Both principal reductions and loan modifications fail to prevent redefault. Borrowers are not sustaining ownership under those circumstances.

Irvine Home Address … 8 HUCKLEBERRY Irvine, CA 92618

Resale Home Price …… $497,000

Less conversation

No moral obligation

I see what's at the ending of the rat trap

…

The rabbit dug a hole straight through to China

So where do we go?

And where is the rabbit's hole?

I'm feeling like I'm pulling away, yea

I'm feeling like I'm pulling away, yea

Stone Temple Pilots — Huckleberry Crumble

In early 2010, i predicted the moral trepidation about strategic default would largely be gone from the American psyche. People are beginning to look at their homes as their other investments, and when the numbers favor waling away, they do so. People are opting to get out of the rat trap of working to service a bottomless pit of debt.

As underwater borrowers strategically default, lenders are trying different methods for holding back the rising tide. Loan modifications have postponed some foreclosures, and principal reductions might postpone a few more. The value in doing a few principal reductions goes beyond the money spent. It makes for a fantastic carrot lenders can dangle in front of distressed borrowers. Lenders benefit if the herd makes a few more payments based on false hope — whether that false hope be imminent appreciation or potential debt relief, lenders don't care. They just want a few more payments.

The article you are about to read touts the success of principal reductions and attempts to persuade the reader principal reductions are a viable alternative. In reality, principal reductions do little to sustain home ownership. The only real benefit is that banks may get a few additional, albeit reduced payments from some borrowers.

Mortgage Servicers Resist But Cut Debts

By RUTH SIMON And NICK TIMIRAOS — March 28, 2011

U.S. banks are resisting efforts by state attorneys general to force them to cut the amounts owed by some borrowers facing foreclosure. Yet mortgage companies already have reduced home-loan balances for more than 100,000 borrowers.

In for a penny, in for a pound? Who cares if they tried some principal reductions? They tried some, found out it didn't help, so now they don't want to do more of them.

How much larger the number will grow is likely to be at the center of negotiations this week aimed at reaching a settlement to the nationwide investigation of mortgage-servicing practices.

Officials from Bank of America Corp., J.P. Morgan Chase & Co., Wells Fargo & Co., Citigroup Inc. and Ally Financial Inc.'s GMAC unit have been summoned to Washington for a Wednesday meeting with state attorneys general and at least three U.S. agencies, according to people familiar with the situation.

It will be the first faceoff since the five companies, the largest home-loan servicers in the U.S., got a 27-page “term sheet” earlier this month from state attorneys general that would require the servicers to consider more borrowers for principal write-downs.

What does it mean to “consider” someone for a principal write down? Won't the banks “consider” each borrower for principal reduction, say no, then foreclose on them? Are the AGs suggesting a specific change to lender guidelines?

In addition, some of the financial penalties resulting from any settlement are “very likely” to be used for reductions in loan balances for certain borrowers, said Iowa Attorney General Tom Miller, who is spearheading the 50-state investigation.

Statements like his merely feed into the false hope of distressed borrowers everywhere. Principal reductions will only occur on the mortgages deepest under water in a belated attempt to keep the hopeless paying a little longer.

Even among state officials, there are disagreements as to whether shrinking loan balances is a good idea.

There's debate about the idea of principal reductions because it's a really bad idea. Foreclosure is a superior form of principal reduction.

The “term sheet's principal reduction proposals may actually foster an unintended 'moral hazard' that rewards those who simply choose not to pay their mortgage,” the Florida, South Carolina, Texas and Virginia attorney generals wrote in a March 22 letter to Mr. Miller.

At least of few of these guys get the implications of their pandering.

The chief executives of Bank of America and Wells Fargo have questioned the fairness of writing down loans, while claiming the costs could be enormous if widespread principal reductions are triggered by a settlement.

Speculation that “we want everybody 'underwater' to receive a principal reduction is not true,” Mr. Miller said in an interview, though lopping off thousands of dollars from what a borrower owes on a mortgage “has been underutilized as a tool.” An underwater borrower is one who owes more on a property than it is worth.

