Spain managed to inflate a nastier housing bubble than the US did. Now Spain is showing US banks how to keep a housing bubble inflated… For now.

Irvine Home Address … 184 ALMADOR Irvine, CA 92614

Resale Home Price …… $399,000

I was a player when I was little

But now I'm bigger, I'm bigger

A heart breaker when I was little

But I'm bigger {I'm bigger}, I'm bigger

And all the haters, I swear

They look so small from up here

Cause we're bigger, our love's bigger

I'm bigger and your bigger

Justin Bieber — Bigger

In the United States, we inflated a massive housing bubble. In Spain, its even bigger. Everything we did, they did with gusto. Their solutions for the problem have been similarly extreme.

For as bad as our problems are here in the United States, we did not create a housing bubble as bad as Spain's. How Spain deals with this issue is instructional for our handling here in the United States.

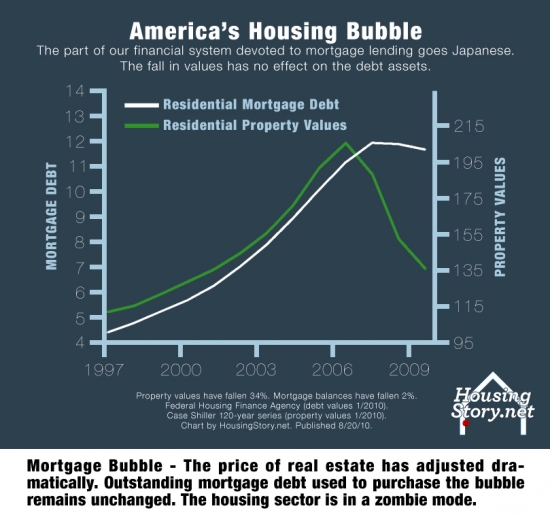

Bankers used loans to inflated house prices, and now that prices are crashing, the debt greatly exceeds the value of the real estate used to secure it.

Bankers believe they can re-inflate the housing bubble and push home values back above the level of debt. That isn't going to happen. The mis-allocation of resources caused by the bubble, the resulting unemployment in the aftermath, and the fact that the level of debt isn't supportable by incomes are forces that will put more inventory on the market preventing house prices from rising until the debt is purged.

Here in America, we have embarked on a policy of amend-extend-pretend. Government regulators are looking the other way while bankers wankers live in a fantasy world where borrowers who couldn't afford the debt when it was issued suddenly go back to work and can afford to diligently pay off the loans bankers foolishly underwrote.

Prices will continue to crash in Spain just as they will continue lower here.

The Inevitability of a Spanish Property Crash

By Tom Harris — 8 Dec 2010

The Inevitability of a Spanish Property Crash, article supplied by Fairhomes (Gibraltar) Limited

Despite the best efforts of the European Financial Stability Facility it was evident that even before the ink had dried on the Irish bail-out agreement that the contagion could not be contained.

Immediately nervous investors began looking to other Eurozone countries, such as Belgium, Italy, Portugal and especially Spain fearing the same issues that dragged Ireland down will resurface elsewhere. After all it was not the state’s inability to borrow (Ireland is well funded until well into 2011) but the inability of Irish banks to refinance their borrowing in the wholesale markets that triggered the bail out.

But could Spain’s banks face a similar problem?

At present the response from Spain seems to be bullish with the country’s Economics Minister, Elena Salgado telling CNN that the eurozone’s fourth biggest economy has “absolutely no need” for an Irish style rescue. This was then followed by the extremely brave statement of Snr Zapatero that speculators betting short against Spain would “lose their shirt” and that the government is already doing enough to avert a debt crisis.

Politicians and bankers lie in their public statements whenever they fear the market's reaction.

[youtube]KIgGix2jmSw[/youtube]

Whilst this may seem like an admirable attempt to re-assure and calm the markets it ignores the hard facts that underlie the current situation. Barclays Capital reckons that combined, the Spanish sovereign and Spanish banks need to raise €73bn in the first four months of 2011, some half of it in April 2011 alone.

