It's a simple question, why are home prices still falling. The answer is a little complicated, There'a a book on the subject.

Irvine Home Address … 5111 DOANOKE Ave Irvine, CA 92604

Resale Home Price …… $700,000

It's crazy I'm thinking

Just knowing that the world is round

And here I'm dancing on the ground

Am I right side up or upside down

And is this real or am I dreaming

Dave Mathhews Band — Crush

Before we can address the question of why home prices are still falling, we need to address why they fell in the first place. The causes of the initial crash have not been addressed for bubble borrowers, and the repercussions for their earlier borrowing simply cannot be wished away, nor will this financial wound heal itself with the passage of time as most are planning on.

Why did house prices go up?

A financial bubble is a temporary situation where asset prices become elevated beyond any realistic fundamental valuations because the general public believes current pricing is justified by probable future price increases. If this belief is widespread enough to cause significant numbers of people to purchase the asset at inflated prices, then prices will continue to rise. This will convince even more people that prices will continue to rise. This facilitates even more buying. Once initiated, this reaction is self-sustaining, and the phenomenon is entirely psychological. When the pool of buyers is exhausted and the volume of buying declines, prices stop rising; the belief in future price increases diminishes. When the remaining potential buyers no longer believe in future price increases, the primary motivating factor to purchase is eliminated; prices fall.

Why did house prices fall?

From the section on visualizing the credit bubble in housing:

…. something strange happens…[when] there is nobody left to make a purchase. (A key indication of the end of a speculative mania is a huge decline in sales, as was witnessed over 2006 and 2007). Transaction volume drops off dramatically, and prices stop their dizzying ascent. Nobody is particularly alarmed at first, but a few of the more cautious sell their assets to pay off their loans. Since there are no more new buyers, the first selling actually causes prices to drop. This is unprecedented: prices have never declined! Most ignore the problem and comfort themselves with the history of rising prices; however, a few are spooked by this unprecedented drop and sell the asset. This selling drives prices even lower. Now those who still own the asset become worried, some continue to deny that there is a problem, and some get angry about the price declines. Some of the late buyers actually owe more than they paid for the asset. They sell the asset at a loss. The lenders now lose some money and refuse to loan any more money to be secured against the asset. Now there are even fewer buyers and a large group of owners who all want to sell before prices drop any lower. Panic selling ensues. Everyone wants to sell at the same time, and there are no buyers to purchase the asset. Prices fall dramatically. This asset which was sought after at any price is now for sale at any price, and there are few takers. People in the market rightfully believe the asset will continue to decline. Owners of the asset have accepted the new reality; they are depressed and despondent.

In any group of people, there are always a few who do not believe the “prices always rise” narrative. Some recognize that asset prices cannot rise indefinitely and cannot stay detached from their fundamental valuations. These people witness the rally and the resulting crash without participating. They wait patiently for prices to drop back to fundamental values, and then these people buy. As these new buyers enter the market, prices stop their steep descent and market participants start to hope again. It takes a while to work off the inventory for sale in the market, so prices tend to flatten at the bottom for an extended period of time; however, just as spring follows winter, appreciation returns to the market in time, and the cycle begins all over again.

What is written above is true of any asset whether it be stocks, bonds, houses or tulips. [1] In this case, it is the local housing market, and the room of new buyers represents subprime borrowers, but the concepts are universal. One phenomenon somewhat unique to the housing market is the forced sale due to foreclosure (stocks have margin calls). Even if the psychological factors at work during the panic could somehow be quelled, the forced sales from foreclosures would drive down prices anyway. True panic is not required to crash a housing market, only dropping prices and an inability to make payments. Subprime lending was one of the leading causes of the Great Housing Bubble, and its implosion exacerbated the market decline.

The crash was allowed to proceed in some markets, and the crash was averted in others by allowing delinquent borrowers to stay in the bank's property. The bank even let them stay on title during the mortgage squatting period.

Why are home prices still falling?

Is this a double-dip housing recession? When will values rise again?

By Karen Datko on Tue, Jan 25, 2011 7:19 PM

This post comes from Marilyn Lewis of MSN Money.

The closely watched Standard & Poor's/Case-Shiller Home Price Index is out: It shows home prices are still dropping.