They may not want everyone to get a principal reduction, but they do want to create the false impression that everyone might get one. Principal reduction has not been underutilized as a tool to cure mortgage default. It doesn't work. Chainsaws are underutilized tools in operating rooms, and I hope it stays that way.

This month's proposal by state attorneys general would require banks to reduce loan balances for some borrowers if a modification that includes a principal reduction would provide a better long-term return than foreclosure or a loan modification that simply cuts the borrower's interest rate or extends the loan's life.

Based on the statistics, there is little or no difference in redefault rates between those who received principal reduction and those who only obtained a modification. How could anyone establish that principal reductions are better when the data clearly shows they aren't?

Loan balances would be trimmed over a three-year period, but only if borrowers made steady payments.

Bailouts and false hopes. String people along for three more years and pray the market has moved higher. It merely delays the inevitable.

Some loan servicers under investigation by state and federal officials already are slicing loan balances on a very narrow basis. In 2009 and 2010, Wells Fargo forgave a total of $3.8 billion in principal—or an average of $51,000 per loan—for roughly 73,000 borrowers whose mortgages are owned by the San Francisco bank.

There are 11,000,000 underwater loan owners. The 73,000 loan owners Wells Fargo gave money to represent 0.66% of the total.

Bank of America, based in Charlotte, N.C., had offered loan modifications to more than 127,000 borrowers as of December as part of its previous settlement with state attorneys general over alleged predatory lending by Countrywide Financial Corp., which it bought in 2008. An estimated 35,000 of those offers included a principal reduction.

Officials at Bank of America and Wells Fargo said the two banks are comfortable reducing loan balances for certain borrowers, but oppose broad-based cuts. One reason: Some borrowers could stop making payments to get their debt reduced.

A recent study by Columbia University economists concluded that Countrywide's relative delinquency rate “increased substantially…during the months immediately after the public announcement” of the 2008 settlement.

Banks have empirical proof of their own common sense. If you give people incentive to quit paying their mortgage to obtain a principal reduction, many borrowers will default.

“It's certainly something to be worried about, but you can't point to this and say, 'Well, we can't do any modifications,' ” said Christopher J. Mayer, one of the study's authors.

Why not? Why do we have to do loan modifications or principal reductions? People are scurrying about in Washington trying to solve a problem they made up in their own minds — a problem that will solve itself if they let the process go forward and foreclose on the delinquent mortgage squatters.

Most loan-modification programs have focused on temporarily reducing interest rates and extending loan terms.

Principal reductions have gotten more attention recently because so many borrowers owe more than their homes are worth.

At the end of 2010, nearly 11.1 million borrowers, or nearly 23.1% of those with mortgages, were underwater, according to CoreLogic Inc. The tepid nature of the housing recovery suggests many borrowers could remain underwater for years.

There isn't much hope for appreciation bailing this group out. With that many distressed owners, enough of them are going to succumb to their own debts that a steady supply of distressed properties will stop any real appreciation.

Supporters of principal reduction say borrowers who receive such cuts are less likely to redefault.

“Principal write-downs are much more likely to create a loan that is sustainable over the long-term,” said Massachusetts Attorney General Martha Coakley, who has made principal reductions a component of four predatory lending settlements.

A study last year by the Federal Reserve Bank of New York found that loan modifications with principal reductions are far more likely to succeed than those that simply reduce interest rates.

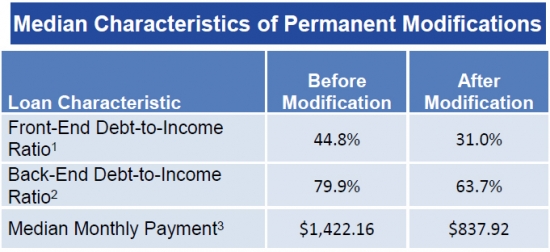

According to mortgage servicer Ocwen Financial Corp., 17% of its borrowers who got a principal reduction were behind on their payments again six months later, compared with 20% of those with a modification that reduced payments but not the loan balance.

The data clearly does NOT support the contention that principal reduction sustains home ownership. If 12 months later the difference in redefault rates is so small as to be negligible. No matter what you do with the over-indebted short of foreclosure and bankruptcy is going to save their homes. It isn't just the first mortgage debt that is weighing these borrowers down. They often have huge second mortgages or HELOCs, large credit card debts, and car payments.

