The much anticipated second leg down in house prices is official. Will we hit bottom this winter?

Irvine Home Address … 8 INDIGO Irvine, CA 92618

Resale Home Price …… $1,049,000

Time is getting closer

I read it on a poster

fanatical exposers

on corners prophesized

I just come back to show you

all my words are golden

so have no gods before me

I'm the light

Alice Cooper — Second Coming

Back in July I wrote All Signs Point to Lower House Prices. Well, here we are….

2nd Leg of Home Price Declines Underway

By: Dirk van Dijk, CFA November 30, 2010

In September, home prices continued to slip, and the declines were very widespread. The Case-Schiller Composite 10 City index (C-10) fell 0.67% on a seasonally adjusted basis, and is up just 1.52% from a year ago. The broader Composite 20 City index (which includes the cities in the C-10) fell by 0.80% on the month and is up 0.55% from a year ago.

In August, the year-over-year gains were 2.50% for the C-10 and 1.61% for the C-20, so it looks like the year-over-year gains are rolling over. Of the 20 cities, only one (Washington DC, and it was only up 0.05%) posted a gain on the month, while 19 saw prices fall. Year over year, five metro areas saw gains and 15 suffered losses.

In August, there were also 19 down and just one up. It thus looks like a new downtrend in housing prices is under way.

It is difficult to argue with data. Prices are falling again — and not simply because they always drop a little bit at the end of the year — prices are falling all over the country on a seasonally adjusted basis.

Consider Seasonal Adjustments to Prices There is a seasonal pattern to home prices, and thus it is better to look at the seasonally adjusted numbers than the unadjusted numbers. Most of the press makes the mistake of focusing on the unadjusted numbers.

While the 0.55% rise in the C-20 year over year in isolation is not the end of the world, it hardly makes up for the damage that was done in the popping of the housing bubble, and it is also unlikely to last. From the April 2006 peak of the housing market, the C-10 is down 29.83%, while the C-20 is off by 29.56%.

Calculated Risk has created a great chart compiling house prices calculated by the Case-Shiller method back to the mid 1970s. It clearly illustrates the two previous bubbles largely concentrated on the coasts as well as the Great Housing Bubble.

As you can see from the chart, the Federal Reserve attempted to halt the house price decline before it reached its natural bottom. Perhaps they prevented an overshoot to the downside and saved many banks from going under. If they did, it was at an enormous cost that will ultimately be borne by taxpayers.

The Case-Schiller data is the gold standard for housing price information, but it comes with a very significant lag. This is September data we are talking about, after all, and it is actually a three-month moving average, so it still includes data from July and August.

Existing home sales have been weak since the home buyer tax credit expired (see "Used Home Sales Fall"). In the process, the inventory-to-sales ratio has been extremely high, at 10 months, although that is down from the June peak of 12.5 months. That is what we saw during the implosion of housing prices that took place in 2007 or 2008. Housing prices are going to fall again in the coming months.

I noted this in Home Price Drop Sudden and Dramatic.

Month-to-Month Data a Bitter Pill

It is hard to find much of a silver lining in the month to month data. Only Washington DC posted an increase, and that was anemic at just 0.05%. Only three other cities kept the decline to less than 0.5%: Las Vegas down 0.21%, Denver down 0.30% and L.A. down 0.43%.

On the other hand, there were five cities that posted month-to-month declines of over 1.5%. The Twin Cities were the hardest hit, plunging 2.21%, followed by Cleveland with a 2.00% decline. Portland was down 1.72%, Detroit fell 1.61% and Phoenix fell 1.55%. Those are similar in magnitude to the monthly declines we were seeing three years ago during the first wave of the housing price implosion.

I doubt the upcoming price declines will approach the depth of the previous drop, but it interesting that the decline is picking up speed and it now rivals the rate of decline from three years ago.

Results by Region

On a year-over-year basis, the strongest cities are in California, which was an early poster child for the housing bust. However, even there the year-over-year gains are starting to erode. San Francisco leads the way with a 5.43% rise, followed by San Diego, up 4.94%. LA was in fourth place with a 4.32% year-over-year increase.

DC was in third place with a 4.40% gain. Boston was the only other city with a year-over-year gain, and it was up just 0.39%. As recently as July, the year-over-year gains in California were 11.06% in SF, 9.26% in SD and 7.5% in LA.

There were nine metropolitan areas where the year over year declines were more than 2.5%. Chicago fared the worst with a 5.63% decline, followed by 4.36% in Tampa. It is not going to take global warming to put that entire city underwater — the housing market has already accomplished that.

Charlotte, which early on seemed relatively immune from the housing bust, is down 3.72% year over year. Portland is down 3.63%, and Detroit is off 3.15%. In other words, significant year-over-year declines are happening in just about every corner of the country.

Declines in the areas which did not rally during the bubble are most likely the result of deteriorating employment in the local economies in those areas. Without the bubble rally to facilitate over-borrowing and to create distressed loan owners, other factors must be driving the declines.

The graph below tracks the cumulative declines for each city over time. If the red bar is shorter to the downside than the yellow bar for a city, it indicates that prices in that city have risen since the start of this year.

