Did government bureaucrats negotiate a good deal for US taxpayers in their loan buyback lawsuits?

Irvine Home Address … 3 CERRITO Irvine, CA 92612

Resale Home Price …… $458,000

I know baby it's hard to be strong

Just take the good with the bad

And don't think you're alone

Cause I know all your sad goodbyes

Cause I've been there before

To help you dry your eyes

Sweetheart

Who love you from the start

Who treats you like a star

Oh sweetheart

Frankie and the Knockouts — Sweetheart

Did Bank of America get a sweetheart deal with the GSEs concerning their poor mortgage origination practices?

Analysis: Bank of America's GSE deal leaves plenty unsettled

By Al Yoon and Tom Hals — Mon Jan 3, 2011 3:51pm EST

NEW YORK/WILMINGTON, Del (Reuters) – Bank of America Corp's $3 billion settlement with Fannie Mae and Freddie Mac may have brought New Year cheer to the bank's stockholders, but now comes the hard part: settling far larger and thornier claims made by private mortgage investors.

After Monday's announcement, Bank of America still faces lawsuits stemming from $375 billion of mortgage-backed bonds.

Compared with the deal with government-backed Fannie Mae and Freddie Mac, those legal claims will be far more difficult and costly and the latest settlement does not change that, according to legal experts and lawyers representing investors.

“It's much more difficult to settle,” Jack Williams, a professor at Georgia State University College of Law, said of the investor lawsuits. “It's going to take a long time and it's going to take a lot of information.”

In other words, investors won't tolerate being ripped off if they have to lose money. If the losses are legitimate market losses, investors may have little grounds for recovery, but if the losses can be demonstrated as stemming from problems in the banks origination pipelines, then perhaps a few lawsuits will prevail. Its an uphill battle for investors to recover anything.

The banks were able to cut a favorable deal with the government because the banking lobby pays off everyone in congress through large donations. They have significant sway with key legislation with their lobbying might. Similar to the NAR.

The deal has little to do with justice or equity. It's looting government reserves by the banks.

The Federal Reserve is the supreme example of regulatory capture. The banks got together and created their own bank and said its edicts are not subject to government pressure. Governments controlling central banks has blown up before. But the banks are now their own regulator answerable to no one, not even Congress (unless Congress revokes their charter).

Talcott Franklin, a Dallas-based lawyer representing asset managers, hedge funds and other investors who have stakes in at least $600 billion of residential mortgage bonds, said the deal might be encouraging because it shows a willingness to resolve claims.

However, he noted Bank of America was particularly eager to settle with the two government entities, which purchase nearly all home loans currently sold by mortgage originators. Investors, in contrast, do not have the same profitable relationship with the bank or its rivals, he said.

Bank of America's stock jumped 5 percent on Monday as investors greeted the settlement as a sign the company would be able to contain demands that it buy back billions of dollars in soured home loans.

I never saw this as a real problem. The contracts for origination would have contained clauses with protections to prevent buybacks. The plantiff will have a high bar to hurdle to force the banking defendant to buy back the loans. The government was never going to force this issue, and the private investors may successfully sue in some instances, but a mass bailout of investors though bank buy-backs is not forthcoming.

In fact, if you look at the subprime lending model, the main reason risky lending was done through companies like New Century Financial instead of by the major investment banks was so that the investment banks could insulate themselves from the liabilities of loan buybacks. New Century went bankrupt facing billions in loan buyback obligations it could never hope to make good on. Goldman Sachs didn't want to face that risk.

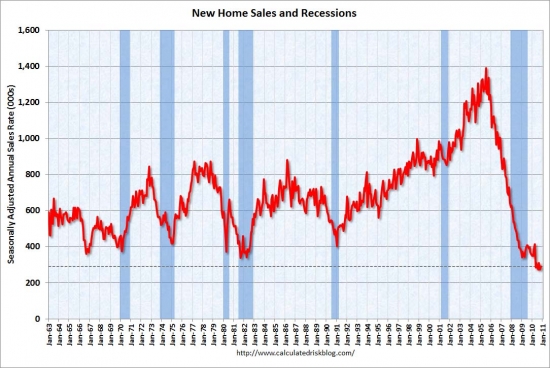

Those loans were packaged into bonds sold as top-rated investments, but their shoddy construction became apparent when the U.S. real estate market suffered its worst crash since the Great Depression.

