The Government and Federal Reserve are scheduled to remove their market props soon. Do you think it will happen on schedule?

Irvine Home Address … 5054 ALDER Irvine, CA 92612

Resale Home Price …… $420,000

{book1}

Forever, got a feelin' that forever

Together, we are gonna stay together

For better, for me there's nothin' better

You're the biggest part of me

Well, make a wish baby

Well and I will make it come true

Make a list baby

Of the things I'll do for you

Ain't no risk now

In lettin' my love rain down on you

So we can wash away the past

So that we may start anew

Biggest Part of Me — Ambrosia

The US Government and the Federal Reserve control the biggest part of the mortgage finance market. They are making a wish that house prices will stabilize through printing money to subsidize borrowers. Can they wash away the past and start anew?

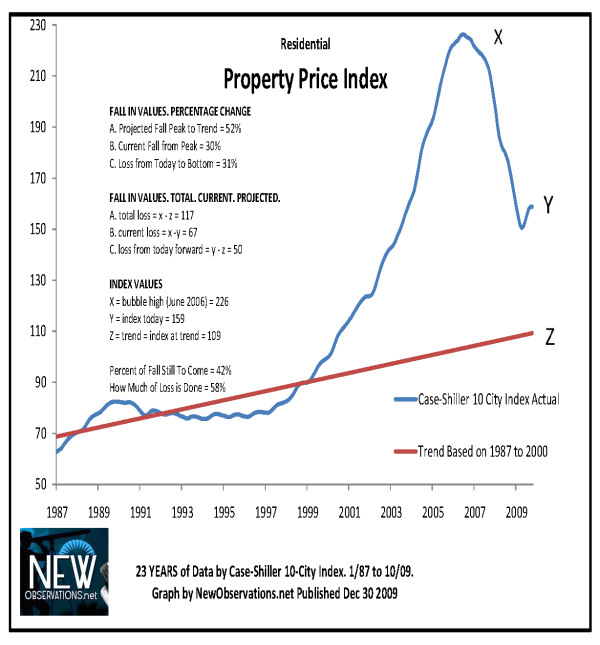

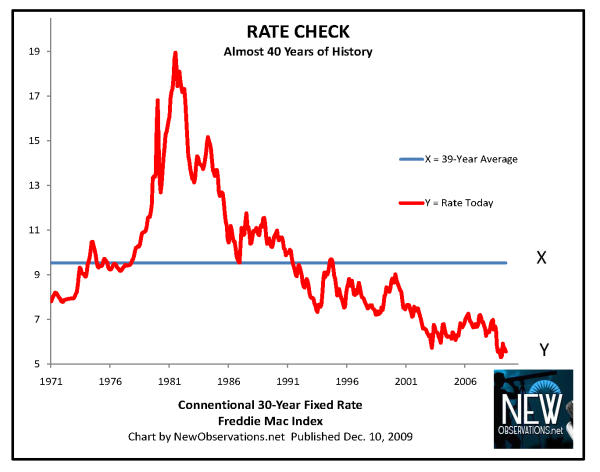

Most financing for our housing market is coming directly from the Federal Reserve through the purchase of agency debt at inflated prices. This unique method for printing money (it has never been done before) is a reaction to the remarkable deflation of debt caused by bank write-downs. Reprinting lost money is not without risks, particularly when this free money has gone to inflate prices in the mortgage market to artificially lower interest rates. At some point, the presses turn off, and the market must adjust to the loss of demand. What happens next is a guess, but it certainly looks as if mortgage interest rates are going to go up.

Stakes are high as government plans exit from mortgage markets:

For more than a year, the government pulled out the stops to revive home buying by driving down mortgage rates.

Now, whether the housing market is ready or not, the government is pulling out.

The wind-down of federal support for mortgage rates, set to end in two months, is a momentous test of whether the Obama administration and the Federal Reserve have succeeded in jump-starting the housing market and ensuring it can hold its own. The stakes for the economy are massive: If the market again falls into a tailspin, homeowners could face another wave of trouble, and it would deal a body blow to President Obama's efforts to get the economy on track.

Keeping the mortgage rates at historic lows, which required a commitment of more than $1 trillion, was viewed within the administration as a central plank of the economic strategy last year, senior officials said. Though the policy did not attract as much attention as rescue efforts to bail out banks, it helped revitalize home buying in some parts of the country and put money in the pockets of millions of homeowners who were able to refinance into lower monthly payments, the officials added.

This is the real stimulus of the mortgage refinance boom from the Fed's money-printing. The real beneficiaries of mortgage interest rate relief are conservative debtors who lock in low rates and pay off existing debts earlier. Any uptick in consumer spending coming out of this recession will be lead by the under-leveraged who now enjoy greater disposable income. Back to the article:

"We did what we thought was necessary to stabilize the market, but we don't think the government should continue special efforts forever," said Michael S. Barr, an assistant secretary at the Treasury Department. "As you bring stability, private participants come back in. We do expect this now that the market has stabilized. I'm not going to say there will be no effect on rates, but we do think you are seeing market signs and market signals that there should be an orderly transition."