These figures in isolation don’t seem to point to bail-out territory but when you take into account the fact that Spanish bond yields are at their highest in 8 years it’s clear that more than words are required to attract investors. The speed of the increase in yields from 4% to 5.2% in a month is a dramatic shift for bond markets which usually move in small doses. It means Spain’s bonds are slumping in value and holders are dumping them as they’re worried they won’t get all their money back.

So what is it that is spooking these investors? The country has made big efforts to scale back spending by central government and the national debt this year will be 60% of GDP – not great but not as bad as Ireland’s near 100%. But as Victor Mallet points out in the FT there’s a lack of clarity about the figures as despite the “strict limits” the debts of the country’s 17 autonomous regions (104.8 bn euros) account for over half of the public sector deficit which makes it much more difficult for the central government to impose reforms. “Spanish sovereign risk is increasingly at the sub-national level” says Nicholas Spiro of Spiro Sovereign Strategy and several regions including Catalonia and Madrid have such financial difficulties that a recovery seems unlikely given the economic stagnation and sluggish growth forecast for Spain.

It’s also in the regions where the problems for the banking systems lie. Spain experienced a huge property bubble, accompanied by a huge rise in private sector debt, and fell into recession when that bubble burst. But whilst the larger national banks such as Santander were well capitalised (and even in a position to acquire troubled foreign firms), in the regions the cajas (regional savings banks) have accumulated vast exposure to the construction and development sector. When the big two banks (BBVA and Santander) put the brakes on in 2006-07, the cajas continued lending more keenly, tapping wholesale debt markets to fund themselves. That alone makes them higher risk. But the savings banks also supplied about half of the €318 billion borrowed by Spain’s property developers. These loans now represent about a fifth of the cajas’ assets, according to Santiago López Díaz, an analyst at Credit Suisse. They are deteriorating fast.

We witnessed a similar phenomenon here in the United States. The primary lenders for acquisition, development, and construction loans were smaller regional banks. I sat in on a meeting in 2009 with representatives of one Midwestern bank that had more than 20 land projects in Southern California. I guess the returns were good when the developers thought it was in their best interest to continue to make payments. Once the land market imploded, land assets declined about 80% in value, and these smaller regional banks ended up with much REO.

So now the cajas are undoubtedly facing the grimmest outlook for sometime in what is already an extremely volatile situation. The results of the stress tests earlier in 2010 were supposed to have calmed fears but investigation revealed that much of the supposed liquidity in the regional banks was due simply to the over-valuation of much of their repossessed housing stock. A recent survey by the Economist estimated that Spanish property is still over-valued by 47.6% which suggests that a painful correction is on the way.

We have the same accounting slight-of-hand here in the US. We allow bankers to use bullish market assumptions concerning the underlying real estate to project loan loss reserves and unrealistically low levels. Banks Refuse to Recognize HELOC and Second Mortgage Losses. "Together with Citigroup the banks hold about 42 percent of the $1.1 trillion in second-home liens. Unlike first mortgages, they are typically not bundled and sold off to investors but kept on the banks' books. The biggest home-equity lender in the U.S. is Bank of America, holding some $138 billion in such loans. Wells Fargo has about $123.8 billion of home-equity loans." Realistically, lenders will lose most of the money they have tied up in these bad loans. That isn't how it is reflected on their balance sheets.

Indeed events of the last few days have only made this more likely. New accounting rules by the Bank of Spain will force lenders to dump depreciating assets, according to Bloomberg News. Under the changes, banks must now make provision for bad loans after just 12 months rather than the current 72 months, which will provide a strong incentive for lenders to sell properties quicker. The rules also force banks to value properties more realistically, which gives them a further incentive to sell.

Interesting that Spanish bank regulators are making the banks recognize their losses whereas here in the United States, regulators are doing everything to prevent banks from recognizing their losses.

Pisos Embargados de Bancos estimates that there are around 100,000 bank owned properties currently on the market but they estimate that this figure will rise to 300,000 next year.

