Borrowers choosing to keep the second mortgage current is an unexepected phenomenon in the outbreak of first mortgage defaults.

Irvine Home Address … 28 YORKTOWN Irvine, CA 92620

Resale Home Price …… $695,000

What has happened to it all?

“Crazy,” some would say.

Where is the life that I recognize?

Gone away…

But I won't cry for yesterday, there's an ordinary world,

Somehow I have to find.

And as I try to make my way to the ordinary world,

I will learn to survive.

Duran Duran — Ordinary World

At a basic level, each of us wants the safety and security of an ordinary world of predictable surroundings and routines. The real estate and mortgage world we live in today is a surreal landscape of failed loan programs, ever-tightening credit standards, and uncertainty about the future of real estate prices.

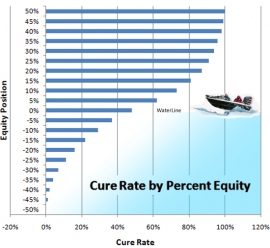

The success or failure of many loan programs will determine the likelihood of their reappearance in an altered form. Subprime first-mortgage lending will return. The 20% down piggy-back loans and 100% HELOCs are not coming back soon. The second mortgage liens — the key problem for bank's residential loan portfolios — are performing very badly, and they will continue to post losses exceeding expectations. However, these loans are performing better than I thought they would because people are choosing to pay these credit lines even if they bail on the first mortgage.

Few good options

A distressed and underwater homeowner has few good options concerning their mortgage obligations. Most just keep paying even if it means sacrificing everything else. Many choose to accelerate their inevitable defaults, and they quit paying on both the first mortgage and the second mortgage.

If a borrower fails to pay either loan, the lender can chose to foreclose or try to negotiate a settlement. A seocnd mortgage lien holder has very little leverage in these negotiations because in a foreclosure, that lender is no longer secured by the property, and if the borrower has no other assets, there is little chance of recovery on the bad loan.

I had expected to see many people default on their second mortgage while keeping the first mortgage current. The first mortgage may not be underwater even though the CLTV is more than 100%. Most borrowers would consider the threat of foreclosure from a second lien holder to be an empty threat because that second mortgage gets wiped out in the foreclosure. People could go on paying the first mortgage and stay in the house because the second mortgage would not foreclose. What we are actually seeing is the opposite of what I expected.

Strategic defaulters opt to continue paying on second liens

by KERRY CURRY — Tuesday, December 14th, 2010, 6:50 am

Borrowers who strategically default on their first mortgage often continue to pay on home equity lines of credit, according to a new white paper from two authors with the Philadelphia Federal Reserve.

The authors, Julapa Jagtiani and William W. Lang, said they wanted to take a closer look at the little-studied phenomenon of strategic default behavior as it relates to first- and second-lien mortgages.

“Predicting mortgage losses has become more difficult with the increase in strategic default behavior and the increase in loan modifications,” the paper said.

Our current accounting fantasies encapsulated in amend-extend-pretend is based on mythical loss recoveries based on past behavior. The study periods do not include times like now — when strategic default is a good idea. Strategic default is going to be much more severe than ever before, and banks are going to lose much more money than they currently project. When amend-extend-pretend becomes a crisis, when the banks lies are fully revealed, lenders will say their fraudulent accounting projections were based on past data. The actual performance didn't match past projections due to the housing bubble. No kidding.

“Focusing on mortgage defaults, our results indicate that the default rate for first mortgages far exceeded those of the second-lien mortgages during the financial crisis. This behavior was not observed in the pre-financial crisis period (i.e., the booming period of 2004-2006).”

About 20% of borrowers in the process of foreclosure due to defaults on the first mortgage kept their second-lien mortgage current. Among those who defaulted on their second-lien mortgages, about 80% also defaulted on their first-lien mortgage.

Data for the study came from a large random sample of individual credit records drawn at the end of each quarter from Equifax, a national credit bureau. The authors only studied consumers who had one first mortgage and at least one home equity line of credit or home equity loan over the period beginning in the fourth quarter of 2004 and ending in the second quarter of 2010. The study merged the Equifax data with another database of loan-level data from LPS Applied Analytics.

The data contradict the hypothesis that consumers would strategically default on a second lien and keep their first lien current to reduce their monthly payment and thus avoid a foreclosure, the white paper said.

