relatively sluggish growth in durables well into 2010. Given that the 2007 to 2009 recession and its aftermath have been closely related to depressed levels of durable consumption and residential investment, our results thus highlight an important role for foreclosures and house prices in understanding weakness in the economy.

Foreclosures one of the symptoms of our national mortgage debt disease. This debt needs to be reduced, and foreclosure is a superior form of principal reduction. Far from being the cause of our ills, foreclosures are essential to the economic recovery.

The fix is in

Whenever I see a property priced under market go pending in a single day, I am suspicious. Did the seller really get the highest and best price? Or did a shady listing agent steer the sale to a favored buyer in exchange for a kickback? I have no idea if anything nefarious happened with this property, but the transaction does look rather strange.

The owner of today's featured property paid $978,000 back on 6/1/2004. The owner used a $782,400 first mortgage, a $100,000 second mortgage, and a $95,600 down payment. On 9/30/2005 he opened a $176,100 HELOC. Since this HELOC matches the loss on the sale after commissions, the negotiations between the second mortgage holder and the borrower are at the forefront of this transaction.

Fast forward nearly seven years, and this house is now selling for a 15% loss. Not to worry, the owner hasn't make a payment in nearly two years, and the bank doesn't seem to be in a hurry to foreclose. Realistically, even if the deal is shady, the bank is probably better off than going through foreclosure and recovering even less.

Foreclosure Record

Recording Date: 03/23/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 06/24/2009

Document Type: Notice of Default

Irvine Home Address … 12 SANTA RIDA Irvine, CA 92606 ![]()

Resale Home Price … $859,000

Home Purchase Price … $978,000

Home Purchase Date …. 6/1/04

Net Gain (Loss) ………. $(170,540)

Percent Change ………. -17.4%

Annual Appreciation … -1.9%

Cost of Ownership

————————————————-

$859,000 ………. Asking Price

$171,800 ………. 20% Down Conventional

5.02% …………… Mortgage Interest Rate

$687,200 ………. 30-Year Mortgage

$178,270 ………. Income Requirement

$3,697 ………. Monthly Mortgage Payment

$744 ………. Property Tax

$278 ………. Special Taxes and Levies (Mello Roos)

$143 ………. Homeowners Insurance

$50 ………. Homeowners Association Fees

============================================

$4,913 ………. Monthly Cash Outlays

-$905 ………. Tax Savings (% of Interest and Property Tax)

-$823 ………. Equity Hidden in Payment

$336 ………. Lost Income to Down Payment (net of taxes)

$107 ………. Maintenance and Replacement Reserves

============================================

$3,629 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$8,590 ………. Furnishing and Move In @1%

$8,590 ………. Closing Costs @1%

$6,872 ………… Interest Points @1% of Loan

$171,800 ………. Down Payment

============================================

$195,852 ………. Total Cash Costs

$55,600 ………… Emergency Cash Reserves

============================================

$251,452 ………. Total Savings Needed

Property Details for 12 SANTA RIDA Irvine, CA 92606

——————————————————————————

Beds: 4

Baths: 3

Sq. Ft.: 2535

$339/SF

Lot Size: 5,504 Sq. Ft.

Property Type: Residential, Single Family

Style: Two Level, Other

Year Built: 1997

Community: Westpark

County: Orange

MLS#: S646668

Source: SoCalMLS

Status: Backup Offers Accepted

On Redfin: 12 days

—————————————————————————–

Great Corner Lot location and bright Single Family Residence. First floor bedroom. 3 Car Garage with long drive way. Walking distance to schools and shopping centers. Close to I-405, I-5, John Wayne Airport, Irvine Spectrum and South Coast Plaza.

That article highlights a lot of things I’ve come to accept. Economists aren’t that smart and have terrible common-sense. Being able to churn through equations is one thing, but being able to apply math to real world scenarios in a constructive fashion is entirely different. So much analysis fails to acknowledge that in 2005-2007 home prices were just too high in many areas. The academic paper (I don’t know if you downloaded the pdf from ssrn) does not mention the role of specuvestors buying 2nd/3rd/vacation properties. Those people act totally differently with respect to defaulting when the asset price starts falling. You also have the issue of speculating on asset prices in often-times 100% leveraged situations.

You have these academic economists putting out this bullshit garbage, and they are the ones teaching future economists. Or you have Federal Reserve economists looking at things, but their findings aren’t made public for many years. Then you have the people really looking at the details and reality on the street: here, calculatedrisk & others. There is a real disconnect that I don’t see being bridged anytime soon.

I have noticed many more reporters and some academics quoting CalculatedRisk and Barry Ritholtz. They have become accepted as a reliable sources of accurate information and sound analysis. Unfortunately, it takes years for a superstars like that to gain credibility, and they are just lone writers. The posse of clueless academics is beginning to read bloggers who know what is going on, but I agree with you that the disconnect will not go away any time soon.