In every city prices are below where they were in April 2006, but there is a huge variation. Las Vegas is the hardest hit, with prices down 57.57% from the peak, followed by Phoenix down 53.65%. Three more cities are down more than 40%, Miami (down 47.92%), Detroit (off 45.19%) and Tampa (with a 43.53% decline).

At the other end of the spectrum are Dallas (down only 6.26%), Charlotte (off 8.13%) and Denver (down 10.25%). (Note: the percentage declines I am quoting are from when the national peak was hit, the numbers in the graph are relative to that city’s individual peak, so there is a little bit of difference.)

No Support for Home Prices

The homebuyer tax credit was propping up home prices, but now with that support gone, prices are resuming their downtrend. People had until June 30 to close on their houses, and they had to agree to the transaction by April 30. That pulled sales into those months that might otherwise have happened in July or August. The credit was up to $8,000, so almost nobody would want to close their deal in early July and simply leave that money on the table.

The tax credit is a textbook example of a third party subsidizing a transaction. When that happens, both the buyer and the seller will get some of the benefit. The buyer gets his when he files his tax return next year, the seller gets hers in the form of a higher price for the house.

Since the tax credit is now over, that artificial prop to housing prices has been taken away. Sales of existing houses simply collapsed in July, after the credit expired, and have remained depressed ever since. The extremely high ratio of homes for sale to the current selling pace is sure to put significant downward pressure on prices.

There is still quite a bit of “shadow inventory” out there, as well. That is, homes where the owner is extremely delinquent in his mortgage payments and unlikely ever to make up the difference, but that the bank has not yet foreclosed on or foreclosed houses that have not yet been listed for sale.

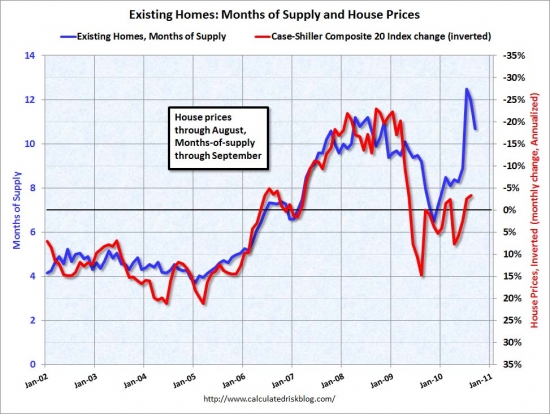

Take a good hard look at the second graph (also from this source) and tell me what you think is going to happen to housing prices over the next few months. A normal market has about six months of supply available. During the bubble, the months of supply generally ran closer to four months, and prices were soaring. It was not until inventories climbed above the six month mark that prices started to fall.

The really collapsed as the months of supply moved into the double digits. The extensive government support for the housing market — including the tax credit, but also the Fed buying up $1.25 Trillion in mortgage paper to artificially depress mortgage rates — helped boost sales and bring the months of supply back down. Now that support is over, and the months of supply far exceed the worst we saw during the heart of the bust (Note: the graph is not updated to include the September data).

Calculated Risk created another interesting chart showing the relationship between months of supply and the monthly price change in the Case-Shiller. He inverted the price change data so the correlation is more obvious.

As you can see, when months of inventory goes up, prices go down. The only way prices hold up is if sales rates remain very low. If banks continue to hold out for top dollar, the inventory will never clear out.

The tax credit was not a very effective means of stimulus, but it did help prop up prices, and that is a pretty important accomplishment, even if it proves to be ephemeral.

Was it really? Why was it so important to temporarily prop up prices? Let's recap what was really accomplished:

- create false hope among debtors,

- prevent prices from bottoming,

- delay the recovery of prices and the economy,

- keep homebuilding in the doldrums,

- keep a few zombie banks in business,

- keep prices artificially high to price out would-be buyers,

- and add billions to the bill for taxpayers.

What about that list is positive?

The credit cost the government about $30 billion. A large part of that money went to people who would have bought anyway, but perhaps would have done so in July or August rather than May or June. To the extent it rewarded people for doing what they would have done anyway, it did nothing to stimulate the economy.

Also, turnover of existing houses really does not do a lot to improve the economy. It is the building of new houses that generates economic activity. And it is not just about the profits of D.R. Horton. A used house being sold does not generate more sales of lumber by International Paper or any of the building products produced by Berkshire Hathaway or Masco. It does not put carpenters and roofers to work. New homes do.

While housing prices are important to the economy, the level of turnover in used houses is not. Home equity is, or at least was, the most important store of wealth for the vast majority of families. Houses are generally a very leveraged asset, much more so than stocks. Using your full margin in the stock market still means you are putting 50% down. In housing, putting 20% down is considered conservative, and during the bubble was considered hopelessly old fashioned.

As a result, as housing prices declined, wealth declined by a lot more. For the most part, we are not talking vast fortunes here, but rather the sort of wealth that was going to finance kids' college educations and a comfortable retirement. With that wealth gone, people have to put away more of their income to rebuild their savings if they still want to be able to send the kids to college or to retire.

The decline in housing wealth is a very big reason why retail sales have been so weak. With everyone trying to save, aggregate demand from the private sector is way down. If customers are not going to spend and buy products, employers have no reason to invest to expand capacity. They have no reason to hire more workers.

