The conditions are set for continued deterioration in house prices.

Irvine Home Address … 79 MIDDLEBURY Ln Irvine, CA 92620

Resale Home Price …… $514,999

I've been waiting for something to happen

For a week or a month or a year

With the blood in the ink of the headline

and the sound of the crowd in my ear

You might ask what it takes to remember

When you know that you've seen it before

Where a government lies to her people

Jackson Browne — Lives in the Balance

The conditions which have the most immediate impact on house prices are the current price levels, housing demand, and available supply. If prices are too high, if demand is too low, and if available supply is too high, prices will move lower as the market seeks a new equilibrium.

The banks have been working to manipulate the market through constricting supply. Lenders have convinced the government and the shoeple that building an enormous shadow inventory is a good thing as long as it temporarily keeps prices elevated. Few loan owners disagree, but those looking for affordable housing find the situation untenable, and many of those potential buyers choose not to buy while potentially deflationary conditions persist.

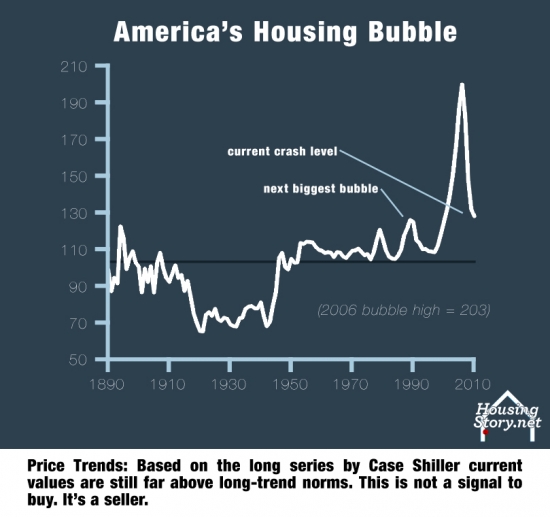

Prices are too high

So are prices really too high? What is the evidence?

House prices historically have only kept pace with inflation.

Another look at similar data…

We are closer to the bottom than to the top, but based on historic trends both inflation adjusted (top chart) and in nominal terms (bottom chart) prices are simply too high.

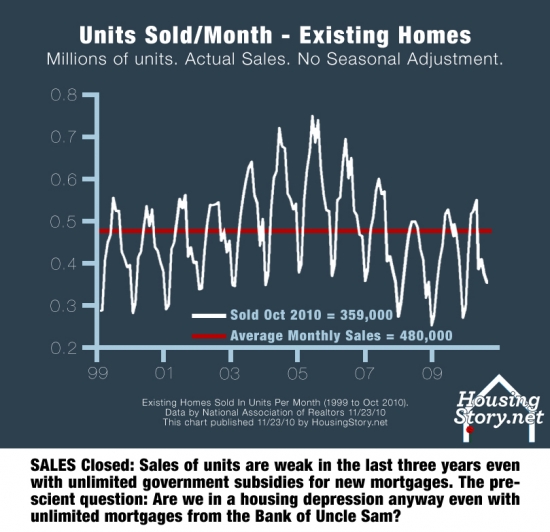

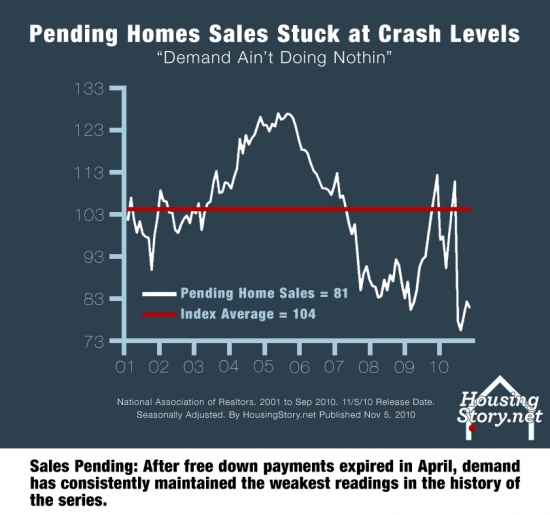

Demand is low

It has been a while since realtors have blathered on about "pent up demand," but as a reminder, Desire is not Demand:

Most people want a house. About 65% of Orange County residents own their homes, but probably 95% of residents wish they did. The desire for housing always exceeds the supply because there is always some segment of the market who is unable to obtain home ownership due to the cost of housing and a lack of available credit. True demand is the amount of money those with the desire for housing can raise to put toward the purchase of real estate. If those with the desire for real estate do not have savings and if they cannot qualify for a loan, they create no measurable demand. When realtors make the assertion that there is pent up demand, they are correctly surmising that there is an increasing number of people who want real estate who cannot obtain it, they are totally incorrect in their idea that this demand is merely sitting on the fence waiting to enter the market at a time of their choosing.

