Spain managed to inflate a nastier housing bubble than the US did. Now Spain is showing US banks how to keep a housing bubble inflated… For now.

Irvine Home Address … 184 ALMADOR Irvine, CA 92614

Resale Home Price …… $399,000

I was a player when I was little

But now I'm bigger, I'm bigger

A heart breaker when I was little

But I'm bigger {I'm bigger}, I'm bigger

And all the haters, I swear

They look so small from up here

Cause we're bigger, our love's bigger

I'm bigger and your bigger

Justin Bieber — Bigger

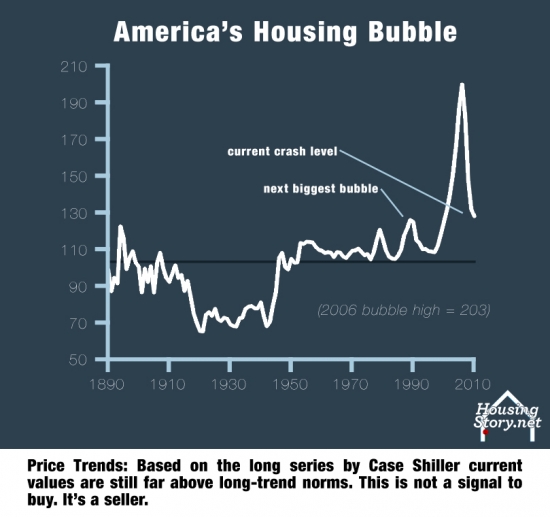

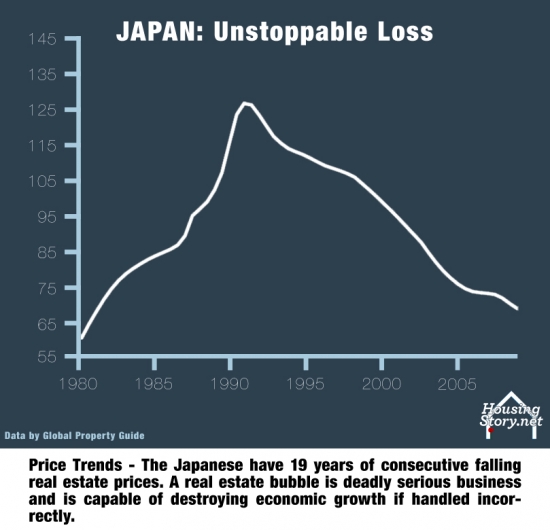

In the United States, we inflated a massive housing bubble. In Spain, its even bigger. Everything we did, they did with gusto. Their solutions for the problem have been similarly extreme.

For as bad as our problems are here in the United States, we did not create a housing bubble as bad as Spain's. How Spain deals with this issue is instructional for our handling here in the United States.

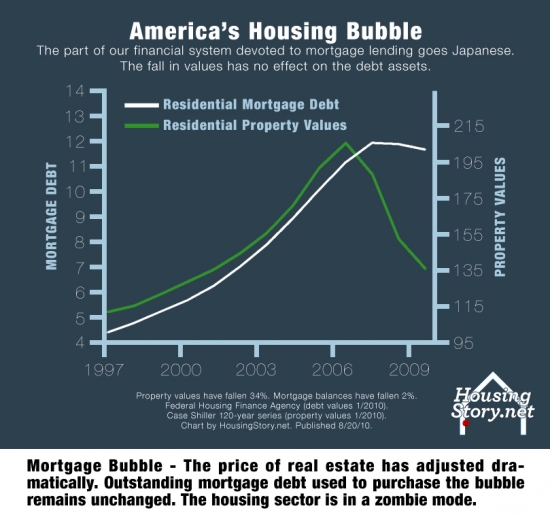

Bankers used loans to inflated house prices, and now that prices are crashing, the debt greatly exceeds the value of the real estate used to secure it.

