Borrowers choosing to keep the second mortgage current is an unexepected phenomenon in the outbreak of first mortgage defaults.

Irvine Home Address … 28 YORKTOWN Irvine, CA 92620

Resale Home Price …… $695,000

What has happened to it all?

“Crazy,” some would say.

Where is the life that I recognize?

Gone away…

But I won't cry for yesterday, there's an ordinary world,

Somehow I have to find.

And as I try to make my way to the ordinary world,

I will learn to survive.

Duran Duran — Ordinary World

At a basic level, each of us wants the safety and security of an ordinary world of predictable surroundings and routines. The real estate and mortgage world we live in today is a surreal landscape of failed loan programs, ever-tightening credit standards, and uncertainty about the future of real estate prices.

The success or failure of many loan programs will determine the likelihood of their reappearance in an altered form. Subprime first-mortgage lending will return. The 20% down piggy-back loans and 100% HELOCs are not coming back soon. The second mortgage liens — the key problem for bank's residential loan portfolios — are performing very badly, and they will continue to post losses exceeding expectations. However, these loans are performing better than I thought they would because people are choosing to pay these credit lines even if they bail on the first mortgage.

Few good options

A distressed and underwater homeowner has few good options concerning their mortgage obligations. Most just keep paying even if it means sacrificing everything else. Many choose to accelerate their inevitable defaults, and they quit paying on both the first mortgage and the second mortgage.

If a borrower fails to pay either loan, the lender can chose to foreclose or try to negotiate a settlement. A seocnd mortgage lien holder has very little leverage in these negotiations because in a foreclosure, that lender is no longer secured by the property, and if the borrower has no other assets, there is little chance of recovery on the bad loan.

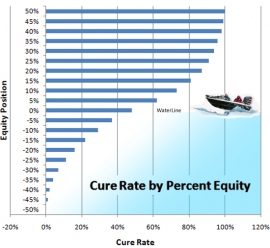

I had expected to see many people default on their second mortgage while keeping the first mortgage current. The first mortgage may not be underwater even though the CLTV is more than 100%. Most borrowers would consider the threat of foreclosure from a second lien holder to be an empty threat because that second mortgage gets wiped out in the foreclosure. People could go on paying the first mortgage and stay in the house because the second mortgage would not foreclose. What we are actually seeing is the opposite of what I expected.

Strategic defaulters opt to continue paying on second liens

by KERRY CURRY — Tuesday, December 14th, 2010, 6:50 am

Borrowers who strategically default on their first mortgage often continue to pay on home equity lines of credit, according to a new white paper from two authors with the Philadelphia Federal Reserve.

The authors, Julapa Jagtiani and William W. Lang, said they wanted to take a closer look at the little-studied phenomenon of strategic default behavior as it relates to first- and second-lien mortgages.

“Predicting mortgage losses has become more difficult with the increase in strategic default behavior and the increase in loan modifications,” the paper said.

Our current accounting fantasies encapsulated in amend-extend-pretend is based on mythical loss recoveries based on past behavior. The study periods do not include times like now — when strategic default is a good idea. Strategic default is going to be much more severe than ever before, and banks are going to lose much more money than they currently project. When amend-extend-pretend becomes a crisis, when the banks lies are fully revealed, lenders will say their fraudulent accounting projections were based on past data. The actual performance didn't match past projections due to the housing bubble. No kidding.

“Focusing on mortgage defaults, our results indicate that the default rate for first mortgages far exceeded those of the second-lien mortgages during the financial crisis. This behavior was not observed in the pre-financial crisis period (i.e., the booming period of 2004-2006).”

About 20% of borrowers in the process of foreclosure due to defaults on the first mortgage kept their second-lien mortgage current. Among those who defaulted on their second-lien mortgages, about 80% also defaulted on their first-lien mortgage.

Data for the study came from a large random sample of individual credit records drawn at the end of each quarter from Equifax, a national credit bureau. The authors only studied consumers who had one first mortgage and at least one home equity line of credit or home equity loan over the period beginning in the fourth quarter of 2004 and ending in the second quarter of 2010. The study merged the Equifax data with another database of loan-level data from LPS Applied Analytics.

The data contradict the hypothesis that consumers would strategically default on a second lien and keep their first lien current to reduce their monthly payment and thus avoid a foreclosure, the white paper said.

That is what I thought would happen.

Instead, a far larger number of households do the opposite; that is, they default on their first lien — thus risking a foreclosure — while keeping their underwater second-lien mortgages current.

The reason?

The authors hypothesized that borrowers have incentives to keep their second lien current — after having stopped paying their first mortgage — in order to maintain their access to credit through the HELOC.

I think that conclusion is highly suspect. Most of these people likely don't have a HELOC they can access because they are underwater.

The study also found that the size of the unused line of credit is an important factor. Homeowners with larger credit lines are less likely to default, as they are motivated to maintain their access to the credit line.

That sounds more reasonable. For people with equity, access is merely having liquidity. Of course, homeowners with larger credit lines and plenty of equity probably don't need to borrow much money and aren't in as much financial distress as those who are maxed out.

Like other studies and white papers, this one also found that negative equity is a big driver in strategic default.

“A large portion of first mortgages with estimated LTV (loan-to-value) ratios greater than 100% is still current, but the continued willingness and ability of these homeowners to make their mortgage payments is subject to great uncertainty,” the authors wrote.

The paper also noted that banks are not punishing borrowers who default on their first mortgages by limiting access to their home equity lines of credit. That could be due to poor risk management practices or lack of timely updates on consumer's risk scores, the paper said.