Over the past year, Ocwen has cut balances on more than 16,000 loans, representing 22% of its modifications.

“We found that it's essential to include principal reduction in our modification arsenal to be able to address the negative equity problem,” said Paul Koches, Ocwen executive vice president. In February, Ocwen rolled out a program that will spread principal reductions over three years and let mortgage investors share in any subsequent increase in value when a home is sold.

Some mortgage companies say principal reductions are best used when borrowers are deeply underwater. PennyMac Loan Services LLC will consider reducing principal if the borrower is likely to remain underwater even after three or four years of loan payments, said Steve Bailey, chief servicing officer for PennyMac, which has used principal reduction in 58% of its modifications.

—Dan Fitzpatrick contributed to this article.

Write to Ruth Simon at ruth.simon@wsj.com and Nick Timiraos at nick.timiraos@wsj.com

How principal reduction could work

The Ocwen program described above is the only way principal reduction could work in the real world.

Let's say a borrower in Las Vegas owes $400,000 on a house currently worth $200,000 — a common occurrence there. Let's say the owner is given a principal reduction down to $200,000, but if they sell the house for a price between $200,000 and $400,000 the overage goes to the lender to recover the loss from the principal reduction. What that arrangement would effectively do is release the borrower from the property. They could sell without future financial liability, and if prices go up all the way to their entry point, they may even have equity again.

Of course, this approach would strongly encourage people who obtained principal reductions to immediately sell their homes. It would be far wiser to sell the house, buy one across the street, and keep the appreciation on that one. Hmmm…. I guess it doesn't work after all….

If you want to explore more on this issue, I recommend one from early in the IHB: 04-16-2007 — How Homedebtors Could Avoid Foreclosure — A look at a potential financing mechanism which might be used to assist homeowners who are underwater. It also examines the potential implications of the widespread use of such tools.

More stamina than most

I have always admired the stamina and determination of Japanese soldiers who never surrendered and finally come out of the jungle years after the war was over. Like the Japanese solders who carried on, many loan owners who bought at the peak will endure the crash and the very long climb back to their purchase price.

For those who put money down or who may not be too far underwater, it's easier to endure a little payment hardship rather than surrender the option value on the house. Prices will eventually go back up.

However, those property owners who bought at the peak and put no money down have a much lower pain threshold. Many of the posts I did in 2008 were peak buyers using 100% financing who walked away. I don't see those very often any more. And like the Japanese soldiers, when we find them, we should acknowldege their sacrifice… Although, I may question their wisdom.

Did they gain anything for their pain and suffering?

I hope they really enjoyed the high rent on this property while they were there. That money was expensive.

This property was purchased for $663,000 on 11/29/2006. The owner used a $530,400 first mortgage, a $132,600 second mortgage, and a $0 down payment. There is no telling how long they may have been delinqent in shadow inventory, but they were finally served notice last fall.

Foreclosure Record

Recording Date: 01/19/2011

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 10/15/2010

Document Type: Notice of Default

Irvine House Address … 8 HUCKLEBERRY Irvine, CA 92618 ![]()

Resale House Price …… $497,000

House Purchase Price … $663,000

House Purchase Date …. 11/29/2006

Net Gain (Loss) ………. ($195,820)

Percent Change ………. -29.5%

Annual Appreciation … -6.5%

Cost of House Ownership

————————————————-

$497,000 ………. Asking Price

$17,395 ………. 3.5% Down FHA Financing

4.79% …………… Mortgage Interest Rate

$479,605 ………. 30-Year Mortgage

$100,463 ………. Income Requirement

$2,513 ………. Monthly Mortgage Payment

$431 ………. Property Tax (@1.04%)

$150 ………. Special Taxes and Levies (Mello Roos)

$104 ………. Homeowners Insurance (@ 0.25%)

$160 ………. Homeowners Association Fees

============================================

$3,358 ………. Monthly Cash Outlays

-$410 ………. Tax Savings (% of Interest and Property Tax)

-$599 ………. Equity Hidden in Payment (Amortization)

