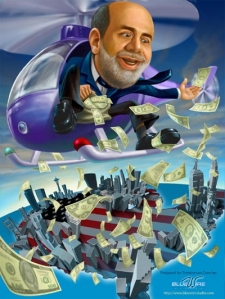

Having been found culpable in a government report, an embarrassed Ben Bernanke admits he failed to see the housing bubble (but it's okay because everyone else failed too, right?)

Irvine Home Address … 14 VIENTO Dr Irvine, CA 92620

Resale Home Price …… $360,000

You've been caught in a lie!!

You can't deny it!

So let the war begin

You're far from innocent

Hell I just don't know where it will end

You are the one to blame

Another fallacy

Is laid in front of me

Now I just don't know

What to believe

This idiot won't let me go

Slowly penetrating the mind

Disturbed — Deceiver

We want our government officials to lie. We must, or we wouldn't continually put liars in positions of power. Ben Bernanke made a number of public statements around the peak of the housing bubble and during the financial meltdown that suggested his grasp of the obvious was challenged.

Personally, I prefer to assume men like Bernanke are knowingly deceiving the general public to avoid feeding into a financial panic. If Bernanke is as clueless as his public statements make him out to be, he is more like Greenspan than I am comfortable with, and our financial system is being run by a fool.

Last week I noted that the government commission to study the housing bubble and the financial meltdown found Greenspan and Bernanke responsible for the debacle due to their negligent handling of monetary policy.

Bernanke Says Fed Failed to See Broader Risks From Housing

By – Jan 27, 2011 9:14 AM PT

Federal Reserve policy makers failed to foresee a threat to the financial system from the housing market in 2005 in part because central bank economists didn’t find major risks, Chairman Ben S. Bernanke said.

At one Federal Open Market Committee meeting in mid-2005, Fed governors and regional presidents heard staff briefings suggesting that the U.S. mortgage system “might bend but would likely not break” from a large home-price drop, and that the market may rest on “solid fundamentals,” Bernanke said in a Dec. 21, 2010, letter to the Financial Crisis Inquiry Commission, providing his views and revealing new details on FOMC meetings from 2005 to 2008.

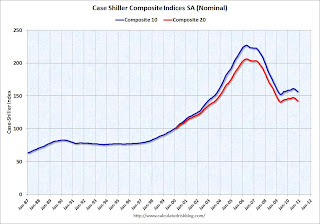

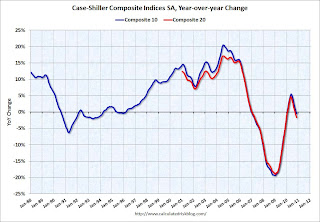

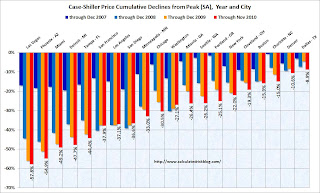

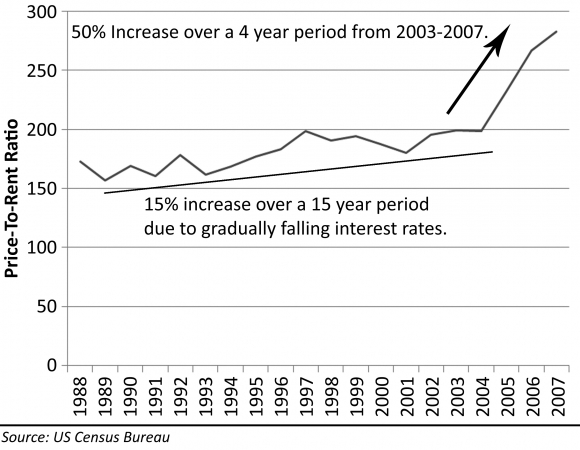

The evidence that prices were not resting on fundamentals was quite compelling. The price to rent ratio went up abruptly.

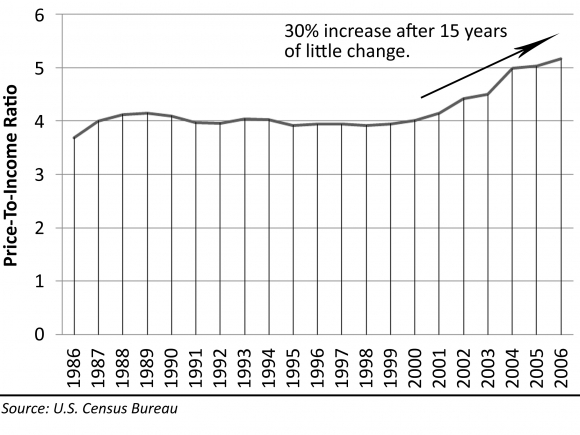

The price-to-income ratio showed the same inexplicable rise after years of flatlining.

