Many housing analysts, myself included, stated the $8,000 homebuyer tax credit would fail to cause the housing market to bottom.

Irvine Home Address … 76 KAZAN St #36 Irvine, CA 92604

Resale Home Price …… $245,000

Don't let me down

Don't make a sound

Don't throw it all away

Remember me

The Klaxons — Not Over Yet

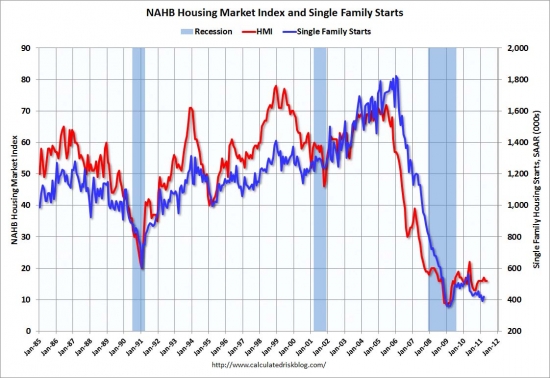

The housing bubble is not over yet. Though delayed for two years, the deflation of the bubble has resumed its progress toward affordability and the purging of kool aid from the beliefs and actions of buyers everywhere.

Many of the buyers in the bear rally of 2009-2010 believed they were getting a good deal on the backs of the taxpayer. They believed they were buying at the bottom and getting government assistance to boot.

They were wrong.

Buyers during the tax credit who purchased early to take advantage of the tax credit were merely being duped into overpaying for real estate by a government intent on bailing out our banking system at the expense of homebuyers and taxpayers alike.

Dean Baker predicted the failure of the tax credit in early 2010.

Dean Baker: We’re Still In a Housing Bubble

January 26, 2010, 11:22 AM ET By Nick Timiraos

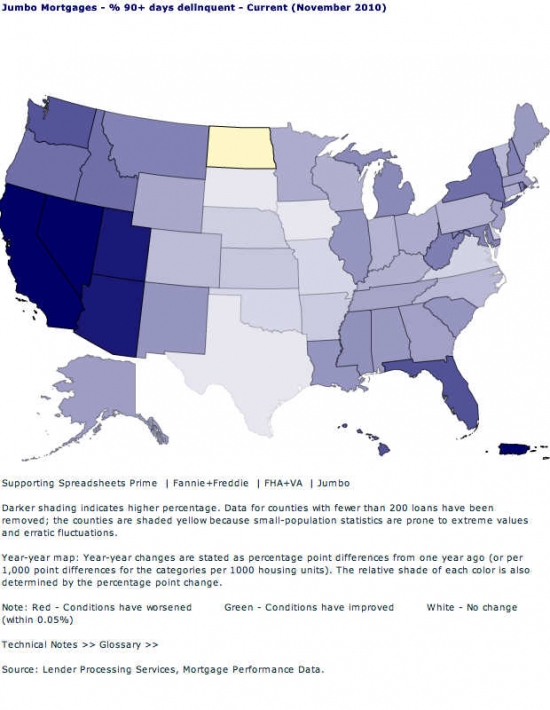

,,, Housing economist Dean Baker, the co-director of the Center for Economic and Policy Research, laid out his case at a risk conference last week for why we still have a housing bubble. Adjusted for inflation, home prices are still 15-20% higher than they were in the mid-1990s. “There’s no plausible fundamental explanation for that,” he says.

Why? Simple, he says: Economic fundamentals are all going in the other direction. Rental apartment vacancies are reaching record highs. Many segments of the housing market are still oversupplied. And the core demographic in the country—the baby boomers—are reaching the age where they’re more likely to downsize, buying less house in the years to come.

Far from some rosy estimates that housing is going through a temporary, once in a lifetime downturn, and that once the market bottoms, homes will again appreciate well beyond the rate of inflation, Mr. Baker argues that home prices are far more likely to increase annually at the rate of inflation, at best.

“If anything, I expect housing to be weaker than normal rather than stronger over the next decade,” he says. “People who say this is a temporary story, there’s no real reason to believe anything like that.”

The recent burst of good housing news has been fueled by government stimulus, including the tax credit, low mortgage rates and easy financing from the Federal Housing Administration. Mr. Baker, who had been a skeptic of the tax credit, concedes that it has worked. So, too, he says, has the FHA effectively supplied credit to goose sales.

But that’s likely for the worse, he argues, taking the opposite view of policymakers at the FHA.

“As a matter of policy I can’t see that we want people to buy a house in 2009 that’s 10-20% higher than it would sell for in 2011,” he says. “In so far as the FHA was encouraging people to buy homes in bubble markets that were not deflated, that’s not good for the FHA and you didn’t help the homeowner. We didn’t do those people a favor.”

Dean Baker was as right as right can be….

How the $8,000 Tax Credit Cost Home Buyers $15,000

Price declines have more than eclipsed savings, new numbers show.

