Barry Ritholtz sees a grim future for America's housing market with either a drift lower or a decade of flat pricing.

Irvine Home Address … 3892 CLAREMONT St Irvine, CA 92614

Resale Home Price …… $425,000

I took my love and I took it down

I climbed a mountain and I turned around

And I saw my reflection in the snow covered hills

'Till Landslide brought me down

Stevie Nicks — Landslide

Prices have fallen in a landslide, and owners everywhere find themselves buried under mountains of debt. Some will reflect on their circumstances and realize their own foolish expectations for appreciation prompted them to borrow until the market brought them down. Some will not. Digging out after the landslide will be difficult because the market is not going to elevate people back to an equity position on its own. Borrowers are going to have to dig themselves out by paying down their debts.

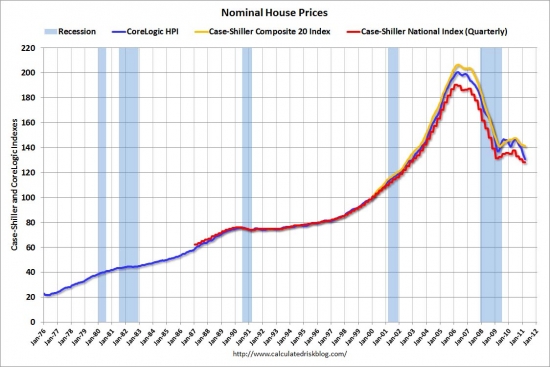

Back in March of 2009, I wrote the post, Real Estate's Lost Decade. Many have noted the similarities between our policy responses to the credit bubble and Japan's of the 1990s.

Japan simultaneously inflated massive financial bubbles in real estate and stocks during the late 1980s. The slow deflation of this bubble and the general economic malaise that impacted Japan during the years that followed became known as the “Lost Decade.” The United States is facing a similar set of circumstances in the aftermath of the Great Housing Bubble. So far, we have been following the same policy actions as the Japanese did. Perhaps our officials have come to believe a Lost Decade is preferable to the next Great Depression.

Today, I want to demonstrate how easy it would be to have a similar result in our own housing market. By lowering interest rates to artificially low levels, the Federal Reserve hopes to stabilize the housing market; however, weaning the housing market off these subsidies will need to be a slow process to prevent real estate prices from taking another nosedive. Gradually increasing interest rates back to long-term norms will result in an erosion of buying power that prevents price appreciation. I want to be clear about the implications of this; we are not looking at a decade to get back to peak prices, we are looking at a decade of stagnate prices at the bottom.

I included the following chart as a projection of the future:

The Lost Decade

Realistically, no market ever goes totally flat. Although Irvine is heading down that road right now.

When considering the options facing policy makers, the powers-that-be decided further price drops were preferable to letting prices fall to market-clearing levels. I discussed those options in a February 2009 post titled, Fire and Ice.

First, let's take off the table any ideas of a return of sustained or rapid appreciation before prices return to fundamental valuations. The only people who suggest such ideas are self-serving liars and those who chose to believe them. Anything is possible, but this outcome is so unlikely that I will not waste any print discussing it.

Above is a look at the Fire and Ice scenarios for Irvine median home prices. There is a tendency when looking at charts like this one to assume that one scenario is aggressive and the other conservative, so the truth must be in the middle. Don't make that assumption. Prices could easily crash below fundamental valuations as I described in How Bad Could Bad Get. If you think this is not possible, I suggest you check out Christopher Thornberg's predictions (PDF) he just delivered to the BIA of Orange County. He is predicting a 32+% decline from today's prices, that is over 50% off the peak. He is more bearish than I am; he may be right.

Take a look at the grey line in the graph above. That is the fundamental value. It is calculated based on income growth (which has now stopped), 6% interest rates, and a 30-year conventionally-amortized, fixed-rate mortgage with a 20% down payment and a 28% DTI. That is where house prices would be if we would not have had a real estate bubble. The Federal Reserve is working to raise this line by lowering interest rates, but even a drop to 4.5% will not raise it enough to intersect those falling lines at a significantly higher price point. Prices will fall to this line before they find support.

