12/10 NOTE: Had to do a DB restore to yesterday morning so we've lost all comments since then. -zovall

The Mortgage Bankers Association released a report comparing strategic default to a virus that is spreading across the land.

Home Address … 16 FAITH Irvine, CA 92612

Asking Price ……. $1,599,000

Virus alert!

Delete immediately before someone gets hurt!

Forward this message on to everybody

Soon, very soon, it will make all the paint peel off your walls

WEIRD AL YANKOVIC – VIRUS ALERT

One of the great advances which has come from the internet is the quick dissemination of useful information. In short, secrets don't remain secret very long.

Lenders don't want borrowers to know that their friends and neighbors have stopped paying their mortgages, and their lives have improved. Lenders want borrowers to remain in the dark and fall victim to old beliefs and habits which prompt them to keep paying even when it is not in their best interest to do so.

Unfortunately, the quick spread of information on the internet is getting out the word, and “mavens” like myself are not helping lenders out. Too bad for lenders.

What disease and strategic default on mortgages have in common

November 17, 2011 — Jamie Smith Hopkins

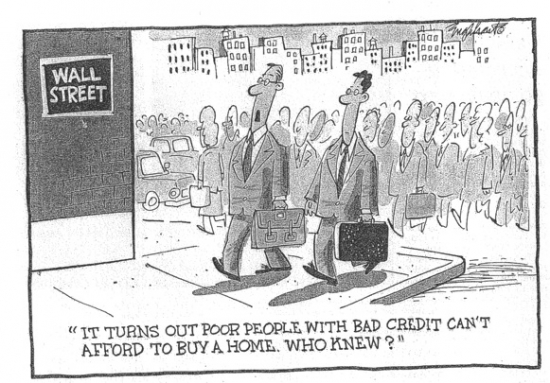

A new report conducted for a mortgage-industry trade group likens “strategic default” — walking away from a mortgage you can afford to pay because you owe more than your house is worth — to a contagious disease.

It's an interesting analogy I imagine lenders embrace. To them it is disease, but to borrowers it is medicine for their debt disease. It depends on your point of view, doesn't it?

It's not just the idea that strategic defaulters spawn more strategic defaulters. The report's authors focus much of their attention on real estate experts — “mavens” — who advocate such a move and sway underwater homeowners to their way of thinking.

“Much the same way as a disease spreads throughout a population, so too do decisions to 'strategically' default,” the report concludes, adding: “Mavens are more contagious than non-Mavens because people place greater trust in their opinions. … In fragile markets, advice by influential Mavens can result in a flood of strategic defaults, causing a contagious downward spiral of home prices and potentially a market collapse.”

I had no idea I was so powerful. I have certainly been advocating strategic default for many reasons, not the least of which is that it's very often the best thing for the families. The fact that it punishes the banks who created this mess is a bonus.

I had no idea I was so powerful. I have certainly been advocating strategic default for many reasons, not the least of which is that it's very often the best thing for the families. The fact that it punishes the banks who created this mess is a bonus.

I have a hard time believing any voice, no matter how influential could really impact a housing market. People are going to do what they are going to do irrespective of what supposed experts say.

The report was sponsored for the Mortgage Bankers Association's Research Institute for Housing America. Last year, the bankers association's then-CEO said would-be strategic defaulters should think about the damage they would do to their neighbors' property values and their own reputations. “What about the message they will send to their family and their kids and their friends?” John Courson told The Wall Street Journal at the end of 2009.

Let't think about that one. What message does strategic default send to a family, kids and friends? It says I am strong enough to admit I made a mistake and change course. It says I value my families financial future more than the profits of a lender.

That just before the Mortgage Bankers Association sold its headquarters building for millions less than its 2007 purchase price — and millions less than its financing, too. The WSJ reported at the time that the association would not disclose the terms it negotiated with its lenders, but sources thought the group would be paying back only part of the $30 million that the sale price hadn't covered. Irony lovers had a field day.

Yes, the mortgage bankers themselves strategically defaulted while simultaneously decrying their borrowers from doing the same. I guess when it is a business decision, the agreements signed in the past go out the window. What message does that say to the families, children and friends of the bankers?

People have debated the ethics and bottom-line considerations of walking away for several years now. The ethics argument boils down to whether paying your debts is a moral obligation or a contractual one (i.e. “I pay the mortgage or I give you back the house, so here's the house, buddy”). On the financial side, there's the chance to get out from under a house that might never be worth what you paid for it vs. the effect on credit scores, the ability to get security clearances and the possibility of future dunning attempts.

Some states are non-recourse, meaning that mortgage holders can't come after you for the difference between what you owe and what they can sell the house for. Others — including Maryland — allow the debt collectors to come calling.

Last year I wrote about a strategic defaulter who was planning to file for bankruptcy protection after he walked away from his Baltimore home.

So, folks: What do you think of strategic default nowadays? Do you think the “disease” theory is apt?