The cycle of deflation is difficult to stop once it gets started. Bernanke is right to be concerned. However, he is foolishly optimistic in his belief that he can do something about it. He can print a lot of money — which he is doing right now — but he will have to print a lot more to get consumers to change their behavior.

Underwater Mortgages Lead to Foreclosures

Also, as housing prices fell, millions of homeowners found themselves owing more on their houses than the houses were worth. That greatly increases the risk of foreclosure. If the house is worth more than the mortgage, the rate of foreclosure should be zero. Regardless of how bad your cash flow situation is — due to job loss, divorce or health problems for example — you would always be better off selling the house and getting something, even if it is less than you paid for the house, then letting the bank take it and get nothing.

By propping up the price of houses, the tax credit did help slow the increase in the rate of foreclosures.

No it didn't. The rate of foreclosure is completely artificial as the banks are doing the amend-extend-pretend dance. Right now, it takes 492 days to process a foreclosure.

Still, 23% of all houses with mortgages are worth less than the value of the mortgage today. Another five percent or so are worth less than five percent more than the value of the mortgage. If prices start to fall again, those folks well be pushed underwater as well.

On the other hand, it is not obvious that propping up the prices of an asset class is really something that the government should be doing. After all, it is hurting those who don’t have homes and would like to buy one.

It pisses me off every day to see my government working against my best interest with my tax dollars, particularly in a blatant giveaway to greedy and stupid bankers and greedy and stupid loan owners.

Support for housing goes far beyond just the tax credit. The biggest single support is the deductibility of mortgage interest from taxes. Since homeowners are generally wealthier and have higher incomes than those that rent, this is a case of the lower middle class subsidizing the upper middle class. Also, even if they are homeowners, people with lower incomes are more likely to take the standard deduction rather than itemize their taxes. The mortgage interest deduction only applies if you itemize.

It is also worth keeping in mind in the current debate over extending the Bush tax cuts for just 97% of the population as Obama has proposed, or for 100% of the population as the GOP insists on, that the $250,000 per couple threshold is for adjusted gross income, not the top-line income. Thus, a couple with income of $274,000 (in wages) but who pay $2000 a month in mortgage interest, would not see an increase in their taxes at all.

Housing Prices to Find a Lower Floor

The real problem though is that, now that the tax credit is over, prices will find their more natural level. Fortunately, relative to the level of incomes and to the level of rents, housing prices are now in line with their long-term historical averages, not way above them as they were last year.

In other words, houses are fairly priced — not exactly cheap by historical standards, but not way overvalued, either. That will probably limit how much price fall over the next six months to a year to the 5 to 10% range, rather than the 30% decline we saw from the top of the bubble. That, however, is more than enough of a decline to do some serious damage.

This authors assessment is a good one. I concur with what he wrote above.

The Case-Schiller report was weaker than the consensus expected. The second leg down in housing prices is underway, but fortunately will probably be a much shorter leg than the first one.

Still, that is bad news for the economy. Used homes make very good substitutes for new homes, and with a massive glut of used homes on the market, there is little or no reason to build any new ones.

Residential investment is normally the main locomotive that pulls the economy out of recessions. It is derailed this time around, and there seems to be little the government can do to get it back on track.

There is nothing the government can do to increase residential investment, and they shouldn't try. If they simply let the market work without continuing manipulation, the problem will fix itself, and the economy will improve.

Unfortunately for California, what our economy needs is a huge home price rally and lenders stupid enough to give out HELOCs like drugs at a rave. The California Economy Is Dependent Upon Ponzi Borrowers like the one I am featuring today. How will we make up for the loss of hundreds of thousands of dollars in consumer spending per household?

High end Ponzi borrowing

HELOC abuse is not restricted to social class or income level. It is a common misconception that only the poor and subprime borrowers don't know how to manage their money. High wage earners are equally likely to go Ponzi, particularly if they are trying to keep up with the other Ponzis in the neighborhood or in their social circles. Since high end homes are more expensive, the Ponzi borrowing was more extreme there. No matter how much people make, if they are offered free money, they will take all they are given — even if it costs them their house.

- Today's featured property was purchased on 4/29/1999 for $528,000. The owners used a $422,000 first mortgage, a $52,750 second mortgage, and a $53,250 down payment.

- On 5/15/2000, after about 1 year of ownership, these owners refinanced with a $540,000 first mortgage, withdrew their $53,250 down payment, and got an extra $12,000 in spending money.

- On 3/2/2001 they got a private-party loan for $35,000.

- On 3/18/2003 they refinanced with a $650,000 first mortgage and obtained a $32,000 HELOC.

- On 8/31/2003 they refinanced with a $738,750 first mortgage.

- On 3/19/2004 they obtained a $150,000 HELOC.

- On 5/31/2005 they refinanced with a $847,000 Option ARM with a 1% teaser rate.

- On 5/31/2005 they obtained a $121,000 HELOC.

- On 10/25/2006 they got their final HELOC for $250,000.

- Total property debt is $1,097,000 plus negative amortization assuming they maxed out the HELOC.

- Total mortgage equity withdrawal is $622,250.

They spent the house, and now they are likely to be a short sale.

