realtors are a whining chorus loudly proclaiming lenders are to blame for failing to inflate a replacement housing bubble.

Irvine Home Address … 12 VIENTO Dr Irvine, CA 92620

Resale Home Price …… $275,000

You've got a little worry,

I know it all too well,

I've got your number,

But so does every kiss-and-tell

Who dares to cross your threshold,

Or happens on your way,

Stop laying blame

You know that's not my thing

R.E.M. — Bang and Blame

Most often blaming others is a way to dodge taking personal responsibility. realtors are suffering right now. Transaction volumes are off and prices are well below what they were a few years ago. Since realtors have disavowed any responsibility for the role their amoral sales practices played in inflated the bubble, they are now blaming banks for failing to inflate a new one.

It's a low risk position for realtors to take. It isn't their money at risk. Lenders must put their money at risk to make loans which results in a real estate transaction and realtor commission. Since lenders don't want to lose any more money, they are being careful about who they loan it to. realtors don't understand that. Or worse yet, they probably do understand, but they just don't care. They just want another commission.

Realtors blame banks for slow recovery

November 11th, 2011, 9:30 am — posted by Jeff Collins

Banks.

That’s the top obstacle to the housing market recovery, Realtors gathered for an annual conference in Anaheim said.

Specifically, tight credit, which makes it hard for many homebuyers to get a loan;

Credit is tight by bubble standards, but it isn't tight by historical standards. Lenders don't want to lose more money, so they don't want to give loans to people who won't pay them back.

and inefficient practices, which make it hard to process loans and short sales on time.

It isn't inefficient practices which is slowing up short sales. It's the fact that lenders are trying to squeeze money out of their deadbeat borrowers who don't want to give them any.

If your a bank, and a borrower is asking you to accept a $150,000 loss, wouldn't you ask for some of the $50,000 they have in other assets? Borrowers are trying to keep their other assets and have the bank eat the entire loss on the short sale, and banks aren't willing to do it. This standoff continues until one party or the other gives up. The bank may decide to foreclose, or the borrower may walk away from the debt and dare the lender to sue them. It's not a process designed for expediency.

We caught up with a handful of Realtors at a 5K run that started this week’s activities at the National Association of Realtors meeting at the Anaheim Convention Center. We asked what they believe is the greatest impediment to recovery.

First, that isn't a good question. What is recovery? When prices stabilize at rental parity, I will consider the market “recovered.” I suspect most realtors and loan owners would define “recovery” as when prices regain their peak. The only thing that will make that happen is the passage of time and wage inflation or a new housing bubble. realtors want a new housing bubble.

Here’s a sampling of what they said:

Renee Holt, Keller Williams Realty, Oviedo, Fla.: “Banks. Banks don’t have the system to help homeowners recover, and they’re not hiring and/or training employees to make the process less painful for homeowners.”

What obligation to the banks have to make their losses less painful for loan owners? These people cost them billions of dollars, and the banks are supposed to be worried about the loan owner's pain?

Former California Association of Realtors President Ann Pettijohn, Oak Tree Realtors in Orange: “Banks,” she said, echoing Holt. “They’re making it tough to borrow.”

Yes, they only want to loan money to people who can pay them back. It's a good business practice they abandoned during the housing bubble.

Former New Jersey Association of Realtors President Chris Clemans: “Before, (lending standards) were too loose. Now they’ve gone to the other side.”

No, they haven't. In the 1980s, there was FHA and 20% down conventional financing. That's it. Today we still have 5% conventional financing, we allow low FICO scores (above 580 FHA can put 3.5% down), and many fringe qualifying standards we did not have 25 years ago. Credit is not tight by historical standards, and the loosening of credit standards over the last 25 years was not innovation, it was folly.

Cindy Wu, Keller Williams Realty, Encino: “It’s really confidence” that’s holding back the recovery. “People are just very pessimistic these days.”

