Some loan owners delayed their mortgage default on the false hope that the robo-signing scandal might net them a free house.

Irvine Home Address … 92 AGOSTINO Irvine, CA 92614

Resale Home Price …… $449,900

.png)

I make a rich woman beg, I'll make a good woman steal

I'll make an old woman blush, and make a young girl squeal

I wanna be yours pretty baby, yours and yours alone

I'm here to tell ya honey, that I'm bad to the bone

B-B-B-B-Bad

B-B-B-B-Bad

B-B-B-B-Bad

Bad to the bone

George Thorogood — Bad To The Bone

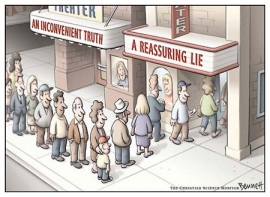

Denial and the desire to be rescued runs deep in our culture. From our religious traditions to popular television, everyone has a sob story and some reason why they need to be relieved of the responsibility for their actions. Back in March of 2008, I wrote about Bailouts and False Hopes:

One of the more interesting phenomenon observed during the bubble was the perpetuation of denial with rumors of homeowner bailouts. Many homeowners held out hope that if they could just keep current on their mortgage long enough, the government would come to their rescue in the form of a mandated bailout program. Part of this fantasy was not just that people could keep their homes, but that they could keep living their lifestyle as they did during the bubble. What few seemed to realize was any government bailout program would be designed to benefit the lenders by keeping borrowers in a perpetual state of indentured servitude. With all their money going toward debt service payments, little was going to be left over to live a life.

All of these plans had benefits and drawbacks. One of the first problems was to clearly define who should be “bailed out.” The thought of bailing out speculators was not palatable to anyone except perhaps the speculators themselves, but with regular families behaving like speculators, separating the wheat from the chaff was not an easy task. If a family exaggerated their income to obtain more house than they could afford in hopes of capturing appreciation, did they deserve a bailout? The credit crisis that popped the Great Housing Bubble was one of solvency, and there was no way to effectively restructure payments when a borrower could not afford to pay the interest on the debt, and this was a very common circumstance. None of the bailout programs did much for those with stated-income (liar) loans, negative amortization loans, and others who are unable to make the payments, and since this was a significant portion of the housing inventory, none of these plans had any real hope of stopping the fall of prices in the housing market.

It has been nearly three years since I wrote that, and every few months, there is another loan modification program, proposed bailout, or some other news issue that gives debtors false hope. The latest has been the robo-signer controversy.

So far, politicians on the Left have used this issue to try to pander for votes with populist appeals of innocent homeowner versus the evil banking machine. The banks were happy to go along if it made a few loan owners make a few more payments in the false hope that may may get their debts forgiven. And as we will see today, attorneys have already found a way to exploit the issue to make a few dollars on the false hope of the masses.

Fannie and Freddie give green light to resume sales of foreclosures

by CHRISTINE RICCIARDI — Monday, November 29th, 2010, 1:35 pm

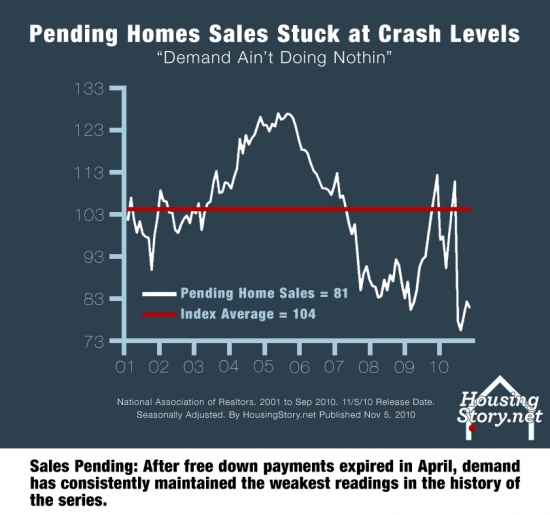

Fannie Mae and Freddie Mac gave real estate agents the green light to resume selling foreclosed homes, after suspending the process as the robo-signing debacle unfolded the past two months.

Freddie told agents in a memo last week to "resume all normal sales activity," as the government-sponsored enterprise will "resume marketing, sales and disposing of assets previously placed 'on hold.'"

Fannie Mae told its real estate agents "to proceed with scheduling and holding the closings" of sales of homes with mortgages owned or backed by the GSE.

The green light is unambiguous. No special conditions or circumstances allowing delay. Foreclose as quickly as possible.

The mortgage-finance giants initially enacted a moratorium on sales of foreclosed properties because servicers were allegedly signing affidavits either without prior knowledge of the case or without a notary present — a phenomenon that became known as robo-signing.

Many other lenders, including Ally Financial, JPMorgan Chase and Bank of America, issued foreclosure moratoriums that have since been lifted.

