With house prices falling, particularly at the high end, many of the wealthy are choosing to rent and wait out the storm.

Irvine Home Address … 52 FANLIGHT Irvine, CA 92620

Resale Home Price …… $1,190,000

I am, I'm too fabulous

I'm so, fierce that it's so nuts

I live, to be model thin

Dress me, I'm your mannequin

Fashion put it all on me

Don't you want to see these clothes on me

Fashion put it all on me

I am anyone you want me to be

Lady Gaga — Fashion

Renting is the latest fad. The rich are dumping their high end real estate and renting instead. Without house price appreciation, even the rich don't like to waste their money owning real estate. Prices at the high end are falling, and with large inventories both visible and shadow, prices will continue to fall.

Orange County asking prices by price range

Leasing is in fashion among wealthy house hunters

Niche data and anecdotal evidence point to a surge in high-end rentals. Instability in housing prices is one reason the rich are shying away from purchases.

Real estate agents have been hustling lately but not necessarily to sell homes. Instead, leasing is in vogue, particularly at the top of the price spectrum.

If phone inquiries are an indication, interest in leasing luxury homes is intense, said Justin Mandile, an agent in the Sotheby's International Realty office in Beverly Hills.

He and partner Mary Swanson received 10 to 15 calls a day for two months on a five-bedroom house in the Sunset Strip area priced at $3.5 million for sale or $10,000 a month to rent. After initially holding out for a sale, the owner recently accepted a short-term lease.

“Surprisingly, there are that many people looking for a $10,000 lease,” Mandile said.

The cost of ownership with a big loan would be about $20,000 a month. Not exactly a great cashflow deal, but some properties truly are special enough to command huge ownership premiums — not single-family detached homes in suburbia (see: Irvine). Unfortunately for this seller, there are too many special properties and not enough buyers who think they are that special.

No single clearinghouse tracks such data for all of Southern California, and many top-dollar leases are handled privately, away from the prying eyes of the public. Still, niche data and anecdotal evidence point to an upswing in upscale rentals.

Lease offerings priced at more than $10,000 a month were up 15% through the first part of April over the same period last year on the Combined L.A./Westside Multiple Listing Service, while those in the $7,500-to-$10,000 price range saw a 7% increase. OCHouseRentals.com, which specializes in luxury leases, reports that business has been brisk in Orange County as well.

“We're seeing increased leasing across the board — both luxury and non-luxury properties,” said Cary Hoffman, manager of Rodeo Realty's Encino office, which has more than 70 agents and listings from the Westside to the south San Fernando Valley.

Are people wising up to the renter's subsidy? When real estate prices aren't rising, it's much cheaper to rent high-end real estate than it is to own it. Wise rich people will chose to rent and let someone else be an owner who is subsidising their housing, particularly when prices are falling.

Are people wising up to the renter's subsidy? When real estate prices aren't rising, it's much cheaper to rent high-end real estate than it is to own it. Wise rich people will chose to rent and let someone else be an owner who is subsidising their housing, particularly when prices are falling.

For instance, let's say you own a million dollar home like today's featured property where the cost of ownership is nearly $7,000 per month. This house, or one similar to it, could be rented for $4,500. If the price of the $1,000,000 property does not change, the renter saved $30,000 just in cost of living. If the value of the house also declines — as is happening at the high end — then the owner loses two ways. When you also take into account the fact that the renter got beneficial use of the property while the owner made huge payments and lost equity. I'd rather be the renter — at least until the market turns.

Underlying the activity in leasing is consumer uncertainty about the direction of housing, said Paul Habibi, a UCLA lecturer on real estate, investment and development.

“People want to wait to buy when they are sure there is a floor underneath the housing market,” Habibi said. “When government intervention pulls back, then we will see where the housing market really is.”

We are seeing where the housing market really is. Sales are weak and prices are down. The market is falling again because a natural bottom was not allowed to form the first time. We delayed the bottom two years, perhaps raised the bottom 15% to 20% locally, but we prolonged our agony to adjust to the reality of the housing crash.

We are seeing where the housing market really is. Sales are weak and prices are down. The market is falling again because a natural bottom was not allowed to form the first time. We delayed the bottom two years, perhaps raised the bottom 15% to 20% locally, but we prolonged our agony to adjust to the reality of the housing crash.

Beyond the usual remodelers and divorcees, those seeking leases include people who can no longer qualify for mortgages.

“The high end got hit last with the wave of foreclosures” and short sales, said Hoffman, who has been an agent for 29 years. “People coming out of those homes have to have a place to go.”

