The California Association of realtors has cherry-picked a few positive stories about working with realtors and assembled them in a new advertising campaign.

Irvine Home Address … 2 RHODE Is Irvine, CA 92606

Resale Home Price …… $836,900

You know I look into the mirror see myself and then

I always often say… “Hot damn I'm great”

Poor Righteous Teachers — Hot Damn I'm Great

Anyone who has ever done any self promotion knows how difficult it can be. The little voices of doubt inside work to keep you down. “You're not that good.” “You don't know what you're doing.” “You can't succeed.” When those voices become a paralyzing distraction, you need to go look in the mirror and say, “Hot damn, I'm great.”

California realtors have launched a new promotional campaign. To judge by the videos they produce, you would think they are great. And some are, but many are not. I always enjoy a little parody to remind us of the dark side.

Calif. Realtors Launch Testimonial Campaign

by Tanya Irwin, Thursday, August 25, 2011, 5:04 PM

The California Association of Realtors is launching an integrated campaign that features testimonials from satisfied consumers.

The effort, from Philadelphia-based Red Tettemer + Partners, marks a change in strategy for the association with creative that is much more “consumer inclusive and conversational.” Spending is under $2 million.

Titled “Champions of Home,” the campaign was created in direct response to the economically challenged real estate market, to show consumers they can rely on their realtor.

realtors can be relied on to make self-serving statements they hope will generate a commission. Otherwise known as “bullshit,” the art of telling prospects whatever they want to hear is openly encouraged by realtor associations and taught at realtor sponsored seminars.

The

multiplatformmanipulative campaign features homeowners in California, telling their individual stories of buying and selling homes and how their realtors helped conquer the process.

We have seen exactly how realtors help their clients conquer the process. realtors voyeuristically listen in on private conversations and manipulate their client's emotions to cajole prospects into buying properties many of them can't afford. Remember Suzanne?

The stories focus on everything from short sales to epic tales of paperwork and highlight realtors as experienced professionals guiding them toward closing. The campaign targets first-time homebuyers and sellers in California.

Media includes cable TV heavy in major California markets including Los Angeles, San Francisco and San Diego, and will include HGTV, AEN and Bravo Networks within “House Hunters,” “Sell this House,” “Design Star,” “Property Virgins” and “Million Dollar Listing.”

Traffic radio will air across 17 markets and more than 145 stations. Online display will blanket the state of California. There will also be a number of social media efforts, primarily focused on Facebook and Twitter. All areas will drive to a microsite, Champions of Home.

With the high page rank of IHB on Google, after this post gets indexed, whenever someone searches for Champions of Home, this post will likely be at the top of the list — even above the CAr site. ~~ giggles to self ~~

The Facebook and Twitter elements will roll out throughout September at facebook.com/CAREALTORS, twitter.com/#!/CAREALTORS and ChampionsofHome.com.

The association launched its first consumer advertising initiative in 1997 to raise awareness in terms of differentiating association members from non-member real estate agents.

CAr should be pleased. I am helping them differentiate realtors from people like myself who are non-member real estate agents.

That first campaign was specifically focused on brand differentiation, says Anne Framroze, vice president, California Association of Realtors. “We then moved to new campaign creative in 2007, when we partnered with Campbell-Ewald,” she says. “This campaign focused primarily on the value of homeownership, and the value of working with a realtor.” That effort aired from 2007 until last year, on TV, radio, and online.

The latest effort represents an entirely new direction given its focus on featuring real consumers speaking directly and from the heart — without the aid of scripts — about the home-buying and home-selling process, she says.

“We realize that in today's socially networked environment, focusing less on what we want to promote and more on what the public has to say is the best way to connect with consumers who have the capacity to access a variety of information via a multitude of channels,” Framroze tells Marketing Daily. “We want to be as authentic as possible, and we anticipate that this type of campaign strategy will continue to build virally and organically, and ultimately will resonate best across a broad spectrum of home buyers and sellers who might see themselves in similar situations.”

Actually their strategy is a good one. The problem is with the product.

Since Google will pick up this post, and many people will find it by accident, today would be a good day for anyone wanting to share their realtor horror stories in the astute observations. I look forward to reading them.

Thanks for the $268,000

Today's featured property is dull by Irvine standards. The Ponzis who owned this house only escaped with their $143,000 down payment plus $125,000 of the bank's money, a small take by Irvine standards. Of course, this is more than a full year wages for most people, but it seems like pocket change compared to the really bad cases I have profiled here.

- The property was purchased on 5/23/2003 for $715,000. The owners used a $572,000 first mortgage and a $143,000 down payment.

- They opened a HELOC for $100,000 on 7/16/2004.

- On 6/21/2005 they obtained a $185,000 stand-alone second.

-

On 3/13/2007 they refinanced with a $840,000 first mortgage. Apparently, they couldn't afford the payments.

Foreclosure Record

Recording Date: 02/28/2011

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 08/16/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/05/2010

Document Type: Notice of Default

The property was taken back by the bank on 4/5/2011 after at least 14 months of squatting. The bank paid $751,500 at auction, and they believe they can get $836,000. With no Mello Roos and low interest rates, the cost of ownership for an owner-occupant us just under $3,000 per month. Despite the high price, that's probably not far from rental parity.