Irvine Home Address … 8 INDIGO Irvine, CA 92618 ![]()

Resale Home Price … $1,049,000

Home Purchase Price … $528,000

Home Purchase Date …. 4/29/1999

Net Gain (Loss) ………. $458,060

Percent Change ………. 86.8%

Annual Appreciation … 5.9%

Cost of Ownership

————————————————-

$1,049,000 ………. Asking Price

$209,800 ………. 20% Down Conventional

4.55% …………… Mortgage Interest Rate

$839,200 ………. 30-Year Mortgage

$206,216 ………. Income Requirement

$4,277 ………. Monthly Mortgage Payment

$909 ………. Property Tax

$250 ………. Special Taxes and Levies (Mello Roos)

$175 ………. Homeowners Insurance

$139 ………. Homeowners Association Fees

============================================.jpg)

$5,750 ………. Monthly Cash Outlays

-$1023 ………. Tax Savings (% of Interest and Property Tax)

-$1095 ………. Equity Hidden in Payment

$355 ………. Lost Income to Down Payment (net of taxes)

$131 ………. Maintenance and Replacement Reserves

============================================

$4,119 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$10,490 ………. Furnishing and Move In @1%

$10,490 ………. Closing Costs @1%

$8,392 ………… Interest Points @1% of Loan

$209,800 ………. Down Payment

============================================

$239,172 ………. Total Cash Costs

$63,100 ………… Emergency Cash Reserves

============================================

$302,272 ………. Total Savings Needed

Property Details for 8 INDIGO Irvine, CA 92618

——————————————————————————

Beds: 4

Baths: 3 baths

Home size: 3,600 sq ft

($291 / sq ft)

Lot Size: 6,175 sq ft

Year Built: 1999

Days on Market: 104

Listing Updated: 40490

MLS Number: S629131

Property Type: Single Family, Residential

Community: Oak Creek

Tract: Kenw

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Gorgeous open concept luxury home nestled on quiet cul de sac in highly sought-after gated community. Huge kitchen opens to family room. Spacious master suite. Upstairs bonus/loft area. WOW!

I disagree with the assessment that the props did nothing good, and that the gov’t should have just let prices fall where they would. The system we had, sans gov’t intervention, was unstable. Unstable systems don’t just go right back to steady-state after a shock. Consider if Case-Shiller, on its way back to the black trend line you show, fell another 30% to 80. They’d be 20% off the trend and we’d have nearly everyone underwater, few able to sell, and even more strategic default and squatting. Is that the better path? What would the cost of that have been? Is that cost more or less than what was spent to slow the decline?

When people talk about residential construction having led the country out of past recessions and expecting it to do the same today, they are showing how blind they were to the past 5 years. Construction is slow because there is oversupply in many places, and enough supply everywhere else. It is really going to take improving employment and new household formation to spur residential construction, and those are going to be slow coming.

Knowing the importance of business cycles, the Fed propped up the housing prices when the cylce was at its lowest trough hoping the upswing of the trajectory of the business cycle would take care what the Fed’s artificial maneuvering falls short. As much as I hate the meddling from the Fed the plan worked for its intended purpose. The second leg of the falling prices will be much milder.

If you look at the second CR chart’s sets of Bars for Washington DC and New York, you get a feel for why TPTB may THINK the measures taken have resolved the RE problem.

In their OWN RE locations prices HAVE been recovering, albeit slowly, until a couple of months ago.

What the US may see now is an absence of action due to Congressional changeover, during a Winter of Pricing Discontent. That might yield some pretty passionate rhetoric if there’s no 2011 spring bounce, but I don’t know (since I’m speculating from FAAAAAR away) if the political dynamic is there for even more extreme price manipulation.

(And in case you didn’t know, everything you have seen in the US so far is chicken feed compared to the measures that have been used in Australia to keep RE prices high and ever-rising over the last 25 years.)

For $1m that is a horrible kitchen design.

Seems the koolaid is still strong in Des Moines..

“My primary concern is being able to afford the home with one salary,” said Jess Mart, a 21-year-old hairdresser. “I’m single and I would have to rely on other people renting a room from me to pay the mortgage.”

http://money.cnn.com/2010/12/02/real_estate/home_buying_angst/index.htm

So help me, at 21 I was thinking about travelling the world barefoot if necessary, and loading up with a 30 yr mtg was the LAST thing I would do. What has happened to kids these days.

Regarding your High End Ponzi Borrowing paragraph, here’s the abstract from a Chicago Fed paper published a few days ago (my **)

“Complex mortgages became a popular borrowing instrument during the bullish housing

market of the early 2000s but vanished rapidly during the subsequent downturn.

These non-traditional loans (interest only, negative amortization, and teaser mortgages)

enable households to postpone loan repayment compared to traditional mortgages and

hence relax borrowing constraints. At the same time, they increase household leverage

and heighten dependence on mortgage refinancing to escape changes in contract terms.

**We document that complex mortgages were chosen by prime borrowers with high income

levels seeking to purchase expensive houses relative to their incomes.** Borrowers with

complex mortgages experience substantially higher ex post default rates than borrowers

with traditional mortgages with similar characteristics.”