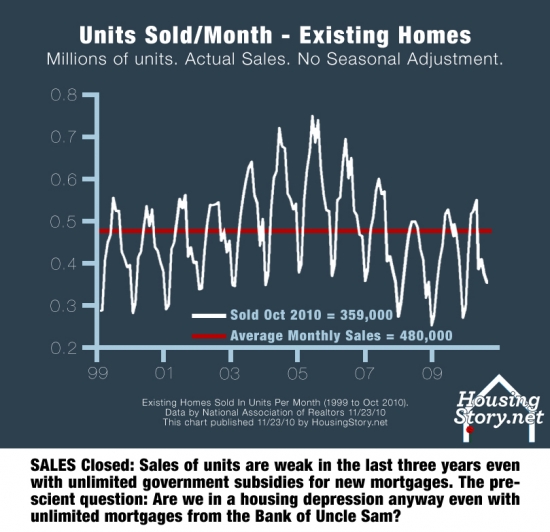

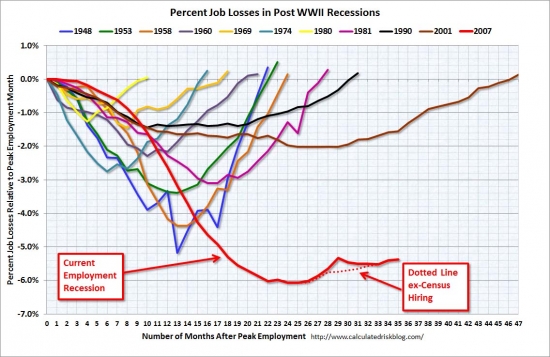

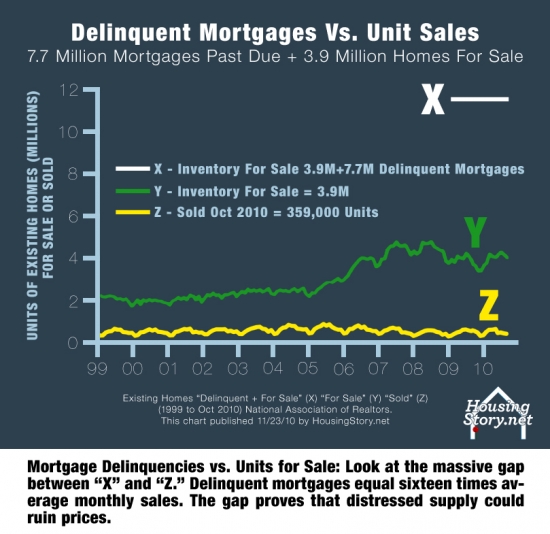

Bankers believe they can re-inflate the housing bubble and push home values back above the level of debt. That isn't going to happen. The mis-allocation of resources caused by the bubble, the resulting unemployment in the aftermath, and the fact that the level of debt isn't supportable by incomes are forces that will put more inventory on the market preventing house prices from rising until the debt is purged.

Here in America, we have embarked on a policy of amend-extend-pretend. Government regulators are looking the other way while bankers wankers live in a fantasy world where borrowers who couldn't afford the debt when it was issued suddenly go back to work and can afford to diligently pay off the loans bankers foolishly underwrote.

Prices will continue to crash in Spain just as they will continue lower here.

The Inevitability of a Spanish Property Crash

By Tom Harris — 8 Dec 2010

The Inevitability of a Spanish Property Crash, article supplied by Fairhomes (Gibraltar) Limited

Despite the best efforts of the European Financial Stability Facility it was evident that even before the ink had dried on the Irish bail-out agreement that the contagion could not be contained.

Immediately nervous investors began looking to other Eurozone countries, such as Belgium, Italy, Portugal and especially Spain fearing the same issues that dragged Ireland down will resurface elsewhere. After all it was not the state’s inability to borrow (Ireland is well funded until well into 2011) but the inability of Irish banks to refinance their borrowing in the wholesale markets that triggered the bail out.

But could Spain’s banks face a similar problem?

At present the response from Spain seems to be bullish with the country’s Economics Minister, Elena Salgado telling CNN that the eurozone’s fourth biggest economy has “absolutely no need” for an Irish style rescue. This was then followed by the extremely brave statement of Snr Zapatero that speculators betting short against Spain would “lose their shirt” and that the government is already doing enough to avert a debt crisis.

Politicians and bankers lie in their public statements whenever they fear the market's reaction.

[youtube]KIgGix2jmSw[/youtube]

Whilst this may seem like an admirable attempt to re-assure and calm the markets it ignores the hard facts that underlie the current situation. Barclays Capital reckons that combined, the Spanish sovereign and Spanish banks need to raise €73bn in the first four months of 2011, some half of it in April 2011 alone.

These figures in isolation don’t seem to point to bail-out territory but when you take into account the fact that Spanish bond yields are at their highest in 8 years it’s clear that more than words are required to attract investors. The speed of the increase in yields from 4% to 5.2% in a month is a dramatic shift for bond markets which usually move in small doses. It means Spain’s bonds are slumping in value and holders are dumping them as they’re worried they won’t get all their money back.

