The high cost of servicing bad loans will force lenders to resolve their problem loans and liquidate the resulting REO.

.jpg)

Irvine Home Address … 8 WESTMORELAND Irvine, CA 92620

Resale Home Price …… $660,900

If I could save time in a bottle

The first thing that I'd like to do

Is to save every day

Till Eternity passes away

Just to spend them with you

If I could make days last forever

If words could make wishes come true

I'd save every day like a treasure and then,

Again, I would spend them with you

But there never seems to be enough time

To do the things you want to do

Once you find them

Jim Croce — Time in a Bottle

If banks could store time in a bottle, they could keep in on the shelf with their worthless paper until the market gives it life again. Unfortunately, rather than storing time in a bottle, the remaining equity capital in our banking system is leaking away through servicing costs like sand in an hourglass. These servicing costs are hidden by amend-extend-pretend until disposition forces recognition of the losses.

Astute housing market observers note the amend-extend-pretend policy of banks is untenable in the long term. As some point, keeping fantasy books must intersect with reality. The fantasy had house prices going up until reality and fantasy intersected. I don't believe it can or will work out that way.

The weight of the inventory and the incentive to liquidate will have individual banks working against their collective best interest. Ultimately, the fantasy of amend-extend-pretend will become so implausible that the banks will find that position is no longer operative.

But what will it take to force banks to end amend-extend-pretend? In my opinion, the answer is increasing loss severities.

Higher loss severities on foreclosures will push servicers to short sales in 2011: Fitch

by JON PRIOR — Thursday, December 16th, 2010, 5:28 pm

Loss severities are expected to increase between 5% and 10% on residential mortgage-backed securities in 2011 as loss mitigation costs and foreclosure expenses go up, according to Fitch Ratings. This, analysts said, will push servicers to short sales.

It will not push servicers to short sales because the loss severities are large there too. In some cases, once the bank has to pay sales commissions, back taxes, back HOA dues and other costs at short sale, they would have been better off simply pushing through a foreclosure and getting their cash.

The loss severity, or the percentage of principal lost when a loan is foreclosed, on prime mortgage loans is currently at 44%. This, according to Fitch, will increase to between 49% and 54% in 2011. For Alt-A loans, the current 59% loss severity should increase to between 64% and 69%.

Currently, the loss severity on subprime loans is 75%, but Fitch predicts it will increase to 80% and 85% by the next year.

These loss severities had remained stable for more than a year. In the second quarter of 2009, the amount a lender could recover when it foreclosed on a mortgage was propped up by slightly improving home prices, low mortgage rates, homebuyer tax credits and government-funded modifications.

Loss severities leveled off because prices made a minor rally during the echo-bubble engineered by the government and Federal Reserve. It takes appreciating prices to make up for the losses from servicing costs.

With the tax break expired, mortgage rates increasing and underwhelming modification numbers pose many tough challenges for the housing market in 2011.

Increased servicing costs from pressures to modify more loans and recent problems with many banks' foreclosure processes will drag down the amount of principal banks can recover from a foreclosure. Borrowers average 19 months without making a payment before they are foreclosed upon, a record high, and Fitch projects this to increase to 25 months in 2011.

Fitch Managing Director Diane Pendley said the answer for some lenders is a short sale.

“Servicers are increasingly turning to less costly alternatives to foreclosure such as short-sales,” Pendley said.

Recovery rates on short sales are usually 10% higher than foreclosures. Pendley said servicers are also reducing the amount of payments they advance to securitization trusts from delinquent borrowers, particularly on subprime loans. In November, Fitch said, servicers advanced only roughly 60% of delinquent subprime loans, down from 90% at the beginning of 2009.

Each month a loan is delinquent it costs 1.5% of the loan balance in carrying costs. That is a troubling rate of financial decay. Time is the actually the bank's enemy when it comes to loan loss severities. Banks are providing squatters time in hopes they will get current and keep the zombie debt alive. Eventually, the carrying costs are going to make the loss severities so large that banks will either liquidate or implode, after which they will be liquidated anyway.

A loan in foreclosure: 492 days — and growing

by PAUL JACKSON

… Let’s start with real-world implications. The average borrower in foreclosure has been stuck in the default pipeline for more than 16 months, according to Lender Processing Services (LPS: 29.66 -1.69%), without making any sort of payment on their mortgage. That's well over a year, with some states even averaging north of this number. No wonder servicers are increasingly halting principal and interest advances, deeming loans unrecoverable. At that level of severe delinquency, there is simply no cure that can restore a loan to performing.

Here’s why: Consider that the average carry cost of a home in foreclosure is 1.5% of unpaid principal balance per month, on average, a figure I’ve been given by various servicing executives. For a $200,000 loan in foreclosure, that amounts to more than $48,000 in accumulated carry costs given the average age. That’s roughly a quarter of the entire original indebted amount.

