Fannie Mae announces a policy to withhold loans from strategic defaulters for seven years and pursue deficiency judgements. Do you think they will really do it?

Irvine Home Address … 28 BELMONTE Irvine, CA 92620

Resale Home Price …… $650,000

I'm the one to taste your death

Basking in your dying breath

Messenger of all demise

Point is where all die

Piercing, impaling no judgement, just punishment

Desecrate, annihilate assault with no regret

Born to kill sweep and clear

Staring down the face of fear

Slayer — Point

A few months ago, I chastised Fannie Mae for their stupid policy of reducing the punishment time for getting a new loan from 5 years to 2 years after a default. Perhaps someone there read the post Fannie Mae Encourages Strategic Default by Reducing Punishment Time for New Loan where I pointed out their new policy would encourage strategic default because now they are modifying their own policy to target those who walk away.

Fannie Mae Increases Penalties for Borrowers Who Walk Away

Seven-Year Lockout Policy for Strategic Defaulters

WASHINGTON, DC — Fannie Mae (FNM/NYSE) announced today policy changes designed to encourage borrowers to work with their servicers and pursue alternatives to foreclosure. Defaulting borrowers who walk-away and had the capacity to pay or did not complete a workout alternative in good faith will be ineligible for a new Fannie Mae-backed mortgage loan for a period of seven years from the date of foreclosure. Borrowers who have extenuating circumstances may be eligible for new loan in a shorter timeframe.

So they have added two conditions: (1) must not have capacity to pay, or (2) must complete a loan modification in good faith.

How is that supposed to work?

First, who determines whether or not the borrower had capacity to pay? Let's say a borrower defaults, and three years from now, they want a new Fannie Mae loan. Is the burden of proof now on the borrower to document that they couldn't afford the payments years earlier when they defaulted? What is the criteria for establishing capacity? Who sets these criteria? Who keeps track of the documentation? Do you really think if the government — who still runs Fannie Mae — will turn away potential buyers in the future when they will be desperately needed?

Second, it is obvious that anyone planning to strategically default will simply get a loan modification and then stop paying. This must be obvious even to Fannie Mae who slipped in a "good faith" clause. Who will determine if the borrower made a good faith effort? And like the previous issue, if there is a need for borrowers to fill foreclosed homes, do you think the government will turn people away? I don't.

I commend Fannie Mae for trying to prevent strategic default, but all they are doing is bluffing existing borrowers with a threat they will never follow through on.

"We're taking these steps to highlight the importance of working with your servicer," said Terence Edwards, executive vice president for credit portfolio management. "Walking away from a mortgage is bad for borrowers and bad for communities and our approach is meant to deter the disturbing trend toward strategic defaulting. On the flip side, borrowers facing hardship who make a good faith effort to resolve their situation with their servicer will preserve the option to be considered for a future Fannie Mae loan in a shorter period of time."

Fannie Mae will also take legal action to recoup the outstanding mortgage debt from borrowers who strategically default on their loans in jurisdictions that allow for deficiency judgments. In an announcement next month, the company will be instructing its servicers to monitor delinquent loans facing foreclosure and put forth recommendations for cases that warrant the pursuit of deficiency judgments.

This is another empty threat. Fannie Mae like any servicer already has criteria for going after defaulting owners who have assets. Nothing has changed. Including this in the press release is an obvious bluff intended only to scare potential borrowers. Most people who strategically default — actually accelerated default — don't have any assets for Fannie Mae to recover.

Troubled borrowers who work with their servicers, and provide information to help the servicer assess their situation, can be considered for foreclosure alternatives, such as a loan modification, a short sale, or a deed-in-lieu of foreclosure. A borrower with extenuating circumstances who works out one of these options with their servicer could be eligible for a new mortgage loan in three years and in as little as two years depending on the circumstances. These policy changes were announced in April, in Fannie Mae's Selling Guide Announcement SEL-2010-05.

Fannie Mae recognizes that strategic default is going to become a bigger problem as people realize that prices are not coming back and that they are merely renting their houses from Fannie Mae at an inflated rental rate. Previous policies of the GSEs have encouraged strategic default, and now that people are doing so in large numbers, they are resorting to empty threats to keep borrowers from walking away. Good idea, but it is too little too late.

Another Ponzi implosion

The owners of today's featured property didn't put much into it, but they certainly pulled a great deal out of it. They are typical of the detritus washing through the Irvine market.