Those predictions were made two and a half years ago. Each of these scenarios is playing out somewhere in America. The Armageddon scenario is happening in Las Vegas.

The Fire scenario is playing out in most of the US.

And the Ice scenario is happening here in Orange County.

I am not the only market observer and analyst to reach these same conclusions.

“Drift Lower” Is BEST-Case Scenario for Housing, Ritholtz Says

By Peter Gorenstein | Daily Ticker – August 12, 2011

“An economy in which you have homeless people and empty homes doesn't make any sense and that's where we're heading,” Nobel laureate Joseph Stiglitz told the Daily Ticker earlier this week.

With home prices continuing to fall in most of the country and sales volume off 13% last quarter compared to prior year, the housing problem, if not getting worse, is certainly still a major mess for America.

True, foreclosure filings dropped 35% last month – to the lowest level in four years – says RealyTrac, but that is in part due to a bottleneck of proceedings caused by the robo-signing induced moratorium.

“The data suggests home prices will continue to drift lower for a couple of years – maybe just go sideways for a decade,” says FusionIQ CEO Barry Ritholtz, who predicts another jump in foreclosures unless and until the weak jobs market picks up.

I agree with Barry to a point. Regardless of what happens in the jobs markets, foreclosures are going to pick up again because the shadow inventory is so large. I agree with Barry that if the job market doesn't pick up, we will see another jump in delinquencies which are the precursor to more foreclosures.

In fact, there are so many delinquent homes and underwater homeowners the federal government is looking into renting their share of them in an attempt to stabilize home prices and ravaged neighborhoods. The Federal Housing Finance Agency says it is seeking input from investors on how to rent the 248,000 homes the owned by government-controlled mortgage firms Fannie Mae (FNMA) and Freddie Mac (FMCC) and the Federal Housing Administration.

Ritholtz is not convinced of the programs merits, based on the governments track record as landlords. “The federal government has subsidized and built low income housing and rented it,” he says. “It hasn't been a successful program for them I hate to see them go down that same road.”

Ritholtz has another idea: Attract new homeowners to the country. He suggests the government should reduce the anti-immigrations measures created after the 9/11 attacks and allow more skilled workers to immigrate into the country. “You want to get rid of excessive supply, the way to do it is to create demand,” he says.

The government and the federal reserve has done everything it can to create demand by lowering interest rates, printing money, and exploding the national debt. The only thing they can do further is to follow Paul Krugman's advice and spend, spend, spend until the voters take the checkbook away.

Make it easier for educated people to live the American dream and those homes will be filled, Ritholtz declares. “That to me makes much more sense than getting into the business of being landlords.”

Below is the interview with Barry Ritholtz. Remember the post, Should the GSEs rent REO instead of selling at very low prices? These guys think having the GSEs becoming America's landlord is a very bad idea.

Day after day, I relay the grim truth of the problems in the housing market. I am not anti-ownership as I am buying properties in Las Vegas and helping my family do the same. And I am not a permabear as I am very bullish on buying Las Vegas real estate. Buying and holding real estate can be very emotionally and financially rewarding, but only if the price is right, and only if the motivation is not to capture appreciation and its associated HELOC booty. If I sound like a broken record, its because I don't want to see people repeat the mistakes of the housing bubble.

Prices are not going up any time soon. Don't buy real estate because you think they will be.

$322,000 in MEW without spending a dime on improvements

The owners of today's featured property paid about $256,000 back in 1999 (the actual purchase price is an estimate from tax data and loan data). They used a $248,000 first mortgage and a $$7,000 down payment. They refinanced on 5/14/2002 with a $270,000 first mortgage and withdrew their tiny down payment.

On 10/7/2005, they refinanced with a $570,000 first mortgage. Since they obviously did not spend this money on home improvements, where did the $300,000 go?