I have been saying for years that the dollar will devalue and that devaluation will reflect in the price of essentials such as energy, food, and staples, but not in home ownership. Folks pipe up and insist that if prices rise, also will wages, and I consistently say not so. For those of you who have insisted that wages will increase as currencies devalue, are you beginning to see that you are wrong? Are you watching as prices of essentials are rising, yet wages are stagnant or decreasing?

My salary continues to increase. People that work for me continue to see their salary increase. People I associate with continue to get promoted, get bonuses, etc.

Food and staples are increasing as well. They are a very small percent of income. A 10% increase in food cost results in only 1% of income. Housing is a much larger percent of income.

Reality is there are several economies. One is for the gainfully employed with relevant degrees and experience in high demand. For those in Real Estate they should have seen this coming back in 2004 and 2005 and updated their skills, move into another profession.

What a crazy freaking world we’re living in now. We see prices in commodities rising, yet assets that are tied to credit are deflating. I’d like to be a fly on the wall at the next FOMC meeting.

Wages cannot increase with unemployment reported at 9%+.

awgee, can you explain the difference between real wages and nominal wages?

While your at it how about real revenue and nominal revenue and how both translate into wages. The upper half with skills in demand, companies need to compete for them.

“can you explain the difference between real wages and nominal wages”

I’m not awgee, but here goes:

Nominal wages are the actual dollars you receive. Real wages represent the buying power of those dollars adjusted for inflation over time.

Basically, if the prices of goods and services go up faster than wages — which is what awgee is observing — then the nominal wages increase while the real wages decline.

Real wages can actually decline and more than cover cost increases since for the upper half buying homes in Irvine those cost only represent 70% of income. However many will also see real wage increases, and currently see them. Most of the cost awgee is talking about represent a very small portion of income. I spend about 4% of my income on food. Even a 20% increase would be hardly noticed.

Housing costing 70% of income is life in the pits. State income tax, federal tax, SSI and other taxes will eat 30% or more of income.

No banker using his own money would make such as loan. The housing bubble was leading other people’s money and not carrying the liability of the loan. We all know what happens and it’s not pretty. A 35% would be a heavy load.

According to the department of numbers blog (the same guy as housing tracker), REAL HH income (adjusted to the CPI) has actually declined from y2k, to Dec 2009, from $52,388 to $49,777.

The price of homes is maybe not so dependent upon PRs increasing wages, incredible foresight, vast skill base, and demand for his services, but maybe rather dependent upon the stagnation and decrease in wages and income of the whole set of potential homebuyers.

Perhaps PRs experience is not representative of the population as a whole? I wonder if that is why we keep statistics on things like unemployment and wages?

“… PRs increasing wages, incredible foresight, vast skill base, and demand for his services …”

I can’t stop giggling to myself….

exactly. the whole point is that he keeps stating that people are arguing that wages will go up in an inflationary environment and they are stupid for thinking so.

They will go up in NOMINAL terms. They may in fact be going down in real terms but in NOMINAL terms, they go up.

But real estate and all other assets are priced in NOMINAL terms.

Its retarded that people keep pointing back to 1990’s pricing and that nothing has changed. Perhaps nothing has changed in real terms, but in NOMINAL terms, wages have gone up.

It was hilarious that IR didn’t understand that your post was rhetorical.

If we see inflation nominal prices will rise across the board. In real terms a can of beans may out perform rent or housing, but in nominal terms both will go up.

I wouldn’t bet against the feds capabily of increasing nominal prices for all assets. That’s their sole purpose in life, create nominal price increases that force people to buy hard assets, whether its a can of beans, a house, or equity in a company. Cost increase, revenues increase, salaries increase (for some), buy more, buy more, buy more that’s the general idea.

“In real terms a can of beans may out perform rent or housing, but in nominal terms both will go up.”

But that hasn’t started yet. When is that gonna start? The FED has already dumped trillions into bank reserves, yet credit related assets are still declining.

The Fed monetary policy has been grossly mismanaged for at least 15 years. We’re not gonna make all these problems disappear by simply applying the same policies that got us here in the first place. Some of us (bears) are saying, the jig is up … we must reset/recalibrate our entire economy for it to have an opportunity to grow without artificial stimulus.

I were a member of the FOMC, I’d say that psychology (perception) is a powerful tool to create economic confidence, however, reality is a dominant force. No matter how much The Bernank talks about improving economic conditions, reality is that millions of people are losing their jobs, houses, etc …

The point is that people will be forced to spend more of their income on essentials and less of their income on luxuries, such as home OWNERSHIP, thus forcing home prices down. They may increase in nominal dollars, but you and PR will be able to afford less home, because you are paid in dollars and own assets which are dollar denominated.

