A California State Keep Your Home plan tries to funnel $2,000,000,000 to the banks; however, lenders are turning down the money due to the moral hazard of principal reduction.

.jpg)

Irvine Home Address … 7 IRON BARK Way Irvine, CA 92612

Resale Home Price …… $580,000

Well now, the eagle on the dollar says "In God we trust"

You say you won't obey me, you wanna see that dollar first

How long, dear, do I have to wait ?

Can I get you now, dear, mm, must I hesitate ?

Janis Joplin — Hesitation Blues

The government is itching to give banks money, but the banks have to give up a dollar first. This is more than hesitation. Banks won't take the money because they know that giving up that first dollar will encourage moral hazard guaranteed to bring down the banks in the end.

California foreclosure aid fund swells, but banks hesitate

The state's Keep Your Home plan has grown to $2 billion from $700 million. However, mortgage servicers haven't officially agreed to participate in the principal reduction part of the program.

By Alejandro Lazo and E. Scott Reckard, Los Angeles Times — November 10, 2010

Federal funding for a California plan that helps borrowers facing foreclosure has snowballed to $2 billion, enough to potentially help more than 100,000 homeowners.

Is anyone surprised that the cost of this government boondoggle has grown significantly from when it was first introduced? Has anyone seen a program like this get smaller?

But the program lacks formal agreements with the nation's largest banks and investors, and their cooperation is needed to make the proposed effort broadly successful.

Out of the three major mortgage servicers — Bank of America Corp., Wells Fargo & Co. and JPMorgan Chase & Co. — only Bank of America has told the state that it will participate in a central part of its Keep Your Home program that would reduce the principal balance of certain troubled mortgages, and even BofA has yet to sign an agreement. Fannie Mae and Freddie Mac have declined to participate in the principal reduction part of the plan.

Wait a minute. How can the GSEs fail to participate in any government program? They are in conservatorship owned and run by the Treasury department. If the GSEs are not participating, then the government doesn't truly believe this is a good idea. This is a deep acknowledgement that the entire program is symbolic politics intended to help no one.

The Keep Your Home program, which uses federal funds reserved for the 2008 rescue of the financial system, is intended for low- and moderate-income people who own only one property. To qualify in Los Angeles County, a family of four couldn't earn more than $75,600. The maximum benefit for any household participating in the program is $50,000.

The income limitation excludes nearly every loan owner in Irvine.

The biggest part of the plan gives $875 million in temporary financial help to homeowners who have seen their paychecks cut or have lost their jobs. The program would provide as much as $3,000 a month for six months to cover home payments, including principal, interest, insurance and homeowner association dues.

Another piece would provide as much as $15,000 to help homeowners get current on their mortgages, and another would provide assistance to move for those people who can't afford to remain in their homes. Most of the big banks and Fannie and Freddie have signaled that they're willing to participate with these parts of the plan.

Look at those massive bank bailouts. Who benefits from a homeowner making payments and getting current on their mortgage? The loan owner? No way. The bank ends up with all the money, and the loan owner ends up with an ongoing mortgage obligation they cannot meet. It delays a few foreclosures for a while, and gives lenders a lot of money. I wonder who designed that program?

But the most controversial part of the program, and the one most difficult for banks and investors to sign on to, dedicates $790 million to principal reduction. This would write down the value of an estimated 25,135 "underwater" mortgages, which are loans in which homeowners owe more on their properties than what they are worth.

All that money, and it is only going to help about 25,000 loan owners? The crash has impacted many more households than what this program will fix.

By making principal reduction part of the program, no bank is going to participate — which is a good thing because this program is a waste of money. Rather than participate in this program, banks would rather lose more money and avoid the moral hazard of principal forgiveness.

The California plan — as well as programs created by Nevada and Arizona — would pay lenders $1 for every dollar of mortgage debt forgiven. Experts say reducing principal on such underwater loans would go far to reducing foreclosures in the three states because home values have fallen so steeply that homeowners are tempted to walk away from their obligations.

Loan owners are more than tempted, they are walking away in huge numbers.

But the financial industry has been reluctant to participate in government-administered programs that would require them to reduce the amount that borrowers owe them.