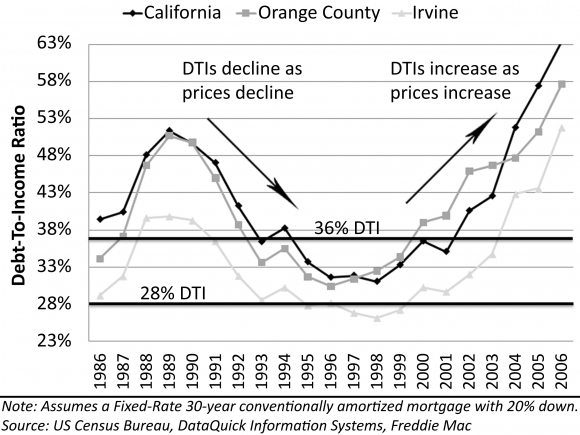

And more importantly, as this is really an market fundamental, the debt-to-income ratio showed borrowers were taking on huge debt loads only sustainable with toxic financing.

Of course, Bernanke argues that none of these were important because money was flowing and the economy was making jobs. In his mind, those were the fundamentals, and anything happening with price would be resolved by continued economic growth. Obviously, Bernanke was totally wrong.

“Given these and other analyses, it was hard for many FOMC participants, in the summer of 2005, to ascribe substantial conviction to the proposition that overvaluation in the housing market posed the major systemic risks that we now know it did,” Bernanke said in the letter, posted on the FCIC’s website.

Really? Given the data above, it is hard not to believe the markets are poised to crash. I said so at the time, and I was not alone.

The FCIC, the congressionally appointed panel assigned to probe the origins of the 2008 credit crisis, heaps blame on “reckless” Wall Street firms and “weak” federal regulators and concludes that the meltdown could have been averted. Some points from Bernanke’s letter are included in the commission’s a 545-page report, released today.

The 2005 presentations were made public this month as part of transcripts of that year’s FOMC meetings. The Fed, which has a policy of giving out FOMC transcripts with a five-year lag, hasn’t published any records from 2006 or later.

It will be interesting to read the meeting notes from later meetings when the housing market was obviously crashing.

Change for ‘Worse’

While most participants at a June 2005 Federal Open Market Committee meeting agreed that “the probability of spillovers to financial institutions from lower housing prices seemed moderate, they recognized that circumstances could change for the worse,” and several officials raised concerns about subprime lending and mortgage-backed securities, Bernanke said in the letter.

Atlanta Fed President Jack Guynn called the housing bubble in 2005.

In 2006, Fed officials “expressed nervousness” about some practices in the mortgage industry, said Bernanke, who became chairman in February of that year. He said he “had in mind increased regulatory oversight” and “increased vigilance” for the implications of housing on interest-rate policy.

He was ready to start looking in to the industry after it already took every housing market in the country to the abyss.

FOMC members were briefed in June 2007 about the liquidation of subprime securities at two hedge funds sponsored by Bear Stearns Asset Management, Bernanke said. Some Fed officials were concerned that the Fed didn’t understand “the scope of the problem” because the central bank couldn’t “systematically collect information from hedge funds,” which were outside the Fed’s jurisdiction, he said.

Extent of Threat

In August 2007, as turbulence in the subprime-mortgage market rose to a “considerable” degree, policy makers at an FOMC meeting disagreed over the extent of the threat to the economy, Bernanke said.

“One participant, in a paraphrase of a quote he attributed to Churchill, said that no amount of rewriting of history would exonerate us if we did not prepare for the more dire scenarios discussed in the staff presentations,” the Fed chairman said.

The federal reserve knows they can commission studies after the fact to justify anything they do. Last year they exonerated themselves for responsibility for the housing bubble. Their argument was that interest rate policy did not cause the housing bubble; therefore, the federal reserve did not cause the housing bubble. The first part is true, but the second part is only true to the degree that interest rates were responsible for the housing bubble. The real failure at the federal reserve was in their oversight of the entire financial system as well as the toxic loans being churned out by the shadow banking system.

At that meeting, Bernanke and his colleagues judged that inflation was their “predominant” concern and left their benchmark interest rate at 5.25 percent. Within two months, they had scrapped that view and begun cutting rates. That December, the worst recession since the 1930s began, and a year later, the federal funds rate was cut almost to zero.

In September 2008, FOMC members briefed on the failure of Lehman Brothers Holdings Inc. were divided on what the government should do in such a situation. Some wanted the government to have no role in a rescue, while others sought capital injections instead of central bank liquidity or monetary policy interventions, Bernanke said.

“My own view at the time was that only a fiscal and perhaps regulatory response could address the potential for wide-scale failure of financial institutions during that period,” Bernanke said. “Such an approach would involve tools such as a robust resolution authority and a capital injection program, neither of which was authorized at that time.”

