Housing will remain stagnate from 2010 to 2020 due to demographic shifts, higher mortgage rates, and shifting consumer taste in real estate

Irvine Home Address … 8 BLACKBIRD Irvine, CA 92618

Resale Home Price …… $829,000

I'm gonna get me a motor car

Maybe a Jaguar

Maybe a plane or a day of fame

I'm gonna be a millionaire

So can you take me there

Wanna be wilde 'cos my life's so tame

Here am I, going nowhere on a train

Here am I, growing older in the rain

Oasis — Going Nowhere

Gear up for another lost decade in real estate. Housing will remain stagnate from 2010 to 2020. Demographic shifts, higher mortgage rates, and shifting consumer taste in real estate.

The dynamics for housing moving forward point to a very bleak future and a potential lost decade yet again from 2010 to 2020. Housing has a treacherous path moving forward and deep down demographic shifts will keep a lid on any significant housing appreciation moving forward. The economy is in the process of deleveraging from a market highly dependent on real estate. Wall Street and the government are doing everything they can to bring back the economy of yesterday but have had little success. This recession has shrunk the middle class so those looking to buy homes have declined simply because many can no longer afford to purchase a home even at today’s lower prices. Focusing on housing first was a big expensive policy mistake where we should have focused on creating sustainable jobs. The market is slowly shifting to a new housing paradigm. Family growth rates, employment trends, baby boomers, and wages will all keep a lid on housing prices moving forward.

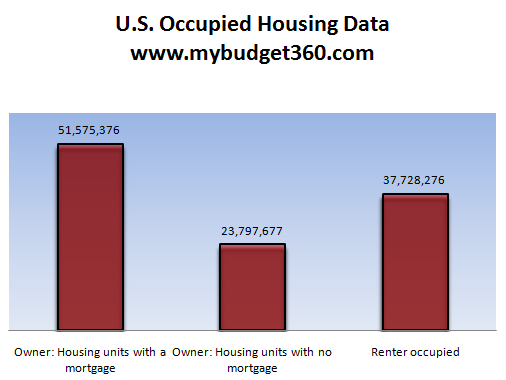

First we should break down the entire housing market:

Source: Census

The U.S. has a large number of homeowners. A total of 75 million Americans can lay the claim to owning their home. 23 million of this group (31 percent) actually owns their homes outright with no mortgage. Of course not having a mortgage does not mean that these homeowners have no housing associated cost. They still need to pay yearly property taxes, insurance, and all the cost in maintaining a home. Another 37 million American households rent. These are the basic dynamics of the housing market.

Of those homeowners with a mortgage, 7.2 million (14%) are in foreclosure or 30+ days late on their mortgage. This practically guarantees a few years of cheaper housing hitting the market in a steady trickle. This puts a herculean hold on any significant home building going forward.

From the recent Federal Reserve Flow of Funds Report, we find that current outstanding mortgage debt is $10.334 trillion. We have to break out the renters and the homeowners with no mortgage and find that the average mortgage debt for homeowners is:

$10.334 trillion / 51.575 million mortgaged households = $200,374

The current median home price comes in at approximately $170,000. Now some would argue that housing will regain traction and go on to rising to new levels. Yet this assumption assumes that middle class wages will be growing moving forward. If we look closely at the data the only real winner so far in this economic crisis is Wall Street but average Americans have seen very little benefit from the current bailout measures. Now those with big investment bank salaries can afford their piece of prime real estate in Manhattan or the Hamptons but this does not make up the bulk of the housing market. The bulk of the housing market is highly dependent on how middle class Americans are doing.

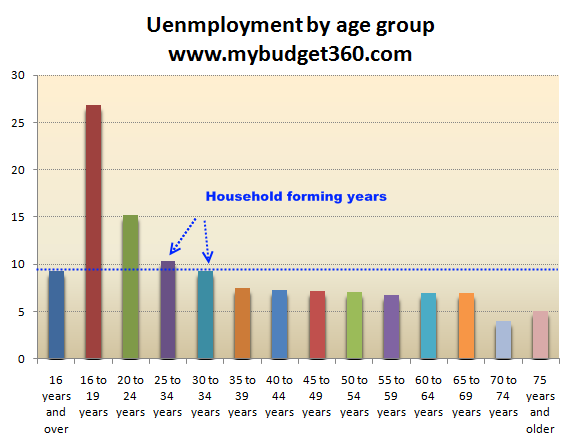

If we look at the current unemployment levels by age group, we see that those in the household forming age ranges or those entering into these categories, are taking on the brunt of this recession:

You can see that up to age 34, the unemployment rate is trending much higher than the total national average. These are prime age groups for forming households and if a family is not feeling safe financially, they will delay on purchasing a home. The middle class young family is also delaying on having children so the necessity for a bigger home is also being pushed out. This demographic shift is happening at the same time that baby boomers start entering retirement age and many will want to downsize.