This property is a test case for lenders. This is the highest priced REO in Irvine. Lenders have many more properties more expensive than this one they are holding vacant until they believe a market exists to sell into. Right now they don't believe there is much of a high end market. They are right.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 2 RHODE Is Irvine, CA 92606

Resale House Price …… $836,900.png)

Beds: 4

Baths: 2

Sq. Ft.: 2944

$284/SF

Property Type: Residential, Single Family

Style: Two Level, Contemporary

Year Built: 1998

Community: Walnut

County: Orange

MLS#: S664624

Source: SoCalMLS

Status: Active

On Redfin: 58 days

——————————————————————————

BANK OWNED beautiful home in the gated community of Harvard Square. 4 bedrooms all with walk in closets, all bedrooms are up, Huge Master with massive walk-in closet, dressing area in master bath, Hardwood floors in entry, living, dining, kitchen, family room. New carpet upstairs in all bedrooms. and Beautiful wide open Kitchen with huge walk in pantry. Custom landscaping in oversized backyard with custom patio dining area. Fireplace in family room and living room. Just Freshly painted and brand new carpet.

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis![]()

Resale Home Price …… $836,900

House Purchase Price … $715,000

House Purchase Date …. 5/23/2003

Net Gain (Loss) ………. $71,686

Percent Change ………. 10.0%

Annual Appreciation … 1.9%

Cost of Home Ownership

————————————————-

$836,900 ………. Asking Price

$167,380 ………. 20% Down Conventional

4.19% …………… Mortgage Interest Rate

$669,520 ………. 30-Year Mortgage

$166,135 ………. Income Requirement

$3,270 ………. Monthly Mortgage Payment

$725 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$174 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$122 ………. Homeowners Association Fees

============================================

$4,292 ………. Monthly Cash Outlays

-$766 ………. Tax Savings (% of Interest and Property Tax)

-$932 ………. Equity Hidden in Payment (Amortization)

$250 ………. Lost Income to Down Payment (net of taxes)

$125 ………. Maintenance and Replacement Reserves

============================================

$2,968 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$8,369 ………. Furnishing and Move In @1%

$8,369 ………. Closing Costs @1%

$6,695 ………… Interest Points @1% of Loan

$167,380 ………. Down Payment

============================================

$190,813 ………. Total Cash Costs

$45,500 ………… Emergency Cash Reserves

============================================

$236,313 ………. Total Savings Needed

——————————————————————————————————————————————————-

.jpg)

The owner of todays featured property bought on 4/26/2005 for $675,000. This near peak purchase was financed with a $540,000 first mortgage and a $72,101 second mortgage, and a $62,988 down payment. They didn't refinance, but falling prices have left them underwater. The stopped paying the mortage back in mid 2009, and they have been negotiatiing a short sale ever since.

The owner of todays featured property bought on 4/26/2005 for $675,000. This near peak purchase was financed with a $540,000 first mortgage and a $72,101 second mortgage, and a $62,988 down payment. They didn't refinance, but falling prices have left them underwater. The stopped paying the mortage back in mid 2009, and they have been negotiatiing a short sale ever since.

.jpg)

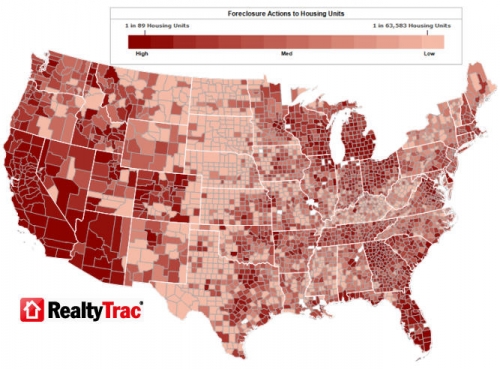

Do you ever find yourself getting impatient with the way lenders have dragged out the housing crash? I do. It isn't merely that I want to see lower house prices as those are prevalent across most of the country. I want to see the economic wounds heal. That isn't going to happen until lenders foreclose on all the delinquent mortgage squatters and resell the resulting REO.

Do you ever find yourself getting impatient with the way lenders have dragged out the housing crash? I do. It isn't merely that I want to see lower house prices as those are prevalent across most of the country. I want to see the economic wounds heal. That isn't going to happen until lenders foreclose on all the delinquent mortgage squatters and resell the resulting REO.

This should be no surprise to IHB readers. I have long contended that robo-signer was merely a ruse, the excuse-of-the-day, to delay foreclosures and avoid writing down more bad loans. Lenders will continue this behavior as long as they believe there is no buyer demand to sell into. Eventually, lenders will realize the buyer demand they are waiting for will never materialize. When they do, they will capitulate and sell for whatever they can get.

This should be no surprise to IHB readers. I have long contended that robo-signer was merely a ruse, the excuse-of-the-day, to delay foreclosures and avoid writing down more bad loans. Lenders will continue this behavior as long as they believe there is no buyer demand to sell into. Eventually, lenders will realize the buyer demand they are waiting for will never materialize. When they do, they will capitulate and sell for whatever they can get.

.jpg)