Investors ranging from hedge fund managers to several Federal Home Loan Banks have sued Bank of America and its Wall Street rivals and most want the banks to buy back the securities or loans backing them.

Money manager BlackRock Inc and bond fund Pimco are in talks with Bank of America over $16.5 billion of mortgage bonds they purchased.

Legal experts said the investor litigation will be tougher to resolve in part because the claims stemming from the loans sold to Fannie and Freddie may have been easier to settle.

The government-sponsored enterprises often had higher standards and well-understood eligibility guidelines for the mortgages they purchased. As a result, the lower quality loans were shipped off to other investors.

The people who bought GSE debt will be covered by the government, but investors who wanted an extra fraction in their returns opted for uninsured mortgage-backed securities. The risk was underpriced. The GSE investors will lose little or nothing. The private label investors are not merely enduring a lower return, they are often losing signficant percentages of their asset valuation. They are getting hit hard.

Williams, who has been researching legal issues surrounding mortgage securities, said Monday's deal may even wear down some of the resistance of bond trustees, who have been a hurdle to investor lawsuits.

That could lead to an increase in new complaints against the Wall Street banks, but he did not think Monday's settlement would expand the range of investors considering a lawsuit.

Investors also have a bit of momentum on their side, thanks to some recent court rulings.

MBIA, a bond insurer, recently overcame objections by Bank of America to the use of sampling from loan portfolios to prove the bank breached promises about the quality of its mortgage underwriting.

Bank of America had wanted MBIA to prove its case on a loan-by-loan basis, an incredibly expensive task in a lawsuit covering more than 375,000 mortgages.

Interesting legal posturing on both sides. MBIA wants to find the least expensive way to prove its claims, and the bank counters with the most expensive way to bog down the process.

In addition, the Federal Home Loan Bank of Pittsburgh recently overcame a motion to dismiss its case against several banks, including JPMorgan Chase & Co

Bank of America stockholders probably should not expect a settlement with private investors any time soon.

“It's going to take a long time, it's going to take a lot of information” to settle investor claims, said Williams.

And it will be handled one case at a time. The attorneys will be busy.

So was this a huge government rip off?

B of A Settlement, Another Taxpayer Rip-off

5 January 2011 — Greg Hunter, Creator of USAWatchdog

In case you have not heard, Fannie and Freddie (also known as Government-Sponsored Enterprises or GSE’s) settled a big lawsuit with Bank of America Monday. The case was settled for cents on the dollar, even though the GSE’s had had a strong case to force B of A to buy back billions in sour mortgage-backed securities (MBS.) I wrote about some of this in a December 1 post called “Foreclosure Bombshell.” The post was about some of the legal trouble Bank of America was having with the mortgage debacle and the possibility of the banks being forced to buy back billions in sour MBS. Here’s part of what I wrote back then, “Mortgage-backed securities have to meet what is called “contractual representation and warranties.” That basically means the MBS are required to be free of fraud and be exactly what the seller says they are. Do you think mortgage-backed securities are free of fraud? Do you think these securities are the triple-A rated risk free investment the big Wall Street banks claim?—NO WAY! The banks are going to be forced to buy back all the toxic mortgage junk they sold. (Click here to read the entire post.)

Unfortunately, the “fraud” in these mortgage-backed securities pools was the underwriting standards often printed in bold on the front cover. The fraud was on its face. The real hurdle investors have to overcome is whether or not the losses were from loans that should not have been in an already tainted pool. A huge number of loans were going bad anyway, the lawsuit would be about the difference created by fraud.

On Monday, after news of the Fannie and Freddie settlement, I got a gloating comment from a reader named “Rick.” Rick tells me he’s retired from the “finance industry.” Here’s some of what he wrote, “I told this would be nowhere as bad as most made out. Hope you read about the settlement with the GSE’s With BofA, 1.3b, this makes BofA total exposure probably around 3b going forward, not the 50B+, everyone thought. Additionally, B of A audit by Moody’s and others has been complete and found that Loan doc’s were delivered. PIMCO will settle for very little in the coming weeks and AG’s to follow. NO Conspiracy and Fraud as you have promoted on your blogs, just very bad process. As stated in our last exchange, I hope you man up and write a new blog retracted and admitting you got a little carried away with you statements. This is what happens when you repeat from others and do not do your own homework. Just remember the fraud was committed buy the rating agencies not the Banks.” (You can read the entire exchange at the end of the Foreclosure Bombshell post.)

