The markets which crashed first and hardest are now in the final phase of the bubble cycle: despair.

Home Address … 160 STREAMWOOD Irvine, CA 92620

Asking Price ……. $159,900

How did it come to this?

I'm trapped behind these walls

I got no air to breathe

It's like I'm under water

Can you hear me?

My silent scream

Lunatica — How Did It Come To This?

So many buyers were so certain prices would rise 10% or more per year forever. Those same kool aid intoxicated fools are now underwater, trapped behind their over-improved walls, eating off their priceless granite tops, wondering how did it come to this? The hope of a recovery is dissipating with the double dip in home prices, and pessimism about the future is pervading the land. Those are exactly the sentiments one finds at the bottom of the real estate cycle.

.jpg)

Housing is in last phase of 'bubble,' expert says

Dec. 2, 2011 05:25 PM

Nishu Sood, director of Wall Street's Deutsche Bank Securities, used the term “revulsion” to describe the current phase of metro Phoenix's housing market.

“Revulsion,” as in many people are averse to the very product that got the nation in trouble in the first place.

Revulsion is another way to describe the conditions of despair. Everyone who owns an underwater house wishes they didn't, and all hope of attaining riches is lost.

The despair stage is actually the best time to buy real estate, but it requires the most patience. First, part of the reason for despair is because nearly everyone knows prices are not going up any time soon. That perception of the market is not wrong. Prices don't rise quickly when the despair stage passes. In fact, prices may languish there for years or even decades. What makes the despair stage an enticing buying opportunity is the current cashflow or savings over renting.

Sood was the lead speaker at the Scottsdale-based Land Advisors' third annual housing forecast for the Phoenix area, presented to a group of the region's top real-estate executives.

He was quick to point out that revulsion was the last phase in the “bubble” cycle before recovery for the region's housing market.

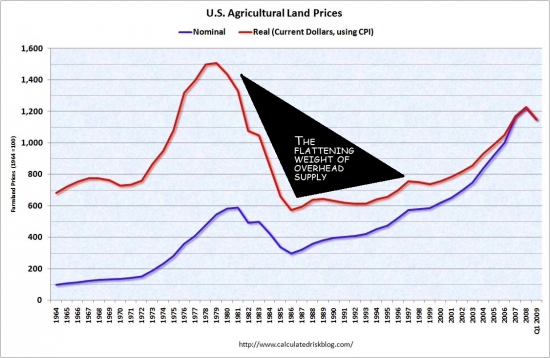

The bottom occurs in the despair stage, but the “recovery” is rarely a robust increase in prices, particularly with the overhang of supply.

He said if Land Advisors would have asked him to speak about Phoenix's housing market in the years between 2006-10, everyone attending would have needed a shot of bourbon to make it through his negative evaluations and projections.

This week, Sood said he felt more positive about Phoenix's housing market and its oncoming recovery than he did about many other parts of the country.

Yes, both Phoenix and Las Vegas are much closer to the bottom than Orange County. We have not reached capitulation here, although recent price drops are showing those signs. The coastal areas are still in denial.

That's something that made the executive sitting next to me smile with relief. This is the same man who brought in a Corona at the start of the 3 p.m conference because he thought he would need it to get through another negative forecast.

Sood's evolution of the housing bubble includes these cycles:

A change in the mortgage business and upgrades in technology during the 1990s made it easier to make and obtain loans.

Upgrades in technology? LOL! Financial innovation, right?

In 2002, home prices started to climb, though most people were more concerned about dot.com stocks.

By 2004, housing euphoria had begun, and home prices were soaring.

Then, in 2005-06, came the explosion of the housing market. One later speaker said that's when “anyone who could fog a mirror with their breath could get a mortgage to buy a home.”

In 2007-08, the painful market reversal hit. Some had expected it, but few were prepared for its carnage.

The financial crisis followed in 2008-09. It continues to shake the

world.

And the current situation: revulsion. Sood said many people now are distrustful and averse to housing.