Obviously this change in provisions has been designed to force banks to raise capital through sales of their property assets which would also provide a boost to domestic demand. The hope being that this income will negate the need for extensive bail-outs. However the release of this vast stock of property onto the market will drive prices down sharply and Fernando Rodriguez from Madrid-based property adviser RR de Acuna & Ass predicts a further 20% fall next year.

The danger here is that the property stock valuation is the only thing that gives the balance sheets of the cajas any respectability. Decrease these assets by 20% and many will be looking extremely vulnerable – and with no chance of borrowing on a nervous bond market the only solution will be to seek European aid.

The central bankers for the Euro aren't giving Spanish banks 0% loans like our Federal Reserve is favoring our banks. IMO, that is a good thing. Spain will see a dramatic house price crash, but then the economy will recover and the mis-allocated capital is released from real estate and allowed to be put to use in more productive assets.

Until now the response from the banks has been distinctly Canute-like, vaingloriously attempting to turn back the tide of falling prices by using their market power to artificially inflate prices.

The method which the banks use to have higher than open market price accepted as the appraisal benchmark for valuations of their property assets, starts with how the banks dispose of the homes they are currently repossessing. The banks are using subsidised mortgages which typically also include 100% mortgages, non-payment windows, extended terms (even up to 50 years) and interest free options to attract buyers.

Perhaps we should bring back 100% financing, Option ARMs, stated-income loans, ninja loans, interest-only loans, and the whole variety of really stupid lending ideas thoroughly discredited during the housing bubble. We get close to that with FHA loans, but we haven't resorted to the recklessness of the Spanish banks.

These mortgage deals are being granted at a subsidised interest rate totally at odds with market rates being offered for deposits. Typically, these subsidised mortgage rates are offered at just 0.3-0.5% over Euribor, whilst deposit rates offered by the same financial institutions are currently around 4%.

How do you sustain that policy without going broke?

The purpose of these subsidised mortgages is to encourage the purchase of bank repossessed homes at valuations that are higher than current open market prices. Indeed they are available only in conjunction with repossessed homes held by the bank offering the mortgage, whereas privately sold homes in the open market must apply through the usual channels for normal mortgage deals, which are typically 65% of value, 25 years and normal market interest rates.

Anecdotal examples show properties with a subsidised mortgage are between 25-40% above the open market price.

We tried that on a smaller scale when the Federal Reserve began buying mortgage-backed securities to drive down interest rates. The main reason interest rates have gotten so low is because lenders would far rather refinance their bad debt at very low interest rates that they would like to take a write down of original capital. Spain takes this idea to its extreme.

In October 2010 in El Rosario, Marbella, a 2000m2, frontline golf villa was sold by CAM Bank which had an asking price on their website of 1.3 million euro but were, in reality, looking for offers of 750,000 euros – however the final sales price was 601,000 euros – a difference of 54%. Another example in Santa Maria Village, Elviria was advertised by a bank at 269,500 euros but sold at 188,400 euros – a difference of 31.1%.

In effect the valuations of the bank’s property assets are supported by the banks own sales data of their repossessed homes, which are artificially inflated prices by the provision of subsidised mortgages. The result is a self perpetuating cycle where property values are kept high which in turn supports the bank’s approach to provisions against non-performing loans being required only at a low level.

We are doing the same here. Low interest rates supports bloated mortgages which in turn supports higher home prices than a natural market would support.

But with 1.4 million homes to sell this response looks remarkably inadequate, indeed many investors point to this practice as being one of the main reasons it’s impossible to judge the real price of property in Spain today – as it over-inflates the official figures so the real price of Spanish property is never reliably reported.

2011 may be the year we finally find out.

We may find out here what prices are supposed to be in 2011. The Federal Reserve is no longer buying mortgage debt and the government tax subsidies have expired. The government is no longer directly supporting house prices; although, it can be argued that the explicit backing of mortgage debt through the FHA and the GSEs is a market support. With the props removed, the market will wend its way toward a natural equilibrium. Most likely that means falling prices in 2011.

No equity left behind

Since the banks were giving out free money, most homeowners (at least the ones who have tried to sell houses in Irvine since 2006) took the free money as it became available and spent it. Their goal seemed to be to make sure no equity was left behind.

