To the chagrin of loanowners, falling prices and low interest rates make houses in many markets very affordable.

Irvine Home Address … 145 PATHWAY Irvine, CA 92618

Resale Home Price …… $425,000

and I'm not going back

into rags or in the hole

and our bruises are coming

but we will never fold

and I was your silver lining

as the story goes

I was your silver lining

but now I'm gold

Rilo Kiley — Silver Lining

Most articles on the housing market appear to be written as if everyone who reads them is a homeowner. Everything written about house prices going down is portrayed as bad and visa versa. Despite the fact that nearly 40% of the general population rents most articles are written as if renters are a lowly subclass not worthy of consideration and totally lacking a point of view.

Lower prices benefit renters who are waiting to buy. That is a benefit to 40% of the population, yet their story is never told. Even today's featured article is clearly aimed at homeowners. The author felt it necessary to point out to homeowners that there is another point of view. Some people are benefiting from the housing bust. Apparently, this is such an alien concept that it needs to be pointed out. This won't be news to regular readers of this blog.

For the young, there’s a silver lining in the housing bust

By Robert J. Samuelson, Published: May 8

If you’re a 20-something or even younger, your economic future is at best clouded. Your taxes will almost certainly be higher than today’s; your public services (schools, police, sanitation, defense, scientific research) will almost certainly be lower. Paying for old people, covering rising health-care costs, repairing dilapidated roads and servicing government pensions and the huge federal debt will squeeze take-home pay. Is there any hope for economic gains?

We are also making college much more expensive for young people so they begin their working lives with massive debts. What little discretionary income they have will not support the entitled lives granted an earlier generation. Do We Owe Baby Boomers Their Imagined Home Equity for Retirement?

Well, yes — and from a surprising source. Housing. Say what?

Almost everyone considers the housing collapse a disaster, and it is.

His bias is openly stated.

Since 2007, roughly 8 million homes have gone into foreclosure. Housing prices, according to the widely cited Case-Shiller index, are down about 33 percent from their 2006 peaks. They’re still falling, albeit at a slower pace. In some cities (Atlanta, Cleveland, Las Vegas, Detroit, Phoenix), they’re at or below 2000 levels. Home sales are stunted, and construction is a quarter of its previous peak. Housing’s implosion retards the economic recovery. Aside from unemployed carpenters and real estate agents, there’s much unsold lumber, carpet and appliances.

But housing’s troubles may have a silver lining. If you’re a homeowner, the steep fall in prices is calamitous. But if you’re a future buyer, it’s a godsend. What we’re seeing is a massive wealth transfer from today’s older homeowners to tomorrow’s younger homeowners. From year-end 2006 to 2010, housing values fell $6.3 trillion, reports the Federal Reserve. Assuming there’s no sharp rebound in prices — a good bet — that’s $6.3 trillion the young won’t pay.

Look at how much less a family in Las Vegas now has to spend on housing. The median home price is back at 1995 levels when interest rates were north of 9%.

Affordability is the highest on record in Las Vegas, and it is likely to get even better as the crushing weight of inventory takes its toll.

Up to a point, the lower home prices merely deflate the artificial “bubble.” But there’s evidence that the declines transcend that. The National Association of Realtors routinely publishes a housing “affordability” index, which judges the ability of median families to buy the median-price home at prevailing interest rates. By this measure, existing homes are the most affordable since the index started in 1970.

Young buyers “will be able to enter the housing market at bargain prices,” argues NAR economist Lawrence Yun.

Finally, Lawrence Yun makes a statement that is not complete bullshit. His job will become much easier when reality begins to coincidentally mirror his spin and bullshit — and it will be a coincidence. He or his replacement will spin bullshit endlessly, and those times when their bullshit comes to pass will be an accident. Remember 2006?

When home prices again rise, increases will parallel income gains, meaning that the relative burden of housing costs will remain roughly stable, Yun says. He expects only modest increases in interest rates. (A rise of one percentage point — say, from 5 percent to 6 percent — on a $150,000 mortgage boosts the monthly payment about $95.)

