This weekend's post is a detailed look at the median price, median loan, and median down payment in Irvine and nearby cities in Orange County, California.

Irvine Home Address … 63 WOODLEAF Irvine, CA 92614

Resale Home Price …… $325,000

I want to be a star, I'm going to have a car

And you'll have to admit, I'll be rich as shit

I'll just sit and grin, the money will roll right in

I would give you some, if you only would have treated me nice

You'll wish that you did, you'll feel pretty stupid

I'll just sit and grin, the money will roll right in

Nirvana — The Money Will Roll Right In

All-cash home sales hit record highs

All-cash home buying is surging across the United States, including in Orange County, as lenders tighten mortgage standards, middle-class buyers are sidelined and investors see opportunity.

Nationwide, cash buyers grabbed 33 percent of all used homes sold in February, the National Association of Realtors reported March 21. The figures, based on agent reporting, do not include foreclosure auctions on courthouse steps, which are usually cash-only.

In Orange County and California real estate, DataQuick Information Systems reports similar trends based on county recordings that do not show any purchase loan.

Cash-only sales have more than doubled in Orange County, from a monthly average of 10.4 percent in the past 23 years to a monthly average of 24 percent in the past 12 months, DataQuick statistics show. In January, all-cash sales hit 28.3 percent in the county – the highest for any month since DataQuick started tracking the figure in 1988.

That is a very large percentage of homes. It would be interesting to see the breakdown of that by cost. I know from what I witness in Las Vegas that most of the all-cash transactions are investors buying properties for less than $100,000. I suspect the bulk of the all-cash sales in Orange County are also at the very bottom of the price ladder.

PHOTOS OF O.C. HOMES BOUGHT WITH CASH

In Irvine, 31.6 percent of the 393 homes sold so far this year were paid for in cash, real estate broker Cathy Haney said. The average sales price of the all-cash deals this year was $657,854, while the median price for all the Irvine homes sold was $535,000, she said.

That sounds like a lot, but historically about a third of all homes are owned with no mortgage anyway. What would be really interesting would be to see the total number of all-cash purchases and percentages over time. Unfortunately, I don't have that data. I have heard anecdotally from someone inside TIC that they did sell nearly 1/3 of their product to all-cash buyers. That amounts to about 200 closed sales last year.

Across California, mortgage-less home purchases have doubled from an average 14.7 percent in the past 23 years to 28.3 percent in the past 12 months, according to DataQuick. Cash deals hit 32.9 percent in February, the highest for any month since at least 1988.

“You're seeing an increase in cash deals at both ends of the price distribution curve,” said Sam Khater, chief economist for CoreLogic Inc., a real estate information company. “You're seeing it in the hardest hit areas, where investors are coming in and picking up low-priced properties. And you're seeing higher cash activity at the upper end as well.”

The “lion's share” of all-cash purchases nationwide are from investors, according to Walter Molony, a spokesman for National Association of Realtors. Real estate investors seek rental income, long-term appreciation or a quick profit.

Vito Antoci, a full-time real estate investor from Newport Beach, recently bought an ocean view home at 1006 White Sail Way in Corona del Mar for $1.45 million in cash. He is spending another $500,000 in cash to expand and renovate the house, and said he will sell the home within six months for $2.5 million to $2.89 million to earn at least a half-million dollars in profit.

Kudos to him if he can pull that off. I'm glad it's not my deal. He may find selling that one is harder than he thinks.

“When you buy with cash, you get the best deals,” Antoci said. “Sellers don't want to deal with the bureaucracy of banks.”

Antoci, who owns Varm Development, saw a nonlocal realtor putting the for-sale sign into the ground as he drove the streets looking for homes to buy. The sellers were asking $1.8 million. He made an offer and it was accepted that same day. It never hit the market, and escrow closed in a week.

“It was a quick, intriguing cash offer, and they took it,” he said.

Cash is always king.

Carl Alford, a retiring owner of a dry-cleaning product business, recently paid cash for two homes in Irvine that he is renting out for income.

“Stocks and bonds are a gamble, and banks certainly aren't paying anything on money,” he said. “You can earn more in real state, and I like something you can touch, feel and correct.”

He has cash earning about 4% in Irvine real estate, and that is better than the stock market that nearly doubled in the last two years? I like cashflow properties, but there are places where you get more bang for the buck.

Alford recently sold a home in Fontana and carried the mortgage note himself, he said, meaning the buyers are paying him monthly payments.