$32 ………. Lost Income to Down Payment (net of taxes)

$62 ………. Maintenance and Replacement Reserves

============================================

$2,442 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,970 ………. Furnishing and Move In @1%

$4,970 ………. Closing Costs @1%

$4,796 ………… Interest Points @1% of Loan

$17,395 ………. Down Payment

============================================

$32,131 ………. Total Cash Costs

$37,400 ………… Emergency Cash Reserves

============================================

$69,531 ………. Total Savings Needed

Property Details for 8 HUCKLEBERRY Irvine, CA 92618

——————————————————————————

Beds: 2

Baths: 2

Sq. Ft.: 1508

$330/SF

Property Type: Residential, Condominium

Style: 3+ Levels, Contemporary

Year Built: 2001

Community: 0

County: Orange

MLS#: P775055

Source: SoCalMLS

Status: Active

On Redfin: 1 day

——————————————————————————

Immaculate Detached 2 Bedroom + Loft Home in the Desirable Gated Community of Oak Creek. Main Floor Bedroom and Own Bathroom with Access to Private Patio. Gourmet Kitchen Features Granite Counter Top, Upgraded Stainless Steel Appliances including Dishwasher, Refrigerator, Gas Oven and Microwave. Kitchen, Dining Area and Livingroom ( Wired for Surround Sound System ) with Balcony on 2nd Floor. Master Bedroom with Large Loft Area on Third Level. 2 Car Attached Garage with Extra Storage Unit, Water Softner and More. ..

How do the AG’s justify this very real outcome of principle reduction?

Two neighbors buy homes in 2006 for $500,000:

The irresponsible one (with Escalade and Jet Skis in the driveway) gets balanced reduced to $400,000.

Several years later they both sell for $600,000.

The iresponsible cry-baby that weaseled his way into a principle reduction walks away with an extra $100,000 (tax free).

How is this right?

I should have specified… The responsible one put down 20% so he CAN’T GET a principle reduction because he’s not “underwater” even though he watched his down payment vanish while the 0-down borrower qualifies for this!

I have a guest post next week exploring this issue.

It is totally unfair. There is no way it can be made fair. The most irresponsible will get the biggest rewards.

It’s fair because that’s exactly what the powers that be in this debt driven inflation economy wanted you to do.

Well, it’s also unfair that the irresponsible homeowners (around the minority of responsible homeowners) live-rent free for months/years, walk-away very likely with no recourse from the bank or IRS, and thereby lower the responsible homeowners’ values.

Life is unfair…

Isn’t real estate as a whole unfair?

It’s unfair that someone bought a home in QH in 2003 for $700k and that same home today is listing for $1m when some people are telling me it should be at 1999 prices.

Or unfair that someone bought that same home for $1.3m in 2007 and it’s now listing for $1m.

No, That’s totally fair as all participants had the same opportunity playing in the same market.

Principle reduction is a gift to be handed-out subjectively to chosen “winners” who perversely will be the more “irresponsible” players.

THAT’S why it’s inherently unfair!

When I feel sorry for myself as to my timing purchase and current “loss,” I remind myself how incredibly cheap undergrad and grad school were for me and the Mrs. These costs are easily three-times what they were just over a decade ago. This more than compensates for my real estate position.

So, the loan modification system works the same way the bankers do – rewarding incompetence. See wednesday’s post.

The crux of the problem is the government decides winners and losers.

Makes me sick.

Well, up to now we have the bankers deciding winners and losers. Doesn’t make for a good feeling either.

It’s not surprising considering that the U.S has been marching slowly towards a total welfare state for the past 50 years.

Ever since the end of the cold war the U.S has lost its competitive spirit, more and more, we do just enough to get by. We need another “enemy at the gates” so to speak, to keep our wits constantly sharpened.

Let’s hope for the First Alien Invasion to occur, or a Zombie Apocalypse. In those type of scenarios, only the sharpest witter survive. Those not even smart enough to calculate whether they can afford a monthly payment on a home, will perish.

“We need another “enemy at the gates” so to speak, to keep our wits constantly sharpened.”

Wasn’t that the entire cynical purpose behind the Bush Administration’s “War on Terror?” That, and the license to squander billions in taxpayer money?

