A California State Keep Your Home plan tries to funnel $2,000,000,000 to the banks; however, lenders are turning down the money due to the moral hazard of principal reduction.

.jpg)

Irvine Home Address … 7 IRON BARK Way Irvine, CA 92612

Resale Home Price …… $580,000

Well now, the eagle on the dollar says "In God we trust"

You say you won't obey me, you wanna see that dollar first

How long, dear, do I have to wait ?

Can I get you now, dear, mm, must I hesitate ?

Janis Joplin — Hesitation Blues

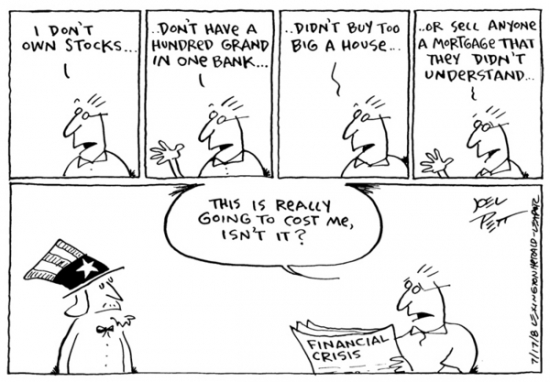

The government is itching to give banks money, but the banks have to give up a dollar first. This is more than hesitation. Banks won't take the money because they know that giving up that first dollar will encourage moral hazard guaranteed to bring down the banks in the end.

California foreclosure aid fund swells, but banks hesitate

The state's Keep Your Home plan has grown to $2 billion from $700 million. However, mortgage servicers haven't officially agreed to participate in the principal reduction part of the program.

By Alejandro Lazo and E. Scott Reckard, Los Angeles Times — November 10, 2010

Federal funding for a California plan that helps borrowers facing foreclosure has snowballed to $2 billion, enough to potentially help more than 100,000 homeowners.

Is anyone surprised that the cost of this government boondoggle has grown significantly from when it was first introduced? Has anyone seen a program like this get smaller?

But the program lacks formal agreements with the nation's largest banks and investors, and their cooperation is needed to make the proposed effort broadly successful.

Out of the three major mortgage servicers — Bank of America Corp., Wells Fargo & Co. and JPMorgan Chase & Co. — only Bank of America has told the state that it will participate in a central part of its Keep Your Home program that would reduce the principal balance of certain troubled mortgages, and even BofA has yet to sign an agreement. Fannie Mae and Freddie Mac have declined to participate in the principal reduction part of the plan.

Wait a minute. How can the GSEs fail to participate in any government program? They are in conservatorship owned and run by the Treasury department. If the GSEs are not participating, then the government doesn't truly believe this is a good idea. This is a deep acknowledgement that the entire program is symbolic politics intended to help no one.

The Keep Your Home program, which uses federal funds reserved for the 2008 rescue of the financial system, is intended for low- and moderate-income people who own only one property. To qualify in Los Angeles County, a family of four couldn't earn more than $75,600. The maximum benefit for any household participating in the program is $50,000.

The income limitation excludes nearly every loan owner in Irvine.

The biggest part of the plan gives $875 million in temporary financial help to homeowners who have seen their paychecks cut or have lost their jobs. The program would provide as much as $3,000 a month for six months to cover home payments, including principal, interest, insurance and homeowner association dues.

Another piece would provide as much as $15,000 to help homeowners get current on their mortgages, and another would provide assistance to move for those people who can't afford to remain in their homes. Most of the big banks and Fannie and Freddie have signaled that they're willing to participate with these parts of the plan.

Look at those massive bank bailouts. Who benefits from a homeowner making payments and getting current on their mortgage? The loan owner? No way. The bank ends up with all the money, and the loan owner ends up with an ongoing mortgage obligation they cannot meet. It delays a few foreclosures for a while, and gives lenders a lot of money. I wonder who designed that program?

But the most controversial part of the program, and the one most difficult for banks and investors to sign on to, dedicates $790 million to principal reduction. This would write down the value of an estimated 25,135 "underwater" mortgages, which are loans in which homeowners owe more on their properties than what they are worth.