So when I say demand is low, I mean the ability of people to put forth sufficient dollars to purchase properties at today's prices is lower than historic norms. Is there any data to back this claim?

The government and the banking cartel has injected the housing market with excessive stimulation through low interest rates and tax subsidies, yet demand is at historic lows.

The above charts are national numbers, but the local numbers are not any better….

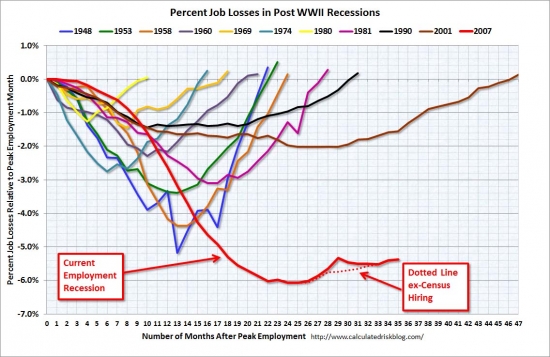

So why is demand so low? Two reasons: (1) unemployment is very high and it isn't projected to get much better any time soon, and (2) the large number of foreclosures has tainted the potential buyer pool with bad credit.

Without a dramatic economic recovery, demand is not going to increase, and few economists are predicting a vigorous economic recovery.

High levels of supply

What evidence do we have that supply is high?

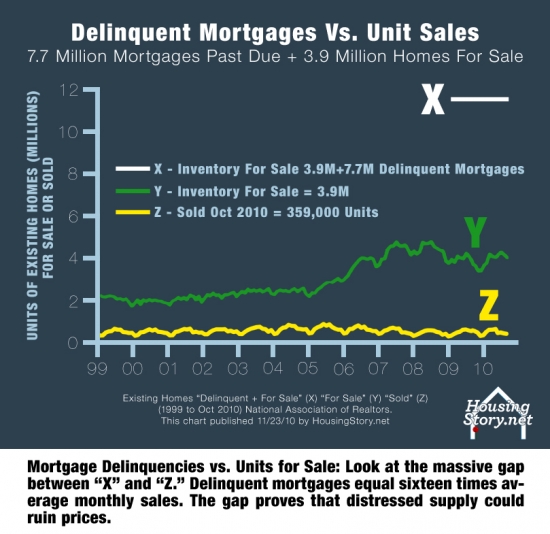

The most troubling part of the elevated inventories is the accumulation of shadow inventory. In order to hold current price levels, banks slowed their foreclosure rates, embarked on amend-extend-pretend, and allowed a great deal of squatting by delinquent borrowers. The above chart is a conservative estimate from First American Core Logic. Other estimates are not so rosy.

When you compare the above chart with the one from First American Core Logic, the most obvious difference is the measure of shadow inventory. The chart above assumes very few of the currently delinquent mortgages will be cured whereas the First American data assumes a healthy cure rate brought about by an improving economy. The real answer is probably somewhere in between, but the situation is probably much worse than First American Core Logic would lead you to believe.

What we really have is a huge pent-up supply.

So why are the banks building this huge shadow inventory? They don't have much choice if they wish to remain solvent.

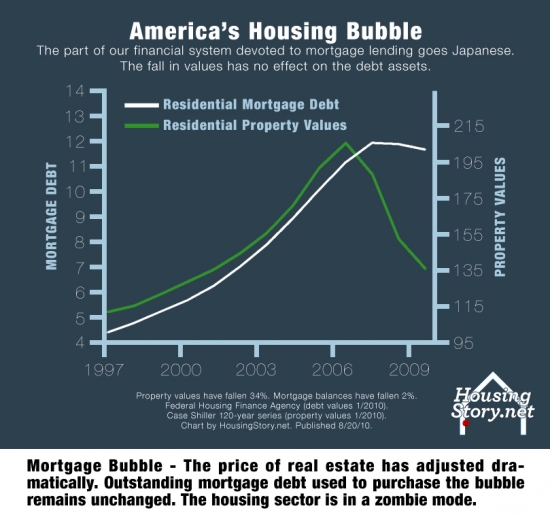

Banks will eventually need to write down this bad debt because prices will not recover as long as the debt overhang exists. If banks had to write down their debt to current values today, they would likely be insolvent, and many would be bankrupt.