So what is it that is spooking these investors? The country has made big efforts to scale back spending by central government and the national debt this year will be 60% of GDP – not great but not as bad as Ireland’s near 100%. But as Victor Mallet points out in the FT there’s a lack of clarity about the figures as despite the “strict limits” the debts of the country’s 17 autonomous regions (104.8 bn euros) account for over half of the public sector deficit which makes it much more difficult for the central government to impose reforms. “Spanish sovereign risk is increasingly at the sub-national level” says Nicholas Spiro of Spiro Sovereign Strategy and several regions including Catalonia and Madrid have such financial difficulties that a recovery seems unlikely given the economic stagnation and sluggish growth forecast for Spain.

It’s also in the regions where the problems for the banking systems lie. Spain experienced a huge property bubble, accompanied by a huge rise in private sector debt, and fell into recession when that bubble burst. But whilst the larger national banks such as Santander were well capitalised (and even in a position to acquire troubled foreign firms), in the regions the cajas (regional savings banks) have accumulated vast exposure to the construction and development sector. When the big two banks (BBVA and Santander) put the brakes on in 2006-07, the cajas continued lending more keenly, tapping wholesale debt markets to fund themselves. That alone makes them higher risk. But the savings banks also supplied about half of the €318 billion borrowed by Spain’s property developers. These loans now represent about a fifth of the cajas’ assets, according to Santiago López Díaz, an analyst at Credit Suisse. They are deteriorating fast.

We witnessed a similar phenomenon here in the United States. The primary lenders for acquisition, development, and construction loans were smaller regional banks. I sat in on a meeting in 2009 with representatives of one Midwestern bank that had more than 20 land projects in Southern California. I guess the returns were good when the developers thought it was in their best interest to continue to make payments. Once the land market imploded, land assets declined about 80% in value, and these smaller regional banks ended up with much REO.

So now the cajas are undoubtedly facing the grimmest outlook for sometime in what is already an extremely volatile situation. The results of the stress tests earlier in 2010 were supposed to have calmed fears but investigation revealed that much of the supposed liquidity in the regional banks was due simply to the over-valuation of much of their repossessed housing stock. A recent survey by the Economist estimated that Spanish property is still over-valued by 47.6% which suggests that a painful correction is on the way.

We have the same accounting slight-of-hand here in the US. We allow bankers to use bullish market assumptions concerning the underlying real estate to project loan loss reserves and unrealistically low levels. Banks Refuse to Recognize HELOC and Second Mortgage Losses. "Together with Citigroup the banks hold about 42 percent of the $1.1 trillion in second-home liens. Unlike first mortgages, they are typically not bundled and sold off to investors but kept on the banks' books. The biggest home-equity lender in the U.S. is Bank of America, holding some $138 billion in such loans. Wells Fargo has about $123.8 billion of home-equity loans." Realistically, lenders will lose most of the money they have tied up in these bad loans. That isn't how it is reflected on their balance sheets.

Indeed events of the last few days have only made this more likely. New accounting rules by the Bank of Spain will force lenders to dump depreciating assets, according to Bloomberg News. Under the changes, banks must now make provision for bad loans after just 12 months rather than the current 72 months, which will provide a strong incentive for lenders to sell properties quicker. The rules also force banks to value properties more realistically, which gives them a further incentive to sell.

Interesting that Spanish bank regulators are making the banks recognize their losses whereas here in the United States, regulators are doing everything to prevent banks from recognizing their losses.

Pisos Embargados de Bancos estimates that there are around 100,000 bank owned properties currently on the market but they estimate that this figure will rise to 300,000 next year.

Obviously this change in provisions has been designed to force banks to raise capital through sales of their property assets which would also provide a boost to domestic demand. The hope being that this income will negate the need for extensive bail-outs. However the release of this vast stock of property onto the market will drive prices down sharply and Fernando Rodriguez from Madrid-based property adviser RR de Acuna & Ass predicts a further 20% fall next year.

The danger here is that the property stock valuation is the only thing that gives the balance sheets of the cajas any respectability. Decrease these assets by 20% and many will be looking extremely vulnerable – and with no chance of borrowing on a nervous bond market the only solution will be to seek European aid.

The central bankers for the Euro aren't giving Spanish banks 0% loans like our Federal Reserve is favoring our banks. IMO, that is a good thing. Spain will see a dramatic house price crash, but then the economy will recover and the mis-allocated capital is released from real estate and allowed to be put to use in more productive assets.

Until now the response from the banks has been distinctly Canute-like, vaingloriously attempting to turn back the tide of falling prices by using their market power to artificially inflate prices.