The paper is ‘Complex Mortgages’ at

http://chicagofed.org/digital_assets/publications/working_papers/2010/wp2010_17.pdf

Even just looking at the figures is interesting, eg see the last gasp suckers being drawn in by 2005 (p48 of 57) & what happens next on the following graphs.

Actually, take a look at trend in the last decade. Places like Iowa only sipped the Kool Aid. People in the middle of the country are a little more likely to understand the “if something seems too good to be true…” logic that many on the coast we’re never taught. Unfortunately they have to help pay for the mess created by the greedy pigs of SoCal, Las Vegas, and Miami. Don’t use anecdotal evidence from a mediocre article to generalize about a state w/ the lowest percentage of defaulters in the nation.

I caught a similar story last night to todays’:

http://lansner.ocregister.com/2010/12/01/high-end-homesellers-cut-prices-sharply/90828/

It mentions one interesting thing: it points out the difference in how low end housing has already dropped significantly in pricing and high end pricing is only starting to decline in a similar way. Keep it coming please!

This makes sense. If prices above the board are falling, those in the bottom tier will probably fall the furthest as everybody who is a buyer moves up in quality, leaving few buyers at the lowest tiers. And we’ve seen that. Percentage-wise, condos are doing worse than houses in most areas, the IE did worse than the OC at large did, and the OC at large did worse than Irvine did.

I think the tax credit expiring might cause only a short term drop in pricing, at least in part. That is, imagine if a 1,200 people want to buy a house this year in a given city, 100 each month. Let’s say that 50 of those who wanted to buy in each of the last six months of the year rushed to buy earlier than they had planned to get the tax credit. Let’s also say that during the first six months 25 people a month who had no plans to buy bought due to the tax credit. So, sales were 175 for the first six months and 50 for the next six months. Obviously, prices would fall significantly.

But if demand was still stable at 100 a month, prices next year would rise (although not as much as when sales were 175 a month). That is, after the tax credit expired, prices would fall fast but eventually partially recover, as people who are buying eventually weren’t even thinking about buying when the tax credit existed.

That is, the tax credit pushed forward demand in the short term, and probably created some demand out of thin air, but that effect will eventually fade.

Now, a lot of this is determined by supply. If supply was consistant throughtout the process at a level above 100 houses a month, prices would continue to fall even after the tax credit effect’s fade (just at a slower pace). And prices would probably never climb back as high as when the tax credit was pumping up demand.

Considering:

Pending home sales UP

New Mortgage applications UP

This would suggest you are correct. It’s not typical for both of these forward looking numbers to be up going into December.

Wow, Irvine inventory is down at 750 to boot.

Looks like another million dollar home in Irvine that will cover the majority of the debtors spending. Bank bailouts are for Vegas losses.

The tax credit had little to do with pumping up demand in premium areas of Irvine.

With the high end, it was never even a factor.

Quite a few homes in $1M+ range that are moving.

If inventory drops, it will resulting in bidding wars and multiple offers etc..

That’s true, It’s so hard to get Irvine specific facts here, do you know a blog where I can find them?

http://www.talkirvine.com

Thank you, finally Irvine specific information once again.

Is this where the facts about Irvine down payments are now posted, remember the detailed transaction by transaction list with down payments over 20%? Also is this where I can find the facts about the new Irvine builing currently going on and the price increases in newly built houses? So much is missing here and not specific to Irvine.

Agree, just checked it out.

Thinking about joining and starting a thread on why FCBs don’t decorate their homes for Christmas?

Anxiously awaiting that thread.

I may join and start a thread about the proper age to buy your daughter a Mercedes and first condo. I was thinking 16 but would like to hear the arguments for 17.

That would be a great and relevant thread PR

Her financial portfolio is already professionally managed so the earlier, the better I say.

Let’s hope my user name: rich whitey doesn’t give me away.

Damn it, that was my first choice for user name.

Also looking forward to the 2038 collection for aspiring 1 year olds who already have the down payment money in trust funds.

Those are all excellent thread suggestions! Come on over…the weather’s great in Stepford! Or is it Pleasantville?

One of us…one of us…

@ten:

Do FCBs celebrate Christmas?

The proper car for a 16 year is a BMW. It’s important to give your children something to which they can aspire.

Bye. Don’t let the door hit you on the way out.

Awgee, it’s so nice of you to take some time off from posting with your intellectual equivalents over at the OCR. Now don’t forget your lunch box and apple for the teacher dear.

Seriously, 90% of your posts are whining and complaining about what is wrong with this blog, so why do keep reading and posting on a blog that you obviously do not like? Why don’t you find one that you do like? Or better yet, if you think that you know better, why don’t you start your own blog? I ask this not to be confrontational, but seriously.

Yes, this is truly the american way…”Don’t agree with me? Think I’m wrong? GTFO!!! or better yet, “We found evidence of weapons of mass destruction”

It is no wonder why we invade sovereign nations, overthrow democratically elected governments, start a WAR on our own population (War on Drugs), revoke the Contitution through the Patiot Act, and generally leverage hate and intimidation.

This is why I hold very little hope for a FREE america, but instead get rewarded with repugnantcans and defacrats that take freedoms away, and deny americans the God given right to life, liberty, and the pursuit of happiness.

I said nothing about disagreement, and your mischaracterization of my post is another baseless strawman argument.