To contact the reporter on this story: Scott Lanman in Washington at slanman@bloomberg.net.

To contact the editor responsible for this story: Christopher Wellisz at cwellisz@bloomberg.net

The real reason Bernanke had to step in and take over AIG was because the debt resolution of such a large entity with international creditors has not been worked out. In short, if we had not paid off a number of foreign banks (and Goldman Sachs) the entire financial system may have ground to a halt as countries begin seizing assets of distressed companies in an chaotic collapse. A wave of international protectionism and the resulting shutdown of international financial transactions would have been an economic catastrophe. It wasn't the housing market that needed to be saved.

The temporary liquidity operations launched by the federal reserve to get us through the crisis were quite successful. Before the fed enjoys too many kudos, it is worth noting that they were cleaning up their own mess.

Milking the cash cow

Many people who bought their first homes in the early 90s kept the property when they moved up and bought a larger home. It used to be that if you wait long enough, rents would rise to cover even the most bloated mortgage. Not thts time.

With payments on many houses significantly more than rental parity, people are faced with the prospect of negative cashflow, perhaps for decades. Of course, that can be made to work in the short term if appreciation is rampant, but most of the time, running negative cashflow is a financial cancer. All who nurture a negative cashflow investment will be consumed by it.

The owners of today's featured property paid $189,500 in 1991 at the peak of that housing bubble. The must have sustained ownership through a nine-year negative equity mortgage period, also known as a home prison sentence. After enduring such a protracted financial hardship, frugality should have been the lesson of the dark times. Instead, they went Ponzi.

- Their original mortgage data is not available, but they likely put 20% down ($37,900) leaving a first mortgage of $151,600. They may have borrowed more. In any case, on 1/4/1999, they had a $163,000 first mortgage.

- On 2/26/2002 they opened a HELOC for $40,000.

- On 7/24/2003 they refinanced the first mortgage for $200,000.

- On 5/27/2004 they obtained a $100,000 HELOC.

- On 1/28/2005 they enlarged to a $194,000 HELOC.

- On 11/3/2006 they got one last HELOC for $285,000.

- Total debt is $485,000.

- Total mortgage equity withdrawal is around $335,000, but I can't be sure how much was borrowed and spent. What would you guess?

Irvine Home Address … 14 VIENTO Dr Irvine, CA 92620 ![]()

Resale Home Price … $360,000

Home Purchase Price … $189,500

Home Purchase Date …. 5/31/1991

Net Gain (Loss) ………. $148,900

Percent Change ………. 78.6%

Annual Appreciation … 3.3%

Cost of Ownership

————————————————-

$360,000 ………. Asking Price

$12,600 ………. 3.5% Down FHA Financing

4.84% …………… Mortgage Interest Rate

$347,400 ………. 30-Year Mortgage

$73,190 ………. Income Requirement

$1,831 ………. Monthly Mortgage Payment

$312 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$60 ………. Homeowners Insurance

$348 ………. Homeowners Association Fees

============================================

$2,551 ………. Monthly Cash Outlays

-$300 ………. Tax Savings (% of Interest and Property Tax)

-$430 ………. Equity Hidden in Payment

$23 ………. Lost Income to Down Payment (net of taxes)

$45 ………. Maintenance and Replacement Reserves

============================================

$1,890 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,600 ………. Furnishing and Move In @1%

$3,600 ………. Closing Costs @1%

$3,474 ………… Interest Points @1% of Loan

$12,600 ………. Down Payment

============================================

$23,274 ………. Total Cash Costs

$28,900 ………… Emergency Cash Reserves

============================================

$52,174 ………. Total Savings Needed

Property Details for 14 VIENTO Dr Irvine, CA 92620

——————————————————————————.jpg)

Beds:: 2

Baths:: 3

Sq. Ft.:: 1460

Lot Size:: 2,269 Sq. Ft.

Property Type:: Residential, Condominium

Style:: Two Level, Traditional

Year Built:: 1978

Community:: Northwood

County:: Orange

MLS#:: S645459

Source:: SoCalMLS

—————————————————————————-

Charming and spacious Sundance home located at Northwood Irvine. Clean and in good conditon. Newer wood laminated flooring throughout. Newer dual-paned vinyl windows. Open and airy. Large living areas. Kitchen sink and great room opens to back patio for outdoor entertaining. Gas fireplace. Laundry area located in attached two car garage. Closet and half bath first level. Master bedroom suite and bath area with tub redone and updated. 2nd bedroom with large window and natural light. This home is close to and walking distance to public schools and shopping areas with restaurants. Northwood Irvine was once part of the old Irvine Ranch with romantic orange groves history and nearby eucalyptus trees and lining streets and roadways. This is a short sale listing.