Investors are also using cash – either their own or from alternative resources – to gain an advantage over buyers using a mortgage in nabbing bank-owned properties, which are plentiful these days and usually less expensive than other homes. Foreclosures in January accounted for 37 percent of all home sales nationwide, 25 percent in Orange County and 54 percent in California.

Traditional lenders often reject mortgage applications for foreclosed properties because the homes need a lot of work, appraisals come in below the accepted price or deals just take too long to close, said Thomas Popik, research director for Campbell Communications Inc., which conducts national surveys of real estate brokers.

Some flippers don't even have to improve a foreclosure.

I think I mentioned something about that recently….

“You buy the house at a discount with cash, then you flip it almost immediately to the first-time homebuyer who's using a mortgage, simply because they were not able to buy at the foreclosure sale,” said Oliver Chang, a housing-market analyst with investment bank Morgan Stanley.

About half of all home purchases were paid for in cash in Miami, Las Vegas and Phoenix, Chang said.

HIGH-END MARKET

In the local, million-dollar-plus home market, buyers are choosing to use their own money to purchase their principal residence, says Chris Valli of luxury real estate brokerage Surterre Properties.

Why? Banks are asking intrusive, exhaustive questions of anyone trying to get financing for a home above $729,000, Valli said. Fannie Mae and Freddie Mac won't insure mortgages over $729,750. Buyers feel it is just less of a hassle to pay for the home with their own money, Valli said. The buyers also want to negotiate a better deal on the property by showing they can close escrow without a third party lender, he added.

All those advantages are real if you have the cash. This guy makes it sound like every buyer has that freedom, and they don't. He does paint an accurate and sobering picture of the jumbo market.

“It puts the seller more at ease and gives them a little more assurance,” Valli said. He recently sold an estate in the $7 million range in Irvine's Shady Canyon community for all cash. Another home in Shady Canyon recently sold for $4.3 million in cash.

Chris Crocker, a Coldwell Banker broker in Corona del Mar, says the wealthy are looking at waterfront dream homes priced 40 percent below the peak as a safe venue to out their money in for the next few years while also having some fun. The cash buyers he or his colleagues have worked with are looking to buy second or third homes as a place to dock their yachts and their money on the West Coast.

There's a general perception that the market has bottomed out on prices, Crocker said.

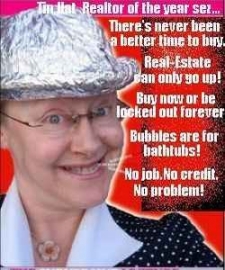

There is a general perceptions that realtors will call the bottom at every opportunity.

CREDIT CRUNCH

Tighter underwriting in general for mortgage loans is also a factor in the percentage increase of cash-only deals among all sales.

Lenders are requiring higher down payments and higher credit scores.

The median down payment for all home purchases with a mortgage rose to 22 percent last year in at least nine major U.S. cities, according to a survey by Zillow.com. That's up from 4 percent in late 2006, when the housing bubble began to burst. During the housing boom, buyers could purchase a home with little or no money down.

The weighted average FICO score for a home purchased with a Fannie Mae mortgage was 762 last year, up from 716 in 2006, the mortgage finance company reported.

The tighter underwriting is sidelining many would-be middle-class buyers, especially first-time buyers, from purchasing a home – even though prices are relatively low because of all the foreclosures.

“The average Joe can't take advantage because he simply cannot get the credit to buy,” said Paul Dales, senior U.S. economist for consulting firm Capital Economics.

People became spoiled by an era of cheap credit and unfettered access. Those days are gone.

The banks who fueled the housing bubble with lax mortgage underwriting are now being too restrictive, said Molony, the realtor association spokesman.

“Lenders have only been willing to lend to the cream of the crop in terms of credit scores,” he said. “As a result, you're seeing a depressed level of traditional buyers.”

Bloomberg News and The Associated Press contributed to this report.

Contact the writer: bmartinez@ocregister.com or 714-796-7955

What does the data show?

When I first graphed the data on median loan amount, I was shocked by the obvious credit bubble that emerged from the data.

The current median loan amount has been steady at around $400,000 since late 2007. This line of support is about what a median income family could support with 5% interest rates. With the lack of jumbo financing, and with loan qualification being based on real incomes and amortizing loans, there isn't much upward pressure on loan balances. Lenders are providing enough air for support, but not enough to reinflate the bubble.

Their strategy to date has been to withhold inventory from the market and sell small numbers of high-end properties to the few buyers with cash. They are trying to drain a large reservoir with a tiny hose. At the current rate of liquidation, prices won't go down, but banks will own high-end properties for decades.