All that money, and it is only going to help about 25,000 loan owners? The crash has impacted many more households than what this program will fix.

By making principal reduction part of the program, no bank is going to participate — which is a good thing because this program is a waste of money. Rather than participate in this program, banks would rather lose more money and avoid the moral hazard of principal forgiveness.

The California plan — as well as programs created by Nevada and Arizona — would pay lenders $1 for every dollar of mortgage debt forgiven. Experts say reducing principal on such underwater loans would go far to reducing foreclosures in the three states because home values have fallen so steeply that homeowners are tempted to walk away from their obligations.

Loan owners are more than tempted, they are walking away in huge numbers.

But the financial industry has been reluctant to participate in government-administered programs that would require them to reduce the amount that borrowers owe them.

The reason banks are reluctant to participate is because they are not in a business of giving away money. Once people believe the banks are giving away money, banks become charities and quickly go out of business. Our entire banking system rests of the belief that borrowed money must be repaid. If borrowers believe they can easily get out of repaying financial obligations with no repercussions, the banking system crumbles.

"If you can't do the principal write-down, you are limited in what you can do," said Dan Immergluck, an associate professor at the Georgia Institute of Technology, who studied the different state plans developed with the federal bailout money.

"It is one thing for them to agree not to write down principal when they are being asked to foot the whole bill," he said, "but when the states are agreeing to match this 50-50, it seems rather ridiculous of the servicers and the investors not to agree to this."

It only seems ridiculous to an associate professor who does not understand the moral hazard associated with principal reduction. The banks shouldn't agree to any principal reductions under any circumstances outside of a bankruptcy.

Diane Richardson, director of legislation for the state's housing finance agency, which created the California plan, said she expects other lenders to follow Bank of America's lead once the program is underway.

"Once the program gets going, and other lenders see how successful it is, I think others will come aboard," she said.

Does she really believe lenders will rush to write off billions of dollars in loans and encourage moral hazard?

The Keep Your Home program was slated to begin Nov. 1, but the launch was pushed back until early next year because the effort grew in complexity and size from when it was announced in February.

A government program grew in size and complexity? I am shocked.

Originally, five states in which home values had dropped more than 20% since 2006 were selected to receive $1.5 billion from the Treasury Department's Troubled Asset Relief Program. The program grew to cover states with high unemployment, which included California, and more federal money was added. California was initially slated to receive $700 million when the Treasury approved the state's plan in July. Then even more money was added, resulting in a $7.6-billion program involving 18 states and the District of Columbia.

California, which accounts for 21% of the nation's foreclosure activity, is the largest recipient of the bailout money.

How long do you think California can convince the rest of the nation to support its housing Ponzi scheme? Any money poured into California mortgages by the US taxpayer is money wasted. The rest of America should not responsible for paying the debts of squatters and squanderers in California, nor should they have their tax money diverted here to bail out the lenders that created this mess.

Homeowners in the Golden State also remain deeply underwater, according to recent data. In California, 27.9% of homeowners who owned single-family residences were underwater at the end of the third quarter, according to data released Wednesday by real estate information site Zillow.com. In Los Angeles County, 17.4% of borrowers owed more on their mortgages than what their homes were worth.

Even as the state struggles to get big lenders to sign on, the program has provoked complaints that it's a giveaway to the banks. Critics say property values have fallen so steeply that much troubled mortgage debt is not worth 50 cents on the dollar.

In Las Vegas, it is common to see properties where the debt is double the current mortgage value. When the banks forecloses, it is assured of losing at least half its loan value. If they participate in this program, they can write down the mortgage and get 50% of that loss paid for by the government. This program is obviously a giveaway to the banks. Critics are pointing out the obvious. The government wants to subsidize and encourage moral hazard.

In Las Vegas, it is common to see properties where the debt is double the current mortgage value. When the banks forecloses, it is assured of losing at least half its loan value. If they participate in this program, they can write down the mortgage and get 50% of that loss paid for by the government. This program is obviously a giveaway to the banks. Critics are pointing out the obvious. The government wants to subsidize and encourage moral hazard.