Overall, real estate values fell 1% between October and November, The New York Times says. According to the S&P survey, prices are just 3.3% above the low reached in April 2009. They've fallen 1.6% from the same time a year ago.

Prices fell from October in 19 of the 20 metro areas watched by S&P. And, compared with the year before, just four of the 20 cities studied saw prices grow: Los Angeles, San Diego, San Francisco and Washington, D.C. In eight of the cities studied, prices fell to new lows: Atlanta; Charlotte, N.C.; Portland, Ore.; Seattle; Tampa and Miami.

“Home prices in the 30 metropolitan cities remained at about 3.0% below the levels attained a year ago,” says a separate analysis by FNC, which makes software used by banks to manage their real estate holdings. Nineteen of 30 cities tracked by the FNC 30-MSA Composite Index saw prices fall an average of 1.8% from October to November.

The worst horror stories from the S&P report, as reported by Forbes, were:

- Las Vegas-area prices have fallen 57.2% since peaking in August 2006.

- Phoenix prices are 53.9% below June 2006 highs.

- Miami prices have fallen 48.6% since December 2006.

The price declines in Las Vegas are truly remarkable. I have pulled comps on several hundred properties in Las Vegas. The nicest areas are still holding out in 2004 and 2005 pricing with very few sales. Most of the above-median market is compressing of its own weight similar to here in Orange County. These houses are generally still priced in the 00s. The median price and below is back to 90s levels. Often at auction I am paying prices last paid in the 80s.

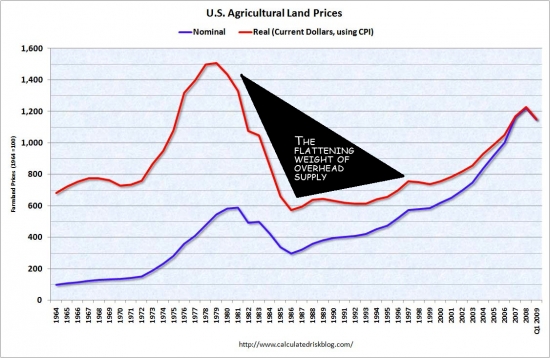

Since prices are so low, strategic default is the norm. When nearly 90% of mortgage holders are underwater — prices back to the 90s will do that — everyone in the market has incentive to walk away if they experience payment distress. This creates an endless overhead supply.

Where's this headed?

To understand where this is going, let's break the question down. There really are two questions:

- Will prices keep dropping or is this the bottom?

- If this is the bottom, when is the ride back up going to begin?

Each forecaster takes the same data and describes it a little differently:

- Based on today's report, The New York Times is calling it a “double-dip” housing recession, which makes it sound kind of grim and endless.

- Forbes also likes the “double-dip” descriptor, predicting a double-dip housing recession before spring. (What's a “double dip”? It's if the S&P price index were to hit new lows in both its 10-city and 20-city surveys. Hasn't happened yet, but the S&P price indexes have been dropping for six months straight.)

- S&P/Case-Shiller report founder Karl Case gives it a slightly more optimistic spin: He told Bloomberg that prices could start back up by spring if jobs cooperate.

- But but but I thought the bottom was 2009?

- US Housing Continues Freefall & Is Nowhere Near Bottom

- House prices in US declined for fifth month in a row

- House prices to hit bottom this year, report says

- Fiserv Case-Shiller: after five years of record declines, slow grinding bottom ahead

-

High prices, low demand, and large supply means lower prices ahead

Bloomberg reports:

“Prices have gone flat, bouncing around at what I think is essentially a bottom,” Case, a retired professor of economics at Wellesley College, said in a radio interview today on “Bloomberg Surveillance.” “We're really going to have to wait to see what the spring market brings.”

I wonder if Dr. Case sold his vacation home yet? He didn't want to give it away.

In a separate Bloomberg article, Case said:

“There's a good chance of a housing turnaround this year, but it's not going to be enough to give much help to the economy. … We're coming off 50-year lows and we still have to deal with the foreclosure mess.”

Last year this time, home prices were looking good. Weak yes, but rising. They'd bottomed (or so it seemed) — in April 2009. They rose nicely after federal homebuyer tax credits between fall 2009 and late spring 2010. They kept rising until July.

And then, boom, they fell, and kept falling — in some cases even lower than before.

Pardon me while I feign surprise. Whocouldanode?