One of the ways this disparity shows up is in down payments. In areas where liquidations are proceeding at full speed, prices have been pushed down to the point that FHA buyers with 3.5% down become nearly half the housing market, hence the down payment percentages near 3.5% in Santa Ana and most of California.

Is this a sign of heavy cash buyers recognizing value and bidding up precious high-end properties? Perhaps, but there is an alternate explanation.

There are only so many frugal savers who have accumulated two or three years salary as liquid savings. Once those few people buy, buyers with smaller and smaller down payments get their opportunities. If there is limited supply, many buyers are left unsatisfied because they can't get property. These buyers are unable to increase their bids because they must qualify for a loan, and supplement with a down payment. Borrowers can't lie and make stuff up anymore to get around affordability.

Lenders know they have a problem, but they believe people will start making enough money to support the pricing on their books from 2006. It isn't going to happen. For now, they are content to withhold inventory from high-end markets and see what happens. As a result, there is very limited product that actually sells, and those go to the few buyers with lots of cash.

If we were seeing large down payments and normal to high transaction volumes, then the increased down payments would be indicative of increased buyer interest among those with cash. But since the transaction volumes are more than 30% below normal and near all-time lows, what we are seeing is the few available buyers paying what is asked with what resources they have. That isn't buying pressure that pushes up prices, that is restricted supply that forces the few buyers to reach for the sky.

The future of large down payment markets

The surest sign of liquidation of inventory is diminishing down payments. Low down payments characterize both market rallies and market bottoms. Moderate to high down payments are common to stable markets. Down payments where the highest after the credit crunch that signaled the collapse of the housing bubble.

To increase transaction volumes properties must be pushed down to buyers with smaller and smaller down payments. The buyer pool with 3.5% saved is much larger than the buyer pool with 20% down.

During the liquidation of high-end shadow inventory, if down payments are likely to compress, then either loan balances need to get larger, or prices are going to fall.

Orange County Asking Prices

I still think prices are going down, particularly at the high end. Here in Irvine, with loan balances holding at $400,000, the median will probably drop below $500,000, but unless loan balances decrease due to higher interest rates, the down payment compression won't get so severe as to push the median below $480,000.

More Ponzis flushed from loan ownership

Today's featured Ponzis put in $8,000 and took out $192,000. Not a bad ratio. They will want to own again.

- The owners of this weekend's featured property paid $240,000 on 6/21/2001. They used a $232,703 first mortgage, and a $7,297 down payment.

- On 10/22/2002 they refinanced with a $250,750 first mortgage. At least they waited a little over a year before getting their first nearly $20,000.

- On 7/16/2003 they obtained a $27,000 HELOC.

- On 3/24/2004 they refinanced with a $348,500 first mortgage.

- On 12/28/2004 they obtained a $40,000 HELOC.

- On 7/20/2005 they refinanced with a $384,000 Option ARM and got a $48,000 HELOC.

- Total property debt is $432,000.

- Total mortgage equity withdrawal is $192,000.

- They just received their NOD.

Foreclosure Record

Recording Date: 02/08/2011

Document Type: Notice of Default

Irvine House Address … 63 WOODLEAF Irvine, CA 92614 ![]()

Resale House Price …… $325,000

House Purchase Price … $240,000

House Purchase Date …. 6/21/2001

Net Gain (Loss) ………. $65,500

Percent Change ………. 27.3%

Annual Appreciation … 3.0%

Cost of House Ownership

————————————————-

$325,000 ………. Asking Price

$11,375 ………. 3.5% Down FHA Financing

4.84% …………… Mortgage Interest Rate

$313,625 ………. 30-Year Mortgage

$66,074 ………. Income Requirement

$1,653 ………. Monthly Mortgage Payment

$282 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$68 ………. Homeowners Insurance (@ 0.25%)

$364 ………. Homeowners Association Fees

============================================

$2,366 ………. Monthly Cash Outlays

-$155 ………. Tax Savings (% of Interest and Property Tax)

-$388 ………. Equity Hidden in Payment (Amortization)

$21 ………. Lost Income to Down Payment (net of taxes)

$41 ………. Maintenance and Replacement Reserves

============================================

$1,885 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,250 ………. Furnishing and Move In @1%