They didn't save it to make future loan payments.

Foreclosure Record

Recording Date: 09/07/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 06/04/2010

Document Type: Notice of Default

They have been squatting since early 2010.

This property is in what used to be known as Culverdale, now known as Westpark I. It was built in the early 70s adjacent to the 5 freeway at Culver drive. I profiled a house on this street in September of 2007 in a post aptly titled, You Ugly.

Parts of my description of that house also applies to today's featured property:

This listing is the least desirable single family detached home in Irvine. Everything about this property is a negative:

- It is 36 years old. (now 40 years old)

- There is no back yard. …

- The house itself is right on the 405 on ramp at Culver. A location guaranteed to have maximize noise and air pollution as people accelerate onto the freeway.

- If that wasn't bad enough, it is adjacent to a huge power pole with enough electricity running through it to make your hair stand on end and give your children brain cancer. Perhaps the hum of the power lines drowns out the freeway noise. Who knows?

I would not live in this house.

At $179/SF, someone will perceive this to be a bargain and buy the property. With all its negatives, there is still a price where someone will deal with its issues in order to live in Irvine. Perhaps $425,000 is the right number? Even an FHA buyer could live here for about $2,200 per month. Someone will probably buy it as a rental. It may even be cashflow positive, a rarity in Irvine. Personally, I will pass.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 3892 CLAREMONT St Irvine, CA 92614

Resale House Price …… $425,000

Beds: 5

Baths: 2

Sq. Ft.: 2376

$179/SF

Property Type: Residential, Single Family

Style: Two Level, Contemporary

View: Faces North, Faces South

Year Built: 1971

Community: Westpark

County: Orange

MLS#: P792026

Source: SoCalMLS

On Redfin: 3 days

—————————————————————————–

WESTPARK — PRICED WAY BELOW MARKET BECAUSE BUYER WILL HAVE SIGNIFICANT DEFERRED MAINTENANCE TO REPAIR. .. .MAJOR FIXER SOLD 'AS-IS' — SHORT SALE. Large home with FIVE bedrooms and 'great bones' with potential! Front courtyard/patio entry. Formal living room w/ beautiful stairway needs finish detail; formal dining room converted to large storage/walk-in pantry. Informal eating area off kitchen to Den/Family Room. Inside laundry room. Garage with work areas. Enclosed patio/workshop — can be converted back. Rear yard w/ raised garden planters. Large master bedroom & dressing area & small walk-in closet. Three other bedrooms + another LARGE bedroom suite upstairs. Attic space w/ pull-down stairs. Diamond in the rough! Home needs lots of TLC and a buyer with vision! INVESTOR's FLIP opportunity. EXCELLENT SCHOOLS. .. walk the kids!

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

The realtor is so desperate they are even appealing to flippers. Funny.

Resale Home Price …… $425,000

House Purchase Price … $255,670

House Purchase Date …. 4/27/1999

Net Gain (Loss) ………. $143,830

Percent Change ………. 56.3%

Annual Appreciation … 4.1%

Cost of Home Ownership

————————————————-

$425,000 ………. Asking Price

$14,875 ………. 3.5% Down FHA Financing

4.19% …………… Mortgage Interest Rate

$410,125 ………. 30-Year Mortgage

$116,389 ………. Income Requirement

$2,003 ………. Monthly Mortgage Payment

$368 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$89 ………. Homeowners Insurance (@ 0.25%)

$472 ………. Private Mortgage Insurance

$75 ………. Homeowners Association Fees

============================================

$3,007 ………. Monthly Cash Outlays

-$315 ………. Tax Savings (% of Interest and Property Tax)

-$571 ………. Equity Hidden in Payment (Amortization)

$22 ………. Lost Income to Down Payment (net of taxes)

$73 ………. Maintenance and Replacement Reserves

============================================

$2,216 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,250 ………. Furnishing and Move In @1%