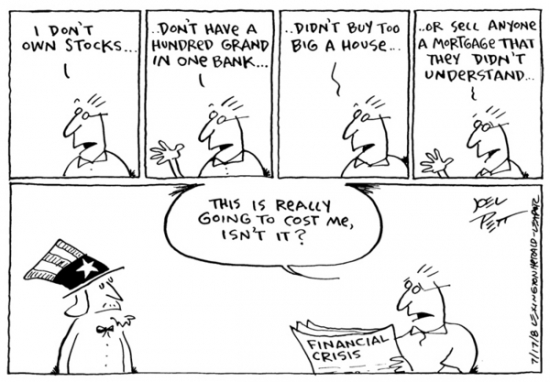

The reason banks are reluctant to participate is because they are not in a business of giving away money. Once people believe the banks are giving away money, banks become charities and quickly go out of business. Our entire banking system rests of the belief that borrowed money must be repaid. If borrowers believe they can easily get out of repaying financial obligations with no repercussions, the banking system crumbles.

"If you can't do the principal write-down, you are limited in what you can do," said Dan Immergluck, an associate professor at the Georgia Institute of Technology, who studied the different state plans developed with the federal bailout money.

"It is one thing for them to agree not to write down principal when they are being asked to foot the whole bill," he said, "but when the states are agreeing to match this 50-50, it seems rather ridiculous of the servicers and the investors not to agree to this."

It only seems ridiculous to an associate professor who does not understand the moral hazard associated with principal reduction. The banks shouldn't agree to any principal reductions under any circumstances outside of a bankruptcy.

Diane Richardson, director of legislation for the state's housing finance agency, which created the California plan, said she expects other lenders to follow Bank of America's lead once the program is underway.

"Once the program gets going, and other lenders see how successful it is, I think others will come aboard," she said.

Does she really believe lenders will rush to write off billions of dollars in loans and encourage moral hazard?

The Keep Your Home program was slated to begin Nov. 1, but the launch was pushed back until early next year because the effort grew in complexity and size from when it was announced in February.

A government program grew in size and complexity? I am shocked.

Originally, five states in which home values had dropped more than 20% since 2006 were selected to receive $1.5 billion from the Treasury Department's Troubled Asset Relief Program. The program grew to cover states with high unemployment, which included California, and more federal money was added. California was initially slated to receive $700 million when the Treasury approved the state's plan in July. Then even more money was added, resulting in a $7.6-billion program involving 18 states and the District of Columbia.

California, which accounts for 21% of the nation's foreclosure activity, is the largest recipient of the bailout money.

How long do you think California can convince the rest of the nation to support its housing Ponzi scheme? Any money poured into California mortgages by the US taxpayer is money wasted. The rest of America should not responsible for paying the debts of squatters and squanderers in California, nor should they have their tax money diverted here to bail out the lenders that created this mess.

Homeowners in the Golden State also remain deeply underwater, according to recent data. In California, 27.9% of homeowners who owned single-family residences were underwater at the end of the third quarter, according to data released Wednesday by real estate information site Zillow.com. In Los Angeles County, 17.4% of borrowers owed more on their mortgages than what their homes were worth.

Even as the state struggles to get big lenders to sign on, the program has provoked complaints that it's a giveaway to the banks. Critics say property values have fallen so steeply that much troubled mortgage debt is not worth 50 cents on the dollar.

In Las Vegas, it is common to see properties where the debt is double the current mortgage value. When the banks forecloses, it is assured of losing at least half its loan value. If they participate in this program, they can write down the mortgage and get 50% of that loss paid for by the government. This program is obviously a giveaway to the banks. Critics are pointing out the obvious. The government wants to subsidize and encourage moral hazard.

In Las Vegas, it is common to see properties where the debt is double the current mortgage value. When the banks forecloses, it is assured of losing at least half its loan value. If they participate in this program, they can write down the mortgage and get 50% of that loss paid for by the government. This program is obviously a giveaway to the banks. Critics are pointing out the obvious. The government wants to subsidize and encourage moral hazard.

Foreclosures on these homes are so costly that the banks will come out ahead financially by writing down loan balances to keep borrowers in the homes, they contend.

"I don't think we should have to be paying the lenders," said Prentiss Cox, a professor at the University of Minnesota Law School Clinic. "We have already paid them in the form of the bailout, and it seems to me what we need is enforced loan modification, because that is in everyone's interest."