That is what I thought would happen.

Instead, a far larger number of households do the opposite; that is, they default on their first lien — thus risking a foreclosure — while keeping their underwater second-lien mortgages current.

The reason?

The authors hypothesized that borrowers have incentives to keep their second lien current — after having stopped paying their first mortgage — in order to maintain their access to credit through the HELOC.

I think that conclusion is highly suspect. Most of these people likely don't have a HELOC they can access because they are underwater.

The study also found that the size of the unused line of credit is an important factor. Homeowners with larger credit lines are less likely to default, as they are motivated to maintain their access to the credit line.

That sounds more reasonable. For people with equity, access is merely having liquidity. Of course, homeowners with larger credit lines and plenty of equity probably don't need to borrow much money and aren't in as much financial distress as those who are maxed out.

Like other studies and white papers, this one also found that negative equity is a big driver in strategic default.

“A large portion of first mortgages with estimated LTV (loan-to-value) ratios greater than 100% is still current, but the continued willingness and ability of these homeowners to make their mortgage payments is subject to great uncertainty,” the authors wrote.

The paper also noted that banks are not punishing borrowers who default on their first mortgages by limiting access to their home equity lines of credit. That could be due to poor risk management practices or lack of timely updates on consumer's risk scores, the paper said.

“Most of the HELOC lines were not increased or decreased after the borrowers defaulted on their first mortgages,” the paper said. “About 90% of the lines remain unchanged even after three quarters following first mortgage default. Interestingly, a small percentage (3% to 6%) of these borrowers had their HELOC lines increased.”

I find it astonishing that people who default don't have their credit lines frozen immediately. Isn't continued borrowing after a default a good sign that a borrower has gone Ponzi? Banks can't be that stupid, can they?

Lenders have the right to foreclose in defaults of first- or second-lien mortgages.

Given the large number of current homeowners with negative equity, there are likely a large number of borrowers who could default on their home equity loans without being forced into foreclosure, the paper noted.

“The data indicate, however, that borrowers rarely engage in this strategy even though it appears to be viable.“

Although homeowners could default on their second-lien mortgages, lower their mortgage payment, and stay in the home, the loan contract stays valid and unpaid interest payments would keep accumulating. Should the house be sold, the second-lien creditor would be eligible for the recovery after the first-lien creditor is paid, the paper said.

Perhaps it is this last point that stops more people from defaulting on their second mortgages. Perhaps borrowers really do recognize that second mortgage debt is just like a credit card that follows them after they leave the house. If people accept that they can't escape the debt without bankruptcy, and they are unwilling to give up access to credit, then they will keep paying their second mortgages to keep the credit lines alive.

How did they spend their house?

I can 't give you a detailed story on how this family buried themselves with mortgage debt. I'm sure their entitlements demanded they spend copious amounts of cash. This house was purchased back in 1993 for $255,000, and it went into foreclosure being worth three times as much. We all know how that happens. Unfortunately, the sordid details are missing from my data source. Whatever they did, we can assume it was typical of the others I have profiled and leave it at that.

Irvine Home Address … 28 YORKTOWN Irvine, CA 92620 ![]()

Resale Home Price … $695,000

Home Purchase Price … $255,000

Home Purchase Date …. 9/10/1993

Net Gain (Loss) ………. $398,300

Percent Change ………. 156.2%

Annual Appreciation … 5.7%

Cost of Ownership

————————————————-

$695,000 ………. Asking Price

$139,000 ………. 20% Down Conventional

4.87% …………… Mortgage Interest Rate

$556,000 ………. 30-Year Mortgage

$141,784 ………. Income Requirement

$2,941 ………. Monthly Mortgage Payment

$602 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$116 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$3,659 ………. Monthly Cash Outlays

-$715 ………. Tax Savings (% of Interest and Property Tax)

-$684 ………. Equity Hidden in Payment

$260 ………. Lost Income to Down Payment (net of taxes)

$87 ………. Maintenance and Replacement Reserves

============================================

$2,607 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,950 ………. Furnishing and Move In @1%