$4,250 ………. Closing Costs @1%

$4,101 ………… Interest Points @1% of Loan

$14,875 ………. Down Payment

============================================

$27,476 ………. Total Cash Costs

$33,900 ………… Emergency Cash Reserves

============================================

$61,376 ………. Total Savings Needed

——————————————————————————————————————————————————-

.jpg)

* * * REDUCED * * * JUST REMODELED AND UPDATED MONTICELLO 3/3 UNIT IN THE VILLAGE OF NORTHPARK SQUARE. REGULAR SALE!! NO WAITING!!! MOTIVATED SELLER!! GREAT LOCATION. .. NO ONE ABOVE OR BELOW. HAS A ONE BEDROOM AND FULL BATHROOM ON THE MAIN FLOOR. MAIN BATHROOM JUST UPDATED WITH NEW LIGHTS, NEW BRONZE FAUCETS, AND NEW MIRRORS. OPEN AND SPACIOUS KITCHEN WITH CENTER ISLAND, BREAKFAST COUNTER, ALL WITH NEW GRANITE COUNTER TOP, NEW BRONZE FAUCETS, AND ALL NEW STAINLESS APPLIANCES. MASTER BEDROOM BOASTS A SPACIOUS WALK-IN CLOSET AND OVERSIZED SOAKING TUB WITH A SEPARATE SHOWER UNIT, WITH ALL NEW LIGHTS AND BRONZE FAUCETS. FIREPLACE IN THE LIVINGROOM. NEW HARDWOOD/LAMINATE FLOORING. CROWN MOLDING. NEW ELECTRICAL LIGHT FIXTURES. NEW DESIGNER PAINT. 2-CAR ATTACHED GARAGE WITH DRIVEWAY AND DIRECT ACCESS. WALKING DISTANCE TO BECKMAN HIGH. COMMUNITY AMENITIES INCLUDE THREE PARKS, JUNIOR OLYMPIC POOL, BBQ AND PINIC AREAS, BASKETBALL COURT, TOT LOT. .. .

* * * REDUCED * * * JUST REMODELED AND UPDATED MONTICELLO 3/3 UNIT IN THE VILLAGE OF NORTHPARK SQUARE. REGULAR SALE!! NO WAITING!!! MOTIVATED SELLER!! GREAT LOCATION. .. NO ONE ABOVE OR BELOW. HAS A ONE BEDROOM AND FULL BATHROOM ON THE MAIN FLOOR. MAIN BATHROOM JUST UPDATED WITH NEW LIGHTS, NEW BRONZE FAUCETS, AND NEW MIRRORS. OPEN AND SPACIOUS KITCHEN WITH CENTER ISLAND, BREAKFAST COUNTER, ALL WITH NEW GRANITE COUNTER TOP, NEW BRONZE FAUCETS, AND ALL NEW STAINLESS APPLIANCES. MASTER BEDROOM BOASTS A SPACIOUS WALK-IN CLOSET AND OVERSIZED SOAKING TUB WITH A SEPARATE SHOWER UNIT, WITH ALL NEW LIGHTS AND BRONZE FAUCETS. FIREPLACE IN THE LIVINGROOM. NEW HARDWOOD/LAMINATE FLOORING. CROWN MOLDING. NEW ELECTRICAL LIGHT FIXTURES. NEW DESIGNER PAINT. 2-CAR ATTACHED GARAGE WITH DRIVEWAY AND DIRECT ACCESS. WALKING DISTANCE TO BECKMAN HIGH. COMMUNITY AMENITIES INCLUDE THREE PARKS, JUNIOR OLYMPIC POOL, BBQ AND PINIC AREAS, BASKETBALL COURT, TOT LOT. .. .

.jpg)

The above list is a small sample. Most of these were mortgages over $1,000,000, and many of them have been owned by lenders since 2008.

The above list is a small sample. Most of these were mortgages over $1,000,000, and many of them have been owned by lenders since 2008.

.jpg)