This weekend we have another borrower who spent the house in hopes that prices would continue to rise and someone else would pay off their bills.

Irvine Home Address … 38 REMINGTON Irvine, CA 92620

Resale Home Price …… $290,000

Cast in this unlikely role

Ill-equipped to act

With insufficient tact

One must put up barriers

To keep oneself intact.

Living in the limelight

The universal dream

For those who wish to seem.

Those who wish to be

Must put aside the alienation,

Get on with the fascination,

The real relation,

The underlying theme.

Rush — Limelight

IHB News

I will be in Las Vegas all next week for a working vacation. I will have posts up every day, but my participation in the comments may be limited.

I'm sure many of you saw the news on Friday that my picture made an article in Money Magazine. Although I was not quoted much, I did provide significant help to the writer on completing the story, so including my picture was a thank you for my time and effort.

I've never sought fame – fortune perhaps, but not fame. It's been amusing to me to become well known for my views on the housing market. It's an interesting side effect of being analytical and opinionated. The IHB has been very good to me.

Housing Market News

Share This | Subscribe (Free) | Mobile | RSS | Mail news links to p@patrick.net

Patrick.net is the top search result for "housing crash" with more than 20,000 daily readers

Fri Nov 19 2010

SF Bay Area housing market weakens in October (latimesblogs.latimes.com)

The 20 Cities With The Most Underwater Houses (businessinsider.com)

House Ownership Gets Slightly More Fair as Lenders Restrict FHA Debt Subsidies (bloomberg.com)

Imagine a second mortgage 3 times the size of original mortgage (doctorhousingbubble.com)

Case-Shiller actually does include foreclousures (zillow.com)

Ireland Poised To Receive Bailout (npr.org)

Ireland will go deeper in debt to bail out German and UK bondholders (Mish)

New Zealand housing market decline continues (nbr.co.nz)

The Fed's dual mission impossible (washingtonpost.com)

Bob Rubin: Bond Market May Be Headed For Implosion (businessinsider.com)

IMF Warns Hong Kong On Rising Housing Costs (blogs.wsj.com)

Dollar to Become World's Weakest Currency', JPMorgan Says (bloomberg.com)

Man Makes Ridiculously Complicated Chart To Find Out Who Owns His Mortgage (huffingtonpost.com)

Mark-to-Make-Believe Perfumes Rotten Bank Loans (bloomberg.com)

Lender seizes desperate borrowers' houses (seattletimes.nwsource.com)

Watch A Protester Flip Out On JP Morgan Exec During Senate Hearings (dailybail.com)

FDR wasn't FDR until people were near revolt (washingtonsblog.com)

A Realtor Finally Speaks the Truth About the US Housing Market (youtube.com)

Find the real worth of property, based on rents

Thu Nov 18 2010

Orange County housing prices flat, sales sinking (ocregister.com)

House prices plunge as sellers compete with foreclosures (centralvalleybusinesstimes.com)

Canary in So. CA housing market shows sizeable price decline for 2011 (doctorhousingbubble.com)

Taking a bath inside the Vegas real estate bubble (lasvegassun.com)

Foreclosures spike in small towns (metrowestdailynews.com)

Self-enslavement to Debt Gets Tougher as Lenders Restrict FHA Mortgages (bloomberg.com)

Canada – Housing bubble a danger (cbc.ca)

Who are the bond holders Ireland is bailing out? (golemxiv-credo.blogspot.com)

Ireland: Skin In The Game (theautomaticearth.blogspot.com)

China to subsidize food after price spike (news.yahoo.com)

India Microcredit Faces Collapse From Defaults (nytimes.com)

QE2: Does Lack of Intent Matter? (timiacono.com)

The Tea Party's Foreclosure Rant Is Totally Wrong (businessinsider.com)

Time to raise taxes on the rich (latimes.com)

Banks, Congress Grapple Over Scope of Foreclosure Problem (pbs.org)

Foreclosure class actions pile up against banks (news.yahoo.com)

Sen. Kaufman Introduces Congressional Oversight Panel's Report On Foreclosures (4closurefraud.org)

Full Year of Muni Gains Wiped Out in 2 Weeks (Mish)

Bonds rise on weak housing, price data (reuters.com)

Pssst… wanna buy some California bonds? (buycaliforniabonds.com)

Thank You James M. ($10) for your kind donation.

