The battle lines in the fight to create a stable housing market is being waged over minimum down payment requirements on qualified residential mortgages.

Irvine Home Address … 2306 SCHOLARSHIP Irvine, CA 92612

Resale Home Price …… $254,900

Oh but ain't that America for you and me

Ain't that America somethin' to see baby

Ain't that America home of the free

Little pink houses for you and me

John Mellencamp — Pink Houses

America was a frontier country. People flocked to America from Europe for the opportunity to own their land, something denied to most living in post-feudal Europe. The idea of having a piece of property with your own pink house is deeply woven into the American culture. it's part of our history, and to this day, many identify home ownership with being American.

I wrote about our modern perversion of ownership in Money Rentership: Housing and the New American Dream. Questions of our concepts of financing and ownership are coming to surface in Washington as we take up debate on down payment requirements for the new qualified residential mortgage.

Homeownership should not be part of the American Dream

Posted by Nin-Hai Tseng, writer-reporter

March 15, 2011 8:30 am

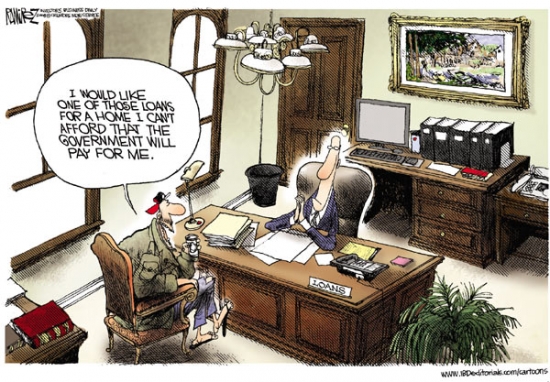

Most banks want to securitize loans made to borrowers buying homes with little money down. Did we learn nothing from the financial crisis?

Lenders did learn from the financial crisis. They learned they can underwrite unconscionable loans to make a quick buck at origination, and when the loans go bad, the government will cover their losses. Why would lenders want to change that system? Keep that in mind as you watch the lending lobby posture in Washington to game the rules in their favor.

In an attempt to fix some of the problems that caused the housing bubble and financial crisis, banking regulators are coming up with new mortgage lending rules that will address what lower-risk quality mortgages should look like. The goal is to let lenders sell so-called “qualified residential mortgages” to investors without having to retain the risks.

The question the Treasury Department must now answer is what makes a qualified mortgage? Regulators including the Federal Deposit Insurance Corporation and the Office of the Comptroller of the Currency are pushing for a 20% down payment on such loans. While the big banks like Bank of America (BAC) and JP Morgan Chase (JPM) have not formally weighed in, their lobbyists at American Bankers Association and the Mortgage Bankers Association say that requirement is far too high and would price many buyers out of the housing market.

The most pernicious lie in real estate lending is that restricting access to loans prices buyers out of the market. The hidden assumption is that bids must always be raised because prices never go down. If the government chose to enact the most Draconian standards possible, it may reduce sales volumes at current pricing, but it does not price buyers out of the market — it prices sellers out of the market. As credit tightens, asking prices need to go down for transactions to occur.

Lenders want to make the largest loan possible at the highest interest rate they can. That is their business model. Of course, they would also like the borrower to repay that money, so pushing loan balances up too high leads to Ponzi borrowing, widespread insolvency, and a catastrophic market crash as we have witnessed. However, lenders don't care about the risks as long as Uncle Sam backstops them. They will push for the ability to make the largest loans they can and pass the risk off to whoever they can.

