The one market with the fewest foreclosures relative to its mortgage delinquency is New York City — the homes of banksters are being spared foreclosure and the resulting declines in value.

Irvine Home Address … 208 MONROE #152 Irvine, CA 92620

Resale Home Price …… $415,000

Start spreading the news, I'm leaving today

I want to be a part of it – New York, New York

These vagabond shoes, are are longing to stray

Right through the very heart of it – New York, New York

Frank Sinatra — New York, New York

One of the most irritating behaviors I have witnessed during the deflation of the housing bubble is the way banksters have chosen to foreclose in some markets and allow delinquent mortgage squatters to flourish in others. The worst market in the entire country for shadow inventory, the place with the most delinquent mortgages and the lowest foreclosure rate is where the banksters live: New York City.

There is only one plausible explanation for this phenomenon: banksters are choosing not to foreclose in places where it would negatively impact the value of their personal real estate.

If pressed on the issue, they would likely spout some nonsense about New York City being different. It's special, everyone wants to live there, and so on. Markets obey laws of supply and demand, and right now, demand for overpriced NY real estate is very low, and the supply of shadow inventory is very high. Of course, that is shadow inventory. If they simply leave that inventory in the shadows, they can balance supply and demand and meter out these properties as the market can absorb them — at least that's the theory.

Strategic default will take over

There is one basic flaw with their plan. As more and more people stop paying their mortgage and don't get foreclosed on, the people who are paying their mortgage realize they are being foolish, so they stop too. Think about it; if you can possess property forever with or without paying for it, why would you pay? Moral obligation? On Wall Street?

Strategic default is usually associated with a beaten down market like Las Vegas where it is foolish to continue paying a $300,000 mortgage on a $100,000 house. However, at the other extreme is New York City where all consequences for default have been removed. And mortgage default has major benefit to someone putting 40% or more of their income toward a mortgage. Each person who decides to quit paying gets to keep their house, and they get to keep the money they used to put toward paying down the mortgage. For many it's like a 40% raise in pay.

We are quickly approaching a tipping point in New York City where residents recognize it is in their best interest to default and pocket the payments. Once that becomes common wisdom, strategic default will become the norm just as it has in Las Vegas. If lenders continue to allow these borrowers to squat, it will eventually rise to the level of entitlement on Wall Street. Everyone who works in New York City in finance will look to their company's REO for their housing and expect it to be free. If nobody else has to pay, why wouldn't they expect it for nothing?

Strategic default is not only a phenomenon of beaten down markets. If mortgage delinquency becomes rampant because borrowers know the repercussions are non-existent, strategic default will take over there too.

Why New York City Home Prices Are Headed for Collapse

By Keith Jurow May 31, 2011 12:15 pm

Editor's Note: Keith Jurow is the author of the MVP Housing Market Report.

Readers of mine know that I have written two articles about why a collapse in Queens home prices was almost certain (see A Housing Price Collapse in Queens New York Is Almost Certain and Queens Housing Market, Like Much of NYC, Is Headed for a Crash). Yet no collapse has occurred. Was I wrong?

I never stated that the collapse was imminent. I said I had no way of knowing when the banks would start foreclosing on all those delinquent borrowers. But they will. Now is a good time to take a look at why the entire New York City (NYC) market is headed for collapse.