He is clearly torn here. The standard line of NAr bullshit right now is that people need to hurry up and buy while interest rates are low. His realistic expectation of slowly rising interest rates doesn't convey the false sense of urgency that accompanies most NAr propaganda.

Falling real estate prices have also affected new homes. They’re getting smaller and less embellished, as they must. New homes typically sell at a 10 to 20 percent premium over comparable existing homes. If prices don’t fall, buyers won’t buy. From 1973 to 2007, the size of the average new home grew by about 50 percent, from 1,660 square feet to 2,521 square feet. By 2009, that was 2,438 square feet, with more declines expected.

“People have become much more value oriented,” says Jeff Mezger, chief executive of KB Home, a major builder. At the height of the boom, with cheap mortgage credit widely available, over-confident buyers selected five-bedroom homes with Jacuzzis and granite-top kitchen counters, he says. Now, buyers favor practical amenities: more kitchen cabinets and bigger closets.

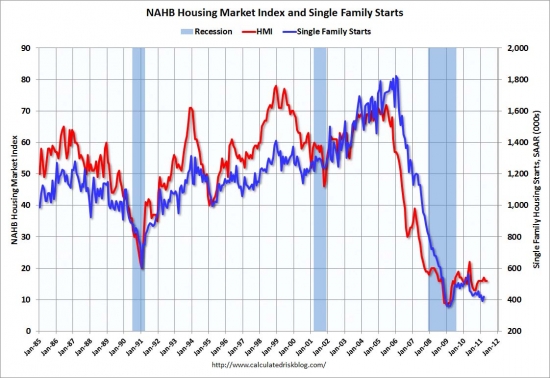

KB Homes made the quickest and best adjustments to falling prices by retreating to their small standard offerings of years past. The housing bust has been very hard on the homebuilding industry. Nobody anticipated new construction taking out the previous low of 1992 and staying below this level for nearly 4 years. This will be remembered as the Great Homebuilding Depression by those who endure.

Prior to the housing bubble, smaller square footage used to demand a premium. The expensive kitchens and baths are required in a small studio unit as well as a large McMansion. When dollars per square foot began to rise as houses got larger, homebuilder incentives are to add as much inexpensive square footage in bedrooms, family rooms, great rooms and so on. Hence, we ended up with seas of McMansions. Until the sales price per square foot of SFDs falls below the sales prices per square foot of condos, the market has not reached a stable point, and McMansions will still be supplied in abundance.

We are, perhaps, at a historic juncture. The relentless expansion of home size since World War II — encouraged by federal subsidies, including the mortgage-interest tax deduction — arguably resulted in many Americans being “over-housed.” Homes grew beyond what was “needed” or could even be enjoyed. The reason they kept expanding, Cornell economist Robert Frank has argued, was social competition. People want to be in the “best” neighborhoods with the “best” schools, and these neighborhoods have ever-larger homes. Somewhat smaller homes, Frank contends, won’t make people less happy.

Useless square footage is a thing of the past. Now that people have to pay for their housing with wage income and HELOC supplementation is not forthcoming, buyers will become conscious of every square foot. Bigger will not mean better. During the housing bubble the most borrowers over-extended, the more they were rewarded with HELOC booty and the illusion of price decline immunity. The incentives were all wrong. Now only the kool aid remains.

If the housing collapse mutes this self-defeating syndrome, the main beneficiaries will be today’s young. Their homes will be somewhat cheaper and smaller; their operating costs (mainly utilities) will be somewhat lower. The sacrifices in living standards will be barely noticeable, and the savings — housing, after all, represents most families’ largest expense — will provide some relief from higher taxes and health costs.

Caveats apply. Housing markets are famously local; what’s true in one won’t be true in another. Moreover, the housing bust still looms large. The young are staying or returning home; new household formations are less than half of previous levels. Mortgage credit is constricted. Private lenders, once promiscuous with loans, are now prudish. Fannie Mae and Freddie Mac are in a state of transition — to what, no one knows. The price adjustment, especially for new homes, is incomplete. Unless these problems are overcome, housing construction will remain depressed. Eventually, the scarcity of homes would push prices up.