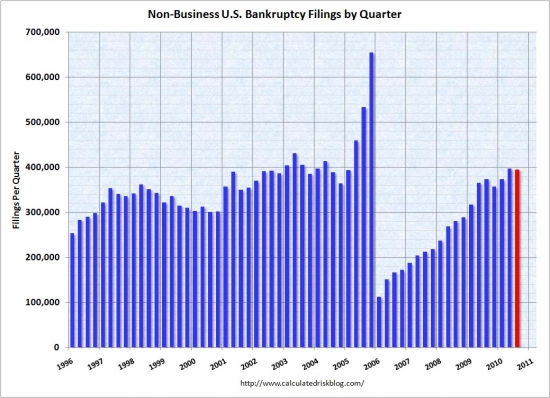

The debate will have broad implications for how homebuyers finance their mortgages. During the housing boom, many Americans took out home loans with little to no money down. When prices fell steeply following their mid-2006 peak, many borrowers didn't have enough equity to cushion the blow, leading to record foreclosures nationwide. Meanwhile, the big banks and investors holding these risky loans suffered huge losses.

We have witnessed many tempest-in-a-teapot issues like robo-signer that flare up and go away without long-term impact on the housing market. This issue is different. The minimum qualifying standard on this loan is going to become the bedrock of mortgage finance. If we get this wrong, we will rebuild the mortgage market on a weak foundation.

Joseph Pigg, vice president and senior council of the ABA, says the 20% proposal is much too narrow and he worries it could further hamper demand for homes, especially when the fragile real estate market is still recovering. And while a heftier down payment generally reduces the risks of a loan, he says, other factors such as income, credit score, and the property's location determine the quality of a loan.

Yes, there are other factors besides the down payment that impact loan quality. There are undoubtedly many buyers who put less than 20% down that will not default on their loan. So what? We are talking about establishing a minimum threshold for all loans. It should be a conservative measure with little or no real risk exposure. Lowing down payment requirements for this loan shifts risk from lenders to the US taxpayer who will end up paying the bills if we create another unstable Ponzi scheme.

But perhaps it's time to question whether homeownership should even be part of the American Dream.

Tighter mortgage lending rules could return the housing market to the way it was in the 1970s, when homeownership was much lower and virtually all homebuyers put down at least 20% of the value of the house. Standards began changing around the 1980s as home prices appreciated significantly and mortgage financing became more sophisticated.

Sophisticated?

Financing has become more sophisticated… sophisticated at creating new Ponzi schemes.

Finance professionals view lower lending standards as progress and tightening lending standards as regression. For an industry of parasites trying to siphon the cashflow from all the world's assets, that paradigm makes sense. In reality, their progress generally amounts to some new Ponzi scheme. I wrote in The Fallacy of Financial Innovation,

“Many in the lending industry think their work is like science that continually advances. It is not. It is far more akin to assembly line work where the same widgets are pumped out year after year. When lenders start to innovate, trouble is brewing. The last significant advancement in lending was the widespread use of 30-year amortizing loans that came into favor after World War II. Prior to that time, home loans were interest-only, short-term loans with very high equity requirements (50% was most common.) This proved problematic in the Great Depression as many out-of-work owners defaulted on their loans. A mechanism had to be found to get new buyers into the markets and allow them to pay off the loan. The answer was the 30-year, fixed-rate amortizing loan. To say this was an innovation is a stretch as this loan has been around as long as banking has existed, but it did not become widely used until equity requirements were lowered. The lenders were willing to lower the equity requirements as long as the loan was amortizing because their risk would decline as time went by and the loan balance was paid off.”

Lenders used to originate loans with an assumption of flat pricing. The reasoning was that they didn't know if that borrower may not be compelled to sell within months of purchase. They wanted to be sure they could discount the sales price, pay a sales commission, and still recover their capital. That meant at least a 10% cushion from day one. Twenty percent was better.

During the housing bubble, the originators of the Option ARM made the assumption that house prices would go up 3% per year every year because past history confirms that house prices rise with inflation. As a lender, if you believed the value of your collateral was rising 3% per year, you could originate with low down payments, increasing mortgage balances, and the whole host of problems the Option ARM created because even when the loans go bad, the loss severities would be low due to the increasing value of the collateral. Hah. That didn't go as planned.