MAY 10, 2011 — By JACK HOUGH

The government's recent $8,000 cash incentive for first-time home buyers has proved even more costly for recipients than for taxpayers, according to data released Monday. Typical buyers have lost twice as much to price declines as they received from the program.

The median home value fell to about $170,000 in March from $185,000 a year earlier, according to Zillow.com. That means a buyer who closed on a house just before the tax-credit program expired in April 2010 collected $8,000 but has since lost $15,000 in value. Those who bought earlier in the program have done worse; the median price is down $20,000 from March 2009.

By the numbers

“The $8,000 first-time home buyers tax credit . . . has brought many new families into the housing market,” the White House boasted in November 2009 upon announcing an extension and expansion of the program. Judging by sales declines since, that seems beyond doubt. Over the past year, the pace of existing home sales has fallen more than 6% and that of new home sales has fallen 22%.

The credit wasn't great for taxpayers, either. IRS says it paid $26 billion in home buyer credits in 2009 and 2010, enough to cover the maximum $8,000 credit for more than 3 million buyers.

So what did the program accomplish? It funneled money to banks who received larger loan payoffs than they would have if market prices had been allowed to correct naturally. The only beneficiaries of the tax credit were banks.

(It says at least $513 million went for fraudulent claims. Some claimants hadn't bought houses. Some filed twice. Some were under age 18 or incarcerated.)

Mortgage fraud is reaching record levels. It shouldn't be surprising that tax fraud is also on the rise.

In October 2009, when the extension of the $8,000 credit for homebuyers was under consideration, I outlined five reasons the U.S. didn't need more housing perks. These included already-high prices and an abundance of benefits, the questionable stimulus value of home subsidies and a gaping budget deficit. In January 2010, with the extension passed, I recommended that eager buyers wait at least nine months and purposely miss the $8,000 tax credit deadline to take advantage of price declines after. The median price fell about $8,000 over the next nine months and another $8,000 since.

i have consistently maintained that buyers who are concerned about declining prices should wait until the government stimulants were removed from the market. Only after the temporary subsidies were removed would we be able to gauge the health of the housing market. Since the props were removed, prices have steadily fallen, and the pace of the decline is quickening even during the prime buying season.

I realize that writing an apology for this program's failure probably isn't high on Congress's or the President's list of priorities right now. But just in case someone's conscience is bothering them, let me offer a simple draft:

“We thought the $8,000 tax credits would raise house prices and spur the economy. We were wrong. For starters, it makes no sense for a housing affordability program to have the stated goal of raising prices, because higher prices mean less affordability, not more. Another thing: The program didn't work. We squandered taxpayer cash, increased the debt and lured many Americans into losses. We're deeply sorry. We'll try not to repeat the mistake. If anything, in light of America's daunting fiscal challenges, we're going to consider sun-setting costly, existing programs that lure house buyers, like the mortgage interest deduction and capital gains exemption, which together are more than 10 times as expensive as the expired tax credit program, costing about $1,200 per household last year alone.”

No government official will admit failure because they consider it a success. The purpose of the program was to give money to banks. In that regard, it was a success.

For homeowners who are wondering if prices are done falling, and for renters who want to know if now is the time to buy, here's my best guess. In April 2007, when I first wrote that renting had come to make more financial sense than home-ownership, I calculated that prices would have to decline by half to restore the historic relationship between prices and rents. Since then, they've fallen 30% nationwide. Inflation has eaten another 8% of their value. So the worst of the plunge seems done, but prices might drift lower or lose ground to inflation in coming years. In some hard-hit markets, of course, houses are a good deal. For a very rough gauge of value in a specific area, divide recent sale prices by the yearly amount charged to renters for comparable properties. If the result is over 20, prices are probably too high. If it's less than 10, houses might be a steal. If it's in between, well, it's in between.

For another take on prices, consider something I and others have argued about the natural rate of price increase for houses. It's exactly the rate of inflation. Houses, after all, are sticks and stones and other ordinary things, and inflation by definition is the gradual rise in the price of ordinary things. If house prices forever rose faster than the rate of inflation, they'd become infinitely expensive relative to rents, incomes and the cost of building materials.

The truth is a bit more nuanced. Wage inflation is the best barometer of house prices. Inflation of other goods and services may eat into the income available to purchase housing, but the general rate of inflation is not as good a measure as local wage inflation. California house prices have gone up more than the rest of the country partly due to kool aid intoxication and partly due to above average wage growth.

House prices indeed tracked the rate of inflation during the 1970s, 1980s and 1990s, straying only slightly and briefly and returning each time. In 2000, house prices began to detach from the inflation rate and race ahead of it. Therefore, normalcy might be restored once the house price rise since 2000 matches the rate of inflation since then.

Houses are up 41% since 2000. Inflation has increased other costs by 32%. By this measure, too, prices on a national level seem nearly back to normal but not quite there yet.

Not enough time to Ponzi

The owners of today's featured property bought near the peak and began the process of serial refinancing to obtain HELOC spending money, but the housing bust stopped their plans short. Now they are selling for a big loss and passing the buck on to the bank.

