In a victory for law enforcement, a borrower who used a liar loan is going to prison. The bankers who offered this toxic product get bonuses.

Irvine Home Address … 31 RESERVE Irvine, CA 92603

Resale Home Price …… $3,499,999

I'm on a highway to hell

On the highway to hell

Highway to hell

I'm on the highway to hell

Highway to Hell — AC/DC

During the Great Housing Bubble, people knowingly lied about their income in order to buy homes. The practice was so common, the loan programs became known as liar loans. I described liar loans back in 2008:

“The Road to Hell is Paved with Good Intentions.” — Samuel Johnson. Most people who took out a “liar loan” did so to provide shelter for their families and hopefully make a few dollars speculating in real estate. Most people did not intend to defraud anyone when they took out the loan, but they ended up doing so by walking away from their payment obligations. This Highway to Hell is paved with good intentions, and it is very well traveled.

State Income Loans

One unique phenomenon of The Great Housing Bubble was the utilization of state-income loans, also known as “liar loans” because most people were not truthful when stating their income. Loan documentation is usually a routine part of obtaining financing. Lenders ordinarily require a borrower to provide documentation proving income, assets and debt. However, during the final stages of the Great Housing Bubble, loan documentation was seen as an unnecessary barrier to completing more transactions, and loan programs which circumvented normal documentation procedures flourished. The fact that these programs existed at all is a remarkable proof of the risk lenders were taking through the relaxing or outright elimination of lending standards. According to a study by Credit Suisse, 81% of Alt-A purchase originations in 2006 were stated income, and 50% of subprime originations in 2005 and 2006 were stated income. Stated income loans increased from 18% of originations in 2001 to 49% in 2006 according to Loan Performance. In a related study by the Mortgage Asset Research Institute, 60% of stated-income borrowers had exaggerated their incomes by more than 50%. …

The stated-income loan, also known as liar loan due to the built-in incentive to exaggerate one’s income, was originally provided to borrowers such as the self-employed who most often do not have W-2s to verify income. When these loan programs were first started, they were not made available to borrowers with W-2s as the transparency of the lie would have been obvious to all parties. During the bubble rally, these loans were made available to anyone, and not just were the borrowers encouraged to lie, they were often assisted in fabricating paperwork by aggressive loan officers and mortgage brokers. Since the loan could be packaged and sold to investors who had no idea what they were buying, there was a complete lack of concern for whether or not the borrower actually made the money stated in the loan application and thereby could actually make the payments on the loan. Everyone involved was making large fees, the borrower was obtaining the real estate they desired, and for a time, the investor was receiving payments from the borrower. As long as prices were rising, everyone benefited from the arrangement. Of course, once prices started to fall, borrowers did not want to continue making payments they could not afford, and the whole system collapsed in a massive credit crunch.

Liar loans went away, but as fate would have it, the reverse liar loan appeared shortly thereafter.

Everyone is doing loan modifications now: Citibank, the GSEs, everyone. They must. … Part of the loan workout requires the borrower to demonstrate they are unable to make payments, and their income is going to be used to figure out how much principal reduction and other loan terms the bank will adjust to accommodate them. I think you can see where this is going… All the people who exaggerated their incomes to obtain more house than they can afford, are now trying to look as poor as Church mice to get the biggest mortgage principal reduction they can: the reverse liar loan. They lied to get in, now they get to lie in order to keep it. We have a great system in place, don't you think?

For every irresponsible borrower, there was a foolish lender who enabled them. Imagine this, you stand on a street corner and had out $20 bills to anyone who promises to pay you back. When most of the people spend the money and don't pay you back, were they immoral for lying to you, or were you stupid for giving them your money?

Lenders are more culpable than borrowers. The power imbalance in the lender-borrower relationship puts greater responsibility on the lender. It stands on principles of fairness that lenders should bear the brunt of the losses, the tarnished image, and other collateral damage associated with such a colossal group failure. The reality is that lenders are getting big bonuses, they aren't foreclosing on each other's houses, they are getting tax bailout money, and they are just as rich and powerful as they were before the disaster of their making. It isn't working out so well for the little guy.

