A review of American Gothic themed cartoons by Irvine Renter.

Irvine Home Address … 27 OROVILLE Irvine, CA 92602

Resale Home Price …… $839,000

Bye, bye Miss American Pie

Drove my Chevy to the levee but the levee was dry

And them good old boys were drinking whiskey and rye

Singing this'll be the day that I die

This'll be the day that I die

Oh, and there we were all in one place

A generation lost in space

With no time left to start again

Don McLean — American Pie

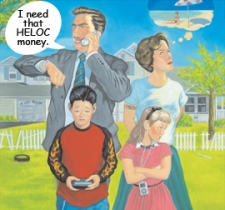

My interest with American Gothic, a classic of American art, began when it was first proposed as the cover to The Great Housing Bubble. I liked the use of American Gothic because it has become a symbol of Mr. and Mrs. America. The work was painted in the Great Depression, which is part of the reference of the book title, but with some modernization we see how today's American family is deeply underwater on their mortgage — a mortgage that was their reservior of unlimited spending money. Parody's of American Gothic are fairly common, and I have assembled many pieces of parody art and added my own words to bring out the American Ponzi.

There are early housing bubble cartoons with Mr. and Mrs. America. And my own attempts to capture Mr. and Mrs. Ponzi.

Mr. and Mrs. America got caught up in an easy money lifestyle fueled by cheap debt.

Mr. and Mrs. America are facing low property values and mortgage payments much higher than staying in a rental.

Once they quit paying, they got to stay rent-free in their houses for a very long time.

Our society was changed forever.

What were we to do about the low house prices.

People want houses because they want to get rich owning them.

Nobody wanted to be left out.

.jpg)

Free money brings entitlement. People get because they deserve, not because they earn.

Many people found their poor decisions landed them in a difficult predicament.

And now I leave you with American Ponzi: Redefining a cultural icon.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

If you bought a property in early 2008, do you have any reason to believe your house is worth more today?

Irvine Home Address … 27 OROVILLE Irvine, CA 92602 ![]()

Resale Home Price … $839,000

Home Purchase Price … $807,000

Home Purchase Date …. 5/29/2008

Net Gain (Loss) ………. $(18,340)

Percent Change ………. -2.3%

Annual Appreciation … 1.5%

Cost of Ownership

————————————————-

$839,000 ………. Asking Price

$167,800 ………. 20% Down Conventional

5.07% …………… Mortgage Interest Rate

$671,200 ………. 30-Year Mortgage

$175,110 ………. Income Requirement

$3,632 ………. Monthly Mortgage Payment

$727 ………. Property Tax

$267 ………. Special Taxes and Levies (Mello Roos)

$140 ………. Homeowners Insurance

$145 ………. Homeowners Association Fees

============================================

$4,911 ………. Monthly Cash Outlays

-$891 ………. Tax Savings (% of Interest and Property Tax)

-$796 ………. Equity Hidden in Payment

$333 ………. Lost Income to Down Payment (net of taxes)

$105 ………. Maintenance and Replacement Reserves

============================================

$3,661 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$8,390 ………. Furnishing and Move In @1%

$8,390 ………. Closing Costs @1%

$6,712 ………… Interest Points @1% of Loan

$167,800 ………. Down Payment

============================================

$191,292 ………. Total Cash Costs

$56,100 ………… Emergency Cash Reserves

============================================

$247,392 ………. Total Savings Needed

Property Details for 27 OROVILLE Irvine, CA 92602

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 2,333 sq ft

($360 / sq ft)

Lot Size: 5,131 sq ft

Year Built: 2002

Days on Market: 98

Listing Updated: 40476

MLS Number: S632323

Property Type: Single Family, Residential

Community: Northpark

Tract: Mnd2

——————————————————————————

Exceptional 3 Bedrooms, 2.5 Baths home plus tech center. Located in the heart of resort-style community of Northpark on a cul-de-sac & interior tract location. Highlighted features: Oversized backyard with custom Outdoor fireplace, BBQ island, and Patio cover. Professionally Landscaped with citrus trees, roses, bougainvillea, cypress trees and Custom Hardscape. Elegant Maple Hardwood floors, Chef's Gourmet Kitchen features double ovens, built-in refrigerator, five burner cooktop, Granite kitchen counters and Large Center island. Maple raised panel Cabinets, Eat-in kitchen, Family room with hearth, Karastan designer carpet, Designer paint colors, Plantation shutters, Crown moulding, Arched doorways and Architectural windows throughout bringing in lots of natural light. 10' Ceilings make a dramatic Formal living and Dining room. Master Suite with walk-in closets, & French doors leading to balcony. Porte Cochere motor court driveway and two-car garage for extra parking. Excellent schools!

Another one on KoolAid! They think prices have gone up since 2008? I see pricing in most areas around 2003-2004 levels in Irvine, 2001-2003 in South Orange County

I read your blog everyday and love the realtor speak glyphs. gourmet kitchen, light and bright, cozy, turnkey are some of my favorites.

Really, we need to thank these KoolAid suckers. By buying this turd in 2008, they saved the prior lender from a (more) massive loss. And by 2008 they probably had to sink 20% of their own money into it. So they will absorb at least $160,000 of the next loss.

Suckers like this will keep the banks solvent. Assuming they can sell this for $600,000, they lose $160,000 and the bank loses $40,000. The next sucker puts $120,000 into it… repeat, repeat, repeat until prices come back to reality, with new buyers/suckers absorbing the first 20% in losses instead of the banks.

buster,

that’s an awesome way of looking at this debacle. i just hope the repetition occurs faster to drive price down faster, but i guess we just have to wait until the fundamentals of the market works itself out.