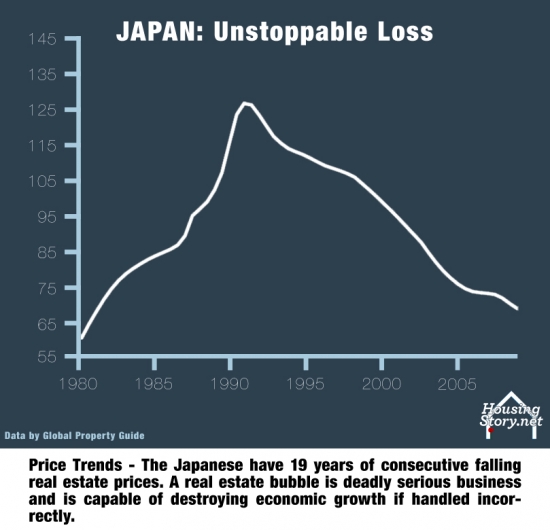

Japan had a similar set of circumstances when their real estate bubble burst in 1989. It didn't turn out well for them either.

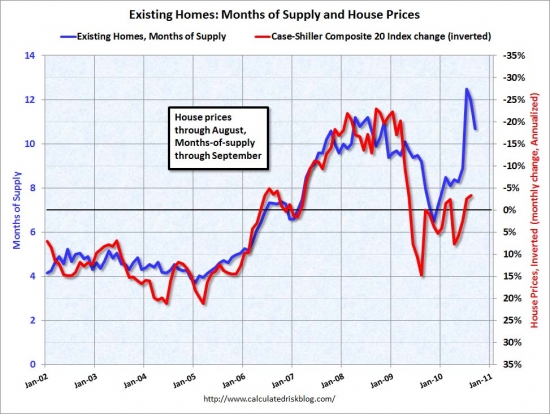

Months of supply points to lower prices ahead

The statistic most cited when examining the balance between supply and demand is the months of supply, the number of months it would take to clear the inventory as current sales rates.

Months of supply has been elevated all year, and back in August it hit the highest level ever recorded. When this indicator exceeds six months, prices generally fall. It first broke above six months in mid 2006 as the market peaked. The months of supply fell off quickly in 2009 as banks stopped foreclosing and began their policy of amend-extend-pretend, but the indicated spiked again with the expiration of the tax credits and it has remained elevated as prices have rolled over in a second leg down.

If the asking price is high enough, it isn't a short sale.

I often giggle to myself when I see a WTF asking price followed by a statement that a property is a standard sale. Well, sure it is a standard sale if the seller asks enough to pay off the Ponzi loans they took out.

- Today's featured Ponzi bought this house on 9/30/1998 for $215,000. She used a $171,600 first mortgage and a $43,400 down payment.

- On 5/17/2001 she obtained a $50,000 HELOC.

- On 9/3/20003 she refinanced with a $223,300 first mortgage.

- On 5/14/2004 she obtained a $100,000 HELOC.

- On 11/10/2005 she refinanced with a $375,000 first mortgage.

- On 12/18/2006 she refinanced with a $392,500 first mortgage.

- On 10/31/2007 she obtained a stand-alone second for $50,000.

- Total property debt is $442,500, so this is a standard sale, assuming she doesn't have to drop her WTF asking price much.

- Total mortgage equity withdrawal is $270,900 including her down payment.

Do you want to pay $468/SF for this tiny house to pay off this lady's debts?

