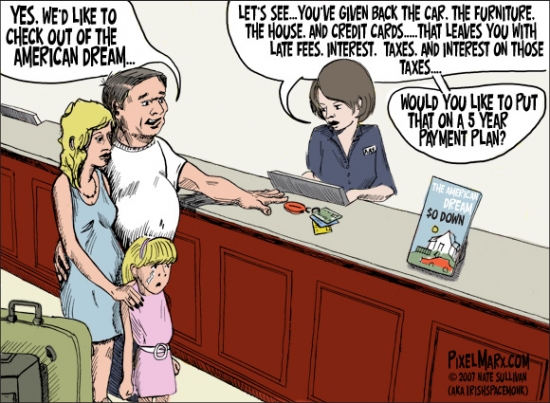

The losses from the housing bubble will exceed $1.1 trillion. Who is going to pay for it?

Irvine Home Address … 29 SMOKESTONE 30 Irvine, CA 92614

Resale Home Price …… $285,000

Yeah runnin' down a dream

That never would come to me

Workin' on a mystery, goin' wherever it leads

Runnin' down a dream

I rolled on as the sky grew dark

I put the pedal down to make some time

There's something good waitin' down this road

I'm pickin' up whatever's mine

Tom Petty and the Heartbreakers — Running Down a Dream

Mortgage Mess: Shredding the Dream

The foreclosure crisis isn't just about lost documents. It's about trust—and a clash over who gets stuck with $1.1 trillion in losses

October 21, 2010 — Peter Coy, Paul M. Barrett and Chad Terhune

In 2002, a Boca Raton (Fla.) accountant named Joseph Lents was accused of securities law violations by the Securities and Exchange Commission. Lents, who was chief executive officer of a now-defunct voice-recognition software company, had sold shares in the publicly traded company without filing the proper forms. Facing a little over $100,000 in fines and fees, and with his assets frozen by the SEC, Lents stopped making payments on his $1.5 million mortgage.

The loan servicer, Washington Mutual, tried to foreclose on his home in 2003 but was never able to produce Lents' promissory note, so the state circuit court for Palm Beach County dismissed the case. Next, the buyer of the loan, DLJ Mortgage Capital, stepped in with another foreclosure proceeding. DLJ claimed to have lost the promissory note in interoffice mail. Lents was dubious: "When you say you lose a $1.5 million negotiable instrument—that doesn't happen." DLJ claimed that its word was as good as paper. But at least in Palm Beach County, paper still rules. If his mortgage holder couldn't prove it held his mortgage, it couldn't foreclose.

Eight years after defaulting, Lents still hasn't made a payment or been forced out of his house. DLJ, whose parent, Credit Suisse, declined to comment for this story, still hasn't proved its ownership to the satisfaction of the court. Lents' debt has grown to about $2.5 million, including unpaid taxes, interest, and penalties. As the stalemate grinds on, Lents has the comfort of knowing he's no longer alone. When he began demanding to see the I.O.U., he says, "I was looked upon like I had leprosy. Now, I have probably 20 to 30 people a month come to me" asking for advice. Lents is irked when people accuse him of exploiting a loophole. "It's not a loophole," he says. "It's the law."

The Lents Defense, as it might be called, doesn't work everywhere.

This guy is obviously a crook. Wether the bank can produce the paperwork or not doesn't change the basic facts:

- There was a note at one time that encapsulated the agreement between this borrower and the lender.

- He did borrow the money.

- He did agree to repay the money or surrender the house in a foreclosure action.

Since these basic facts are not in dispute, and since Mr. Lent's is not disputing that he failed to meet his contractual obligations, why can't this foreclosure go forward? He says this is not a loophole, but this clearly is a loophole or technical evasion. This squatter needs to get out the bank's house, then he can fight with them over "damages" caused by their failure to produce the note. Since he obviously is not being damaged in any way, his frivilous counter-suit would be dismissed.

So who ends up paying for the losses caused by this squatter. On the surface, this looks like a bank loss, but we all know that the taxpayer will ultimately be on the hook. Are you happy about this guy squatting in luxury while you pay for it?