And many of these people have a buffer for equity to sell since they bought prior to the housing bubble. Take for example data on current owner households:

Moved in before 1989: 20.5% of all homeowners

Moved in before 1999: 40.9% of all homeowners

It is highly likely that in this group, you have many baby boomers that will sell to downsize in the years coming forward and the current decline in prices will only cut into their equity but not put them underwater given the decade long bubble. They purchased before that. Those that moved in before 1989 will have a much larger cushion. So there is a large group of people that will sell regardless of market trends because they will have to simply because of life changing events.

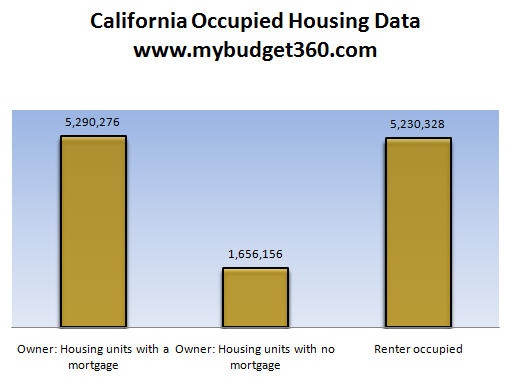

And then on the other hand we have the fact that one-third of homeowners in certain states are underwater on their mortgages. Take for example California:

California has a large renting population and most that own a home carry a mortgage (77 percent). Of those that carry a mortgage a stunning one-third are underwater. In other words 1.76 million mortgages in California are attached to homes that are worth less than the actual balance of the mortgage creating a large incentive to walk-away. Many of these loans come from Alt-A paper and option ARMs. These loans will impact the market at least until 2012 and hurt the state. California isn’t immune and other states like Nevada, Florida, and Arizona have similar dynamics. In fact, here is the amount of mortgage debt in a negative equity position according to a recent Deutsche Bank analysis:

California: $969 billion

Florida: $432 billion

Arizona: $140 billion

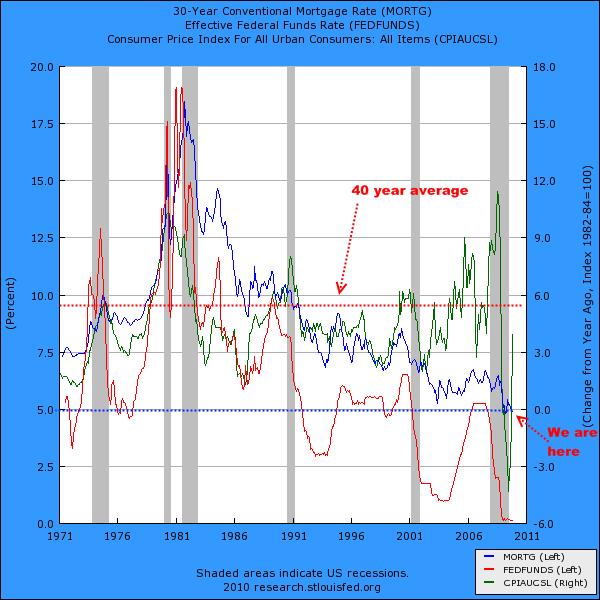

The only way that things would improve for banks is if prices moved higher. But how can prices move higher if middle class Americans are dealing with high unemployment and stagnant wages? The Federal Reserve and U.S. Treasury have really reached the end of options in terms of what they can do. Even the 30 year fixed mortgage is at all time lows in the midst of all this turmoil:

The 40 year average for 30 year rates is closer to 9 percent. Today it is under 5 percent. That is unsustainable and as we move forward with insurmountable levels of national debt, the rate will have to rise. I know this seems impossible for many but as we have seen with other debt ridden countries, the market can turn on like a tornado and quickly change the dynamics of the situation. For the housing market, this will mean even more pressure to keep prices muted.

The only way home prices can rise in a healthy manner is if we start seeing wage inflation. We saw some of this in the 1970s where wages went up in tandem with home prices. In the last decade, wages moved sideways while home prices went into a bubble. As far as the economy going forward, the big job sectors seem to be in low paying service sector jobs. Certainly someone can purchase a house with these jobs but not at current prices even though they appear to be solid.

The Federal Reserve and the U.S. Treasury have done everything to slam the dollar and create some level of inflation. Yet other central banks are doing the same. So what happens is easy money flows to Wall Street for gambling while the real economy stagnates. It is hard for many to believe that we will have another lost decade in housing but there is little reason to believe that prices will soon start to outpace inflation. In fact, in the last year or two we have been dealing more with aspects of deflation. We need to keep an eye on the real value of home prices adjusting for inflation/deflation.