The method which the banks use to have higher than open market price accepted as the appraisal benchmark for valuations of their property assets, starts with how the banks dispose of the homes they are currently repossessing. The banks are using subsidised mortgages which typically also include 100% mortgages, non-payment windows, extended terms (even up to 50 years) and interest free options to attract buyers.

Perhaps we should bring back 100% financing, Option ARMs, stated-income loans, ninja loans, interest-only loans, and the whole variety of really stupid lending ideas thoroughly discredited during the housing bubble. We get close to that with FHA loans, but we haven't resorted to the recklessness of the Spanish banks.

These mortgage deals are being granted at a subsidised interest rate totally at odds with market rates being offered for deposits. Typically, these subsidised mortgage rates are offered at just 0.3-0.5% over Euribor, whilst deposit rates offered by the same financial institutions are currently around 4%.

How do you sustain that policy without going broke?

The purpose of these subsidised mortgages is to encourage the purchase of bank repossessed homes at valuations that are higher than current open market prices. Indeed they are available only in conjunction with repossessed homes held by the bank offering the mortgage, whereas privately sold homes in the open market must apply through the usual channels for normal mortgage deals, which are typically 65% of value, 25 years and normal market interest rates.

Anecdotal examples show properties with a subsidised mortgage are between 25-40% above the open market price.

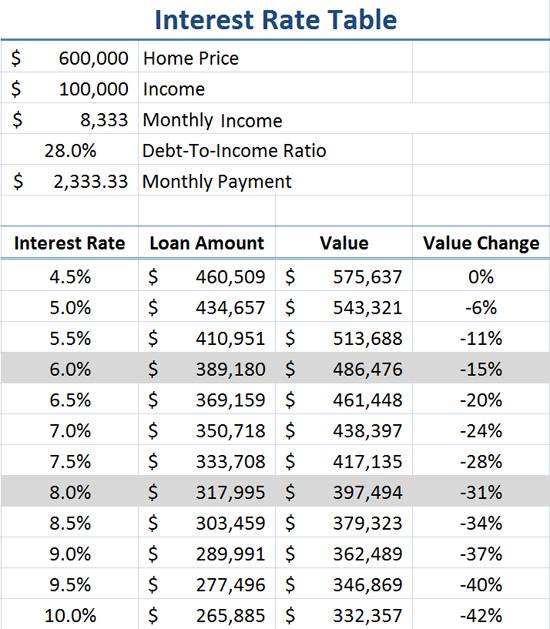

We tried that on a smaller scale when the Federal Reserve began buying mortgage-backed securities to drive down interest rates. The main reason interest rates have gotten so low is because lenders would far rather refinance their bad debt at very low interest rates that they would like to take a write down of original capital. Spain takes this idea to its extreme.

In October 2010 in El Rosario, Marbella, a 2000m2, frontline golf villa was sold by CAM Bank which had an asking price on their website of 1.3 million euro but were, in reality, looking for offers of 750,000 euros – however the final sales price was 601,000 euros – a difference of 54%. Another example in Santa Maria Village, Elviria was advertised by a bank at 269,500 euros but sold at 188,400 euros – a difference of 31.1%.

In effect the valuations of the bank’s property assets are supported by the banks own sales data of their repossessed homes, which are artificially inflated prices by the provision of subsidised mortgages. The result is a self perpetuating cycle where property values are kept high which in turn supports the bank’s approach to provisions against non-performing loans being required only at a low level.

We are doing the same here. Low interest rates supports bloated mortgages which in turn supports higher home prices than a natural market would support.

But with 1.4 million homes to sell this response looks remarkably inadequate, indeed many investors point to this practice as being one of the main reasons it’s impossible to judge the real price of property in Spain today – as it over-inflates the official figures so the real price of Spanish property is never reliably reported.

2011 may be the year we finally find out.