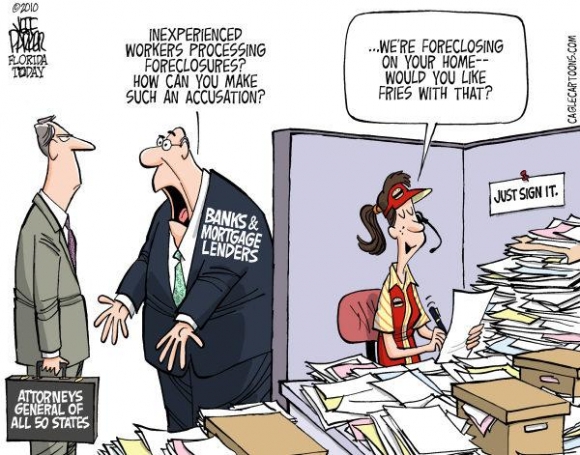

Thousands of Floridians have lost their homes in lightning-fast "rocket dockets." In 27 other states, judges don't even review foreclosures, making it harder for homeowners to fight back….

Even if the documentation problems turn out to be manageable—as Bank of America (BAC) and others insist they will be—the economy will still suffer long-term consequences from the loose underwriting that caused the subprime housing bubble.

Bullshit alert! This was NOT a subprime housing bubble. The damage has largely been felt by subprime borrowers only because the alt-a and prime borrowers who defaulted have been allowed to squat. When the media begins falsely portraying this as a subprime housing bubble, it implies this was a problem caused by and limited to subprime. That is not accurate, and if widely believed may cause policy errors directed toward the "subprime" problem.

According to an Oct. 15 report by J.P. Morgan (JPM) Securities, some $2 trillion of the $6 trillion in U.S. mortgages and home-equity loans that were securitized during the height of the bubble, from 2005 through 2007, are likely to go into default. The report says the housing bust will ultimately cause losses of $1.1 trillion on those bonds.

Who is going to absorb the $1,100,000,000,000 in losses? The banks can't absorb that much as it would completely wipe out the capital in our banking system. In the end, it will be a combination of investor losses, bank losses, and US taxpayer bailouts that mop up this mess. As you might imagine, investors and bankers are working feverishly to pass that loss on to you.

While banks and investors take their hits, millions of homeowners continue to be punished by unaffordable mortgage payments and underwater home values.

Punished? Well, it they stupidly took on a mortgage payment they cannot afford, they deserve it. If they bought an overvalued house, that is their problem. The authors are setting up loan owners as victims when many of them were buying based on greed.

Laurie Goodman, a mortgage analyst at Amherst Securities Group, said in an Oct. 1 report that if government doesn't step up its intervention, over 11 million borrowers are in danger of losing their homes. That's one in five people with a mortgage. "Politically," she wrote, "this cannot happen. The government will attempt successive modification plans until something works."

We are revisiting this nonsense again. Why can't this happen? What if it does? People will move out of their homes, and new people will move in. So what?

I think she is right that the government will do everything it can to prevent the market from doing what it must to clear the bad debt, and in the process, the government's actions will delay the recovery and cause more people to suffer. When it's all over, the government will release some bullshit report claiming everything they did was right and helpful.

Meanwhile, a high-stakes fight is breaking out between the banks that made loans and the investors who bought them. A shot was fired on Oct. 18 when a group of major investors claimed that Bank of America's Countrywide Home Loan Servicing had failed to live up to its contracts on some of more than $47 billion worth of Countrywide-issued mortgage bonds. The group said Countrywide Servicing has 60 days to correct the alleged violations, such as failure to sell back ineligible loans to the lenders. According to people familiar with the matter, the group includes Pimco, BlackRock (BLK), and the Federal Reserve Bank of New York.

For banks that have just started making money again after near-death experiences in 2008, mortgage losses could delay the return to good health. Chris Gamaitoni, an analyst for Compass Point Research & Trading, a Washington financial advisory firm, estimates losses for the big banks of $134 billion from having to buy back bad loans from private investors and another $27 billion in losses from buying back loans from Fannie Mae and Freddie Mac. Other estimates are lower—from $20 billion to $84 billion—in part because those analysts are less certain than Gamaitoni that investors will succeed in court.

This battle between investors and bankers is more important than most realize. If the investors win, and if banks are liable to repay these losses, banks will suffer longer, and the economy will continue to sputter.

Bank of America, the nation's largest lender, has resorted to tough tactics in resisting repurchases of bad loans. Facing pressure from Freddie Mac, one of the two government-controlled mortgage financing companies, to buy back money-losing home loans with problems like inflated appraisals, overstated borrower income, or inadequate documentation, Bank of America issued a blunt threat, according to two people with direct knowledge of the incident. If Freddie Mac did not back off its demands for the buybacks, Bank of America officials said, the bank would take more of the new, more profitable mortgages it is originating these days to rival Fannie Mae, these people said. Freddie and Fannie, known as GSEs (government-sponsored entities), need a steady supply of healthy new loans to climb out of their financial hole.