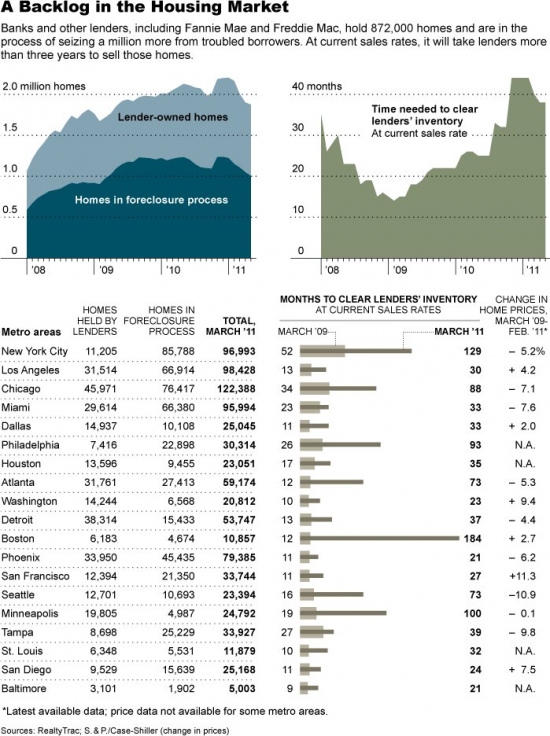

Based on the volume of shadow inventory in New York City, the housing market should collapse, but the banksters are determined to prevent this from happening even if that means giving away properties to delinquent mortgage squatters. New York City may be on its way to a decade-long slow deflation. If they sell the properties slowly enough, incomes will eventually come back. Right now it would take an astounding 129 months to clear out their backlog.

First, let’s see what’s happened to home prices around the country since the expiration of the first-time buyer tax credit. The best source for this is Clear Capital and its excellent Home Data Index (HDI) Market Report.

Since the end of last summer, home prices nationwide have plunged by an average of 11.5% through April 2011. Some of the worst major metros have fallen even more. Talk of home prices bottoming has stopped. For a year, I’ve been saying that there is no housing recovery in sight.

Yet NYC median home prices have held up pretty well during this period. Why?

Prices have held up in New York City for the same reason they are holding up here in Orange County: lenders are not foreclosing on delinquent mortgage squatters.

In my two articles about Queens, I pointed out that the servicing banks are simply not foreclosing on delinquent homeowners. They aren’t even putting them into default (NOD). Take a look at this chart from the first article showing the rise in serious delinquencies in that borough.

A year ago, 11.2% of all Queens homeowners with a mortgage were delinquent by 60 days or more. I obtained these figures from TransUnion, the credit-reporting firm which puts out a quarterly mortgage delinquency report based on its database of 27 million anonymous credit reports. In the first quarter of 2008, that figure was only 3.9%.

That 11.2% figure equaled roughly 25,000 seriously delinquent homeowners. This number was confirmed by a fairly recent NY Federal Reserve Bank report which stated that 10% of all first liens in Queens were delinquent by 90 days or more. Remember, these figures are for only one of five boroughs in NYC. The NY Fed’s report also showed a 90+ day delinquency rate of 11.8% for the Bronx and 9.5% for a Brooklyn.

The delinquency rates in the New York City boroughs are higher than the rest of the nation. With 25,000 delinquent mortgage squatters in Queens and a liquidation rate of less than 250 per month, it will take over 100 months to clear out the existing inventory.

Are the banks making any attempt to foreclose on all these delinquent homeowners who are living rent-free? You judge.

Let’s take a good look at this amazing graph. New York City has roughly 8 million residents, easily the largest city in the nation. The graph from PropertyShark breaks down the new foreclosure auctions (actually sheriff sales) scheduled by borough. You can see that the vast majority scheduled are for Queens. None of the other four boroughs exceeded 150 scheduled auctions in any month since the end of 2008.

Notice carefully that the peak number for Queens starts to decline well before the robo-signing mess occurred last fall. Sorry, that problem had nothing to do with the bank’s refusing to foreclose on delinquent homeowners. It did provide some cover for the banks, though.

Lenders will use whatever news story that's available to continue to put off foreclosure. They are trying to buy time because they know prices will crash if they liquidate. If they don't liquidate, their borrowers will figure it out and strategically default.

The plain truth is that for more than two years, the servicing banks have made no effort to foreclose on these seriously delinquent borrowers throughout the Big Apple. Take a look at these incredible figures for the number of NYC REOs for sale on foreclosure.com on May 30.

Repossessed Properties on the Market in NYC — May 30

- Queens: 232

- Brooklyn: 95

- Bronx: 76

- Staten Island: 75

- Manhattan: 27

I’m not making these numbers up. Go to foreclosure.com and check for yourself.

So what does all this mean for the NYC housing markets? Homeowners in any of the five boroughs do not have to compete with foreclosures for sale as they do in every other major metro. So can they list their property for anything they want. And they do. Every once in a while, like the Venus flytrap, a seller is fortunate enough to catch a buyer.

That is the Orange County experience as well, particularly at the high end. I see delusional sellers all the time on Redfin who bought at the peak and think their property value has gone up. Occasionally, they are right. Of course, it requires borrowers to come up with enormous down payments, and as a result sales volumes are very low, but if lenders are willing to drag this process out for ten years, they might be successful. In the meantime, they will be supporting a lot of squatters.