Irvine Home Address … 79 MIDDLEBURY Ln Irvine, CA 92620 ![]()

Resale Home Price … $514,999

Home Purchase Price … $215,000

Home Purchase Date …. 9/30/1998

Net Gain (Loss) ………. $269,099

Percent Change ………. 125.2%

Annual Appreciation … 7.2%

Cost of Ownership

————————————————-

$514,999 ………. Asking Price

$18,025 ………. 3.5% Down FHA Financing

4.71% …………… Mortgage Interest Rate

$496,974 ………. 30-Year Mortgage

$103,143 ………. Income Requirement

$2,580 ………. Monthly Mortgage Payment

$446 ………. Property Tax

$150 ………. Special Taxes and Levies (Mello Roos)

$86 ………. Homeowners Insurance

$134 ………. Homeowners Association Fees

============================================

$3,397 ………. Monthly Cash Outlays

-$419 ………. Tax Savings (% of Interest and Property Tax)

-$630 ………. Equity Hidden in Payment

$32 ………. Lost Income to Down Payment (net of taxes)

$64 ………. Maintenance and Replacement Reserves

============================================

$2,444 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,150 ………. Furnishing and Move In @1%

$5,150 ………. Closing Costs @1%

$4,970 ………… Interest Points @1% of Loan

$18,025 ………. Down Payment

============================================

$33,295 ………. Total Cash Costs

$37,400 ………… Emergency Cash Reserves

============================================

$70,695 ………. Total Savings Needed

Property Details for 79 MIDDLEBURY Ln Irvine, CA 92620

——————————————————————————

Beds: 2

Baths: 2 baths

Home size: 1,100 sq ft

($468 / sq ft)

Lot Size: 2,700 sq ft

Year Built: 1998

Days on Market: 52

Listing Updated: 40514

MLS Number: S635678

Property Type: Single Family, Residential

Community: Northwood

Tract: Glle

——————————————————————————

Charming detached cottage home in Northwood Pointe. This is the LOWEST PRICED DETACHED HOME that's a STANDARD SALE in Northwood Pointe.  Beautifully maintained with laminate wood floors & upgraded neutral carpet & paint. Gourmet kitchen with sparkling white tile counters & white cabinetry opens to living room & dining area. Living room features a cozy gas fireplace, & built-in media unit. French doors open to a secluded front porch area. The dining nook features built-in seating & shelves. From the kitchen, enter a serene garden w/patio area, & wrap around yard- great for relaxing & entertaining. Custom window coverings accent the home. Located on a quiet interior cul de sac street, with one of the larger lots for this floorplan. Association amenities include heated pool, lighted tennis courts, sport courts, playground areas, BBQ's. Walking distance to award winning schools-Canyon View Elem., Northwood High. Close to Tustin & Irvine Marketplace for dining, shopping, entertainment.

Beautifully maintained with laminate wood floors & upgraded neutral carpet & paint. Gourmet kitchen with sparkling white tile counters & white cabinetry opens to living room & dining area. Living room features a cozy gas fireplace, & built-in media unit. French doors open to a secluded front porch area. The dining nook features built-in seating & shelves. From the kitchen, enter a serene garden w/patio area, & wrap around yard- great for relaxing & entertaining. Custom window coverings accent the home. Located on a quiet interior cul de sac street, with one of the larger lots for this floorplan. Association amenities include heated pool, lighted tennis courts, sport courts, playground areas, BBQ's. Walking distance to award winning schools-Canyon View Elem., Northwood High. Close to Tustin & Irvine Marketplace for dining, shopping, entertainment.

Oh and you are walking distance to award winning schools too!

DAY-YAM! When can the lucky family move in?!

The lucky family have to be very tiny to fit in this “lowest price detached home”. Watch out you don’t knock yourself out when you stand up from eating your porridge 🙄

One thing the late 80’s bubble had in common with this one, is geographic dependence. NYC peaked sept 88, while LA peaked in July 1990. Charlotte never really peaked as their prices didn’t fall during that period.

It’ll be interesting if the wikileaks revelations say anything about shadow inventory strategy. In our area banks have moved on builders in high priced neighborhoods, foreclosed, got on the market and sold at pretty good discounts (but not bargain basement that I’ve seen in SoFla). If prices aren’t falling then there’s no reason to sit on inventory. Also, if there aren’t many foreclosures in an area, there is more local staff to attend to each deal (generous view of banks).

Shadow inventory will be the bane of new home construction. Prices will seem to rebound and then the bank will turn the spigot back on, and builders will get undercut.

You know how you can really tell if there was a bubble somewhere?

You look at the condos.

http://www.trulia.com/NC/Charlotte/#for_sale/Charlotte,NC/CONDO_type/price;d_sort/

Charlotte had bubble. Period. So did Asheville.

Why do you try to convince everyone on EVERY SINGLE THREAD that there wasn’t a bubble in NC?

There was. Deal with it.