It is laughably stupid to suggest there will be no effect on rates; the real debate is over how fast rates will go up and how high they will go — and whether or not the powers-that-be will intervene again if necessary.

A few federal officials and many industry advocates disagree, saying the government is exiting too soon. They offer dire warnings of higher rates and a slowdown in home sales. Fed leaders say they will end a marquee program supporting the mortgage markets in March. Obama's economic team, led by Treasury Secretary Timothy F. Geithner, has decided not to replace it and has been shutting down its own related initiatives.

Over the past year, these programs have enabled prospective home buyers to get cheap loans, helping those buying and selling property as well as those eager to refinance existing mortgages. If the end of the initiative drives up interest rates, say from 5 percent to 5.5 percent, homeowners could be deterred from refinancing, industry officials say. A sharper increase in rates could make homes too expensive for many buyers, forcing them from the market and causing the recent pickup in home sales to stall.

Notice the fear is not any rise in interest rates, but a sharp increase. I agree with this assessment. If rates went to 7% in 2010, the housing market would collapse.

"Mortgage rates are the lifeblood of the housing market, and we have cautioned the Fed about the sudden stoppage of this program," said Lawrence Yun, chief economist of the National Association of Realtors.

But senior government officials said it could be hard to reverse course without damaging the credibility of the Fed and the administration. If the government loses the trust of the financial markets, preparing them for policy changes could be tougher, possibly resulting in economic disruptions. The officials said they also worry that the mortgage market is becoming overly dependent on federal support, inserting the government too deeply into private enterprise.

The Government is concerned about inserting itself too deeply into private enterprise? Porn-stars show more restraint!

Only a new crisis would be able to persuade the administration and the Fed to change their minds, officials said."

Pulling out of the mortgage market? Government will stop subsidizing mortgages until prices start going down, at which point, Government will declare a National Banking Emergency and reinsert their members into private enterprise.

Have Government supports reached climax?

So what do you think? Is the Government really out of the housing market, or are they committed to writing a blank check to support home prices?

Irvine Home Address … 5054 ALDER Irvine, CA 92612

Resale Home Price … $420,000

Income Requirement ……. $88,257

Downpayment Needed … $14,700

3.5% Down FHA Financing

Home Purchase Price … $148,000

Home Purchase Date …. 8/23/1996

Net Gain (Loss) ………. $246,800

Percent Change ………. 183.8%

Annual Appreciation … 7.7%

Mortgage Interest Rate ………. 5.13%

Monthly Mortgage Payment … $2,208

Monthly Cash Outlays ………… $2,960

Monthly Cost of Ownership … $2,200

Property Details for 5054 ALDER Irvine, CA 92612

Beds 2

Baths 1 full 1 part baths

Home Size 1,189 sq ft

($353 / sq ft)

Lot Size 3,136 sq ft

Year Built 1973

Days on Market 4

Listing Updated 1/26/2010

MLS Number P719210

Property Type Single Family, Residential

Community University Park

Tract Tr

WOW! NOT A SHORTSALE – GREAT PRICE. Vaulted Ceilings, Warm Fireplace, Enormous Kitchen, and Attached Garage make this home an unbelievable value. Attractive Patio Entry and Patio Backyard have generous planters for the greenthumb who wants a private oasis. Only 1/4 mile from walking bridge that leads you to the Lakes in Woodbrige. You are also a short walk to Strawberry Farms – a haven for golfers and agriculturalists alike. This home is in one of the highest nationally ranked school districts – University High, and central to the best Irvine has to offer. Community is full of greenbelts and has a fantastic community center, pool and spa. HOA is very low, but nothing is sacrificed. Owner wants this sold – bring in your offer before it is gone! Older roof has 1 year warranty – Seller to offer $4000.00 credit to buyer for use towards new roof of their choice.

If this is not a short sale, the borrowers have not maxed-out their HELOC because the total indebtedness on the property includes a $351,000 first mortgage and a $80,000 HELOC.

- This property was purchased on 8/23/1996 near the last market bottom for $148,000.

- The owners used a $140,600 first mortgage and a $7,400 downpayment.

- The refinanced in 1997 for $138,200, so they were diligently paying down the loan for at least 18 months.

- On 11/18/2003 they liberated their equity with a $247,100 first mortgage.

- On 10/19/2006 they refinanced again with a $231,393 first mortgage — three years of relative frugality.

- On 2/22/2007 they refinanced on last time with a $351,000 first mortgage and a $81,000 HELOC

- The $81,000 HELOC was replaced with an $80,000 HELOC a few months later.

- Total debt is between $351,000 and $432,000.

-

Mortgage equity withdrawal is between $210,400 and $290,400.

I wasn't sure how to classify this kind of HELOC abuse. These owners invested less than $8,000 and extracted over $210,000; quite a bountiful cash harvest. I can see why people want one of those.

These borrowers more than doubled their original $140,600 mortgage, so I think they earn an "E," but based on the not-a-short-sale come on, the borrowers at least believe they borrowed below the level of appreciation on the unit, so they might argue for a "D" instead. In either case, while we are debating the subtleties of irresponsibility; the owners are losing their prize steed.