But crises pass and have unintended consequences. The young just might catch a much-needed break from this one.

And so will patient IHB readers.

Your time will soon be at hand. IMO, the steep drop in house prices will continue through the end of the year, and it marks the opening of the window of opportunity to find better properties at lower prices. Sellers, mostly banks, will be more abundant and more motivated, particularly as prices decline. The patient will be able to find good deals. Everyone needs to be prepared for a long drawn-out bottoming process with yearly false spring rallies and late-year declines. One of the next few spring rallies will be an enduring one, but there is no way to know which one it will be. It isn't very likely to be 2011, and 2012 is looking even more suspect. Perhaps January to March of 2013 will mark the bottom tick of prices for coveted Irvine SFRs. Perhaps it will be even later.

For me, those are reasons to be bullish. But I am a contrarian, and I won't mind an extended bottoming period to carefully select the property or properties I want to own. If the bottom drags out for five years and provides a window where new owner-occupants find great deals, and I can acquire cashflow positive real estate, I think that is a great thing.

Past Peak Buyer

I don't have a category for the owners of today's featured property. They bought in December of 2007 when prices were just beginning their steep drop. Perhaps this looked like a relative bargain at the time, but since the builders on the Ranch were not lowering their prices in late 2007, they were one of the few sales that took place as down payments skyrocketed. Needless to say, they weren't readers of the blog back then.

These owners put 10% down, and took out a purchase money HELOC for 10% of the price. If they didn't use it, it may retain its non-recourse status. If they did use this HELOC, their recourse protections are gone, and their loss is doubled. In either case, they likely didn't see this purchase as a fast track to losing their money and trashing their credit. By purchasing when they did, they got to experience the steepest drop the market had to offer, at least until now.

Irvine House Address … 145 PATHWAY Irvine, CA 92618 ![]()

Resale House Price …… $425,000

House Purchase Price … $627,500

House Purchase Date …. 12/6/2007

Net Gain (Loss) ………. ($228,000)

Percent Change ………. -36.3%

Annual Appreciation … -11.1%

Cost of House Ownership

————————————————-

$425,000 ………. Asking Price

$14,875 ………. 3.5% Down FHA Financing

4.59% …………… Mortgage Interest Rate

$410,125 ………. 30-Year Mortgage

$90,001 ………. Income Requirement

$2,100 ………. Monthly Mortgage Payment

$368 ………. Property Tax (@1.04%)

$233 ………. Special Taxes and Levies (Mello Roos)

$89 ………. Homeowners Insurance (@ 0.25%)

$472 ………. Private Mortgage Insurance

$418 ………. Homeowners Association Fees

============================================

$3,680 ………. Monthly Cash Outlays

-$339 ………. Tax Savings (% of Interest and Property Tax)

-$531 ………. Equity Hidden in Payment (Amortization)

$26 ………. Lost Income to Down Payment (net of taxes)

$73 ………. Maintenance and Replacement Reserves

============================================

$2,908 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,250 ………. Furnishing and Move In @1%

$4,250 ………. Closing Costs @1%

$4,101 ………… Interest Points @1% of Loan

$14,875 ………. Down Payment

============================================

$27,476 ………. Total Cash Costs

$44,500 ………… Emergency Cash Reserves

============================================

$71,976 ………. Total Savings Needed

Property Details for 145 PATHWAY Irvine, CA 92618

——————————————————————————

Beds: 3

Baths: 2

Sq. Ft.: 1700

$250/SF

Property Type: Residential, Condominium

Style: Two Level

View: Hills, Mountain

Year Built: 2007

Community: Portola Springs

County: Orange

MLS#: P775467

Source: SoCalMLS

Status: Active

——————————————————————————

Beautiful home located in the village of PORTOLA SPRINGS and in the IRVINE SCHOOL DISTRICT. This home is located at END-UNIT. Light bright and beautiful kitchen features GRANITE COUNTERTOPS and STAINLESS STEEL appliances with plenty of cabinet and counter space. 10 years builder warranty. Enjoy association POOL, PARK with basketball court, two tennis courts and a recreation center. Easy access to FWY and TALL ROAD. /////MUST SEE!!!/////

Noticing something interesting.. IR, the last few properties you featured were modest but decent-sized in the mid-$200/sf range. Is this now the average in Irvine, or are you picking them out, or is this just coincidence?

