Due technical difficulties with our threaded comments, we closed the comments on the original post. The entire post is now here, and comments are open.

Do you want to pay the losses from jumbo loans — big loans to rich people — with your taxes?

Irvine Home Address … 7 PEPPERCORN Irvine, CA 92603

Resale Home Price …… $767,000

We be fallin up (up)

Never fallin down (down)

We keep it at a higher level elevating now,

(put it in your) in your area,

(city or your) town,

Black Eyed Peas — Fallin' Up

In our modern mortgage era, nearly all loans are backed by the US government. At one time we had something resembling a free market, but the quasi-governmental entities Freddie Mac and Fannie Mae crowded out much of the mortgage market, and when they were taken over by the Treasury department, they basically took over the mortgage market together with the FHA.

The GSEs and the FHA were originally intended to provide mortgages to lower and middle income Americans who where not being served by the free market. Rich people can get loans because they have assets and often high incomes.

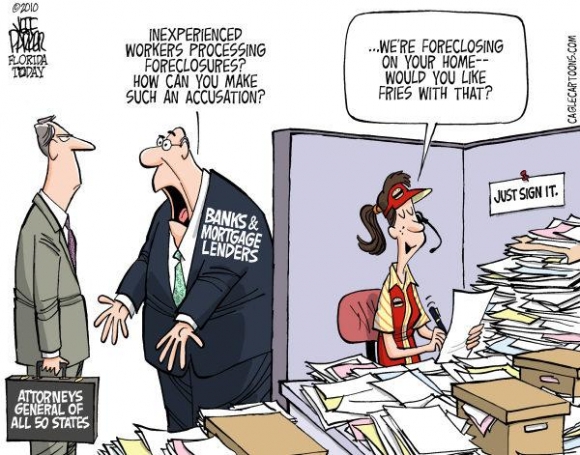

There hasn't been much need to subsidize rich people, and there isn't much support among the electorate for such subsidies. That is why we have a conforming limit to GSE and FHA loans. Raising this conforming limit would offer a government subsidy to wealthy or high-income borrowers. It would also give opportunity for lenders to refinance many of their toxic jumbo loans into government-backed toxic loans and shift losses to the US taxpayer.

Total Mortgage founder: Increase jumbo loan limit nationwide to spur the market

John Walsh is founder and president of Total Mortgage Services, a direct mortgage lender and broker based in Milford, Conn. For this edition of In This Corner, Walsh gives his take on the jumbo loan market and the limit restrictions imposed across the country.

HousingWire recently spoke with an analyst who said jumbo loans are now performing similarly to the subprime market during the housing bubble. The delinquency rate for this type of mortgage is becoming abnormally high. How does this compare to your experience in the marketplace?

There's been a large loss in value in the jumbo market that has to do with a number of factors: the loss of liquidity on the jumbo side and the fact that there are fewer jumbo outlets has put further pressure on the jumbo housing market. I think that's the reason why there are troubles in that sector.

Let's put the horse back in front of the cart. The reason there is less liquidity and fewer jumbo outlets is because 10% of the borrowers are delinquent, and there is no government agency stepping up to take these losses. The lack of liquidity is the symptom of the market's real trouble: delinquent borrowers.

As far as a percentage decline in value, the jumbo market seems to have been hit extremely hard which has contributed to the performance on those loans — a lot of those jumbo loans are underwater.

That being said, prices have gotten to somewhere near a low.

What tea leaves did he read to come to that conclusion?

With the mortgages that we're giving out today, the loan-to-value requirements are a lot steeper, the credit score requirements are a lot steeper, the debt-to-income requirements are a lot more stringent. So I think the jumbo loans being written today as opposed to the ones written even as little as six months ago or a year ago, are going to perform significantly better. That's why you're beginning to see an ease on the jumbo side of loans.

The tightening of requirements he is talking about has also reduced the number of borrowers in the jumbo loan pool considerably. Think about how many homes are priced over $1,000,000 in Orange County, and pair that with the number of borrowers who can actually qualify for and make the payments on a jumbo loan — not factoring in mortgage equity withdrawal to make Ponzi payments. The supply of these homes greatly exceeds the potential demand.

There's also a lot of legacy jumbo problems which I think is just a function of the value of homes.

The legacy problems are a function fo the value of homes? I thought the problems were because lenders were insanely stupid and gave out huge loans to anyone with a pulse. And in fact, it was giving out those stupid loans with inflated the housing bubble and a created the problem with home values we have today.

There was a lot of no income (documentation) loans that were done on jumbo borrowers — that seemed to be the way a lot of the jumbo loans were done. A lot of places did no income option ARMs. So a lot of those problems, that's what you're seeing now from a legacy side of things.