PR whines, criticizes, and complains about the blog content. That is like repeatedly going to the same restaurant and complaining about the food each time. Is he there to eat or whine? (wine, get it?)

I didn’t mischaracterize your post, I posted my opinion. You are what you are. I like what you have to post for the most part Awgee, but I REALLY like what PR posts…it appeals to my nature.

If every person here starts agreeing and posting the same old intellectual vomit, I’ll find another place to entertain myself. Those groups worked well in high school, but I discovered that I didn’t need to hang around people who acted, felt, talked or even looked like me in order to justify my views, thoughts and opinions on life. (quite the opposite, I’ve found I have the most to learn from people who differ from me)

PR posts great stuff…awgee posts great stuff, but that doesn’t mean I’ll agree with both of you all the time, hell man, I change MY OWN opinion and views as experiences happen.

Enjoy the ride…I am 🙂

I love my haters, they keep me motivated to support the defenseless upper middle class, well to do, and of course the wealthy FCBs of Irvine.

In fact this year I’m not putting up christmas lights as a sign of solidarity to support my FCB breathren. Are they even in the country to notice, who knows? Perhaps, sight unseen they will, like the 2011 collection home they just bought.

Absolutely you mischaracterized it. You said I was suggesting he leave because he disagreed. I did nothing of the sort. I suggested he leave because he whines, complains, and criticizes the content on the blog. Do you not understand the difference between disagreeing and complaining?

Interesting that you posted defensively but did not answer my question.

If you re-read the thread there is only one person who needs a little cheese to go along with their whiny post and it’s not

me.

You hate the fact that people generally agree with me, and have the intellectual capacity to interpret the voice and position I am taking.

I call it like I see it. In regards to Irvine specific information this blog has become the Irvine Debtor of the Day Blog – expose some poor shmuck in financial ruin. Unfortunately there is a side to the story that is not being told here, god forbid someone try to share some realities of Irvine that the blogger is unwilling to discuss because they go against core beliefs.

Irvine Renter could probably write an amazing Las Vegas Housing blog that will be far superior to what this blog has evolved into.

I’m with awgee on this one. Differing points of view are great, and I see a wide variety in the comments. The first comment on this post started with “I disagree.” On the other hand, it is fairly obvious to everyone who reads the comments who is here to whine, complain, and talk up the market.

It’s a shame that those new to the country move to places like Irvine and locate next door to guys like you. It is a disservice to the country and it probably a bigger reason why neighbors don’t talk to each other in Irvine, than say, language barrier.

“Are they even in the country to notice, who knows?” One way to find out would be to ASK THEM.

I think it’s perspective. What awgee and IR see as whining and complaining… I see as a different point of view.

Considering that if everyone agrees, it will be boring here… I like the difference of opinions.

Since the majority of IR’s posts always end with the HELOC of the day, a little balance should be expected. I don’t know how many times I read comments where a poster thinks Irvine is the “epicenter” of loan/HELOC abuse just because they read it here daily.

Considering that if everyone agrees, it will be boring

Sounds like a thread over at TalkIrvine.

IR, I actually thought that you had become intellectually aware of the position but I was wrong. Instead you are busy with your new endeavor. I imagine you are feeling your long due reward.

PR whines, criticizes, and complains about the blog content.

It’s not just that he criticizes, it’s how he does it. You can tell he really gets his jollies off by being extra specially retarded. He is just playing games while many on here are trying to engage him seriously. That’s what makes it fun for him.

He knows that he will get fed here so he keeps coming back. I recall he took a break for a couple of weeks last year after IrvineRenter suggested he take a hike. However, he could not resist and ended up coming back as we all do.

PR is basically the new Kirk except that PR is for real.

AZDave witfully writes:

Oooooo… good one.

Yet another demonstration of your lack of knowledge and actual experience.

Ok, I get it. Why I did not see it, I don’t know, but thanks. He gets his jolly’s in the attention, no matter if it is negative or not. Point in fact, I think he said as much, “I love my haters”.

Kinda reminds me of a 6 year old boy with ADHD.

And so I actually received an answer to my question and I did not recognize it. “I love my haters”

Irvine home owner – Here is the difference as I see it, even if I am a bit near sighted.

I have a blog, the Coto Housing Blog, and there is a commenter who disagrees with me, … constantly … incessantly … frigging all the time. And it is a bit annoying, but he does not make it personal and much of the time he backs up his opinion with data or fact.

I invited him, Delroy, to be my partner on the blog.

And there was another commenter, Sighburdewd, who whined and complained about the content of the blog. He also disagreed, which is fine. But he is paying nothing and I had no idea why he thought I cared shineola about what he thought about my blog and the subjects I was posting about or whether it was balanced or whatever.

Do you see the difference? I do, but then again, I am a bit nearsighted.

@awgee:

No need to explain. Everyone is entitled to their opinion, viewpoints and perspective.

I understand that you don’t see any value in what PR is posting… but again… that’s your opinion. But that’s not everyone’s and in order to not disservice this blog or its followers, all should get to be heard.

I value everyone’s opinions, even AZDave’s (believe it or not)… although I may not agree with him on certain ones, there are others where he is quite astute.