Quick question…attempting to learn…

Had they initially walked away, would there be no repercussions (non-recourse loan?) They claim to have received a loan mod; again in trouble…would the loan mod now make this a recourse loan, can/will the bank come after them for years trying to get their money back?

http://www.radaronline.com/exclusives/2010/12/oc-housewife-alexis-bellino-foreclosure-drama

Just curious how something like this plays out.

Chances are about 99% that if the lender forecloses, it will go through a non-judicial foreclosure which precludes the lender from obtaining a deficiency judgement.

Exactly.

The clock is ticking though on the IRS and FTB debt forgiveness income tax relief which expires for debt discharged after 12/31/2012. If it takes two years for the servicer to foreclose and discharge the debt, you may have to consider living rent-free now.

Regarding loan mods and judicial vs. non-judicial foreclosure – I wonder if households not suffering financial hardship should even consider a loan mod application?

e.g. If your financials have improved through the Great Recession (less the home value decline), should you disclose your financials to the servicer in a mod app? Could that push a servicer into choosing non-judicial foreclosure (if the loan is recourse)? If you don’t apply for a mod, then all the servicer has is your credit report and financials from the original loan app. They may assume you’re in some form of financial hardship now (or you can claim such).

It doesn’t work that way, at least from all the real life modification stories I have read online, and even heard from friends/neighbors. You have to produce all your documents, W-2’s, paycheck stubs, bank statements, etc, and more often than not, produce these documents over and over again, while the bank decides, processes, or maybe just rolls a big gigantic roulette wheel in regards to your loan modification.

Some people get them, most don’t. One neighbor I know got a 40 year fixed loan, with some wild balloon payment at the end, while another was put on a 5 year ARM, and yet another got a fixed rate principal bearing loan, 2% for the first 5 years, then increasing 1% a year to a maximum of 5%.

Out of all of them, the only reasonable one is the last, yet all are still clearly underwater. Personally, I’d bail from the first two “modifications”, and I’d have to think long and hard on the last.

“High prices, low demand, and large supply means lower prices ahead”… or that it’s time to start restricting supply again see Irvine inventory chart.

But does that really apply to Irvine?

Prices are still high here, demand is high (depending on who you ask) and a blog post during the summer claimed that supply was going to keep going up (if I remember correctly… it’s rumored I have Alzheimer’s).

I do hope there are lower prices ahead… to hedge my best I even asked Santa for a 3CWG for Christmas.

Since demand had nothing to do with it, you should ask Santa for some of that magic pixie dust they used to sell all those new homes.

Supply and demand have everything to do with price supports for Irvine properties. See what happened to the Acacia tract in Oak Creek, Irvine in the last few months when supply out weighed demand. While in many other areas despite the economy, the state of California’s budget, large numbers of HELOC abusers, etc. demand is still holding strong relative to supply and prices are holding steady. In some areas these prices are still above rental parity.

it’s rumored I have Alzheimer’s

And a personality disorder!

I saw the Ben Bernak on 60 Minutes last night. OMG, what a complete disaster to see an obviously shaken Fed Chairman trying to instill confidence in the US economy. And to watch that weak suck interview, full of underhanded pitches makes me question, what has happened to the hardcore questioning that used to come from 60 Minutes? Jeeze, maybe they should have shaken the dust off of Mike Wallace, brought him in to ask the tough questions to The Ben Bernak.

Mike Wallace – “A lot of people may question you in your ability to prevent inflation and control monetary policy”

The Ben Bernak – “I am 100% confident”

Mike Wallace – “But you said there was no housing bubble, were you not 100% confident in that too?”

The Ben Bernak – “This interview is over”

He’s also in full-political mode now. He is trying to shape public opinion. He is even misrepresenting the facts. He said last night that the Fed is “not printing money.” Of course the journalist doesn’t understand the topic, so he didn’t push further. Otherwise, the follow-up to that answer would have been, “So where did the money come from to add all of these Treasuries to the Fed’s balance sheet?”

The Fed doesn’t actually “print money”. The US Treasury owns the printing presses. However, The Bernak’s definition of QE, is kinda like Bill Clinton’s definition of sex.

Quantitative Easing is when The Fed buys gov’t bonds from banks and insurance co’s. They simply deposit the money into the brokers account … the money is nothing more than a push of the button, and a billion dollars can appear from nowhere. They simply make deposits, without any backing. They devalue the US dollar, by making more of them available to be loaned out.

