The FHA is continuing to tighten it standards despite the government's desire to get more buyers to absorb the foreclosure problems facing the market.

Irvine Home Address … 66 GOLDEN GLEN St 4 Irvine, CA 92604

Resale Home Price …… $262,000

I respect your time

Don't mean to hit you on a work night

But what I gotta do girl (do girl)

Baby can't you bend them rules

Did I miss that cut off time

Used to be down did I drop the dime

Omarion — Cut Off Time

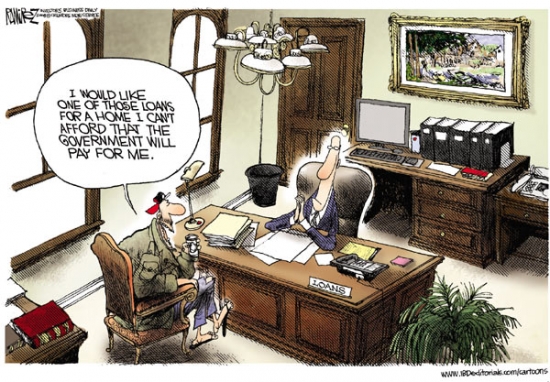

Why is the FHA tightening their standards at a time when we need every buyer we can find? With a sky-high delinquency rate, and with the taxpayer on the hook for the losses, the FHA didn't have much choice. People who fall below the cutoff line are the ones most likely to default on their mortgage. Expect standards to tighten further before this crisis is over.

Home Buying Gets Tougher as Lenders Restrict FHA Loans

By Jody Shenn and John Gittelsohn – Nov 17, 2010 11:41 AM PT

Home ownership may be falling out of reach for more Americans as lenders toughen their standards for Federal Housing Administration-insured loans beyond what the agency itself requires.

Mortgage lenders including Wells Fargo & Co. and Bank of America Corp., the two largest, have raised the minimum credit score on FHA-insured loans that they will buy to 640 from 620. About 6.3 million people fall within that range, according to FICO, which created the formula for the ratings.

With about 10 million distressed properties coming to market, this one small change just eliminated 6.3 million potential buyers. That can't be good for the housing market.

The higher hurdles for FHA loans, used in about a fifth of U.S. home purchases, add to challenges for a housing market already struggling with record-low sales and surging foreclosures. While lax lending fueled the bust that led the U.S. into recession, the new requirements will stifle the real estate recovery needed to revive the economy, said Ron Phipps, president of the National Association of Realtors.

“We’ve gone from silly to stupid,” Phipps, principal partner of Phipps Realty Inc., said in a telephone interview from his home in Warwick, Rhode Island. “People who should be getting credit can’t get it. To have a healthy real estate market, you need activity. You need transactions.”

The National Association of realtors has gone from silly to stupid.

In order to have stable transactions where borrowers actually get to keep their homes, we need to know they can really make the payments. There is no more Ponzi borrowing. Borrowers cannot borrow money to make payments. The really need to make money and have income.

FHA Rules

The FHA, which previously didn’t have minimums for FICO scores, began in October to require grades of at least 500, and more than 580 for loans with down payments of as little as 3.5 percent. Borrowers with scores between those levels must put 10 percent down. Several lenders moved minimums to about 620 at the start of 2009, the companies said then.

FICO scores range from 300 to 850. The grades are based on data such as whether borrowers have missed debt payments, balances on their credit cards relative to borrowing limits, and the length of their credit history, meaning consumers who’ve never fallen delinquent can have lower scores, according to the company’s website.

The 6.3 million people with grades between 620 and 640 equate to about 3.7 percent of U.S. consumers with credit information available, according to FICO, the Minneapolis-based company formally known as Fair Isaac Corp.

Requiring a 640 credit score excludes as much as about 15 percent of FHA borrowers, David Stevens, the agency’s commissioner, said in an interview yesterday. Minorities and borrowers in communities hardest hit by the recession are most likely to lose based on FICO scores, he said.