If you remember, I took issue with PR when he started insulting AZDave about his income. So there are things that I don’t like… but it’s not up to me to say who or who should not post here.

Again… it’s perspective… I don’t think a majority of PR’s posts are whining or complaining… maybe contrarian… which I explained earlier is good for any blog/discussion/forum.

There’s quite a bit of difference between the Coto market and Irvine.

The plethora of new construction happening in Irvine along with an influx of FCBs come to mind.

PR has an excellent grasp of the Irvine market and it’s dynamics.

No one is willing to give him credit for that or even acknowledge his call on lower interest rates, which he nailed.

Actually, I did acknowledge his being correct on interest rates, more than once. But his grasp of the Irvine market and it’s dynamics is anything but excellent.

Interest rates are about the only thing PR has been correct on, akin to a broken watch.

No one is willing to give him credit for that or even acknowledge his call on lower interest rates, which he nailed.

He gets no credit because the broken clock is correct twice a day.

All of his predictions are generic – like a psychic doing a cold read on someone where they say “I see the letter T” and the mark starts jumping and going wild “Oh it must be T for Thelma! My Aunt Thelma!” and the psychic responds “Yes! I can see Thelma now!”

PR does the same thing. He casts wide statements and then later claims to have foreseen everything.

AZDP – there was a pretty strong argument against interest rates rising, even when the fed stopped buying MBS’s. We were looking for a loan around then and the banker pushed that we needed to lock in because rates were sure to rise after the fed stopped buying. I figured on the spread between treas & GSE-MBS to rise a little, but Treas rates to fall (money still had to go to some ‘no-risk’ asset).

What I’ve said is that mortgage rates will go up when general rates go up. That will happen either due to inflation or the economy improving to the point the fed feels safe raising rates. Both of those things exert positive pressure on prices which will, to some degree, offset the increased interest rates putting downward pressure on prices.

How a message is delivered also factors into how people respond to it.

That’s certainly true, but I was referring to the talk about the credit in the original post. Very few properties in Irvine qualified for the tax credit. Mentioning it at all is talking about areas other than Irvine.

Whew, a whirlwind of comments on seemingly nothing…

Anyways in response to the initial assumption here, I think you are merely leading the readers to a positive outcome here rather than looking at this more objectively. You had initially indicated the the aggregate demand was 1,200, but somehow with the tax credit scenario that number swelled to 1,350… suggesting that the incentive caused a swell in demand with no recourse to the other side on the back end. I think if you want to assume that the demand increased by 25/mo initially because of the tax credit due to people who buy that otherwise would not have, then you must equally assume that the demand will decrease by the same amount because once the incentive ends, there will be those that will no longer buy that were initially in the market. If you trend the stats in a biased direction, of course you’ll get a more positive impact. For your scenario to be objective and in the end valid, you need to maintain the 1,200 demand assumption.

So then with you assumption that the demand will increase to 175 because of the incentive, you assume the demand will decrease to 25 for the next six months, ending up with the same aggregate of 1,200. That’s a BIG drop and a killer on prices. And if you combine the same depressed demand for 6 months, I’m guessing the price drop will continue and you may drop to the initial level that it SHOULD have dropped to in first place.

Now, I’m actually in agreement with Winstongator in his top post that the tax credits did help in preventing what could have been a disaster, despite that I disagree with the principle of a government intervention in such matters. So to a lesser degree than you, Geotpf, I do think the prop will in the end help temper the price decline.

Yes, as you say, stability of supply is key here. But if foreclosures are actually processed that knocks the bottom out of this system.

The mortgage interest deduction is being discussed daily on CNBC. I know the talking heads need topics, and the Debt Commission’s report is out now, but there appears to be a general willingness to at least debate the issue. Is it no longer a sacred cow?

I support ending it, but I think in all fairness it should be phased-out over a number of years. Some people made decisions to purchase/finance homes by running the numbers and calculating the tax “benefit” of owning.

TurboTax is a wonderful tool. You can run alternative scenarios to see how your taxes are affected. e.g. For the 2009 tax year, we would have paid over $20k more in income tax (IRS+FTB) if the mortgage interest were not deductible.

I think we should modify the mortgage deduction. Only allow it on primary residences, and interest up to a stated amount based on NATIONAL home price index. Why should the rest of the country subsidize places like The OC.

stated amount based on NATIONAL home price index

Agree with this 100% No reason whatsoever for the other 49 states to help the citizens of California overpay for their houses. If the weather is really so wonderful then let people pay the premium with their own money.

We’ve been taught that buyers and sellers determine markets … they do, but only part of it … Most asset prices are only worth what a bank is willing to loan a third party to pay.

Has anybody noticed what’s going on with commodities — especially groceries? Inflation comes in two parts: 1) Too many dollars, AND 2) the anticipation of sellers facing future price increases. JMHO ~ In the case of housing, we still have deflation because the banks are deleveraging and not loaning money due to fear and insolvency. In the case of commodities, we have the anticipation of higher cost (BUT NO PROOF) Bubble? Despite all the Feds attempts to print money, we still don’t have enough dollars to support current asset prices. As they throw more money at the problem, they lose more credibility.