- Today's featured property was purchased for $363,000 on 3/13/2003. The owner used a $286,000 first mortgage and a $77,000 down payment.

- On 6/7/2004 he obtained a stand-alone second for $90,000 and withdrew his down payment plus another $13,000.

- On 9/20/2004 he refinanced with a $384,000 first mortgage.

- On 8/30/2006 he obtained a $10,000 HELOC.

- On 10/17/2006 he got a $24,900 HELOC.

- On 1/8/2007 he refinanced with a $455,000 Option ARM first mortgage.

- Total mortgage equity withdrawal is $169,000 plus negative amortization.

- He quit paying early in 2010.

Foreclosure Record

Recording Date: 08/20/2010

Document Type: Notice of Default

Irvine Home Address … 184 ALMADOR Irvine, CA 92614 ![]()

Resale Home Price … $399,000

Home Purchase Price … $363,000

Home Purchase Date …. 3/13/2003

Net Gain (Loss) ………. $12,060

Percent Change ………. 3.3%

Annual Appreciation … 1.2%

Cost of Ownership

————————————————-

$399,000 ………. Asking Price

$13,965 ………. 3.5% Down FHA Financing

4.71% …………… Mortgage Interest Rate

$385,035 ………. 30-Year Mortgage

$79,911 ………. Income Requirement

$1,999 ………. Monthly Mortgage Payment

$346 ………. Property Tax

$50 ………. Special Taxes and Levies (Mello Roos)

$67 ………. Homeowners Insurance

$280 ………. Homeowners Association Fees

============================================

$2,742 ………. Monthly Cash Outlays

-$325 ………. Tax Savings (% of Interest and Property Tax)

-$488 ………. Equity Hidden in Payment

$25 ………. Lost Income to Down Payment (net of taxes)

$50 ………. Maintenance and Replacement Reserves

============================================

$2,003 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,990 ………. Furnishing and Move In @1%

$3,990 ………. Closing Costs @1%

$3,850 ………… Interest Points @1% of Loan

$13,965 ………. Down Payment

============================================

$25,795 ………. Total Cash Costs

$30,700 ………… Emergency Cash Reserves

============================================

$56,495 ………. Total Savings Needed

Property Details for 184 ALMADOR Irvine, CA 92614

——————————————————————————

Beds: 2

Baths: 2 full 1 part baths

Home size: 1,307 sq ft

($305 / sq ft)

Lot Size: n/a

Year Built: 1989

Days on Market: 19

Listing Updated: 40512

MLS Number: S639158

Property Type: Condominium, Residential

Community: Westpark

Tract: Lp

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Elegant Westpark home with prime private location featuring two master suites, two and one-half baths, two-car attached garage with built-in storage cabinets, and spacious yard! Fabulous floor plan with soaring vaulted ceilings, cozy fireplace, and convenient inside laundry. Highly upgraded kitchen includes stainless steel dishwasher and oven/range, built-in microwave, and dry-foods pantry. Upgrades include custom tile floors, custom paint, and custom window treatments. Dual master suites each with their own master bath. Enjoy Las Palmas resort style amenities and Irvine Schools!

A 1% rise in bond yields is not unusual in today’s environment, so it should not signal impending doom for Spain.

Spain’s problem, and Ireland’s too, is the Euro. Yes, their prices are too high, but relative to other Euro-zone countries that lent to their banks. They could very quickly get to where they need to be by a devaluation of the peso, but the Spanish peso is long-gone.

Also, for those saying gov’ts need to run low deficits or surpluses to be safe, that’s what Ireland and Spain did. It was private sector debt that is doing them in (for Ireland, it became public sector when they back-stopped their banks).

We are also not Spain, nor Ireland. Our debts are, for the most part, to other Americans, so the politics, while still thorny, is not nation-v-nation.

The one similarity is what inflated the bubble. Spain being on the euro made their debt seem the same risk-wise as German debt. In our case it was AAA rated sub-prime MBSs being considered comparable or better (they yielded better) than AAA rated prime MBSs.

No one is trying to re-inflate the bubble, at least no one in power at least. I think Obama finally understands the nature of the housing bubble .