Sellers don’t catch many, though. In Jonathan Miller’s thorough quarterly report on the Queens market put out by Prudential Douglas Elliman Real Estate, he counted a total of 2,483 1-3 family houses, coops, and condo units sold during the fourth quarter of 2010. That is roughly 830 per month. This is for a borough with roughly 2.2 million residents. These buyers paid a median price of $363,000. If you weren’t aware of what I’ve explained, you would think that the Queens market has held up fairly well. No way. The overwhelming majority of properties on the market in all five boroughs just sit … and sit … and sit.

That also sounds like Orange County.

Where All Five Boroughs Are Headed

At some point, the banks will be under tremendous pressure to foreclose on the huge number of seriously delinquent properties that are now either vacant or occupied by “walkaways” who have been enjoying the free ride longer than anywhere else. Look at this shocking chart from Lender Processing Services.

It shows that In New York State, homeowners with a notice of default (NOD) on their property have not made a mortgage payment for an average of 644 days. That is more than 21 months. Nice deal, isn’t it?

That is the best deal in the country. People who quit making their loan payments get two years of free housing. If they save that money, after the lender finally does foreclose, they can wait two years and buy another property. Since prices will likely continue to fall, particularly at the high end, they will repurchase at a lower price and have equity from their down payment. The people who don't strategically default will make payments and fall further and further behind.

When the banks begin to foreclose and dump the REOs on the market, prices in all five boroughs will completely collapse. This is almost as certain as night follows day. Ignore it at your own risk.

Keith will be focusing on the entire NYC housing market and the suburbs in the seventh issue of his Housing Market Report due out in mid-July.

For much more from Keith Jurow, see his Housing Market Report. Keith provides actionable data, charts, in-depth analysis and specific advice to help investors and sellers make better property decisions. Learn more. Also, watch Keith talk about why he launched the Housing Market Report.

Looking at the continuum of lender liquidation behavior, Las Vegas is on one extreme and New York is on the other. Desirability has nothing to do with it. Las Vegas has been pummeled by foreclosures and liquidation selling. New York has been spared any meaningful price declines because there are very few foreclosures and almost no liquidation selling.

Both Las Vegas and New York have a huge problem with mortgage delinquency and strategic default, but for opposite reasons. In Las Vegas, borrowers are hopelessly underwater and see continued payment as pointless. In New York, borrowers are offered two years of free housing if they quit paying, so many are taking advantage. Both markets have a huge shadow inventory.

Orange County has been somewhat more balanced in its foreclosure and disposition efforts. Lenders have foreclosed and process more homes at the low end than at the high end, so high end prices are still inflated while low end prices are nearer the bottom. Only time will tell which path is the correct one for lenders. For future borrowers, the tiny mortgages in Las Vegas will be a huge benefit. For buyers in the slowly deflating markets like New York, the huge mortgages will be an economic dead weight.

Get out while you can

With the leading edge of prices now in 2003 in Irvine, many 2003 buyers are chosing to bail while they still can. The owner of today's featured property paid $353,500 on 3/28/2003. She borrowed $282,000 and put $71,500 down. She opened a HELOC for $35,200 on 11/17/3003, but didn't add to her mortgage again until 1/8/2007 when she took out a stand-alone second for $80,000. Her total property debt of $362,000 is only slightly more than she paid. That's conservative by Irvine standards.

She must have fallen on hard times because she stopped paying the mortgage and decided to sell.

Foreclosure Record

Recording Date: 05/18/2011

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 01/26/2011

Document Type: Notice of Default

She could be one of many working in a real estate related industry who succumb to the long recession. With no history of HELOC abuse, and what appears to be a relatively small mortgage, she could be an innocent casualty of the housing bubble.

