That housing markets in the most beaten down areas are now experiencing widespread despair. Prices are so low that existing owners have little hope of recovery.

Irvine Home Address … 263 HUNTINGTON Irvine, CA 92620

Resale Home Price …… $300,000

They used to tell me

I was building a dream.

And so I followed the mob

I was always there

Right on the job.

They used to tell me

I was building a dream

With peace and glory ahead.

Why should I be standing in line

Just waiting for bread?

Brother, can you spare a dime?

Al Jolson — Brother, Can You Spare a Dime?

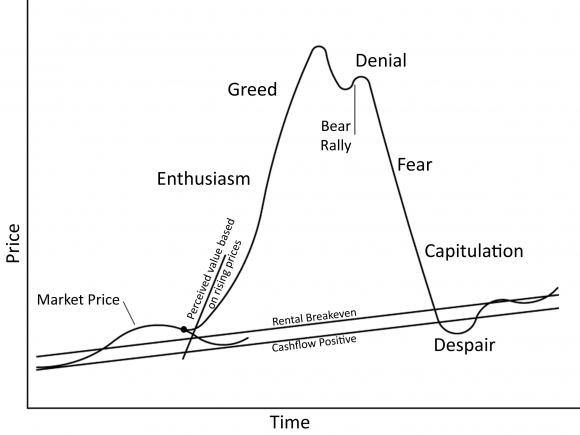

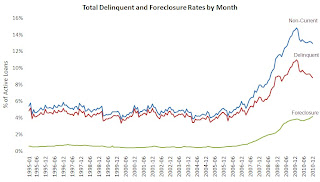

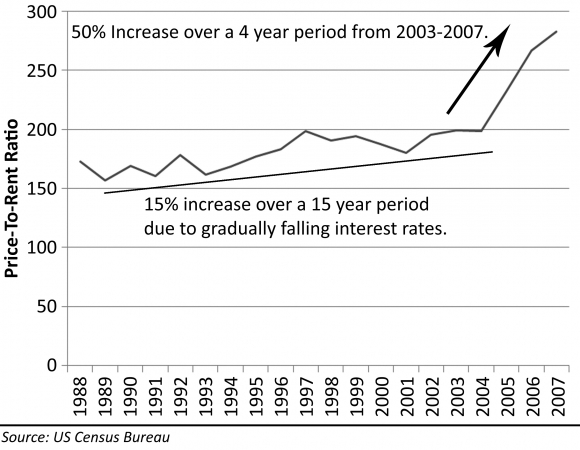

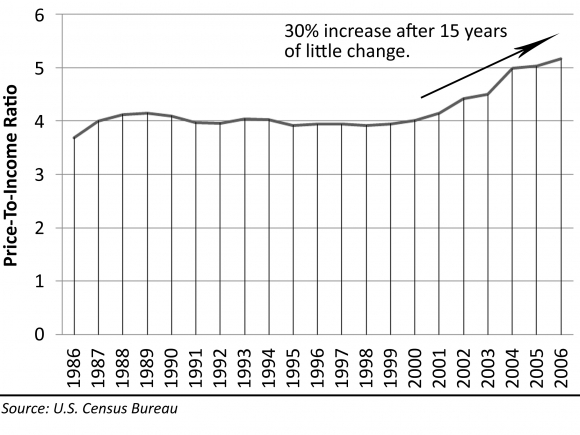

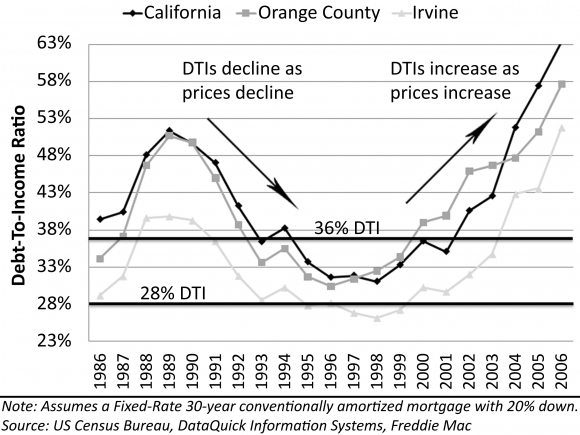

Financial markets all exhibit the same psychological stages during a bout of irrational exuberance. A precipitating factor such as lowered interest rates or financial innovation folly, causes prices to rise when valuations suggest they should fall. This changes the market's perception of value, and buyers eagerly buy and drive prices higher. Greed and delusion set in as prices are propelled ever higher.