One thing is certain, and this is probably pissing the FOMC off more than anything, employees have NO Leverage with wages. If anything, they’ll take a pay decrease or a demotion or accept less benefits. We have no cost push inflation people, and we have double digit real unemployment. This applies much more pressure on real estate in places like The OC, where our home prices are almost 3 times the national average, but our incomes are at a lower multiple that the national income average.

Okay, off my soap box now.

It’s good to see you stop by and get on the soap box again.

It is hard to even consider asking/demanding higher pay when you know: a) so many people who were out-of-work for such long periods, and b) so many people at your office have been laid-off. I haven’t received a raise since Jan 2008 (although I’ve been fortunate not to receive a decrease in pay).

Most asset prices are only worth what a bank is willing to loan a third party to pay

Exactly. As we see with houses, the price of the house does not even really matter. The main thing buyers are thinking about is the monthly payment on a 30 year mortgage. The house could cost a trillion dollars – the douches do not care as long as they can pay it in 1500.00 increments.

This is why I am dumbfounded that the masters of the universe did not fix the house problem price problem by replacing 30 year loans with 40 year loans.

The sheeple would have been lining up.

I just threw up in my mouth.

I’m looking for a property in a non-quiet cul de sac. In addition, I would prefer that it not be nestled. Am I too much of a niche buyer? Is this like trying to find a non-balsamic vinaigrette, or a bottle of high-fat milk?

@Hydro:

You’re in luck… there are tons more non-quiet non-nestled non-cul-de-sacs… TONS!

And you can make vinaigrette from almost anything.

High-fat milk = regular milk.

No need for regurgitation.

WOW!

“This is why I am dumbfounded that the masters of the universe did not fix the house problem price problem by replacing 30 year loans with 40 year loans.”

They have. And more.

Go read the forums at Loansafe.org where people talk about their WONDERFUL loan modifications.

There are a TON of 40 year mortgages, balloon payments etc.

The sheeple were initially given enough rope to hang themselves with their neg-AM loans. Now their masters are letting them breath…barely.

You write: “I doubt the upcoming price declines will approach the depth of the previous drop, but it interesting that the decline is picking up speed and it now rivals the rate of decline from three years ago.”

I reply: Yes it is significant that the decline is picking up speed.

And why, just why do you believe that believe there are limits to the depth of drop?

I perceive of things globally.

On November 4, 2010, traders reacted to the Fed announcement of QE 2 of money printing operations, and Mrs Merkel’s call for a sovereign debt default mechanism, by calling the Interest rate on the US 30 Year US Government Note, $TYX, higher, and selling World Corporate Bonds, BWX, and International Corporate Bonds, PICB.

Since November 5, 2010, a global debt deflationary bear market has been underway. Accumulated currency losses inflicted by the currency traders are as follows: Euro, FXE, 5.7%, New Zealand Dollar, BNZ, 5.4%, Swedish Krona, FXS, 4.3%, Australian Dollar, FXA, 3.9%, British Pound Sterling, FXB, 3.7%, Russian Ruble, XRU, 3.6%, Swiss Franc, FXF, 3.0%.

Debt deflation is the contraction and crisis that follows credit expansion. One of the most famous quotations of Austrian economist Ludwig von Mises is from page 572 of Human Action: “There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of a voluntary abandonment of further credit expansion or later as a final and total catastrophe of the currency involved.”

Today’s rise in stocks was simply a rally in a debt deflationary bear market, that is a currency deflationary bear market. Stocks will be going down again. The most deflationary of all bear market ETF, Direxion Daily Emerging Markets Bear 3X Shares, EDZ, has turned up November 4, 2010, as is seen in this Stockcharts.com chart of EDZ. The bear, not the bull, is in charge of the markets. The bear is termed a “global currency war” by the currency traders, as they have introduced competitive currency deflation, that is competitive currency deflation, on rising interest rates globally.

I believe that out of soon coming financial market place crash, a Sovereign, a leader like Herman van Rompuy, as well as a Seignior, an old English word meaning top dog banker who takes a cut, a minister such Olli Rehn, or Jean-Claude Trichet, will arise to establish strong economic governance to deal with sovereign crisis, both in Europe as well as worldwide, as the currency traders sell off the major currencies, DBV, as well as the emerging market currencies, CEW in a global currency war against the world central bankers. The Seignior will establish fiscal sovereignty, unified banking of globally, a common Eurozone Treasury, both credit and fiscal seigniorage, and enforce austerity resulting in internal devaluation.

When the financial market crashes, and that is imminent, there will be practically no, repeat no bottom in real estate prices.

Finding any renters for those houses in Vegas IR? Enquiring minds want to know.

Please don’t feed the troll(s). All it gets you are comment threads like today’s.

Thanks in advance,

-Darth

Tampa homes are in the same boat as CA… although I think you guys have it worse… at least as long as we don’t get any more hurricanes 🙂

Property History for 8 INDIGO

Date Event Price Appreciation Source

Aug 16, 2010 Listed $1,049,000 — CARETS #S629131

Mar 21, 2003 Sold (Public Records) $1,550,500 31.9%/yr Public Records

Apr 29, 1999 Sold (Public Records) $528,000 — Public Records

From 1999 to 2003 the house when up from $528K to 1,55 million — 284% ! Did the medium income in that neighorhood go up even 50% ?