Irvine House Address … 208 MONROE #152 Irvine, CA 92620 ![]()

Resale House Price …… $415,000

House Purchase Price … $352,500

House Purchase Date …. 3/28/2003

Net Gain (Loss) ………. $37,600

Percent Change ………. 10.7%

Annual Appreciation … 2.0%

Cost of House Ownership

————————————————-

$415,000 ………. Asking Price

$14,525 ………. 3.5% Down FHA Financing

4.49% …………… Mortgage Interest Rate

$400,475 ………. 30-Year Mortgage

$86,862 ………. Income Requirement

$2,027 ………. Monthly Mortgage Payment

$360 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$86 ………. Homeowners Insurance (@ 0.25%)

$461 ………. Private Mortgage Insurance

$190 ………. Homeowners Association Fees

============================================

$3,123 ………. Monthly Cash Outlays

-$325 ………. Tax Savings (% of Interest and Property Tax)

-$528 ………. Equity Hidden in Payment (Amortization)

$24 ………. Lost Income to Down Payment (net of taxes)

$72 ………. Maintenance and Replacement Reserves

============================================

$2,366 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,150 ………. Furnishing and Move In @1%

$4,150 ………. Closing Costs @1%

$4,005 ………… Interest Points @1% of Loan

$14,525 ………. Down Payment

============================================

$26,830 ………. Total Cash Costs

$36,200 ………… Emergency Cash Reserves

============================================

$63,030 ………. Total Savings Needed

Property Details for 208 MONROE #152 Irvine, CA 92620

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1495

$278/SF

Property Type: Residential, Townhouse

Style: Two Level

Year Built: 1985

Community: 0

County: Orange

MLS#: H10122016

Source: CRMLS

Status: Active

————————————————-

GREAT PRICE FOR THE LARGEST FLOOR PLAN TOWNHOME IN TIMBERLINE. 3 BR 2.5 BA 1495 SQ. LAMINATED FLOORING THROUGHOUT. OPEN FLOOR PLAN IN PRIME LOCATION. LOW HOA FEES.

Thank you, IHB readers

I want to thank everyone for the kind words of support yesterday. I hope to put the issue behind me, but depending on how foolish and vindictive the Orange County Association of realtors wants to be, we may see this story resurface again. Wouldn't that be fun? Perhaps they will quietly go away and drop their complaint. I'm not holding my breath.

“PRIME LOCATION. LOW HOA FEES.”

So realtors can say WHATEVER they want, but anyone else (IR) with an opinion gets slapped with a ‘grievance’!

Dues is $190. What makes that “low”? Compared to what?

Location is up against the 5 Freeway. What makes that “prime”? By what standard?

great points.

lower than the insane $500 a mo. TIC is charging for their new “exclusive” communities I guess, if you like comparing apples to oranges. personally I would never pay more than $200 a mo. for HOA on a home, and even that I consider a heavy burden, so to me this is barely passable. $190 for what? what amenities does “Timberline” have that could possibly cost $190 per household to maintain? A grassy knoll?

I know people who bought near the bubble in Southern Calif. and were paying $175 HOA for communities that included things like a playground and a pool, plus common landscaping. Then the HOA stopped maintaining these things, and they were incensed at being stuck with this albatross.

So it’s all relative. low? how about keeping it under half a percent of purchase price per year? now we’re talking.

alas, before I’m slandered or taken out of context – I’m not saying this could or would happen in Irvine. but it does happen; be aware of them. for that matter, beware any hidden costs of Loaning (capital L) a home.

I spent a few days in the Big Apple in May, and made a couple of observations. The Times is beginning to discuss the glut of “luxury” condos, which are now seen as great rental opportunities at a fraction of the cost. By looking at Redfin in Westchester and comparing asking to recently sold, there is about a $150,000 disparity. And finally, i was able to visit family at the site of the worst investment ever by PERS, the purchase of Stuyvesant Town.Folks there do believe that it is different there, and I guess it is, but more for the reason that IR presents than NYC exceptionalism.

SB

Now imagine a sane world with 20% down.

Who in their right mind would drop $80k on this small, outdated, badly located townhouse for the right pay $2500/month to live here for 30 years?

Maybe PR?

Yeap, when you consider the years of hard work and savings required to save a 20% downpayment, I think it makes it so much harder to “make the move.” That’s why there’s so much push-back on these “qualified residential mortgage” standards that are using a 20% downpayment as a baseline for a reasonably safe mortgage.

How far would auto sales drop if we required 20% down? 75%? We might kill the industry, but we’d save so many countless people from themselves…

the problem is not 20% down, the problem is in many areas the real estate price is still too high.