Finally, the bubble bursts, and the market enters a phase of denial. Irvine and Orange County have been stuck in this phase due to the bear rally. Finally, fear begins to set in, and sellers reduce their prices in order to get out while they still can. This is currently happening at the high end in California. The market is slipping into fear, but it is far from capitulation or despair.

The subprime real estate markets were crushed first because their loans reset before the alt-a and prime markets. The subprime markets are much farther along the process. Las Vegas capitulated in late 2009, and most other subprime markets have given up since then. Despair now rules these markets. Is that an opportunity?

Homeowners face 'new normal' in housing bust

By Julie Schmit, USA TODAY

MERCED, Calif. — Life has changed in ways big and small in this central California county, which is still trapped in the wreckage of a housing boom that went bust five years ago.

The median home price, $116,000, is down 68% from its peak in 2006. Three of five homeowners with a mortgage here owe more on their loans than their houses are worth, compared with about one in five nationally.

Socked by a sharp loss of property and sales tax revenue, Merced County and its cities have slashed budgets, workers and services. The grass is being mowed less often in city parks. A senior center is open fewer hours.

Families have adjusted, too. Forget dreams of making big bucks on California real estate. Many here now count the years — guessing, really — until they'll no longer owe more on their homes than they're worth.

“We're in survival mode, waiting for recovery,” says Stephen Hammond, 42, pastor at Bethel Community Church in Los Banos, a Merced County town of 35,000 amid cotton and tomato fields.

More cuts are possible because of looming budget deficits, Merced government officials say. Dozens of other communities nationwide may face the same tough choices in the wake of huge drops in home values, which often lead to less property tax revenue. In Merced, the impacts have hit hard, and they hint at what may be to come for others.

For Merced County government, property taxes are the No. 1 source of general fund revenue, says Scott De Moss, deputy county executive officer. Property tax revenue has dropped 25% during the past three years. Almost 15% of the county's workforce has been slashed. Social and mental health service positions took the biggest hits, officials say.

In the city of Merced, sales tax revenue is down 24% and property tax collections, about 34%, from 2007 levels, city officials say. That's forced cuts in the police and fire departments. Police might not show up anymore to take fender bender reports and firetrucks may no longer always roll on the same calls as ambulances, says Merced City Manager John Bramble. The city's 80,000 trees now get pruned once every three years, instead of every two. The senior center is open 28, not 40, hours a week. Asphalt patches, not new concrete, are being used to repair sidewalks.

“People are used to a higher level of service,” says Bill Spriggs, who serves as mayor for the city of 80,600. “But this is the new normal.“

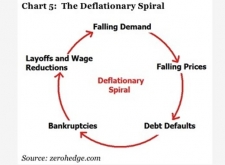

The old normal was an unsustainable Ponzi scheme. The new normal is an endless series of financial bailouts to prevent losses from the collapse of the unsustainable Ponzi schemes that come about because investors believe the federal reserve will bail them out. A self-reinforcing vicious circle.

Now the Ponzi scheme is collapsing into a deflationary spiral. The cuts in city services will cause further declines in local spending which will hurt a fragile economy.

In Los Banos, the grass is now cut in city parks every 15 days. It used to be cut weekly. Vacant houses dot nearly every neighborhood. New roads end in cul-de-sacs surrounded by vacant lots. A weather-beaten billboard announces a 35,000-square-foot retail center that is “coming soon” but never has.

“This was, right here, all going to be industry,” says Tommy Jones, Los Banos' former mayor, as he points to a goat pasture.

Nationwide, local governments typically get more than half of their revenue from local sources, the largest of which is property taxes, says economics professor John Anderson at the University of Nebraska. Because property tax collections can lag behind market values by 18 months to several years, they continued to rise for U.S. cities through 2009 — despite housing price declines in most areas. But city property tax collections fell 2% last year as reduced assessments started to kick in, according to survey data collected by the National League of Cities. More drops are expected this year and next as the decline continues.

