Groovy Little Hippie Pad — ZZ Top

I have profiled today’s featured property before, but the price is so outrageous, the decor so over-the-top, that it warrants another look.

Original Asking Price: $1,059,000

Income Requirement: $208,750

Downpayment Needed: $167,000

Monthly Equity Burn: $6,958

Purchase Price: $479,000

Purchase Date: 6/27/2003

Address: 337 Tall Oak, Irvine, CA 92603

| Beds: | 2 |

| Baths: | 3 |

| Sq. Ft.: | 1,800 |

| $/Sq. Ft.: | $464 |

| Lot Size: | – |

| Property Type: | Condominium |

| Style: | Spanish |

| Year Built: | 2003 |

| Stories: | 3+ Levels |

| Floor: | 1 |

| View: | Canyon, City Lights, City, Hills, Mountain, Panoramic, Valley, Has View |

| Area: | Quail Hill |

| County: | Orange |

| MLS#: | S544203 |

| Source: | SoCalMLS |

| Status: | Active |

| On Redfin: | 2 days |

exec. w/ the homebuilder. Every detail was considered w/the goal of

making this home not just a notch above the rest, but THE BEST. An

entertainer’s delight, this designer-inspired home has commanding 270

degree views from the Spectrum to L.A., and an innovative flr plan w/2

bedrm stes (one main floor master + upstairs master)w/dual walk-in

clsts+computer office fully wired + a separate room/studio w/own

private gated entryway. Every bldr & seller upgrade imaginable,

incl. custom distressed wood flring, surround sound, upgraded indoor

& outdoor liting, a 2nd fl. deck w/custom blt-in furniture,

stainless prof. Viking BBQ, fully mature garden w/fruit trees, wine

vines, rose garden, outdoor liting–the largest in the Ivy Wreath–spa,

fountain, stainless heater & fire ring, lites & custom outdoor

furniture & music! This property is unique, edgy, urban–feels like

a Manhattan or San Francisco abode w/CA attitude!

“customized by a senior

exec. w/ the homebuilder.” You mean someone who should know better…

Feels like

a Manhattan or San Francisco abode — except that this is Irvine!

The place looks like a Bordello to me. Don’t the pictures above look like they need some hookers and a piano man?

The master bedroom has inviting double doors and plenty of vanity mirrors so you can watch yourself doing whatever…

If you prefer a red bedroom in the “red light district,” it has one of those too. Don’t you love the chairs? Is that Dogs Playing Poker in the background? Perhaps not…

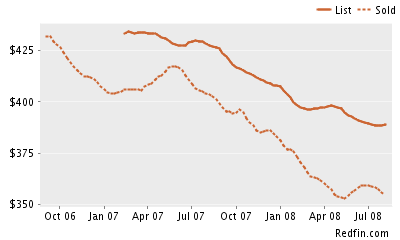

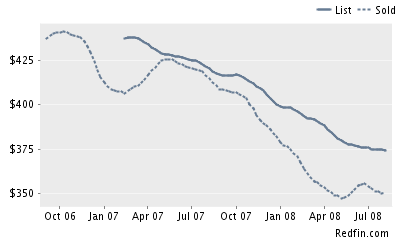

First, let’s get to the price. There is no way this is worth $835,000, forget the $1,059,000 he was asking last November. There is an identical floorplan (not so gaudy I hope) at 143 Tall Oak asking $550,000. That comparable is going to make financing this Groovy Little Hippie Pad next to impossible. Basically, someone will need to come up with about $400,000 cash to close the deal. Can anyone possibly think this property warrants a $285,000 premium due to the dubious tastes of its owner? You could buy 143 Tall Oak and spend $285,000 making your own brothel if you wanted. You could pay for some big-time designers and top-of-the-line everything and still not spend the premium. The last time I profiled this property, I challenged everyone to come up with a rationale for the price. I still can’t come up with one.

At least this guy was a conservative borrower. He only owes between $400,000 and $450,000 depending on whether or not he tapped his HELOC. If this property sells for its ridiculous asking price, and if a 6% commission is paid, the owner stands to make $305,900. The $225,000 he backed off of his initial asking price must feel like a huge discount to him. The recession is hurting everyone, I guess.

.

I’m gonna find me a groovy little hippie pad.

I’m gonna find me a groovy little hippie pad.

I’m gonna find me a groovy little hippie pad.

I work a hundred grand scam from a border town.

Well, I’ll be feeling glad.

I’m gonna find me a blonde-haired mama,

In a jeep with a german shepherd by her side.

I’m gonna find me a blonde-haired mama,

With boots and a fourty-four on her side.

And if I ain’t too hjigh or used up,

I’ll have her take me for a groovy little hippie ride.

I’m gonna fix brown rice every day,

And drink down a bottle of midnight red.

I’m gonna fix brown rice every day,

And drink down a bottle of midnight red.

That’s all I need to get groovy,

That’s what all the little hippie said.

Groovy Little Hippie Pad — ZZ Top

Adventure seeker on an empty street

Adventure seeker on an empty street

Shes a good girl, loves her mam a

Shes a good girl, loves her mam a

Tremendous value! Clean, light and bright. Vaulted ceilings. Recessed

Tremendous value! Clean, light and bright. Vaulted ceilings. Recessed How we stop the black panthers?

How we stop the black panthers?