Buyer sentiment does play a minor role, but the real problems are a depleted buyer pool, and the lack of a move-up market caused by a lack of equity.

Mark Gavin, director of administrative services for the Iowa Association of Realtors: “It’s more than one thing, but probably some of the contributing factors are the ability to get loans. They’ve tightened up some of the restrictions and limitations on getting loans. … We want responsible lending practices, but we don’t want it to be over-restrictive.”

Fair enough, but we should also let the people whose money is at risk determine what standards are not over-restrictive.

2011 National Association of Realtor President Ron Phipps: “Our number one strategic priority is a reliable flow of mortgage capital.

“We live (in an industry) that requires mortgage capital, and our biggest single priority and challenge this year was making sure that was reliable and that the credit standards and underwriting standards move more toward equilibrium, rather than the extremely vigorous dynamics that we have right now.”

Every quote I have read from Mr. Phipps has been complete and utter bullshit, and the above is no exception. What does this mean, “credit standards and underwriting standards move more toward equilibrium, rather than the extremely vigorous dynamics”? equilibrium? vigorous dynamics? To me it reads like a rectal extraction.

What he means to say is that he has been lobbying hard to get free money flowing again to inflate a new housing bubble, and he has failed.

We also asked what the mood of the industry is as we enter a seventh year since the housing slump started. Here are a few responses:

Art Carter, CEO of the California Regional Multiple Listing Service in San Dimas: “I’d say the mood of the industry is acceptance and realization that we’re not near the bottom yet.”

Wow! I don't see that attitude in the industry at all, despite the fact it is the truth.

Rob Arrietta, Corona associate broker and president of CRMLS: “Distressed properties are on everybody’s mind in the last couple of days. … (But if) you work hard in this business, and you’ll survive and you’ll thrive.”

Yes, hard work and perseverance will win in the end. realtors should stop looking for people or conditions to blame and work harder to serve their customers. That will contribute to their success.

Hunt Cooper, communications and education director for the Kentucky Association of Realtors: “In Kentucky, we didn’t see the spikes and the down side. So we’ve been pretty strong — strong and steady. Sales have picked up over the last quarter.”

The non-bubble markets of flyover country have not been suffering like we have. realtors in these markets probably wonder what everyone here is whining about.

44 months of squatting on a 2002 rollback

Today's featured property was purchased for $378,000 on 11/7/2003. The owners used a $302,300 first mortgage, a $75,550 second mortgage, and a $150 down payment.

On 8/3/3005 they refinanced with a $424,000 first mortgage, and on 3/1/2006 they obtained a $89,000 HELOC. They quit paying the mortgage at the latest in January of 2008.

Foreclosure Record

Recording Date: 12/08/2008

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 08/25/2008

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/16/2008

Document Type: Notice of Default

It looks as if the house was purchased by a third party on 9/27/2011 for $275,000. That makes this a closed sale on a 2002 rollback.

——————————————————————————————————————————————-

This property is not available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Irvine House Address … 12 VIENTO Dr Irvine, CA 92620

Resale House Price …… $275,000

Beds: 2

Baths: 2

Sq. Ft.: 1419

$194/SF

Property Type: Residential, Single Family

Style: Two Level, Cape Cod

Year Built: 1979

Community: Northwood

County: Orange

MLS#: S624194

Source: CRMLS

Status: Closed

——————————————————————————————————————————————-

Proprietary IHB commentary and analysis ![]()

Resale Home Price …… $275,000

House Purchase Price … $300,000

House Purchase Date …. 10/18/2002

Net Gain (Loss) ………. ($41,500)

Percent Change ………. -13.8%

Annual Appreciation … -0.9%

Cost of Home Ownership

————————————————-

$275,000 ………. Asking Price

$9,625 ………. 3.5% Down FHA Financing

4.06% …………… Mortgage Interest Rate

$265,375 ………. 30-Year Mortgage

$84,075 ………. Income Requirement

$1276 ………. Monthly Mortgage Payment

$238 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$57 ………. Homeowners Insurance (@ 0.25%)