Foreclosures on these homes are so costly that the banks will come out ahead financially by writing down loan balances to keep borrowers in the homes, they contend.

"I don't think we should have to be paying the lenders," said Prentiss Cox, a professor at the University of Minnesota Law School Clinic. "We have already paid them in the form of the bailout, and it seems to me what we need is enforced loan modification, because that is in everyone's interest."

What is an enforced loan modification? All our loan modification programs are stealth bank bailouts which also encourage moral hazard.

Critics also are unhappy that homeowners who refinanced their homes to take cash out of their properties will not be allowed to participate in the program. That will exclude many African American and Latino borrowers in low-income communities who were hustled into loans they did not understand or could not afford, said Yvonne Mariajimenez, deputy director of Neighborhood Legal Services of Los Angeles County.

These borrowers were "enticed by predatory lenders to refinance and pull out equity to pay medical debt, fix their houses and the like," Mariajimenez said.

I find this kind of bullshit particularly offensive.

First, perhaps one in a thousand pulled out equity to pay a medical debt. That is always the first excuse offered, and in most cases, it is not true.

Second, although a small percentage of borrowers put a small percentage of their mortgage equity withdrawal toward "fixing" their houses with pergraniteel, the vast majority spent the vast majority of their HELOC money on cars, vacations, massages and other non-essential consumer goods.

Third, no matter what use people had for this money, why am I supposed to pay for it? Why is the US taxpayer supposed to pay for some HELOC abusers trip to Tahiti and new Porsche?

If people were enticed by evil lenders, let them experience the consequences of their poor decision making, and perhaps they will not repeat their mistake. Give them free money, and they will almost certainly spend their equity again in the next cycle and look for a bailout when the Ponzi Scheme collapses again.

"A disproportionate number were people of color that live in minority communities."

Playing the race card too? Shame on her. Lenders were not discriminating in their targeting of fools.

Getting banks to write down principal has proved difficult through government programs, though some lenders have done it through their own proprietary initiatives. The federal government's loan modification program, which is also funded by money from TARP, has always allowed loan servicers to forgive principal on troubled mortgages, but has never required them to do so.

Proponents of forgiving principal say this is a serious flaw. They contend that debt forgiveness is the only workable way to address the problem created by underwater loans. alejandro.lazo@latimes.com, scott.reckard@latimes.com

Proponents of forgiving principal are idiots. Foreclosure Is a Superior Form of Principal Reduction.

Too good to be true

I'm sure many in Irvine and the rest of America don't pay much attention to financial matters unless something changes. People will pay the same mortgage for years even if great refinancing opportunities exist. But if a sales pitch that is too-good-to-be-true is backed up with real money, the result can be a catastrophic housing bubble.

The sales pitch is easy: "fill out some loan paperwork (with the broker's help), and I will give you a lower payment and $200,000 to spend any way you want." That is a very tempting offer.

Imagine ordinary worker bees paying their bills and watching late-night TV when that sales pitch comes from a subprime lender. Call a number to get free money. The response rates must have been very high.

It only takes one mistake if it's for hundreds of thousands of dollars. And once they go Ponzi, it is only a matter of time before creditor cutoff signals an end of ignorant bliss.

-

Today's featured property was purchased on 6/19/2002 for $385,000. The owners used a $308,000 first mortgage, a $38,500 second mortgage, and a $38,500 down payment.

- On 7/16/2003 they refinanced with a $424,000 first mortgage and a $106,000 second mortgage. On that day about a year after buying, they cashed out their $38,500 down payment plus another $68,000 in booty. Not bad for one year of ownership. The extra $68,000 per year income would be a nice ownership stipend.

- On 1/19/2005 they refinanced with a $520,000 first mortgage and a $130,000 stand alone second. That is going Ponzi.

With their final refinance, they put $650,000 in debt on the property. The managed to loot $226,500.