Now that is playing hardball. Good for Bank of America.

The claimed threat from Bank of America, which was not put into writing, according to one of these people, was taken seriously enough that it has been discussed at several Freddie Mac board meetings, including one in mid-October. Some officials have urged the Federal Housing Finance Agency—the government conservator that has controlled Fannie and Freddie since they were bailed out in 2008—to confront Bank of America and prevent it from trying to play one against the other, which may be infuriating but is not illegal. "If the tactic worked, I'd be shocked and appalled," said Thomas Lawler, a former portfolio manager at Fannie Mae and now an economic consultant. "The GSEs are supposed to be run now to minimize losses to the taxpayers. Freddie ought to ignore the threat." FHFA Acting Director Edward J. DeMarco declined to comment, as did officials of Freddie Mac. Bank of America also declined to comment.

Why shouldn't Bank of America play one off against the other? The whole reason there are two GSEs instead of one was to foster competition and prevent either from having monopoly powers.

For policymakers, the dilemma is this: Enormous losses will cause problems wherever they end up. They could further harm Fannie and Freddie, which insure the vast majority of the nation's mortgages and have already received nearly $150 billion in taxpayer support. Or, if Fannie and Freddie succeed in pushing the burden back to the banks, the losses could cripple some of the major institutions that have just emerged from a government bailout. Bank of America faces $12.9 billion in buyback requests, and mortgage insurers have asked for the documents on an additional $9.8 billion on which they may consider seeking repurchases, according to regulatory filings. (Bank of America has put aside $4.4 billion for buybacks, and CEO Brian T. Moynihan says the costs will be manageable.) "The Treasury is very aware that they can't push too hard on this because if you do push too hard it might put the companies in negative capital again," says Paul J. Miller, an analyst at FRB Capital Markets. "There's a lot of regulatory forbearance going on."

Aside from ignoring banks' bad debts, Washington hasn't done much to fix the crisis. Both houses of Congress easily passed a bill this year that would have undermined centuries of law by requiring every state to recognize MERS-type electronic records from other states. Only a pocket veto by President Barack Obama kept it from becoming law.

One option, opposed by the Obama Administration and most Republicans in Congress but favored by Senate Majority Leader Harry Reid and others, is a national moratorium on foreclosures. It would last until regulators assure themselves that lenders have straightened out their foreclosure procedures.

So how is that supposed to work? The banks have all resumed their foreclosure proceedings, and they all claim they have worked out any procedural problems. Who can claim otherwise? Do we want to give a bunch of bureaucrats the ability to hold up foreclosures because in their opinion the banks procedures are inadequate? If the banks were not complying with existing laws, then they should be held accountable, but so far, there have been very few cases where any procedural flaws have been identified, and many reporters, loan owners, and attorneys have been looking.

Opponents say it would delay the recovery of the housing market by preventing qualified buyers from getting their hands on foreclosed homes.

Opponents of a moratorium say those things because it does delay the recovery, and it does prevent a qualified buyer from getting their new home.

Look at the language the authors used, "getting their hands on foreclosed homes." They portray the new buyer — a buyer qualifying under new stricter lending standards who will likely make their payments — as some kind of illegitimate claimant, a greedy buyer trying to get their filthy hands on someone else's property. The author's agenda is showing.

Supporters of the idea, such as Dean Baker, co-director of the Center for Economic and Policy Research, say there are plenty of already foreclosed homes available for sale and thus no urgent need to add to the supply.

Goodman, the Amherst Securities analyst, says banks need to reduce the principal that people owe on their homes so they have an incentive not to walk away. "Ignoring the fact that the borrower can and will default when it is his/her most economical solution is an expensive case of denial," Goodman writes. If the home whose mortgage was reduced happens to regain value, 50 percent of the appreciation would be taxed, she says. Meanwhile, to discourage people from sitting tight in homes while foreclosure proceedings drag on, she would have the government tax the benefit of living in the home rent-free.

Those ideas are bad on many levels. First, Foreclosure Is a Superior Form of Principal Reduction. Giving borrowers money only encourages the worst kind of moral hazard. Banks are far better off losing more money now and eliminating moral hazard than encouraging borrowers to steal from them over and over again in the future. Second, the 50% tax on appreciation sounds great, but as soon as some seller somewhere has to actually pay that tax, there will be a tax revolt, and congress will roll over and repeal the tax.