What is an enforced loan modification? All our loan modification programs are stealth bank bailouts which also encourage moral hazard.

Critics also are unhappy that homeowners who refinanced their homes to take cash out of their properties will not be allowed to participate in the program. That will exclude many African American and Latino borrowers in low-income communities who were hustled into loans they did not understand or could not afford, said Yvonne Mariajimenez, deputy director of Neighborhood Legal Services of Los Angeles County.

These borrowers were "enticed by predatory lenders to refinance and pull out equity to pay medical debt, fix their houses and the like," Mariajimenez said.

I find this kind of bullshit particularly offensive.

First, perhaps one in a thousand pulled out equity to pay a medical debt. That is always the first excuse offered, and in most cases, it is not true.

Second, although a small percentage of borrowers put a small percentage of their mortgage equity withdrawal toward "fixing" their houses with pergraniteel, the vast majority spent the vast majority of their HELOC money on cars, vacations, massages and other non-essential consumer goods.

Third, no matter what use people had for this money, why am I supposed to pay for it? Why is the US taxpayer supposed to pay for some HELOC abusers trip to Tahiti and new Porsche?

If people were enticed by evil lenders, let them experience the consequences of their poor decision making, and perhaps they will not repeat their mistake. Give them free money, and they will almost certainly spend their equity again in the next cycle and look for a bailout when the Ponzi Scheme collapses again.

"A disproportionate number were people of color that live in minority communities."

Playing the race card too? Shame on her. Lenders were not discriminating in their targeting of fools.

Getting banks to write down principal has proved difficult through government programs, though some lenders have done it through their own proprietary initiatives. The federal government's loan modification program, which is also funded by money from TARP, has always allowed loan servicers to forgive principal on troubled mortgages, but has never required them to do so.

Proponents of forgiving principal say this is a serious flaw. They contend that debt forgiveness is the only workable way to address the problem created by underwater loans. alejandro.lazo@latimes.com, scott.reckard@latimes.com

Proponents of forgiving principal are idiots. Foreclosure Is a Superior Form of Principal Reduction.

Too good to be true

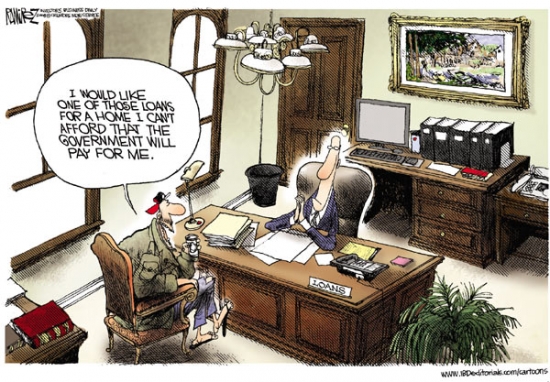

I'm sure many in Irvine and the rest of America don't pay much attention to financial matters unless something changes. People will pay the same mortgage for years even if great refinancing opportunities exist. But if a sales pitch that is too-good-to-be-true is backed up with real money, the result can be a catastrophic housing bubble.

The sales pitch is easy: "fill out some loan paperwork (with the broker's help), and I will give you a lower payment and $200,000 to spend any way you want." That is a very tempting offer.

Imagine ordinary worker bees paying their bills and watching late-night TV when that sales pitch comes from a subprime lender. Call a number to get free money. The response rates must have been very high.

It only takes one mistake if it's for hundreds of thousands of dollars. And once they go Ponzi, it is only a matter of time before creditor cutoff signals an end of ignorant bliss.

-

Today's featured property was purchased on 6/19/2002 for $385,000. The owners used a $308,000 first mortgage, a $38,500 second mortgage, and a $38,500 down payment.

- On 7/16/2003 they refinanced with a $424,000 first mortgage and a $106,000 second mortgage. On that day about a year after buying, they cashed out their $38,500 down payment plus another $68,000 in booty. Not bad for one year of ownership. The extra $68,000 per year income would be a nice ownership stipend.

- On 1/19/2005 they refinanced with a $520,000 first mortgage and a $130,000 stand alone second. That is going Ponzi.