In Prison for Taking a Liar Loan

By JOE NOCERA

Published: March 25, 2011

A few weeks ago, when the Justice Department decided not to prosecute Angelo Mozilo, the former chief executive of Countrywide, I wrote a column lamenting the fact that none of the big fish were likely to go to prison for their roles in the financial crisis.

Soon after that column ran, I received an e-mail from a man named Richard Engle, who informed me that I was wrong. There was, in fact, someone behind bars for what he’d supposedly done during the subprime bubble. It was his 48-year-old son, Charlie.

On Valentine’s Day, the elder Mr. Engle said, his son had entered a minimum-security prison in Beaver, W.Va., to begin serving a 21-month sentence for mortgage fraud. He then proceeded to tell me the tale of how federal agents nabbed his son — a tale he backed up with reams of documents and records that suggest, if nothing else, that when the federal government is truly motivated, there is no mountain it won’t move to prosecute someone it wants to nail. And it was definitely motivated to nail Charlie Engle.

There is no way to know what prosecutors real motivations were for bringing a case. From their point of view, with the information they had, this case looks quite different. It's always a good idea to preface these stories with a reality check because a good writer will lead you down the path before you know it.

Mr. Engle’s is a tale worth telling for a number of reasons, not the least of which is its punch line. Was Mr. Engle convicted of running a crooked subprime company? Was he a mortgage broker who trafficked in predatory loans? A Wall Street huckster who sold toxic assets?

No. Charlie Engle wasn’t a seller of bad mortgages. He was a borrower. And the “mortgage fraud” for which he was prosecuted was something that literally millions of Americans did during the subprime bubble. Supposedly, he lied on two liar loans.

Prosecutors like to get a few high-profile scalps as a deterrent to others considering similar crimes. The utility of a few important prosecutions can go far beyond the resources devoted. Apparently, someone singled out this guy to be the poster child for liar loans. I think Casey Serin would have been a better target.

“The Department of Justice has made prosecuting financial crimes, including mortgage fraud, a high priority,” said Neil H. MacBride, the United States attorney for the Eastern District of Virginia, in a statement. (Mr. MacBride, whose office prosecuted Mr. Engle, declined to be interviewed.)

Apparently, though, it’s only a high priority if the target is a borrower. Mr. Mozilo’s company made billions in profit, some of it on liar loans that he acknowledged at the time were likely to be fraudulent and which did untold damage to the economy. And he personally was paid hundreds of millions of dollars. Though he agreed last year to a $67.5 million fine to settle fraud charges brought by the Securities and Exchange Commission, it was a small fraction of what he earned. Otherwise, he walked. Thus does the Justice Department display its priorities in the aftermath of the crisis.

I wrote last year that Countrywide's Mozilo should go to jail. The facts are as presented above. Mozilo is a crook who gamed the system, took his slap on the wrist, and kept his ill-gotten booty. The penalties being doled out to the parties are grossly unfair.

It’s not just that Mr. Engle is the smallest of small fry that is bothersome about his prosecution. It is also the way the government went about building its case. Although Mr. Engle took out the two stated-income loans, as liar loans are more formally called, in late 2005 and early 2006, it wasn’t until three years later that his troubles began.

As a young man, Mr. Engle had been a serious drug addict, but after he got clean, he became an ultra-marathoner, one of the best in the world. In the fall of 2006, he and two other ultra-marathoners took on an almost unimaginable challenge: they ran across the Sahara Desert, something that had never been done before. The run took 111 days, and was documented in a film financed by Matt Damon, who served as executive producer and narrator. Mr. Engle received $30,000 for his participation.

The film, “Running the Sahara,” was released in the fall of 2008. Eventually, it caught the attention of Robert W. Nordlander, a special agent for the Internal Revenue Service. As Mr. Nordlander later told the grand jury, “Being the special agent that I am, I was wondering, how does a guy train for this because most people have to work from nine to five and it’s very difficult to train for this part-time.” (He also told the grand jurors that sometimes, when he sees somebody driving a Ferrari, he’ll check to see if they make enough money to afford it. When I called Mr. Nordlander and others at the I.R.S. to ask whether this was an appropriate way to choose subjects for criminal tax investigations, my questions were met with a stone wall of silence.)