- They paid $335,000 on 1/21/2005 using a $268,000 first mortgage, a $67,000 second mortgage, and a $0 down payment. Haven't seen many 100% financing deals lately. A few survivors must be around.

- On 10/14/2005 they refinanced with a $274,891 first mortgage and a $67,000 second.

- On 9/11/2006 they enlarged their second mortgage with a $80,000 refinance.

- On 2/28/2007 they obtained a $85,000 HELOC.

- Their total debt is $359,891 which only represents $24,891 in mortgage equity withdrawal. They bought too late to get much HELOC money, but based on their behavior, that was clearly the plan.

- They were served notice in February. There is no way to know how long they were in shadow inventory before that.

Foreclosure Record

Recording Date: 02/23/2011

Document Type: Notice of Default

Irvine House Address … 76 KAZAN St #36 Irvine, CA 92604 ![]()

Resale House Price …… $245,000

House Purchase Price … $335,000

House Purchase Date …. 1/21/2005

Net Gain (Loss) ………. ($104,700)

Percent Change ………. -31.3%

Annual Appreciation … -4.8%

Cost of House Ownership

————————————————-

$245,000 ………. Asking Price

$8,575 ………. 3.5% Down FHA Financing

4.59% …………… Mortgage Interest Rate

$236,425 ………. 30-Year Mortgage

$51,883 ………. Income Requirement

$1,211 ………. Monthly Mortgage Payment

$212 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$51 ………. Homeowners Insurance (@ 0.25%)

$272 ………. Private Mortgage Insurance

$185 ………. Homeowners Association Fees

============================================

$1,931 ………. Monthly Cash Outlays

-$112 ………. Tax Savings (% of Interest and Property Tax)

-$306 ………. Equity Hidden in Payment (Amortization)

$15 ………. Lost Income to Down Payment (net of taxes)

$51 ………. Maintenance and Replacement Reserves

============================================

$1,578 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,450 ………. Furnishing and Move In @1%

$2,450 ………. Closing Costs @1%

$2,364 ………… Interest Points @1% of Loan

$8,575 ………. Down Payment

============================================

$15,839 ………. Total Cash Costs

$24,100 ………… Emergency Cash Reserves

============================================

$39,939 ………. Total Savings Needed

Property Details for 76 KAZAN St #36 Irvine, CA 92604

——————————————————————————

Beds: 2

Baths: 1

Sq. Ft.: 900

$272/SF

Property Type: Residential, Condominium

Style: One Level, Other

Year Built: 1972

Community: 0

County: Orange

MLS#: S644297

Source: SoCalMLS

Status: Active

On Redfin: 117 days

——————————————————————————

Great location! Award winning Irvine Schools, and shopping. Quiet and private upstairs location, and close to HOA Amentities. Washer dryer room in unit. Well kept and Perfect for investors or the first time buyer.

One of my former co-workers is a deeply moral man. He views life rather simply, and most issues to him are either black or white. I watched him deal with the struggles of our declining incomes as the real estate bust dragged on, yet he remained committed to paying his mortgage on a house in Riverside County that declined about 50% in value. He was paying $3,200 per month for a property he could rent for $1,800.

One of my former co-workers is a deeply moral man. He views life rather simply, and most issues to him are either black or white. I watched him deal with the struggles of our declining incomes as the real estate bust dragged on, yet he remained committed to paying his mortgage on a house in Riverside County that declined about 50% in value. He was paying $3,200 per month for a property he could rent for $1,800.

.jpg)

.png)

Those are the standard reasons for strategic default we have discussed at length on this blog. They are good reasons. Anyone facing those circumstances will benefit financially from walking away. That's why strategic default is so common and will become the norm before this crisis has past.

Those are the standard reasons for strategic default we have discussed at length on this blog. They are good reasons. Anyone facing those circumstances will benefit financially from walking away. That's why strategic default is so common and will become the norm before this crisis has past.

Large master bedroom with huge views over the city of Irvine and a spacious bathroom with separate shower and tub, double sinks and walk in closet. There is a separate laundry room, off the huge kitchen with gorgeous granite counter tops and new dishwasher and a private outside patio just right for BBQ's and a quiet morning coffee and paper reading! New upgraded carpet and padding throughout and Italian porcelain tile on the bathroom and kitchen floors. New fittings and fixtures in wetbar and bathrooms and kitchen, just move in!! What a FIND!

Large master bedroom with huge views over the city of Irvine and a spacious bathroom with separate shower and tub, double sinks and walk in closet. There is a separate laundry room, off the huge kitchen with gorgeous granite counter tops and new dishwasher and a private outside patio just right for BBQ's and a quiet morning coffee and paper reading! New upgraded carpet and padding throughout and Italian porcelain tile on the bathroom and kitchen floors. New fittings and fixtures in wetbar and bathrooms and kitchen, just move in!! What a FIND!