$6,950 ………. Closing Costs @1%

$5,560 ………… Interest Points @1% of Loan

$139,000 ………. Down Payment

============================================

$158,460 ………. Total Cash Costs

$39,900 ………… Emergency Cash Reserves

============================================

$198,360 ………. Total Savings Needed

Property Details for 28 YORKTOWN Irvine, CA 92620

——————————————————————————

Beds: 4

Baths: 2 baths

Home size: 1,918 sq ft

($362 / sq ft)

Lot Size: 4,758 sq ft

Year Built: 1977

Days on Market: 44

Listing Updated: 40526

MLS Number: S638130

Property Type: Single Family, Residential

Community: Northwood

Tract: Ip

——————————————————————————

INVESTOR OWNED FORECLOSURE, INCREDIBLE OPPORTUNITY ON THIS QUIET CUL-DE-SAC HOME!! This home just had a $70K remodel and is totally turnkey. It has never been lived in since the remodel. Spacious private master suite, w/ walk-in closet. Three other larger than average bedrooms w/ mirrored closets. The complete kitchen remodel will be the pride of you at home gourmet with its New Appliances, Granite Counters, Stone Floor, & Custom Cabinets. The living room features soaring cathedral ceilings & a cozy Travertine fireplace. The bathrooms are completely remodeled including under mount sinks, Granite Counters, New Fixtures, and Custom Cabinets. The ceilings have been scraped, Canned lights, 4' Base boards, Crown Moulding, Plantation shutters, New carpet, & New designer paint throughout. Extra large 3 car garage has direct entry to the home. A great location just steps from Northwood Park.

IR,

Forgive me if you’ve addressed this point previously… The income requirement on most of the profiled homes likely makes the buyer subject to AMT, which means no tax savings on the property tax. I realize income isn’t the only driver, but still.

Given one might be subject to AMT over the course of ownership, does it make sense to show property tax deductibility in the analysis?

Your point is fair, but the AMT calc and circumstances are too complicated to assume it will eliminate every dollar of property tax from your itemized deductions. TurboTax allows you to run various scenarios to see how the AMT affects your decisions.

Given the rest of the analysis is appropriately conservative, and that home buying is a long term decision, the likelihood of being subject to AMT over the course of the term of ownership -AT SOME POINT- is real and probable.

It seems odd, given the rest of the analysis is so conservative, that property tax is assumed to be deductible. Just out of place, IMO.

It is real and probably, but it’s not dollar-for-dollar. So what can you assume – that the AMT will reduce the deductibility of property tax, the size of the reduction to be determined under your specific tax circumstances?

Anecdotally, friends who are high-earners, have stay-at-home spouses, and 2+ kids, tend to get hit the hardest by the AMT. A high-earning husband + high-earning wife + 0 kids = very low AMT liability.

Once you are hit with AMT, you cannot deduct property tax AT ALL. It’s an all or nothing situation.

I appreciate your anecdotes, but AMT is generally more likely to hit when you have sizeable deductions (i.e. interest).

Earning over $150k per year + a mortgage + charitable contributions = highly likely to put a household into AMT.

It’s counterintuitive: a household close to hitting the AMT threshold should defer deductions into the following year.

My point is this: don’t count on property tax being deductible for the life of the loan. Unless you plan on earning or deducting less or are far below the AMT threshold.

If you’ve got equity and access to a heloc, you can self ponzi by using heloc money to make 1st mortgage payments. Or you do a cash-out refi and save the cash for future payments.

Maybe its a southern California thing, but if the ceilings have been scraped, don’t you think they should repair that before they sell the house? My 5 year old has scraped the walls and this leads to them needing to be sanded and/or repainted.

The repair and repaint is implied. In Southern California, when we say the ceiling has been scraped, it means the popcorn texture has been removed and the ceiling has been restored to a smooth finish.

I myself was wondering WTF that meant. My first guess was that it meant they removed the popcorn but surely the “r”ealtor could have come up with a description that wasn’t based on slang. But then again, they capitalized every other word in the description and wrote nonsensical statements like:

The complete kitchen remodel will be the pride of you at home gourmet.

(Seriously? WTF does this mean? The pride of you at home gourmet? It almost sounds like mind control.)

Just another listing written by a moron. Nothing should surprise me.

We have a lot of English-as-2nd-language people in Irvine (recent immigrants are attracted to the real estate agent “profession” too, as it requires no education and little skill).