Find the real worth of property, based on rents

Wed Nov 17 2010

S&P predicts more house price declines through 2011 (housingwire.com)

House Prices Will Keep Falling (cnbc.com)

Southern California housing market weakens in October (latimes.com)

The Appraisal Racket (slate.com)

Legal maneuver can help when lenders refuse to pay dues (articles.latimes.com)

Dodd: Robo-signing the tip of the iceberg (marketwatch.com)

Consequences of Mortgage Irregularities for Financial Stability… in Plain English (minyanville.com)

It's Back! H.R. 3808 Interstate Recognition of Notarization Act of 2010 (4closurefraud.org)

Foreclosure Renewal: A New Housing Mess? (zacks.com)

California will default on its debt says Chris Whalen (finance.yahoo.com)

Europe Fears That Debt Crisis Is Ready to Spread (nytimes.com)

Sarkozy Under Pressure as France Feels Irish Heat (bloomberg.com)

Is Europe Coming Apart Faster Than Anticipated? (gonzalolira.blogspot.com)

Is the gold bubble about to go manic? (marketwatch.com)

Commercial Real Estate: Slow-Mo Cliff-Dive Gathers Speed (Charles Hugh Smith)

Owner of NY's Lipstick Building files bankruptcy (reuters.com)

Choose a label for yourself (political masturbation) (theadvocates.org)

Thank You Kelvin S. ($50) and Susan ($20) for your kind donations.

Find the real worth of property, based on rents

Tue Nov 16 2010

U.S. Housing Excess Seen Lasting Four More Years (bloomberg.com)

Detroit real estate is a really good investment, say people selling Detroit real estate (mlive.com)

Metro Detroit house sales slide 23% (freep.com)

The Relationship between property taxes and house prices (patrick.net)

Are we better off renting? (guardian.co.uk)

Attack on the Middle Class (motherjones.com)

The Housing Dilemma: It's Holding Workers Back (npr.org)

China Real-Estate Bubble Concern Fails to Deter Investors (bloomberg.com)

China Limits Property Purchases By Foreigners (online.wsj.com)

Consumer-credit economy cannot work long term (from 2008 – earlyretirementextreme.com)

Amateur Hour at the Federal Reserve (creditwritedowns.com)

Open Letter to Bernanke from 23 Economists Complaining About QE II (Mish)

Weaker Dollar Seen as Unlikely to Cure Joblessness (nytimes.com)

Why gold is a bad investment (marketwatch.com)

Would you buy without the mortgage deduction? (sfgate.com)

US mortgage debt subsidy disproportionately helps the rich (breakingviews.com)

Puzzle: You Fix the Budget (Where is mortgage deduction ELIMINATION?) (nytimes.com)

Foreclosure company finds itself in default (tbo.com)

Thank You Matthew B. ($20) for your kind donation.

Mon Nov 15 2010

America's real mortgage rates (finance.fortune.cnn.com)

Taking Aim at the Mortgage Debt Subsidy (nytimes.com)

Projections remain grim for future U.S. foreclosures (news.xinhuanet.com)

Victims and Martyrs of the Housing Bubble (irvinehousingblog.com)

With good jobs going away, middle class downsizes (mcclatchydc.com)

Canada's coming housing bust (money.cnn.com)

Australia's "Negative Gearing" Exposed — from June (unconventionaleconomist.com)

Ireland's young flee abroad as economic meltdown looms (guardian.co.uk)

The Tidal Forces Ripping Europe Apart (gonzalolira.blogspot.com)

Fed's ability to influence market may be over (msnbc.msn.com)

Fed official sounds buyout bubble alarm (news.yahoo.com)

Japan's and China's quantitative easing examples (doctorhousingbubble.com)

QE II Bet Starts to Unravel (Mish)

Ron Paul will have Congressional Federal Reserve oversight (money.cnn.com)

Jim Grant on a possible return to the gold standard (nytimes.com)

Gold Prices Get Slaughtered, Settle Lower (finance.yahoo.com)

Who Will Stand Up to the Superrich? (nytimes.com)

What Are The Elites Holding Over Us? (lewrockwell.com)

All the banksters are chillin', cuz we robbed your punk asses for $700 billion (dailybail.com)

Typical Irvine Ponzi Borrower

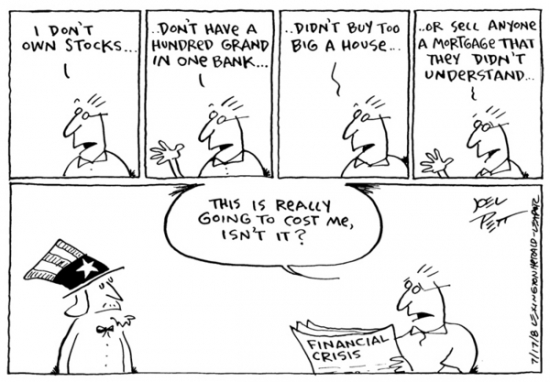

Banks spend a great deal of time and effort educating their customers on how to use financial products. Banks want customers who think borrowing money is sophisticated and wise. Banks will promote any habit that prompts borrowers to borrow more money and carry large balances.