The bottom engineered by the federal reserve in 2009 was not a natural and durable bottom. The market is like a river, although temporarily diverted, it is flowing to its own course.

However, all's not dark. There are signs of gathering strength, however modest:

- Home construction is showing “stronger activity going forward,” reports Hanley Wood's Market Intelligence report for builders.

I wish homebuilders were doing better. I have many friends who are still suffering and wondering if this recession is ever going to end.

- Sales of existing homes grew, for the second straight month, Market Intelligence said. Sales were up 12.3% in December. But because they'd dropped badly in 2010, the numbers still were less than at the same time the year before.

- The Leading Economic Indicator Index has risen for six months straight, surprising analysts in December by hitting 112.40, a 1.10 point monthly increase, reports Bloomberg.

- The Consumer Confidence Index, also out today, rose to 60.6, up from 53.3 in December.

- Bloomberg reports that the unemployment rate dropped to 9.4% in December after hitting a seven-month high of 9.8% in November.

And, now that mortgage rates are rising, you'd expect fence-sitters to buy while money is cheap. But will they buy in numbers large enough to pull up prices?

Prices are not pulled up by buyers. Prices are pushed up by buyers who increase their bids with cheap money. As I have noted, cheap money is not the answer. Low Interest Rates Will Not Create Demand. Further, money is not getting any cheaper because you will not see 4% mortgage interest rates again in your lifetime.

The real problems going forward are twofold: (1) Supply will exceed demand due to huge foreclosure inventories and a diminished buyer pool. And (2) The cost of borrowing is going to increase making loan balances smaller and preventing borrowers from raising their bids. Even if employment and income numbers improve, the supply and demand imbalance and the increasing cost of borrowing will be persistent problems plaguing the housing market for the next decade.

We may still keep prices inflated and unaffordable. Kool aid intoxication is powerful, but the weight of inventory and the need to liquidate may be enough to crush the financial hopes of even the most ardent appreciation buyer.

The dark tunnel

“The enormous supply overhang of existing homes (particularly factoring in all those in foreclosure or soon to be) promises to keep pressure on prices for some time,” Joshua Shapiro, chief U.S. economist of MFR Inc., told the Times.

And that's the issue: The huge glut of foreclosure properties — homes now in the hands of banks and other homes soon to be in the hands of banks. Not just are there a lot of homes on the market now, but many more are coming. Buyers — lots and lots of them — must chew through this mammoth “inventory overhang” before prices will rise.

As analysts at Radar Logic explain in their (subscription) newsletter:

If housing demand increases because of improvements in the employment and other sectors of the economy, financial institutions will respond by putting more of the homes in their inventories on the market, and home prices will remain depressed.

On top of that, there's an uncounted but presumably huge group of homeowners who would put their homes on the market right now but are holding off until prices improve. So, given a little price recovery, you can count on this pent-up supply to be added to the market, further stringing out the housing recovery.

How The Lending Cartel Disposes Their REO Will Determine the Market’s Fate.

Prices won't rise until buyers have fewer homes to choose from and they are forced to compete with each other to get a home they want.

“Everything in this report is unfortunately still sagging and still pointing downward. … We still seem to be at best scraping along the bottom,” David Blitzer, S&P Index Committee chairman, told CNBC. Prices could fall three or four more percentage points, nationally, in the next month or two, Blitzer added.

The light at the end

Radar Logic, whose economist Nouriel Roubini was nearly alone in predicting the 2007 housing crash, tells newsletter readers to expect home values to keep falling until spring. After that, it'll take time before they start rising again. The newsletter says:

Given the current supply of homes for sale, the enormous shadow inventory of homes in bank inventories plus mortgages in default and foreclosure, and the millions of at-risk homeowners with negative equity in their homes, we do not expect home prices to increase on a sustained year-over-year basis until 2012.

Prices may not see sustained appreciation for quite some time, but we may have other bear rallies while the overhead supply from the housing bubble is worked off. It is difficult to forecast because so much depends on interest rates, job growth and household formation, and government policies toward real estate. Right now, the market faces many obstacles to sustained price appreciation.