Wages have not gone up in nominal or real terms in the last five years, and in real terms they will continue to decline, and possibly even in nominal terms.

The huge increase in M2 is not translating into rising wages and is instead manifesting in increased commodity prices. It is ignorant to think that the Fed can control where the “printed out of thin air” money goes. In order to translate into increase wages, the increase in the money supply must be absorbed by business capital asset and demand expansion. It is not, and there is nothing the Fed can do about it. At this stage, the increase in money supply may be having the opposite effect the Fed is intending, but Bernanke is literally too stupid to see it.

If you have any doubts, think employment.

Been betting against the FED since 2005.

I won.

lol. what the hell are you talking about Awgee?

Show me your data that shows California nominal incomes have gone down for 5 years.

according to BEA, in California, personal incomes in 2005 were 1.387 T dollars. In 2009(last update), personal incomes for CA is 1.572T. That looks like a 5 year increase of 13% to me.

Nationally, its actually 16% higher over that period. Why don’t you actually look up these statistics before making your statements. It isn’t like it is hard to look up.

And what is this non-sense you are spewing about

luxuries such as homes? You actually admit that home prices may increase nominally? Wow thats a news flash.

I have to admit that I didn’t foresee the USD being devalued so much (thank you Benny Bernokio). But I was consistent with your analysis that neither housing prices nor wages will go up even if USD were to be devalued.

This is just my personal opinion which I have been saying since 2007 housing market peak:

I am fairly certain that US housing prices will not recover its inflation-adjusted price until 2027 at the earliest. In terms of nominal prices, I am less certain but I also tend to think that housing prices will not recover its nominal prices until the same time-frame. My reasoning is fairly simply. Every financial bubble in human history will NOT repeat itself for at least 20 years. Usually it’s AFTER 20 years have passed that the same asset class can have a new chance to begin to rise in prices.

The two main negatives that have not been priced in by the current buyers are

1. Bond bubble bursting causing rise in interest/mortgage rates, AND shortening of the duration of the mortgage term. This will cause the domestic US buyers to decrease their offering prices.

2. Increasing deficits will most likely result in increase in property taxes. This will increase the holding cost of houses and therefore decrease the home ownership benefits.

The third negative that has not been priced in by the foreign cash buyers is that the current US housing price can possibly become 50%-off, once US dollar drop another 50% against the stronger Asian(Japan-excluded)/commodity currencies. These buyers will probably not flock into US after 50% off because the relative political/economical stability across regions can change in detriment to US, and that these “savvy” businessman and “corrupted” government officials won’t probably be throwing good money after bad.

You’re in a good industry if wages are increasing PR, be thankful yet don’t get cocky. I don’t think any industry is immune.

I work in education. More teachers may get laid off this year in CA than in any other time. Yes, there is waste in education spending but it is an easy target of politicians and such alike. In LA they estimate over 7200 will get pink slips by March 15th. Last year many of the pink slips were rescinded but that was because of federal money that came in. This year it isn’t happening. People can blast the public sector all you want but if thousands of more teachers are unemployed they are not going to be supporting a lot of other industries. It will lower the tax base that the state gets and the spiral continues. I work for another district and they too are planning a record number of layoffs.

The economists and media love to spin positive news but I don’t see that economy improving with the people I talk too.

The teachers unions are going to get killed off.

I have a friend thats a High School teacher in LA.

He was grading term papers the other day while waiting for me at lunch. These were seniors. My 8 year old who happens to be in Private School has a better ability to write a paragraph than these 12th grade students. And my friend says. “I have to pass these kids” “Otherwise they wont graduate” Our eduaction system has failed. And the Teachers and the Unions are about to fail as well.

JK, I am thankful. I’m not trying to be cocky. You make your own luck.

I am trying to motivate people to take charge and make changes to advance. There is only one person to blame if you are not continually learning and upgrading your skills to move to a productive industry. Anyone who saw this coming back in 2004 or 2005 had an opportunity to make those changes.

Nicely said.

People make choices in life, and they have to live by them. Most of us are products of our childhood, and our past becomes our future.

That would’ve been very few people in 2004 and 2005. Now, it’s too late (and too expensive) for many people to re-calibrate their lives. I would bet in many cases, if one was laid off and needed to go back to school for a different career, one would have used the equity from their home. But now, many people in that position don’t have the equity to use. They are stuck.

Plus there’s the simple matter of age – It’s much more difficult to be competitive in a new career at age 54 than at age 24, especially in technical fields. That’s not exactly the sort of luck one makes…

That’s so true. For an entry level position, I THINK employers generally prefer a younger GRADUATE than someone who is rediscovering him/herself.