So in all reality, The Fed isn’t actually “printing dollars”, but they are attempting to devalue the dollars worth.

That IS “printing” money. No one ever refers to printing money in the physical sense.

That interview was way too easy for Ben. Then again, most average Joe’s in America will probably believe that idiot. It might not be printing money in the physical sense, but it is creating money out of thin air with just a couple strokes of the keyboard. Same result!

Then again, most average Joe’s in America will probably believe that idiot.

Been to your local mall lately? You should go sometime. Pick someone out of the crowd at random and ask yourself how often you think that that person thinks about economic theory as opposed to making babies or wanking himself in the bathroom with the Victoria’s Secret catalog.

AZDave, I agree 100%. The common person in this country has no idea who Benanke or the Federal Reserve is. The government wants it that way. An ignorant, uneducated populous is an easy controlled populous.

George Carlin nailed it in his reason that education sucks bit.

“Nobody seems to notice…”

“Nobody seems to care…”

Not sure education is the core problem – I think it’s more the ancient Roman “Bread and Circuses” distraction. Keep the plebians happy with enough bread – which we clearly have – and provide circuses to distract them from bankers’ malfeasance. Circuses = Fox news, reality TV, Glenn Beck, Rush Limbaugh, Victoria’s Secret, etc. – all spouting sex and slogans, fact-check-free.

To everyone above….excellent posts.

I believe the problem IS education, or the lack thereof. There was a 1999 Report done by Gary Hart, Newt Gingrich, and a host of other politicians, and in that report they stated the lack of a good education system, posed more of a threat to our national security than terrorism. That was in 1999.

How much money have we poured into scholastic uses, versus, let’s say, all the wars and military spending since then?

Your average Joe does not even know who Ben Bernanke is.

The Bernake interview needed a real interviewer:

do norcal lefties ever think of anything else besides Fox News? it is an unhealthy obsession. read your NY times, vote for your Pelosi’s and convince yourself that you are not the duped one.

what a complete disaster to see an obviously shaken Fed Chairman trying to instill confidence in the US economy

Oh don’t worry about it, Lee. Fundamentals are strong!

Hello All –

I think the writting is on the wall.

Bernanke and informed others are far more afraid of deflation of leveraged assets like housing than they are in the obvious commodity inflation. The middle class will get continuously squeezed. Housing that deflates and grinds lower over the next decade while gas, and food grow more expensive daily and wages stagnate b/c of a huge problem with structural unemployment – poorly educated populus who used to earn big dollars laying tile and now cant even compete for a job paying 1/4 as much at Starbucks.

As much as I disagree with what he is doing he is doing the only thing he thinks he can. He is pushing on a string but, if he didn’t rates would be at least a point or two higher. That would make housing and refinancing even more difficult and put even more deflation of leveraged assets on the horizon.

CA and other ‘high priced’ markets will be Japan for sure. We pulled forward decades of appreciation during the bubble. Prices now will correct to CA historic multiples or even lower to that which exists in the rest of the nation.

Median housing prices should reflect median incomes. They simply don’t now but, will….

Just my .02

BD

You all hopefully realize that the entire world of finance is predicated on assumptions on ‘future rate of return’. Public and private pension plans which are already underfunded dramatically have 7-10 percent rates of growth in their assets plugged into the models.

If Bernanke doesn’t do what he is doing the short falls will be even more dramatic. This will force major restructuring and lots of pain. This includes the federal gov. IR has posted many times the charts showing that assets have declined in value but, debt has not. This debt must be refinanced at much lower rates or there must be major restructures.

We are on the verge of states looking very much like the countries in the EU. CA, NY, IL, and others are too big to fail but, will…. that is they will bet a federal bailout.

Let’s hope that the debt and deficit commision can come back with their proposals. Otherwise we are just postponing the ineveitable. CA RE is just a symptom of the problem.

Timber! Look out below.

BD

High RE prices do help many people and so do low RE prices. It all depends on who you want to help. Those working on the RE commis and banking fees or the general public? The Democrats and Republican have both shown who they want to help — The RE commisers and bank fee collectors.

The private employer defined benefits pension plans are almost extinct. Generous penisons are still available from government work and executive work. I just need to crack that barrier before I retire.

I’ve notice that higher education and thought are frowned upon in many corporate enviroments. A yesman or henchwomen will go further.