The one idea I do like is taxing the squatters. These people are receiving the beneficial use of the property as surely as if it were a gift of cash. It should be taxed to help pay for the bailouts.

CitiMortgage is testing an innovative alternative based on the legal procedure known as "deed in lieu of foreclosure." The owner turns the deed over to the bank without a fight if the bank promises not to foreclose, lets the family stay in the house after the agreement for six months, and gives relocation assistance.

In other words, CitiMortgage is giving cash for keys, a practice I am learning much about in Las Vegas.

Other ideas: In a New York Times blog post on Oct. 19, Harvard University economist Edward Glaeser suggested federal assistance to overwhelmed state and local courts, as well as $2,000 vouchers for legal assistance to low-income families that can't afford to fight foreclosures.

Just what we need, a handout for attorneys.

Bloomberg News columnist Kevin Hassett, who is director of economic policy studies at the American Enterprise Institute, says in his Oct. 18 column that the newly created Financial Stability Oversight Council should make the foreclosure mess its first big project, "take authority for solving it, and do so as swiftly as possible."

Speed is essential. The longer it drags on, the more the foreclosure crisis corrodes Americans' faith in their financial and legal systems. A pervasive sense of injustice is bad for the economy and democracy as well. Take Joe Lents. The Boca Raton homeowner hasn't made a mortgage payment since 2002, but he perceives himself as a victim. "I want to expose these guys for what they're doing," Lents says. "It's personal now."

Yes, let's take Joe Lents as an example. He is a perfect example of how a pervasive sense of injustice and victimhood can be cultivated among those perpetrating the injustice. Squatters need to get out of the houses they are not paying for. The pervasive injustice is that good families with the buying power to purchase a home are being denied that opportunity by delays in the foreclosure process and political grandstanding.

Evict the squatters now!

He nearly quadrupled his mortgage debt

Some borrowers were obviously gaming the system. No amount of careless spending can explain a borrower that methodically increases his mortgage to its maximum at every opportunity. This borrower had to know he was stripping the equity out of this place, and he was going to do so until he couldn't borrow any more. There was no thought given to actually paying down the mortgage.

- Today's feature property is one of the hardest working condos I have seen to date. The property was purchased on 8/24/1998 for $130,000. The owner used a $104,000 first mortgage, a $13,000 second mortgage, and a $13,000 down payment.

- On 3/9/2000 he got a stand alone second for $35,000. After about 18 months of ownership, he got back his down payment plus $18,000 (about $1,000 per month). It almost makes this property cashflow positive if you look at it that way.

- On 6/7/2002 he refinanced the first mortgage for $176,000.

- On 6/5/2003 he refinanced the first mortgage for $262,675.

- On 4/14/2003 he refinanced with a $274,400 first mortgage.

- On 7/8/2004 he refinanced with a $364,500 first mortgage and obtained a HELOC for $20,250.

- On 11/1/2006 he refinanced with a $353,000 first mortgage and a $43,950 stand-alone second.

- Total property debt is $396,950.

- Total mortgage equity withdrawal is $279,950.

-

Total squatting time is over two years.

Foreclosure Record

Recording Date: 07/08/2010

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 04/16/2009

Document Type: Notice of Sale

Foreclosure Record

Recording Date: 01/12/2009

Document Type: Notice of Default

So what do you think about this borrowers behavior? Perhaps we should reward him with principal reduction. He would be happy to borrow that money all over again, particularly if you are going to pay it off for him through your tax dollars.

Irvine Home Address … 29 SMOKESTONE 30 Irvine, CA 92614 ![]()

Resale Home Price … $285,000

Home Purchase Price … $130,000

Home Purchase Date …. 8/24/1998

Net Gain (Loss) ………. $137,900

Percent Change ………. 106.1%

Annual Appreciation … 6.5%

Cost of Ownership

————————————————-

$285,000 ………. Asking Price

$9,975 ………. 3.5% Down FHA Financing

4.29% …………… Mortgage Interest Rate

$275,025 ………. 30-Year Mortgage

$54,336 ………. Income Requirement

$1,359 ………. Monthly Mortgage Payment

$247 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$48 ………. Homeowners Insurance

$290 ………. Homeowners Association Fees

============================================.jpg)

$1,944 ………. Monthly Cash Outlays

-$123 ………. Tax Savings (% of Interest and Property Tax)

-$376 ………. Equity Hidden in Payment

$15 ………. Lost Income to Down Payment (net of taxes)