Four years of squatting

Today's featured property is the worst example of squatting I have seen to date.

- The property was purchased on 6/7/1999 for $348,500. The owners used a $260,000 first mortgage and an $88,500 down payment.

- On 3/31/2003 they refinanced with a $369,000 first mortgage.

- On 8/5/2003 they opened a $100,000 HELOC.

- On 10/14/2005 the obtained a stand-alone second from a private party.

- On 5/25/2006 they obtained a $57,000 HELOC. Here is where the story gets wierd.

- The began squatting shortly after getting the last HELOC.

Foreclosure Record

Recording Date: 11/30/2006

Document Type: Notice of Sale (aka Notice of Trustee's Sale)

Click here to get Foreclosure Report.

Foreclosure Record

Recording Date: 11/22/2006

Document Type: Notice of Sale (aka Notice of Trustee's Sale)

-

Then they managed to consolidate their private-party second and their HELOC with a $310,000 stand-alone second on 12/7/2006. It doesn't look like they bothered to make a payment.

Recording Date: 04/12/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 06/10/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 12/31/2007

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 09/26/2007

Document Type: Notice of Default

Foreclosure Record

Recording Date: 08/02/2007

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 07/18/2007

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 04/12/2007

Document Type: Notice of Default

The second mortgage holder finally foreclosed on 4/30/2010 for $445,274. At first glance it looks like they got a great deal, but unfortunately, the $369,000 first mortgage — which probably has not been paid since 2006 — is still there. The balance on that mortgage probably exceeds $500,000. The second mortgage holder is trying to sell to recover what they can of the $445,274 they have in the property. Based on the listing description, it appears they had to evict the squatting homeowners.

I guess 4 years of squatting wasn't enough….

Irvine Home Address … 8 BLACKBIRD Irvine, CA 92618 ![]()

Resale Home Price … $829,000

Home Purchase Price … $348,500

Home Purchase Date …. 6/7/1999

Net Gain (Loss) ………. $430,760

Percent Change ………. 123.6%

Annual Appreciation … 7.5%

Cost of Ownership

————————————————-

$829,000 ………. Asking Price

$165,800 ………. 20% Down Conventional

4.80% …………… Mortgage Interest Rate

$663,200 ………. 30-Year Mortgage

$167,765 ………. Income Requirement

$3,480 ………. Monthly Mortgage Payment

$718 ………. Property Tax

$250 ………. Special Taxes and Levies (Mello Roos)

$69 ………. Homeowners Insurance

$139 ………. Homeowners Association Fees

============================================

$4,656 ………. Monthly Cash Outlays

-$843 ………. Tax Savings (% of Interest and Property Tax)

-$827 ………. Equity Hidden in Payment

$304 ………. Lost Income to Down Payment (net of taxes)

$104 ………. Maintenance and Replacement Reserves

============================================

$3,394 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$8,290 ………. Furnishing and Move In @1%

$8,290 ………. Closing Costs @1%

$6,632 ………… Interest Points @1% of Loan

$165,800 ………. Down Payment

============================================

$189,012 ………. Total Cash Costs

$52,000 ………… Emergency Cash Reserves

============================================

$241,012 ………. Total Savings Needed

Property Details for 8 BLACKBIRD Irvine, CA 92618

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 2,389 sq ft

($347 / sq ft)

Lot Size: 7,840 sq ft

Year Built: 1999

Days on Market: 52

Listing Updated: 40302

MLS Number: P733648

Property Type: Single Family, Residential

Community: Oak Creek

Tract: Othr

——————————————————————————

According to the listing agent, this listing is a bank owned (foreclosed) property.

Beautiful area of Irvine , home is only eleven years old , gated commuinty drive by only at this time

The journalist has made the mistake of comparing an average mortgage ($200,000) to a median house price ($170,000). It’s reasonable to assume that the ditribution of mortgages and house prices has a long tail upward so the median and the average of the two distributions are likely to be closer than these two figures.

A $750,000 house: O.C. vs. elsewhere

Jul 6th, 2010

http://lansner.ocregister.com/2010/07/06/750000-house-for-sale/71605/

Hedge fund Paulson bullish on housing

Krugman or Paulson: Who You Gonna Bet On?

http://www.businessweek.com/magazine/content/10_28/b4186004424615.htm

After winning Nobel prices, Krugman’s next goal is Fed chair or chief economist of National Economics Council. Don’t surprise, if he replace Bernanke or Summers.

Ha ha, Krugman’s got way too big a mouth to have any kind of job that requires tact and discretion ….

Are you kidding, he has the best tact to winning anything he wanted. With his big mouth, he gets the Nobel prices ( the is the same as Obama winning president election with a lot of cheap talks).

