The latest estimate to clear shadow inventory is 40 months. Based on tightening credit standards and very low sales rates, this estimate is likely too low.

Irvine Home Address … 14 BLUEBELL Irvine, CA 92618

Resale Home Price …… $499,000

I'd rather kill myself than turn into their slave

Sometimes

I feel that I should go and play with the thunder

Somehow

Cause somehow I just don't wanna stay and wait for a wonder

I've been watching

I've been waiting

In the shadows for my time

The Rasmus — In The Shadows

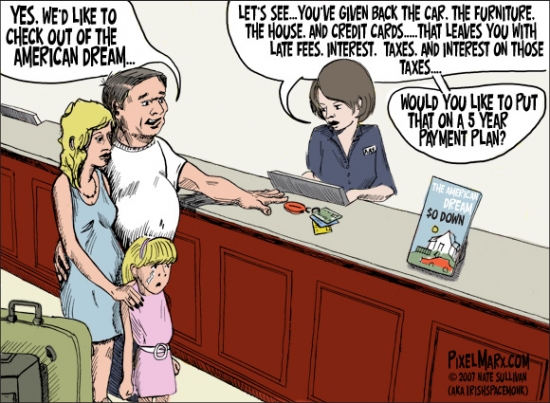

How many of you lurk in the shadows waiting for lenders to release their shadow inventory? Personally, I refuse to become a debt slave, so I've been watching, and I've been waiting in the shadows for my time.

Some pundits believe Shadow Inventory Signals Three Years of Falling Prices. Some think it will take much longer. I side with the latter group.

The whole reason banks have accumulated a shadow inventory is because there are not enough buyers to replace all the delinquent borrowers — at any price. It is clear that Low Interest Rates Are Not Clearing the Market Inventory, and Low Interest Rates Will Not Create Demand. There is only one viable solution: Fix the Housing Market: Let Home Prices Fall.

Las Vegas has demonstrated that if you lower prices, sales rates go up. All estimates of time to clear the shadow inventory assume sales rates will be at or near historic norms. Right now, that isn't happening. In August Existing-Home Sales Sank to Lowest Level Ever Recorded. Inflated markets like Orange County see sales rates about 20% or more below normal.

As the economy improves and people go back to work, the sales rate will improve somewhat, but until prices are lower, sales will not improve enough to clear out the shadow inventory in a timely manner.

Further, estimates of shadow inventory are static. They are not estimating how many more homes will be added to shadow inventory as other borrowers give up and accelerate their defaults. The big false assumption here is that an improving economy will eliminate the mortgage distress and people will start paying back their loans again. That isn't going to happen. The debt is far too large. Many of the people who are hanging on will eventually succumb to the debt disease. As these people give up, they will add new delinquencies to shadow inventory.

The market needs a cathartic event. The kool aid intoxicated borrowers need to puke up their debts and clear the system. Until then, the economy will sputter as the over-indebted give up their meager incomes to keep the illusion of solvency at our major banks.

Over 7 Million 'Shadow Homes' May Take 40 Months to Clear, Says Fitch

Posted by Alex Finkelstein 11/09/10 8:00 AM EST

If you thought the U.S. housing market is showing any signs of improvement, a new report by New York City-based Fitch Ratings puts the damper on that view.

Fitch says seven million homes in the "shadows" will take 40 months to clear.

Just in case you are in the "Irvine is different" crowd, keep in mind that There are 3,600+ Distressed Properties in Irvine, and There are 36,000+ Distressed Properties in Orange County. Further, Emergence of Shadow Inventory to Push Prices Lower in 2011: Altos Research, Fiserv.

The agency defines the shadow supply of properties as loans that are delinquent, in foreclosure, or real-estate-owned (REO) by the servicer. Fitch says based on recent liquidation trends, it will take at least 3 ½ years to clear this existing distressed inventory.

DSNews.com reports that according to the ratings agency, the number of months between the date of the borrower's last payment and the date of liquidation has steadily increased over the past several years, and is now at more than 18 months on average.