“They could very quickly get to where they need to be by a devaluation of the peso”

What kind of mad man argues that stealing from citizens (via inflation via loss in purchasing power) is the solution?

Who is most a/effected by this sort of policy?

Please do the lower class a favor and reconsider ever voting again.

Subprime MBS offered a higher return because they had higher risk, not because they were comparable or better.

Our debts are short term and must be rolled over, in effect, an adjustable rate mortgage. Who is the largest holder of US treasuries? Last i checked it was the federal reserve (bag holder).

The potential devaluation of the peso would happen on its own, it wouldn’t take major intervention. The way you talk you sound like a return to the gold standard would fix everything. But, during the Great Depression, the nations that exited the gold standard first, recovered first, while the ones that stayed with it, were the last to recover.

You can look to many major debt crises over the past 30 years and the key problem is borrowing in someone else’s currency.

Subprime MBS and Prime MBS were considered comparable from a regulatory point of view. Both were AAA and required little capital held against potential loss. That is one of the basic problems of the credit crisis.

The fed is not the biggest holder of treasuries – that would be the SS trust fund (2.4T vs. ~1T). Even after QE2, that will only be up to about ~1.5T.

I agree the devaluation would occur sans intervention, as would the US dollar. Intervention makes the devaluation unnecessarily greater. Private sector debt needs to be liquidated, rates must rise, and the currency will suffer short term, but remain strong long term. The problem is private debt being transferred to the taxpayer. Therein lies the intervention.

Leaving the gold standard is the equivalent of defaulting. Discipline evaporates and wreckless spending is no longer kept in check as other countries following down the path of overspending and inflation. It may appear, through inflation, that countries recover quickly just as it appears we are recovering currently.

It matters not how regulators view different security products. The proper mechanism is the market mechanism of creditors/investors using their own judgement to determine the risk reward ratio. Relying on a regulator or rating agency is foolish.

I did not know the SS (Social Security I am assuming) trust fund is the largest holder. Big bagholder. Have we forgotten the percentage of foreign bagholders?

there are plenty of countries who dont run long term fiscal deficits who have fiat currencies.

In fact, in the 90’s, we ran fiscal surpluses.

As for inflation giving the appearance of recovery, GDP growth is measured in real terms, not nominal terms.

If you don’t believe GDP statistics, give us another measure that we can use for a 14 Trillion dollar economy. and what does this measure tell us about real GDP growth right now?

Not having a currency backed by anything other than the citizens ability to service the debt is dangerous, especially if you are the world reserve currency. Other countries are given less slack in spending as dictated by the market price of the currency. they do not have world reserve currency status and size, thus the market has lower perceived faith. It is possible to be fiscally conservative and fiat, but politically there is much temptation to overspend.

You’re measuring 2 metrics:

One which is manipulated to understate inflation and the other which includes a great deal of unproductive fluff and credit driven consumer spending bolstered by government subsidy. Experiencing true gdp growth during a contraction is impossible.

Private sector production would be the best metric. However, during a boom or bear rally fueled by cheap money, this number may be increasing due to business’ misreading indicators and making malinvestments. Such is the danger of using interest rates to control economies. It also results in a lot of confused citizens trying to figure out if up is down and down is up.

The gold standard is necessarily deflationary and does not promote stability any better than paper money – research the history of panics and depressions in the 1800’s.

Flexible exchange rates are generally accepted to be superior to fixed exchange rates. What’s our complaint with China? They aren’t letting their currency float.

If i have $100, deflation helps me. It encourages me to save money. This is capital creation and a necessary component for jobs. savings represents stability on all levels from the individual to sovereign level.

inflation hurts me. it encourages me to spend money on things with inherent value or gamble to keep pace with inflation. it encourages me to borrow so i can pay debt back with cheaper currency in the future.

Paper money gives the illusion of stability as problems can be deferred to the future. Money tied to a commodity discourages overspending and overborrowing as the consequences must be dealt with in the very near term. this inhibits a society from becoming laden with debt.

Use your mind and common sense to see which is more stable.

so let me get this straight, you want a deflationary environment because it encourage savings?