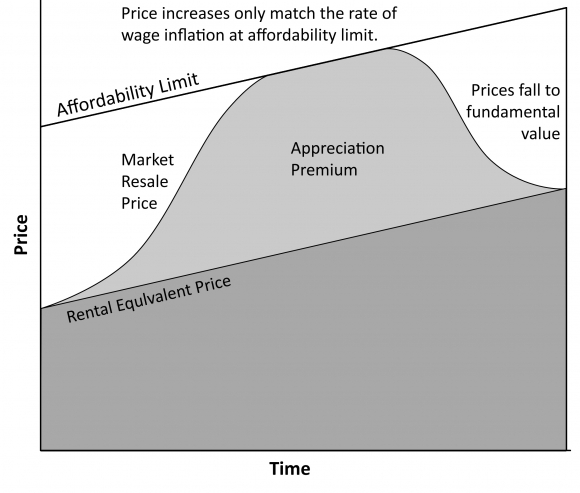

Borrowing against the increasing value of an asset destabilizes the price of that asset. Once aggregate debt levels get too high, a financial disruption can cause prices to crash which in turn spawns wave after wave of strategic default which drives house prices well below fundamental values. The upward frenzy of rally buying is closely mirrored by the downward spiral of default, foreclosure, excess supply and lower prices which causes more default.

It's easy to see why bankers would gripe about the 20% minimum. Smaller loans translate into smaller profits, and a smaller market for securitized mortgages. And lenders can fully securitize only qualified mortgages — any loans made without the designated down payment can still be sold, but the lenders would have to retain 5% of their value on their books.

Wells Fargo (WFC) is the one exception among the banks on this rule — it's arguing for a 30% down payment for qualified mortgages. Wells executives call it skin in the game, but smaller lenders are calling it an unfair competitive advantage — as one of the largest lenders, Wells would be able to tolerate more risk on its balance sheet from the many borrowers who won't be able to afford such a down payment.

That is fantastic. With internal division on policy, it will be much harder for the lending lobby to push a 10% down mortgage.

Certainly a 20% down payment — much less a 30% one — isn't easy for many homebuyers, especially as unemployment stays unnervingly high. The average loan-to-value ratio for January 2011 was 73%, which means borrowers on average put 27% down, according to the Mortgage Bankers Association.

The Irvine bulls always tout the high down payments of Irvine buyers as a sign of special interest by FCBs. Apparently, averaging more than 20% down is normal for real estate markets. Considering almost of third of homeowners own outright, it isn't surprising some amount of ported equity moves from property to property keeping down payments up. Perhaps Irvine is not that special after all?

But while home sales have started to tick up slightly, demand is mostly coming from cash-rich investors who are scooping up foreclosed properties at bargain prices, not from first-time buyers. Economist Paul Dales of Capital Economics recently pointed out that more than two-thirds of existing home sales since last summer were made to cash buyers or investors, while a mere 6% were sold to first-time homebuyers.

Maybe the answer isn't to give borrowers more leeway, but less. Given all we've learned in the years following the housing crash, perhaps a little time travel back to the 1970s might not be so bad. During the boom years, many lenders passed on their mortgages, including all of the risk, to speculative investors. That proved disastrous, leading to a banking crisis and a housing bubble that all too quickly went bust.

It will be painful to endure a longer, deeper housing crisis that could come from tighter standards. But do we want to relive the nightmare that got us here?

I wholeheartedly agree with the author's contentions. Returning to sane lending standards is not regression, it is progress from where we are today. Lending lost its way. The billions in losses prove that. We need to retreat to what works. Some may chose to view that as going back to the stone ages. I prefer to view it as a return to fiscal sanity and a stable housing market.

Nearly $500,000 for a one bedroom apartment condo?

The Jamboree Corridor condos were 20 years before their time, just like the prices of 2006 in general. These condos don't make sense. They never did. Even after a 50% decline in prices and below 5% interest rates, these properties still don't make sense. The prices on these properties are only now reaching rental parity — and these properties should trade at a discount to rental partiy because it is not a place people want to live long term. This is a great 20-something apartment, but it makes for a less desirable family home.