I try to feature properties that are low-price leaders that have interesting back stories. The typical Irvine property is now trading in the low $300s per SF and falling. I doubt the average $/SF will get to the mid $200s/SF, but I could easily see $275/SF particularly this fall and winter after the lower conforming limit further restricts demand and the inventory weight pushed prices lower.

“The housing bust has been very hard on the homebuilding industry. Nobody anticipated new construction taking out the previous low of 1992 and staying below this level for nearly 4 years.”

Hey, I resent being called “Nobody”! 🙂

Few were as bearish as I was in 2006/2007 and I still don’t see much room for optimism today. I think it will be several years before I’ll be able to find a decent job in homebuilding again in Orange County.

Wonder if there is any snapshots spillover in Irvine…

Chinese Homebuyers Spreading Wealth Make Vancouver Pricier Than Manhattan

http://www.bloomberg.com/news/2011-05-16/chinese-spreading-wealth-make-vancouver-homes-pricier-than-nyc.html

“associated spillover” I mean ( crazy spelling autocorrector!)

Similar buying could happen in US cities, but Vancouver has a leg up since Canada is a marshmallow at handing out residency/investor visas, and both Canada and formerly HK are Commonwealth countries.

Also, HK prices are insane, so Vancouver still looks cheap in comparison.

Most of the current Chinese RE investors are literally parking money. They like the ease of emigrating to Canada someday in case of political turmoil in China, but realistically that rarely happens since the action is in China.

If this place sells for the ask,that’s a 200K plus loss all for the pleasure of living in Irvine for 3.5 years. I doubt these were the ultra smart FCBs we always hear about. Genes like this are not passed down to Ivy league college material. Bwahahahaha!

More than likely an FCB will buy this place as an investment.

From their standpoint, it’s a $200K discount off what the previous owner paid.

Yes, we all know that FCBs are much too smart to pay for overinflated real estate. The Japanaese from 20 years ago were an anomaly!

Bwahahaahahaha!!!!!!!!!!!!!!!!!!!!

TIC seems to still have their blinders on.

They just opened up Laguna Altura on Sunday and prices for those homes are $100k-$200k more than their almost exact same floorplans in Stonegate/Woodbury. There were tons of lookie-loos… but let’s see if that translates into sales.

I think Dan Young was wrong… 2011 will not be better than 2010. In fact, they’ve already started offering broker co-ops in Stonegate/Woodbury, something they didn’t have to do in 2010.

Is their current pricing higher compared to the 2010 product?

I believe it is for Laguna Altura.

Stonegate might be on par or even a bit less than Woodbury.

The double dip may be the perfect storm for TIC sales. They may have built the wrong product in the wrong place for the wrong price at the wrong time. Only time will tell.

TIC is running a very effective marketing campaign.

Brokers co-op and other design or closing incentives are already baked in their pricing models.

The use of “faux” financial incentives like the broker co-op allows TIC to enlist area realtors that will do the heavy lifting and pump their product for a small cut.

It’s the equivalent of hiring mercenaries under the pretense of throwing the buyers a bone.

Buyers feel that they’re getting over on TIC, when it’s actually the other way around.

are they offering broker co-ops in laguna Altura yet? I guess closer to the beach deserves that premium? in Univ HS district?

With all their billions couldn’t TIC have vetted the name “Laguna Altura”. By trying to mimic Spanish sounding place names they have come up with laughable gibberish on par with the silly tranliterated English signs found in China. What they were going for was “Laguna Alta” or “Los Altos de Laguna”.

This annoyance is on par with me with TIC’s insistence that Portola is “North” Irvine. Hey TIC when you go to the store for a Spanish usage guide pick up a compass as well.

Sorry to sweat the small stuff but I expect better from billionaires.

Portola is North Irvine, geographically… unfortunately, I think you’re referring to Portola Springs, as most people would when they refer to “Portola”, which is more like East-North-East Irvine.