Resisting temptation

Some borrowers refinanced for various reasons during the bubble. Rates were near historic lows (the lows we took out when the federal reserve went to zero) so many borrowers refinanced to lower their payments. At each refinance, the temptation to take a little free money was there. During the bubble, these cash-out loans were aggressively peddled by mortgage brokers who were often making large incentive payments for pushing borrowers into dodgy loans.

At each transaction there must be a willing borrower. Some simply say no. Unfortunately, those that said no are going to have to pay for the losses on those that gave in to their temptation and spent their houses.

Between 1997 and 2004 the owners of todays featured property added somewhat to their mortgage, it went from $197,000 to $210,000. Their mortgage was never larger than their original purchase price — an accomplishment in Irvine from what I've seen. There is a later HELOC but no evidence they used it. The last mortgage they recorded was the smallest of all.

These people at least tread water during most of the housing bubble while many of their cohorts went Ponzi.

Irvine Home Address … 5111 DOANOKE Ave Irvine, CA 92604 ![]()

Resale Home Price … $700,000

Home Purchase Price … $246,000

Home Purchase Date …. 6/23/97

Net Gain (Loss) ………. $412,000

Percent Change ………. 167.5%

Annual Appreciation … 7.7%

Cost of Ownership

————————————————-

$700,000 ………. Asking Price

$140,000 ………. 20% Down Conventional

4.99% …………… Mortgage Interest Rate

$560,000 ………. 30-Year Mortgage

$144,777 ………. Income Requirement

$3,003 ………. Monthly Mortgage Payment

$607 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$117 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$3,726 ………. Monthly Cash Outlays

-$734 ………. Tax Savings (% of Interest and Property Tax)

-$674 ………. Equity Hidden in Payment

$271 ………. Lost Income to Down Payment (net of taxes)

$88 ………. Maintenance and Replacement Reserves

============================================

$2,677 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,000 ………. Furnishing and Move In @1%

$7,000 ………. Closing Costs @1%

$5,600 ………… Interest Points @1% of Loan

$140,000 ………. Down Payment

============================================

$159,600 ………. Total Cash Costs

$41,000 ………… Emergency Cash Reserves

============================================

$200,600 ………. Total Savings Needed

Property Details for 5111 DOANOKE Ave Irvine, CA 92604

——————————————————————————

Beds: 4

Baths: 3

Sq. Ft.: 2329

$301/SF

Lot Size: 5,500 Sq. Ft.

Property Type: Residential, Single Family

Style: Two Level, Other

Year Built: 1970

Community: El Camino Real

County: Orange

MLS#: P768305

Source: SoCalMLS

Status: ActiveThis listing is for sale and the sellers are accepting offers.

On Redfin: 6 days

——————————————————————————

Absolutely Stunning Home in a Quiet Neighborhood, Two stories, 4 bedrooms with 2 Master suites and remodel bathrooms, new guard rail for balcony, wood-laminate flooring, Kitchen with granite counter top, Re-faced cabinets, New windows and doors, New A/C unit, new Heatng and A/C ducts, Stonework on the garage, the stairs, and on the balcony. Swimming pool and Spa in the backyard, with new filter and pump. No HOA, No Mello Roose, Excellent School district. Close to Library, park and shoping place. Show and Sell !!!!!!

shoping? Mello Roose?

I really find it hard to believe that people are saying, “However, all’s not dark. There are signs of gathering strength, however modest:” about the new construction market. Housing permits and new home starts are at or near all-time recorded lows. They are about 25% of what they were at the peak: http://www.calculatedriskblog.com/2011/01/new-home-sales-increase-in-december.html Not 25% off, 75% off.

I don’t know why people in Seattle might have thought their market was immune. It nearly doubled from 2000 to peak, and is only down 26% – it’s still got plenty to burn off.

Not all markets are crashing. For the most part, the areas that are crashing all saw massive price increases. What drove a lot of that was second home sales. Investors/flippers/landlords who bought properties w/loans in 2005-2007 were the first to walk. Now those homes never had a stable income backing up their price. Add to that construction that finished after the market peaked, and the outsized unemployment in those areas and you have a major overhang of supply. In areas where there is the most overhang, it will be many (20-30) before construction comes back to ‘normal’ levels.

New construction coming back is a strong sign that prices are stabilizing. I’m in SoFla now and prices are pretty much where they’ve been for about a year or two. That is crushed, but there is no active crushing still going on. The other thing is being near the ocean is different. It doesn’t mean constant appreciation, but tiny box condos are worth a lot more with views of the water than other parts of the country. It might be Canadiens who only use them 4 or 6 months a year, but someone will buy them…at the right price.