$36 ………. Maintenance and Replacement Reserves

============================================

$1,496 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$2,850 ………. Furnishing and Move In @1%

$2,850 ………. Closing Costs @1%

$2,750 ………… Interest Points @1% of Loan

$9,975 ………. Down Payment

============================================

$18,425 ………. Total Cash Costs

$22,900 ………… Emergency Cash Reserves

============================================

$41,325 ………. Total Savings Needed

Property Details for 29 SMOKESTONE 30 Irvine, CA 92614

——————————————————————————.jpg)

Beds: 2

Baths: 2 baths

Home size: 917 sq ft

($311 / sq ft)

Lot Size: n/a

Year Built: 1980

Days on Market: 174

Listing Updated: 40480

MLS Number: R1003214

Property Type: Condominium, Residential

Community: West Irvine

Tract: Othr

——————————————————————————

According to the listing agent, this listing may be a pre-foreclosure or short sale.

A CLEAN 2 BR 2 BATH DOWN STAIRS CONDO. HARDWOOD FLOORS, PLANTATION SHUTTERS. COZY. GREAT FOR A STARTER OR DOWN-SIZING FAMILY. ENJOY THE CLEAN COMMUNITY OF WOODBRIDGE.

Hard working condonium indeed. Somebody buy that condo a beer! It’s earned it.

Perhaps we should reward him with principal reduction. He would be happy to borrow that money all over again, particularly if you are going to pay it off for him through your tax dollars.

No, I am sure this condo-debtor is ready to move up by now. Let’s all chip in and get him a nice McMansion to HELOC the SH_T out of. There are many of us who have been waiting for years and years for the chance to acquire a 917 SQFT condo for 285K.

Depressing isn’t it? I would have thought prices would have dove more, but PR is right, Irvine just keeps hanging on to WTF prices.

The sad thing is, this place will sell, and I think pretty fast. $285,000 and you get to live in Irvine? That’s about as cheap as it gets except for the Orangetree Ghetto.

IrvineRenter: “This battle between investors and bankers is more important than most realize.”

IMHO, there is no way to fool Mother Nature. No matter who wins, economy suffers one way or another. Simply because stolen money cannot be recovered in this battle.

How much has WaMu & its remains lost due to cutting corners, under-staffing and outsourcing their operations to the point of losing this note? Close to $1M in unpaid interest and possibly the loss of the ability to reclaim their collateral? A $1M loss pays for a lot of $50k/yr back-office employees. But $1M is a drop in the bucket in terms of WaMu related losses, so it wouldn’t produce any change.

Is the publicity this guy’s getting for going 8 years w/o payment going to help his cause or hurt it? At what point can the city/county foreclose for non-payment of taxes? Is the mortgage holder paying the taxes? Are they paying the property insurance?

It sounds like nobody is paying the property taxes, which makes me wonder why the state hasn’t seized the property yet (it takes a long time for that to happen, but not eight years).

While on vacation, I met a retired bank loan officer. After a year into retirement, he got bored and when back to the bank as a contractor. He mentioned that the out sourcing on paper saved a lot of money until the rework was counted. It looks like lost paperwork is the newest rework.

The money lost (HELCO out, squatting cost) will not be recovered into the economy. The lost will just be transferred to the taxpayers, who will suffer with debt and high unemployment. The investors have a right to have the bank make good on the defective loans. Unfornately, the banks will make good by delaying, making the public suffer until the liabliity is shifted to the govt/taxpayers.

Great depression used regulated high prices and inflation as an attempt to get the US out of the depression. But major factor were wars in Europe and Asian to buy American goods, especially weapons, ships and food. What will the US sell this time?

What will the US sell this time?

Dollars, of course. Big demand for our paper!

IR:

While I generally like your postings, I am confused about one thing: Why do you support a bank foreclosing when they cannot prove that they own the note?

Yes, the home “owner” owes the money. He admits that. The central point, that you completely ignore, is that in order to foreclose, the note holder MUST show the note. This isn’t a mere technicality. What is to stop other banks from similarly claiming ownership of the note? With mortgages sliced and diced, any number of banks (or investors) can claim ownership. Shouldn’t we be worried about ensuring the proper party is the only one able to foreclose? How do you get around the issue of who, exactly, is ALLOWED to foreclose?

I agree that people shouldn’t be allowed to squat. But unfortunately, the banks are the ones who screwed up a viable, well documented and easy to use recording system. We can’t just say “oh well, too bad. The owe *someone* the money, and we’ll take Bank A’s word on this.”