I agree that prices are still too high, but are you suggesting that 20% is not a huge hurdle for borrowers?

lower the price to historical norms, then there’s no worry about “push-back” on such oh-so-silly standards.

translation: Irvine, like most other areas in So Cal which have not yet properly de-leveraged from the height of the bubble, is still 10-20% overpriced.

No, PR would not pay that much to live there. He just wants other people to pay that much to live there so he can profit from it.

“We are quickly approaching a tipping point in New York City where residents recognize it is in their best interest to default and pocket the payments”

Out of curiosity, how do you know this? How do you know we are “quickly” approaching the oh so fateful “tipping point”? Seems to me, people have been saying we have been “quickly” approaching that tipping point since 2008, and yet its still not here?

Put another way, the banksters extend and pretend has allayed the residents recognition of the tipping point for years. Given thats the case, why is it all going to “quickly” change?

As far as I can tell, the banks are in no hurry whatsoever to make a move.

IrvineRenter does make an intetesting point. As word gets around that you can live rent free for years and years, it is going to make it that more enticing to people sitting on negative equity. Especially those who falsely believe that a stock-market-like “recovery” is on the way for housing. These people waiting on the housing “recovery” are slowly going to accept that it is not going to happen and when they do, they are going to be pissed off and feel entitled to a few years of free rent.

Do the banks care at this point? The TBTF ones know that Government and the Fed have their backs.

1 year ago, I had a huge argument with my collectivist friend who feels government intervention will help buoy prices thus lessening strategic default.

My argument was, regardless of prices, there are those who are overleveraged and efficient, timely foreclosure sans government subsidy is the only cure.

He still will not admit i am right. Not only is he a collectivist, now he is officially an asshole.

How does one come to the conclusion that spreading the pain around and throwing a lifevest to poor decion making companies is the solution?

and i did not foresee the unintended consequence of free housing. This is becoming mutiny.

There are big differences between NYC and LV. NYC has lots of high paying job on WS/government jobs and the supporting activies. LV is essentially the gaming industries and its supporting activies.

With may high paying jobs, the corporation pays for the housing or has a profit share on the house. If the value goes up, they split the profit. If the value goes down the company eats the loss. Some university had that arrangement too. It’s capitalism/communism. Capitalism if a profit is made. Communism if there’s a loss. Upper WS as we know it.

IR,

Will you be expecting a complaint from NYC-RA? :-< May HOA are mini-govt agency to get around directly collecting a tax and keeping people out. Some are more sucessful than others. Just think if libraries were run by HOA instead of local govt. ?

I often wonder how long the squatting can go on before the banks cry Uncle?

These days, 2 years of free squatting seems to the norm before the bank drops the foreclosure hammer.

Could we go out 3,4,5 even 10 years?

For example, 5 years of saved mortgage payments

could equate to some serious capital.

Such squatters could have it 3 ways:

if prices seem stable, default on payments, save the cash and possibly “cure” the loan at the last minute

OR

if prices continue downward, simply walk away with 5 years of saved cash payments, and use saved cash towards a down payment on the next (and cheaper) home.

OR

forget home ownership and used save cash to rent.

Seems a no loose situation to me.

Don’t local property tax assessors begin foreclosure proceedings once property tax payments are two years past due? If this is the case, then I guess you could still pay your property tax (or let the bank).

Irvine real estate broker admits $4.3 million Ponzi scam

http://www.ocregister.com/news/sparks-303684-irvine-choi.html

A dime a dozen.

He ripped off people in his church and then the writer calls him a family man. Hopefully he’ll share a cell with Bubba. This society is rotten to the core!

… and he doesn’t even work at Crystal Cathedral. surprising

Proposed rules could shut many out of housing market

(Bankers, community advocates protest tough down payment requirements – 20%)

“… 376 pages of proposed rules for “Qualified Residential Mortgages,” which would require a 20 percent down payment and limit a borrower’s debt payments to no more than about one-third of income.”

Like the good ole days. 🙂

Irvine Renter:

Many people are working 12-15 hours per day to make payments on the property “Suzanne Researched.” They have no time to read your posts, so I prepared a summary of today’s post for them:

Today, Irvine Renter told the OC ASSociation of Realtards:

https://www.youtube.com/watch?v=C_OyYzqjv-Y

Best,

Joe