Great Book.

Is it me or are open houses few and rare right now? Spent weekend looking at open houses all over irvine and there were so few…and those that did have one seemed empty. One house, guy showing it wasn’t agent and was helping out and he said less than 10 people came and this was at 4pm on sunday…

I’ve been thinking the same. By this time last year, the main intersections were cluttered with open house signs all weekend and even some weekdays. Now you’ll find a few scattered open houses here and there or none at all. I’m thinking this spring market is going to disappoint a lot of people.

-Darth

You guys are looking in the wrong places.

All of the buyers are lined up for the new home sales.

Don’t underestimate those FCBs either!

Fair point-new homes are moving but even those are getting a little soft. My wife and I love las colinas 4 in PS and went by to see it again..the 30 min we were there a whole 4 other people showed up and there are builder incentives on some of the lots now. I am NOT saying doom and gloom but there definitely isn’t a lot of open houses.

Also I think majority of stuff bought recently and on market now are short sales with owners having no interest/desire for open houses or even decent mls pics…

Those floor plans are nice.

I liked the last one, not sure if that’s plan4.

The place was jammed when we checked out the models a few weeks back on a Sat. afternoon.

Parking was down the block with a constant stream of people coming and going.

Looked like a hive of buyer activity taking place.

These properties DEEP into El Camino Real crack me up. What was the developer thinking? To get to this house from the nearest main street (Walnut), you have to drive past a minimum of 39 other houses. That’s just to get out of your own neighborhood! That’s nowhere near as bad as the properties back on Dahlquist and Yearling up against the tracks, but it’d still be annoying. On the plus side, there are no speed bumps, so you can rush through this annoying stretch of your little drive pretty quickly. On the down side, there are no speed bumps, so everyone is flying past your house pretty quickly. This neighborhood design is just all sorts of fail.

-Darth

“No speed bumps, so everyone is flying past your house pretty quickly.”

One more reason I would not buy in a neighborhood with features like this. You’ll have all those snooty OC residents in their trendy SUVs going 50 mph. God forbid you have children who play in front of the house. But buying in Irvine is usually “for the children.” 🙂

If I lived there, I would organize my fellow homeowners with kids to pressure for speed bumps or some other type of “traffic calming”. Residential streets should be pedestrian friendly, especially for youngsters, who are not known for being cautious and alert to hazards.

One more reason I would not buy in a neighborhood with features like this. You’ll have all those snooty OC residents in their trendy SUVs going 50 mph. God forbid you have children who play in front of the house.

This is why much of Woodbridge is a sea of back-to-back cul-de-sac’s. For example, find the streets Cottoncloud and Daybreak in Woodbridge. Rather than have a single street running straight through from Blue Lake N to Earlymorn, the streets are broken up into back-to-back cul-de-sac’s, so only a small number of residents would have a reason to drive onto those streets, and they probably won’t be driving there at high speeds. This is a frequently-seen pattern throughout Woodbridge.

Conversely, no houses face onto the high-speed thoroughfares of Alton and Barranca, and the houses facing onto the relatively high-traffic Woodbridge loop are set far back from the street with common space between the houses and the private lots. These features combine speed and ease of access with relative safety and security for playing children.

But I admit that I may be biased, given that I live nearby… 😉

-Darth

…unabashed Woodbridge fan

They used the same basic idea in Westpark. It works pretty well.

In Woodbury, rather than back to back cul-du-sacs, they have short grid streets that often end in “T” intersections. It makes traffic make stops and turns which discourages drive-through traffic.

Yes, it’s weird reading about this featured house since there’s no aggressive put to the bank going on.

Seems like a lot of remodelling to do before a sale,

but then it is a 40 year-old house.

Gasp! Maybe they used the HELOCs for maintenance. 🙂

Makes me curious what the reason for selling is.

Haivng just moved to Austin TX from CA last summer, I feel this market is truely one of the unvulnerable examples of a housing market with prices soaring 10 and 15% still, and looking to appreciate even more going forward. We just closed on a 1300 sq ft rancher for 415K with 10K annual property taxes. It sold in ’06 for 299! That is appreciation!