The Merced city and county governments have softened the blow to services by eating through millions in financial reserves. But budget deficits are still the norm. This summer, Merced city plans to ask residents to approve a half-cent sales tax increase to cover a $5.2 million budget shortfall.

If the new tax doesn't pass, Bramble says, “The quality of city services will be severely changed.”

This tax revenue is not coming back because house prices are not coming back. Local governments are going to have to adjust to budgets based on current property values, not some fantasy of what properties were selling for in 2006. California's Ponzi Scheme economy has collapsed. Municipalities like Merced that are spending their financial reserves are being foolish and irresponsible, and it will hurt them in the end.

|

Deeply underwater

|

|||

|

|

|||

| At least half of homeowners with a mortgage owe more than their homes are worth in 17 of 386 U.S. counties. Counties with the highest percentage of mortgages under water as of Sept. 30. | |||

|

|

|||

| Rank | County | State |

Mortgages under water

|

|

|

|||

| 1 | Clark | Nev. |

71.1%

|

|

|

|||

| 2 | Osceola | Fla. |

66.5%

|

|

|

|||

| 3 | Merced | Calif. |

63.1%

|

|

|

|||

| 4 | St Lucie | Fla. |

62.4%

|

|

|

|||

| 5 | San Joaquin | Calif. |

59.6%

|

|

|

|||

| 6 | Stanislaus | Calif. |

57.5%

|

|

|

|||

| 7 | Clayton | Ga. |

56.1%

|

|

|

|||

| 8 | Orange | Fla. |

56.1%

|

|

|

|||

| 9 | Solano | Calif. |

55.6%

|

|

|

|||

| 10 | Maricopa | Ariz. |

54.4%

|

|

|

|||

| 11 | Washoe | Nev. |

53.3%

|

|

|

|||

| 12 | Pinal | Ariz. |

52.6%

|

|

|

|||

| 13 | Flagler | Fla. |

52.5%

|

|

|

|||

| 14 | Pasco | Fla. |

51.5%

|

|

|

|||

| 15 | Riverside | Calif. |

50.5%

|

|

|

|||

| 16 | Kern | Calif. |

50.2%

|

|

|

|||

| 17 | Broward | Fla. |

50.1%

|

|

|

|||

| 18 | Lee | Fla. |

49.5%

|

|

|

|||

| 19 | Canyon | Idaho |

49.0%

|

|

|

|||

| 20 | Henry | Ga. |

48.8%

|

|

|

|||

| 21 | Polk | Fla. |

48.5%

|

|

|

|||

| 22 | Hillsborough | Fla. |

48.5%

|

|

|

|||

| 23 | Dade | Fla. |

48.2%

|

|

|

|||

| 24 | Sacramento | Calif. |

47.9%

|

|

|

|||

| 25 | Paulding | Ga. |

47.5%

|

|

|

|||

| 26 | Prince William | Va. |

47.4%

|

|

|

|||

| 27 | San Bernardino | Calif. |

46.9%

|

|

|

|||

| 28 | Brevard | Fla. |

46.9%

|

|

|

|||

| 29 | Wayne | Mich. |

46.6%

|

|

|

|||

| 30 | Hernando | Fla. |

46.5%

|

|

|

|||

| Source: CoreLogic | |||

Underwater, with few options

The double whammy of the recession and the real estate crash has forced changes in how consumers spend, plan for their futures and view their neighbors. Businesses also have suffered, because homeowners have less equity in their homes or none at all. Overlaying everything is a local economy in which one of five workers is jobless, in part because of the collapse of the area's once-fast-growing home construction industry.

The “last good year” was 2008, says Greg Parle, owner of the Branding Iron Restaurant in Merced. Business is off at least 20% since then, he says. He's adding lower-priced items to the menu.

The region's ability to foster such small businesses will suffer because of so much lost home equity. Almost one-quarter of small-business owners borrow against their homes or use them as collateral to fuel businesses, according to a 2009 Gallup survey of small-business owners. That'll likely be less now in Merced and other places with so many underwater homeowners. Start-ups will feel the greatest impact, says Mark Schweitzer, director of research for the Federal Reserve Bank of Cleveland.

Loreina Childress, 39, a county environmental health worker, has felt the impact of the new normal at home and work.

The previous work of 26 in her department is now done by 21. At home, a lot remains vacant, and there are more renters in her neighborhood than before the real estate bust.