They may want to stay in the same school districts or close to familiar shops and businesses. For others, it's a matter of keeping up appearances.

“Some people who are losing $3-million homes are very happy, happy to lease for $10,000 a month because they want to still look like they are making it,” said broker Anita Rich, who oversees the Rich Group Keller Williams in Encino. “It's really important they still have an address that goes along with the lifestyle.”

Interesting that posers turn to renting when the housing ATM gets shut off. Perhaps that's a renter's buy signal? Be a poser contrarian.

Leasing still represents a relatively small segment of the market compared with sales, but it's not uncommon to see homes listed both for sale or lease these days, creating a safety net for the homeowner if the house doesn't sell right away.

Rich recently completed three leases for $8,000 a month and up. One was a Hollywood Hills three-bedroom listed for sale at $1.7 million or for lease at $12,000.

“They got a lease offer before an offer on a sale,” said Rich, who has 30 years of real estate experience.

Adding to the supply of lease houses are absentee owners and investors who haven't been able to sell and decide to take their for-sale homes off the market, put them up for lease and “sit out for six months or a year” or more, Rich said. “They don't want the perception that the property is getting stale or old.”

Other houses for lease are owned by people who purchased at the height of the market. The owners are keeping their homes and renting them out to cut costs.

Floplords are everywhere. The failed plan B of any speculator is to rent the property out. Only when they try this do they realize the ramifications of negative cashflow. If held long enough, the property may go up in value, but it may never recover the accumulate negative cashflow while the floplord waited for prices to go up.

“I know of several cases where people moved into other arrangements that cost them less,” UCLA's Habibi said.

Downsizing is the reason that restaurant owner Benny Borsakian gives for leasing out his primary residence.

He recently signed up a two-year tenant for his 4,400-square-foot home in Encino with the help of Rodeo Realty agent Carol Wolfe, who also represented the renter. His family grown, Borsakian no longer needs a house of that size.

“It's just me, my wife and a housekeeper,” he said.

Borsakian, whose house is nearly paid off, plans to re-evaluate the situation when the lease is up.

Although she doesn't agree with the thinking, Wolfe is seeing more potential sellers choose to be landlords rather than sell now. “They are going to hold on to the property longer and sell when the market is better,” she said.

Everyone's playing the housing market. It's a big casino where timing your position to flip from renter to owner and visa versa has a major impact on your financial well being.

It's a sentiment also being expressed on the part of tenants unsure that the housing market has hit bottom. Luc Vanhal, who is renting Borsakian's home, looked at four or five other places before settling on the Encino house.

The first-time leaser needed a place close to his children's schools but didn't want to buy another house. “Why make a huge commitment to something that's clearly not worth it right now?” said Vanhal, president of a direct marketing company.

In Orange County, Jay Gordon of OCHouseRentals.com recently leased out a house on Newport Beach's Lido Isle, where homes can cost from $3 million to $25 million, for $9,500 a month. “You'd spend twice that to live in the same exact area” if you bought, said Gordon, chief executive of the Laguna Beach company.

“Renters are not worrying about losing money,” he said. “Leasing takes the guesswork out of where the market is going.”

Was it all a dream?

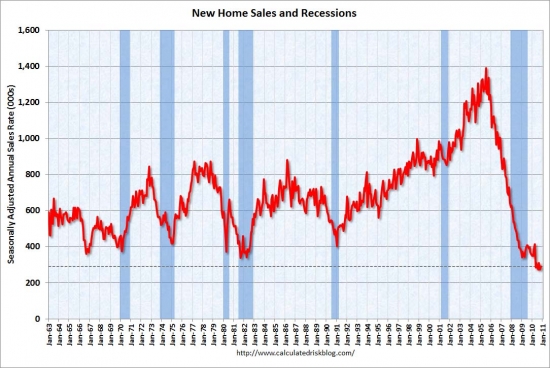

What if prices grind lower for a decade or more here like they did in Japan?

Californians have come to believe their real estate market is truly magic. Prices go up at rates that far exceed inflation or wage growth enriching every home owner. If you own a house you have the potential for unlimited wealth and HELOC buying power for doing absolutely nothing. It is free money from the housing market gods.

.png)

Like a child outgrows magical thinking in their pre-teens, will Californians let go of their fantasies about real estate? Would a slow grinding decline squeeze the kool aid out of the California dream? The generation burned by the California housing market may continue to shun real estate just as a generation after the stock market crash of the 1930s stayed away from the stock market.