The housing bubble must have felt like a panacea for lenders. Borrowers were taking on massive debt loads, interest income was flowing in, and the economy was prospering. Unfortunately, borrowing money to pay interest on borrowed money is a Ponzi scheme, and when creditors limit borrowers ability to Ponzi borrow, the entire systems falls apart.

The owners of today's featured property did everything banks want: They grew their debts exponentially, and as long as they could continue to borrow, they made their payments. Further, since this was a real estate loan, it was secured by property, so lenders thought they had no risk. If it weren't for the fact this is a Ponzi scheme, it would have been great.

- This property was purchased as the last bubble was deflating on 1/23/1992. The the original mortgage data is not available, but based on later loans, it is likely this was a 20% down loan. The purchase price was $151,000. The first mortgage was likely $120,800 and the down payment was likely $30,200.

-

On 5/31/2000 (the date I was married), the owners refinanced with a $140,000 first mortgage.

.jpg)

- On 6/6/2002 they refinanced with a $147,000 first mortgage.

- On 12/4/2002 hey refinanced with a $185,250 first mortgage.

- On 6/11/2004 they obtained a $125,000 HELOC.

- On 4/12/2005 they refinanced the first mortgage with a $316,500 Option ARM.

- After five years on the Option ARM, they likely hit their recast and couldn't afford the payments.

Foreclosure Record

Recording Date: 07/22/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 04/13/2010

Document Type: Notice of Default

Foreclosure Record

Recording Date: 04/13/2010

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 03/12/2010

Document Type: Notice of Default

Irvine Home Address … 38 REMINGTON Irvine, CA 92620 ![]()

Resale Home Price … $290,000

Home Purchase Price … $151,000

Home Purchase Date …. 1/23/1992

Net Gain (Loss) ………. $121,600

Percent Change ………. 80.5%

Annual Appreciation … 3.5%

Cost of Ownership

————————————————-

$290,000 ………. Asking Price

$10,150 ………. 3.5% Down FHA Financing

4.21% …………… Mortgage Interest Rate

$279,850 ………. 30-Year Mortgage

$54,765 ………. Income Requirement

$1,370 ………. Monthly Mortgage Payment

$251 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$48 ………. Homeowners Insurance

$250 ………. Homeowners Association Fees

============================================

$1,920 ………. Monthly Cash Outlays

-$123 ………. Tax Savings (% of Interest and Property Tax)

-$388 ………. Equity Hidden in Payment

$15 ………. Lost Income to Down Payment (net of taxes)

$36 ………. Maintenance and Replacement Reserves

============================================

$1,460 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,900 ………. Furnishing and Move In @1%

$2,900 ………. Closing Costs @1%

$2,799 ………… Interest Points @1% of Loan

$10,150 ………. Down Payment

============================================

$18,749 ………. Total Cash Costs

$22,300 ………… Emergency Cash Reserves

============================================

$41,049 ………. Total Savings Needed

Property Details for 38 REMINGTON Irvine, CA 92620

——————————————————————————

Beds: 2

Baths: 2 baths

Home size: 987 sq ft

($294 / sq ft)

Lot Size: 1,024 sq ft

Year Built: 1986

Days on Market: 95

Listing Updated: 40488

MLS Number: P747776

Property Type: Condominium, Residential

Community: Northpark

Tract: Othr

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Well Kept 2 bedroom 2 full bath room condo, it is a bottom floor unit with a nice patio to relax on across from the pool and play area. The bathrooms have granit counter tops . Come see this wonderful home and make it yours.

granit?

But the volume of foreclosures has gone down. In the first quarter of 2009, there were 35,321 Las Vegas properties that received a filing, compared to the third quarter of this year when 32,288 properties received a filing. It's a decrease of 8.5% over that span.

But the volume of foreclosures has gone down. In the first quarter of 2009, there were 35,321 Las Vegas properties that received a filing, compared to the third quarter of this year when 32,288 properties received a filing. It's a decrease of 8.5% over that span.

.jpg)

.jpg)

.jpg)

In Las Vegas, it is common to see properties where the debt is double the current mortgage value. When the banks forecloses, it is assured of losing at least half its loan value. If they participate in this program, they can write down the mortgage and get 50% of that loss paid for by the government. This program is obviously a giveaway to the banks. Critics are pointing out the obvious. The government wants to subsidize and encourage moral hazard.

In Las Vegas, it is common to see properties where the debt is double the current mortgage value. When the banks forecloses, it is assured of losing at least half its loan value. If they participate in this program, they can write down the mortgage and get 50% of that loss paid for by the government. This program is obviously a giveaway to the banks. Critics are pointing out the obvious. The government wants to subsidize and encourage moral hazard.