For those thinking about accelerated default, they can look forward to an average of 15 months before they have to leave their properties — and that is if they don't game the system for more time.

Irvine Home Address … 10 BUTTONWOOD Irvine, CA 92614

Resale Home Price …… $699,500

Suspicions lead to questions

And questions to alibis

Is it just my imagination

Or has her love turned into lies

There's a stranger in my house

Somebody's here that I can't see

Stranger in my house

Ronnie Milsap — Stranger In My House

Attention renters looking to buy: Right now, there is a stranger living in your house — squatting in your house. Banks are refusing to foreclose on delinquent borrowers and allowing them to live freely in what should be your house. Are you waiting patiently for them to foreclose and kick out the squatters? Don't hold your breath. Lenders continue to increase the time squatters get to live for nothing in your house. It isn't your imagination; it is really happening. Squatters are gaming the system in order to stay in your house, and the government and the banks are conspiring to keep it that way.

Mortgage Default Update: Homeowners Staying in Homes Longer

By Lita Epstein Jul 8th 2010 @ 12:54PM

More than 7.3 million home loans are in some state of delinquency or foreclosure, and there's no end in sight. That's because the number of homeowners who are 90 days or more delinquent jumped 9.2 percent in May 2010 over May 2009, according to the Mortgage Monitor Report from Lender Processing Services (LPS).

When you add that to the inventory of home foreclosures (3.18 percent), 12.38 percent of homeowners are at risk of losing their homes.

In 12 states the delinquency rate is even higher — over 10 percent. These include Nevada (14.5 percent), Mississippi (14 percent), Georgia (12.3 percent), Florida (11.2 percent), Arizona (11 percent), California (10.8 percent), Rhode Island (10.6 percent), Tennessee (10.6 percent), Alabama (10.5 percent), Michigan (10.4 percent), Louisiana (10.3 percent), and West Virginia (10.3 percent).

Truly abysmal numbers. We have gotten so used to numbers several orders of magnitude outside of historic norms that we don't think much of it. What are we going to do with all those mortgage holders in default?

Let them squat, of course.

The good news, if you can call it that, is that people in trouble are able to stay in their homes longer — even if they do default on a mortgage.

Thanks to the backlog from the record-breaking foreclosure activity, people in trouble might stay in their homes 449 days — starting from the time they are 30-days delinquent and ending at the foreclosure sale — which is a new all-time high.

If you had told me back in 2007 that lenders would simply allow people to live indefinitely in homes they were not paying for, I would have thought you were crazy. Isn't that going to cause everyone to quit paying? Won't that cause our entire mortgage-based property acquisition system to cease to function?

Well, we all know the answers to those questions. Many have quit paying, and strategic default is becoming the norm. If the government were not underwriting almost all new mortgages, private lenders would not be making new loans, and our system would grind to a halt. There isn't much of a private mortgage market today, and with the extreme moral hazard we are creating, investors would be crazy to put their money into mortgage loans not insured by the federal government.

Were these problems will finally surface is in the jumbo market. Right now, the spreads between conforming and jumbo are very, very large, and there is little reason to think the jumbo loan market will recover. Why would banks underwrite loans with risk at very low interest rates when government-backed loans with no risk are available?

Eventually, the bad loans and bloated prices in the jumbo market will need to clear — unless we are going to give those homes away. If lenders don't start to foreclose on these squatters soon, more will join their ranks, particularly if they no longer believe in the threat of foreclosure. Why would anyone pay when they can keep the house for free?

Banks are finally wising up and allowing more people to sell their homes using a short sale process rather than dragging their feet and waiting until they can foreclose. In March 2009 only 18,619 homes were sold using short sales. That number jumped 120.4 percent to 41,030 in March 2010. But even with that improvement, there were foreclosures on152,654 homes in March 2010 versus 90,695, an increase of 68.3 percent.

Is it really "wising up" or are they merely recognizing that they already have many more foreclosures in process than the system can handle? I watch the local trustee sale market very closely, and with an 80% postponement and cancelation rate and an 18 month supply of properties, closing a few more short sales isn't going to relieve the pressure on the trustee sale backlog. Either process will put more inventory on the market, and the MLS inventory locally has already risen from 434 homes to 749 since January 1, 2010.

In the past two months more homes fell into a "worse" status. LPS found that two-and-one-half times as many loans rolled to "worse" status than "improved." The number of "delinquent loans that 'cured' [become current] declined for every category" except those greater than six months delinquent. LPS thinks the improvement in the six-months category can be credited to newly completed loan modifications.

LPS also found improvement in the success of mortgage modifications. While 19.4 percent defaulted again in just three months, in the fourth quarter of 2008. In the fourth quarter of 2009, the number of new defaults dropped to 6.4 percent.

So that may mean that the banks and the government have gotten better at finding mortgage modifications that work.

