in a recent report, the federal reserve measured the median wealth loss in California households at 27.7%. The Illusions of wealth are shattered.

Irvine Home Address … 13 HAWTHORN Irvine, CA 92612

Resale Home Price …… $419,000

World turns black and white

Pictures in an empty room

Your value starts fallin' down

Better change your tune

Yeah, you reach for the golden ring

Reach for the sky

Van Halen — Dreams

Most people during the bubble bought a house as an investment. The fantasy was perfect: the better and more expensive the house, the more free money the house provides as it goes up in value forever. Just by purchasing real estate and using the largest loan available, everyone was enabled to be or do whatever they desired with abundant debt.

Much of the wealth created during the bubble was an accounting trick. Prices were temporarily and unsustainably elevated, and the wealth created was ephemeral and illusory.

People can't lose what they never had. Only the lingering attachment to an old dream remains to torment the kool aid intoxicated.

Californians' wealth took one of the biggest hits in the recession

In California and other Western states, 67.5% of households saw their net worth fall, compared with 62.5% in the U.S. overall. The median decline in the West was 27%, well above the 18.1% national median..jpg)

March 24, 2011 — By Jim Puzzanghera, Los Angeles Times

The federal government has for the first time detailed the sharp drop in wealth that the Great Recession caused American households — and it shows that families in California and other Western states took the biggest and broadest hits by far.

The average net worth of U.S. households — the value of their homes, stocks and all other assets — fell 20% to $481,000 by mid-2009 from $598,000 in mid-2007, according to a Federal Reserve survey released Thursday.

In the Western states, 67.5% of households saw their wealth drop, compared with 62.5% for the nation overall. The median decline in wealth for households in the West was 27.7%, well above the 18.1% national median and nearly triple the 9.5% decrease for families in the Northeast.

While it's widely known that the recession slammed household wealth and that the housing market in the West took some of the hardest hits, the unusual Fed survey attempted to quantify the damage.

The central bank does a broad consumer finance survey of about 4,000 households every three years. But to gauge the effect of the recession, the Fed in mid-2009 began re-interviewing the same households it had surveyed in 2007.

The new data compare the state of those households just before the recession officially hit in December 2007 with how they were faring in the second half of 2009, after the recession technically ended and the economy began growing again.

Although about two-thirds of households saw their wealth fall, “a sizable fraction of households experienced gains in wealth, while some families' financial situation changed little,” the Fed said in its 37-page report, titled “Surveying the Aftermath of the Storm: Changes in Family Finances from 2007 to 2009.”

The banksters and above median home price squatters have done well as everyone else's wealth went negative.

Although overall wealth declined nationally, well-off families — those in the top quarter of net worth — saw their overall wealth increase by about 27%.

Still, the recession hit most households hard, leading to families in all income brackets to cut back spending so they would have “greater precautionary savings.“

That decline in spending “may act in some ways as a brake on reviving the economy in the short run,” the report said.

jim.puzzanghera@latimes.com

Frugality and savings accompany every recession. Some economists complain as if savings is a problem. Recessions end when people save, and that savings is loaned by banks into the economy. There is always a lag between when the money is saved and when it permeates the economy. The federal reserve seems to exist only to prevent the natural healing mechanisms of the market from working properly.

The credit bubble, the housing bubble, and illusions of wealth

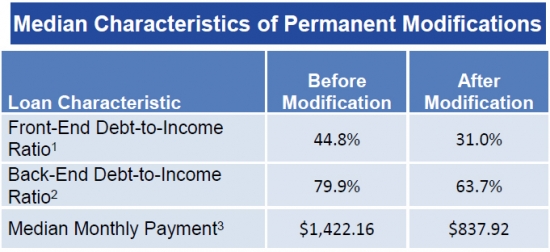

The chart below illustrates the credit bubble that took our already burgeoning housing bubble and made it into an uber-bubble. For a more detailed analysis, please read the weekend post, Are large down payments supporting high-end home pricing?

Prices have stabilized along with aggregate loan balances at a level manipulated by government policy and federal reserve policy.

Note the average loan balance at the peak is very near current pricing. Banks are eager to hold prices at this level because any significant price decline would trigger strategic default as more and more owners submerge beneath their mortgage obligations. The loan balances are so large here that a cascade of strategic default similar to Las Vegas would cost lenders billions of dollars.

The false bottom of 2009 is most durable at the bottom of the market. Irvine has already double-dipped, and other premium communities in Orange County are facing similar circumstances.

What does the housing recession really look like?