“Most of the HELOC lines were not increased or decreased after the borrowers defaulted on their first mortgages,” the paper said. “About 90% of the lines remain unchanged even after three quarters following first mortgage default. Interestingly, a small percentage (3% to 6%) of these borrowers had their HELOC lines increased.”

I find it astonishing that people who default don't have their credit lines frozen immediately. Isn't continued borrowing after a default a good sign that a borrower has gone Ponzi? Banks can't be that stupid, can they?

Lenders have the right to foreclose in defaults of first- or second-lien mortgages.

Given the large number of current homeowners with negative equity, there are likely a large number of borrowers who could default on their home equity loans without being forced into foreclosure, the paper noted.

“The data indicate, however, that borrowers rarely engage in this strategy even though it appears to be viable.“

Although homeowners could default on their second-lien mortgages, lower their mortgage payment, and stay in the home, the loan contract stays valid and unpaid interest payments would keep accumulating. Should the house be sold, the second-lien creditor would be eligible for the recovery after the first-lien creditor is paid, the paper said.

Perhaps it is this last point that stops more people from defaulting on their second mortgages. Perhaps borrowers really do recognize that second mortgage debt is just like a credit card that follows them after they leave the house. If people accept that they can't escape the debt without bankruptcy, and they are unwilling to give up access to credit, then they will keep paying their second mortgages to keep the credit lines alive.

How did they spend their house?

I can 't give you a detailed story on how this family buried themselves with mortgage debt. I'm sure their entitlements demanded they spend copious amounts of cash. This house was purchased back in 1993 for $255,000, and it went into foreclosure being worth three times as much. We all know how that happens. Unfortunately, the sordid details are missing from my data source. Whatever they did, we can assume it was typical of the others I have profiled and leave it at that.

Irvine Home Address … 28 YORKTOWN Irvine, CA 92620 ![]()

Resale Home Price … $695,000

Home Purchase Price … $255,000

Home Purchase Date …. 9/10/1993

Net Gain (Loss) ………. $398,300

Percent Change ………. 156.2%

Annual Appreciation … 5.7%

Cost of Ownership

————————————————-

$695,000 ………. Asking Price

$139,000 ………. 20% Down Conventional

4.87% …………… Mortgage Interest Rate

$556,000 ………. 30-Year Mortgage

$141,784 ………. Income Requirement

$2,941 ………. Monthly Mortgage Payment

$602 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$116 ………. Homeowners Insurance

$0 ………. Homeowners Association Fees

============================================

$3,659 ………. Monthly Cash Outlays

-$715 ………. Tax Savings (% of Interest and Property Tax)

-$684 ………. Equity Hidden in Payment

$260 ………. Lost Income to Down Payment (net of taxes)

$87 ………. Maintenance and Replacement Reserves

============================================

$2,607 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$6,950 ………. Furnishing and Move In @1%

$6,950 ………. Closing Costs @1%

$5,560 ………… Interest Points @1% of Loan

$139,000 ………. Down Payment

============================================

$158,460 ………. Total Cash Costs

$39,900 ………… Emergency Cash Reserves

============================================

$198,360 ………. Total Savings Needed

Property Details for 28 YORKTOWN Irvine, CA 92620

——————————————————————————

Beds: 4

Baths: 2 baths

Home size: 1,918 sq ft

($362 / sq ft)

Lot Size: 4,758 sq ft

Year Built: 1977

Days on Market: 44

Listing Updated: 40526

MLS Number: S638130

Property Type: Single Family, Residential

Community: Northwood

Tract: Ip

——————————————————————————

INVESTOR OWNED FORECLOSURE, INCREDIBLE OPPORTUNITY ON THIS QUIET CUL-DE-SAC HOME!! This home just had a $70K remodel and is totally turnkey. It has never been lived in since the remodel. Spacious private master suite, w/ walk-in closet. Three other larger than average bedrooms w/ mirrored closets. The complete kitchen remodel will be the pride of you at home gourmet with its New Appliances, Granite Counters, Stone Floor, & Custom Cabinets. The living room features soaring cathedral ceilings & a cozy Travertine fireplace. The bathrooms are completely remodeled including under mount sinks, Granite Counters, New Fixtures, and Custom Cabinets. The ceilings have been scraped, Canned lights, 4' Base boards, Crown Moulding, Plantation shutters, New carpet, & New designer paint throughout. Extra large 3 car garage has direct entry to the home. A great location just steps from Northwood Park.

.jpg)

That being the case, a prolonged period of stagnant home prices immobilizes the population. With no equity to pay the transaction costs of leaving, homeowners with less than 10% equity are effectively underwater.

That being the case, a prolonged period of stagnant home prices immobilizes the population. With no equity to pay the transaction costs of leaving, homeowners with less than 10% equity are effectively underwater.

.jpg)

.jpg) .

.

.jpg)

It's a good time to buy if you believe a cartel of lending interests that control the sale of millions of properties can hold price levels above what people can realistically afford and divest themselves of all their inventory. If you believe the banking cartel can do this, then we are near enough to the bottom that buying now doesn't hurt. On a nominal basis, it may not, but on an inflation-adjusted basis, it is not great planning to tie up money in an asset that treads water for 10 years while inflation ravages the buying power of the currency.

It's a good time to buy if you believe a cartel of lending interests that control the sale of millions of properties can hold price levels above what people can realistically afford and divest themselves of all their inventory. If you believe the banking cartel can do this, then we are near enough to the bottom that buying now doesn't hurt. On a nominal basis, it may not, but on an inflation-adjusted basis, it is not great planning to tie up money in an asset that treads water for 10 years while inflation ravages the buying power of the currency.