Legacy loans: a feel-good euphemism for everything stupid in the housing bubble. The word legacy almost makes it sound regal, just, and important, like something meant for the aristocracy. I say we let the aristocracy eat the legacy loan cake they baked.

Going forward, the loans that are being written today are significantly better credit risks. That's why you're beginning to see some liquidity in the jumbo market.

As far as the demand for jumbo loans, where do you see most of the demand coming from? What kind of loans are these?

We don't really do commercial lending, so it's all residential lending on the jumbo side. The jumbo side is not really regional, there's just more people calling about them these days. I would say demand is up at least 25% over the past couple of months. We're beginning to refinance some of our customers from two, three, four years ago that got really good jumbo mortgage rates, but because the rates have come down so much, they're beginning to come into that area where a refinance makes sense. We have seen a fairly significant uptick in the jumbo refinances recently.

Phone calls asking about jumbo loans is not demand. I can imagine the calls he must be getting…

Qualified borrowers is real demand, and that kind of jumbo loan demand is not increasing with near 10% unemployment.

You mentioned in a statement that you believe conforming loan limits should be raised across the country, not just in "high-cost areas." What do you mean high-cost areas? How would this change affect the market?

There's a conforming jumbo now, so in certain areas of the country you can go and get virtually the same prices as a conforming loan and get the loan to go to either Fannie Mae or Freddie Mac. Normally the conforming loan limit is $417,000, but in certain areas you can go up to $729,750 as a mortgage amount. That's only in 20 metropolitan areas. So even though you're in one town, where you may only be able to go up to $650,000, in another town the limit is $729,000. So it varies from ZIP code to ZIP code. My thought is you should expand that increased conforming loan limit countrywide because a lot of people fall between $417,000 and $729,750.

Do the taxpayers want to subsidize loans between $417,000 and $729,750 everywhere? I think it is a ripoff for the taxpayer that those loans are insured here, but to do that everywhere would simply expose the taxpayer to more risk.

It would put a lot more people in the purchase market that wouldn't necessarily qualify under the jumbo program, but may qualify under this particular program. You also bring FHA into the possibility, which is 3.5% down up to $729,750. I think it would expand a ton of potential, not only buyers and a lot more purchases in the range $417,00 to $729,750, but also allow a lot of people to refinance and take advantage of these unbelievably, historically low rates.

We may be able to re-inflate the housing bubble nationally if we allowed 3.5% down loans up to $729,750. I don't think that would be a good thing, particularly since the taxpayer would be absorbing all the losses when the echo bubble burst.

A lot of people just don't qualify based on their loan-to-value; a lot of people have lost so much equity they can't capitalize on these low rates. And if all these people have the ability to refinance, you're looking at a lot of people saving money, a lot more money being pumped into the economy from a refinancing perspective. From a purchasing perspective, obviously when people buy a home they hire more contractors and go to Home Depot more. The good things that happen when people buy houses will happen and spur the purchase market even more all across the country; not in just these defined areas.

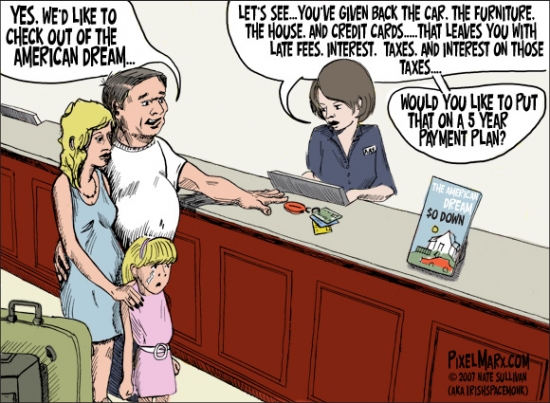

I am always amazed that people think you can borrow your way out of debt. Excessive debt is the problem. Adding to that debt is not a viable solution, and neither is refinancing excessive debt at a lower interest rate.

I think that could be a great thing on top of all the things the government is trying to do.

I think it is a terrible thing to do just as the other failed things the government is trying to do.

It's not like the short sale refinance program where they're actually going to subsidize the write down or the mortgages. This is just you're taking on a larger loan size.

Great idea: take on more debt because you can't afford the debt you already have. Brilliant!

I think it's a great time because the underwriting standards have gotten so much more stringent these days you're getting a lot more qualified borrowers.

Why hasn't the government already put in place some policy to deal with jumbo loans?

I'm sure there's a rationale as to why they only did it in pocket areas. I think they did it upon median income in particular areas. I sort of understand why they did it, but my philosophy in that area is this: just because you live in Fairfield, Conn., you have the ability to take advantage of this program. But if you live in Omaha, Neb., and you have a loan amount that meets the value of the home and you still have to meet the same underwriting guidelines, why can't you, in Nebraska, take advantage of that particular program? Again to spur more purchase activity and also to take advantage of lower rates for the ability to refinance and put more money back into the economy.