- The property was purchased on 12/8/2003 for $600,000. The owners used a $400,000 first mortgage, a $170,000 second mortgage, and a $30,000 down payment.

- On 7/26/2004 they obtained a $196,000 HELOC.

- On 1/26/2005 they refinanced with a $585,000 first mortgage and a $99,900 stand-alone second.

- On 3/31/2005 they refinanced again with a $585,000 Option ARM with a 1% teaser rate.

- On 12/14/2006 they refinanced with a $710,000 first mortgage.

- On 5/7/2007 they obtained a $131,000 HELOC.

- Total property debt is $841,000.

- Total mortgage equity withdrawal is $271,000.

- Total squatting time is at least 7 months.

Foreclosure Record

Recording Date: 04/28/2010

Document Type: Notice of Default

Irvine Home Address … 28 BELMONTE Irvine, CA 92620 ![]()

Resale Home Price … $650,000

Home Purchase Price … $600,000

Home Purchase Date …. 12/8/2003

Net Gain (Loss) ………. $11,000

Percent Change ………. 1.8%

Annual Appreciation … 1.2%

Cost of Ownership

————————————————-

$650,000 ………. Asking Price

$130,000 ………. 20% Down Conventional

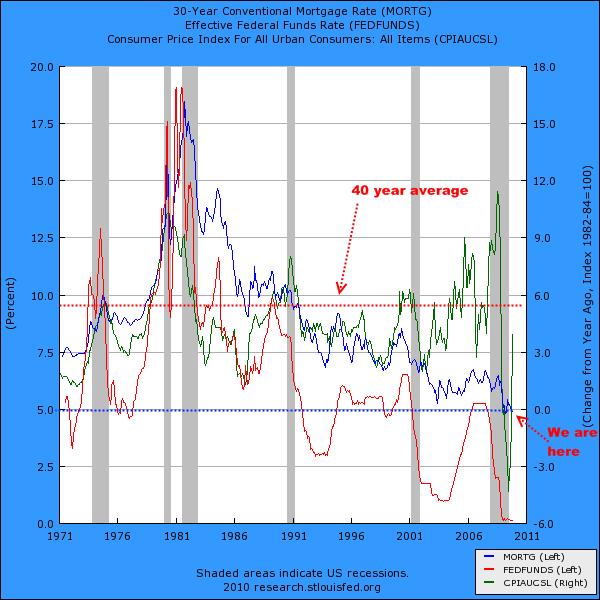

4.80% …………… Mortgage Interest Rate

$520,000 ………. 30-Year Mortgage

$131,541 ………. Income Requirement

$2,728 ………. Monthly Mortgage Payment

$563 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$54 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$3,346 ………. Monthly Cash Outlays

-$463 ………. Tax Savings (% of Interest and Property Tax)

-$648 ………. Equity Hidden in Payment

$238 ………. Lost Income to Down Payment (net of taxes)

$81 ………. Maintenance and Replacement Reserves

============================================

$2,555 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,500 ………. Furnishing and Move In @1%

$6,500 ………. Closing Costs @1%

$5,200 ………… Interest Points @1% of Loan

$130,000 ………. Down Payment

============================================

$148,200 ………. Total Cash Costs

$39,100 ………… Emergency Cash Reserves

============================================

$187,300 ………. Total Savings Needed

Property Details for 28 BELMONTE Irvine, CA 92620

——————————————————————————

Beds: 4

Baths: 2 full 1 part baths

Home size: 2,144 sq ft

($303 / sq ft)

Lot Size: 5,000 sq ft

Year Built: 1979

Days on Market: 43

Listing Updated: 40348

MLS Number: S616799

Property Type: Single Family, Residential

Community: Northwood

Tract: Ol

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

Spacious home on a quiet cul-de-sac location. Living room with fireplace. Dining room with wet bar. Kitchen overlooks family room. Oversized master bedroom. Large private backyard. Three car attached garage.

I'm Back

I made it back from my vacation yesterday. I really did go off the grid for 10 days. I managed to not think about work or real estate for the entire trip (I'll talk more about my trip on the weekend Writer's Corner). It may take me a few days to get back into the swing of things. I need a vacation from my vacation.

I plowed through about 200 emails — and I apologize to anyone I may have missed responding to. I will try to go back through the comments, but I may miss a few.

I hope you all enjoyed your holiday weekend.