I wasn’t trying to be too harsh PR. I don’t know if you make your own luck as luck is an intangible that we usually have no control over.

I do agree about constantly learning and upgrading your skills. It therefore creates more chances for advancement which some people will conclude he/she is so lucky.

I don’t recall if I saw all this coming in 04 or 05 but at the same time I didn’t get caught up in the real estate euphoria. I remained grounded enough and disciplined enough that it has paid off.

People are crazy again at Westpark II Irvine

12 PIENZA

Irvine, CA 92606

2450 sqft and tile countertop, asking for 1.133 million. The owner bought at 1.08 million at the peak and want to break even.

27 Arbusto

2535 sqft, asking for 1.099 million.

Perhaps the tiny swimming pool is worth 200K at least.

Very true… weak dollar from enormous deficits and debt and the printing of dollars is contributing to food and fuel inflation. Add to that the real growth in Asia people moving from poverty to just poor people that can afford a cup of coffee of cheap automobile and you have a BAD mix for serious inflation for food and fuel!

Now…you will also have rising interest rates to fight this inflation and you will get systematic decline in all assets purchased with borrowed money.

Stagflation / screwflation is here… Grinding lower or flat for OC housing and Irvine for as long as we can look forward. Higher rates, higer downpayments, lower conforming loan limits, and the government saying they are going to reduce the tax deductability of mortgage interest paid to $500-$750K.

Wow!! Talking about headwinds to housing prices!! If only one or two of these things happen housing will be flat for a decade.

If people can’t afford a house with 3% down and 5% rates wait until you see 7,8,9+% rates and 20% down requirements!

BD

Today’s post brings to mind something that has been rattling around my head for a few years now … the idea that homebuilding as an economic foundation for a region is really just a fools errand.

Yes, building and selling homes when there is real demand, available land and a growing economy can be a significant part of a region’s economy. However, I view it as more a contributor and not as a major core industry … after all there WILL come a time when either there is no more usable space or perhaps more significantly, no more demand. It’s this latter point where the vast majority of efforts were and are aimed … to build and sustain demand. A major feature of our most recent bubble was pulling demand forward, the financial products were engineered to artificially accelerate home ownership (or more to the point, loan ownership or indebtedness). The financial industry’s sole goal, stated or unstated, was to plumb the depths of a consumer’s ability to assume and service debt.

This brings me back to my original point. It’s my opinion homebuilding is an unsustainable economic engine, it cannot be the major source of wealth for a region. There must be other contributors to the pie … manufacturing, technology and perhaps things like tourism to drive employment. Employment is at the heart of demand for housing. Without professional or sustainable job growth, housing has no real reason to exist. Put bluntly, why keep building homes if the only activity taking place is an elaborate game of trading one shell for the next? Furthermore, I think we’ve now demonstrated how easy it is to overshoot demand and overbuild. As foreclosures move from “shadow inventory” to quantifiable inventory we will truly be able to analyze how much product was built under false demand propositions and how long it will take for the natural demand rate to return and consume the inventory. It’s my admittedly non-expert opinion that it will take perhaps as long as a decade for the OC,IE, LA area to chew through the real, existing inventory. But if there are no jobs, and more importantly well paying jobs, to finance these overpriced homes then where will the demand come from? Sure, there is the old argument about foreign investment or emigration but the census data tells us otherwise and more importantly are we going to populate SoCal with a class or idle rich or wealthy leisure class? Not likely.

Unless we see an improvement in job creation through an increase in sustainable industry growth outside of homebuilding, then I simply cannot see how $600K to $1MM dollar homes are sustainable.

Very astute observation. Thank you.

I see the dependence upon construction being a real problem in Las Vegas. The big drag on the Las Vegas economy is all the unemployed construction workers waiting to build the next mega resort. There will always be some demand for real estate related activities including construction, but it will become less prominent over time as regions get built out. Adjusting to a buildout condition is difficult on the building industry to say the least.

What is particularly astute about pointing out that having a well diversified economic base with good paying jobs is beneficial to real estate? Heck, what isn’t it beneficial to? Yes, no area can have an economy that is based solely on producing one item and swapping that one item endlessly. Shocking and insightful.

As for Vegas, the big drag isn’t on unemployed construction workers, it is that tourism is down. It is Vegas’s singular dependence on a highly cyclical tourism and service based economy that will make it go through boom and bust cycles. This wasn’t the first and it won’t be the last.

It is like pointing out that unemployed auto workers in Detroit are a real drag on the area’s economy or that oil field workers in Texas in the mid 80s were a drag when oil was at 15 dollars a barrel.

Do you have any doubt that if the economy was doing better average room rates and occupancy rates were higher that more mega projects would be getting built and that those unemployed drags you speak of would be employed?