Mr. Engle’s tax records showed that while his actual income was substantial, his taxable income was quite small, in part because he had a large tax-loss carry forward, due to a business deal he’d been involved in several years earlier. (Mr. Nordlander would later inform the grand jury only of his much lower taxable income, which made it seem more suspicious.) Still convinced that Mr. Engle must be hiding income, Mr. Nordlander did undercover surveillance and took “Dumpster dives” into Mr. Engle’s garbage. He mainly discovered that Mr. Engle lived modestly.

In March 2009, still unsatisfied, Mr. Nordlander persuaded his superiors to send an attractive female undercover agent, Ellen Burrows, to meet Mr. Engle and see if she could get him to say something incriminating. In the course of several flirtatious encounters, she asked him about his investments.

After acknowledging that he had been speculating in real estate during the bubble to help support his running, he said, according to Mr. Nordlander’s grand jury testimony, “I had a couple of good liar loans out there, you know, which my mortgage broker didn’t mind writing down, you know, that I was making four hundred thousand grand a year when he knew I wasn’t.”

Mr. Engle added, “Everybody was doing it because it was simply the way it was done. That doesn’t make me proud of the fact that I am at least a small part of the problem.”

A basically honest man who confesses to a seductress, a confession for a crime hundreds of thousands of borrowers were guilty of — and encouraged to commit by lenders — and this is who the government wants to go after? I truly hope the prosecutors had other motives. Calculated Risk also wonders why the prosecutors chose this case.

Unbeknownst to Mr. Engle, Ms. Burrows was wearing a wire.

Lying on a stated-income loan is, without question, a crime, and one ought not to excuse it even though, as Mr. Engle says, “everybody was doing it” — usually with the eager encouragement of their brokers. But the Engle case raises questions not just about the government’s priorities, but about something even more basic: did he even commit the crimes he is accused of?

Partly, I concede, Mr. Engle is easy to root for. He is a personable, upbeat man who has conquered some serious demons. Part of his Sahara expedition was aimed at raising money for a charity to help bring clean water to Africa. “Every experience in life has the ability to teach lessons if I am open to them,” he wrote on a blog as he prepared to enter prison. How can you not like someone like that?

But the more I looked into it, the more I came to believe that the case against him was seriously weak. No tax charges were ever brought, even though that was Mr. Nordlander’s original rationale. Money laundering, the suspicion of which was needed to justify the undercover sting, was a nonissue as well. As for that “confession” to Ms. Burrows, take a closer look. It really isn’t a confession at all. Mr. Engle is confessing to his mortgage broker’s sins, not his own.

Whose crime is this? Isn't the real problem with this whole prosecution that the guilty parties are not being charged? Mr. Engle committed a crime, but the lender who put him up to it is even more responsible.

Perhaps anticipating that problem, when Mr. Nordlander finally arrested Mr. Engle in May 2010, he claims to have elicited a stronger, better confession while Mr. Engle was handcuffed in the back seat of his car. Mr. Engle fervently denies this. This second supposed confession, however, was never captured on tape.

As for the loans themselves, on one of them Mr. Engle claimed an income of $15,000 a month. As it turns out, his total income in 2005, according to his accountant, was $180,000, which amounts to … hmmm …$15,000 a month, though of course Mr. Engle didn’t have the kind of job that generated monthly income. (In addition to real estate speculation, Mr. Engle gave motivational speeches and earned around $50,000 a year as a producer on the hit show “Extreme Makeover: Home Edition.”)

The monthly income listed on the second loan was $32,500, an obviously absurd amount, especially since the loan itself was for only $300,000. It was a refinance of a property Mr. Engle already owned, allowing him to pull out $80,000 of the $215,000 in equity he had in the property.