Bank of America started refiling new affidavits Oct. 25. A spokesperson for JPMorgan Chase said they have not started refiling and will do so state-by-state. The process should take three to four months.

Ally Financial said it will move forward with a foreclosure in the 23 judicial states when it has reviewed and remediated the affidavit. Cook County, Ill., restarted foreclosure evictions two weeks ago.

Both Fannie Mae and Freddie Mac recently pulled their existing foreclosures cases from one Florida-based firm at the center of the robo-signing scandal, The Law Offices of David J. Stern.

David Stern already made a fortune, and the pullout by the GSEs is more for press relations than anything else. As scandalous details emerge, this issue will re-appear now and again over the next few months, but with exception of the articles promising more false hope, this issue is behind us.

Robo-signing scandal overrated?

By: Liz Farmer 12/09/10 12:05 PM

A foreclosures expert says that the national investigation into the robo-signing scandal, in which lenders blazed through thousands of foreclosure filings without reading them, is so far not yielding any results that would give people their homes back.

The definition of false hope: people are not getting their houses back, nor are they getting any principal reductions.

Rick Sharga, CEO of RealtyTrac, a foreclosure tracking firm, said the investigation by state attorneys general will likely result in fines against mortgage servicers and even some criminal prosecution. But the bottom line for homeowners who have lost their homes is the same.

"We've seen very little fallout in the way of forseclosures … being overturned," Sharga said. "There's not a single case where a home that has already sold has been overturned."

The 50 states and the District are participating in the investigation into illegally filed foreclosures.

Reporters have been scouring the nation looking for the victims of robo-signer, and so far, nothing. Sometimes people forget that the reason robo-signer is after these debtors is because the debtors are not making payments on the loan for the money they used to buy the house they are squatting in. Borrowers used the bank's money, and now that they can't pay the bank back, the bank wants to take the house purchased with the bank's money. That's how the system works.

Money Talks: Foreclosure Rip-Off

by Stacy Johnson — Posted: 12.10.2010 at 7:35 AM

Some look at a foreclosure and all they see is someone who borrowed money they didn't repay.

The homeowner is the bad guy, the bank is the victim.

It's more nuanced than that black-and-white view. Clearly, a foreclosure is a process against a borrower who did not repay the money they borrowed. If lenders didn't have ability to get their money back, there would be no lending. Whether these people are good or bad is beside the point. The borrower needs to either repay the money or give up the house pledged as security to the loan.

A foreclosure defense lawyer, however, sees it differently.

It isn't the way most people think it is in terms of "Oh, these people haven't paid their mortgage."

These people were sucked into a horrible deals buying ARMs that they never should have been able to put into.

I grow tired of this nonsense. Lenders Are More Culpable than Borrowers because lenders should only extend loans to those capable of repayment. The greater responsibility of lenders in this mess does not relieve borrowers of their responsibilities, nor does it entitle them to special rights not extended to them by law or by contract.

Why is it when someone wants to screw the banks, they justify it by making borrowers blameless and the lenders the epitome of evil?

Why?

Because the conscience was out of the deal.

Peter Tickten's firm is defending more than 3,000 foreclosures.

His goal?

Using things like lost paperwork and robo-signing to get a a mortgage wiped out so the homeowner never has to pay it back.

It doesn't happen often, but it does happen.

No, it doesn't happen ever.

As it turns out, however, the fees some of these lawyers are charging may send some homeowners seeking a defense from their defense lawyers.

Can you think of a worse example of preying on someone's false hope?

Because this lawyer has pioneered a new fee structure: 40% of any mortgage reduction he achieves.

Say you've got a 200,000 mortgage and it gets dismissed: you never have to pay it back.

The fee will be 40% of $200,000: $80,000.

Where does a consumer in foreclosure come up with $80,000?

Why, with a mortgage, of course.

OMG! Who is going to give the borrower this mortgage? Will the attorney lien the property and put the loan owner on a new payment plan? This attorney is trying to crowd out the lender and become the recipient of the borrowers home payment income stream.

And that leaves only one question.

How can a lawyer possibly justify a fee like this?

"If I do that in a case where you lose your leg and I get a million dollars for you, I get 40% of that.

So if I do the same thing in a case where I save you a million dollars on the mortgage on your home, I should be able to get the same amount."

Mr. Tickten said his fee is negotiable and he'd never foreclose on a homeowner to collect it.

But still it seems like when it comes to foreclosures, even when you win you lose.

He would never foreclose on a homeowner to collect? How nice of him. No, if you fail to pay him, he will put a judgement lien on the property — a lien that will be in first position after the mortgage is wiped out — and he can wait until the property sells. Most likely he won't need to wait that long because eventually the former loan owner will want to get access to their newfound equity, and in order to get a new loan, the judgment will need to be paid off first.

Should this owner be given his home?

The owner of today's featured property is a HELOC abuser. He could probably make the argument that he was "sucked in" by unscrupulous mortgage brokers to take out a loan he never should have been given.