If the house doesn't provide the HELOC money to support an upscale suburban lifestyle, what's the point in the high price and huge payment?

If interest rates go up, HELOC money goes from being free to being very expensive. Falling interest rates to permit larger debts to be serviced with the same payment. Rising interest rates cause larger payments on the same debt.

Those people who come of of this recession with large debts need to hope the upcoming monetary inflation translates to higher wages. For those in the right industries, rising wages will enable them to at least tread water with their old debts. Those who are in stagnant industries, like real estate, may not see rising wages, and the upcoming inflation may make their debt service payments untenable, and many may be pushed into bankruptcy.

Was it all a dream? Will Californians realize their delusions about housing were all wrong? Or will the gold rush mentality of California's past stay alive and prompt a new generation to chase free money in the housing market? The market is always right, no matter how irrational it is.

A multi-generational house in Irvine

This property a semi-private room or casita for long-term guest stay or running a home business. There aren't many houses like this in Irvine, which is probably a good thing: I see the lure of staying home in Irvine. Many would probably never leave.

Peak buyers iin Woodbury are taking big losses to get out. The owners of today's featured property borrowed nearly the current asking price. After nearly 5 years of ownership, if they sell the property, they lose all their equity, and if they don't have other resources, it may become a short sale.

That's got to hurt.

Irvine House Address … 52 FANLIGHT Irvine, CA 92620 ![]()

Resale House Price …… $1,190,000

House Purchase Price … $1,476,500

House Purchase Date …. 11/17/2006

Net Gain (Loss) ………. ($357,900)

Percent Change ………. -24.2%

Annual Appreciation … -4.9%

Cost of House Ownership

————————————————-

$1,190,000 ………. Asking Price

$238,000 ………. 20% Down Conventional

4.87% …………… Mortgage Interest Rate

$952,000 ………. 30-Year Mortgage

$215,793 ………. Income Requirement

$5,035 ………. Monthly Mortgage Payment

$1031 ………. Property Tax (@1.04%)

$450 ………. Special Taxes and Levies (Mello Roos)

$248 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$105 ………. Homeowners Association Fees

============================================

$6,869 ………. Monthly Cash Outlays

-$1371 ………. Tax Savings (% of Interest and Property Tax)

-$1172 ………. Equity Hidden in Payment (Amortization)

$446 ………. Lost Income to Down Payment (net of taxes)

$169 ………. Maintenance and Replacement Reserves

============================================

$4,942 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$11,900 ………. Furnishing and Move In @1%

$11,900 ………. Closing Costs @1%

$9,520 ………… Interest Points @1% of Loan

$238,000 ………. Down Payment

============================================

$271,320 ………. Total Cash Costs

$75,700 ………… Emergency Cash Reserves

============================================

$347,020 ………. Total Savings Needed

Property Details for 52 FANLIGHT Irvine, CA 92620

——————————————————————————

Beds: 6

Baths: 6

Sq. Ft.: 3649

$326/SF

Property Type: Residential, Single Family

Style: Two Level, Contemporary

Year Built: 2006

Community: 0

County: Orange

MLS#: S648953

Source: SoCalMLS

Status: Active

On Redfin: 52 days

——————————————————————————

Fabulous Mille Fleur plan 3, majestically sitting on a Cul-de-sac, this beauty offers 6 bedrooms and 6 1/2 bathrooms. main house has 5 bedrooms, each bedroom with their own bath and independent Casita with its own bath, ideal for in-laws, Teenagers, .. .Professionally designed landscaped and hardscaped, gorgeous brick steps with light collumns invites you in, Beautiful back yard with built-in BBQ and Bar. Rediscover passion in cooking in this grand gourmet kitchen with kitchen Island, granite counter tops and stone back splash and SS appliances. Just walking distances to Woodbury elementary school and Woodbury Town Center and to the Common. This is a must see.

Did the lender really obtain a greater recovery at short sale? If they had foreclosed in a timely manner months ago when the borrower first went delinquent, prices were higher, and the recovery would have been greater. Plus, the real estate commissions and other sales costs not paid at auction eat into recovery amounts. Further when you factor in the portfolio cost of lowering neighborhood values, and short sales aren't the magic elixir they are made out to be.

Did the lender really obtain a greater recovery at short sale? If they had foreclosed in a timely manner months ago when the borrower first went delinquent, prices were higher, and the recovery would have been greater. Plus, the real estate commissions and other sales costs not paid at auction eat into recovery amounts. Further when you factor in the portfolio cost of lowering neighborhood values, and short sales aren't the magic elixir they are made out to be.

.png)