So a general environment where prices of assets and wages and other things always go down is conducive to inducing savings and investment?

Why don’t use your mind and common sense to actually learn basic economics.

You do realize that you have no idea what you are talking about right?

The basic definition of GDP:

GDP= Consumption + Investment + Government + net exports or minus net imports.

You seem to talk about economics like you understand them but are strangely lacking even the most basic understanding of how GDP is defined.

It is precisely because free markets and the pure gold standard lead inevitably to falling prices that monetarists and Keynesians alike call for fiat money. Yet, curiously, while free or voluntary deflation has been invariably treated with horror, there is general acclaim for the draconian, or compulsory, deflationary measures adopted recently–especially in Brazil and the Soviet Union–in attempts to reverse severe inflation.

But first, some clarity is needed in our age of semantic obfuscation in monetary matters. “Deflation” is usually defined as generally falling prices, yet it can also be defined as a decline in the money supply which, of course, will also tend to lower prices. It is particulary important to distinguish between changes in prices or the money supply that arise from voluntary changes in people’s values or actions on the free market; as against deliberate changes in the money supply imposed by governmental coercion.

Price deflation on the free market has been a particular victim of deflation-phobia, blamed for depression, contraction in business activity, and unemployment. There are three possible causes for such deflation. In the first place, increased productivity and supply of goods will tend to lower prices on the free market. And this indeed is the general record of the Industrial Revolution in the West since the mid-eighteenth century.

But rather than a problem to be dreaded and combatted, falling prices through increased production is a wonderful long-run tendency of untrammelled capitalism. The trend of the Industrial Revolution in the West was falling prices, which spread an increased standard of living to every person; falling costs, which maintained general profitability of business; and stable monetary wage rates–which reflected steadily increasing real wages in terms of purchasing power.

This is a process to be hailed and welcomed rather than to be stamped out. Unfortunately, the inflationary fiat money world since World War II has made us forget this home truth, and inured us to a dangerously inflationary economic horizon.

A second cause of price deflation in a free economy is in response to a general desire to “hoard” money which causes people’s stock of cash balances have higher real value in terms of purchasing power. Even economists who accept the legitimacy of the first type of deflation react with horror to the second, and call for government to print money rapidly to prevent it.

But what’s wrong with people desiring higher real cash balances, and why should this desire of consumers on the free market be thwarted while others are satisfied? The market, with its perceptive entrepreneurs and free price system, is precisely geared to allow rapid adjustments to any changes in consumer valuations.

Any “unemployment” of resources results from a failure of people to adjust to the new conditions, by insisting on excessively high real prices or wage rates. Such failures will be quickly corrected if the market is allowed freedom to adapt–that is, if government and unions do not intervene to delay and cripple the adjustment process.

A third form of market-driven price deflation stems from a contraction of bank credit during recessions or bank runs. Even economists who accept the first and second types of deflation balk at this one, indicting the process as being monetary and external to the market.

But they overlook a key point: that contraction of bank credit is always a healthy reaction to previous inflationary bank credit intervention in the market. Contractionary calls upon the banks to redeem their swollen liabilities in cash is precisely the way in which the market and consumers can reassert control over the banking system and force it to become sound and noninflationary. A market-driven credit contraction speeds up the recovery process and helps to wash out unsound loans and unsound banks.

Peso, peseta, irrelevant.

Note i used the word “includes” which does not mean those are the only components of GDP. Being able to recite the GDP equation is unimportant.

My point is that the consumption and government components of GDP can make it appear as if the 14 trillion dollar economy is “humming”.

In theory, government can always ride to the rescue, laundering money through govt jobs or subsidizing consumption, and increase GDP to keep public perception positive.

I want currency tied to a commodity to discipline government spending.

I do not want government and central bank arbitrarily expanding and contracting the money supply. It creates instability.

I want my cash to hold or increase in value.

Currency would hold value if the government was taken out of the equation. End fiat currency and let the free market decide what is or isn’t money.

Would we only be able to measure prices in nominal terms in a deflationary environment?

Pedantry attack: Spanish currency before the euro was the peseta, not the peso.