In some ways you have to admire the swashbucklers. The swooped in, took the money, raped and pillaged the economy, and took off without a trace. For most, it must have been a very good time. A worthy adventure. Not a virtuous way to live, but it serves some people.

In the end, all those who went Ponzi is a lost home, a low credit score, and an unceremonious fall from entitlement.

.jpg)

Irvine Home Address … 7 IRON BARK Way Irvine, CA 92612 ![]()

Resale Home Price … $580,000

Home Purchase Price … $385,000

Home Purchase Date …. 6/19/2002

Net Gain (Loss) ………. $160,200

Percent Change ………. 41.6%

Annual Appreciation … 4.9%

Cost of Ownership

————————————————-

$580,000 ………. Asking Price

$116,000 ………. 20% Down Conventional

4.38% …………… Mortgage Interest Rate

$464,000 ………. 30-Year Mortgage

$111,763 ………. Income Requirement

$2,318 ………. Monthly Mortgage Payment

$503 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$97 ………. Homeowners Insurance

$179 ………. Homeowners Association Fees

============================================

$3,096 ………. Monthly Cash Outlays

-$384 ………. Tax Savings (% of Interest and Property Tax)

-$624 ………. Equity Hidden in Payment

$186 ………. Lost Income to Down Payment (net of taxes)

$73 ………. Maintenance and Replacement Reserves

============================================

$2,346 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,800 ………. Furnishing and Move In @1%

$5,800 ………. Closing Costs @1%

$4,640 ………… Interest Points @1% of Loan

$116,000 ………. Down Payment

============================================

$132,240 ………. Total Cash Costs

$35,900 ………… Emergency Cash Reserves

============================================

$168,140 ………. Total Savings Needed

Property Details for 7 IRON BARK Way Irvine, CA 92612

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 1,900 sq ft

($305 / sq ft)

Lot Size: 3,328 sq ft

Year Built: 1966

Days on Market: 286

Listing Updated: 40469

MLS Number: P719994

Property Type: Single Family, Residential

Community: University Park

Tract: Othr

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Back on the Market!!!! Bank already approved for $580,000, they wont take any less. This 2 story home is located in a nice quiet area of Irvine. Features wood and ceramic floors, granite counter tops, the backyard opens up to the park which is near the pool, 2 fireplaces and much more. The home is in excellent condition and a Must See. Thank you and Good Luck.

IR, you are mistaken in your view of banks. They restructure debt all the time, which is exactly what a principal reduction would be. Does every business whine that Trump gets a principal reduction on his debt, but they don’t? Sometimes the biggest restructuring are in bankruptcy court which is what some Democrats wanted with cram-down legislation. Debt getting restructured is a more reasonable part of banking than the massive bailouts, debt guaranteeing and other government actions already taken.

You’re also somewhat wrong about California fleecing taxpayers. There was a Fox commenter who said that CA should take no more money from DC, completely ignoring that Californians send a lot of money to DC. I don’t know how much things have changed, but in 2005, CA got $0.78 back from DC for every dollar they sent in taxes.

I would agree that much of the foreclosure mitigation is really about just keeping people paying for as long as possible, when it’s in their best interest to give up, hand over the keys and become renters. We already have a program that helps people who have lost their jobs pay their mortgage/rent – it’s unemployment insurance.

Did anyone who objects to QEII ever complain about the Greenspan put? AG lowered rates at every sniff of the Dow falling. They also were quiet as investment banks cranked out trillions as they cranked up their leverage ratio (banks can create money, not just the fed).

Thanks for pointing this out.

For some reason, when the little people go through bankruptcy and have debt restructured, it’s a matter of serious concern due to moral hazard, but when Donald Trump or William Randolph Hearst does it, it’s a sensible business decision.

I understand objections to making real property subject to cramdown when the loans were written under a belief that real property is off the table in bankruptcy court, but I believe that the moral hazard happened the day these horrid loans and HELOCs were handed out.

Mass cramdowns look better than what has actually transpired. With cramdowns, there is no foot dragging by banks, debt levels are reduced immediately, and property values quickly return to a sensible multiple of incomes, allowing sensible renters to purchase using cash or small mortgages.