Mr. Engle claims that he never saw that $32,500 claim and never signed the papers. Indeed, a handwriting analysis conducted by the government raised the distinct possibility that Mr. Engle’s signature and his initials in several places in the mortgage documents had been forged. As it happens, Mr. Engle’s broker for that loan, John J. Hellman, recently pleaded guilty to mortgage fraud for playing fast and loose with a number of mortgage applications. Mr. Hellman testified in court that Mr. Engle had signed the mortgage application. Early this week, Mr. Hellman received a reduced sentence of 10 months, less than half of Mr. Engle’s sentence, in no small part because of his willingness to testify against Mr. Engle.

Even the jurors seemed confused about how to think about Mr. Engle’s supposed crime. When it came time to pronounce a verdict, the jury found him not guilty of providing false information to the bank, which would seem to be the only fraud he could possibly have committed. Yet it still found him guilty of mortgage fraud. “I think the prosecution convinced the jury that I was guilty of something but they weren’t sure what,” Mr. Engle wrote in an e-mail.

Like many people, Mr. Engle’s biggest mistake was believing that housing prices could only go up. When the market collapsed, Mr. Engle defaulted on the two properties, which of course is not a crime. Although his accountant tried to persuade the banks to do a complicated refinancing, they refused and foreclosed on the properties. Like many Americans, Mr. Engle wound up being punished by the market for his mistake, losing all his remaining equity along with the properties themselves. Thanks to the government, though, his punishment was far more severe than most.

So this guy lost everything, and he is being sent to prison. Amazing.

At his sentencing, Mr. Engle told the judge: “I can say with confidence that I can turn negatives into positives. I have no doubt I will make the best of it.” With his inspiring prison blog, Running in Place: A Blog About Surviving Adversity, he has already begun to do that.

Even when he emerges from prison, though, his ordeal will not be over. As part of his sentence, Mr. Engle was ordered to pay $262,500 in restitution to the owner of his mortgages. And what institution might that be? You guessed it: Countrywide, now owned by Bank of America.

Angelo Mozilo ought to get a good chuckle out of that one.

It wouldn't be quite so outrageous for this guy to be forced to pay restitution if the others who did the same thing were similarly compelled. For this one guy to get singled out for such a severe punishment when many others walk away scot-free doesn't serve justice.

That's a big mortgage

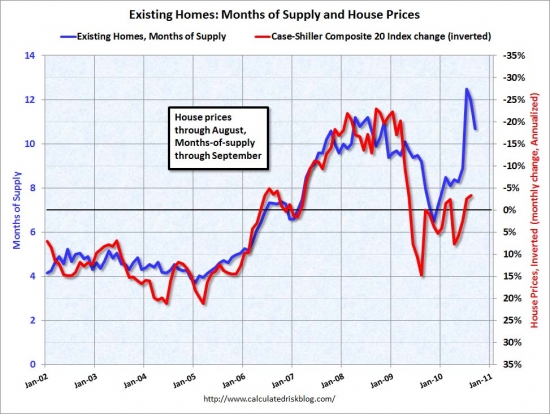

High wage earners, like the dentist who owns today's featured property, were given access to copious amounts of credit during the housing bubble. As I have stated on many occasions, high-end pricing did not get where it is by people making large down payments. Prices got so high because lenders were willing to underwrite $3,000,000 loans.

Prior to the housing bubble, loans over $1,000,000 were very rare. Since any amounts over $1,000,000 can't be deducted (assuming the AMT allowed it anyway), very few borrowers took out such large loans.

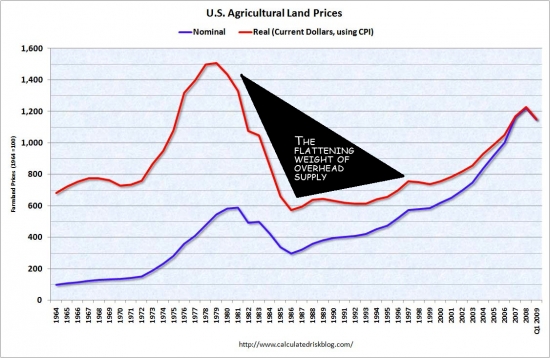

Prices in the over $1,000,000 range tended to have equity for amounts over $1,000,000. Since equity was necessary to inflate prices, high-end homes tended to be less volatile. However, once lenders started underwriting loans over $1,000,000 prices went up with the lender air, and now with the jumbo market in tatters, lenders are requiring borrowers to document their income which is reducing the borrower pool significantly.