Right, Portola Springs as in the house featured in the blog today.

gotcha. now “West Irvine”, talk about a potential head scratcher.

I can imagine the conversation between a perspective buyer and agent going something like, “How do I get there?” “Go North-North-East on Jamboree until you pass the Marketplace. Then turn right (East)”.

I am currently renting ($2300 per month)in Irvine. I plan to live here at least another 4-5 years while my kid attends school. Is it a good time to buy a condo in the Woodbridge HS area?

It’s never a good time to buy a condo, except before a bubble.

It is a good time to shop around for cheaper rent though.

Agreed, set your sights for a house in Irvine. At your current monthly you are in condo/old home range already…

CHEWB,

I have been seeing more condos in my daily profiles selling at or below the cost of an equivalent rental. Under those circumstances, saving money versus renting may be a good option for you if you accept the value may not rise for several years and will likely go down.

I am buying real estate for myself in a declining market in Las Vegas because it’s cashflow positive. If you save money versus renting during your ownership, and if you can wait out the market bottoming period, it can work out in your favor. However, should you need to sell for any reason over the next 3 to 5 years, you will likely lose money.

Yes some people are realizing that whatever house you buy now, you are going to get stuck to it for a while…therefore why is the rush to buy something now if you are not going to be able to upgrade in the near future?!

This is a market with little buyer urgency, and it will remain so until prices are low enough to motivate buyers.

“Carlsbad foreclosure lawyer loses his license

Declaring that he poses a substantial threat of harm to the public, the State Bar Court lifted the law license of MICHAEL T. PINES, the Carlsbad attorney who made national headlines by advising clients to break into their foreclosed homes and start living there again. He was placed on involuntary inactive status May 1…” http://www.calbarjournal.com/May2011/AttorneyDiscipline/Feature.aspx

CHEWB- With the artificially low rates and current prices, some properties are at or below rental parity. That said, if you are only planning on holding the property for 5 years, you will most likely be better off continuing to rent. There is still a lot more downside risk than upside potential. Particularly when you factor in added risks with HOA’s, shadow inventory, and the high likelihood of rising interest rates that will put downward pressure on prices over the next few years.

There’s only one thing guaranteed in 5 years:

You will be 5 years older and you will have 5 less years to live.

Outside of that there is no guarantee as to whether renting or owning will be better. Market factors and individuals factors will dictate that, suggesting one is clearly better lends itself to 5 year folly.

You have to consider your quality of life and what a home means to you. For most people fixing it up and painting, decorating, planting makes a house a home. Having folks over for dinner and just enjoying your home makes it worth owning over renting. Money can’t always be your factor in life because that chase is never ending.

You forgot ANOTHER thing that’s guaranteed; in 5 years the U.S. will resemble Guatemala EVEN MORE.

affordability? $250/sqft needs to be the rule, not the exception. we’re still $50 a square foot too high. interest rates and seasonality aren’t helping get prices where they need to be. wait til October or December, we’ll be there.

With some of the very high HOA as in the NKT and WM, it’s almost like renting from the HOA. The HOA is almost like a landlord. Some of the HOA are so restrictive and in approvig the exterior painting, landscaping, remodeling, it’s rent city except you need to arrange and pay for the repairs. The down side risk of buying in Irvine is still too high, but cash on the side line has down side risk too.

limited approved paint colors doesn’t necessarily bother me, it arguably helps property values and continuity, which keeps people living in these neighborhoods longer and therefore a sense of community.

but paying anywhere near $285 a month for landscaping and a community pool hurts. and I bet this one has Mello Roos tax too (didn’t find it in the listing but that’s what I usually find on the newer Irvine developments).

The annual tax on this one is;$8,551 based upon the current tax assessment of $534,000 so the mello roos is circa $3200/year. The newer construction ie. 2003 or newer rarely make sense in Irvine because mello roos started to get out of control.

I doubt the young will benefit much from a continually deteriorating American economy.

Cheap houses aren’t really very cheap when you can’t afford your student loan payments or to move out of your parents’ basement.

Of course an eventual recovery would be good for those who buy low and can then sell high, but what if that never happens?