But, he said, the next and, one hopes, the last phase of housing bubble will be the

recovery.

Speakers also included Land Advisors CEO Greg Vogel, Avatar Properties President Carl Mulac, Cromford Report founder and analyst Mike Orr, and the CEO of homebuilder Taylor Morrison, Sheryl Palmer.

None of them believes full recovery will come in 2012. But most agree it could start next year and be in full swing by 2014.

Reach the reporter at catherine.reagor@arizonarepublic.com.

I think the markets which have been totally crushed including Phoenix, Las Vegas, Riverside County, and other fringe markets will begin to recover in 2014, and the pace of new construction should pick up considerably by 2015. Many of the developers I know are making plans for that end. We have been only building homes at the rate of replacement for the last 4 years. By 2014, we should have absorbed the housing stock from 2003-2007 through foreclosure and resale. It's always darkest before the dawn.

Larry Roberts is hosting a Las Vegas cashflow properties presentation at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618) on December 7, 2011, at 6:30. Please RSVP at sales@idealhomebrokers.com.

Blair Applegate of Peter Schiff's Euro Pacific Capital, Inc. will be presentating at the offices of Intercap Lending (9401 Jeronimo, Suite 200, Irvine, CA 92618) at 7:30 on December 7, 2011. Please RSVP at sales@idealhomebrokers.com.

There is no bottom until these units bottom

The housing market stabilizes from below. Until the bottom of the housing ladder finds firm support, the rest of the market will drift lower. It's people buying properties like this one who will in many years have enough equity from the sale to make a 20% down payment on a property higher up the housing ladder. It will take a very long time to create any substantial move up equity, but without this equity, the higher rungs on the property ladder must reach lower and lower to find qualified buyers. The result is a slow downward drift in prices.

Check out this comp buster: 204 Springview which just sold for $119,000. Or the record low for Irvine set back in April on 122 Streamwood which sold for $110,000.

For the record, this owner did not HELOC himself into oblivion. There is a large HELOC on the property, but based on his lack of history with cash-out refinancing, it's likely he did not use this HELOC. It really is a standard sale.

——————————————————————————————————————————————-

This property is available for sale via the MLS.

Please contact Shevy Akason, #01836707

949.769.1599

sales@idealhomebrokers.com

Home Address … 160 STREAMWOOD Irvine, CA 92620

Asking Price ……. $159,900

Beds: 1

Baths: 1

Sq. Ft.: 639

$250/SF

Property Type: Residential, Condominium

Style: One Level, Contemporary

Year Built: 1977

Community: Northwood

County: Orange

MLS#: S681308

Source: CRMLS

Status: Active

On Redfin: 1 day

——————————————————————————

Upper Unit * * Standard Sale * * Take a walk through the garden to enter this upgraded Home. Remodeled Kitchen and master bathroom, Vaulted ceiling makes it open and spacious. Newer AC in the living room, ready to move in.

——————————————————————————————————————————————-

Proprietary commentary and analysis ![]()

Asking Price ……. $159,900

Purchase Price … $92,000

Purchase Date …. 4/12/2000

Net Gain (Loss) ………. $58,306

Percent Change ………. 63.4%

Annual Appreciation … 4.7%

Cost of Home Ownership

————————————————-

$159,900 ………. Asking Price

$5,597 ………. 3.5% Down FHA Financing

4.02% …………… Mortgage Interest Rate

$154,304 ………. 30-Year Mortgage

$51,476 ………. Income Requirement

$0,738 ………. Monthly Mortgage Payment

$139 ………. Property Tax (@1.04%)

$0 ………. Special Taxes and Levies (Mello Roos)

$33 ………. Homeowners Insurance (@ 0.25%)

$177 ………. Private Mortgage Insurance

$242 ………. Homeowners Association Fees

============================================

$1,330 ………. Monthly Cash Outlays

-$66 ………. Tax Savings (% of Interest and Property Tax)

-$222 ………. Equity Hidden in Payment (Amortization)