@bob

Thanks for asking the question that I have been wondering on as well.

The law is pretty clear. The note establishes ownership. If a bank is sloppy enough to loose the note/paperwork, how can anyone trust them not to foreclose on the wrong address? If I recall, there was an incident a while back where the bank tried to foreclose on the wrong address.

Yeah, I’m going to have to call BS too. On the MBE (multistate bar examination) that every law student takes, there are several questions regarding recording of notes, who can sue on promissory notes, etc. etc. There are always questions regarding what happens when the bank fails to record or fails to produce a note. The answer has always been, and will always be, they can’t prove ownership.

In this day in age, with debt being bought and sold like grain on the Chicago Commodities Exchange, I wouldn’t trust ANYONE who sent me a notice claiming I owed them money. Bullshit. SHOW ME THE NOTE. Oh, you don’t have it? I’m not paying.

Just as you’ve stated several times, IR, the contract spells out legal obligations and consequences for breach. There are no “moral” considerations. So just as an underwater loan owner can make an amoral (as opposed to immoral) decision to stop paying on an underwater mortgage, you can make an amoral decision to require proof of a debt. This is centuries old law, not a loophole. BANK ERROR IN YOUR FAVOR.

So you wouldn’t trust the bank you went to in order to get a $1.5M loan. The bank that recorded a mortgage? The note and mortgage are separate, but the mortgage is recorded (I can send you the link to this guy’s). There signed (by the borrower) notice to the fact that WaMu had a right to foreclose in event of default.

If the second party can prove the loan was sold by WaMu to them, they should have solid standing as well. As for the sale of the note, if it were recorded each time, the local authorities would know who would or would not have standing to foreclose.

So WaMu could foreclose, if they could prove that they still owned the note (by showing the note). OR DLJ could foreclose, if they could prove that they own the note (by showing the note).

But neither of them can *show the note*!!!

Why should either of them be able to foreclose???

(that said, the state/county should have foreclosed by now, and thrown the guy out!)

ok, i posted too fast and didn’t read below.

how about: show us the mortgage assignment!

Good luck with your argument here in California.

December 2008

“Losing a note is like losing cash,” said Mitchell Roth, a lawyer in Sherman Oaks, California. “The right to payment depends, with limited exceptions, upon the actual possession of the note. To defend against a foreclosure, the first line of defense is, ‘Show me the note.’ And show me how you have the right to payment under the note by proper endorsement or assignment.”

August 2010

Former Los Angeles attorney Mitchell Roth has agreed to settle charges that he allegedly collected fees from 2,000 debt-entrenched homeowners with promises of foreclosure relief, but only filed “frivolous and phony” lawsuits, according to the California attorney general’s office.

Roth has agreed to pay $1 million in restitution to homeowners plus $125,000 in penalties, according to the settlement reached Tuesday.

Read your mortgage and who you agreed is allowed to foreclose (hint: it’s not solely the holder of the note).

I can only speak to California since I am unfamiliar with the laws of other states. In California, the foreclosing party does not have to be in possession of the note. Thousands of these lawsuits were filed in the state over the past several years. Each and every one of them was dismissed. The attorney that brought the majority of these has been disbarred and the state AG forced him to pay back over $1,000,000 in fees that he charged desparate borrowers. California specifically allows for someone other than the holder of the note to foreclose. There is a statutory scheme in place that must be followed to foreclose. Nowhere in the statute is it required that the note be produced or that only the note holder can foreclose.

You speak of the boogey man. As far as I am aware, I have never heard of multiple parties claiming the same interest in the property and trying to foreclose. PSA’s and other contracts make it clear what mortgage interests were sold and what trusts the mortgages reside in. This isn’t a quesiton of disputed ownership.

IR, what’s with all these kooky folks who seem to have come out of the woodwork to post on IHB chanting “show me the note” for the past few weeks?

I didn’t think the mortgage process can be so screwed up as to let someone off the hook so easily, or can it? I wonder if holders of student-loan backed debt are just as sloppy with their paperwork and records keeping – if so, someone should start challenging their legality too.

Is the fear that someone can get foreclosed on by party A and then still owe a house to party B as party A never really owned the loan? If so, can’t a bank just write a commitment that they will cover the defaulter in the event anyone makes that claim in the future?

It amazes me how Honcho says the exact same thing on a daily basis and we still get these folks coming on here acting like they know what they are talking about, and defending this “show me the note” charade.