I’ll “man up”alright. Yes, Rick you were right, the American taxpayer got ripped-off once again. It was not that bad for B of A because it is another back door bailout for the banks that caused the mortgage mess in the first place. The headline over at Fortune/ CNNMoney.com says it all “Is Fannie bailing out the banks?” Of course, the answer is YES! The report goes on to say, “Monday’s arrangement, according to this view, will keep the banks standing — but leave taxpayers on the hook for an even bigger tab should a weak economic recovery falter. Sound familiar? ‘The administration is trying to weave a path between two bad alternatives,’ said Edward Pinto, a resident scholar at the American Enterprise Institute. “They want to bail out the big banks without doing apparent damage’ to the sagging U.S. budget position.” (Click here to read the entire Fortune/CNN report.)

By limiting BofAs responsibility, the government has taken the remainder onto itself.

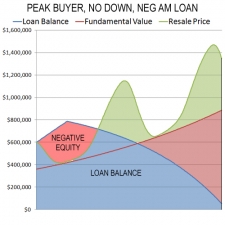

This is an outrage, especially when you consider what kind of a sweet deal B of A got. Investing expert and owner of a blog called The Big Picture, Barry Ritholtz framed the B of A settlement this way, “Bank of America settled numerous claims with Fannie Mae for an astonishingly cheap rate, according to a Bloomberg report. A premium of $1.28 billion was paid to Freddie Mac to resolve $1 billion in claims currently outstanding. But the kicker is that the deal also covers potential future claims on $127 billion in loans sold by Countrywide through 2008. That amounts to 1 cent on the dollar to Freddie Mac. Imagine if you had a $500,000 mortgage, and you got to settle it for $5,000 — that is the deal B of A appears to have gotten from Freddie Mac.” Click here for the complete Ritholtz post.)

Maxine Waters, a senior Democrat on the House Financial Services Committee, also thinks taxpayers got a bad deal. The Congresswoman’s statement was included in a story from the Businessinsider.com. Representative Waters said, “. . . I’m fearful that this settlement may have been both premature and a giveaway. The fact that Bank of America’s stock surged after this deal was announced only serves to fuel my suspicion that this settlement was merely a slap on the wrist that sets a bad example for other negotiations in the future. I understand that the questions raised by fraudulent servicing practices were not addressed in these settlements, and I hope that Fannie Mae and Freddie Mac, along with their conservator, are more aggressive in pursuing banks for the fraud I documented in my Subcommittee during the last Congress.” (Click here for the complete Business Insider post.) The sad thing here is I don’t think this administration or any Republican administration will pursue the “fraud” Congresswoman Waters has documented. I envision every other major Wall Street bank that dumped its toxic mortgage-backed securities onto the GSE’s to also get a sweet deal at the taxpayers’ expense. Many more billions will be poured into the banks to prop them up when some are clearly engaged in malfeasance. Former bank regulator and professor of economics William Black has called for banks such as B of A to be dismantled in receivership. He co-wrote a piece last October called “Foreclose on the Foreclosure Fraudsters,” but what is happening here is just the opposite. Once again, incompetence and alleged crime is being rewarded. (Click here to read the William Black article.)

My only question is how long can the bailouts and spending go on? The banks will no doubt get another round of bailouts via the GSE’s, costing hundreds of billions of new dollars. In his most recent post, Jim Willie of Goldenjackass.com sums up the end result of the massive and ongoing bank bailouts in one chilling sentence. Willie writes, “The extraordinary efforts and attempts to save the big US banks will be the precise policy that leads to systemic failure and the US Treasury Bond default, all in time.” (Click here for the complete Willie post.)

Meanwhile, the Fed continues QE2 at a rate of $75 billion a month of pure money printing to finance the country. When QE2 is finished in June of 2011, how difficult will it be to get foreigners to buy our debt? QE3 anyone? I have a novel idea–the U.S will once again raise its debt ceiling. (Currently it stands at $14.3 trillion.) That will be painless for the politicians, and besides, nobody goes bust or gets punished in America anymore. We do not have leadership in this country; we have political hacks taking turns protecting their donors and cashing in—at the expense of the American people.