Oops, I forgot. I should have written sensible renting FAMILIES. See? Now they look even more deserving!

Cramdowns would also come at less cost to taxpayers.

Odious? You bet! But more sensible than what has transpired, and in line with how rich people and corporations do business – and, yes, I know this is far from a ringing moral endorsement.

Agreed 100%, but what *is* happening is that banksters will not give principal reductions because they know the government already will cover their losses.

Yes, it is not good to do principal reductions, yet when the property is foreclosed, WE pay for the losses, and the new buyer picks up the property at what the OLD owner should have been re-financed on (as long as they can meet realistic DTI ratios).

To top it all off, we have the citizens vilifying the owners (moral hazard!!! yet companies routinely walk away from investments and it’s all good). All the BS needs to stop, but it will not because we pay for it both ways. Bankster losses, and kicking out people on the streets. The house of Morgan should be proud. Anyone notice the complete takeover by east coast banks? Every corner has a Chase, every single 7-11 has a Citi-Bank.

Where do the principal reductions stop? If banks reduce to the current FMV, what happens if/when prices continue to drop? Is there a perpetual reduction system in place? Do you limit someone to only 1 reduction? Why give them 1 reduction, but not 2, or even 7 if prices continue to drop?

Why isn’t the bank/investor entitled to determine how to best mitigate its losses after a borrower has defaulted?

Had we not had massive gov’t intervention in the banking sector, gov’t would have no say is principal reductions. But we are where we are. My preferred method for the reductions is bankruptcy court, like my linked article re:Trump. If Trump (the business) gets to renegotiate his debt, what’s to stop him from doing it over and over again (bad example, because that is what he does). You can’t file for bankruptcy as rapidly as you are implying.

Reductions won’t work for everyone, but they would for some, and that has the potential to help both banks and tenants/homeowners. For those that say if this were a good idea, banks would already be doing it, consider how we got to where we’re at.

@ Honcho – I’m not sure where principal reductions stop Honcho, I have been against any principal reductions my entire life….until I witnessed the sellout of America with the bankster bailout. After that, I’m all for average, hard working americans being entitled to the SAME TREATMENT as the banksters…namely. if you are going to give the banksters our money, at least treat us the same.

Why spend all that money to evict someone, sit on the property and leave it empty and blighted, and then sell it at 50-70% of what was owed. How many thousands upon thousands of homeowners would willingly stay in their properties if DTI’s could be worked out to a reasonable amount? A huge majority would be my guess, or else they wouldn’t be in the house that long anyhow. The speculators are long gone as they understood their goal…..investment.

The whole thing sucks of crony capitalism. Boot the defaulters (who were snookered into the bubbled housing market), sit on the property to maximize losses…which in turn the taxpayers cover, and then refuse to release the property, or better yet, only release it to a few investors buying all cash. This will be at 40-50% of what was owed, allowing the INVESTOR, but not the homeowner, to reap the profits…if any.

The whole damn system makes me sick and that’s why I no longer victimize those whom are losing their house. Yes, plenty of a-holes were greedy, but there are thousands of us out here who simply got screwed by government shenanigans and a complete failure of financial regulation to protect us (Hi Christopher Cocks from Newport Beach!, you should be in prison)

Swiller writes:

> I have been against any principal reductions my entire life

“No principle reductions!” were your first words as a baby, then, I take it? 😛

[Sorry, principle -> principal.]

Restructuring happens when you foreclose. However, when you foreclose, you get punished for not paying your mortgage. Then, somebody else, gets a chance to be responsible and get a good deal.

When you do principal reduction. The person that did not pay their mortgage, and likely was irresponsible, gets rewarded.

So, how is debt reduction better than foreclosure? It is not.

We are in desperate need of financial education in this country. “The program would provide as much as $3,000 a month for six months to cover home payments, including principal, interest, insurance and homeowner association dues.” However the maximum income is $75,000. Our leaders still don’t get it.

Are you kidding me? Considering the average American’s other debt service, particularly those that are going to need a program like this, what message does that send?