Childress bought her Merced County home in 2006, when the market was still hot. She owes $241,000 on the 1,500-square-foot home that might sell for $140,000.

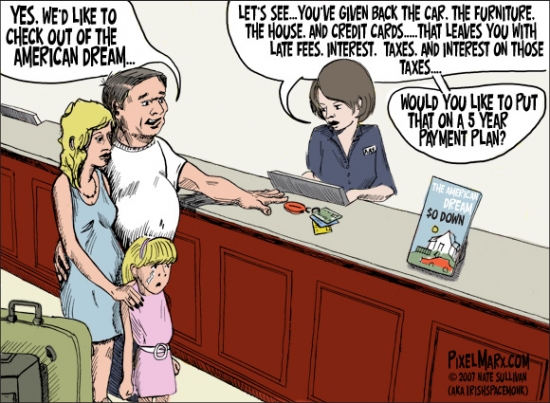

These people are so screwed. Typically, it takes 15 to 20 years for prices to double. People who have houses worth half their mortgage will spend the rest of their working lives paying a bloated debt and waiting for prices to come back.

Her husband, Gary, 38, switched careers a year ago, from forklift driver to emergency medical technician. He can't find full-time work. That's placed new stress on the family's finances, along with the reality of being so far underwater on the house.

Loreina now pours milk in her coffee, not cream. She eats TV dinners at her desk for lunch, rather than fresh sandwiches at a deli. She can recite, down to the penny, the cost of South Beach Diet bars at three retailers. Plans to landscape the yard have been scrapped.

Gary might have more luck pursuing work in other states. That would mean selling the house at a big loss or doing what the couple say they won't do: Give the house back to the bank and walk away.

“We made an agreement,” Loreina says. “We can't go anywhere until we can break even on the house.“

I hope they don't have anywhere to go any time soon. They are trapped in their debtors prison. I hope it is a gilded cage.

Los Banos Unified School District Superintendent Steve Tietjen, 55, is underwater on his home, too. He bought his Los Banos home in 2007. If a job change appears, “I'll have a dilemma,” he says. “I never would've conceived that somebody who's a superintendent would have that dilemma.”

Like Tietjen, many people here know someone who lost their house — either because of a job loss or a decision not to stick it out. Some former homeowners now rent. Some bought other homes at distressed prices, then walked away from underwater ones.

Buy-and-bail was a lot more common in the last housing bust. Lenders caught on early, and since 2007, most borrowers have been required to demonstrate the ability to make both house payments. That requirement prevented most buy-and-bail problems.

John Betham, 58, and his wife, Sandra, 55, are staying put. They owe $375,000 on their Los Banos home. They estimate it would sell now for $150,000.

The Bethams both teach in Los Banos. They can make the house payments and will delay their retirements if needed. They love their house and feel an obligation to pay the debt. “A lot of these people bailed. But we did everything right, and we're stuck,” John says. “It's a bit of a bitter pill.”

Not much relief in sight

Little relief is expected anytime soon here, despite signs of a strengthening U.S. economy.

Nationwide, home prices are down 30% from their 2006 peak. Moody's Analytics economist Celia Chen says national home prices will regain that ground by 2021.

Some areas will take far longer. In 22 U.S. metropolitan regions, most in California and Florida, home prices won't return to their 2006 peaks before 2030, Chen estimates. That includes such cities as Miami, Detroit, Phoenix, Las Vegas and Riverside, Calif.

Merced is so far off its peak that it'll take “many decades” for home prices to return to their 2006 peaks, Chen says.

People will have forgotten about the peak in these markets long before prices ever get there.

Like other central California communities, Merced's housing boom was fueled by San Francisco Bay Area commuters looking for cheaper housing. The opening of a University of California campus in Merced in 2005 attracted builders and investors who saw a big future for rentals.

In 2005, almost 3,500 single-family-home building permits were issued in Merced County, Moody's data show. That was up from an average of 1,053 a year in the 1990s. Merced's unemployment rate dropped below 10% in 2006 as home construction soared.

But Merced's fall was just as steep. Since 2006, the county has lost more than 2,500 construction jobs, state employment data indicate. In the past three years, just 415 single-family building permits have been issued countywide. Last year, one of 14 Merced homes received foreclosure filings vs. one of 45 nationwide, says researcher RealtyTrac.