$8 ………. Lost Income to Down Payment (net of taxes)

$40 ………. Maintenance and Replacement Reserves

============================================

$1,091 ………. Monthly Cost of Ownership

Cash Acquisition Demands

——————————————————————————

$1,599 ………. Furnishing and Move In @1%

$1,599 ………. Closing Costs @1%

$1,543 ………. Interest Points

$5,597 ………. Down Payment

============================================

$10,338 ………. Total Cash Costs

$16,700 ………… Emergency Cash Reserves

============================================

$27,038 ………. Total Savings Needed

——————————————————————————————————————————————————-

The 2000 price of 92k seems more realistic for this and I predict this is where it will eventually fall to. Ok for minimum wage singles thats about it.

Quick, get PR on the phone. This baby is below rental parity, he can’t miss such a great opportunity.

Bwahahahahahaha!

Only because it is so old there is no Mello-Roos in that part of town. “Rental parity” must include all costs of ownership, including HOA; Mello-Roos or any other name, ie. CFD; taxes; insurance; maintainence. Otherwise, the tax breaks are not enough to offset costs. In this price range, an FHA with 3.5% down + closing is only a little more than 1st, last, and security deposit.

“snapshot” of a moment. The facts can change. If wages continue their downward trend, how long will rents stay up? Right now, residents of OC are spending a huge portion of their income on rent. That cannot continue forever either. Wages need to go up… or rents will eventually fall.

Renting’s edge over homebuying at record low

http://lansner.ocregister.com/2011/12/06/rentings-edge-over-homebuying-at-record-low/155092/

‘Ole Jon said it, you read it, believe!

The article is not bad, but the headline is misleading. He should have touted that payment affordability is at a record high compared to rent. It’s another version of a rental parity analysis.

I am sorry (and I’m a huge fan of yours), but that chart is dead wrong. Despair is when the Mother of All Bubbles (bond market) bursts, and interest rates skyrocket to 20% or higher, which is inevitable.

Like almost everyone everywhere, you are projecting out these historically-low interest forever and ever, amen. Further 50% haircuts lie ahead when the full implosion occurs — which it hasn’t.

My articles on Safehaven did correctly call each stage of real estate deflation correctly thus far, so hopefully I’ve established some credibility by now.

Steve

If interest rates shoot up to 20% without a corresponding increase in wages, then yes, house prices will crater. Even at 50% off, prices will be too high relative to payment affordability.

BTW, I am not projecting historically low interest rates forever. I believe interest rates will go back up, and we may need to raise rates very high to protect the value of the dollar just as Volcker did in the late 1970s. I don’t think that will happen any time soon, but anything is possible.

The government painted themselves into a corner. If they raise interest how are they going to pay their own debt? What are the reasons we would raise interest rates? We are stuck in the low interest rate trap and only through implosion can we get out of it.

So I say low interest rates forever or this fractional reserve lending system collapses.

Your nuts… 20% interest rates would be financial armageddon…. Like a game of musical chairs, when the music stops… Those without a seat are screwed. (renters). Those in their homes will get to keep the free and clear because all the banks would go bankrupt or be nationalized. Another 50 % drop would put those buying homes in the mid 1990s underwater.

http://news.yahoo.com/collegians-ditching-dorms-mcmansions-155643852.html

“So many students have moved to these giant suburban homes that the university has shuttle buses to transport them to and from classes. Chang and Laird said that several other college students lived on their street and that the neighborhood was mostly made up of students.

“I guess it’s kind of sad to see all these students living in such nice houses, when there could be families living there,” Chang said, “[but] we are bringing income to this area, so better us rent these houses than have them just sit here and nobody rents them at all.”

If you ever thought that highway projects were built to relieve existing traffic, check out:

http://www.cotohousingblog.com/?p=18115

I see you still believe all road improvements are a conspiracy among land developers to increase their property values.