LOL! Loan modification programs that work. ROFLMAO! Those borrowers will all default again. With a back-end DTI over 70%, these borrowers still have way too much debt. The only thing the loan modification did accomplish was moving the debt from the bank's balance sheet to the government's. The ripoff of the US taxpayer continues unabated.

They couldn't afford it

Like most buyers in Irvine during the bubble, the owners of today's featured property could never afford their mortgage. Through a combination of greed and wishful thinking, they leveraged themselves into a property in hopes of HELOC riches from the boundless appreciation that was sure to come their way.

These owners put some of their own money into the deal. They probably wished they didn't.

This property was purchased at the peak in the prime season of 2006. The owners paid $804,000 using a $643,200 Option ARM, an $84,400 HELOC and a $76,400 down payment. Since they were peak buyers, they never got the chance to live off the HELOC.

Irvine Home Address … 10 BUTTONWOOD Irvine, CA 92614 ![]()

Resale Home Price … $699,500

Home Purchase Price … $804,000

Home Purchase Date …. 5/31/2006

Net Gain (Loss) ………. $(146,470)

Percent Change ………. -18.2%

Annual Appreciation … -3.3%

Cost of Ownership

————————————————-

$699,500 ………. Asking Price

$139,900 ………. 20% Down Conventional

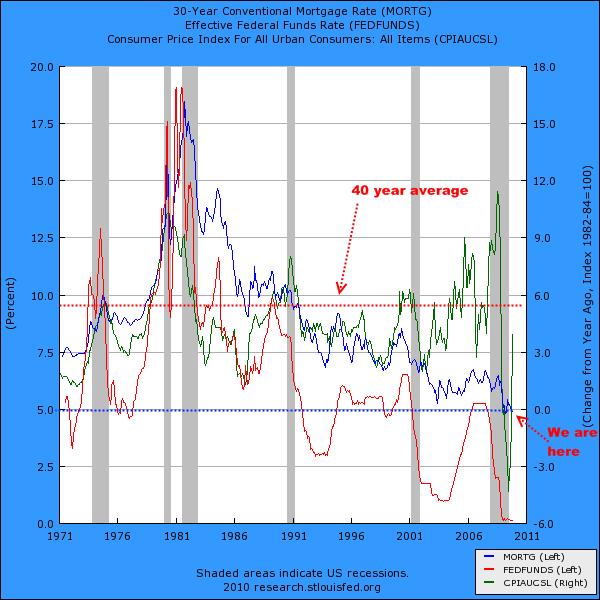

4.61% …………… Mortgage Interest Rate

$559,600 ………. 30-Year Mortgage

$138,476 ………. Income Requirement

$2,872 ………. Monthly Mortgage Payment

$606 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$58 ………. Homeowners Insurance

$78 ………. Homeowners Association Fees

============================================

$3,615 ………. Monthly Cash Outlays

-$689 ………. Tax Savings (% of Interest and Property Tax)

-$722 ………. Equity Hidden in Payment

$242 ………. Lost Income to Down Payment (net of taxes)

$87 ………. Maintenance and Replacement Reserves

============================================

$2,532 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,995 ………. Furnishing and Move In @1%

$6,995 ………. Closing Costs @1%

$5,596 ………… Interest Points @1% of Loan

$139,900 ………. Down Payment

============================================

$159,486 ………. Total Cash Costs

$38,800 ………… Emergency Cash Reserves

============================================

$198,286 ………. Total Savings Needed

Property Details for 10 BUTTONWOOD Irvine, CA 92614

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 1,789 sq ft

($391 / sq ft)

Lot Size: 6,742 sq ft

Year Built: 1985

Days on Market: 107

Listing Updated: 40351

MLS Number: S610348

Property Type: Single Family, Residential

Community: Woodbridge

Tract: Bg

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

This property is in backup or contingent offer status.

Rare Listing in Irvine. Property is pie-shaped, opening to a very large yard on the side and rear. Lots of fruit trees in a private park-like yard. Excellent location/location/location in the middle of Woodbridge SouthLake and Irvine. Easy commute access: minutes from John Wayne Airport, 405 Fwy, Beach Cities, UCI campus, shopping, entertainment and, of course, quiet walks around Woodbridge South and North Lakes. The home doesn't have many modern upgrades but it has lots of potential in a light bright home that is truly a wonderful home in a great location. You won't be disappointed that you came to see this home. Offers are expected soon.

Rare listing? Give me a break.

Offers are expected soon? Do you feel the urgency. You better run down and make an offer quickly. It's only been on the market 107 days.

I hope you have enjoyed this week, and thank you for reading the Irvine Housing Blog: astutely observing the Irvine home market and combating California Kool-Aid since 2006.

Have a great weekend,

Irvine Renter

.jpg)