Enough is enough! Move on!

When will the public catch on? The notes in question didn’t go missing because of sloppiness or mistakes. This was wholesale fraud on a scale not seen before. If it was sloppiness, we might be talking about a couple hundred or a thousand notes, not hundreds of thousands.

Think about it — those notes will never be found! They have been shredded, burned and buried.

I am not saying those that are not paying their mortgages should be let off the hook. They won’t be getting free houses. I am saying it’s total clusterbomb.

One of the things being bandied around as a solution is for the banks to do major mortgage revisions, write-downs on existing mortgages.

How is this fair to those who pay their mortgage? If I heard my neighbor, the one who sucked all the equity out of his home already and has been living free in his house for more than a year, was being offered a downward revision in the principal on their mortgage, I’d ask for one too.

The question really is if banks don’t have the foreclosure option anymore, what will happen?

“The question really is if banks don’t have the foreclosure option anymore, what will happen?”

It would be the end of mortgage finance as we know it. Who in their right mind would give a home loan if you had no security in getting repaid?

“How is this fair to those who pay their mortgage? If I heard my neighbor, the one who sucked all the equity out of his home already and has been living free in his house for more than a year, was being offered a downward revision in the principal on their mortgage, I’d ask for one too.”

You got me to wondering. If the banks started writing down principal on some mortgages, and they refused a write down to someone else, would the someone else have a good basis for a lawsuit? Would it not seem only fair that everyone be entitled to a write down of their mortgage? The key word being “entititled.”

Would it not seem only fair that everyone be entitled to a write down of their mortgage?

Exactly. How do we figure it out? I guess anyone who claims financial hardship will be entitled to have their mortgage subsidized by the rest of us.

That does seem to be what the entire point of all of this is – “helping” all of the people who foolishly bought more house than they could really afford. Helping those who were stretching their finances and those who were gaming the HELOC system.

Either way, all of these struggling house debtors share one thing: none of them ever planned on paying off the mortgage.

Like a game of musical chairs – we have a bunch of grown adults left standing when the music turned off only to start whining and yapping about how they got cheated.

From 2008 @ Calculated Risk

Loan was a refi, so recourse. Think the foreclosing party may sue to get whatever they can after 8 years of trying to just get their collateral back?

When a debtor ask the bank to show them their loan note the response should be something like this:

“Ok dipshit here is your loan note now get the f-ck out of the house”

It should be similar to an old man getting asked for his ID at a liquor store. Ok dipshit here is my ID, I’m over 21.

The response should not be like this:

“well ugggghhh geee it’s kind of funny when we were loaning out money to people we shouldn’t have been loaning money to, we have no freaking clue where the paper work went, but ugggghhh please get out of the house you haven’t been paying the loan on for a year, we promise we own the loan”

Bad answer.

There is NO requirement in California to show the note. It is all an attempt to slow the process down (not that it could really get any slower than it already is).

I will tell you that we had every single note in the cases where I was defending these bogus lawsuits in the event that a judge was going to make us present it in court.

Hell, we even offered to let opposing counsel come to our office to inspect the note if they wanted. Guess what? They never took us up on our offer to come inspect the note. Instead, they kept filing more and more bogus lawsuits and kept filing amended complaints to simply drag out the process (and keep collecting their fees from the defaulted borrowers).

“I will tell you that we had every single note in the cases where I was defending these bogus lawsuits in the event that a judge was going to make us present it in court.”

You are missing the point that people (or at least I am) are trying to make.

The issue is not that the deadbeat should be allowed to stay in the house or even if they are trying to cheat the system. And I can definitely see how scumbag lawyers may try to just drag out the process to collect fees.

The point is how do banks establish ownership when they cannot reproduce the note? As a layman, I always thought that to foreclose one HAS to posses the note but you are explaining to me that the note is not required. But even I understand that there must be *some* procedure in place for situations where the note is stolen, destroyed in fire, flood etc. What exactly is that process? What happens if the process breaks down? A mistyped address, incorrect paperwork results in wrong house being foreclosed upon? Even a layman understands that the loan does not just disappear if the note goes missing.

My *assumption* is these notes do exist and it is just sloppy record keeping by the banks. The reason I am inclined towards is that because 1) I am not a conspiracy theory guy and 2) If Kelja is right and there are no notes, heck this is even more messed up than I ever thought possible.

If there is NO requirement to show the note, how does the governing body establish that the entity foreclosing has the right to foreclose? It would seem that the right to foreclose would be important in a country based on private property rights?