At the peak, most cities in Orange County were trading at more than $400/SF. The Irvine premium was low by historic standards relative to surrounding cities. The crash has witnessed significant expansion of premiums between the highest value cities and the lowest value ones.

The current resale 311/SF is the lowest in seven and a half years. Anyone who bought since late 2003 and still owns is financially behind anyone who rented instead. When you factor in transaction costs, the additional cost of ownership (they paid more than rental parity in 2003), and the loss of buying power due to monetary inflation, and the money-pit of home ownership becomes apparent.

This spreading out of values could be attributed to savvy buyers recognizing a premium. I imagine the savvy buyers of the bear rally would embrace that idea.

In reality, the high end simply hasn't deflated yet. The distressed inventory is being withheld from the market, and the few buyers who are active are being forced to come up with huge down payments in order to transact.

Any way you slice it, the local housing market is facing significant headwinds, and with maximum foreclosure rates and a huge overhead supply, things will get worse before they get better.

Anyone want to guess where the HELOC money went?

The decor and staging are rather unique. Did you notice they didn't bother to hide the bong above?

Actually, it looks like this is a college rental. The owner is listed as having an Idaho address.

- The property was purchased on 10/21/1997 for $190,000. The owner used a $133,000 first mortgage and a $57,000 down payment.

- On 7/9/2001 they refinanced with a $310,000 first mortgage. Perhaps they took the $170,000 of mortgage equity withdrawal and bought the property in Idaho cash? I don't have a clue.

- On 6/28/2004 they returned to the ATM and obtained a $382,525 first mortgage. They were just issued a NOD.

Foreclosure Record

Recording Date: 02/28/2011

Document Type: Notice of Default

They may not have paid the mortgage in a while considering this is listed as a short sale at $419,000. With renters in this place, it produces some income that could have gone toward making payments. Do you think they stopped charging the renters when they stopped paying the mortgage?

Irvine House Address … 13 HAWTHORN Irvine, CA 92612 ![]()

Resale House Price …… $419,000

House Purchase Price … $190,000

House Purchase Date …. 10/21/1997

Net Gain (Loss) ………. $203,860

Percent Change ………. 107.3%

Annual Appreciation … 5.9%

Cost of House Ownership

————————————————-

$419,000 ………. Asking Price

$14,665 ………. 3.5% Down FHA Financing

4.84% …………… Mortgage Interest Rate

$404,335 ………. 30-Year Mortgage

$85,185 ………. Income Requirement

$2,131 ………. Monthly Mortgage Payment

$363 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$87 ………. Homeowners Insurance (@ 0.25%)

$209 ………. Homeowners Association Fees

============================================

$2,791 ………. Monthly Cash Outlays

-$349 ………. Tax Savings (% of Interest and Property Tax)

-$500 ………. Equity Hidden in Payment (Amortization)

$27 ………. Lost Income to Down Payment (net of taxes)

$52 ………. Maintenance and Replacement Reserves

============================================

$2,021 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,190 ………. Furnishing and Move In @1%

$4,190 ………. Closing Costs @1%

$4,043 ………… Interest Points @1% of Loan

$14,665 ………. Down Payment

============================================

$27,088 ………. Total Cash Costs

$30,900 ………… Emergency Cash Reserves

============================================

$57,988 ………. Total Savings Needed

Property Details for 13 HAWTHORN Irvine, CA 92612

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1539

$272/SF

Property Type: Residential, Condominium

Style: One Level, Contemporary

Year Built: 1974

Community: 0

County: Orange

MLS#: S643461

Source: SoCalMLS

Status: Active

On Redfin: 86 days

——————————————————————————

Single level home with no one above or below. Home is at the end of a cul de sac with an oversized driveway and a two car attached garage with direct access to the house. There are three large bedrooms and one has a secluded small patio/atrium. There is a large patio off the living area with plenty of room to entertain. The kitchen has an eat-in area and plenty of counter and cabinet space. This lovely home is surrounded by greenbelts and this family community has two pools, a club house, lots of walking trails and tot lots for the little ones to play in. Walking distance to Irvines award winning schools (Uni High is also very close), stores and parks. Also close to the 405 and 5 and toll roads.

The “term sheet's principal reduction proposals may actually foster an unintended 'moral hazard' that rewards those who simply choose not to pay their mortgage,” the Florida, South Carolina, Texas and Virginia attorney generals wrote in a March 22 letter to Mr. Miller.

The “term sheet's principal reduction proposals may actually foster an unintended 'moral hazard' that rewards those who simply choose not to pay their mortgage,” the Florida, South Carolina, Texas and Virginia attorney generals wrote in a March 22 letter to Mr. Miller.