I hope that is the real reason. You would think that the “r”ealtor group would hire a couple of English Literature majors from UC Irvine and pay them 20.00$ an hour to proof read these listings on 700K houses. 6% on a 700K house is 42K; not sure what the going rate for a proof reader is these days but something tells me they could find one even on a super-tight budget like that.

It means that there had been black rain leak stains and mold. Then the ceilings were cosmetically repainted.

Why would a homeowner in foreclosure pay thousands to an unionized roofer?

My guess about the first vs second defaults is pretty simple. Most homeowners who default on the first and keep current on the second don’t know what the hell they are doing.

They don’t have a grand plan… it is just that they can’t afford to pay both, and figure it makes no difference which one they pay, so they pay the smaller of the two bills.

Or if they are a little smarter, they choose to pay the loan with the higher interest rate, which would typically be the 2nd mortgage.

I agree, I think we give the general population too much credit.

By defaulting on the 1st and keeping the 2nd current, it increases your opportunity to get a loan modification on the 1st. After you obtain your modification, THEN you default on the 2nd as you are upaside down and they will not foreclose. Following this, you declare chapter 7 or chapter 13 and go from there.

How much of this can also be the fact that the first might be securitized and on someone else’s balance sheet, while the 2nd might be held by the servicing bank. At that point, the servicing bank would have an incentive to tell borrowers to pay them (the 2nd) and not the 1st, in the hope of getting a mod on the 1st. I’m sure that is against the rules of the securitization/servicing agreement, but so are a lot of other things that have been going on.

“The ceilings have been scraped, Canned lights, 4′ Base boards, Crown Moulding, Plantation shutters”

http://www.crackthecode.us/images/Canned_Lights.jpg

I wonder what the 4 foot base board looks like.

Those go in the Yoga studio:

http://www.crackthecode.us/images/Irvine_BaseBoard_Room.jpg

This is your best one ever! I’ll be seeing “4′ base boards” the rest of the day! Thanks! Now could you respin it with this picture in the background?

http://www.cerwinvega.com/images/Products/Vega-Bass/le36-lg.jpg

<EMBED SRC=”http://www.cerwinvega.com/images/Products/Vega-Bass/le36-lg.jpg” ALIGN=”bottom” ALT=”Earthquake!”>

LOL – if they had those in the house it would make the house worth $695k.

I also noticed the ‘extra large’ 3 car garage – that is good, I prefer the extra large 3 car garage to the extra small 4 car garage any day of the week.

Great job on the transporter room! What a great way to entertain your Irvine guests!

http://www.crackthecode.us/images/Irvine_Transporter_Room.jpg

Beam us up!

Dude, you better be glad you aren’t wearing a red shirt!

Breaking NEWS!

Used House Sales Down 30% Year Over Year

Although give due credit to the reporter for trying his best to spin it!

Oh my gosh! Every body in the office is staring at me because I laughing so hard.

Looks like house is already in contract and accepting only back up offers. $362/sqft..its almost close to the peak price. Irvine great.

The housing crash in Irvine continues LOL.

There’s very low demand for Irvine housing and few people with large down payments.

Like I said… we can be shocked by the prices for these “upgraded” homes… but someone is buying them.

Irvine inventory down to 730. Wasn’t there some blog entry where that number was supposed to keep going up?

Irvine inventory down to 730. Wasn’t there some blog entry where that number was supposed to keep going up?

Last year at this time there were 461 Irvine homes on the market. So seasonally adjusted, we have a 58% increase in inventory over last year. Ouch! We also have thousands of homes that are either in default, or in the foreclosure process (shadow inventory). Then you have to add all the mortgage owners that are either in a negative equity position, or are withing 5-10% of negative equity … these people will only add to the growing shadow inventory.

Exactly,

Even the low hanging fruit like today’s property is selling for a premium.

http://www.crackthecode.us/images/28_Yorktown_Nothing_To_See_Here.jpg

Those that purchased in Irvine before 2002 are not losing a home to FC, they are just locking in their profits and ending their free rent to FC. The equity was withdrawn and will not be taxed if completed before ____?___ (end of debt tax forgiveness). Better than stocks or other investments.

Only ones lossing their house and equity to FC are those who made large downpayments at the peak or thereafter. According to the leading US economists and policymakers, the US needs to spend it self out of a recession using borrowed money.