Playing the race card? Give me a break. The people most likely to have problems with their FICO scores are the millions of people who stopped making their mortgage payments.

Finding Better Way

“We are restricting opportunity and access for those who can least afford it,” Stevens said. “We need to find a better way to provide access to these families who are being cut out simply because lenders are putting arbitrary overlays on top of our requirements.”

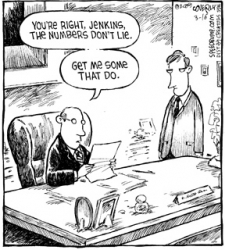

Arbitrary? Obviously lenders are putting these restrictions on their loans becaue these people default at higher rates than others. There is nothing arbitrary about it. Think about it. Why would lenders put arbitrary standards in place that restricts their ability to profitably do business?

FHA insurance covers lenders or debt investors when borrowers default. One of every five U.S. home purchases relied on the loans in the fiscal year through July, the agency said in a report yesterday. They accounted for a third of purchases by first-time homebuyers in the year ended Sept. 30.

The FHA, the Department of Veteran Affairs and Fannie Mae and Freddie Mac, the companies taken over by the government in 2008, have been providing about 95 percent of new mortgage financing after falling home prices sparked retreats by banks and by investors in mortgage bonds without U.S.-backed guarantees, according to Inside Mortgage Finance newsletter. The S&P Case-Shiller Index of property values in 20 cities fell as much as 33 percent from its 2006 peak.

Now that the government is the market and taxpayers have to absorb future losses, I am relieved that lending standards are getting tighter.

Larger Role

“It’s absolutely clear that, today, FHA is playing a larger role than it should,” Stevens said during a conference call with reporters yesterday. “But it’s a counter-cyclical force providing liquidity in a market where private capital still is completely absent.”

I agree with him on this point. There is a viable place for the FHA. I would like to see the GSEs dismantled, but the FHA does serve a useful role in cleaning up after disasters like the Great Housing Bubble. Can you imagine what would have happened if the FHA were not around?

Mortgage companies are tightening FHA standards partly because of the higher costs they face in servicing delinquent loans, said Luke Hayden, president of the mortgage unit of Mount Laurel, New Jersey-based PHH Corp. By keeping defaults low, they can also boost the prices they fetch for bonds filled with the loans and thus offer lower rates, he said.

When FHA-backed loans go into default, the lender bears a greater share of the expenses than when the mortgage is backed by Fannie Mae and Freddie Mac, Hayden said. Lenders whose delinquency rates stray too far from averages can also face being cut off by the FHA or other sanctions from the agency, said David Lykken, president of Mortgage Banking Solutions, an Austin, Texas-based consulting firm.

Now we see why lenders are putting tighter standards in place.

Lender Buybacks

With Fannie Mae and Freddie Mac mortgages, lenders are forced to buy back bad mortgages that were improperly underwritten, which has also prompted them to adopt tougher guidelines for those loans.

More banks tightened standards on prime residential mortgages in three months ending Oct. 31 than loosened them, a switch from the prior period, a Federal Reserve survey found. …

‘Huge Effect’

“When the big companies change their standards and rules, it has a huge effect on the market,” said Bob Walters, chief economist at the Detroit-based company.

JPMorgan Chase & Co., the third-largest lender, had already been generally requiring credit scores of at least 640 on FHA loans before the tightening by competitors, said Tom Kelly, a spokesman for the New York-based company.

Matt Hackett, underwriting manager at New York-based Equity Now Inc., said higher requirements among buyers of its FHA loans cut off about 5 percent of his potential customers. A 640 score disqualifies about 15 percent of customers who were getting FHA loans through Chris Murphy, a loan originator at Main Street Home Loans LLC, an independent mortgage bank based in Alpharetta, Georgia.

“It’s bad from the originator’s standpoint because fewer people qualify,” Murphy said in a telephone interview from his office in Charlotte. “But it’s less likely they’re going to default and so, from the standpoint of the economy, it’s probably a good thing.”