Does that mean we should forgive his debt?

Should this house remain in the hands of someone who made a stupid financial mistake at the expense of a new owner buying under today's stricter terms?

Existing loan owners — particularly the stupid ones who over borrowed — are crowding out new buyers. Any of you looking to buy today have to pay higher prices than you should because banks are keeping loan owners and squatters in houses they can't afford. This inventory is being held off the market to screw you, and the higher price you will pay is going to pay the debts of someone who over-borrowed and couldn't afford their house.

- This property was purchased on 5/13/1994 for $225,000. The owner used a $213,700 first mortgage and a $11,300 down payment.

- On 12/20/1999 he refinanced with a $215,200 first mortgage.

- On 2/13/2003 he refinanced with a $280,000 first mortgage.

-

On 10/1/2003 he refinanced with a $310,000 first mortgage.

- On 1/18/2005 he obtained a $150,000 HELOC.

- On 7/31/2006 he refinanced with a $417,000 first mortgage, and he got a $150,000 HELOC.

- Total property debt is $567,000. He more than doubled his mortgage during the time he owned the property.

- Total mortgage equity withdrawal is $353,300.

- He recently received his NOD.

Foreclosure Record

Recording Date: 09/13/2010

Document Type: Notice of Default

Let's say this guy gets his loan balance forgiven due to the robo-signer problem. Would that be a good thing? Should borrowers like this be given a pass?

If they are giving away houses, I'll take two.

Irvine Home Address … 92 AGOSTINO Irvine, CA 92614 ![]()

Resale Home Price … $449,900

Home Purchase Price … $225,000

Home Purchase Date …. 5/13/1994

Net Gain (Loss) ………. $197,906

Percent Change ………. 88.0%

Annual Appreciation … 4.2%

Cost of Ownership

————————————————-

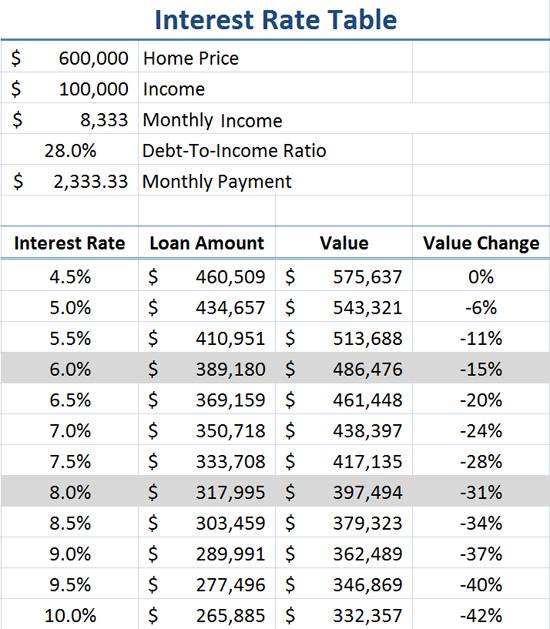

$449,900 ………. Asking Price

$15,747 ………. 3.5% Down FHA Financing

4.87% …………… Mortgage Interest Rate

$434,154 ………. 30-Year Mortgage

$91,782 ………. Income Requirement

$2,296 ………. Monthly Mortgage Payment

$390 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$75 ………. Homeowners Insurance

$308 ………. Homeowners Association Fees

============================================

$3,069 ………. Monthly Cash Outlays

-$377 ………. Tax Savings (% of Interest and Property Tax)

-$534 ………. Equity Hidden in Payment

$29 ………. Lost Income to Down Payment (net of taxes)

$56 ………. Maintenance and Replacement Reserves

============================================

$2,244 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,499 ………. Furnishing and Move In @1%

$4,499 ………. Closing Costs @1%

$4,342 ………… Interest Points @1% of Loan

$15,747 ………. Down Payment

============================================

$29,086 ………. Total Cash Costs

$34,300 ………… Emergency Cash Reserves

============================================

$63,386 ………. Total Savings Needed

Property Details for 92 AGOSTINO Irvine, CA 92614

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 1,597 sq ft

($282 / sq ft)

Lot Size: n/a

Year Built: 1989

Days on Market: 6

Listing Updated: 40521

MLS Number: S641019

Property Type: Condominium, Residential

Community: Westpark

Tract: Lp

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Feels like a single family home!! — Largest floorplan in Las Palmas Community with private enclosed entry, 2 car-attached garage with storage, inside laundry and easy access to community parks, pools, tennis courts, and bike paths. This open floorplan has cathedral ceilings, spacious kitchen with plenty of counter space and serving bar into dining room, mirrored wall and fireplace in living room, dining room access to large patio with spanish pavers and built in bbq. Conveniently located near UC Irvine, Irvine business district, 405 fwy and John Wayne Airport. Enjoy the convenience of Irvine, award winning schools, and a 5 star lifestyle in Westpark!

.jpg)