Newcomers to Merced are winning in the hard-times economy. Home prices are so low that sales are made “as fast as we can stick a (for sale) sign in the ground,” says Loren Gonella, owner of Gonella Realty in Merced. In December, median prices were up 5% from a year ago, he adds.

He says home prices will recover. The UC campus is expanding, as is a relatively new hospital. Wal-Mart plans to open a distribution center here in the next few years, which would eventually employ up to 900. The San Francisco Bay Area has funneled home buyers to the Central Valley for decades. That will continue, he says.

The feared mass exodus from the county has not occurred. In Los Banos, student enrollment dipped in 2008 and 2009 but has returned to 2006 levels, Tietjen says. In many cases, multiple families inhabit homes that used to contain one, he says.

Ray Ortiz, 40, bought his Los Banos home in 2009 for $150,000. At the peak, it would have cost more than $400,000.

Ortiz commutes 90 minutes to his job in San Jose as a maintenance supervisor for a garbage company. He pays $50 more a month to own in Los Banos than he would to rent in San Jose.

Even if home prices drop more before they go up, Ortiz is confident he made a good buy.

“I feel like I won the lottery,” he says.

Buyers feel that way because they still believe prices will skyrocket and they will make a fortune. Kool aid will never die.

What was the bank doing for the last two years?

Today's featured property is the best example of seasoned shadow inventory I have found to date. This property has been bank owned since April of 2008. The owner, a buyer from 1991, managed to HELOC himself into oblivion with a $378,000 first mortgage in 2004.

The Notice of Default was issued on 12/5/2007, but it is safe to assume the loan was delinqent long before then.

I don't know if this has been empty or occupied. I presume it has sat empty as lenders continue to withhold inventory like this from the market.

When will the rest of this inventory be released? How the lending cartel releases its shadow inventory will determine the housing market's fate.

Irvine Home Address … 263 HUNTINGTON Irvine, CA 92620 ![]()

Resale Home Price … $300,000

Home Purchase Price … $410,666

Home Purchase Date …. 4/8/2008

Net Gain (Loss) ………. $(128,666)

Percent Change ………. -31.3%

Annual Appreciation … -10.7%

Cost of Ownership

————————————————-

$300,000 ………. Asking Price

$10,500 ………. 3.5% Down FHA Financing

4.99% …………… Mortgage Interest Rate

$289,500 ………. 30-Year Mortgage

$62,047 ………. Income Requirement

$1,552 ………. Monthly Mortgage Payment

$260 ………. Property Tax

$0 ………. Special Taxes and Levies (Mello Roos)

$50 ………. Homeowners Insurance

$250 ………. Homeowners Association Fees

============================================

$2,112 ………. Monthly Cash Outlays

-$146 ………. Tax Savings (% of Interest and Property Tax)

-$348 ………. Equity Hidden in Payment

$20 ………. Lost Income to Down Payment (net of taxes)

$38 ………. Maintenance and Replacement Reserves

============================================

$1,675 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$3,000 ………. Furnishing and Move In @1%

$3,000 ………. Closing Costs @1%

$2,895 ………… Interest Points @1% of Loan

$10,500 ………. Down Payment

============================================

$19,395 ………. Total Cash Costs

$25,600 ………… Emergency Cash Reserves

============================================

$44,995 ………. Total Savings Needed

Property Details for 263 HUNTINGTON Irvine, CA 92620

——————————————————————————

Beds: 2

Baths: 3

Sq. Ft.: 1058

$284/SF

Lot Size: –

Property Type: Residential, Condominium, Townhouse

Style: Two Level, Traditional

Year Built: 1986

Community: Northwood

County: Orange

MLS#: P767933

Source: SoCalMLS

Status: ActiveThis listing is for sale and the sellers are accepting offers.

On Redfin: 9 days

——————————————————————————

Northwood's Horizon premium interior location, close to pool and amenities, no one above or below. Dual master bedrooms, over 1,000 square feet, and bonus half bath down stairs. Must see! Irvine Unified School District, Close to Parks, Shopping, Irvine Spectrum, Tustin Market Place and much more. Easy Freeway access: 5, 405, 133, Toll Road 73, 44, 57 and 22. Turn-key condition , submit offer today!

.jpg)