$305 ………. Private Mortgage Insurance

$295 ………. Homeowners Association Fees

============================================

$2172 ………. Monthly Cash Outlays

-$199 ………. Tax Savings (% of Interest and Property Tax)

-$378 ………. Equity Hidden in Payment (Amortization)

$14 ………. Lost Income to Down Payment (net of taxes)

$54 ………. Maintenance and Replacement Reserves

============================================

$1,663 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,750 ………. Furnishing and Move In @1%

$2,750 ………. Closing Costs @1%

$2,654 ………. Interest Points

$9,625 ………. Down Payment

============================================

$17,779 ………. Total Cash Costs

$25,400 ………… Emergency Cash Reserves

============================================

$43,179 ………. Total Savings Needed

——————————————————————————————————————————————————-

.png)

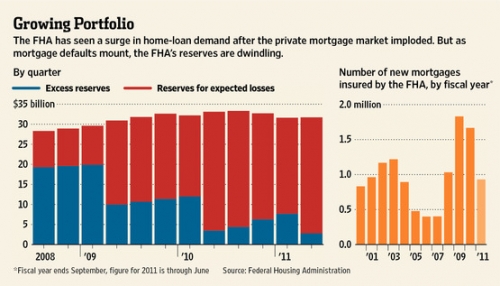

Despite the fact that the FHA should raise its downpayment requirement and its insurance premium, neither one is going to happen because the effect it would have on the housing market would be too politically unpopular. We are already having difficulty finding wam bodies with jobs to clean up the foreclosure mess. If we make the qualified buyer pool even smaller, the market bottom and ultimate recovery would be even further off into the future.

Despite the fact that the FHA should raise its downpayment requirement and its insurance premium, neither one is going to happen because the effect it would have on the housing market would be too politically unpopular. We are already having difficulty finding wam bodies with jobs to clean up the foreclosure mess. If we make the qualified buyer pool even smaller, the market bottom and ultimate recovery would be even further off into the future. They are only expecting to lose $31 billion on its trillion dollar portfolio? Since the vast majority of these loans were underwritten with 3.5% down payments, most of this portfolio is underwater. There is no way they will only lose 3% on a trillion dollar portfolio of underwater loans.

They are only expecting to lose $31 billion on its trillion dollar portfolio? Since the vast majority of these loans were underwritten with 3.5% down payments, most of this portfolio is underwater. There is no way they will only lose 3% on a trillion dollar portfolio of underwater loans.

FANTASTIC END UNIT TOWNHOME NESTLED IN A VERY PRIVATE LOCATION IN THE HIGHLY SOUGHT AFTER WOODBRIDGE PARKVIEW COMMUNITY. THIS WONDERFUL HOME HAS IT ALL. LOVELY FLOOR PLAN WITH 3 BEDROOMS, 2.5 BATH, COZY LIVINGROOM WITH FIREPLACE, CATHEDRAL CEILINGS, PLANTATION SHUTTERS, OPEN KITCHEN WITH DINING AREA AND GOOD SIZE PATIO. CLOSE TO SHOPPING, SCHOOLS, ENTERTAINMENT, FREEWAYS AND MUCH MUCH MORE!!

FANTASTIC END UNIT TOWNHOME NESTLED IN A VERY PRIVATE LOCATION IN THE HIGHLY SOUGHT AFTER WOODBRIDGE PARKVIEW COMMUNITY. THIS WONDERFUL HOME HAS IT ALL. LOVELY FLOOR PLAN WITH 3 BEDROOMS, 2.5 BATH, COZY LIVINGROOM WITH FIREPLACE, CATHEDRAL CEILINGS, PLANTATION SHUTTERS, OPEN KITCHEN WITH DINING AREA AND GOOD SIZE PATIO. CLOSE TO SHOPPING, SCHOOLS, ENTERTAINMENT, FREEWAYS AND MUCH MUCH MORE!!