With their final refinance, they put $650,000 in debt on the property. The managed to loot $226,500.

In some ways you have to admire the swashbucklers. The swooped in, took the money, raped and pillaged the economy, and took off without a trace. For most, it must have been a very good time. A worthy adventure. Not a virtuous way to live, but it serves some people.

In the end, all those who went Ponzi is a lost home, a low credit score, and an unceremonious fall from entitlement.

.jpg)

Irvine Home Address … 7 IRON BARK Way Irvine, CA 92612 ![]()

Resale Home Price … $580,000

Home Purchase Price … $385,000

Home Purchase Date …. 6/19/2002

Net Gain (Loss) ………. $160,200

Percent Change ………. 41.6%

Annual Appreciation … 4.9%

Cost of Ownership

————————————————-

$580,000 ………. Asking Price

$116,000 ………. 20% Down Conventional

4.38% …………… Mortgage Interest Rate

$464,000 ………. 30-Year Mortgage

$111,763 ………. Income Requirement

$2,318 ………. Monthly Mortgage Payment

$503 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$97 ………. Homeowners Insurance

$179 ………. Homeowners Association Fees

============================================

$3,096 ………. Monthly Cash Outlays

-$384 ………. Tax Savings (% of Interest and Property Tax)

-$624 ………. Equity Hidden in Payment

$186 ………. Lost Income to Down Payment (net of taxes)

$73 ………. Maintenance and Replacement Reserves

============================================

$2,346 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$5,800 ………. Furnishing and Move In @1%

$5,800 ………. Closing Costs @1%

$4,640 ………… Interest Points @1% of Loan

$116,000 ………. Down Payment

============================================

$132,240 ………. Total Cash Costs

$35,900 ………… Emergency Cash Reserves

============================================

$168,140 ………. Total Savings Needed

Property Details for 7 IRON BARK Way Irvine, CA 92612

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 1,900 sq ft

($305 / sq ft)

Lot Size: 3,328 sq ft

Year Built: 1966

Days on Market: 286

Listing Updated: 40469

MLS Number: P719994

Property Type: Single Family, Residential

Community: University Park

Tract: Othr

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Back on the Market!!!! Bank already approved for $580,000, they wont take any less. This 2 story home is located in a nice quiet area of Irvine. Features wood and ceramic floors, granite counter tops, the backyard opens up to the park which is near the pool, 2 fireplaces and much more. The home is in excellent condition and a Must See. Thank you and Good Luck.

.jpg)

The current cap on the HMID is $1,000,000 for first mortgages, and $100,000 for HELOCs

The current cap on the HMID is $1,000,000 for first mortgages, and $100,000 for HELOCs

Reducing the home mortgage interest deduction would certainly take much of the air out of the bubble. It would reduce loan balances, and thereby lower offers of new buyers. This will lower prices for homes in areas where loans exceed $500,000. It would immediately reduce the net worth of homeowners in those areas. However, this policy would not impact anyone else. New buyers would be taking on less debt — which is a good thing. Renters would no longer be subsidizing the debts of homeowners through tax incentives — which is a good thing. And tax revenues would increase — which is why the commission is considering it.

Reducing the home mortgage interest deduction would certainly take much of the air out of the bubble. It would reduce loan balances, and thereby lower offers of new buyers. This will lower prices for homes in areas where loans exceed $500,000. It would immediately reduce the net worth of homeowners in those areas. However, this policy would not impact anyone else. New buyers would be taking on less debt — which is a good thing. Renters would no longer be subsidizing the debts of homeowners through tax incentives — which is a good thing. And tax revenues would increase — which is why the commission is considering it.

There are only two consituencies that should oppose the changes to the HMID offered by the commission: (1) homeowners with mortgages over $500,000 — which isn't very many people, and (2) raw land owners in the path of development — which is very few people. Everyone else should be in favor of these changes because everyone else is sending their tax dollars to the two effected groups every year through the tax break.

There are only two consituencies that should oppose the changes to the HMID offered by the commission: (1) homeowners with mortgages over $500,000 — which isn't very many people, and (2) raw land owners in the path of development — which is very few people. Everyone else should be in favor of these changes because everyone else is sending their tax dollars to the two effected groups every year through the tax break.