Like many good proposals for reforming mortgage finance, lowering the loan limits insured by the GSEs and FHA likely will not happen because it will lower house prices.

Irvine Home Address … 5732 SIERRA CASA Rd Irvine, CA 92603

Resale Home Price …… $1,999,900

The grass was greener

The light was brighter

With friends surrounded

The nights of wonder

Looking beyond the embers of bridges glowing behind us

To a glimpse of how green it was on the other side

Steps taken forwards but sleepwalking back again

Dragged by the force of some inner tide

At a higher altitude with flag unfurled

We reached the dizzy heights of that dreamed up world

Pink Floyd — High Hopes

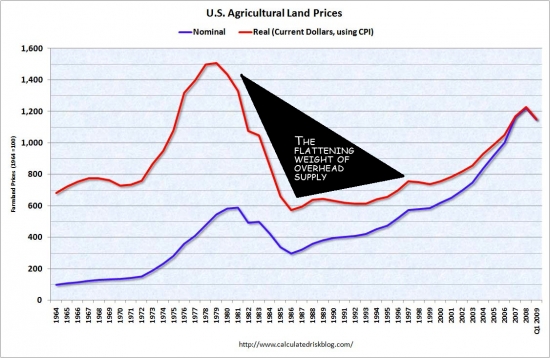

During the housing bubble rally, the grass was greener and the light was brighter. At higher prices with boundless hope, we reached the dizzying heights of real estate wealth, a dreamworld of unlimited appreciation and personal spending power.

Currently our housing market is completely supported by and dependent on government loan guarantees. By offering to assume all risk of loss, the federal government though the GSEs and the FHA is underwriting loans at historically low interest rates. This caused money to flow into mortgage lending at a time when proper risk management was to flee. This kept some of the air in the housing bubble which allowed the government to get control of the market's descent. The question is how do we move forward?

What do we do with a housing market completely hooked on government juice?

Treasury report advocates slashing GSE jumbo loan ceiling

Reducing conforming loan limits at Fannie Mae and Freddie Mac will help reduce the GSEs' dominance in the mortgage market by driving jumbo mortgage financing back to the private sector for financing, the U.S. Treasury said in its “Reforming America's Housing Finance Market” report on Friday.

Under the Treasury's plan, a 2008 increase in loan limits that allowed GSEs to temporarily back loans valued as high as $729,750, would expire on Oct. 1, reverting to the previous ceiling of $625,500. In a report from the George Washington University Center for Real Estate and Urban Analysis this week, researchers concluded that the Federal Housing Administration substantially raised its risk when it agreed to insure GSE loans valued as high as $729,000 during the financial crisis. The report advocated a return to 2006 levels when the FHA loan ceiling topped out at $362,790.

The Treasury report also said lowering conforming loan limits on jumbo mortgages and requiring a 10% down-payment for GSE loans will eventually ease the mortgage market back to the private sector while containing systematic risks.

Easing the market back to the private sector is secret code for easing the housing market off interest rate subsidies and loan guarantees. Private lending evaluating and taking risk would be great. Private lending taking risk with assumption of an Uncle Sam bailout would be a catastrophe. Which do you think we would get?

In the Treasury report, the current GSE-model is criticized for allowing Fannie Mae and Freddie Mac “to behave like government-backed hedge funds, managing large investment portfolios for the profit of their shareholders with the risk ultimately falling largely on taxpayers.” To curb some of the risk, the PSPAs, which provide financial support to the GSEs, would require the GSEs to wind down their investment portfolios at a rate of no less than 10% annually.

To brace for risks and shocks in the economy, the Treasury also advocates for a mortgage securitization model where securitizers and originators are required to retain 5% of a security's credit risk when a loan is sold to investors.

In addition, the Treasury would require banks originating loans to have more skin in the game by holding higher levels of capital to withstand economic downturns and to hedge against the risk of default on higher-risk loans.

Write to Kerri Panchuk.

Turning lending over to the private sector would be a great thing; however, as Bill Gross pointed out:

Ninety-five percent of existing mortgage creation over the past 12 months were government guaranteed. The private market was nowhere to be found because they charged too much. It was the cost of private origination and securitization, perhaps more than any other factor, that justified government involvement. Prime, but non-conforming, mortgages (jumbos, insufficient down payments) were being purchased by PIMCO in the hundreds of millions of dollars every week, but at yields of 6, 7, and 8%. If that was the risk/reward tradeoff, compared to FNMA and FHLMC yields at 3.5–4%, how could policymakers pretend that the housing baton could be quickly and cost-effectively passed back to the private market? Few, if any, could afford a new home at those interest rates. If you were a believer in the dominance and superiority of private markets, how could you deny the signal that markets were sending – that the risk was too high given the substantial losses of recent years?

Any turnover of lending to the private sector would need to be phased in to stop mortgage interest rates from spiking and causing the Bernanke Put to prompt the fed to intervene.

.jpg)

Report: FHA should lower loan limits

The Federal Housing Administration substantially raised its risk when it agreed to insure loans valued as high as $729,000 during the financial crisis, says a new report from the George Washington University Center for Real Estate and Urban Analysis.

“Without question, FHA played a major role in keeping the housing market afloat during the economic collapse of 2008 and 2009, and we need to be careful about cutting back too rapidly,” said Van Order, Oliver T. Carr professor of real estate and chair of CREUA.

The FHA has been filling this role in every period of housing market instability since the Great Depression. in the past, since the FHA underwriting standards are so strict and the paperwork is so cumbersome that the private mortgage market was able to offer competing products and take market share from the FHA. Since the government is not concerned about market share or making profits, having the FHA as a low-volume emergency back up is probably a good thing.