My views on strategic default are clear:

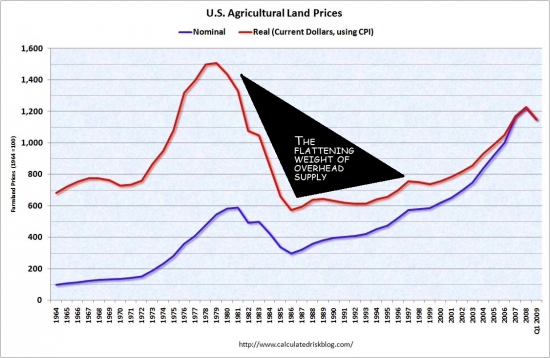

Has Turtle Rock continued to appreciate?

Turtle Rock is a special community. It is probably my favorite in Irvine. It has large lots, nice homes, a great trail system, and many homes have nice views. There is much to like about the community. But is it immune to the effects of the collapsing housing bubble?

As prices crumble all around Turtle Rock, the substitution effect starts to kick in. Yes, people may prefer Turtle Rock, but if a similar property can be found for much less nearby, many people will not pay an exaggerated premium. The Turtle Rock owners will either have to lower price or simply not sell their homes.

Today's featured property is a nice home, but it's not as nice as this one:

|

$1,650,000

Sold on Nov 29, 2011 |

0.96 miles

4 bd / 3 ba 3,235 Sq. Ft. |

And is it $500,000 better than this one?

|

$1,062,625 |

0.06 miles

4 bd / 4 ba 3,109 Sq. Ft. |

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Home Address … 16 FAITH Irvine, CA 92612

Asking Price ……. $1,599,000

Beds: 5

Baths: 3

Sq. Ft.: 3200

$500/SF

Property Type: Residential, Single Family

Style: Two Level, Other

View: Hills, Mountain

Year Built: 1995

Community: Turtle Rock

County: Orange

MLS#: S681346

Source: CRMLS

On Redfin: 1 day

——————————————————————————

Magnificent, highly upgraded executive home located in the exclusive gated community of Concordia. A professionally designed lush front yard welcomes you to gorgeous interior. Spiral staircase greets you as you enter the foyer. Vaulted ceiling. Two Greek Columns lead you into the formal dining room. Breakfast area overlooks a beautiful landscaped backyard with built-in BBQ and fountain. Family room comes with fireplace and built-in cabinets. Fully upgraded Gourmet Kitchen with granite countertops and center island. Walk in pantry, new stainless steel appliances. Other upgrades include crown molding, recess lights, plantation shutters and new gorgeous slates at front & backyard. 5 bedrooms up & 1 office/bath down. Master suite includes a large retreat with a two sided fireplace. NO MELLO ROOS, LOW TAX. Walking distance to the famous Uni High School, Turtle Rock Elementary, Preschool and Concordia University. Minutes away from UCI, OC Airport and Newport Beach. This home is a must see to appreciate!

——————————————————————————————————————————————-

Proprietary commentary and analysis ![]()

Asking Price ……. $1,599,000

Purchase Price … $825,000

Purchase Date …. 12/22/2000

Net Gain (Loss) ………. $678,060

Percent Change ………. 82.2%

Annual Appreciation … 6.1%

Cost of Home Ownership

————————————————-

$1,599,000 ………. Asking Price

$319,800 ………. 20% Down Conventional

4.02% …………… Mortgage Interest Rate

$1,279,200 ………. 30-Year Mortgage

$312,030 ………. Income Requirement

$6,122 ………. Monthly Mortgage Payment

$1386 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$333 ………. Homeowners Insurance (@ 0.25%)

$0 ………. Private Mortgage Insurance

$220 ………. Homeowners Association Fees

============================================

$8,061 ………. Monthly Cash Outlays

-$1326 ………. Tax Savings (% of Interest and Property Tax)

-$1837 ………. Equity Hidden in Payment (Amortization)

$448 ………. Lost Income to Down Payment (net of taxes)

$220 ………. Maintenance and Replacement Reserves

============================================

$5,566 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$15,990 ………. Furnishing and Move In @1%

$15,990 ………. Closing Costs @1%

$12,792 ………. Interest Points

$319,800 ………. Down Payment

============================================

$364,572 ………. Total Cash Costs

$85,300 ………… Emergency Cash Reserves

============================================

$449,872 ………. Total Savings Needed

——————————————————————————————————————————————————-

Sometimes when I see what people paid at the peak, it really takes my breath away. This tiny one bedroom one bath condo sold for $417,000 at a time of 6.5% interest rates. The cost of ownership would have been nearly $3,500 per month for a shoebox.

Sometimes when I see what people paid at the peak, it really takes my breath away. This tiny one bedroom one bath condo sold for $417,000 at a time of 6.5% interest rates. The cost of ownership would have been nearly $3,500 per month for a shoebox.

.jpg)

As it should. Remember, lenders inflated this housing bubble with their shoddy lending practices. It is fair and just for them to eat the losses in the aftermath. Each borrower who does not strategically default is agreeing to pay the losses of the lender who deserves it.

As it should. Remember, lenders inflated this housing bubble with their shoddy lending practices. It is fair and just for them to eat the losses in the aftermath. Each borrower who does not strategically default is agreeing to pay the losses of the lender who deserves it.