I never stop being amazed at how many people just don’t think, or their logic stops working, or just plain stupidity, or they just let their emotion takes over, when it comes to buying a house. They just can’t see that OC houses are way overpriced. Don’t they look at the sale records at 1998, 2000, 2002 for people buying in 2005, 2006, or even 2008 like this idiot, and see that the house triple in price in 7-8 years, and don’t they question that they might be the ones holding the bags.

People are clueless and have no sense of how much a house should cost, and I think that’s THE biggest problem. I usually use this example when talking about house price to my relatives: let’s say you want to buy a shirt, a car or whatever. let’s use the example of buying a car. let’s say you want to buy a Camry, and you know that that model you want should cost around $20,000. Now, let’s say there a Camry bubble, and the dealer is asking $60,000. would you buy it? Think about it, no one in their right mind would buy a 60K Camry, and yet people are buy houses that cost 3X its value. Isn’t that mind boggling?

but then that’s bubble mentality. Why should a tulip cost anything at all in the 1600’s! just plain madness!

the greater fool theory.

many people think the camry could be sold for $80k or $120k so will will buy at $60k and try to sell for a higher price.

everyone thinks they are smarter than everyone else and there will be a greater fool to bail them out.

but when the music stops, they find they were the greatest fool.

it makes economic sense (it’s simply a buy low, sell high strategy), but it takes skill to play the game. skill people think they have, but don’t.

any “fool” with the down payment and income can play the game. this is both good and bad. good for those with skill who can take advantage of the fools. bad for fools who think they have skill and get taken advantage of.

One thing to consider is that there is more or less an unlimited supply of Camrys. The creators of sudden acceleration will ramp up production to fill supply, keeping a lid on prices.

Housing is much more inelastic and therefore a great candidate for boom and bust cycles.

Plus, your Realtor can not tell you the old “they ain’t making any more Camrys”.

Don’t bet on people not being stupid enough to bid up the prices on cars, or any other type of common manufactured junk.

Do you remember the first Miatras? Morons were bidding these cars up at the dealerships and waiting six months when these cute little sports cars made their debut. Same thing when the Mustang re-do was released a few years ago.. I heard of a number of wealthy old men with nostalgic cravings and ample garage space offering absurd prices for this ordinary, trouble-prone car. Often, they were paying triple the list for these inferior autos.

But for real absurdity, you just can’t beat the Tickle-Me-Elmo craze- prices for an ugly stuffed toy for which a reasonable price was perhaps $15, ran up to $750, and hysterical women with tear-streaked faces were shrieking that they just HAD to have this toy for their kid. When the fad died a year later, you couldn’t sell the things for even $10.

Worked with a woman a number of years back who had collected 600 Beanie Babies, the cost of which would have made a down payment on the house she no doubt borrowed against to buy all this crap.

One of my dreams has always been to dream up some ridiculous, simple-to-manufacture toy like the Pet Rock or Hula Hoop or Elmo, to sell signed and numbered editions to idiots for hundreds of dollars. Anyone who can come up with some catchy thing that costs pennies to make and inspires well-healed cretins to part with hundreds or even thousands of dollars for, just on emotion, is welcome to every dime he or she makes.

There is absolutely no limit to human irrationality, stupidity, self-indulgence, self-deception, and credulity, and you will find these traits evenly distributed among both sexes, all genders, and all races and ethnic groups. The only diff is WHAT they fall for.

Yay, the double-dip is finally here:

http://money.cnn.com/2010/12/28/real_estate/home_prices_fall/index.htm?hpt=T2

Fasten your seatbelts!

Balanced reporting, for a change

Faces of the Home-Foreclosure Crisis

The Tidal Wave of Defaults and Delinquencies That Began Four Years Ago Has Hit Individuals at All Levels of Society

http://online.wsj.com/article/SB10001424052748704610904576031632838153532.html?mod=WSJ_hp_LEFTTopStories

From the link above:

“We had a ball”

The whole CA and especially Southern CA had a ball during those years too, just like Ms. Carr!

“After the Good Life Goes Sour

Like many Americans who saw their home values shoot up during the housing boom, Christine Carr found lots of ways to spend her equity windfall.

A decade ago, she and her husband paid nearly $180,000 for a three-bedroom home in Dallas, N.C., outside Charlotte. Their income easily covered the $1,100 monthly mortgage payment.

In 2006, after discovering the house’s value had skyrocketed by $100,000, the couple took out a second mortgage and got cash. They bought a $70,000 camper, took a cruise to Alaska and vacationed in Belize. The new loan added $698 to the couple’s monthly payment.

“We had a ball,” she said.

Three years later, her husband moved out and stopped contributing to the mortgage payments, she said. Then she lost her job as a consulting firm’s marketing manager. In April 2009, Ms. Carr put the house on the market for about $235,000. With no income, Ms. Carr, now divorced, didn’t qualify for a loan modification, which would have lowered her mortgage payment.

In July 2009, she asked the lender, Bank of America, to let her hand over the home to avoid the foreclosure process. But the two sides couldn’t come to terms.

With no interest from buyers, Ms. Carr stopped making payments that August. “It was a gut-wrenching decision,” the 46-year-old woman said. “I was raised to live up to my commitments.”

These days, she receives a monthly statement that details the swelling late fees and penalties for both of her loans. Although she found work in March this year, Ms. Carr said she had no intention of paying: She has moved to a rental and her Dallas home sits abandoned. The luxury camper was sold for “a lot less” than the purchase price, she said.

Ms. Carr said she felt guilty but was ready to move on. “It makes me sick to my stomach sometimes, just thinking about it,” she said. “But once you make the decision, you stick with it.”