Don’t worry, for sure Krugman knows how to appreciate his boss, and he is ready to grab the position that can fill the gap between Obama and liberalism which is quite essential for Obama winning next presidency.

It is quite simple to know that a person is lying, when everything, no matter wrong or right, the person did is because “love” the country (BTW, who does not or cannot “love” this country?)

This is applying to Krugman now.

IR

These owners appear to have been out to game the system from the get go. Why have you given them a D instead of an F?

I gave them a D because they did leave some equity in the house. If they had a more consistent pattern of abuse, or if they had extracted every penny of equity on the last loan, I would have given them an F.

It is a judgment call, and you can make a case for an F with all the squatting they managed.

The “air view” in Zillow reveals homes nearby are valued at $750,000.

My thinking is that the second mortgage holder may recover $250,000, which is $750,000 likely sale price less the $500,000 on the first mortgage.

California has a Trillion Dollars of mortgage debt in a negative equity position; this has led to a lot of people strategically defaulting and squatting in their underwater homes.

The US average mortgage debt for homeowners is $200,000, and that the median home price is $170,000; the net household mortgage debt is $30,000; this will hasten the day when we will see the end of credit; and it will hasten the day when entitlement spending will end as when credit ceases, small businesses, such as the Russell 2000, IWM, will fold; and US Government debt will fail to auction; and there will not be funds in the US Treasury for entitlements.

When I look at the figures of mortgage debt in a negative equity position, California: $969 billion, Florida: $432 billion, Arizona: $140 billion, I am of the opinion that the economy of Arizona and Florida cannot absorb any more foreclosures and transfer of homes to the banks, but of course will have to. And I of the opinion that the banks have been comparatively holding off on foreclosing in California compared to Florida and Arizona, leading to what may be a larger percentage of squatting in California.

I think the only people who really benefited from the Alan Greenspan liquidity from 2001 to 2008 were stock market traders, squatters and those working in the financial industry exemplified by those living in the Northeast Gold Coast who earned a lucrative income and saw home values rise steadily. And of course those working in the financial industry benefited from the recent Ben Bernanke QE, as did those who went long the stocks for well over a year. The squatters were “savvy and shrew” like insightful investors who trade the stock market waves up and down.

I sure hope those who benefited, are smart enough to invest in gold, as the coming debt deflation is going to wipe out stock market values, US Treasuries values and real estate values.

The soon coming end of credit means that banks will be integrated, that is melded, into government; government will provide seigniorage for credit, which will be available only for strategic national purposes.

People will be evicted or will lease properties from the bank-government combine.

While I’m enjoying the plethora of 3CWG articles lately I’m still wondering when these high $800k+ homes are going to get down to the sub/low $700ks like predicted a couple of years ago.

Do you think we are going to see another $100k+ price drop by 2013?

Maybe not by 2013, but by 2015 these $750K OC/Irvine homes will be under $500K….

Black swan, black swan

Gary Watt’s take on the 2010 resedential real estate market:

http://www.bubbleinfo.com/wp-content/uploads/2010/07/Gary-Watts.pdf

talk about a complete 180. beware the two-faced douche:

Home prices, Watts says, will rise 15 percent to 18 percent in 2006. Interest rates will stay flat, but even if they rise, they won’t hurt real estate appreciation.

“I feel real confident,” Watts told the audience at the Old Ranch Country Club in his third such gathering this month. “One year from now … we’ll be able to look at each other and say, ‘Wow! Another 15 percent.’

…

“I only forecast off the numbers,” Watts said. “It’s all based on pure economics.”

For 90 minutes Friday, Watts rattled off an array of numbers to show that job growth and a shortage of housing were key factors in the 1990s bust and are key factors in the current housing boom.

Supplies are tight and will only get tighter, Watts maintained, noting that population growth, demographics and immigration are creating three waves of homebuyers.

He argued further that others give too much weight to an “affordability index” indicating that just 11 percent of Orange County households can afford a single-family home here.

That index fails to take into account the huge number of homebuyers who have large incomes or already own homes they can use to finance a new purchase, he said.

Watts suggested that real estate agents use a new sign on clients’ lawns. To make the point, he held aloft a placard reading: “For Sale – Rich People Only.”

“The affordability index doesn’t work,” he said.

IT’S ALL BASED ON PURE ECONOMICS IDIOT

I have an option for a bridge from CA to HI. Only one thousand dollars for each option. Have 200 million available.

Low risk, affordable with the low interest rates.

Buy now before you’re priced out of the market. :}

A note on demographics: I’ve heard school districts are now competing with each other for students because enrollment has dropped so dramatically the past couple of years. The more prestigious districts will have “open enrollment” periods where students from other districts may apply there to become a student.

Bottom line is people are moving out of California.

Govt. A dollar short and a day late. Or in CA’s case a billion short and eight years late.

No comments about the squat picture?!