I never said it was a conspiracy and never thought so. It is business, as it always has been. Please do not stoop to the level of a conspiracy strawman? I have worked in the industry for 30 years, and lived here all my life. I know what I know. It is no conspiracy, just as the real estate bubble was not a conspiracy. People thought I was a conspiracy nut when I told them about mortgage derivatives in 2005. It is just about money, and a lack of interest or foresight. Don’t put it down just because you do not have the time or experience here to understand it.

And I never said it was all road improvements; more strawman since you do not have a real argument.

Look at the map. Will the toll road extension relieve existing traffic? Or? I think maybe you let your career blind you from the facts.

Three comments. I see I struck a nerve.

Road improvements increase the quality of life of the people who use the road. It’s very inconvenient to live where the transportation systems are not good. This inconvenience lowers the quality of life for all citizens. It reduces trips to stores and hinders commerce.

Transportation doesn’t add value to land, it unlocks the potential value that was already there. Land gets its value from the utility it can provide. Transportation increases utility and improves everyone’s life. Increasing land value is generally a sign of a growing and vibrant economy.

The 241 corridor expansion is a classic case on NIMBY. Right now, the city of San Clemente must endure the full brunt of all the noise and air pollution from traffic between San Diego and LA because the 5 is the only transportation corridor. If the 241 were to bypass San Clemente, it would improve the quality of life in San Clemente dramatically. The areas near the 241 — like Coto — would pay the price by receiving some of the pollution that used to be dumped in San Clemente. I’m not surprised you don’t want to see the 241 go through.

Not all road improvements improve the quality of life for those who use the road, because not all road improvements decrease traffic congestion or smog or noise pollution. Some roads are built or improved only to provide ingress and egress for undeveloped areas which can not be developed unless they have ingress and egress, and the end result is they do nothing to imporve anybody’s quality of life. It is naive to think that the 241 will relieve traffic or pollution from the 5, because the 241 extension will only bring more homes with resultant pollution, waste, traffic, etc. The 5 will get no less traffic and San Clemente will be relieved on NOTHING. Has traffic or pollution been reduced by the building of the toll roads? YOu know where I work, and I can assure you, the 5 is no less congested. Neither is the 405, the 91, or any other state hwy. Name me a hwy that has been built or extended in the last thirty years in California that has relieved congestion or pollution anywhere. Forget what you have been taught or told and think.

IR – Are you aware that we do traffic counts? We count before a project and we count after. And we measure speeds before and after. Have you ever seen the counts?

BTW, your NIMBY assertion is ad hominem and displays a lack or argument. Your three points are assertions with no data to back them up, and the traffic data shows quite the opposite. But why pay attention to reality?

As for quality of life, I recall lots of “Detroit river” comments. People seem to be not very interested in houses anywhere near large roads, much less highways.

Is quality of life improved by 2-hour commutes?

Is this information current the legend in the map for the extension has a date of 2006? Is this outdated information?

Is this map current it shows a 2006 date in the legend for the extension? Is this map outdated?

You have 204 Springview and 122 Streamwood listed as comps but they are not. They are smaller studio units when 160 Streamwood is a 1 bedroom unit.

The owner should have tapped some of that HELOC money to upgrade this place. I can’t figure out why the owner thinks he deserves to list at a 10% premium over other “model matches” on the market in the complex that have been updated?

I’m betting that, if this one closes, it happens to be much closer to the 204 Springview sale price than the most recent “model match” sale price at 228 Springview.

“You have 204 Springview and 122 Streamwood listed as comps but they are not. They are smaller studio units when 160 Streamwood is a 1 bedroom unit.”

You are correct. I should have been more clear. Those two smaller condos are comp busters for the models they match. The one bedroom unit is a close substitute however, and as the tiny studios go down in value, the next step up the housing ladder will get dragged down with it.

See this article:

http://www.dailymail.co.uk/news/article-2070787/Wealthy-couple-live-1-2m-home-drive-Jag-claiming-benefits-years.html

This is one of the few ways that “renters” can scam the system: by abusing section 8 housing!

That one is really bad. I hope those people go to jail.