Fitch says that is the highest figure on record.

Thinking About Accelerated Default? The Average Squatting Time Is Up to 449 Days. .

While the volume of newly delinquent mortgages has begun to improve in recent quarters, Fitch says liquidation rates of existing distressed properties have been constrained by weak demand and expanded initiatives to modify loans for troubled borrowers, DSNews reports.

On top of that, the agency's analysts believe the recent discovery of defects in the residential mortgage foreclosure process will further extend liquidation timelines, slowing the resolution of distressed properties in the shadow inventory and preventing home prices from finding a floor.

"While the reduced volume of distressed sales since 2009 has temporarily helped home prices, Fitch believes that the extension in foreclosure and liquidation timelines is simply prolonging the housing correction underway," the agency reported.

Government Props Weakened the Housing Market and Delayed the Recovery. Notice that Fitch is talking about a temporary bottom. They see prices rolling over too.

The total number of troubled loans reached a peak in early 2010 and had begun to show some improvement prior to the most recent foreclosure moratoriums resulting from documentation issues, Fitch said.

Fitch says for judicial foreclosure states, such as Florida, it is expected to take longer than the national average of 40 months to resolve the distressed loans, while for non-judicial foreclosure states, like California, the inventory will likely be resolved faster.

The agency points out in its report that the market's ability to absorb the supply of distressed homes has been affected by limited demand for home purchases, DSNews reports.

While interest rates are near historical lows and affordability has improved, fewer potential buyers can qualify for new loans due to the heightened credit standards, Fitch says.

Fed: Banks expect tight lending standards for foreseeable future. "In general banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans). …[A] special question asked banks whether their current level of lending standards remained tighter than the average level over the past decade and, if so, when they expected that standards would return to their long-run norms, assuming that economic activity progressed according to consensus forecasts. For all loan categories, substantial fractions of respondents thought that their bank's lending standards would not return to their long-run norms until after 2012 or would remain tighter than longer-run average levels for the foreseeable future."

Fed: Banks expect tight lending standards for foreseeable future. "In general banks have stopped tightening standards (they are already very tight), and demand has stopped falling (there is little demand for loans). …[A] special question asked banks whether their current level of lending standards remained tighter than the average level over the past decade and, if so, when they expected that standards would return to their long-run norms, assuming that economic activity progressed according to consensus forecasts. For all loan categories, substantial fractions of respondents thought that their bank's lending standards would not return to their long-run norms until after 2012 or would remain tighter than longer-run average levels for the foreseeable future."

Banks will never return to the standards to the 00s unless they want to lose a trillion dollars again. What we now consider tight standards — 20% down and conventionally amortized loans — were the standards prior to the housing bubble. All we are doing is returning to what works and what's stable.

Additionally, high unemployment, weak consumer confidence, and uncertainty about the future of home prices have prevented some potential buyers from entering the market.

"Recent concerns about the title-transfer process for foreclosed homes could further weigh on demand," Fitch noted.

The agency says at this point, it is still unclear how much the foreclosure process will be extended specifically due to document defects.

Should You Fear You Won’t Get Clean Title to Real Estate? .

However, even prior to recent developments, Fitch assumed the ultimate resolution of the backlog of distressed properties would result in further home price declines and prevent sustained home price increases for a number of years, DSNews reports.

"Fitch is currently assuming approximately a further 10 percent home price decline nationally, with the majority of the adjustment occurring by the end of 2012," the agency says.

"However, the timing of the adjustment will be affected by the timing of the distressed inventory resolution."

Absolutely correct: How The Lending Cartel Disposes Their REO Will Determine the Market’s Fate.

How long will it take? I estimate it will take five to seven more years before this mess is behind us. For three to five years, the foreclosure machines will be operating 24/7 at the maximum rate the market will absorb. After that, it will take another two to four years of elevated foreclosure volumes to finish the job. It's a bit like draining a bathtub when your drain is partially clogged. It's going to take a long time, and there isn't much that can be done to speed the process.