Logical and responsible fiscal policy will lead to logical and responsible behavior. Although lending restrictions are getting tighter, we still have illogical and irresponsible fiscal policy. When will we learn?

Nothing. Collectively we’ll never learn anything that is contrary to human nature.

The responsible will always pay for the irresponsible.

Greed wll always influence people.

History will always repeat itself.

I caught that too. $3k/mo @ $75k/yr income makes a DTI of 48%. Maintaining that DTI is detrimental to everyone. It would be best to transition that person as quickly as possible to a situation where their housing payments are closer to $1500/mo. My family’s housing costs are about $3600/mo…but at a DTI of ~15%. $3k/mo on housing is a luxury.

We have a good national program to do something like this – it’s unemployment insurance, and people have been able to collect for nearly 2 years. If you haven’t been able to figure out how to get your housing situation corrected after 2 years, you shouldn’t really get more options.

Exactly—

While I had heard some of the debate, the time one can collect UE benefits may go back down to ~6 months, which is not a lot of time. The money set aside for HAMP (not a good program) could be applied to extend UE benefits (a good program), or at least taper the drop-off (go from 99 to 88 to 77 … over a year’s time).

I am puzzled as to the consequences of the end of the 99-week unemployment payouts. It’s directly deflationary, but what will it affect first/foremost? There don’t seem to be direct near-term effects on real estate.

People on unemployment aren’t house hunting, so the direct effect on housing demand will be nil. Of the homedebtors on unemployment, more will default, but there is already so much inventory backed up, and so many delays on the part of the banks, that I don’t see a short-term effect on housing supply.

So, for the moment, this is just a downer for aggregate demand.

Longer term, however, this does not help house prices. This will add an extra boost to the housing supply in mid-2012. It’s only changing the shape of the supply flood, and not the total volume: all of these folks were headed to foreclosure, anyway.

Or is there something else here? Will delinquencies kick up enough to crush the banking cartel and break the shadow-inventory dam? Could there be a quantum bump in supply?

The program would provide as much as $3,000 a month for six months to cover home payments

Government hates renters.

That is why I would give up on the program IR mentions and improve(boost) unemployment insurance. Unemployed & a home’owner’ or renter, shouldn’t matter. But then the people with jobs, but who could never afford their payments might complain.

“First, perhaps one in a thousand pulled out equity to pay a medical debt.”

You seem to have completely missed the massive syphilis epidemic in Irvine.

Substance abuse treatment. The dealer doesn’t know from doors – a lot of HELOC money went to rebuilding the walls he crashed through – but he brings the happy juice.

“Oh yeeaaaah!”

“Hilarious” as ever, Kirk.

There’s another program available that requires a principal reduction – the FHA Short Refi. http://www.hud.gov/offices/adm/hudclips/letters/mortgagee/files/10-23ml.pdf

It requires a 10% write-down by the first and allows underwater homeowners to refi at the current low rates. There are no income limitations or “hardship” requirements. The stated goal is to minimize foreclosures by making mortgage payments more affordable and to mitigate strategic default. The program runs through 2013. We’ll see how successful it is.

If this FHA loan were available with no 10% first write-down, I’d apply today. However, as currently constructed, my first would be highly unlikely to consider writing-down 10% just to get my fully-performing loan that really isn’t underwater (the 2nd is) off of their balance sheet.

How about reversing the equation, and making pain go 2 ways….

Grandfather in initial interest rate before adjustable rate hikes. Wipe out the “Due on Sale Clause” in mortgage loans if they cant qualify for new loans. Force people to move out of their expensive unaffordable homes to a pool of cheaper more affordanble “Homes of their own”.

In exchange for any writeoffs for the affordable loans, new loan agreements provide equity sharing at sale (to reimburse Uncle Sam)

People have managable mortgage payments, people resume paying their loans, Uncle Sam is an equity partner and can see a future pay back

Movers, Agents, Construction has a bonanza

Higher end homes get decimated and return to more affordable levels when the vacancy rate shoots to high levels as there is a mass move down.