Since we are all paying the bills as taxpayers, I agree that tightening standards are a good thing. In fact, there are only three groups that want to see standards loosen: (1) those who make money off the transactions regardless of the outcome, (2) those who want to sell property at inflated values, and (3) government officials who feel pressure to expand home ownership. I could add buyers who no longer qualify for loans to that list, but the desires of those unlikely to repay their debts doesn't count for much.

Mortgage Delinquencies

About 9.8 percent of U.S. home mortgages were delinquent at the end of the second quarter, with an additional 4.6 percent in the foreclosure process, according to the Mortgage Bankers Association. The Washington-based group releases figures through Sept. 30 tomorrow.

Nearly 10% of mortgage holders are not paying. That number is truly astounding.

FHA lending to the riskiest borrowers has declined in the past two years. Only 3.8 percent of FHA loans had scores below 620 or no score in the quarter ended Sept. 30, down from a peak of 50.4 percent in the period through Dec. 31, 2008, according to a Nov. 4 agency report to Congress. A score below 620 was typically considered subprime before the credit crisis, meaning the borrower had a bad or limited credit history.

More Than Expected

“Mortgage credit availability has tightened even more than we expected,” Morgan Stanley analysts Oliver Chang, Vishwanath Tirupattur and James Egan said today in a report.

At the same time, the recession and unemployment has spurred a decline in borrower credit scores, they said. There has been about a 23-point drop in FICO scores among current borrowers who took loans without government backing in 2006 and 2007, they said.

The U.S. home-ownership rate remained at a 10-year low of 66.9 percent in the quarter ended Sept. 30, in part because of rising foreclosures, the U.S. Census Bureau reported Nov. 2. The rate reached a record high of 69.2 percent in the second and fourth quarters of 2004.

Sales of existing homes were at an annual pace of 4.53 million in September, compared with the average rate of 5.82 million for the past decade, according to the Chicago-based National Association of Realtors. The pace in July was 3.84 million, the lowest in data going back to 1999.

Restricting access to credit threatens to slow a rebound even as reduced home prices and interest rates near record lows boost affordability, said Stevens, the FHA commissioner.

“This has a broad potential impact to the economic recovery in total,” he said. “We’re not asking for lenders to be reckless. In fact, we believe we have prudent policies for the market. But we do believe that lenders need to put more work into making certain that they provide accessibility for families who can qualify for a mortgage.”

To contact the reporters on this story: Jody Shenn in New York at jshenn@bloomberg.net; John Gittelsohn in New York at johngitt@bloomberg.net.

To contact the editors responsible for this story: Alan Goldstein at agoldstein5@bloomberg.net; Kara Wetzel at kwetzel@bloomberg.net.

How does a bank "put more work into making certain?" This nonsense is bureaucratic bullshit.

Put to the bank at the peak

In the post Mortgages as Options, I discussed how people used the "put" feature of loans to transfer the risk of falling prices to the lender.

Another method speculators and homeowners alike used was the “put” option refinance. Late in the bubble when prices were near their peak, many homeowners refinanced their properties and took out 100% of the equity in their homes. In the process, they were buying a “put” from the lender: if prices went down (which they did,) they already had the sales proceeds as if they had actually sold the property at the peak; if prices went up, they got to keep those profits as well. The only price for this “put” option was the small increase in monthly payments they had to make on the large sum they refinanced. If fact, on a relative cost basis, the premium charged to these speculators and homeowners was a small fraction of the premiums similar options cost on stocks. Of course, mortgages are not option contracts, and lenders did not view themselves as selling option premiums to profit from the premium payments; however, speculators certainly did view mortgages in this manner and treated them accordingly.

The owner of today's featured property owned the property for 18 years, then it went into foreclosure. WTF? Anyone who thinks adding to their mortgage is a good idea should consider the possibility that they may lose their house years later. It's very foolish.