IR is correct that the Spanish situation is much, much worse than the American situation. My son lives there; he and his fiancee (especially the latter) have wanted to buy a house, but, using lots of quotes from IHB, we’ve talked them out of it. What is especially interesting is that the Koolaid has lasted much longer there than here — absurdly inflated prices were still being quoted to the kids as recently as 6 months ago (half-a-million euros for a very ordinary 3-bedroom townhouse in a not-very-convenient neighborhood in a provincial city, for instance). Around the big cities in the center of the country there are acres and acres and acres of empty developments with many unfinished buildings with huge signs trying to attract buyers — this in a country with 20% official unemployment and the salaries of government workers (a much higher % of the population than here) being cut by numbers like 5 and 7%. This is a scary situation.

Apologies for the error. It had been so long since it was used, I could not remember.

Sometimes I tried to *Wiki* almost everything I type before hitting the ‘Send’ button 🙂

FYI, the old Spanish currency was the Peseta, not the Peso.

subsidized mortgages allowing buyers to pay 25-40% above market:

?como se dice “knife catcher”?

check out distressed properties on google maps (this is for the SF bay area).

CRAZY!

http://maps.google.com/maps?f=q&source=s_q&hl=en&q=&mrt=realestate&sll=37.391709,-122.026863&sspn=0.172391,0.362206&ie=UTF8&ei=lREBTdSEGovKpQSR8riaAw&attrid=ee6d68e1e5cb9843_&rq=1&ev=p&split=1&radius=11.93&hq;=&hnear;=&ll=37.333586,-121.973991&spn=0.172525,0.362206&z=12

credit to barry ritholtz for the google map trick:

http://www.ritholtz.com/blog/2010/12/google-map-foreclosures/

Check out “Government, Fannie Mae Considering Help for Housing Investors” http://www.cnbc.com/id/40590863

Son of bitches again trying to make rich richer! Let the damn thing correct! If vulures want to buy, let them pay market rate and not discounted rate or any assistance!

Hello All –

It seems that the bond bubble and RE mortgage rates maybe starting to loose the hot air.

Let’s hope that QE 2/3/4 can keep things low long enough to absorb all of this overpriced housing in OC. If not we will see a significant step down in pricing. Also, please realize there is a huge difference between commodity inflation (which we see now) and the pressue put on “leveraged assets” like housing. It’s one thing to pay more for gas and milk (those prices will go up with inflation) but, totally different when you have to borrow money to pay for “leveraged assets” like housing.

There will be terrible compression IMHO for housing prices as rates rise. If people can barely afford housing at 4% rates wait untill you see what happens when rates hit 7,8,10% rates on a 30 year fixed.

It’s not the price point you buy at but, the price point you have to sell at in a decade when people have to borrow the money at much higher rates.

Inflation will raise the cost of cash purchases but, destroy the prices of assets that need leverage.

Just my .02

BD

All this said, I never would have thought that a bus driver in LA working for the city would make 65K a year. Let’s hope we all see huge wage inflation.

We are in a bad, bad, bad, scenario. This is the result of a bubble and huge excesses. We in the OC will likely be Japan. Prices grind lower for a decade and then go sideways for another….

BD

The public and private pension excesses will keep the ‘redistribution of wealth’ at the top of the agenda. We in CA and OC / LA / SF are in for a long bumpy ride over the forseeable future.

How do you raise taxes on the makers to give to the takers? Housing is just a symptom of the problem compounded by ‘never seen on Earth’ excesses in housing – especially in the high-priced markets.

Timber!

My .02

BD

Ben Franklin and FDR come to mind of American who used inflation to pay off the US debt. Pay back with cheapen money. It’s worked for 200+ years and the bankster got to Federal Reserve to keep that sort of inflating in check or at least for their members. It’s just human nature at work — greed.

Any long term graphes on Japan’s housing prices to see the span for the bubble and the burst. Mostly one the burst, but how long did it take to inflate? The US policy is Japan II, low interest, high unemployment and attempts to inflate housing. As I recall, there’s a number of Japanese Gen-Xers that have never worked. Their parents continue to work in their retirement year to support their grown children. Very sad and a high social cost that those families. Will it happen in America?