Talk about unfair.

uh no, and btw the blog you are looking for is called “Huffington Post” – try AOL.

I vote for Zombie Apocalypse. I’ve been waiting for one of those for decades.

-Darth

“Let’s say a borrower in Las Vegas owes $400,000 on a house currently worth $200,000 — a common occurrence there. Let’s say the owner is given a principal reduction down to $200,000, but if they sell the house for a price between $200,000 and $400,000 the overage goes to the lender to recover the loss from the principal reduction. What that arrangement would effectively do is release the borrower from the property. They could sell without future financial liability, and if prices go up all the way to their entry point, they may even have equity again.

Of course, this approach would strongly encourage people who obtained principal reductions to immediately sell their homes. It would be far wiser to sell the house, buy one across the street, and keep the appreciation on that one. Hmmm…. I guess it doesn’t work after all…”

I think this does work (for the banks) if the balance is set to 10% – 20% above current market. The loan owner can either stay in the house making a payment until the market recovers, sell the house and cough up the deficiency to get out(I am sure this will rarely happen), or the owner stops making the payments and we are right back where we started. At that point FC and get it over with.

I know some loan owners that are way underwater but say that will spend their last penny to “keep the house”. For these poor souls, principal reduction is better then losing everything and still getting FC’d in the end.

This seems like a nice starter home at rental parity for a young Irvine couple.

Irvine continues to be the exception.

Today’s flipper/seller purchased it for $431K and listed at $497K

Assuming the net on this one is around $50K

It’s a 3-Month CD returning almost 12%

Investor appetite remains strong.

so is las vegas the exception as well?

Since IR buys and flips and makes a profit, by your logic, that is exception.

What does flipper profiting have to do with “exception”

Making that kind of juice in a short time frame sans headaches is the exception I’m referring to.

What will happen to the housing market if the stock market turns down?

So called Quantitative Easing (hell of a term) QE1 and QE2 will now come to a close (as of June). IMO it’s been the major thing inflating the stock market for the past year. Like crack to an addict, bad things will happen when it’s unavailable.

One of the goals of all the so-called QE was to re-ignite the housing market. Didn’t happen. All the new cash went for equities and commodities.

…and helped keep the inflated air inside home prices. what happens when all of this magically created QE2 wealth stops blowing into the system?

KaBoom?

Regardless of market conditions, this is such a poorly designed home. 3 floors for a two bedroom home?

And the balcony over the garage? You can scream obscenities at your neighbors as they park their cars:

“I fart in your general direction. Your mother was a hamster and your father smelt of elderberries!!”

Real uncertainity in the economy and housing prices coming. The end of QE2 could spike rates near term or could lead to a fading US economy and stable or even lower rates in the near term.

What is not uncertain is that rates will rise dramatically over the next 10 years. Borrowing 4 billion dollars a day that we don’t have is not a recipe for stable rates regardless of what happens to the US economy – boom or bust.

It seems to me that if we bust then we embark on QE3/4/5 and that only will weaken the dollar and drive rates higher later than sooner. If we boom because of all of the cheap money then rates will sky rocket to keep inflation in check.

We can only hope we thread the needle. Housing has at best a long grind sideways. This is exactly what happend in Japan after their housing / RE bubble. Only they didn’t go sideways. They are 50% off 20 years later just like our NASDAQ. If you buy today be prepared to stay and pay!

You will likely buy today on a 30 year fixed and pay down 18% of your mortgage in the first 10 years (this is what happens …you live there for 1/3 of the mortgage and only add 18% to your equity)and sell to someone who has to borrow money at 3-7 percent higher and find out that your 1M$ house in 2011 is worth 775K$ in 2020.

It has happened before (Japan) and will happen here. It is just about the math. Just figure out what you can afford on a monthly basis and then plug in 5% rates – this gives you your purchase amount after downpayment. Then do the same exercise with 9% rates… Pobre Si! Subtract 40% from asset value…. 🙁

If you disagree you must see huge jumps in your income coming – not related to inflation.

BD

Anything that requires borrowed money will suffer as rates rise.