I think the government will continue to borrow and spend stimulus money, and the federal reserve will print money and hold down interest rates as long as it has to in order to ignite some price inflation. Hopefully, people will get many new, high-paying jobs to cover their increasing cost of living. I think it is more likely that the inevitable price inflation will pick its victims. Some will see wage increases to match the new cost of living, and some will not. What is your COLA?

Another knife catcher trapped by zero appreciation

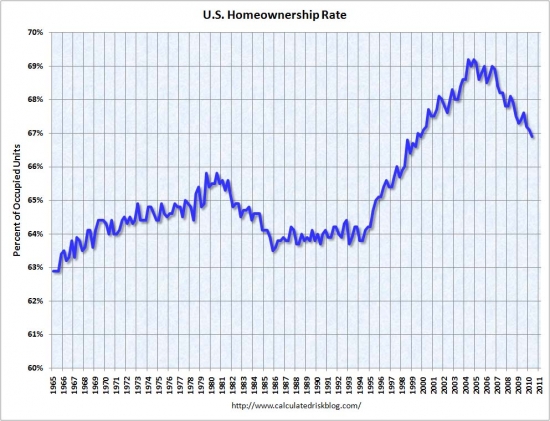

California real estate is supposed to be a wellspring of unlimited amounts of free money. When prices don't rise and the populace cannot get their HELOC fix, the economy founders, and many borrowers get trapped in their homes.

The previous owners

The owners who went through foreclosure were typical Ponzis living the Irvine home price appreciation fantasy. They bought the property on 7/29/2003 for $399,000 with 100% financing. By 2/17/2005, about 20 months later, they managed to extract $150,000 in free money through continued refinancing.

Think about that: zero down, $150,000 in free money in 20 months. I want one of those… and so did the knife catcher.

The current owners

The bank took the property back from the Ponzis for $473,694 on 9/24/2007, and they sat on it for a full year before selling it to our current knife catcher for $390,500 on 10/1/2008. I imagine the owners thought they were getting a great deal. The house appraised for $550,000 at the peak, so they were getting a 30% discount.

Did they get an under-market steal? Or did they catch a falling knife?

Irvine Home Address … 3 CERRITO Irvine, CA 92612 ![]()

Resale Home Price … $458,000

Home Purchase Price … $390,500

Home Purchase Date …. 10/1/2008

Net Gain (Loss) ………. $40,020

Percent Change ………. 10.2%

Annual Appreciation … 6.9%

Cost of Ownership

————————————————-

$458,000 ………. Asking Price

$16,030 ………. 3.5% Down FHA Financing

4.86% …………… Mortgage Interest Rate

$441,970 ………. 30-Year Mortgage

$93,328 ………. Income Requirement

$2,335 ………. Monthly Mortgage Payment

$397 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$76 ………. Homeowners Insurance

$384 ………. Homeowners Association Fees

============================================

$3,192 ………. Monthly Cash Outlays

-$383 ………. Tax Savings (% of Interest and Property Tax)

-$545 ………. Equity Hidden in Payment

$30 ………. Lost Income to Down Payment (net of taxes)

$57 ………. Maintenance and Replacement Reserves

============================================

$2,352 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$4,580 ………. Furnishing and Move In @1%

$4,580 ………. Closing Costs @1%

$4,420 ………… Interest Points @1% of Loan

$16,030 ………. Down Payment

============================================

$29,610 ………. Total Cash Costs

$36,000 ………… Emergency Cash Reserves

============================================

$65,610 ………. Total Savings Needed

Property Details for 3 CERRITO Irvine, CA 92612

——————————————————————————

Beds : 2

Baths : 2 baths

Home size : 1,463 sq ft

$0,000

Lot Size : n/a

Year Built : 1975

Days on Market : 204

Listing Updated : 40548

MLS Number : S621727

Property Type : Condominium, Residential

Community : Rancho San Joaquin

Tract : Jh

——————————————————————————

This absolutely charming top level end unit is located in the prestigious golf course community of Rancho San Joaquin and has a large entry foyer that opens into the great room which has high ceilings and a custom fire place. This model has two master suites. Remodeled master bath and floors. For your enjoyment and entertaining this home has two balconies with quiet and serene views of tree lined streets. Near University of Califronia Irvine, Airport, freeways and great shopping. This is a great place to live, why not make it home.

.png)

.jpg)