When will housing be affordable in OC?

Newbie 2001 –

Yep…! We are at a tipping point with housing in the OC.

Be not afraid! Ha! Housing prices and other leveraged assets will spiral down if we end up with a decade or more of rising rates. The best that can happen is slowly rising rates and modest inflation. The worst than can happen is the US economy recovers at the same time Brazil, Russia, India, and CHINA continue to consume larger and larger parts of the commodity pie i.e resources. Then we will see Carter like rates – 17% on borrowed money.

I dare anyone to go to a mortgage calculator and plug in 17% rates on a 30 year fixed and see if they believe thay can afford to pay 400K on a 1M property listed today!

Not possible.

My .02

BD

IR – Although not an Irvine property, will you work your magic and post a property history on this Riverside listing? The owner is an acquaintance and is bragging about not making a mortgage payment in 3 years.

http://www.redfin.com/CA/Riverside/10133-Woodbridge-Ln-92509/home/6444230

Thanks for writing another interesting article.

1) You write: “the level of debt isn’t supportable by incomes are forces that will put more inventory on the market preventing house prices from rising until the debt is purged.”

The debt will never “be purged”.

I believe, currencies world wide will collaps, and then the debt be applied to all people, that is every man, woman, and child: all will live in debt servitude.

2) You reference your article of earlier this year where you state: “Prices are only sustained by very low inventories which are a result of lenders refusing to foreclose.”

It MAY be that this will continue.

3) In my article …

Mortgage Backed Bonds And Real Estate Tumble Lower As The Ten Year Interest Rate Moves Higher … I wrote: “The rise in the mortgage interest rate has terminated the bankers FASB 157 entitlement to mark real estate to managers best estimate; now higher mortgage interest rates are calling real estate prices lower.”

As interest rates go higher the sham of current valuations will be exposed and may produce an incentive for bankers and real estate companies to foreclose and rent.

4) In today’s article, which I have linked to, I write: I believe that we are on the verge of another strong sell off of the world’s major currencies, DBV, and emerging market currencies, CEW, driving financial and small cap shares quickly lower as concerns arise once again over the ongoing European sovereign debt banking symbiosis crisis.

5) You ended your article with this rather postive remark: We may find out here what prices are supposed to be in 2011. The Federal Reserve is no longer buying mortgage debt and the government tax subsidies have expired. The government is no longer directly supporting house prices; although, it can be argued that the explicit backing of mortgage debt through the FHA and the GSEs is a market support. With the props removed, the market will wend its way toward a natural equilibrium. Most likely that means falling prices in 2011.”

My response is that I see a catastrophic failure of banking both in the US and in Europe, and I see that coming withing days and weeks, most certainly by February 2011.

6) You write: “Since the banks were giving out free money, most homeowners (at least the ones who have tried to sell houses in Irvine since 2006) took the free money as it became available and spent it. Their goal seemed to be to make sure no equity was left behind.”

I find that helpful, because you are one of the few to reveal the truth of the widespread use of mortgage equity withdrawl … No equity left behind was an important economic stimulus, that I believe after having read other reports, Alan Greenspan was aware of … Not only was it the homeowners goal to make sure no equity was left behind, but also Alan Greenspan’s as well. He could have shut down toxic lending, but I think he wanted to have an expansionary economy, and I think that he and Robert Rubin, knew of a day when the banks and the Federal Government would be integrated into a combine, that is melded together into state corporatism. So he let things go their wild way.

Had I not found your blog, I would have been to “callow” to comprehend and believe in the widespread and deep practice of mortgage equity withdrawl, even to the point of leaving no equity behind.

My callowness precluded me from getting and coolaid and stimulus.

7) The Fed has a real problem on its hands, its QE2 is not working, as it has set the bond markets on fire. And there is 1 Trillion in excess reserves that will continually destroyed by higher interest rates. And it has distressed securities, which trades like junk bonds, on its books.

So I am expecting deleverging, disinvestment and falling financial market prices and no real estate sales.