This idea is dumb for many reasons, but as the jumbo loans losses continue to mount, expect to see this dumb idea resurface. Personally, I don't want to become liable for the extravagant borrowing of fools with huge losses on their jumbo loans. As you read about today's featured borrower, ask yourself if you want to pay his bill.

Buy, refi, and bye-bye

Most of the foreclosure properties I see today have this familiar pattern: fools overpays during the bubble, and as prices go up, they add to their bloated mortgages until finally they implode and lose their property. Many of these people borrow enough to recoup their down payment and get some extra money out of the bank, and some do not. The owner of today's featured property had access to his entire down payment, but unless he used the HELOC, he may have left the down payment in the bank.

- This property was purchased for $720,000 on 7/16/2004. The owner used a $575,200 first mortgage, and a $144,800 down payment.

-

On 8/8/2005 he refinanced for $584,600 and recovered some of his down payment.

- On 10/14/2005 he opened a $180,000 HELOC.

- He quit paying in late 2008, and he squatted for about 21 months before the auction.

Foreclosure Record

Recording Date: 07/08/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 05/11/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 02/05/2009

Document Type: Notice of Default

The flipper that purchased the property at auction is playing games with the listing price. This is the slow grinding loss of imaginary equity.

| Date | Event | Price | ||

|---|---|---|---|---|

| Nov 04, 2010 | Price Changed | $767,000 | ||

| Oct 23, 2010 | Price Changed | $772,000 | ||

| Oct 15, 2010 | Price Changed | $775,000 | ||

| Oct 01, 2010 | Price Changed | $779,000 | ||

| Sep 23, 2010 | Price Changed | $785,000 | ||

| Sep 17, 2010 | Price Changed | $789,000 | ||

| Sep 01, 2010 | Listed | $795,000 | ||

Irvine Home Address … 7 PEPPERCORN Irvine, CA 92603 ![]()

Resale Home Price … $767,000

Home Purchase Price … $661,500

Home Purchase Date …. 8/23/2010

Net Gain (Loss) ………. $59,480

Percent Change ………. 9.0%

Annual Appreciation … 60.7%

Cost of Ownership

————————————————-

$767,000 ………. Asking Price

$153,400 ………. 20% Down Conventional

4.21% …………… Mortgage Interest Rate

$613,600 ………. 30-Year Mortgage

$144,845 ………. Income Requirement

$3,004 ………. Monthly Mortgage Payment

$665 ………. Property Tax

$225 ………. Special Taxes and Levies (Mello Roos)

$128 ………. Homeowners Insurance

$222 ………. Homeowners Association Fees

============================================

$4,244 ………. Monthly Cash Outlays

-$704 ………. Tax Savings (% of Interest and Property Tax)

-$851 ………. Equity Hidden in Payment

$231 ………. Lost Income to Down Payment (net of taxes)

$96 ………. Maintenance and Replacement Reserves

============================================

$3,015 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$7,670 ………. Furnishing and Move In @1%

$7,670 ………. Closing Costs @1%

$6,136 ………… Interest Points @1% of Loan

$153,400 ………. Down Payment

============================================

$174,876 ………. Total Cash Costs

$46,200 ………… Emergency Cash Reserves

============================================

$221,076 ………. Total Savings Needed

Property Details for 7 PEPPERCORN Irvine, CA 92603

——————————————————————————

Beds: 3

Baths: 2 full 1 part baths

Home size: 2,046 sq ft

($375 / sq ft)

Lot Size: n/a

Year Built: 2004

Days on Market: 66

Listing Updated: 40486

MLS Number: P750630

Property Type: Condominium, Residential

Community: Quail Hill

Tract: Laur

——————————————————————————

A True Turnkey Property with An Incredibly Open And Spacious Floor Plan Boasting High Ceilings, Plantation Shutters, Hardwood Flooring, New Paint, and Stainless Steel Appliances!!! Along with the Bedrooms there is any Extra DEN downstairs & LIVING AREA upstairs!!! Customized Tiles and Kitchen with Granite Countertops and Stainless Steel Appliances with a Brand New Wine Cooler! Boasts a TRUE Master Bedroom Features Walk-In Closet, Private Balcony, Dual Sinks, Roman Tub & Separate Shower. Inside Separate Laundry Rooom And Plenty Of Storage. This Fantastic End Unit Share Only 1 Wall. Situated In A Quiet Location Of A Very Desireable Complex Located In The Heart Of Irvine. Close to Restaurants, Theater And Shopping. Close To The Toll Road And It Is One Of Irvine's Newest complexes.

Why is this in Title Case?

Do you feel the excitement with the exclamation points!!!

pared with the 3.4 percent earned by those below the poverty line.

pared with the 3.4 percent earned by those below the poverty line.

.jpg)

.jpg)