My data service doesn't pick up this particular address, but the details of who lost what isn't important. The lender didn't likely require a big downpayment, so the first mortgage is taking a big hit.

The assymetric nature of drawdown

People who study financial markets and portfolio returns note an interesting phenomenon regarding returns on financial investments: losses are more devastating to returns than slow gains. This property has declined nearly 50% in value since it was purchased in 2006. So when the property goes back up 50% in value, will it be back up to the peak?

Nope. A 50% decline requires a 100% increase to offset it. By the time peak buyers see values reach their entry points, buyers from today will have accumulated $250,000 in equity. Timing does matter.

The frenzied rally of the Great Housing Bubble saw double-digit appreciation for several consecutive years. Depending on the market, most of all of that gain was wiped out in two-years of double-digit declines in 2007 and 2008.

The savvy buyer who picked up this great investment undoubtedly expected double-digit appreciation from his starting point. This should be reselling for a $1,000,000 by now. instead it's REO hoping for a quarter of that.

Irvine Home Address … 2306 SCHOLARSHIP Irvine, CA 92612 ![]()

Resale Home Price … $254,900

Home Purchase Price … $478,500

Home Purchase Date …. 6/12/06

Net Gain (Loss) ………. $(238,894)

Percent Change ………. -49.9%

Annual Appreciation … -13.0%

Cost of Ownership

————————————————-

$254,900 ………. Asking Price

$8,922 ………. 3.5% Down FHA Financing

4.82% …………… Mortgage Interest Rate

$245,979 ………. 30-Year Mortgage

$51,703 ………. Income Requirement

$1,294 ………. Monthly Mortgage Payment

$221 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$42 ………. Homeowners Insurance

$310 ………. Homeowners Association Fees

============================================

$1,867 ………. Monthly Cash Outlays

-$121 ………. Tax Savings (% of Interest and Property Tax)

-$306 ………. Equity Hidden in Payment

$16 ………. Lost Income to Down Payment (net of taxes)

$42 ………. Maintenance and Replacement Reserves

============================================

$1,499 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,549 ………. Furnishing and Move In @1%

$2,549 ………. Closing Costs @1%

$2,460 ………… Interest Points @1% of Loan

$8,922 ………. Down Payment

============================================

$16,479 ………. Total Cash Costs

$22,900 ………… Emergency Cash Reserves

============================================

$39,379 ………. Total Savings Needed

Property Details for 2306 SCHOLARSHIP Irvine, CA 92612

——————————————————————————

Beds: 1

Baths: 1

Sq. Ft.: 0738

$345/SF

Lot Size: –

Property Type: Residential, Single Family

Style: One Level, Modern

Year Built: 2006

Community: Airport Area

County: Orange

MLS#: P774302

Source: SoCalMLS

Status: Active

On Redfin: 2 days

——————————————————————————

REO Bank Owned – New complex near John Wayne Air Port between Irvine and Newport Beach. Excellent amenities include tennis courts, pool, spa, BBQ area, basketball court A rare opportunity Make you best offer.

.jpg)

We developed the IHB calculator because most of the online calculators are intentionally misleading. Most rent-versus-buy calculators were not designed to give people accurate information. Most of these calculators were designed by realtors with the intention to present buying in a favorable light no matter the truth. It part of the ongoing campaign by realtors to dupe buyers into action — even if buying is harmful to the buyer — to generate sales commissions.

We developed the IHB calculator because most of the online calculators are intentionally misleading. Most rent-versus-buy calculators were not designed to give people accurate information. Most of these calculators were designed by realtors with the intention to present buying in a favorable light no matter the truth. It part of the ongoing campaign by realtors to dupe buyers into action — even if buying is harmful to the buyer — to generate sales commissions.

.jpg)

.jpg)

.jpg)