- This property was purchased for $133,500 sometime in 1992 — 18 years ago. The original loan information is not available.

- On 5/1/2002, he opened a HELOC for $53,600. The kool aid must have tasted good.

- On 1/28/2004 he obtains a loan for $117,838. This may have been a refinance of the first mortgage.

- On 4/1/2005 he obtained a $139,427 HELOC.

- On 2/28/2006 he got a GSE loan for $224,000.

-

He stopped paying in late 2009, but Fannie Mae didn't fool around with the foreclosure.

Foreclosure Record

Recording Date: 06/02/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 03/01/2010

Document Type: Notice of Default

They bought the property at auction for $215,800, and now they are trying to get a full recovery of their losses in a resale. Do you think they will get it?

Irvine Home Address … 66 GOLDEN GLEN St 4 Irvine, CA 92604 ![]()

Resale Home Price … $262,000

Home Purchase Price … $215,800

Home Purchase Date …. 7/20/2010

Net Gain (Loss) ………. $30,480

Percent Change ………. 14.1%

Annual Appreciation … 47.5%

Cost of Ownership

————————————————-

$262,000 ………. Asking Price

$9,170 ………. 3.5% Down FHA Financing

4.55% …………… Mortgage Interest Rate

$252,830 ………. 30-Year Mortgage

$51,505 ………. Income Requirement

$1,289 ………. Monthly Mortgage Payment

$227 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$44 ………. Homeowners Insurance

$240 ………. Homeowners Association Fees

============================================

$1,799 ………. Monthly Cash Outlays

-$119 ………. Tax Savings (% of Interest and Property Tax)

-$330 ………. Equity Hidden in Payment

$16 ………. Lost Income to Down Payment (net of taxes)

$33 ………. Maintenance and Replacement Reserves

============================================

$1,399 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,620 ………. Furnishing and Move In @1%

$2,620 ………. Closing Costs @1%

$2,528 ………… Interest Points @1% of Loan

$9,170 ………. Down Payment

============================================

$16,938 ………. Total Cash Costs

$21,400 ………… Emergency Cash Reserves

============================================

$38,338 ………. Total Savings Needed

Property Details for 66 GOLDEN GLEN St 4 Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 1 full 1 part baths

Home size: 864 sq ft

($303 / sq ft)

Lot Size: n/a

Year Built: 1971

Days on Market: 109

Listing Updated: 40463

MLS Number: S627597

Property Type: Condominium, Residential

Community: El Camino Real

Tract: Ws

——————————————————————————

According to the listing agent, this listing is a bank owned (foreclosed) property.

Upper Level End Unit Condo in Irvine. 2 Bedrooms, 1.25 Baths, and 1 Car Detached Garage. New carpet, new paint, and ready to open escrow. Enjoy the association amenities. HOA dues include water and trash. Close to shopping, restaurants, and schools.

Many loan owners started out in the late 90s and the 00s, so a housing bubble and irresponsible lending is all they know. However, many others survived the previous housing bubble and should have known better than to borrow themselves into oblivion. Today's featured owner borrowed all he could as soon as he could. He didn't leave much equity in the house before the market collapsed.

Many loan owners started out in the late 90s and the 00s, so a housing bubble and irresponsible lending is all they know. However, many others survived the previous housing bubble and should have known better than to borrow themselves into oblivion. Today's featured owner borrowed all he could as soon as he could. He didn't leave much equity in the house before the market collapsed..jpg)

.jpg)

But the volume of foreclosures has gone down. In the first quarter of 2009, there were 35,321 Las Vegas properties that received a filing, compared to the third quarter of this year when 32,288 properties received a filing. It's a decrease of 8.5% over that span.

But the volume of foreclosures has gone down. In the first quarter of 2009, there were 35,321 Las Vegas properties that received a filing, compared to the third quarter of this year when 32,288 properties received a filing. It's a decrease of 8.5% over that span.

.jpg)