Inflation is coming with much higher rates….

http://www.cnbc.com/id/42377057

BD

I know, I know… Irvine is different because nobody borrows money to buy their 600K apartment. We shall see…

BTW, guys have any of you just done the math?? I would expect public school people from Irvine to do it correctly. That said, maybe this is not about intellect and more about hope and emotion. Maybe a self-fulfilling prophecy???

Let’s see how that works out…

Planet Reality – you must be able to do math. So what is your magic 8 ball telling you about future housing prices???? How wrong am I…??

BD

“In early 2010, i predicted the moral trepidation about strategic default would largely be gone from the American psyche.”

We’re definitely there.

Suze Orman did a segment recently on TV on the pros and cons for an audience member considering it. That’s as mainstream as you can get.

Trivia: 90% of Suze’s money is in idiot-proof tax-free munis.

Hey, they are doing this reductions for first time homebuyers and many others that bought their homes from a company that inflated prices and mislead customers. I bought my house for 149,000 mid of 07, today I can’t sell it for 100,000. I’ve tried, a lot. I say if your upset about it stick it up your piehole. People makin up hypothetical shit. I bet the person who listed their nieghbors financials have no idea wtf they are talking about. Prob tea partiers.

Your assumption that ANY and ALL principal reductions are both unfair and unworkable is simply wrong. This time, lad, U B not good.

First, for businesses this type of adjustment is routinely made in chapter 11’s. BK judges and trustees – for both the BK estates and the debtors – and the attorneys for the creditors ALL know how to do this, and they do it every single day in every state in this country. To say that it CANNOT be done is untrue.

Second, to assume that it cannot be MADE fair is, we admit probably true today in this political environment. However, financially, economically, and legally it CAN be made fair.

Take your low-down “no down” buyers, please. There is a simple solution to that problem – limit the amount of the principal reduction by the amount that was NOT put down, dollar for dollar, say below 20% down.

If the goal is to help keep people in their homes, that too can be addressed by a recapture rule, say 10% of the principal reduction per year – reversed, of course. You have NOT forced them to stay in the home, they can leave whenever they want; but if they try to take the money and run, they get cut off at the pass.

Third, what you do NOT address is the simple economic fact that for the investor who put up the money for the RE loan, a workable reduction program can SAVE them a ton of money.

IF the average decline in assessed values in Phoenix is 62%, which it is by the way; WHY is it in the investors best interest to foreclosure and take back a home that is now worth 38 cents on his hard dollar investment? Please, explain to NY Life, Allstate and all those other insurance companies, why that is a good or even a fair deal for them.

“IF the average decline in assessed values in Phoenix is 62%, which it is by the way; WHY is it in the investors best interest to foreclosure and take back a home that is now worth 38 cents on his hard dollar investment? Please, explain to NY Life, Allstate and all those other insurance companies, why that is a good or even a fair deal for them.”

Because the longer they wait, the worse the losses will get. The urgency in writing down a loan 62% is that if you wait, you will end up writing it down 85%.

IHB, permit me to suggest/argue something slightly different.

That both HARP and bank loan modifications were never intended to work. And, Jamie Dimon is not refusing to do them, bcuz he hates U.S. – he probably does, but that’s not the reason.

If a servicing bank forecloses, they do NOT have to immediately pay that money to the investors. They can and do re-invest it. And, all of the interest and the profits from those re-invested funds are ALL retained by the servicing banks.

Not only do they not have an incentive to modify, they have a very powerful, if immoral, reason not to do that.

And, in addition, they do not have to write down the RE loans on their own books. Were they to do that, they would impair their “capital” and need to charge you even more late fees, penalties, interest, etc. Or, they would have to sell shares to buy enough “capital” to stay under SEC and FDIC limits.

Bluntly, until they have “papered over”, as in “covered up” all the loan losses they do have, but have not written off or down, they cannot afford to DO principal reductions. Geithner knew that, even if Barack did not. And, HAMP was not designed to force them to – only to stall U.S. out long enough for the Big Bad Bailed-out Banks(ters) – the BBBB’s, pronounced like in “bee-bee” brains – to squeeze out of U.S. the funds they needed in order to survive.

We were intentionally skewered(sp)!