California has a comprehensive statute that must be followed to perfect a foreclosure. Producing the note is not required.

The holder can designate a party to initiate and conduct the foreclosure. These parties are authorized in the mortgage and are duly recorded in the real property records.

No playing these foolish games in California. You authorize/designate someone other than the holder to foreclose (the statue permits this too). That party initiates foreclosure upon default and follows the prescribed methods for perfecting the foreclosure.

California seems to be working better than many of these states out there at the moment.

Do you have any insight into FL law? How is this guy still in his house 8 years after stopping payment?

To build on what winstongator is saying

Is it because in FL, the *note* is needed to foreclose?

Thanks for your post. You learn something new everyday.

they kept filing more and more bogus lawsuits and kept filing amended complaints to simply drag out the process (and keep collecting their fees from the defaulted borrowers)

Outrageous. And look at these State Attorney Generals who are now perpetuating the nonsense – almost giving merit to this garbage. And of course the media is right there to pump and pump with shill “expert” one after another to confuse the situation even more without informing the audience of the truth. “Live from the Jack-Off Institute of Wyoming, professor Harry Dick says house debtors should demand to see the note! Back to you Bob!”

1-in-14 O.C. mortgages are in default

http://mortgage.ocregister.com/2010/11/01/1-in-14-o-c-mortgages-are-in-default/39666/

This is pretty sobering to ponder. I wonder how this will end?

I have been waiting since 2004 to buy, I am hoping next year will be a OK time to buy. At this rate, waiting for all these defaults to hit the market will be another 5 years. Not sure I want to wait that long.

What if a loan gets paid off but “the note” cannot be produced?

Notice how none of these house debtors were at all concerned about the note back in the good ol days when prices were rising.

Imagine they were making payments to someone who did not have the legal right to accept those payments since they didn’t “

If bread is 50 cents a loaf, no one cares. When bread rises to $50 a loaf, people start to cry foul. Same with banking industry.

Your analogy of musical chairs is funny, except the government and the FED control both the supply of chairs, AND wehn the music stops. Ooops, it was just CHANCE you got burned and their buddies all made trillions.

that was pretty good reading until the lawyers got into a pissing match

I think that Kelja is right, unfortunately. By the way, is anyone reading “Monster” (about Ameriquest, etc..)? Just the first 5 pages are incredible.

Why is everything so complicated?

Cancel all fixed-rate mortgages and significantly increase rates on existing loans to cover bank losses. During risky periods for financial institutions, rates always go up. That’s already happening with credit cards.

Why would a taxpayer cover all these losses? Every working American’s share of the national debt is already $100,000. It’s a nice house somewhere in Texas.

I have an idea for recovering part of the trillion: Hire auditors and have the feds go after each fraudster on every level and recover every dime that we can from the people who actually committed the fraud. And every congressman/senator who tries to offload this to their taxpayers without first trying to recover loses their job in the very next election.

Or am I just crazy?

HEY! It’s MY old condo!!! I kid you not, I lived in this very condo for over 2 years! I lived here from December 2006-Jan 2009. The owner must have gotten quite a loan mod. He tried to sell it to us for $429K in Jan 2007, because he said that was what he paid for it a couple years before, and he just wanted to cut ties with the place. We said no thanks, we’ll keep renting it for less than half that monthly payment. We were paying him $1,850/mo until we renegotiated the rent down to $1,650/mo in July 2008 to reflect nearby comps.

If you’re looking to buy this, even as an investor, be sure to ask some questions about the water damage to the kitchen flooring. There was a water leak that the landlord procrastinated on for ~2 weeks, and it ended up flooding the kitchen and warping the wood flooring. It turned out to be from a water pipe going to the unit above, so the upstairs neighbor’s insurance paid for the damages, but the landlord did not replace any of the damaged flooring while we lived there. So far as we are aware, he just pocketed the cash! Hardworking condo, indeed!

If you are looking to live here, it’s actually a nice enough place, in spite of the damage to the kitchen. The upstairs neighbors are a very nice middle-aged couple that we still keep in touch with (not too hard, as we just moved a couple blocks away), and the neighbors that this unit shares a wall with on the first floor are the current owner’s (seller’s) parents. (The seller owns this unit, #29 to the right in the picture, and the unit above #29. The numbering on these units does not match the numbers in the MLS. The unit pictured has a mailing address of #27 Smokestone.) They (the seller’s parents) are very nice as well. They don’t speak much English, but they were always very kind to us.

-Darth