(If you wondered how loss severities above 100% are materializing on liquidated debt, by the way, this is how you get there.) …

Loan severities will continue to increase as appreciation no longer hides the bleeding on bank's balance sheets. The longer these foreclosures are dragged out, the worse the loss severities will become.

A HELOC the bank deserves to lose

Sometimes when I see a really stupid loan in the property records, it really infuriates me that taxpayers are making up the business losses of people who approved such stupid loans. The owners of today's featured property went Ponzi. It was obvious they had gone Ponzi. However, some banking genius thought it was a good idea to extend a HELOC to a Ponzi in second position to an Option ARM. WTF?

Second position to an Option ARM?

Lenders willing to take on that kind of risk deserve the losses they receive. They gave the owners of this house free money to spend. They spent it, and now they can't pay it back. Anyone with an ounce of common sense could look at the property records and see this coming. Why didn't the banks bother?

Banks won't worry about future loan losses either now that they know the rest of us will bail them out. Moral hazard is an impossible problem to overcome. It can only be avoided.

- This property was purchased on 6/26/2000 for $392,000 according to the property records. There is also a $392,000 first mortgage and a $58,800 second mortgage, so it is more likely the owners paid closer to $450,800.

- On 3/18/2002 they refinanced with a $387,000 first mortgage.

- On 11/13/2002 they refinanced with a $300,000 first mortgage and a $92,000 second mortgage.

- On 3/2/2004 they obtained a $220,000 HELOC, and the problems began.

- On 7/21/2004 they refinanced the first mortgage for $522,000 and obtained a $128,000 HELOC.

- On 6/20/2006 they refinanced with a $656,000 Option ARM first mortgage and obtained a $82,000 HELOC.

I find that HELOC offensive in its stupidity. Anyone in lending with half a brain could see it was only a matter of time before these borrowers imploded (they already went Ponzi) yet they were extended a $82,000 HELOC on top of a loan product with a growing balance, the Option ARM.

If lenders had any concern for risk, they would not have made that loan. It angers me that I am paying for it with taxpayer bailouts.

Next housing bubble, I am going to figure out how to get a HELOC on my rental.

.jpg)

Irvine Home Address … 8 WESTMORELAND Irvine, CA 92620 ![]()

Resale Home Price … $660,900

Home Purchase Price … $392,000

Home Purchase Date …. 6/26/2000

Net Gain (Loss) ………. $229,246

Percent Change ………. 58.5%

Annual Appreciation … 5.0%

Cost of Ownership

————————————————-

$660,900 ………. Asking Price

$132,180 ………. 20% Down Conventional

4.87% …………… Mortgage Interest Rate

$528,720 ………. 30-Year Mortgage

$134,828 ………. Income Requirement

$2,796 ………. Monthly Mortgage Payment

$573 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$110 ………. Homeowners Insurance

$75 ………. Homeowners Association Fees

============================================

$3,554 ………. Monthly Cash Outlays

-$476 ………. Tax Savings (% of Interest and Property Tax)

-$651 ………. Equity Hidden in Payment

$247 ………. Lost Income to Down Payment (net of taxes)

$83 ………. Maintenance and Replacement Reserves

============================================

$2,758 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,609 ………. Furnishing and Move In @1%

$6,609 ………. Closing Costs @1%

$5,287 ………… Interest Points @1% of Loan

$132,180 ………. Down Payment

============================================

$150,685 ………. Total Cash Costs

$42,200 ………… Emergency Cash Reserves

============================================

$192,885 ………. Total Savings Needed

Property Details for 8 WESTMORELAND Irvine, CA 92620

——————————————————————————

Beds: 4

Baths: 3 baths

Home size: 2,132 sq ft

($310 / sq ft)

Lot Size: 4,750 sq ft

Year Built: 1985

Days on Market: 75

Listing Updated: 40522

MLS Number: U10004545

Property Type: Single Family, Residential

Community: Northwood

Tract: Cs

——————————————————————————

According to the listing agent, this listing is a bank owned (foreclosed) property.

Price reduction. REO. Nice 4 bedroom, 3 full baths SFR in very nice Courtside neighborhood. Newly painted interior, new stove, over the range microwave, new sink, disposal, etc. Very nicely landscaped with a deep lot. Near everything, freeways & shopping.

.jpg)

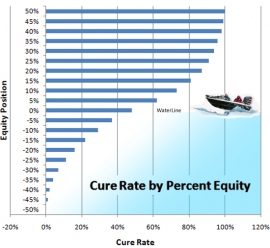

That being the case, a prolonged period of stagnant home prices immobilizes the population. With no equity to pay the transaction costs of leaving, homeowners with less than 10% equity are effectively underwater.

That being the case, a prolonged period of stagnant home prices immobilizes the population. With no equity to pay the transaction costs of leaving, homeowners with less than 10% equity are effectively underwater.

.jpg)