AMT is not an all or nothing. I have a wife and kitds and don’t have interest payments but am hit often with AMT. The charitable deductions can not be carried forward and the SchA deductions are just reduced. I just let TurboTax or an accountant figure out the reduction.

REVERTING TO THE MEAN

————————————————–

Vol. 5, No. 14

December 2010

Federal Reserve Bank of Dallas

The Fallacy of a Pain-Free Path to a Healthy Housing Market

by Danielle DiMartino Booth and David Luttrell

In the mid-1990s, the public policy goal of increasing the U.S. homeownership rate collided with a huge leap in financial innovation. …

Reverting to the Mean Price

As gauged by an aggregate of housing indexes dating to 1890, real home prices rose 85 percent to their highest level in August 2006. They have since declined 33 percent, falling short of most predictions for a cumulative correction of at least 40 percent.[1] In fact, home prices still must fall 23 percent if they are to revert to their long-term mean (Chart 1). The Federal Reserve’s purchases of Fannie Mae and Freddie Mac government-sponsored-entity bonds, which eased mortgage rates, supported home prices. Other measures included mortgage modification plans, which deferred foreclosures, and tax credits, which boosted entry-level home sales.

http://dallasfed.org/research/eclett/2010/el1014.html

————————————————–

Somebody at the Fed is going rogue!

Do yourself a favor and sign up for a free 3 day trial at ForeclosureRadar or RealtyTrac.

The good:

The number of loanowners living rent/mortgage free in their stucco boxes in the magic land of Irvine is STAGGERING. It is literally a Christmas tree with brightly colored ornaments on the map.

The bad:

When you drill in on the NOD/NTS stories, you’ll see folks have squatted many months and years beyond the traditional 6 month mark.

The ugly:

I personally know (work with) two loan owners that are doing strategic defaults. One is on month ELEVEN with NO NOD FILED. That’s right, he’s a hidden ornament on that Christmas tree. Add his stucco box to the properties taken back by the bank but not on the market, plus the known properties under NOD/NTS – THEN you have the true picture.

Truly a giant train wreck in the slowest of motion.

As many have stated on this blog, it is we who have diligently waited and/or prudently purchased that are the absolute FOOLS. By all rights, we should have bought with nothing down, refi’d, cashed out and strategically defaulted, regardless of timing or price or location.

Half the schadenfreude on this site stems from that regret. ‘Coulda been a contender.

What about:

The untold:

Many of those ornaments seem to disappear over time. I remember foreclosure radar maps of Quail Hill that graphrix used to post that were supposed to tell the story of utter destruction in that area. 2 years later… Quail Hill still survives, SFRs are still above their 2003 build date prices and although the condos have started to drop to that pricing… the foretold apocalypse has not arrived. Maybe in 2012 with the rest of the world?

And if you really want a Christmas tree… try some other city than Irvine… many more lights… and more red ones too.

Yeah, I remember graphrix’s maps and tables too.

You are correct that other areas have more NODs than Irvine (Ladera, Talega, much of the IE, anything built out during the boom) but that doesn’t validate your narrative.

No one predicted the ‘robo-signing’ problem at the banks. And it’s very hard to fight the Feds – they’ve propped this thing up, given free money to banks to assist with mods/make it less painful to carry the toxic assets. So folks have ended up staying in “their” homes.

The bubble was built with marginal increases in sales prices.

It has deflated in some areas with the correlated marginal decreases in sales prices in the form of distressed sales.

Irvine is different, I think, because the loan owners are more sophisticated and manage default differently and there remains an irrational, emotional interest in buying property there. I say irrational because it is gobs cheaper to rent and makes no sense from an investment perspective (cap rates). And the rentals are very, very compelling. We had a place across from the Woodbury Commons that was to die for – it was $2600 per month – on a $750k place! WTF ?! Why in God’s name would you buy that place?

See… I like it in Irvine too and I can sort of understand it. But it really does boggle my mind that people are still buying at these prices.

I do find it ironic that everyone knows that the bubble inflating in the first place was irrational and defied fundamentals, yet they find it hard to believe those same factors are what’s preventing a hard deflation of that bubble in Irvine. Psychology and perception play just as big a role as economics and valuation.

And I’m no expert so I’m not looking for validation… just telling it like I see it.

Psychology and perception play just as big a role as economics and valuation

Only in the short term. Fundamentals always win long term.