In the story above, the borrower who lied on his income stood out as unusual. Here, the posers blend in with the achievers.

Today's featured property was purchased on 5/9/2006 for $4,288,500. The owner used a $3,000,000 first mortgage, a $200,000 second mortgage, and a $1,088,500 down payment. It is listed as a short sale for $3,500,000.

Ponder that for a moment. There is no NOD filed on this property, yet the owner cannot pay off the two mortgages at a $3,499,999 selling price? The only way the mortgage balance could be that large is if this borrower hasn't made any payments in quite a while. That makes this true shadow inventory. It doesn't appear on any reports, but it's clearly a distressed property working to push prices lower.

Irvine House Address … 31 RESERVE Irvine, CA 92603 ![]()

Resale House Price …… $3,499,999

House Purchase Price … $4,288,500

House Purchase Date …. 5/9/2007

Net Gain (Loss) ………. ($998,501)

Percent Change ………. -23.3%

Annual Appreciation … -5.2%

Cost of House Ownership

————————————————-

$3,499,999 ………. Asking Price

$700,000 ………. 20% Down Conventional

4.79% …………… Mortgage Interest Rate

$2,799,999 ………. 30-Year Mortgage

$707,482 ………. Income Requirement

$14,674 ………. Monthly Mortgage Payment

$3033 ………. Property Tax (@1.04%)

$600 ………. Special Taxes and Levies (Mello Roos)

$729 ………. Homeowners Insurance (@ 0.25%)

$430 ………. Homeowners Association Fees

============================================.png)

$19,466 ………. Monthly Cash Outlays

-$1967 ………. Tax Savings (% of Interest and Property Tax)

-$3497 ………. Equity Hidden in Payment (Amortization)

$1279 ………. Lost Income to Down Payment (net of taxes)

$437 ………. Maintenance and Replacement Reserves

============================================

$15,719 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$35,000 ………. Furnishing and Move In @1%

$35,000 ………. Closing Costs @1%

$28,000 ………… Interest Points @1% of Loan

$700,000 ………. Down Payment

============================================

$798,000 ………. Total Cash Costs

$240,900 ………… Emergency Cash Reserves

============================================

$1,038,900 ………. Total Savings Needed

Property Details for 31 RESERVE Irvine, CA 92603

——————————————————————————

Beds: 5

Baths: 6

Sq. Ft.: 6000

$583/SF

Property Type: Residential, Single Family

Style: Two Level, Mediterranean

View: Canyon, Catalina, Coastline, Ocean, Panoramic, Trees/Woods

Year Built: 2006

Community: Turtle Ridge

County: Orange

MLS#: S632477

Source: SoCalMLS

Status: Active

——————————————————————————

SHORT SALE AT END OF CUL-DE-SAC WITH PANORAMIC OCEAN AND CITY LIGHTS VIEW ON ONE LARGEST LOTS IN TURTLE RIDGE WITH ALMOST 20,000 SQUARE FEET * * * LAST TWO SALES WERE $4.05M AND $3.6M FOR LESSER VIEWS AND SMALLER LOTS. HOME FEATURES TWO KITCHENS WITH EXQUISITE FULL BUTLERS PANTRY AND KITCHEN. UPGARDES ARE TOO NUMEROUS TO MENTION BUT INCLUDE HARDWOOD FLOORS, IMPORTED ITALIAN GRANITE, STANLESS STEEL APPLIANCES, INCERDIBLE BBQ PAVILION. GUARD GATED WITH AMAZING AMENITIES THAT INCLUDE FAMILY AND ADULT SWIMMING FACILITIES, GYMNASIUM, HOA BUSINESS CENTER, ENTERTAINMENT THEATRE, HIKING TRAILS AND ACCESS TO AWARD WINNING YEAR AROUND VISTA VERDE SCHOOL AND UNIVERSITY HIGH SCHOOL.

STANLESS? INCERDIBLE?

.jpg)