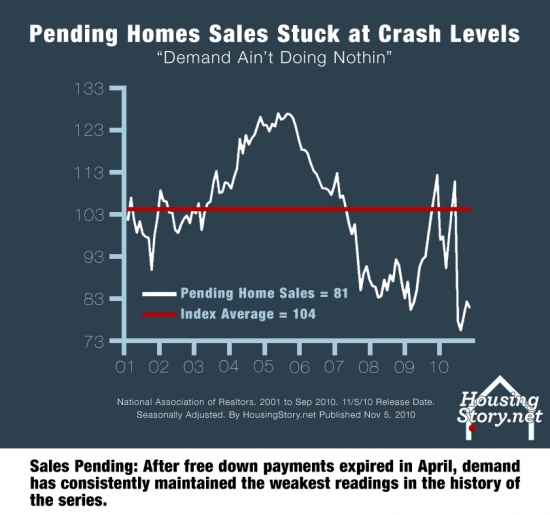

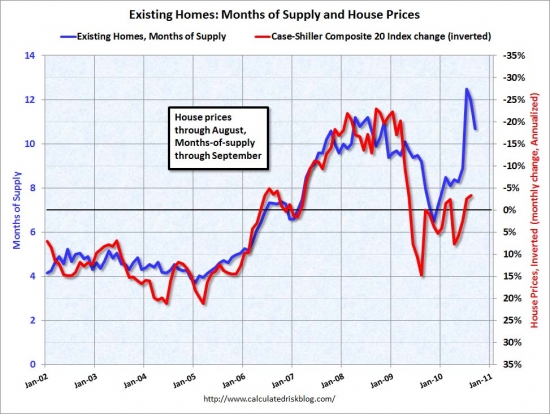

We may find out here what prices are supposed to be in 2011. The Federal Reserve is no longer buying mortgage debt and the government tax subsidies have expired. The government is no longer directly supporting house prices; although, it can be argued that the explicit backing of mortgage debt through the FHA and the GSEs is a market support. With the props removed, the market will wend its way toward a natural equilibrium. Most likely that means falling prices in 2011.

No equity left behind

Since the banks were giving out free money, most homeowners (at least the ones who have tried to sell houses in Irvine since 2006) took the free money as it became available and spent it. Their goal seemed to be to make sure no equity was left behind.

- Today's featured property was purchased for $363,000 on 3/13/2003. The owner used a $286,000 first mortgage and a $77,000 down payment.

- On 6/7/2004 he obtained a stand-alone second for $90,000 and withdrew his down payment plus another $13,000.

- On 9/20/2004 he refinanced with a $384,000 first mortgage.

- On 8/30/2006 he obtained a $10,000 HELOC.

- On 10/17/2006 he got a $24,900 HELOC.

- On 1/8/2007 he refinanced with a $455,000 Option ARM first mortgage.

- Total mortgage equity withdrawal is $169,000 plus negative amortization.

- He quit paying early in 2010.

Foreclosure Record

Recording Date: 08/20/2010

Document Type: Notice of Default

Irvine Home Address … 184 ALMADOR Irvine, CA 92614 ![]()

Resale Home Price … $399,000

Home Purchase Price … $363,000

Home Purchase Date …. 3/13/2003

Net Gain (Loss) ………. $12,060

Percent Change ………. 3.3%

Annual Appreciation … 1.2%

Cost of Ownership

————————————————-

$399,000 ………. Asking Price

$13,965 ………. 3.5% Down FHA Financing

4.71% …………… Mortgage Interest Rate

$385,035 ………. 30-Year Mortgage

$79,911 ………. Income Requirement

$1,999 ………. Monthly Mortgage Payment

$346 ………. Property Tax

$50 ………. Special Taxes and Levies (Mello Roos)

$67 ………. Homeowners Insurance

$280 ………. Homeowners Association Fees

============================================

$2,742 ………. Monthly Cash Outlays

-$325 ………. Tax Savings (% of Interest and Property Tax)

-$488 ………. Equity Hidden in Payment

$25 ………. Lost Income to Down Payment (net of taxes)

$50 ………. Maintenance and Replacement Reserves

============================================

$2,003 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,990 ………. Furnishing and Move In @1%

$3,990 ………. Closing Costs @1%

$3,850 ………… Interest Points @1% of Loan

$13,965 ………. Down Payment

============================================

$25,795 ………. Total Cash Costs

$30,700 ………… Emergency Cash Reserves

============================================

$56,495 ………. Total Savings Needed

Property Details for 184 ALMADOR Irvine, CA 92614

——————————————————————————

Beds: 2

Baths: 2 full 1 part baths

Home size: 1,307 sq ft

($305 / sq ft)

Lot Size: n/a

Year Built: 1989

Days on Market: 19

Listing Updated: 40512

MLS Number: S639158

Property Type: Condominium, Residential

Community: Westpark

Tract: Lp

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Elegant Westpark home with prime private location featuring two master suites, two and one-half baths, two-car attached garage with built-in storage cabinets, and spacious yard! Fabulous floor plan with soaring vaulted ceilings, cozy fireplace, and convenient inside laundry. Highly upgraded kitchen includes stainless steel dishwasher and oven/range, built-in microwave, and dry-foods pantry. Upgrades include custom tile floors, custom paint, and custom window treatments. Dual master suites each with their own master bath. Enjoy Las Palmas resort style amenities and Irvine Schools!

.jpg)