The Squatter's Lair

I first profiled today's featured property back in September of 2009 in the post Bluebell, and then I profiled it again in One Defaulting Owner’s Free Ride: Three Years and Counting.

- The owner of today's featured property paid $465,000 on 10/23/2003. She used a $372,000 first mortgage, a $93,000 second mortgage, and a $0 down payment.

- On 12/30/2004 she refinanced into an Option ARM for $486,500.

- Two months later on 2/3/2005 she opened a HELOC for $67,000.

- Total property debt is $553,500 plus 3 years of missed payments, negative amortization, and fees.

-

Total mortgage equity withdrawal is $88,500.

Foreclosure Record

Recording Date: 02/08/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 12/03/2008

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 08/28/2008

Document Type: Notice of Default

Foreclosure Record

Recording Date: 08/08/2007

Document Type: Notice of Rescission

Foreclosure Record

Recording Date: 05/25/2007

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 01/24/2007

Document Type: Notice of Default

First the bank lost a great deal of money, and now a flipper is going to lose money too.

This property was purchased by a flipper (Mamo Properties Inc.) on 8/23/2010 for $470,000. I don't know what they thought they could sell this for, but it looks like they spent about $20,000 fixing the place up, and with the other costs and fees, they are likely in this for over $500,000. Unless this is a no-cost listing, the flipper is going to lose money.

While I was raising money for the fund, I told many people that I was hesitant to buy in Orange County because in July and August, I was watching flippers pay what I thought was too much, and I believed prices were going to roll over. So far, both my observations have proven correct.

How much do you think this flipper will lose on this property?

Irvine Home Address … 14 BLUEBELL Irvine, CA 92618 ![]()

Resale Home Price … $499,000

Home Purchase Price … $470,100

Home Purchase Date …. 8/23/2010

Net Gain (Loss) ………. $(1,040)

Percent Change ………. -0.2%

Annual Appreciation … 24.1%

Cost of Ownership

————————————————-

$499,000 ………. Asking Price

$17,465 ………. 3.5% Down FHA Financing

4.21% …………… Mortgage Interest Rate

$481,535 ………. 30-Year Mortgage

$94,234 ………. Income Requirement

$2,358 ………. Monthly Mortgage Payment

$432 ………. Property Tax

$150 ………. Special Taxes and Levies (Mello Roos)

$83 ………. Homeowners Insurance

$160 ………. Homeowners Association Fees

============================================.jpg)

$3,183 ………. Monthly Cash Outlays

-$371 ………. Tax Savings (% of Interest and Property Tax)

-$668 ………. Equity Hidden in Payment

$26 ………. Lost Income to Down Payment (net of taxes)

$62 ………. Maintenance and Replacement Reserves

============================================

$2,232 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,990 ………. Furnishing and Move In @1%

$4,990 ………. Closing Costs @1%

$4,815 ………… Interest Points @1% of Loan

$17,465 ………. Down Payment

============================================

$32,260 ………. Total Cash Costs

$34,200 ………… Emergency Cash Reserves

============================================

$66,460 ………. Total Savings Needed

Property Details for 14 BLUEBELL Irvine, CA 92618

——————————————————————————

Beds: 2

Baths: 2 full 1 part baths

Home size: 1,508 sq ft

($331 / sq ft)

Lot Size: n/a

Year Built: 2000

Days on Market: 31

Listing Updated: 40484

MLS Number: S635284

Property Type: Condominium, Residential

Community: Oak Creek

Tract: Acac

——————————————————————————

Quiet, Cul-De-Sac location. This beautiful home shows like a model featuring maple hardwood floors, new upgraded carpet, gourmet kitchen with granite countertops and new appliances. Great floorplan with dual master suites: Oversided garage, one suite with full bath on ground level and one suite with loft/office on top level. Tropical Oasis backyard with palm trees. Enjoy resort-style amenitities such as pool and spa. Walk to shopping, dining and more!

Oversided? amenitities?

.jpg)