We find the bottom faster

Economic crisis solved

“Force people to move out of their expensive unaffordable homes to a pool of cheaper more affordanble “Homes of their own”.”

Which arm of thugs will enact this? OCSD? FBI? CIA? Military Police? U.N. Security forces?

Maybe we can force people to live in horse stalls like we did to Japanese-Americans during WWII.

“Force people to move out of their expensive unaffordable homes to a pool of cheaper more affordanble “Homes of their own”.”

I think by this he means that if people cannot afford the fully amortized payment at the prevailing interest rate foreclose. This makes perfect sense and why we have/had the system that we had/have.

By, “to a pool of cheaper more affordable homes,” I believe, that he means rent, like thousands of responsible Americans have been doing while waiting for this disaster to be over.

Of course, if once the property is foreclosed on, the seller still refuses to leave, they can be evicted and this can be enforceable through court and then police action if necessary.

I am making some assumptions on what Tom meant, however, ultimately there is a reason the foreclosure process is in place, the fact that the banks are not following it while our tax dollars are subsidizing their poor choices and bad bets while artificially inflating the prices of the homes that many responsible American’s want to purchase and sacrificing the future of our children is not acceptable.

The argument that compares affordable rental units and draws parallels to WWII atrocities is exactly what the banks want to make people picture when they think about those living in McMansions they can’t afford getting foreclosed on and is playing a role in this debacle that is making average American’s pay for the bad bets of Wall Street elite. In reality, even if one cannot afford a $5000/month mortgage, they can still afford $2500/month rent and most likely live in a similar property and not a horse stall.

Interesting that all of a sudden we credit banks with considering moral hazard as a factor… I don’t think that ever entered their minds when they said no to the program, there’s nothing in history that indicates that was ever a factor in banks making fiscal decisions.

Cramdown seems to make sense to everyone directly affected, although at the cost of moral hazard. What will that do to housing prices though? Will it artificially prop up prices again? I don’t see how cramdown would return prices to sensible multiples, as HydroCarbon suggested…

I’m not sure if moral hazard is the correct term, however, I think that there is evidence that banks are avoiding these types of programs because they are likely to encourage more strategic default.

I was just working on a short sale transaction that had a 2nd for over $200,000 that will be completely wiped out at foreclosure, however, the credit union refused the 20k+ offered by the first. The explination the negotiator hired by the listing agent gave was essentially that the credit union was morally opposed to allowing the seller to short sale and not have the foreclosure in their record. They wanted the seller to pay via foreclosure rather than short sale.

I could speculate on the real reason. However, apparently to them it was worth 20k to not allow the short sale, however, more than that, it’s possible these banks want to send a message to strategic defaulters. Who knows what they were thinking, but this is what the negotiator said she was told.

Interesting explanation by the credit union, and maybe an earnest one considering that CUs seem to have been largely immune from the credit fallout. Having said that, I too suspect there is an underlying reason other than teaching homeowners a lesson.

What underlying reason(s)?

Go ahead. Speculate.

They could still claim the asset at $200K.

I think that’s the best bet.

The last loanowner purchased with a sub-prime lender, then refi, refi, refi, refi’d again all with companies that imploded some time ago. This property was worked harder than a $2.00 hooker during Fleet Week.

Was this loanowner taken advantage of by predatory lenders? Methinks it’s the other way around.

My .02c

Soylent Green Is People.

Was it a “COLORED” debtor?! I didn’t realize how racist these predator lenders were! Seeking out people “of color” who had medical bills! GASP!!