$3,250 ………. Closing Costs @1%

$3,136 ………… Interest Points @1% of Loan

$11,375 ………. Down Payment

============================================

$21,011 ………. Total Cash Costs

$28,900 ………… Emergency Cash Reserves

============================================

$49,911 ………. Total Savings Needed

Property Details for 63 WOODLEAF Irvine, CA 92614

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1267

$257/SF

Property Type: Residential, Condominium

Style: One Level, Contemporary

View: Peek-A-Boo

Year Built: 1983

Community: Woodbridge

County: Orange

MLS#: P773002

Source: SoCalMLS

Status: Active

——————————————————————————

Gorgeous conner upper unit. 3bed/2bath, cozy fireplace. Recessed lighting, granite countertops in kitchen. Master bedroom is separaed from other 2 bedrooms and inside laundry room. Newly done in bathrooms, master bath has double sink. Travertine flooring in kitchen, dining room and master bathroom. Double pane windows and custom paint. Home is close to pool, lake shopping and schools.

conner? separaed?

Irvine Home Inventory jumped to 1048?

Redfin’s only showing 834 as of today.

I’m not sure what is going on with today’s inventory number. We’ll have to find another source if this doesn’t get corrected soon.

Great post IrvineRenter. I love the new charts. Thanks

IR: good roundtable on the nuances of govt policy contributing to the Great Housing Bubble:

http://www.ideasinactiontv.com/episodes/2011/02/did-fannie-mae-and-freddie-mac-cause-the-financial-crisis-and-how-can-they-be-reformed.html

One of the interesting points was that securitization of loans was promoted by the govt to spread loan risk nationally, as a “solution” to the regional failures of the previous S&L Crisis.

Another was that govt policy promoting home ownership to lower-income buyers forced banks to actually do that – utlimately helping nobody.

Great to see a post where everything’s not necessarily “hold your money until next year, you’re an idiot for buying this year” kind of mentality.

I think it’s good to see both sides (as long as the data is there to support it)….

It’s still the case that you’re an idiot for buying this year.

The only things supporting high prices are:

1) artificially low interest rates

2) artificially restricted inventory by the banks.

My guess is that prices will come down another 30% in California as economic realities are recognized.

Casual comments can cost a home buyer or seller

http://www.latimes.com/business/realestate/la-fi-lew-20110403,0,7072126.story

I’m diggin all of those cool graphs you’ve posted. I just saw the report about many of the OC zip codes going up in value. Good news for those that are getting in soon.

Keep up the great work,

Cameron

Corona Real Estate Agent

Corona, Ca.

Did anyone see this link? (Sorry, I don’t know how to get embed the url)

http://www.latimes.com/business/realestate/la-fi-harney-20110403,0,6735337.story

Two points:

1) Given the substantial decrease in sales volumes in OC, in reality cash deals have not doubled, they have only risen modestly while mortgage purchase volumes have dropped by 30-40%+. I’m surprised that IR did not point out the data sleight of hand by the OCR.

2) Cash buyers really only improve the housing market if they are buying to live in the home or rent to rent it out. If instead, the cash buyer is planning to flip the house (like the million $ deal mentioned in the article), all that is really being accomplished is temporarily moving that property into shadow inventory.

Good points on both. I think all the increase in cash buy proportions tell us is that those with cash still have cash and think the market is down enough to jump into it for a return rate that looks better than a savings account. My guess is that as the market flattens out, cash buyers will begin to decrease further as the cash flippers disappear and landlord buyers dry up.

Flippers will decrease as 1) they flip most likely to borrowers, not cash buyers, and 2) steady prices make it no longer worthwhile to flip.

We’re only 2-3 years into what will likely be a 5-7 year doldrum before prices START to make a steady gain. I think the market behavior in the next 2 years will be a lot different than it has been in the last 2.

What we are seeing in AZ is a return of cash buyers. When prices appeared to have stabilized, they came back with a vengeance. When prices began to drop, again, they pulled back, again.

However, with the number of REO/foreclosure listings now being fed into the AZ supply inventory only as fast as they sell, the very bottom appears to have been balanced/stabilized. As a result, cash buyers are scooping up ALL of the least priced homes. And, almost none of those above. A very bifurcated RE market.

However, as was written in the AZRub this weekend the number of vacant homes in the Valley of the Sons is way over 15%. What that means is that renting out homes purchased at the floor MAY be difficult to do for a very long time.

Proof once again that even in a desert hope springs eternal. And, into each life a little rain must fall.

[mEDITate-OR:

see the Pigs fly out of our RE sales offices…!!!

———

Dr John, my Philosophy, Logic and Ethic prof

opined that IF you could not be right, at least be funny.

——

In our re-search, we have found YOU to be someone who is both.