“However, these large loan sizes are unlikely in the long run to assist FHA in reaching its historical constituencies,” he added. “Our research indicates that larger loans are likely to perform worse than FHA’s traditional market, and we are concerned that the rapid increase in FHA’s market share will be hard to manage.”

Of course they will perform badly. These loans were given out to overextended borrowers to acquire property declining in value. Strategic default will be a serious problem for many of these loans.

Researchers who worked on the report say FHA loan limits hovered at $362,790 in 2006, about $400,000 less than today's limit.

With loans valued at or above $350,000 performing worse than smaller FHA-insured loans, the research center is advocating a return to lower FHA loan limits and a renewed emphasis on first-time and minority homebuyers. Researchers who compiled the report found higher loan limits do little for minority homebuyers since 95% of the agency's African-American and Hispanic borrowers opt for loans valued under $300,000.

Write to Kerri Panchuk.

The bursting of the housing bubble forced the GSEs and the FHA to start making loans to upper middle class borrowers who shouldn't require subsidies. Transitioning the housing market back to a private system with the free market determining interest rates will take a long time, and it will not be painless.

Lower loan limits would severely impact markets like Irvine

I wish I knew where this debate on mortgage finance reform is going. I suspect they will talk a lot, the rhetoric may get heated, but in the end they will do little or nothing now preferring to kick the can down the road to another crisis.

However, if they do lower the jumbo conforming limit from $729,750 to $417,000 or below, the meat of the Irvine market would suddenly have to pay jumbo rates. We would be among the first markets in the country to experience the transition from public to private financing. Jumbo rates are somewhere between half-a-point and one point higher than conforming rates. If future buyers are facing higher interest rates, their hopefully higher incomes will not be leveraged as much, and the loan balance will not be larger.

Markets where jumbo conforming loans ($417,000 to $729,750) are prevalent, the market impact will be the most noticeable. If you combine that with the possibility that loans that large will no longer be tax deductible, and borrowing huge sums to take a position in real estate doesn't seem quite so appealing. Future take-out buyers will not be so leveraged.

$30,000 plus 15 years equals $1,700,900?

The owners of today's featured property paid only $299,000 for this corner lot back in 1996. These owners used a $269,000 first mortgage and a $30,000 down payment. It looks like they tore down what was there and built a new home on the lot. Apparently, it was quite the upgrade because now they think this property is worth many times what they paid for it.

They refinanced on 2/2/2003 for $412,000 which likely paid for the upgrade and renovation. The description says this owner is an architect. If so, he is starving right now, and the 4/27/2010 refinance for $578,000 probably went to pay the bills. This isn't the only architect i know trying to sell their house because they aren't making any money. Very sad.

So this starving architect is selling his dream home. It may be sad to lose a dream home, but if we walks away with over a million dollars, he shouldn't cry very long.

Irvine Home Address … 5732 SIERRA CASA Rd Irvine, CA 92603 ![]()

Resale Home Price … $1,999,900

Home Purchase Price … $299,000

Home Purchase Date …. 2/20/96

Net Gain (Loss) ………. $1,580,906

Percent Change ………. 528.7%

Annual Appreciation … 12.9%

Cost of Ownership

————————————————-

$1,999,900 ………. Asking Price

$399,980 ………. 20% Down Conventional

4.99% …………… Mortgage Interest Rate

$1,599,920 ………. 30-Year Mortgage

$413,628 ………. Income Requirement

$8,579 ………. Monthly Mortgage Payment

$1733 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$333 ………. Homeowners Insurance

$125 ………. Homeowners Association Fees

============================================

$10,771 ………. Monthly Cash Outlays

-$1650 ………. Tax Savings (% of Interest and Property Tax)

-$1926 ………. Equity Hidden in Payment

$776 ………. Lost Income to Down Payment (net of taxes)

$250 ………. Maintenance and Replacement Reserves

============================================

$8,220 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$19,999 ………. Furnishing and Move In @1%

$19,999 ………. Closing Costs @1%

$15,999 ………… Interest Points @1% of Loan

$399,980 ………. Down Payment

============================================

$455,977 ………. Total Cash Costs

$126,000 ………… Emergency Cash Reserves

============================================

$581,977 ………. Total Savings Needed

Property Details for 5732 SIERRA CASA Rd Irvine, CA 92603

——————————————————————————

Beds: 5

Baths: 5

Sq. Ft.: 5403

$370/SF

Lot Size: 10,160 Sq. Ft.

Property Type: Residential, Single Family

Style: Two Level, Contemporary, Mediterranean, Modern, Tuscan

View: City Lights, Hills, Mountain, Panoramic, Yes

Year Built: 2008

Community: Turtle Rock

County: Orange

MLS#: S646188

Source: SoCalMLS

Status: ActiveThis listing is for sale and the sellers are accepting offers.

——————————————————————————

Stop! You have never seen anything like this magnificent custom home with a unique floorplan that offers the ultimate in privacy, a flexible floorplan, outstanding outdoor entertaining areas built with remarkable finishes. This trend setting home, designed by the owner/architect, offers a huge (1,049 SF) home office with conference room which could also be a separate apartment or in law suite. In addition, the layout offers 2 master suites on the first floor, 2 view retreats, a welcoming 459 sq. ft. outdoor veranda with fireplace and 12' wood beamed ceiling, a huge (813 sq. ft) upstairs wing dedicated to entertaining while capturing the fabulous sunsets, city lights, snow capped mountains and surrounding hillsides. At the heart of the home is the kitchen with exquisite custom mahogany cabinetry designed by renowned Ziething Cabinets w/ gorgeous granite counters and top of the line stainless steel appliances. Over 2,300 sq. ft of travertine stone flooring throughout.

.jpg)

.jpg)

.jpg)