I report, you decide… I obviously hit a hot button…

—–Original Message—–

From:

Sent: Wednesday, November 17, 2010 10:26 AM

To: Lazo, Alejandro; Reckard, Scott

Subject: piece on principal forgivness

Sirs:

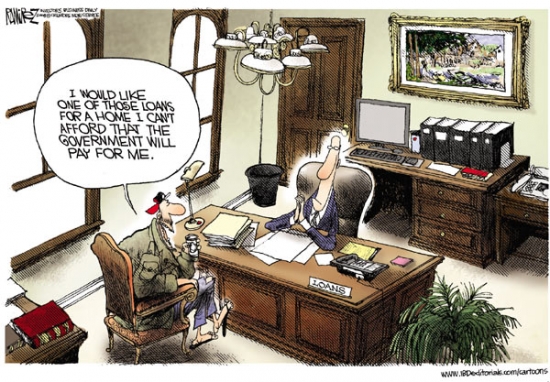

Was it possible to write a more slanted piece? Perhaps instead of criticizing lenders for not participating in principal write downs, you could have also presented the shadow side of principal write downs, namely, the moral hazard created by doing so. Foreclosure or bankruptcy provides principal write downs AND consequences for poor decision making. Principal write downs outside of foreclosure or bankruptcy encourage people to take out loans they cannot afford and allows them to feel that they can indiscriminately swipe money from tax payers (see attached cartoon). With unbalanced articles like these, is it any wonder that the LA Times and other major newspapers are seeing their circulation numbers swirl down the drain?

V/r,

Sir:

I think moral hazard is a legitimate point – if not a bit of an abstract one. I mean, like it or not, we have bailed out the banks and already allocated this money to bail out the homeowners. The story was more about how this program is struggling to get going.

But sure, we could have mentioned what, in my opinion, is a fairly obvious and abstract point: moral hazard. But there is also a lot of stuff we could have mentioned that didn’t make it into a fairly succinct newspaper article – which was actually long by today’s standards. I don’t think that made the story “slanted” in any way, I really don’t.

On a personal level, your email is thoroughly obnoxious. How about congratulating me for putting together a complex story in a readable fashion so that the public, i.e., you, can have this kind of discussion in the first place? No other media outlet is stepping up and doing stories on the program. Why not? It’s a complicated matter that requires some expertise and, absent that, a lot of hard work to get right.

Because of the Internet, stories produced by the LA Times and other major news organizations are more widely read than at any point in human history. But yes, because of the Internet, the traditional revenue model of print media is suffering and circulation is declining. Don’t confuse the two things.

Take care. And please understand when I don’t respond to anything else you may write to me.

Alex.

IR, I think you should delete this guys real name, phone number, and email.

The article writer makes a reasonable point. You can’t beat the dead horse called “moral hazard” without getting parochial. If people don’t understand the moral hazards involved after years of bailouts and proposed bailouts, maybe they have they are choosing to ignore it.

True, the moral hazard was created a long time ago.

It should be well understood by now that the responsible pay for the irresponsible.

The responsible continue to be responsible.

LOL!

“How about congratulating me for putting together a complex story in a readable fashion so that the public, i.e., you, can have this kind of discussion in the first place? ”

He thinks he has done all of us retards a big favor! Now we can figure it all out thanks to his amazing research!

“I would like one of those loans I can’t afford so the gov will pay if for me” lmao at that joke, sad part its true.

Why isn’t this program entitled “Keep the Bank’s Home”?

Thank you and Good Luck.

LOL! WTF?

Forgot to ask: what’s up with the super-goofy Photoshop effect on the kitchen picture? Does that go with the listing? Clicked over to the commercial IHB site but that picture didn’t appear.

We sold our first house and moved up in 2007. I had to pay half of the profit to my ex husband. We put 164K down on a 640k house and took a 500k loan. The house is now worth 320k.We could keep paying now but are walking so we can start over. Our house wont be out from under when we can no longer work or manage the stairs. We never refinanced ever in either house. We are victims of the massive fraud the banks perpetuated and we are walking all homeowners in California this underwater should do the same. We had perfect credit until this. We cant recover financially if we stay. We are in our early 50’s. This loss was not a normal market loss the bubble was created by these unscrupulous immoral lenders and the modifications they offer people will just prolong the pain. They should write down the loans and it would be over. I feel no shame. My only sin was wanting a bigger house for my large family (we have foster kids)Dont take a modification that keeps you enslaved forever and never allows you to get back on your feet financially. Homeowners take the pain now and start over as these morally corrupt bankers are not going to do the right thing and share the loss their fraud created with you.